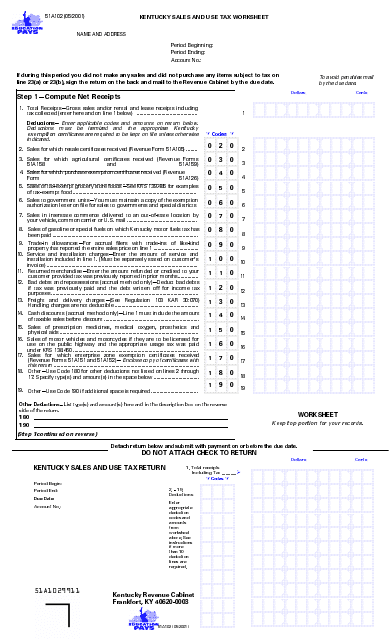

40 kentucky sales and use tax worksheet

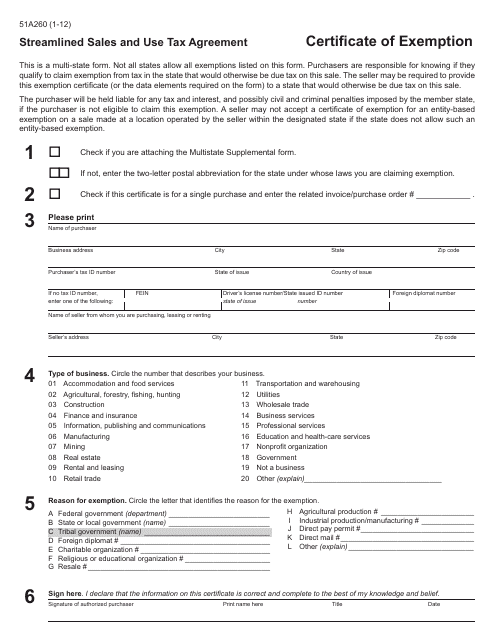

Tax-Rates.org provides free access to printable PDF versions of the most popular Montana tax forms. Be sure to verify that the form you are downloading is for the correct year. Keep in mind that some states will not update their tax forms for 2022 until January 2023. Displaying all worksheets related to - Ky Sales And Use Tax. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Application for fueltax refund for use of power takeoff, Department of revenue, Nebraska and local sales and use tax return form, These materials are, Work and where to file, State of new jersey.

