39 worksheet for figuring net earnings loss from self employment

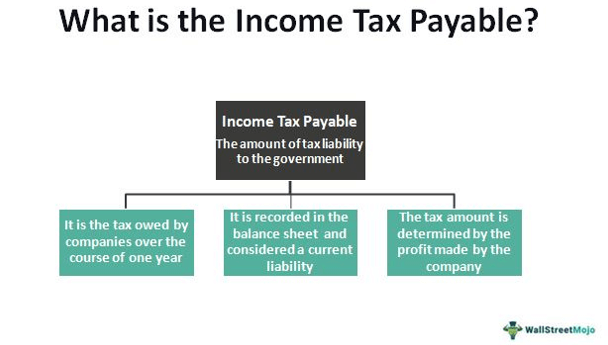

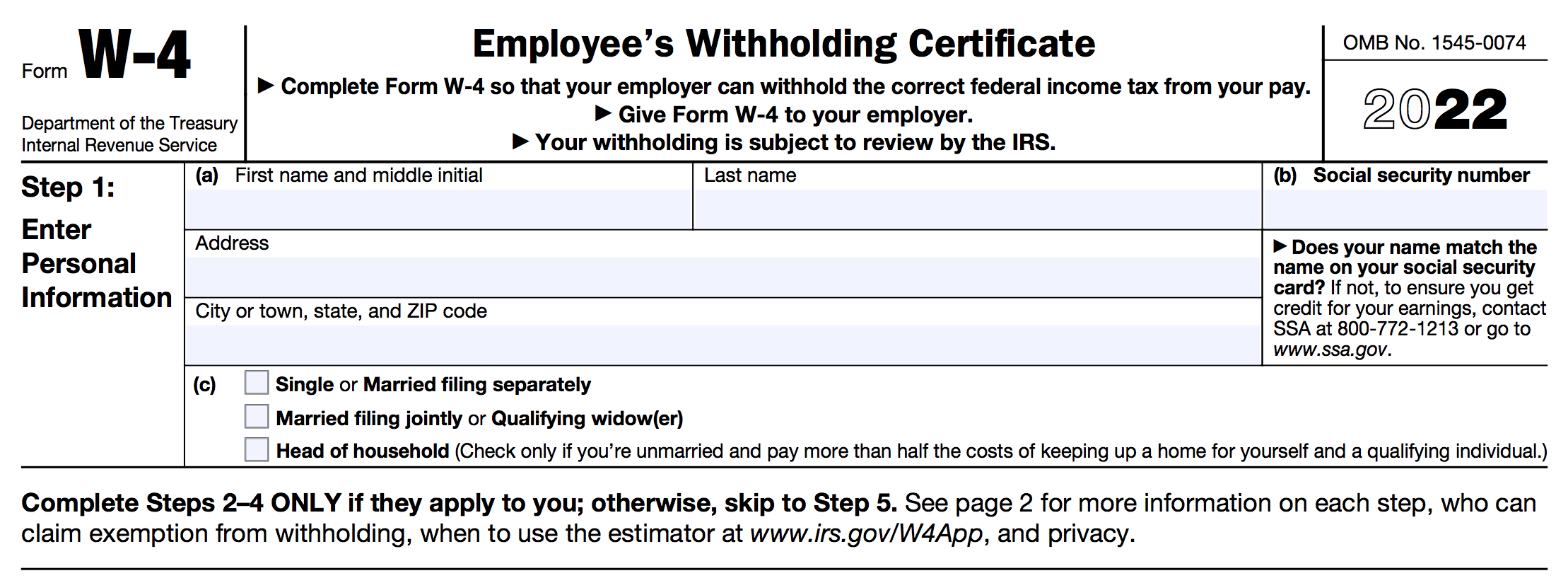

Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai After all, a self-employed taxpayer will owe 15.3% on their earnings from self-employment or Social Security and Medicare taxes. After you calculate your net earnings from self-employment, multiply it by the self-employed tax rate and you'll see how much you'll owe Uncle Sam. If you are concerned with how much you'll owe, don't worry. Calculating Your Net Earnings From Self-Employment You must complete the following federal tax forms by April 15 following any year in which you have net earnings of $400 or more: Form 1040 (U.S. Individual Income Tax Return). Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) as appropriate. Schedule SE (Self-Employment Tax).

