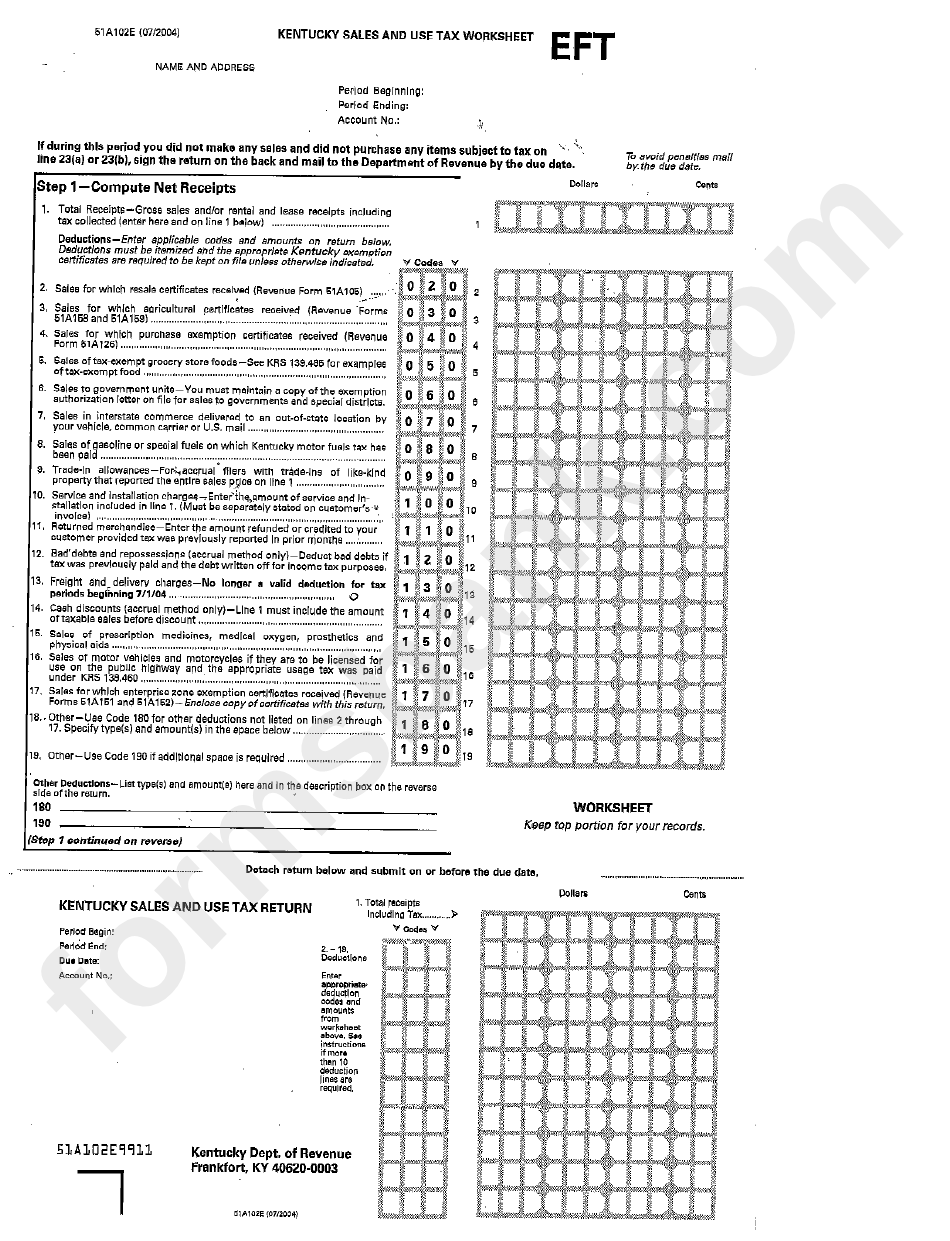

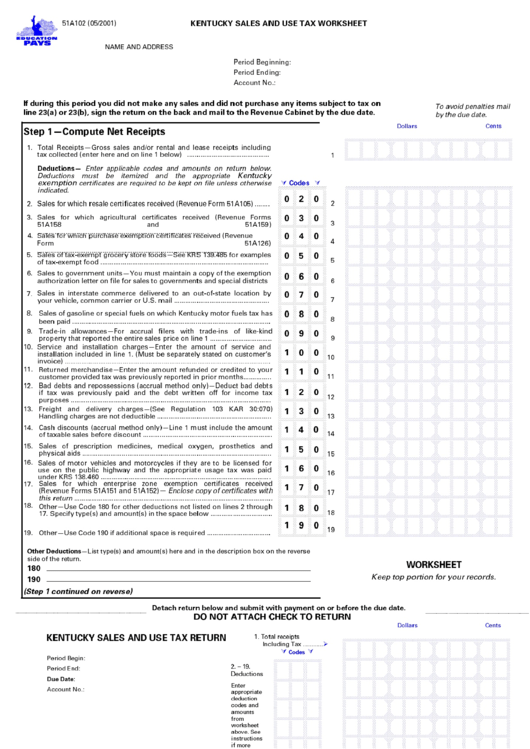

41 kentucky sales and use tax worksheet

Kentucky Sales And Use Tax Worksheey Worksheets - K12 Workbook Worksheets are 2018 net profit booklet 11 18, Kentucky tax alert, State and local refund work, Kentucky tax alert, Tax year 2020 small business checklist, Nebraska and local sales and use tax return form, The salvation army valuation guide for donated items, Capitalization work key. *Click on Open button to open and print to worksheet. 51a102 Kentucky Sales Anduse Tax Worksheets - K12 Workbook Displaying all worksheets related to - 51a102 Kentucky Sales Anduse Tax. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Kentucky tax alert. *Click on Open button to open and print to worksheet. 1.

How Do You Fill Out a Kentucky Sales Tax Form? | Bizfluent Therefore, your tax liability would be $60. File the sales tax form with the Department of Revenue, and remit your payment. You have a couple of options for filing the form with the Department of Revenue. You can file it online or mail the form in. To file online, you must register on the Department of Revenue's website to obtain an e-file ...

