41 irs form 886 a worksheet

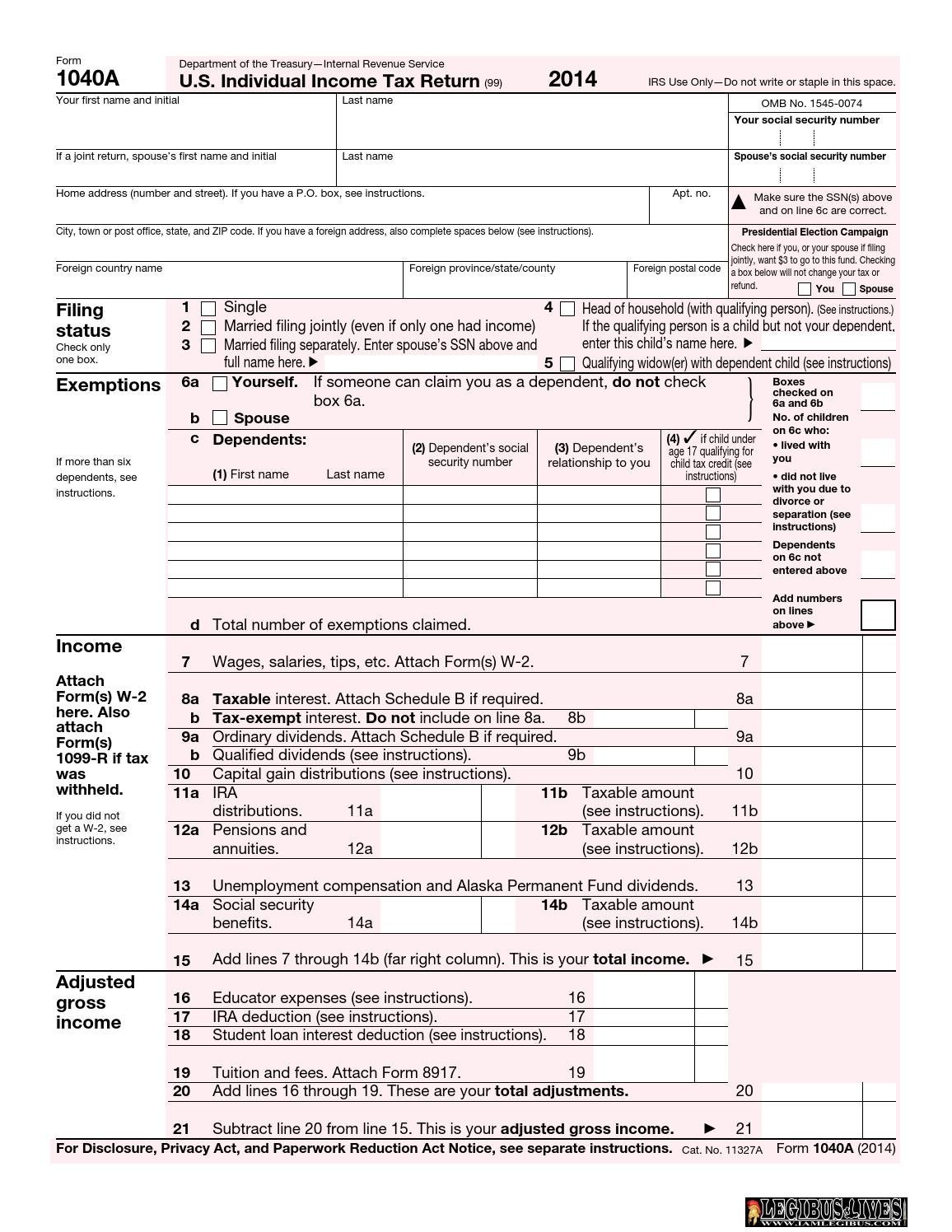

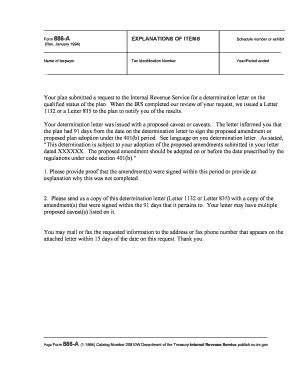

PDF Form 886-H-DEP Supporting Documents for ... - IRS tax forms Catalog Number 35111U. Form 886-H-DEP (Rev. 10-2019) . Form 886-H-DEP (October 2019) Department of the Treasury-Internal Revenue Service . Supporting Documents for Dependents PDF Form 886-A - IRS tax forms Form 886-A EXPLANATIONS OF ITEMS Schedule number or exhibit (Rev. January 1994) Name of taxpayer Tax Identification Number Year/Period ended __ Your plan submitted a request to the Internal Revenue Service for a determination letter on the qualified status of the plan.