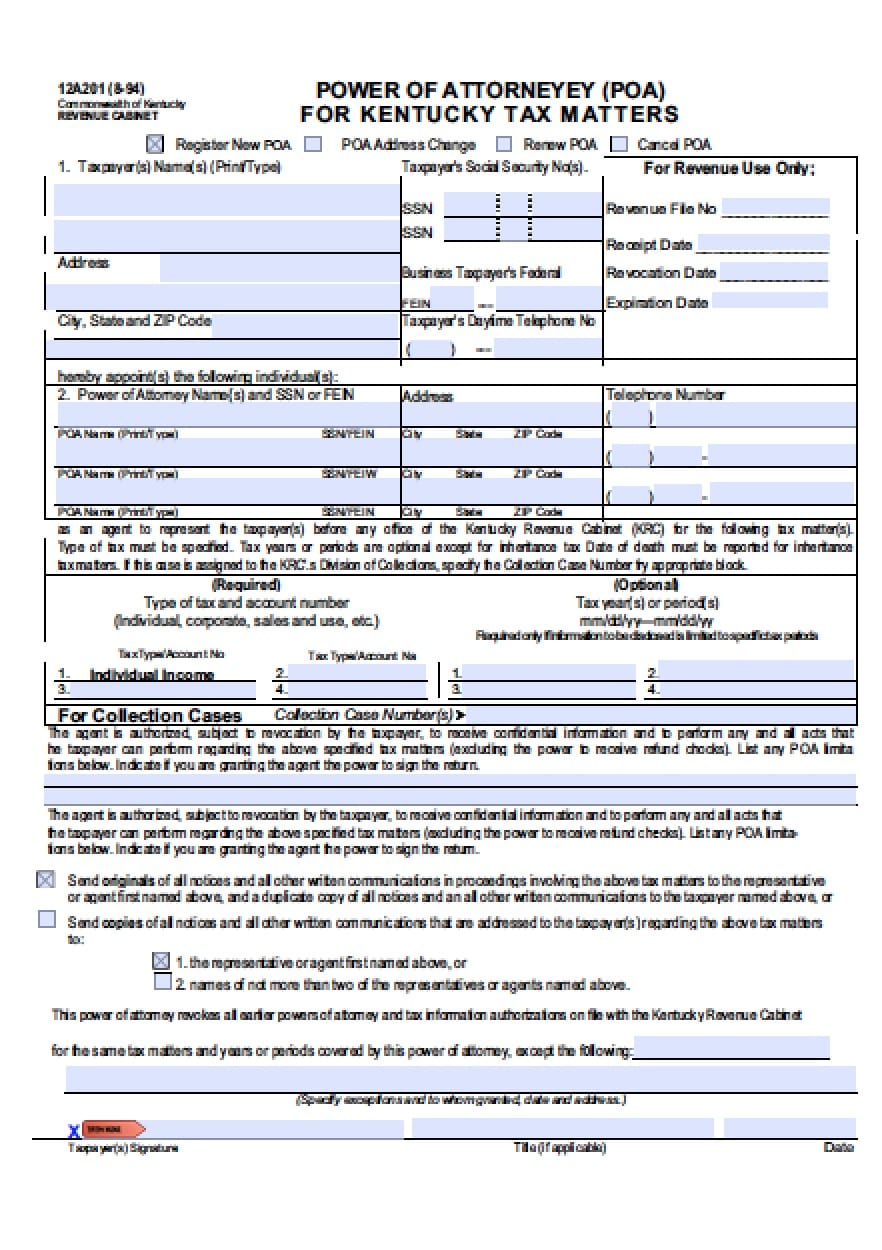

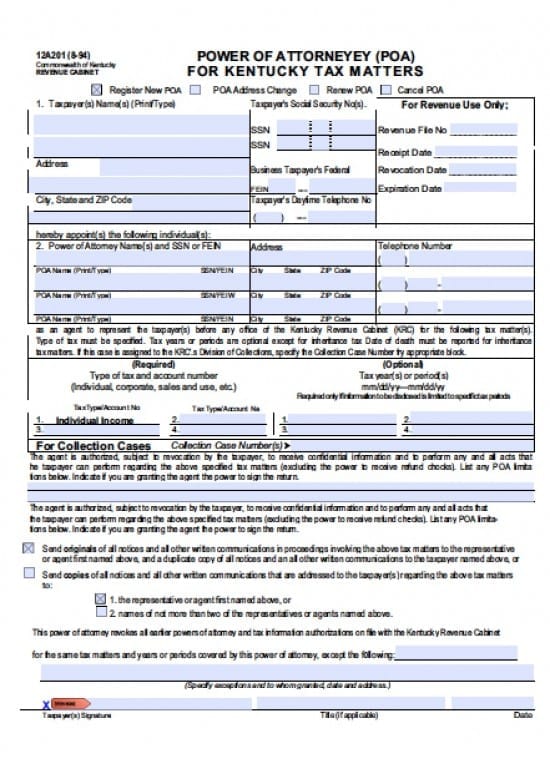

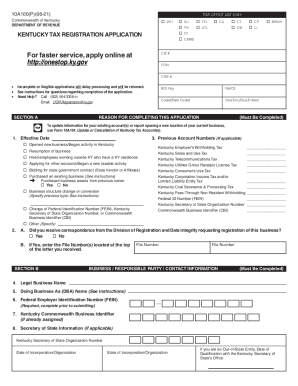

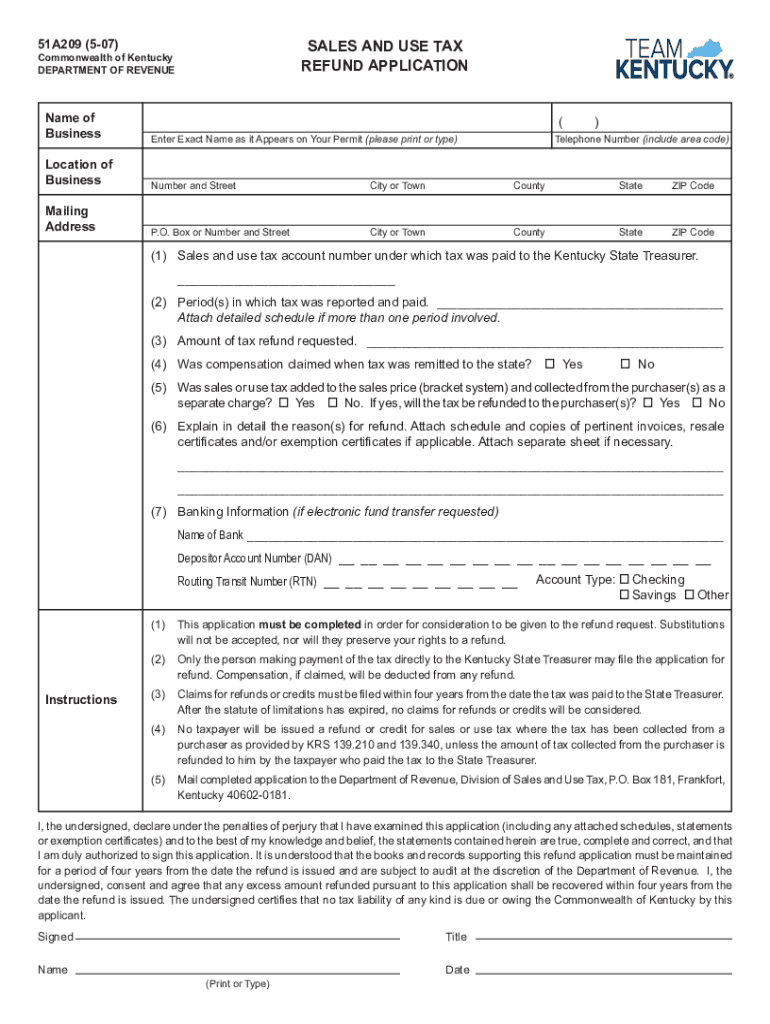

Therefore, DOR guidance cannot be appealed to the Kentucky Claims Commission, Tax Appeals. Also, a taxpayer may not file a protest based on issuance of DOR guidance. If a taxpayer disagrees with DOR guidance, he or she may file a return contrary to the DOR guidance and may either seek a refund for any overpayment or may protest an assessment …

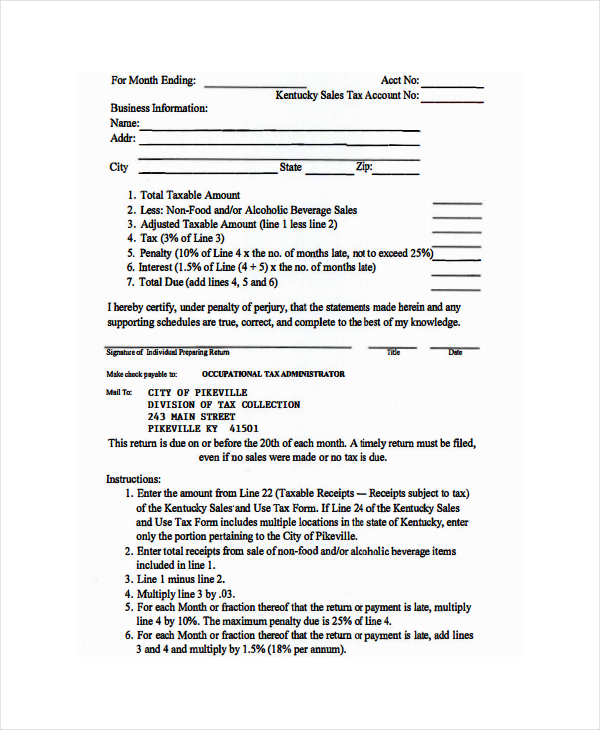

Kentucky sales and use tax worksheet

Displaying all worksheets related to - Kentucky Sales And Use Tax. Worksheets are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. Form IN-111: Vermont Income Tax Return : Use Tax Worksheet: Vermont Use Tax Worksheet : Schedule IN-112: Vermont Tax Adjustments and Credits : Schedule IN-113: Vermont Income Adjustment Schedules : Form IN-116: Income Tax Payment Voucher : Schedule IN-117: Credit for Income Tax Paid to Other State or Canadian Province KENTUCKY SALES AND USE TAX WORKSHEET Period Beginning: Period Ending: Account No.. To avoid penalties mail by the due date. Cents If during this period you did not make any sales and did not purchase any items subject to tax on line 23(a) or 23(b), sign the return on the back and mail to the Department of Revenue by the due date. Dollars

