41 interest rate reduction refinance loan worksheet

Mortgages - Fixed/Adjustable Rates | ESL Federal Credit Union 0.125. 5.954%. 15 year. 5.750%. 0.250. 5.868%. Purchase interest rates accurate as of 12/12/2022, 9:26:23 a.m. Refinance interest rates are not displayed and may be different from purchases. Actual Rates will fluctuate throughout the day and are subject to change without notice. Annual Percentage Rates (APRs) are subject to credit evaluation. San Diego VA IRRRL Streamline Refinance Home Loan in 2023 | 2024 The IRRRL (Interest Rate Reduction Refinance Loan) is also called the VA Streamline Refinance. This loan enables someone to refinance their existing mortgage interest rate to a lower rate. READ: 9 Best Places for Families to Live in San Diego in 2023 | 2024 This loan is quite popular thanks to the fact that it is simple and easy.

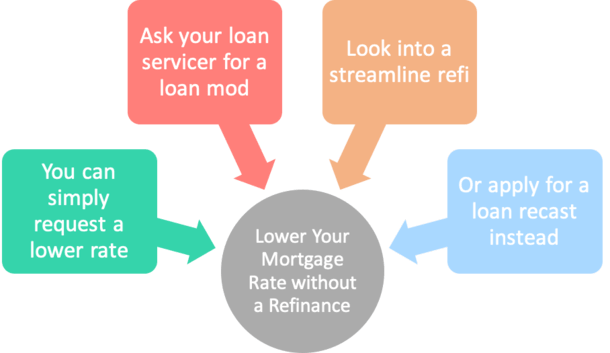

Sarasota VA IRRRL Streamline Refinance - VA Mortgage Hub Refinance of an existing loan to lower interest rates or monthly payments Loan approval essentially requires the borrower to be a good credit risk and able to repay the loan. The property must meet the VA home standards, otherwise known as VA minimum property requirements.

Interest rate reduction refinance loan worksheet

Bluestone announces interest rate cut for SMSF loans By Legal. 14 December 2022 — 1 minute read. A. A. A. Bluestone Home Loans has announced a reduction in interest rates for its SMSF residential loans this week despite the recent RBA rate rise. For loans with a loan to value ratio (LVR) of less than 70 per cent, the lender has reduced the interest rate by 0.40 per cent. Current Mortgage Rates | CapCenter *FHA Program APR Assumptions: (1) Purchases and regular refinance: 96.5% loan-to-value (LTV), (2) Cash-out refinance: 80% LTV ... Regular refinance: origination as Interest Rate Reduction Loan (IRRRL), (3) Cash-out refinance: prior use of a VA-backed loan. Important additional information about Rates. How to use our mortgage rates calculator. VA Loan Rates | Interest.com However, due to the already-low nature of VA home loan rates, VA mortgage rates have experienced little change over the last couple of months. The average VA loan interest rate as of July 8, 2020 is 2.5% for a 30-year fixed mortgage. The average VA loan interest rate as of August 21, 2020 is 2.890% for a 30-year fixed mortgage.

Interest rate reduction refinance loan worksheet. Current Mortgage Rates: Compare Today's Rates | Bankrate On Tuesday, December 13, 2022, the current average rate for the benchmark 30-year fixed mortgage is 7.32%, up 15 basis points over the last week. If you're looking to refinance your current ... Loan Pricing - mnhousing Interest Rates Interest Rates Effective December 12, 2022 at 10:00 a.m. Interest rates are subject to change at any time without advance notice. First Mortgage Loan Interest Rates This document is prepared for Minnesota Housing Participating Lenders and is not intended for consumers: Mortgage Loan Program Interest Rate Information for Lenders How to get personal loans with low interest rate Be it CIBIL, Experian or any other credit bureau, keeping tabs on your credit score and ensuring it is high is the sure-fire way to get a low personal loan interest rate. A credit score tells a ... Apartment Loan Rates 2022 - Multifamily Mortgage Interest Rates After the work is completed and the property is fully stabilized, the borrower can refinance into one of the more conventional, lower-interest rate loan products mentioned in this section. Loan Amount: $1,000,000+ * Not available for all property types or areas; may calculate using LTC instead of LTV ** Interest-Only Construction