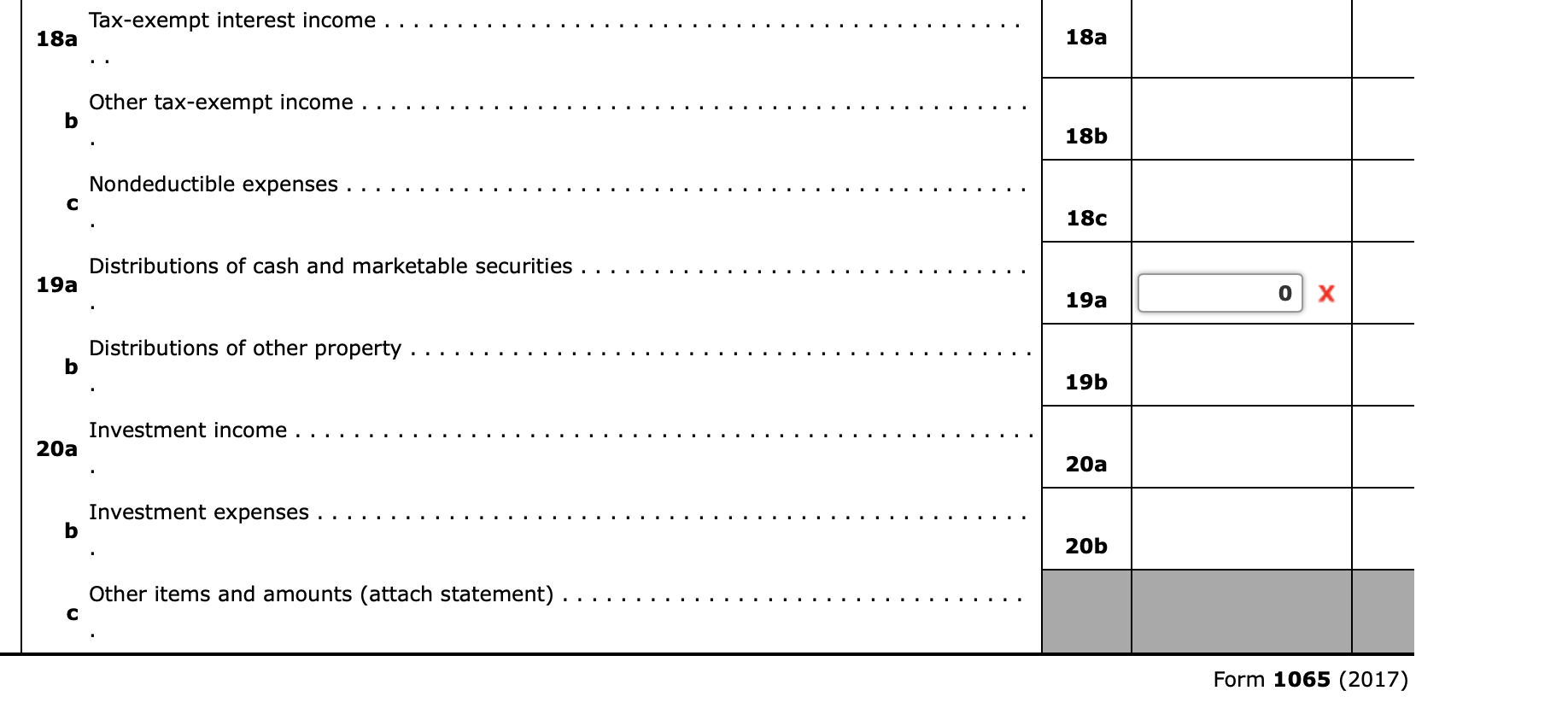

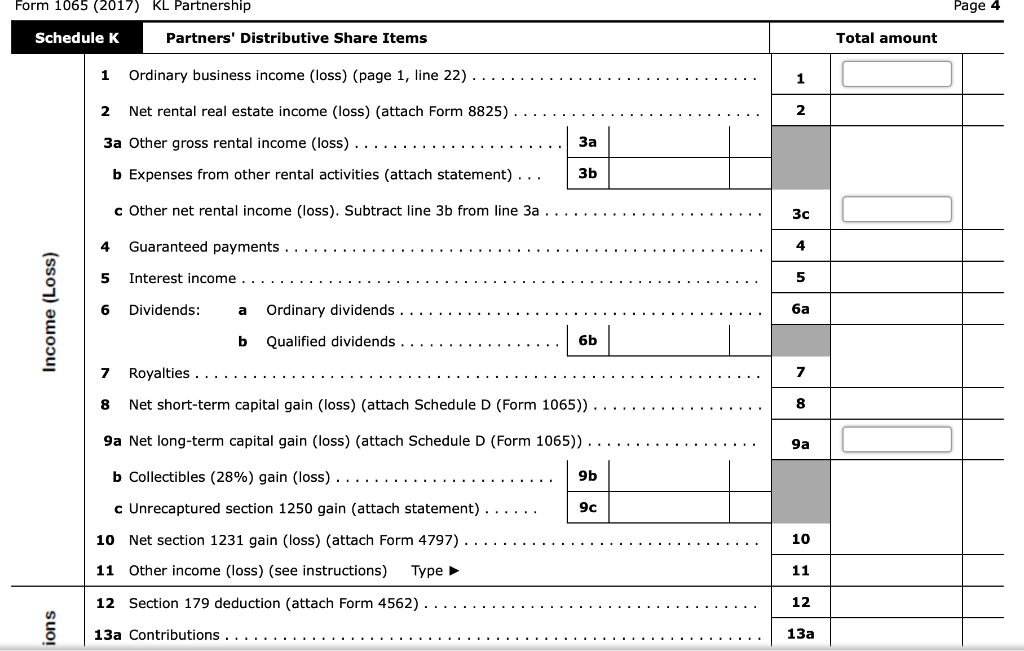

1065-US: Calculating Schedule K, line 14a - Net earnings from self ... UltraTax CS calculates self-employment earnings (SE) per activity for partners in the Partner's Self-Employment Worksheet based on the type of partner selected in the Partner tab in the Partner Information window in View > Partner Information. General Partner and LLC Member (SE Income) calculate SE for all applicable items.

Worksheet for figuring net earnings loss from self employment

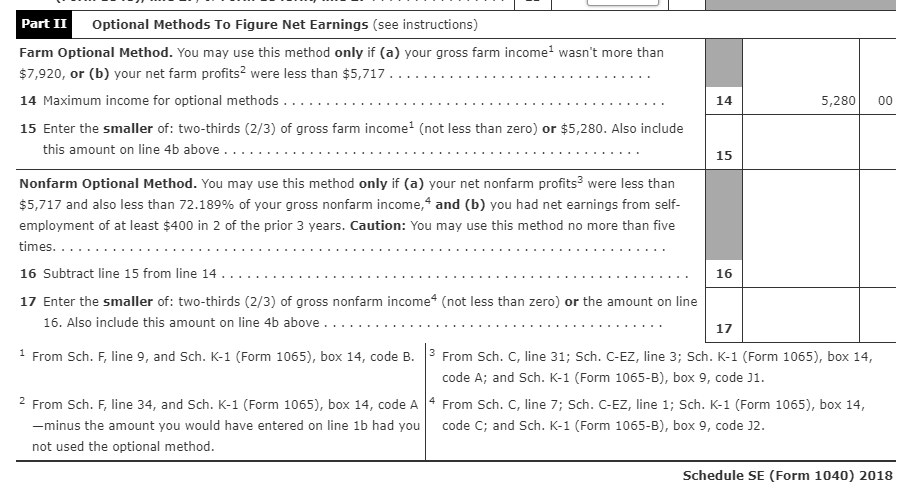

2021 Instructions for Schedule SE (2021) | Internal Revenue ... Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits. PDF FHA Self-Employment Income Calculation Worksheet Job Aid The FHA Self-Employment Income Calculation Worksheet, which is located at . wholesale.franklinamerican.com under Forms > FHA, is a tool to be used for FHA loans when any borrower is self -employed. • The worksheet is to be used for evaluation of only one self-employment business per borrower. • A new worksheet will need to be used for ... Understanding Schedule K-1 self-employment income for partners ... - Intuit The program creates a worksheet to show the calculation of net earnings from self-employment. Follow these steps to view the Self-Employment Worksheet: Go to the Forms tab. Select Worksheets from the left-side Form window. Select Self-Emp. Worksheet from the left-side Page window. How do I enter adjustments or overrides for self-employment income?

