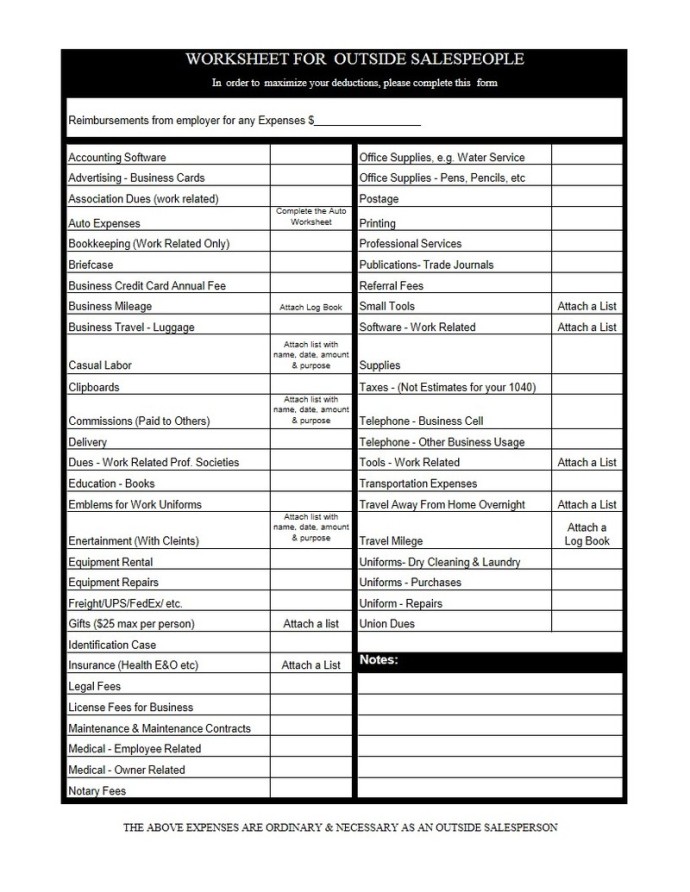

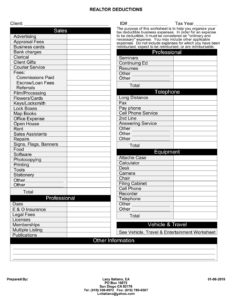

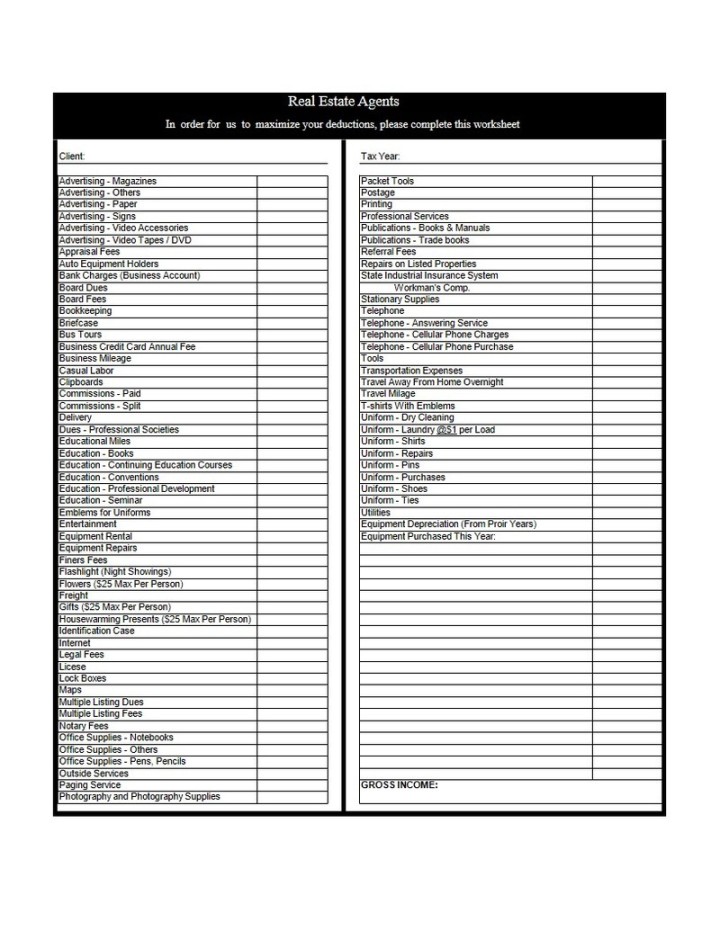

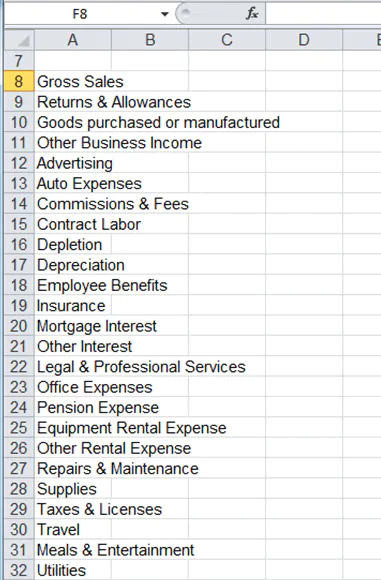

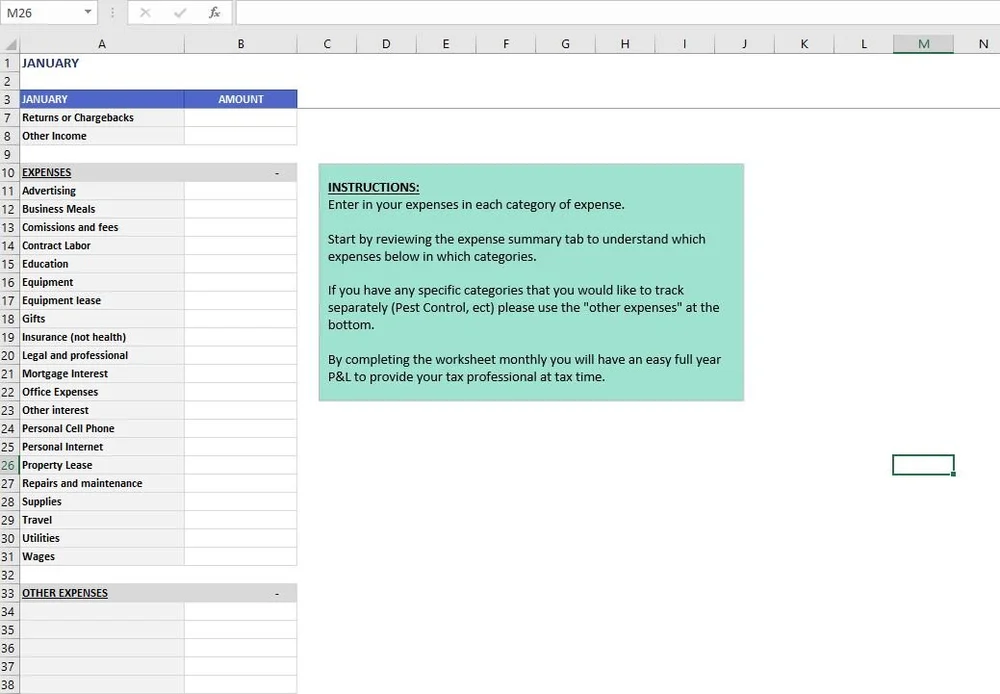

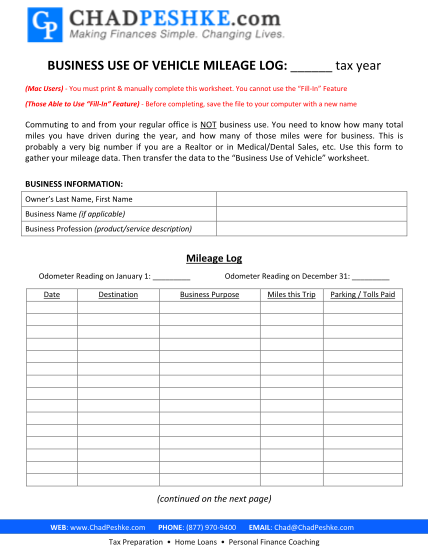

45 realtor tax deduction worksheet

Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... 14.10.2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc › taxes › donation-value-guideDonation Value Guide For 2021 | Bankrate Sep 29, 2021 · If the total of all your contributed property comes to more than $500, you have to file IRS Form 8283 with your tax return. SHARE: Share this article on Facebook

› fill-and-sign-pdf-form › 29895Realtor Tax Deduction Worksheet Form - signNow How to create an electronic signature for the REvaltor Tax Deduction Worksheet Form on iOS devices real estate agent tax deductions worksheet21iPhone or iPad, easily create electronic signatures for signing a rEvaltor tax deduction worksheet form in PDF format. signNow has paid close attention to iOS users and developed an application just for ...