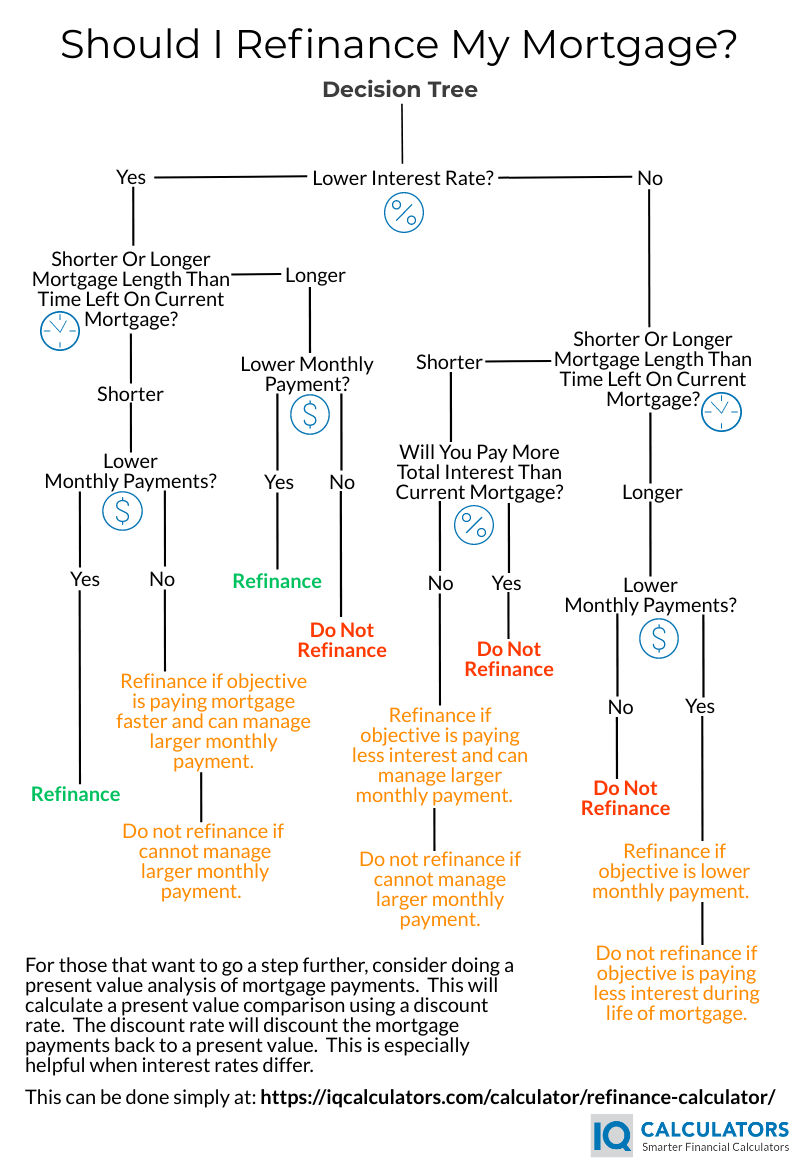

Home Refinance Loans - Current Interest Rates in Georgia Use ERATE ® 's rate chart to compare today's top rates in Georgia and find a lender that's the best fit for you. We recommend that you reach out to at least 2 to 3 mortgage lenders for your refinance loan to ensure you get the best rate and pricing. (Last Updated: 12/11/2022) Home Refinance Loan Georgia Rates Advertiser Disclosure Compare Current Mortgage Refinance Rates - Forbes Advisor Today's Mortgage Refinance Rates The average APR for a 30-year fixed refinance loan fell to 6.78% from 6.79%. This time last week, the 30-year fixed APR was 6.84%. Meanwhile, the average... Car loan interest rates in Canada - finder CA Based on the latest information available from the Bank of Canada in 2022, the average car loan interest rate in Canada is 6.79%. The average buyer can expect to pay anywhere between 5.5% to 8.0% interest on their car loan, depending on whether the car is new or used and whether the interest rate is fixed or variable. Mortgage Interest Rates Today, December 9, 2022 | Rates Hover Near 6.6% ... Today's refinance rates are: 30 Year Fixed Refinance Rates: 6.64% 20-year fixed-rate refinance: 6.56% 15-year fixed refinance rate: 6.08% 10-year fixed refinance rate: 6.11%...

Is a VA Cash-Out Refinance a Good Idea? | The Sacramento Bee If you're looking for a faster VA refinance, try the Interest Rate Reduction Refinance Loan (also called the VA streamline refinance or IRRRL). These don't require appraisals and tend... Car Loan Interest Rate - Compare Car Loan Rates Dec 2022 - Deal4loans Top 20 Car Loan Banks Interest Rates - Updated as on 28 October 2022. Car loan Banks. Interest Rates. EMI per Rs 1 lakh for 7 Years. Axis Bank. 7.99%. Rs. 1,558. Bank Of Baroda. 7.10% - 10.10%. Interest Rate Risk Management.docx - Interest Rate Risk... Options Risk Certain types of loans and deposits give the customer the option (but not the obligation) to alter the level and timing of the loan or deposit's cash flows. Prepayment/refinancing risk arises from a borrower's option to repay a loan, or a portion of a loan, before it is contractually due. Market interest rates are a significant factor affecting prepayments. Today's VA Mortgage Rates | December 2022 | Purchase & Refi There are two main refinance options for VA-eligible borrowers: Interest Rate Reduction Refinance Loan (IRRRL): With one of these, you reduce your interest rate and get a lower...

