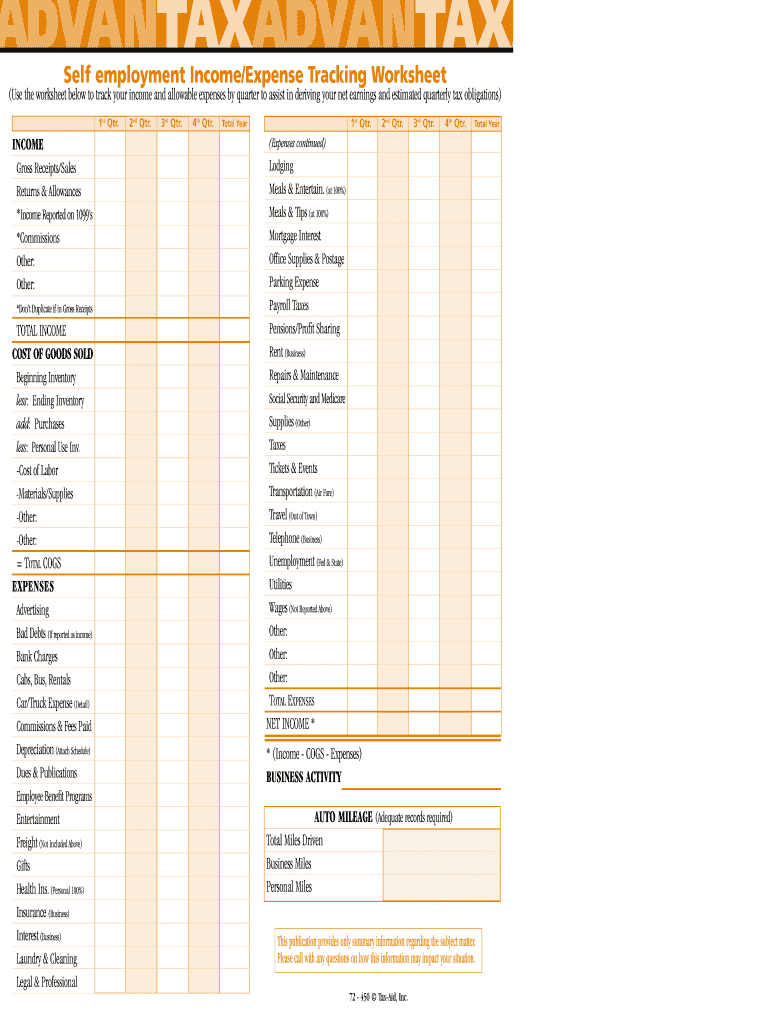

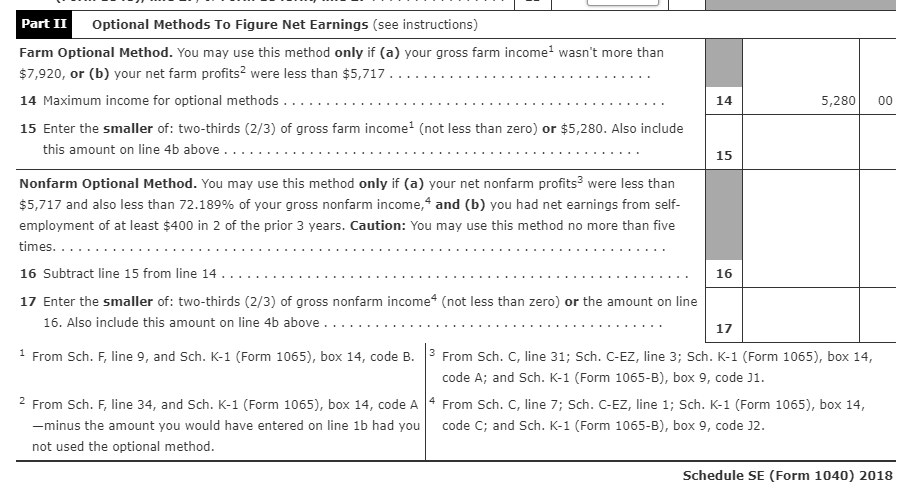

40 worksheet for figuring net earnings loss from self employment

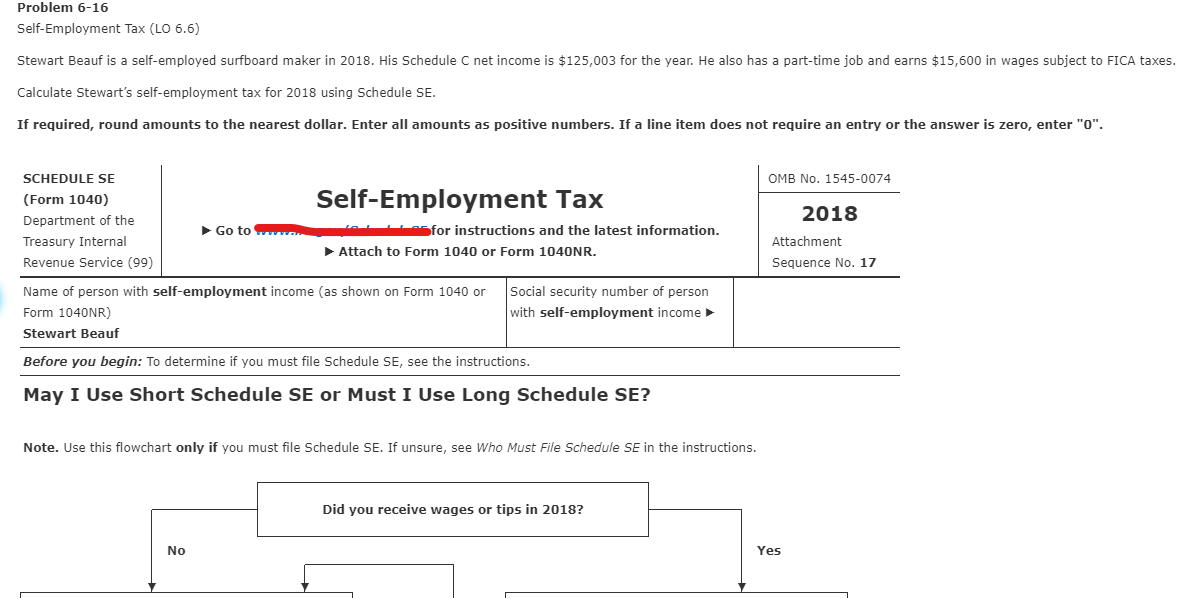

Publication 505 (2022), Tax Withholding and Estimated Tax If self-employed, first complete Worksheet 2-3 to figure your expected deduction for self-employment tax. Subtract the amount from Worksheet 2-3, line 11, to figure the line 1 entry: 1. 2. If you: • Don’t plan to itemize deductions on Schedule A (Form 1040), use Worksheet 2-4 to figure your expected standard deduction. • Publication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions.

Instructions for Form 1065 (2021) | Internal Revenue Service Line 4c. Worksheet for Figuring Net Earnings (Loss) From Self-Employment · Credits · Low-Income Housing Credit · Line 15a.