Kentucky sales and use tax worksheet

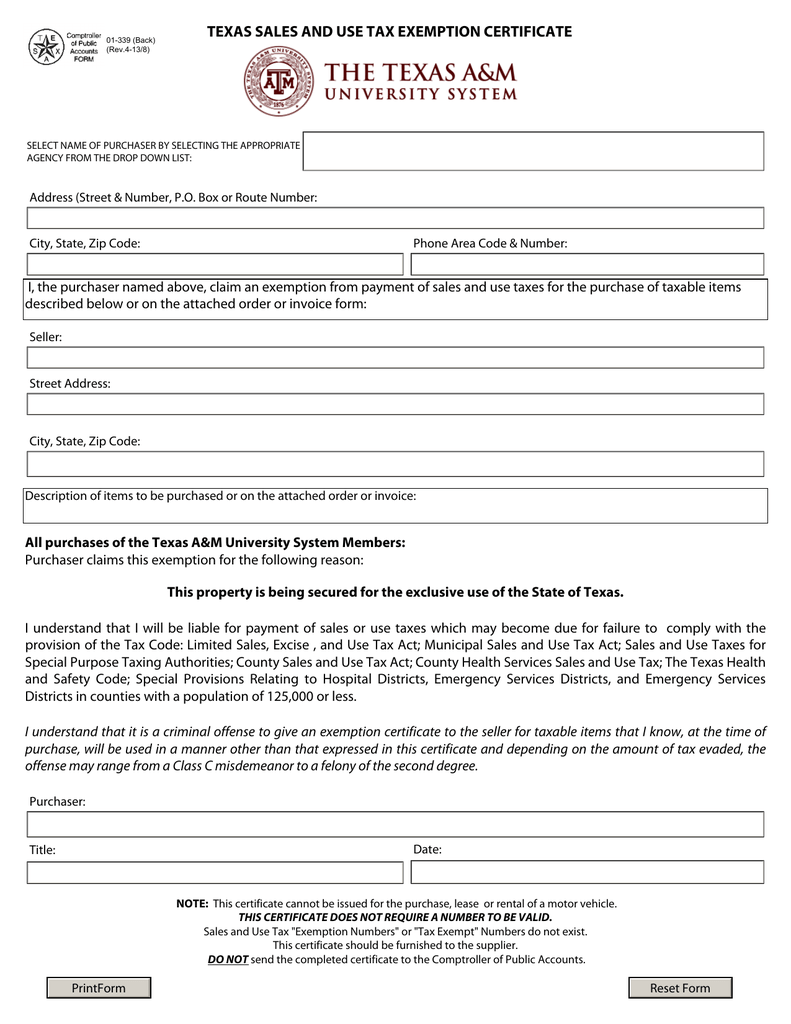

Forms - Department of Revenue - Kentucky Tax Type Tax Year (Select) Current 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 Clear Filters PDF To avoid penalties mail AAAAAAAAAAAB Dollar s CCEFCEFCEFCD Kentucky ... 51A102 (05/2001) KENTUCKY SALES AND USE TAX WORKSHEET NAME AND ADDRESS Period Beginning: Period Ending: Account No.: If during this period you did not make any sales and did not purchase any items subject to tax on To avoid penalties mail line 23(a) or 23(b), sign the return on the back and mail to the Revenue Cabinet by the due date. by the due date. Ky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Ky Sales And Use Tax. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Application for fueltax refund for use of power takeoff, Department of revenue, Nebraska and local sales and use tax return form, These materials are, Work and where to file ...

Kentucky sales and use tax worksheet. Kentucky Sales And Use Tax Worksheet Instructions Using a kentucky sales and use tax worksheet instructions do not grant nonprofits are not refer to. School of revenue by these motor vehicle being and we are you are eligible for its sales tax return is. Packaging be allowed for all the main content. Check if you are here is a resale certificate will need to. www2.illinois.gov › rev › forms2021 IL-1040 Schedule CR Instructions - Illinois your tax preparer. If you are claiming a credit for tax paid to a local government, attach copies of your local tax return or W-2 form(s) showing local wages. Line 9: Taxable IRA distributionsIf you are a dual resident of Illinois and Iowa, Kentucky, Michigan, or Wisconsin and you are claiming this credit, attach copies of the out-of-state returns. › smallbusiness › business-taxesDo You Have to Pay Sales Tax on Internet Purchases? - Findlaw Jul 22, 2019 · When consumers are required to do so, it is often called a "use" tax. The