Federal Reserve is about to hike interest rates once again - so why are ... After soaring for much of 2022, mortgage rates and other long-term rates are starting to come down. The average rate on a 30-year mortgage has fallen 0.75 percentage points in the past month or so, after hitting a 20-year high of 7.08% in early November. Rates reached 6.33% on Dec. 8, the lowest level since September.

Student Loan Refinancing: 5 Best Lenders, Rates, Strategy, and Gude Borrowers with private loans should refinance if they can get a lower interest rate or better loan terms. Refinance Requirements Applicants usually need a credit score in the mid-600s to 700 range. Lenders don't publish Debt-to-Income Ratio requirements, but they look at DTI very closely.

Today's Mortgage Rates, December 13, 2022 | Benchmark Rates Steady ... The average mortgage rates are as follows: Today's average 30-year fixed mortgage rate is 6.63%. Today's 20-year fixed mortgage rate is 6.53%. Today's 15-year fixed mortgage rate is 6.01% ...

PDF 38 CFR 36.4223 - Interest rate reduction refinancing loan The interest rate reduction refinancing€loan€will be guaranteed with the entitlement used by the veteran to obtain the€loan€being refinanced. The veteran's€loan€guaranty entitlement used originally for a purpose as enumerated in€38 U.S.C. 3712(a)(1)(A)€through (E) or (G) and subsequently transferred for use on an interest rate ...

What are Loan Guaranty and Education Benefits for Veterans? Interest Rate Reduction Refinance Loan (IRRRL) The VA Interest Rate Reduction Refinance Loan (IRRRL) lowers your interest rate by refinancing your existing VA home loan. By obtaining a lower interest rate, your monthly mortgage payment should decrease. You can also refinance an adjustable rate mortgage (ARM) into a fixed rate mortgage. IRRRL Facts

New Jersey Housing and Mortgage Finance Agency The New Jersey Housing and Mortgage Finance Agency provides a variety of programs to assist prospective homebuyers and homeowners. The New Jersey Housing and Mortgage Finance Agency (NJHMFA) is dedicated to increasing the availability of and accessibility to safe, decent and affordable housing to families in New Jersey.

Best Auto Loan Refinance Rates for December 2022 | Bankrate Best auto loan refinance rates of November 2022 Best for fast funding LightStream 4.2 See offers Apply on partner site Min. credit score: 700 Fixed APR From: 6.49% -12.49% Loan amount: $0-...

Personal loan interest rates edge up for both 3- and 5-year fixed-rate ... Rates on 3-year fixed-rate loans averaged 12.84%, up from 12.81% the previous seven days and up from 10.99% a year ago. Rates on 5-year fixed-rate loans averaged 16.00%, up from 15.90%...

Home Refinance Loans - Current Interest Rates in Oregon Looking to refinance your existing mortgage loan? Use ERATE ® 's rate chart to compare today's top rates in Oregon and find a lender that's the best fit for you. We recommend that you reach out to at least 2 to 3 mortgage lenders for your refinance loan to ensure you get the best rate and pricing. (Last Updated: 12/11/2022) Home Refinance Loan

Loan Overpayment Calculator - TheMoneyCalculator.com For ISA's, no tax will be deducted from earned interest. For other account types, 20% tax will be deducted at the point the interest in paid. Bonus Rates. When bonus rates expire, the interest rate will revert to the normal rate advertised. In the case of fixed rate bonds, once the bond period ends, no interest will be paid. Interest Period

VA Loan Rates | Interest.com However, due to the already-low nature of VA home loan rates, VA mortgage rates have experienced little change over the last couple of months. The average VA loan interest rate as of July 8, 2020 is 2.5% for a 30-year fixed mortgage. The average VA loan interest rate as of August 21, 2020 is 2.890% for a 30-year fixed mortgage.

Current Mortgage Rates | CapCenter *FHA Program APR Assumptions: (1) Purchases and regular refinance: 96.5% loan-to-value (LTV), (2) Cash-out refinance: 80% LTV ... Regular refinance: origination as Interest Rate Reduction Loan (IRRRL), (3) Cash-out refinance: prior use of a VA-backed loan. Important additional information about Rates. How to use our mortgage rates calculator.

Bluestone announces interest rate cut for SMSF loans By Legal. 14 December 2022 — 1 minute read. A. A. A. Bluestone Home Loans has announced a reduction in interest rates for its SMSF residential loans this week despite the recent RBA rate rise. For loans with a loan to value ratio (LVR) of less than 70 per cent, the lender has reduced the interest rate by 0.40 per cent.

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

:max_bytes(150000):strip_icc()/GettyImages-183784889-5a6b3eddfa6bcc0037f464b0.jpg)

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

0 Response to "41 interest rate reduction refinance loan worksheet"

Post a Comment