Worksheet for figuring net earnings loss from self employment. Publication 536 (2021), Net Operating Losses (NOLs) for Individuals ... Use Worksheet 1 to figure your NOL. The following discussion explains Worksheet 1. See the Instructions for Form 1045. If line 1 is a negative amount, you may have an NOL. Nonbusiness capital losses (line 2). Don't include on this line any section 1202 exclusion amounts (even if entered as a loss on Schedule D (Form 1041)). SSA Handbook § 1200 - Social Security Administration To calculate the net earnings from self-employment, follow the steps below: Add up your total gross income as calculated under the income tax law. Include income from all your trades and businesses. Subtract all the deductions, including the allowances for depreciation that you are allowed when you calculate your income tax from the result in (A). 5 Look at the Worksheet for Figuring Net Earnings Loss from ... - In general, Line1, 3c, and 4 are involved in the calculation of Self-Employment income. Line 1---Ordinary business income (Loss) Line 3C---Other net rental income (Loss) Line 4---Guaranteed payments to partners - In a partner’s self-employment income, the guaranteed payment included are payments to partners derived from a trade or business. How To Calculate Net Earnings (loss) From Self-employment Calculate net earnings from self employment. You can't simply multiply your net profit on schedule c by 10%. To do this, multiply the net income by 92.35 percent. Find your net profit before taking exemptions or paying taxes (from schedule c of your tax return) for the two most recent years you filed taxes. You must use form 1040 for your tax ...

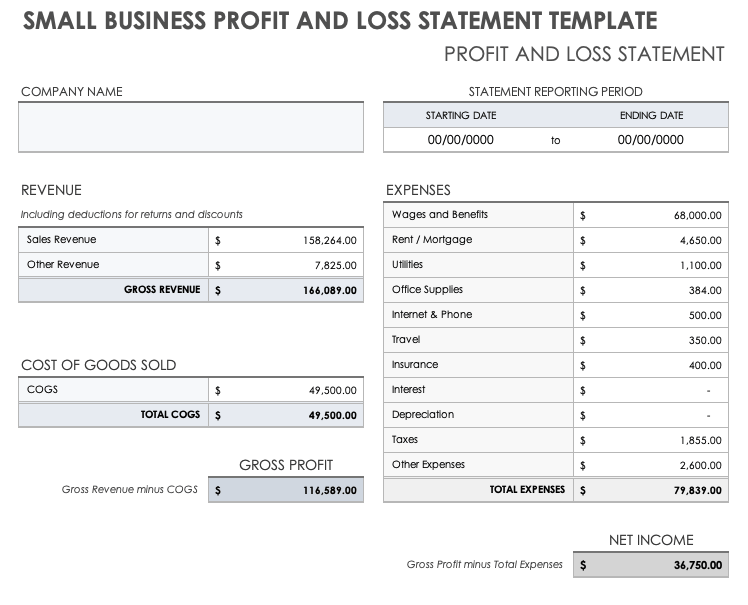

PDF Self-employment Income Worksheet - Ndhfa Anticipated income for the next 12 months may be different. If the resident expects to earn less, obtain a written explanation why s/he expects to earn less. If it is anticipated to be more- include the higher amount. The amount on line 12, "Business income or (loss)" on form 1040 should equal "Net profit or (loss)" on Line 31 of Self-Employed Individuals – Calculating Your Own Retirement ... Oct 25, 2022 · You can use the Table and Worksheets for the Self-Employed (Publication 560) to find the reduced plan contribution rate to calculate the plan contribution and deduction for yourself. Deducting retirement plan contributions Total limits on plan contributions depend in part on your plan type. See the contribution limits for your plan. Schedule K-1 (Form 1065) - Self-Employment Earnings (Loss) SELF-EMPLOYMENT EARNINGS (LOSS) Line 14A - Net Earnings (Loss) from Self-Employment - Amounts reported in Box 14, Code A represent the amount of net earnings from self-employment. For Limited Partners this amount generally includes any guaranteed payments received for services rendered to or on behalf of the partnership. 5 Look at the Worksheet for Figuring Net Earnings Loss from Self ... What do they tell you about using the Worksheet? That sec 179 expenses should reduce self-employment income, something not onthe worksheet. Also, TAM 9750001 says that SE losses are only usable against SEincome if the actual losses are deductible under the passive loss rules, somethingalso not on the worksheet.