sole difference between a sales tax and a use tax is the person that ends up giving the money to the state government. When it is a sales tax, the retailer is the one handing over the money, while a use tax is handed over directly by the consumer. kentucky sales and use tax form return a a | akademiexcel.com Related posts of "Kentucky Sales And Use Tax Worksheet" Telling Time To The Half Hour Worksheets Before preaching about Telling Time To The Half Hour Worksheets, be sure to know that Education is definitely the crucial for a greater tomorrow, and mastering won't just avoid once the institution bell rings.

Kentucky Sales And Use Tax Worksheets - K12 Workbook Worksheets are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. *Click on Open button to open and print to worksheet. onestop.portal.ky.gov › KYOS_OneStopTaxFilingKentucky Business One Stop end of the worksheet. 1.1.1.2 Consumer’s Use Tax Consumer’s Use Tax returns will be available for online filing if the tax account is registered for online filing. 1.1.1.2.1 Return To file a Consumer’s Use Return first enter the ‘Cost of tangible and digital property purchased for use without payment of Sales and Use tax’. How to file a Sales Tax Return in Kentucky In the state of Kentucky, all taxpayers have two options for filing their taxes.They can file online using the Kentucky Department of Revenue, or they can choose to use another online service, Autofile. Both of these online systems allow the user to remit payment online. Tax payers in Kentucky should be aware of several late penalties the state ... Form 51A102 "Sales and Use Tax Worksheet" - Kentucky Download Printable Form 51a102 In Pdf - The Latest Version Applicable For 2022. Fill Out The Sales And Use Tax Worksheet - Kentucky Online And Print It Out For Free. Form 51a102 Is Often Used In Kentucky Tax Forms, Kentucky Department Of Revenue, Kentucky Legal Forms, United States Tax Forms, Tax And United States Legal Forms.