Worksheet for figuring net earnings loss from self employment

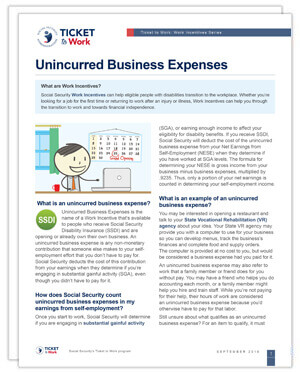

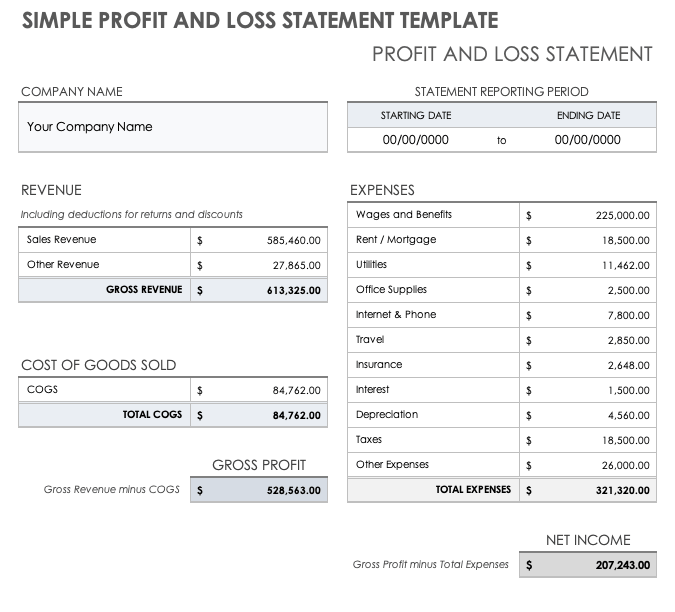

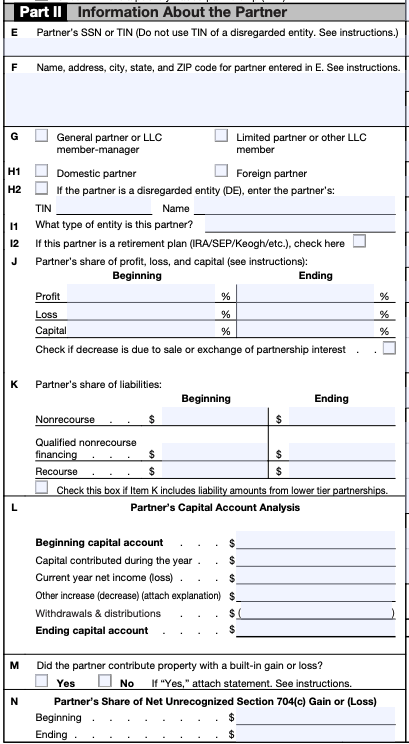

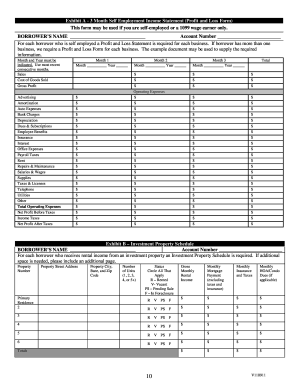

self employed income worksheet: Fill out & sign online - DocHub Self-Employment Tax: Figuring Net Earnings. Regular Method Worksheets; How To Get Tax Help and self-employment income are combined to. Learn more. Self-Employed ... SELF EMPLOYMENT INCOME WORKSHEET (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value. ) > Allowable expenses that can be ... Self-Employment Income Worksheet: Partnership (Schedule K-1 ... INSTRUCTIONS: Complete all the fields on this worksheet. ... Name – Self-Employed Individual. Case Number ... 2 Net rental real estate income or loss.

Worksheet for figuring net earnings loss from self employment. Publication 575 (2021), Pension and Annuity Income Net unrealized appreciation (NUA). The NUA in employer securities (box 6 of Form 1099-R) received as part of a lump-sum distribution is generally tax free until you sell or exchange the securities. (See Distributions of employer securities under Figuring the Taxable Amount, earlier.) However, if you choose to include the NUA in your income for ... Schedule K-1 (Form 1065) - Self-Employment Earnings (Loss) Sep 13, 2020 ... Line 14A - Net Earnings (Loss) from Self-Employment - Amounts reported in Box 14, Code A represent the amount of net earnings from self- ... Schedule K Line 14a (Form 1065) Calculating Self-Employment ... Jul 13, 2022 ... Lacerte computes line 14a using the Worksheet for Figuring Net Earnings (Loss) From Self-Employment from page 41 of the 1065 form ... How do I suppress the self-employment income calculation and ... ... is self-employment income, an "X" on this line suppresses both the calculation and printing of the Net Earnings from Self-Employment worksheet.

Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. 1065 Preparation and Planning Guide 2009 Sidney Kess, Barbara Weltman · 2008 · Business & EconomicsSee Passive Activity Self - Employment Reporting Requirements on page 13 . ... from Worksheet for Figuring Net Earnings ( Loss ) From Self - Employment 3a ... Publication 537 (2021), Installment Sales | Internal Revenue ... Gain or loss. If the FMV of the repossessed property is more than the total of your basis in the obligation plus any repossession costs, you have a gain. If the FMV is less, you have a loss. Your gain or loss on the repossession is of the same character (capital or ordinary) as your gain on the original sale. . 5 Look at the Worksheet for Figuring Net Earnings Loss from Self ... That sec 179 expenses should reduce self - employment income , something not on the worksheet . Also , TAM 9750001 says that SE losses are only usable against ...

1065-US: Calculating Schedule K, line 14a - Net earnings from self ... Note: Enter an amount in the Net earnings (loss) from self-employment (Force) field in ... (This will eliminate the supporting worksheet for the partners.). Publication 334 (2021), Tax Guide for Small Business Maximum net earnings. The maximum net self-employment earnings subject to the social security part of the self-employment tax is $147,000 for 2022. Standard mileage rate. For 2022, the standard mileage rate for the cost of operating your car, van, pickup, or panel truck for each mile of business use is 58.5 cents a mile. Topic No. 554 Self-Employment Tax | Internal Revenue Service Oct 13, 2022 · The law sets a maximum amount of net earnings subject to the social security tax. This amount changes annually. All of your net earnings are subject to the Medicare tax. Optional Methods. If you had a loss or small amount of income from your self-employment, it may be to your benefit to use one of the two optional methods to compute your net ... Self-Employment Income Worksheet: Partnership (Schedule K-1 ... INSTRUCTIONS: Complete all the fields on this worksheet. ... Name – Self-Employed Individual. Case Number ... 2 Net rental real estate income or loss.

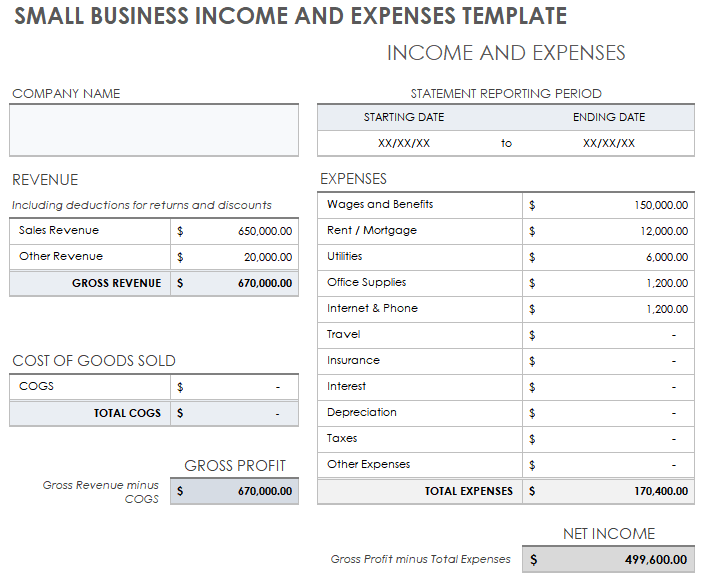

SELF EMPLOYMENT INCOME WORKSHEET (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value. ) > Allowable expenses that can be ...

self employed income worksheet: Fill out & sign online - DocHub Self-Employment Tax: Figuring Net Earnings. Regular Method Worksheets; How To Get Tax Help and self-employment income are combined to. Learn more. Self-Employed ...

0 Response to "40 worksheet for figuring net earnings loss from self employment"

Post a Comment