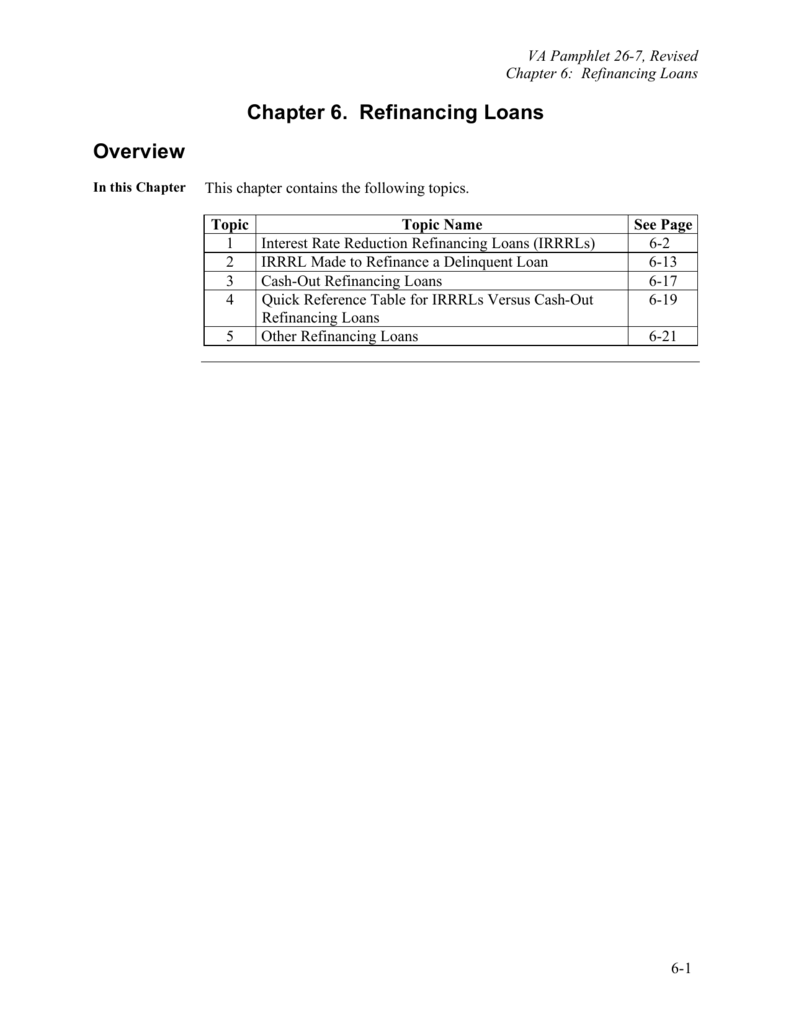

40 interest rate reduction refinancing loan worksheet

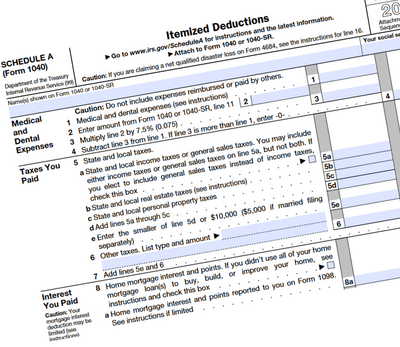

Publication 936 (2021), Home Mortgage Interest Deduction Enter the annual interest rate on the mortgage. If the interest rate varied in 2021, use the lowest rate for the year: 0.09: 3. Divide the amount on line 1 by the amount on line 2. Enter the result: $27,778 Accounting Terminology Guide - Over 1,000 Accounting and ... Aug 10, 1993 · Reduction from the full amount of a price or DEBT. Discount Bond BOND selling below its REDEMPTION VALUE. Discount Rate Rate at which INTEREST is deducted in advance of the issuance, purchasing, selling, or lending of a financial instrument. Also, the rate used to determine the CURRENT VALUE, or present value, of an ASSET or incomestream.