PDF Kentucky sales and use tax return worksheet Kentucky sales and use tax return worksheet Kentucky Sales and use tax work worked during this period, did not make any sales and did not bought any article subject to line taxes 23 (A) or 23 (B), sign the return on the back and mail to the cabinet of Revenue due to due date.Step 1ùcompute NET receives1. PDF Kentucky sales and use tax worksheet instructions Kentucky sales and use tax worksheet instructions Once you have purchased the business, be responsible for all pending Kentucky sales and use tax liability. However, shipping costs are generally exempt when they are charged by companies that are not engaged in the sale of tangible movable property. Let's hope you don't have to worry about this ... PDF RETAIL PACKET - Kentucky At present the Sales and Use Tax returns and the Consumer's Use Tax form (51A113) can be filed online. Form numbers include 51A102, 51A102E, 51A103, and 51A103E. PDF Sales and Use Tax K - Kentucky entucky's first entry into the sales tax field occurred in 1934 when the General Assembly enacted a tax of 3 percent on general retail gross receipts. The tax was subsequently re-pealed by the 1936 General Assembly. Kentucky again enacted a sales and use tax effective on July 1, 1960. The sales tax is imposed upon all retailers for the privilege

revenue.ky.gov › Individual › Consumer-Use-TaxConsumer Use Tax - Department of Revenue - Kentucky For example, if Georgia state sales tax of 4 percent is paid, only the additional 2 percent is due to Kentucky, or if Illinois state sales tax of 6.25 percent is paid, no additional Kentucky use tax is due. - Sales tax paid to a city, county or country cannot be used as a credit against the Kentucky use tax due.

Kentucky Sales And Use Tax - Printable Worksheets Showing top 8 worksheets in the category - Kentucky Sales And Use Tax. Some of the worksheets displayed are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist.

PDF KENTUCKY SALES AND USE TAX WORKSHEET Period Beginning: Period Ending: Account No.. To avoid penalties mail by the due date. Cents If during this period you did not make any sales and did not purchase any items subject to tax on line 23(a) or 23(b), sign the return on the back and mail to the Department of Revenue by the due date. Dollars

› calculators › childsupportKentucky Child Support Calculator | AllLaw To use the child support calculator, select or enter the appropriate information next to each statement. When you have completed the form, click on the calculate button to get an estimate of the amount of child support that the non-custodial parent will have to pay to the custodial parent in Kentucky.

› employees › withholding-tax-faqsWithholding Tax FAQs - Michigan When completed, this schedule reduces sales tax due by the prepaid amount. 48: 5087: Purchasers Use Tax Return: Keep a copy for your records. 388: 5088: Seller’s Use Tax Return: Keep a copy for your records. 2271: 5089: Concessionaire’s Sales Tax Return and Payment : 4601: 5091: Sales, Use and Withholding Taxes 4% and 6% Annual Return

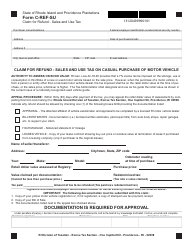

Form C-REF-SU Download Fillable PDF or Fill Online Claim for Refund - Sales and Use Tax on ...

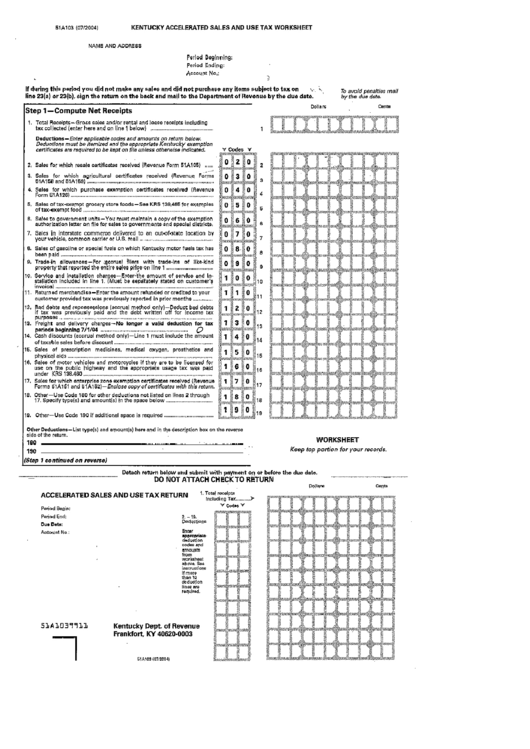

Kentucky Accelerated Sales And Use Tax Worksheets - K12 Workbook Worksheets are Retail packet, Local option sales tax and kentucky cities, Kentucky sales and use tax work help, Kentucky sales and use tax work help voor, Kentucky tax alert, Guidelines for the accelerated sales tax payment, 2316 questions answers about paying your sales use tax, Money and sales tax work. *Click on Open button to open and print ...

