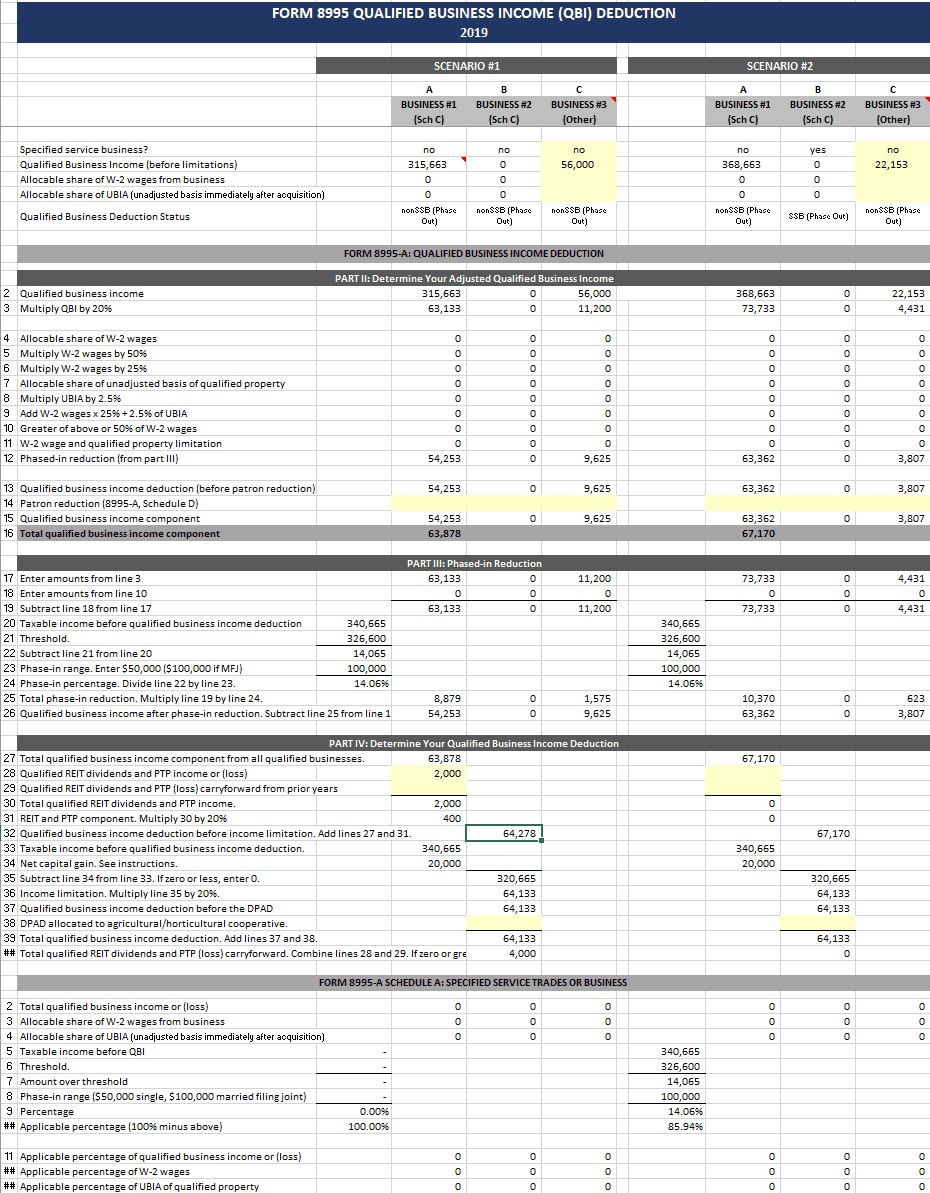

42 qualified dividends and capital gain tax worksheet calculator

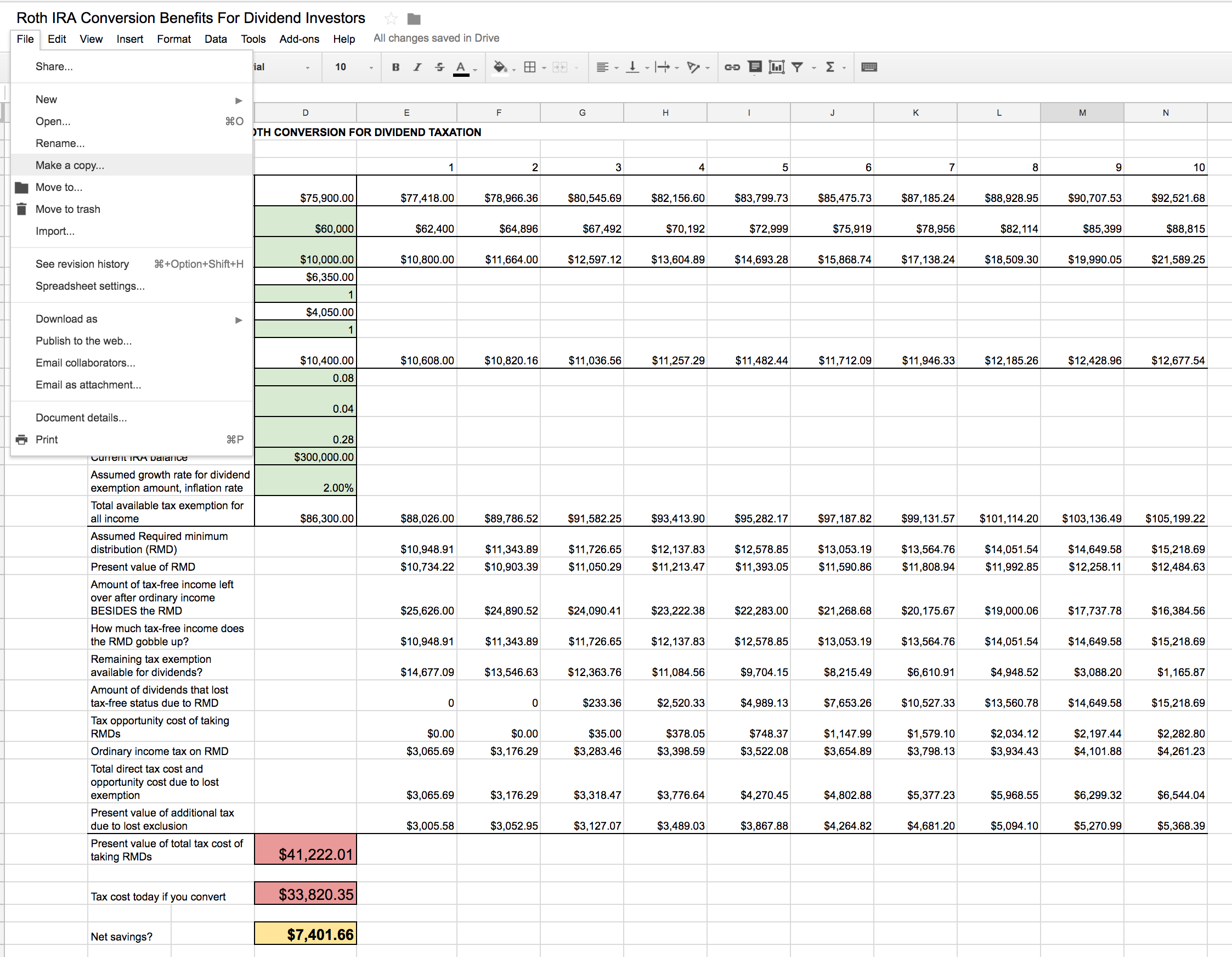

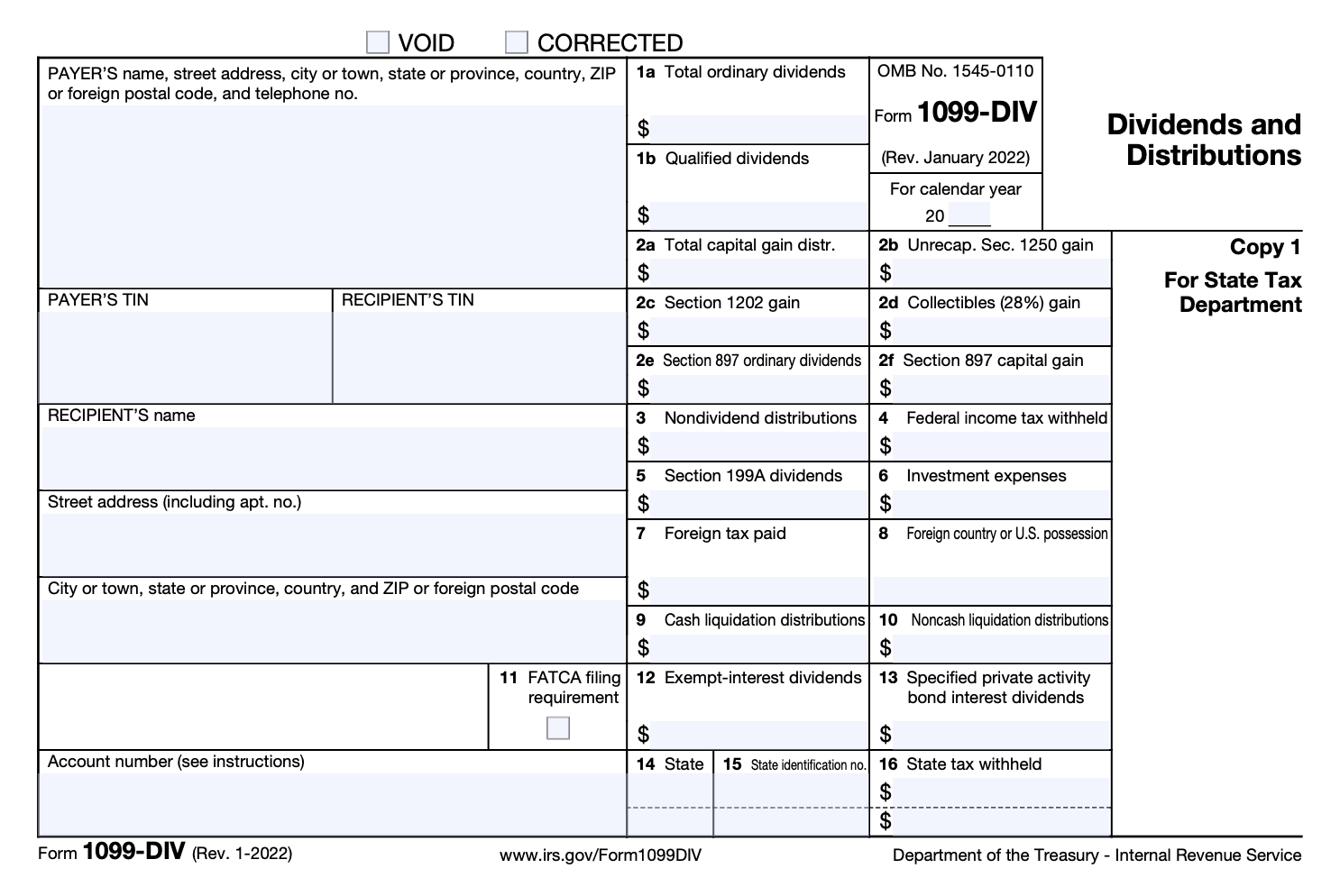

2022-2023 Long-Term Capital Gains Tax Rates | Bankrate Nov 23, 2022 · Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. Topic No. 409 Capital Gains and Losses - IRS tax forms Nov 25, 2022 · Capital Gain Tax Rates. The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow(er).

Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Certain investment income must be $10,000 or less during the year. For most people, this investment income is taxable interest and dividends, tax-exempt interest, and capital gain net income. See Worksheet 1 in Pub. 596 for more information on the investment income includible in the amount that must meet the $10,000 limit.

Qualified dividends and capital gain tax worksheet calculator

Qualified Dividends And Capital Gain Tax Worksheet 2021 ... Once you’ve finished signing your 2021 qualified dividends and capital gain tax worksheet, decide what you want to