Realtor tax deduction worksheet

Donation Value Guide For 2021 | Bankrate 29.9.2021 · This list of some common items offers an idea of what your donated clothing and household goods are worth, as suggested in the Salvation Army’s valuation guide. › blog › real-estate-agent-tax16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr Apr 15, 2022 · If you are subject to paying self-employment tax, you can deduct one-half (50%) of the self-employment tax you pay on line 27 of your Form 1040, regardless of whether you itemize or take the standard deduction. For Example. Annie Agent, a single Washington D.C. based realtor, took home $400,000 in commissions last year net of all business expenses. Rental Income and Expense Worksheet - Rentals Resource Center 1.1.2021 · To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or HOA dues, gardening service and utilities in the “monthly expense” category.

Realtor tax deduction worksheet. › en › expert-insightsExpenses Related to Your Home Office Are Deductible Oct 17, 2020 · Furthermore, claiming the home office deduction means that some of your real estate taxes and mortgage interest will be used to reduce your adjusted gross income (AGI), which in turn can improve your eligibility for numerous tax benefits including IRAs, miscellaneous itemized deductions, and the deduction for medical expenses that exceed 7.5 ... › taxes › sales-tax-deductionSales Tax Deduction: What It Is, How To Take Advantage - Bankrate Sep 22, 2021 · The sales tax deduction gives taxpayers the opportunity to reduce their tax liability when they deduct state and local sales taxes or state and local income taxes that they paid in 2021 — but ... Could Call of Duty doom the Activision Blizzard deal? - Protocol 14.10.2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal. Realtor Tax Deduction Worksheet Form - signNow How to create an electronic signature for the REvaltor Tax Deduction Worksheet Form on iOS devices real estate agent tax deductions worksheet21iPhone or iPad, easily create electronic signatures for signing a rEvaltor tax deduction worksheet form in PDF format. signNow has paid close attention to iOS users and developed an application just for ...

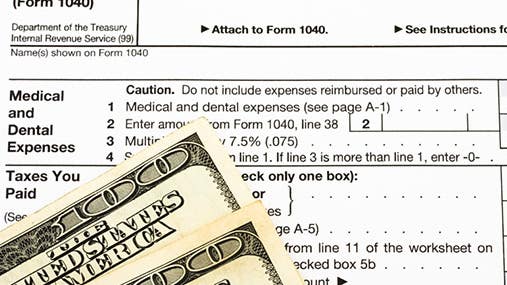

› 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... 16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr 15.4.2022 · If you are subject to paying self-employment tax, you can deduct one-half (50%) of the self-employment tax you pay on line 27 of your Form 1040, regardless of whether you itemize or take the standard deduction. For Example. Annie Agent, a single Washington D.C. based realtor, took home $400,000 in commissions last year net of all business expenses. 5 Tax Deductions When Selling a Home: Did You Take Them All? - realtor… 27.3.2022 · This deduction is capped at $10,000, Zimmelman says. So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct the amount you paid in property ... Expenses Related to Your Home Office Are Deductible 17.10.2020 · The home office deduction can be a real tax break for those who rent their home. ... Your realtor or insurance agent may be able to help you make a reasonable estimate of fair market value. ... The easiest way to compute these two amounts is to use IRS Form 4684, Casualties and Thefts, as a worksheet.

› overwatch-2-reaches-25-millionOverwatch 2 reaches 25 million players, tripling Overwatch 1 ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc How To Deduct Stock Losses From Your Taxes | Bankrate 14.6.2022 · You can enter any stock gains and losses on Schedule D of your annual tax return, and the worksheet will help you figure out your net gain or loss. You may want to consult with a tax professional ... Sales Tax Deduction: What It Is, How To Take Advantage - Bankrate 22.9.2021 · The sales tax deduction gives taxpayers the opportunity to reduce their tax liability when they deduct state and local sales taxes or state and local income taxes that they paid in 2021 — but ... Rental Income and Expense Worksheet - Rentals Resource Center 1.1.2021 · To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or HOA dues, gardening service and utilities in the “monthly expense” category.

› blog › real-estate-agent-tax16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr Apr 15, 2022 · If you are subject to paying self-employment tax, you can deduct one-half (50%) of the self-employment tax you pay on line 27 of your Form 1040, regardless of whether you itemize or take the standard deduction. For Example. Annie Agent, a single Washington D.C. based realtor, took home $400,000 in commissions last year net of all business expenses.

Donation Value Guide For 2021 | Bankrate 29.9.2021 · This list of some common items offers an idea of what your donated clothing and household goods are worth, as suggested in the Salvation Army’s valuation guide.

0 Response to "45 realtor tax deduction worksheet"

Post a Comment