45 form 886 a worksheet

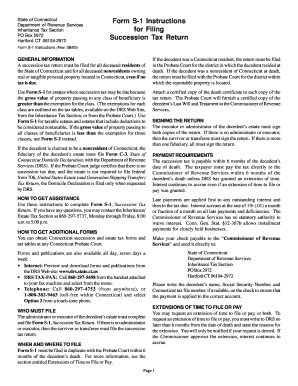

8.17.5 Special Computation Formats, Forms and Worksheets | Internal ... If a Counsel case is received by APS and no worksheet was previously completed in Appeals or a revised worksheet is needed, APS may prepare a Request for Audit Work, Form 3608, requesting that TCS complete the Form 5403 Worksheet. Counsel's IRM is called the Chief Counsel Directives Manual, or CCDM. Forms 886 Can Assist You | Earned Income Tax Credit - IRS tax forms Forms 886 Can Assist You Some tax preparers told us they are uncomfortable asking the probing, sometimes sensitive questions necessary to meet the due diligence knowledge requirement. Consider using the forms IRS uses to request documentation during audits. Tell your clients here's what you need to support your claim if you are audited by IRS.

Tax Dictionary - Form 886A, Explanation of Items | H&R Block IRS Definition Form 886A, Explanation of Items explains specific changes to your return and why the IRS didn't accept your documentation. More from H&R Block In addition to sending Form 4549 at the end of an audit, the auditor attaches Form 886A to provide an explanation as to why your documentation was not accepted.

Form 886 a worksheet

PDF Mortgage Deduction Limit Worksheet - adftaxes.com 1) 2) Enter the average balance of all home acquisition debt incurred prior to December 16, 2017............................................ 2) 3) Enter $1,000,000 ($500,000 if married filing separately).......................................................................................................... Is there a downloadable/fillable version of Schedule C-7 (Form 886-A ... The IRS uses Form 886A to requests information or to explain items they propose to adjust in an audit. They often request more information than what they really need but you also have a duty to supply sufficient evidence to win your case. Income Issues: The IRS has reviewed and has noticed a discrepancy in the items reported. Forms and Instructions (PDF) - IRS tax forms Earned Income Credit Worksheet (CP 09) (Spanish Version) 0322 06/02/2022 Form 15112 (sp) Earned Income Credit Worksheet (CP 27) (Spanish Version) 0122 06/02/2022 ... Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children 1019 07/31/2020 Form 13588 (sp) ...

Form 886 a worksheet. PDF 886-H-EIC Documents You Need to Send to Claim the Earned Income Credit ... Catalog Number 35113Qwww.irs.govForm 886-H-EIC (Rev. 10-2020) We must have proof for all three: you are related to the child, the child lived with you and the child's age. If you don't have or can't get the legal documents that we ask for, you can't claim EITC with that child. But, you may still be eligible for EIC without a qualifying child. PDF 886-H-HOH (October 2020) Supporting Documents to Prove Head of ... Form 886-H-HOH Form 886-H-HOH (October 2020) Department of the Treasury - Internal Revenue Service Supporting Documents to Prove Head of Household Filing Status You may qualify for Head of Household filing status if you meet the following three tests: Marriage Test, Qualifying Person Test, and Cost of Keeping up a Home Test. PDF Irs form 886 a worksheet - premiercontainerlines.com Submit Form 886 A completed worksheet no longer needs to be confused. If there is a need to change any information³ the on-line editing tool ³ its wide range of instruments is ready for use. Download the new document to your device by clicking Done. This form is mainly informative. Add the date and place your e-³ graph once you complete all ... PDF Form 886-L (Rev. December 2014) Form 886-L (Rev. 12-2014) Catalog Number 73202A Department of the Treasury - Internal Revenue Service Form 886-L (Rev. December 2014) Supporting Documents Please provide a photocopy of the document or documents requested below. Return the photocopies with this form in the envelope provided. Name of Taxpayer Tax Identification Number ...

Get Form 886 A Worksheet Fillable - US Legal Forms Follow these simple instructions to get Form 886 A Worksheet Fillable prepared for sending: Select the form you require in the collection of templates. Open the template in our online editor. Read through the recommendations to find out which details you will need to give. Click on the fillable fields and include the necessary details. PDF EITC Audit Document Checklist Form 886-H-EIC Toolkit - IRS tax forms Use this checklist as you prepare the response to your audit letter by going through the toolkit. Use a new checklist for each child listed on your return. Remember: If at any time, going through this toolkit, you find you won't be able to get the information to the IRS within the 30 days, call the number on the notice to ask for more time. PDF Form 886-H-DEP Supporting Documents for Dependents - IRS tax forms A statement from any government agency verifying the amount and type of benefits you and/or your dependent received for the year. Rental agreements or a statement showing the fair rental value of your residence (proof of lodging cost). Utility and repair bills (proof of household expenses) with canceled checks or receipts. 8863 Credit Limit Worksheet - Fill Out and Use - FormsPal Step 2: You will find all of the functions that it's possible to use on your file once you have accessed the 8863 credit limit worksheet form editing page. The PDF form you desire to create will consist of the following parts: Step 3: Select "Done". It's now possible to transfer your PDF form. Step 4: Get a minimum of several copies of your ...