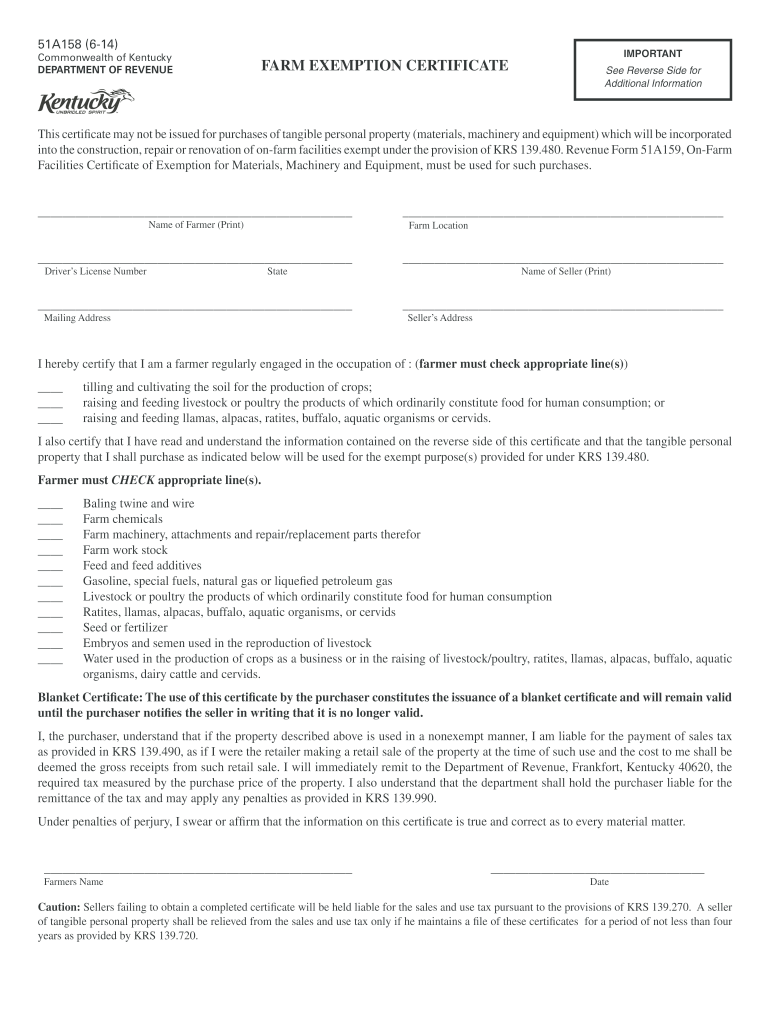

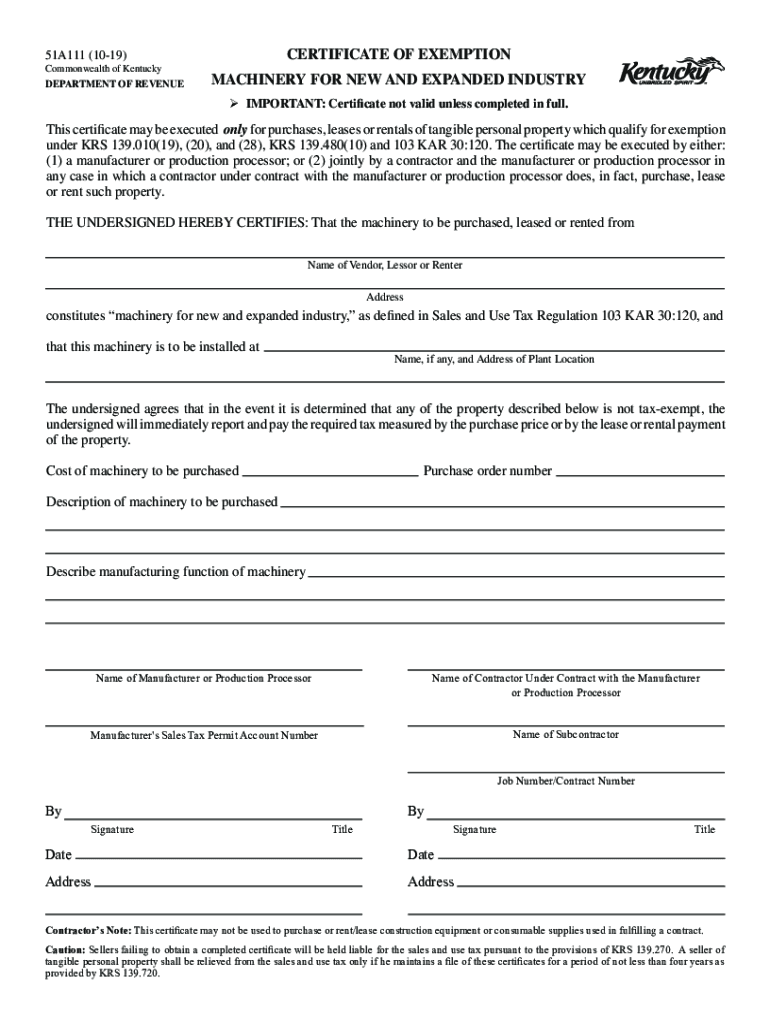

Kentucky sales and use tax worksheet. Showing top 8 worksheets in the category - Kentucky Sales And Use Tax. Some of the worksheets displayed are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. For Sales: 844-877-9422. Sign in. Sign in. Lacerte. ProSeries. ProConnect. Other Intuit Services. Products . Professional tax software. Intuit Lacerte Tax. Tap into highly powerful tools designed for complex returns and multiple preparers. Intuit ProConnect Tax. Gain added flexibility delivered fully on the cloud with nothing to download. Intuit ProSeries Tax. Get simple forms-based … Tax-Rates.org provides free access to printable PDF versions of the most popular Illinois tax forms. Be sure to verify that the form you are downloading is for the correct year. Keep in mind that some states will not update their tax forms for 2022 until January 2023. The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes.

Your trusted 1040 tax book for quick reference tax answers. The 1040 Quickfinder Handbook is your trusted source for quick reference to tax principles that apply when preparing individual income tax returns.It covers all aspects of preparing a Form 1040, including tax law changes and IRS developments, and is presented in a concise, easy-to-use format. If you are still unable to access the form you need, please Contact Us for assistance. Main Content. Filter Results. Search within. Forms 30. Tax Type. 24.01.2022 · Use Military Worksheet B to compute the local tax for the civilian taxpayer. If you are not certain which filing status to use, figure your tax both ways to determine the best status for you. For more information, see Instruction 26 in the resident booklet . COVID-19 TAX ... If you are still unable to access the form you need, please Contact Us for assistance. Main Content. Filter Results. Search within. Forms.

01.05.2001 · Download Printable Form 51a102 In Pdf - The Latest Version Applicable For 2022. Fill Out The Sales And Use Tax Worksheet - Kentucky Online And Print It Out For Free. Form 51a102 Is Often Used In Kentucky Tax Forms, Kentucky Department Of Revenue, Kentucky Legal Forms, United States Tax Forms, Tax And United States Legal Forms. In Kentucky, child support orders are enforced through the Child Support Enforcement program (CSE), which is a division of the Department for Income Support. The CSE has many resources at