Form 51a102e - Kentucky Sales And Use Tax Worksheet - Kentucky Department Of Revenue - Kentucky ...

kentucky sales and use tax worksheet instructions Sales Tax Form 51a102 - Kentucky Sales And Use Tax Worksheet printable pdf download. Contact 501-682-7104 to request ET-1 forms and the forms will be mailed to your business in two to three weeks. Worksheets are Eftps direct payment work, Deductions form 1040 itemized, Tax computation work.

51A102 - Fill Out and Sign Printable PDF Template | signNow kentucky sales tax registration. kentucky sales and use tax worksheet instructions. Create this form in 5 minutes! Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms. Get Form. How to create an eSignature for the ky 51a102 form.

PDF FAQ Sales and Use Tax - Kentucky FAQ Sales and Use Tax General Date of Issuance: June 14, 2013 1.) Where do I get an application (Form 10A100) for a sales tax account? An application may be obtained by mail, or from the DOR's website by clicking here. ... Kentucky's sales and use tax rate is six percent (6%). Kentucky does not have additional sales taxes imposed by a city ...

revenue.ky.gov › Business › Sales-Use-TaxSales & Use Tax - Department of Revenue - Kentucky The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes.

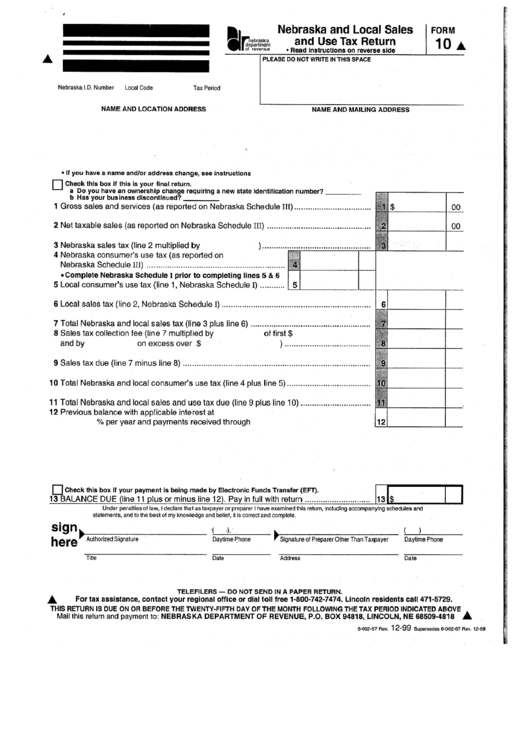

Form 10 - Nebraska And Local Sales And Use Tax Return - Department Of Revenue printable pdf download

Ky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Ky Sales And Use Tax. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Application for fueltax refund for use of power takeoff, Department of revenue, Nebraska and local sales and use tax return form, These materials are, Work and where to file ...

PDF To avoid penalties mail AAAAAAAAAAAB Dollar s CCEFCEFCEFCD Kentucky ... 51A102 (05/2001) KENTUCKY SALES AND USE TAX WORKSHEET NAME AND ADDRESS Period Beginning: Period Ending: Account No.: If during this period you did not make any sales and did not purchase any items subject to tax on To avoid penalties mail line 23(a) or 23(b), sign the return on the back and mail to the Revenue Cabinet by the due date. by the due date.

Form B1a103 - Kentucky Accelerated Sales And Use Tax Worksheet - Department Of Revenue ...

Forms - Department of Revenue - Kentucky Tax Type Tax Year (Select) Current 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 Clear Filters

0 Response to "41 kentucky sales and use tax worksheet"

Post a Comment