Forms and Instructions (PDF) - IRS tax forms Earned Income Credit Worksheet (CP 27) (Spanish Version) 0722 08/18/2022 Form 15112: Earned Income Credit Worksheet (CP 27) 0722 08/17/2022 Form 13588 (sp) ... Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children 1019 07/31/2020 ... Form 886 A Worksheet - Fill Online, Printable, Fillable, Blank - pdfFiller Сomplete the form 886 a worksheet for free Get started! Related Content - irs form 886 a worksheet Internal Revenue Manual - 4.19.15 Discretionary Programs (Cont. 3) Use Form 886-H-FTHBC-LTR, First-Time Homebuyer Credit or Special Rule for Long-Time Resident Supporting Documents, when requesting documentation for ... PDF Deduction Interest Mortgage - IRS tax forms You file Form 1040 or 1040-SR and item-ize deductions on Schedule A (Form 1040). • The mortgage is a secured debt on a quali-fied home in which you have an ownership interest. Secured Debt and Qualified Home are explained later. Both you and the lender must intend that the loan be repaid. Note. Interest on home equity loans and IRS Form 886A | Tax Lawyer Shows What to do in Response - TaxHelpLaw Most often, Form 886A is used to request information from you during an audit or explain proposed adjustments in an audit. This form is extremely important because the IRS will want their questions answered by you! Audit Procedure You will need to provide more than just a few cancelled checks to the government.

Form 886 A Worksheet For Qualified Loan Limit - pdfFiller Fill Form 886 A Worksheet For Qualified Loan Limit, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. Try Now!

Recd a Form 886-A worksheet re Qualified Loan limit and Ded. - JustAnswer Rec'd a Form 886-A worksheet pre Qualified Loan limit and Ded. Mort Interest. Ask an Expert. Tax Questions. Disclaimer: Information in questions, answers, and other posts on this site ("Posts") comes from individual users, not JustAnswer; JustAnswer is not responsible for Posts. Posts are for general information, are not intended to substitute ...

I have to fill out a form 886-A and send it to the IRS along… I'm not sure how to fill out the 886-A form? Accountant's Assistant: The accountant will know how to help. Please tell me more, so we can help you best. The IRS wants mortgage interest information sent back to them. So they are asking me to do the worksheet 886-A and sent them a 1098 from the mortgage holder

Forms and Instructions (PDF) Additional Child Tax Credit Worksheet 0321 03/22/2021 Form 15110 (sp) Additional Child Tax Credit Worksheet (Spanish Version) 0122 06/02/2022 Form 1040 (Schedule 3) ... Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children 1019 07/31/2020 Form 1040 (Schedule EIC) ...

Form 886 A Worksheet - Fill Online, Printable, Fillable, Blank - pdfFiller form 886 a. Form 886A (Rev. January 1994)EXPLANATIO NS OF ITEMSSchedule number or exhibitName of taxpayer Identification Lumberyard/Peri od ended Your plan submitted. Please provide the information requested in the attached Form 886-A, Explanation of Items, within 20 days of the date of this letter. Failure to provide.

Form 886 A Worksheet - Fill and Sign Printable Template Online Make sure the information you add to the Form 886 A Worksheet is up-to-date and accurate. Add the date to the document using the Date tool. Click the Sign tool and create an electronic signature. Feel free to use 3 available choices; typing, drawing, or uploading one. Make sure that each field has been filled in properly.

Form 886-A Schedule C-5 is asking for a log of business - JustAnswer Form 886-A Schedule C-5... Form 886-A Schedule C -5 is asking for a log of business mileage which i can provide, but it also asks for two receipts/documents showing mileage at the beginning and at the end of the year for each vehicle.

PDF 886-H-HOH (October 2019) Supporting Documents to Prove Head of ... Form 886-H-HOH Form 886-H-HOH (October 2019) Department of the Treasury-Internal Revenue Service Supporting Documents to Prove Head of Household Filing Status You may qualify for Head of Household filing status if you meet the following three tests: Marriage Test, Qualifying Person Test, and Cost of Keeping up a Home Test.

Form 886-A Deductible Home Mortgage Interest Taxpayer has… IRS auditing 2015 Federal Return regarding reverse mortgage accumulated interest on 1098 for $93k. Sent Form 886-A Worksheet for Qualified Loan Limit and Deductible Home Mortgage Interest. … read more

PDF 886-A EXPLANATIONS OF ITEMS - IRS tax forms Form 886-A EXPLANATIONS OF ITEMS Schedule number or exhibit (Rev. January 1994) Name of taxpayer Tax Identification Number Year/Period ended N/A Please check the appropriate boxes and answer the following questions: 1. Please specify the reason for filing the form 5310-A, see instructions for appropriate codes for line 1.

PDF Irs form 886-a worksheet instructions 2020 form pdf download Irs form 886-a worksheet instructions 2020 form pdf download. ... The Braille Ready File format is a widely recognized form of contracted Braille that can be read with a refreshable Braille display or embossed to produce high quality hard-copy Braille. Some mobile devices can read .brf files using eBook reading software, contact your software ...

Forms and Instructions (PDF) - IRS tax forms Earned Income Credit Worksheet (CP 09) (Spanish Version) 0322 06/02/2022 Form 15112 (sp) Earned Income Credit Worksheet (CP 27) (Spanish Version) 0122 06/02/2022 ... Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children 1019 07/31/2020 Form 13588 (sp) ...

Is there a downloadable/fillable version of Schedule C-7 (Form 886-A ... The IRS uses Form 886A to requests information or to explain items they propose to adjust in an audit. They often request more information than what they really need but you also have a duty to supply sufficient evidence to win your case. Income Issues: The IRS has reviewed and has noticed a discrepancy in the items reported.

PDF Mortgage Deduction Limit Worksheet - adftaxes.com 1) 2) Enter the average balance of all home acquisition debt incurred prior to December 16, 2017............................................ 2) 3) Enter $1,000,000 ($500,000 if married filing separately)..........................................................................................................

0 Response to "45 form 886 a worksheet"

Post a Comment