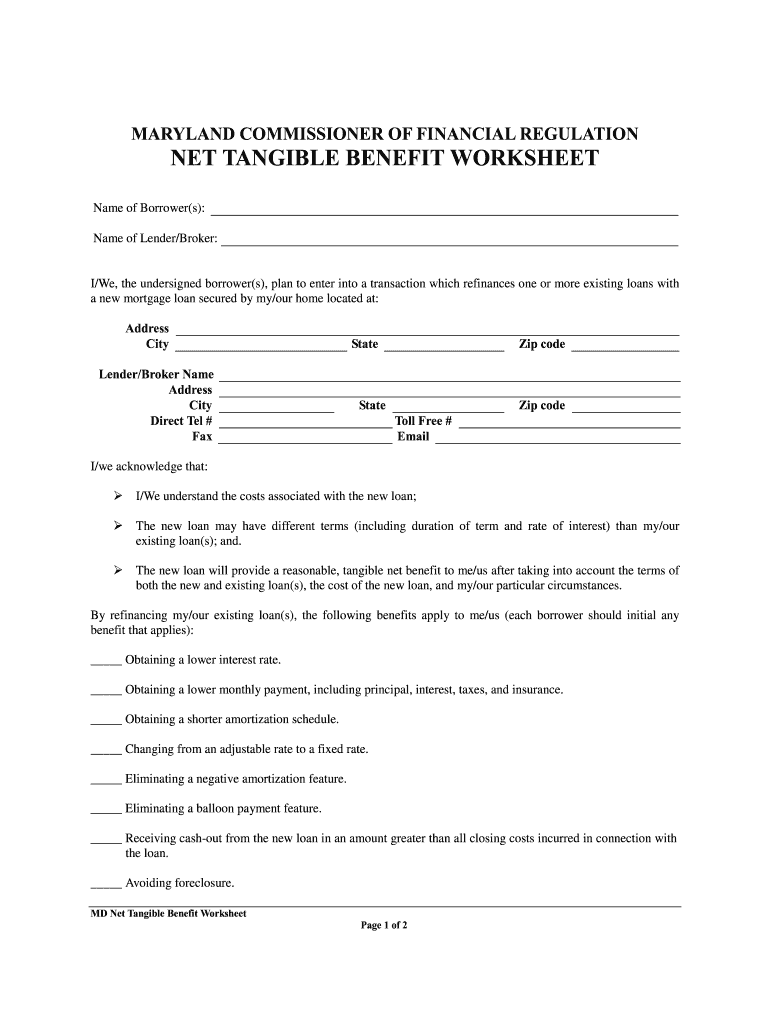

Mortgages key terms | Consumer Financial Protection Bureau An annual percentage rate (APR) is a broader measure of the cost of borrowing money than the interest rate. The APR reflects the interest rate, any points, mortgage broker fees, and other charges that you pay to get the loan. For that reason, your APR is usually higher than your interest rate. Learn how to compare APRs

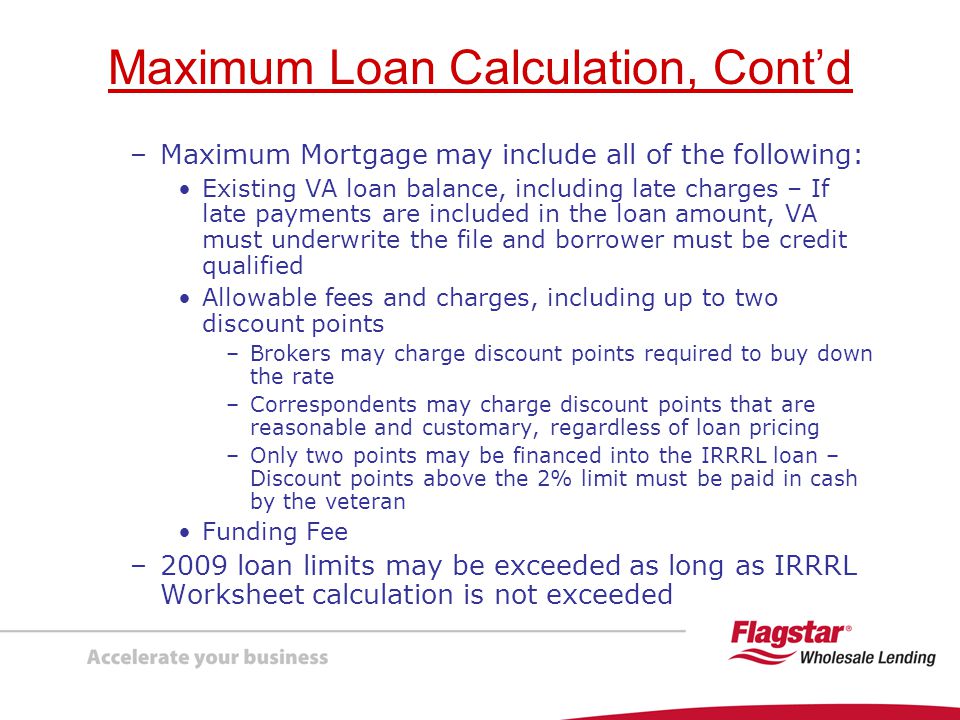

Interest rate reduction refinancing loan worksheet

Course Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The Shockingly Simple Math Behind Early Retirement Jan 13, 2012 · I think by “interest rate on savings”, he means any investment return, not necessarily the interest rate on a savings account in a bank. If you plug in 4%, you’ll get numbers close to what you have in the table above: ln(.50) / 0.04 = 17.329 years to retire at 50% savings rate ln(.80) / 0.04 = 5.5786 years to retire at 80% savings rate Publication 537 (2021), Installment Sales | Internal Revenue ... The test rate of interest for a contract is the 3-month rate. The 3-month rate is the lower of the following applicable federal rates (AFRs). The lowest AFR (based on the appropriate compounding period) in effect during the 3-month period ending with the first month in which there’s a binding written contract that substantially provides the ...

Interest rate reduction refinancing loan worksheet. Instructions for Form 706 (09/2022) | Internal Revenue Service Interest on the portion of the tax in excess of the 2% portion is figured at 45% of the annual rate of interest on underpayments. This rate is based on the federal short-term rate and is announced quarterly by the IRS in the Internal Revenue Bulletin. Publication 537 (2021), Installment Sales | Internal Revenue ... The test rate of interest for a contract is the 3-month rate. The 3-month rate is the lower of the following applicable federal rates (AFRs). The lowest AFR (based on the appropriate compounding period) in effect during the 3-month period ending with the first month in which there’s a binding written contract that substantially provides the ... The Shockingly Simple Math Behind Early Retirement Jan 13, 2012 · I think by “interest rate on savings”, he means any investment return, not necessarily the interest rate on a savings account in a bank. If you plug in 4%, you’ll get numbers close to what you have in the table above: ln(.50) / 0.04 = 17.329 years to retire at 50% savings rate ln(.80) / 0.04 = 5.5786 years to retire at 80% savings rate Course Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

0 Response to "40 interest rate reduction refinancing loan worksheet"

Post a Comment