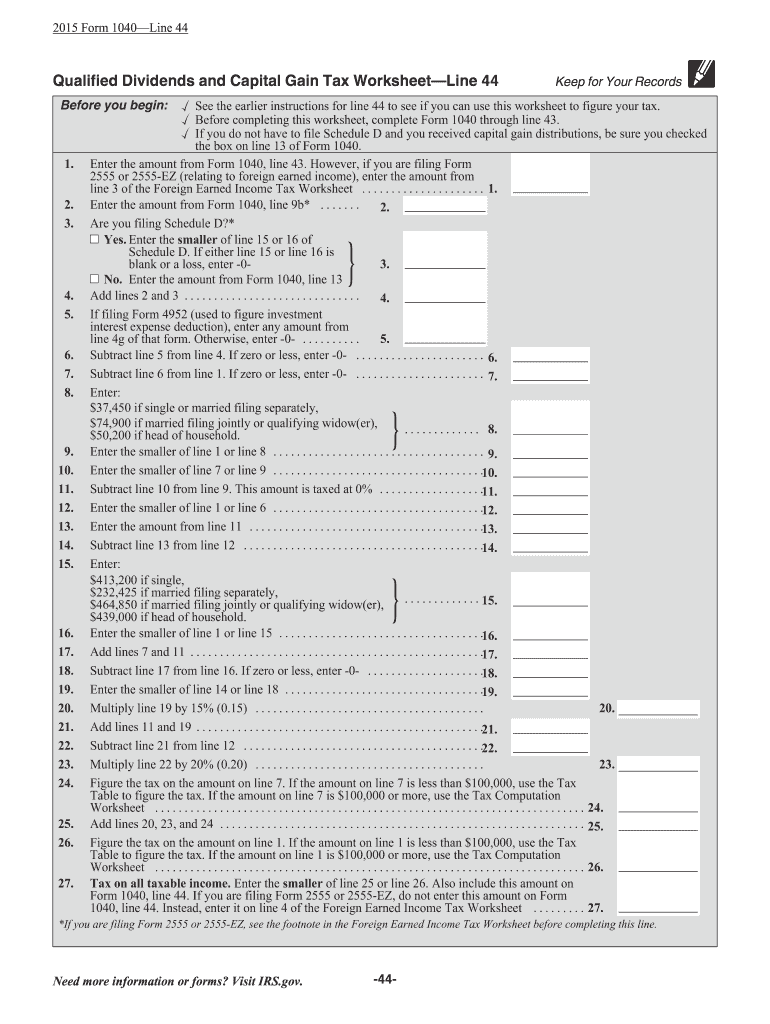

38 qualified dividends and capital gain tax worksheet

img1.wsimg.com › blobby › goQualified Dividends and Capital Gain Tax Worksheet (2020) Tools or Tax ros ea Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. • Before completing this worksheet, complete Form 1040 through line 15. › file › 109252604Qualified Dividends and Capital Gain Tax Worksheet - 2021 ... Qualified Dividends and Capital Gain Tax Worksheet – Line 16 1. Enter the amount from Form 1040 or 1040-SR, line 15. 118,915 2. Enter the amount from Form 1040 or 1040-SR, line 3a* 2,000 3. Are you filing Schedule D? ☐ Yes. Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter -0-.

› instructions › i8801Instructions for Form 8801 (2021) - IRS tax forms Jan 13, 2022 · You figured your 2020 tax using the Qualified Dividends and Capital Gain Tax Worksheet in the Form 1040 and 1040-SR instructions and (a) line 3 of that worksheet is zero or less, (b) line 5 of that worksheet is zero, or (c) line 23 of that worksheet is equal to or greater than line 24.

Qualified dividends and capital gain tax worksheet

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records ... Before completing this worksheet, complete Form 1040 through line 10. apps.irs.gov › app › vitaForeign Earned Income Tax Worksheet (PDF) - IRS tax forms Schedule D Tax Worksheet). Next, you must determine if you have a capital gain excess. To find out if you have a capital gain excess, subtract Form 1040, line 10, from line 6 of your Qualified Dividends and Capital Gain Tax Worksheet (line 10 of your Schedule D Tax Worksheet). If the result is more than zero, that amount is your capital gain ... support.cch.com › kb › solutionQualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet.

Qualified dividends and capital gain tax worksheet. Qualified Dividends and Capital Gain Tax Worksheet - Drake ... Before completing this worksheet, complete Form 1040 or 1040-SR through line 15. • If you don't have to file Schedule D and you received capital gain ...2 pages › investment › stocksWhen To Use Qualified Dividends And Capital Gain Tax ... When To Use Qualified Dividends And Capital Gain Tax Worksheet? By The Money Farm Team The worksheet is intended for taxpayers who only have dividend income or capital gains distributions recorded in boxes 2a or 2b on Form 1099-DIV from mutual funds, other regulated investment companies, or real estate investment trusts, respectively. en.wikipedia.org › wiki › Qualified_dividendQualified dividend - Wikipedia Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income. The rates on qualified dividends range from 0 to 23.8%. support.cch.com › kb › solutionQualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet.

apps.irs.gov › app › vitaForeign Earned Income Tax Worksheet (PDF) - IRS tax forms Schedule D Tax Worksheet). Next, you must determine if you have a capital gain excess. To find out if you have a capital gain excess, subtract Form 1040, line 10, from line 6 of your Qualified Dividends and Capital Gain Tax Worksheet (line 10 of your Schedule D Tax Worksheet). If the result is more than zero, that amount is your capital gain ... Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records ... Before completing this worksheet, complete Form 1040 through line 10.

How Your Tax Is Calculated: Understanding the Qualified Dividends and Capital Gains Worksheet ...

Qualified Dividends And Capital Gains Worksheet 2019 Instructions Worksheet : Resume Examples

Qualified Dividends and Capital Gain Tax Worksheet Mychaume.com - Worksheet Template Tips And ...

0 Response to "38 qualified dividends and capital gain tax worksheet"

Post a Comment