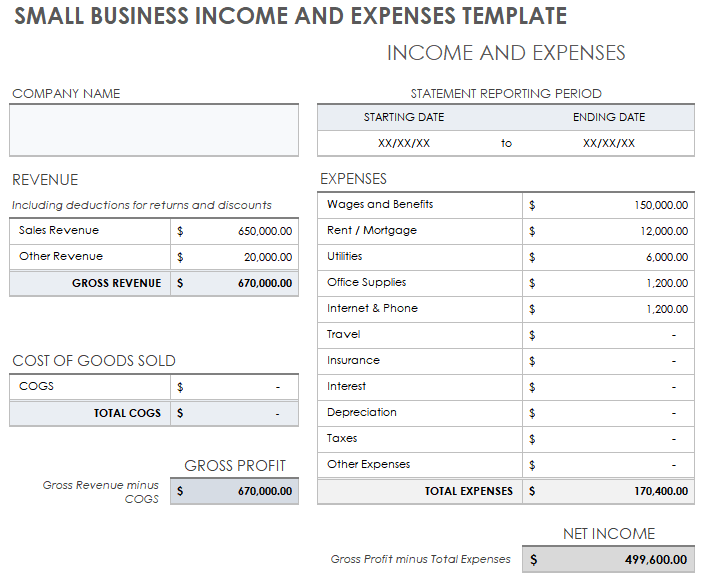

1084 self employed worksheet worksheet income rental calculation mae fannie fillable 1084 cash flow sam form. 29 Worksheet For Figuring Net Earnings Loss From Self Employment - Free dotpound.blogspot.com. worksheet self employment income template figuring earnings worksheets tax plan motivation worksheeto loss care printable. Cash Flow Analysis (Form 1084): PDF studylib.net Schedule K Line 14a (Form 1065) Calculating Self-Employment Earnings Lacerte computes line 14a using the Worksheet for Figuring Net Earnings (Loss) From Self-Employment from page 41 of the 1065 form instructions. To generate Lacerte's version of the Self-Employment worksheet: Click on Settings. Click on Options. Select the Tax Return tab. Scroll down to the Federal Tax Options section. PDF Income Calculations - Freddie Mac Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300. PDF SELF EMPLOYMENT INCOME WORKSHEET - caclmt.org - Net Losses (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value.) > Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). -Income Taxes (federal, state, and local) EXPENSES: 2. Other Income (specify sources): 3. Total Gross Income

Net Earnings (Loss) Definition | Law Insider Worksheet for Figuring Net Earnings (Loss) From Self-Employment 1a Ordinary income (loss) (Schedule K, line 1) b Net income (loss) from certain rental real estate activities (see instructions) c Net income (loss) from other rental activities (Schedule K, line 3c) d Net loss from Form 4797, Part II, line 18, included on line 1a above.

Understanding Schedule K-1 self-employment income for partners ... - Intuit The program creates a worksheet to show the calculation of net earnings from self-employment. Follow these steps to view the Self-Employment Worksheet: Go to the Forms tab. Select Worksheets from the left-side Form window. Select Self-Emp. Worksheet from the left-side Page window. How do I enter adjustments or overrides for self-employment income?

PDF FHA Self-Employment Income Calculation Worksheet Job Aid The FHA Self-Employment Income Calculation Worksheet, which is located at . wholesale.franklinamerican.com under Forms > FHA, is a tool to be used for FHA loans when any borrower is self -employed. • The worksheet is to be used for evaluation of only one self-employment business per borrower. • A new worksheet will need to be used for ...

2021 Instructions for Schedule SE (2021) | Internal Revenue ... Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits.

:max_bytes(150000):strip_icc()/Magi-ea7d64c7ba3f426cb9a7f0bb1382aa15.jpg)

![How to Prepare a Profit and Loss Statement [Free Template]](https://assets-blog.fundera.com/assets/wp-content/uploads/2019/05/22094451/profit-and-loss-statement.jpg)

0 Response to "39 worksheet for figuring net earnings loss from self employment"

Post a Comment