do next - download it or share the doc with other people. The signNow extension offers you a selection of features (merging PDFs, adding numerous signers, and many others) for a better signing experience. 2022-2023 Capital Gains Tax Rates & Calculator - NerdWallet Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year (also known as a long term investment). The long-term capital gains tax rate is 0%, 15% or 20% ... 1040 Tax Calculator - Dinkytown.net For common stock dividends to be considered qualified dividends, you need to have owned the stock for at least 60 days during a 121 day period that starts 60 days before the ex-dividend date. The same rule applies for preferred stock for dividends attributable to periods totaling more than 366 days, but the holding period is 90 days during a ...

Qualified dividends and capital gain tax worksheet calculator. Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. Use Pub. 974, Premium Tax Credit, instead of the worksheet in the 2021 Instructions for Forms 1040 and 1040-SR if the insurance plan established, or considered to be established ... 1040 Tax Calculator - Dinkytown.net For common stock dividends to be considered qualified dividends, you need to have owned the stock for at least 60 days during a 121 day period that starts 60 days before the ex-dividend date. The same rule applies for preferred stock for dividends attributable to periods totaling more than 366 days, but the holding period is 90 days during a ... 2022-2023 Capital Gains Tax Rates & Calculator - NerdWallet Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year (also known as a long term investment). The long-term capital gains tax rate is 0%, 15% or 20% ... Qualified Dividends And Capital Gain Tax Worksheet 2021 ... Once you’ve finished signing your 2021 qualified dividends and capital gain tax worksheet, decide what you want to do next - download it or share the doc with other people. The signNow extension offers you a selection of features (merging PDFs, adding numerous signers, and many others) for a better signing experience.

0 Response to "42 qualified dividends and capital gain tax worksheet calculator"

Post a Comment