Form 886 A - Fill Out and Sign Printable PDF Template ... irs form 886-a worksheet for qualified loan limit. form 886-h-dep. form 4549. irs form 13825. explanation of items irs. irs form 886i. form 866 a worksheet. Create this form in 5 minutes! Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Irs form 886 a worksheet

Form 886 A Worksheet - Fill and Sign Printable Template ... Click the orange Get Form option to begin filling out. Turn on the Wizard mode on the top toolbar to get more recommendations. Fill in every fillable area. Make sure the information you add to the Form 886 A Worksheet is up-to-date and accurate. Add the date to the document using the Date tool. Click the Sign tool and create an electronic signature. Feel free to use 3 available choices; typing, drawing, or uploading one. Form 886 A Worksheet Fillable - Fill and Sign Printable ... Follow these simple instructions to get Form 886 A Worksheet Fillable prepared for sending: Select the form you require in the collection of templates. Open the template in our online editor. Read through the recommendations to find out which details you will need to give. Click on the fillable fields and include the necessary details. PDF Deduction Interest Mortgage - IRS tax forms Table 1, which is a worksheet you can use to figure the limit on your deduction. Comments and suggestions. We welcome your comments about this publication and sug-gestions for future editions. You can send us comments through IRS.gov/FormComments. Or, you can write to the Internal Revenue Service, Tax Forms and

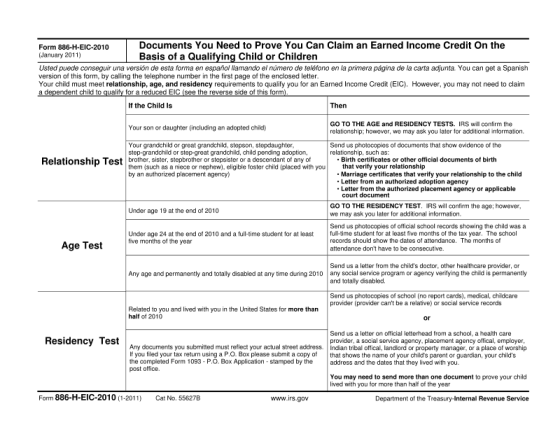

Irs form 886 a worksheet. Section 5. Special Computation Formats ... - IRS tax forms Form 886-W, Distribution of Beneficiaries' Share of Income and Credit, is a distribution schedule of beneficiaries' shares of income, credits, etc. Use either Form 4605-A or pattern a schedule to fit the needs of the case, when adjusting fiduciary income. 8.17.5.8 (09-24-2013) Net Worth Method PDF EITC Audit Document Checklist Form 886-H-EIC Toolkit EITC Audit Document Checklist Form 886-H-EIC Toolkit. 3 Post Office) • Your child's U.S. address • The dates the child lived at the same address as you (the dates must be inthe tax year on your notice and the dates must cover more than half of the tax year on the notice) I have or can get a document or documents showing the irs form 886-a worksheet - Fill Online, Printable ... Get the irs form 886-a worksheet and fill it out with the feature-rich PDF editor. Work easily and keep your data risk-free with irs form 886-a worksheet online. Irs form 886-a worksheet. Get . Irs 886-a worksheet Form 2017-2022. Get Form. Home; TOP Forms to Compete and Sign; Tax Dictionary - Form 886A, Explanation of Items | H&R Block IRS Definition. Form 886A, Explanation of Items explains specific changes to your return and why the IRS didn't accept your documentation. More from H&R Block. In addition to sending Form 4549 at the end of an audit, the auditor attaches Form 886A to provide an explanation as to why your documentation was not accepted. Form 886A may include the facts, tax law, your position, the IRS ...