their fingertips that can help them enforce your child support order. Some of the tactics they might take include intercepting the non-custodial parent's state and/or federal tax refunds, … The use tax is a tax on tangible personal property and digital property used in Kentucky upon which the sales tax has not been paid. In other words, it is a sort of “backstop” for the sales tax. Consumer Use Tax Return - Form 51A113(O) may be filed during the year each time you make taxable purchases. · You can report and pay use tax on an annual basis ...

your tax preparer. If you are claiming a credit for tax paid to a local government, attach copies of your local tax return or W-2 form(s) showing local wages. Line 9: Taxable IRA distributionsIf you are a dual resident of Illinois and Iowa, Kentucky, Michigan, or Wisconsin and you are claiming this credit, attach copies of the out-of-state returns.

of which is subject to Kentucky sales tax, is not subject to the use tax. From its inception in 1960 until 1986, the sales and use tax was the most productive tax in the General Fund. In 1986, it was surpassed by the individual income tax and continues to be the second most productive today. Receipts for FY07 totaled $2,817.7

Use a kentucky sales and use tax worksheet 51a102 1997 template to make your document workflow more streamlined. Get form Perfected upon receipt at the following address: Division of Security & Compliance, Department of Workers’ Claims, Prevention Park, 657 Chamberlin Ave., Frankfort, KY 40601.

The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for ...

KENTUCKY SALES AND USE TAX WORKSHEET Period Beginning: Period Ending: Account No.. To avoid penalties mail by the due date. Cents If during this period you did not make any sales and did not purchase any items subject to tax on line 23(a) or 23(b), sign the return on the back and mail to the Department of Revenue by the due date. Dollars

Form IN-111: Vermont Income Tax Return : Use Tax Worksheet: Vermont Use Tax Worksheet : Schedule IN-112: Vermont Tax Adjustments and Credits : Schedule IN-113: Vermont Income Adjustment Schedules : Form IN-116: Income Tax Payment Voucher : Schedule IN-117: Credit for Income Tax Paid to Other State or Canadian Province

Displaying all worksheets related to - Kentucky Sales And Use Tax. Worksheets are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist.

0 Response to "40 kentucky sales and use tax worksheet"

Post a Comment