Forms 886 Can Assist You | Earned Income Tax Credit Mar 09, 2022 · Most of the forms are available in both English and Spanish. For example, you could use the Form 886-H-EIC PDF and/or the 886-H-EIC (Spanish Version) PDF, Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children for Tax Year 2021. Review the document with your client, showing the client the ... Forms and Publications (PDF) - IRS tax forms Form 886-H-DEP (SP) Supporting Documents for Dependency Exemptions (Spanish Version) 1019 07/31/2020 Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children 1019 07/31/2020 Form 886-H-EIC (SP) PDF 886-H-HOH (October 2020) Supporting ... - IRS tax forms Form . 886-H-HOH (October 2020) Department of the Treasury - Internal Revenue Service . Supporting Documents to Prove Head of Household Filing Status. You may qualify for Head of Household filing status if you meet the following three tests: Marriage Test, Qualifying Person Test, and Cost of Keeping up a Home Test. ... Instructions for Form 8863 (2021) | Internal Revenue Service Form 2555-EZ will no longer be available beginning with tax year 2019. You will file Form 1040 or 1040-SR; all references to these instructions have been revised accordingly. If you need to file a prior year tax return, use the form and instructions revision for that tax year. .

PDF 886-H-EIC Documents You Need to Send to ... - IRS tax forms Visite IRS.gov/espanol para buscar la versión en español del Formulario 886-H-EIC (SP) (Rev. 10-2020) o llame al 1-800-829-3676. Visit IRS.gov/eitc to find out more about who qualifies for EIC. 1. Each child that you claim must have lived with you for more than half of 2020* in the United States. The United States includes the 50 states and the IRS Form 886A | Tax Lawyer Shows What to do in Response ... Most often, Form 886A is used to request informationfrom you during an audit or explain proposed adjustmentsin an audit. This form is extremely importantbecause the IRS will want their questions answered by you! Audit Procedure You will need to provide more than just a few cancelled checks to the government. PDF 886-H-HOH (October 2019) Supporting ... - IRS tax forms Form . 886-H-HOH (October 2019) Department of the Treasury-Internal Revenue Service . Supporting Documents to Prove Head of Household Filing Status. You may qualify for Head of Household filing status if you meet the following three tests: Marriage Test, Qualifying Person Test, and Cost of Keeping up a Home Test. ... Forms and Publications (PDF) - IRS tax forms Form 886-H-DEP: Supporting Documents for Dependency Exemptions 1019 07/31/2020 Form 886-H-DEP (SP) Supporting Documents for Dependency Exemptions (Spanish Version) 1019 07/31/2020 Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children ...

Forms and Publications (PDF) - IRS tax forms Possible Federal Tax Refund Due to the Earned Income Credit (EIC) 1221 12/15/2021 Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children 1019 07/31/2020 Form 886-H-EIC (SP) Documents You Need to Provide So You Can Claim the Earned Income Credit on the Basis of a Qualifying ...

Is there a downloadable/fillable version of Schedule C-7 ... IRS Notices - Audit Form 886A. The IRS uses Form 886A to requests information or to explain items they propose to adjust in an audit. They often request more information than what they really need but you also have a duty to supply sufficient evidence to win your case. Income Issues: The IRS has reviewed and has noticed a discrepancy in the ...

PDF Deduction Interest Mortgage - IRS tax forms Table 1, which is a worksheet you can use to figure the limit on your deduction. Comments and suggestions. We welcome your comments about this publication and sug-gestions for future editions. You can send us comments through IRS.gov/FormComments. Or, you can write to the Internal Revenue Service, Tax Forms and

Form 886 A Worksheet Fillable - Fill and Sign Printable ... Follow these simple instructions to get Form 886 A Worksheet Fillable prepared for sending: Select the form you require in the collection of templates. Open the template in our online editor. Read through the recommendations to find out which details you will need to give. Click on the fillable fields and include the necessary details.

Form 886 A Worksheet - Fill and Sign Printable Template ... Click the orange Get Form option to begin filling out. Turn on the Wizard mode on the top toolbar to get more recommendations. Fill in every fillable area. Make sure the information you add to the Form 886 A Worksheet is up-to-date and accurate. Add the date to the document using the Date tool. Click the Sign tool and create an electronic signature. Feel free to use 3 available choices; typing, drawing, or uploading one.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "41 irs form 886 a worksheet"

Post a Comment