42 non cash charitable contributions worksheet

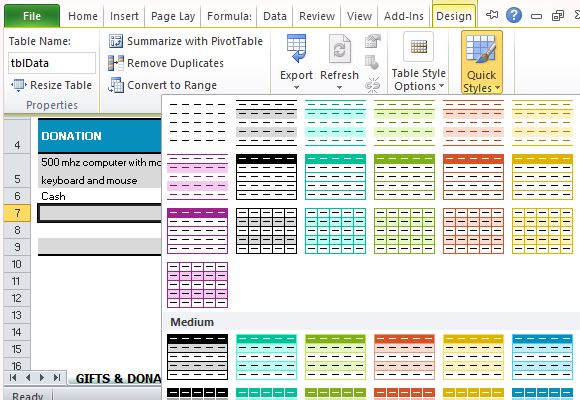

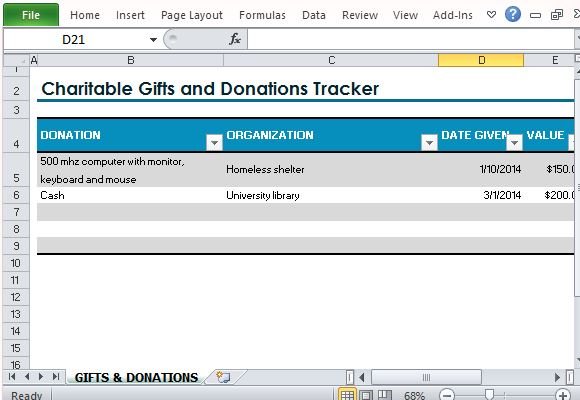

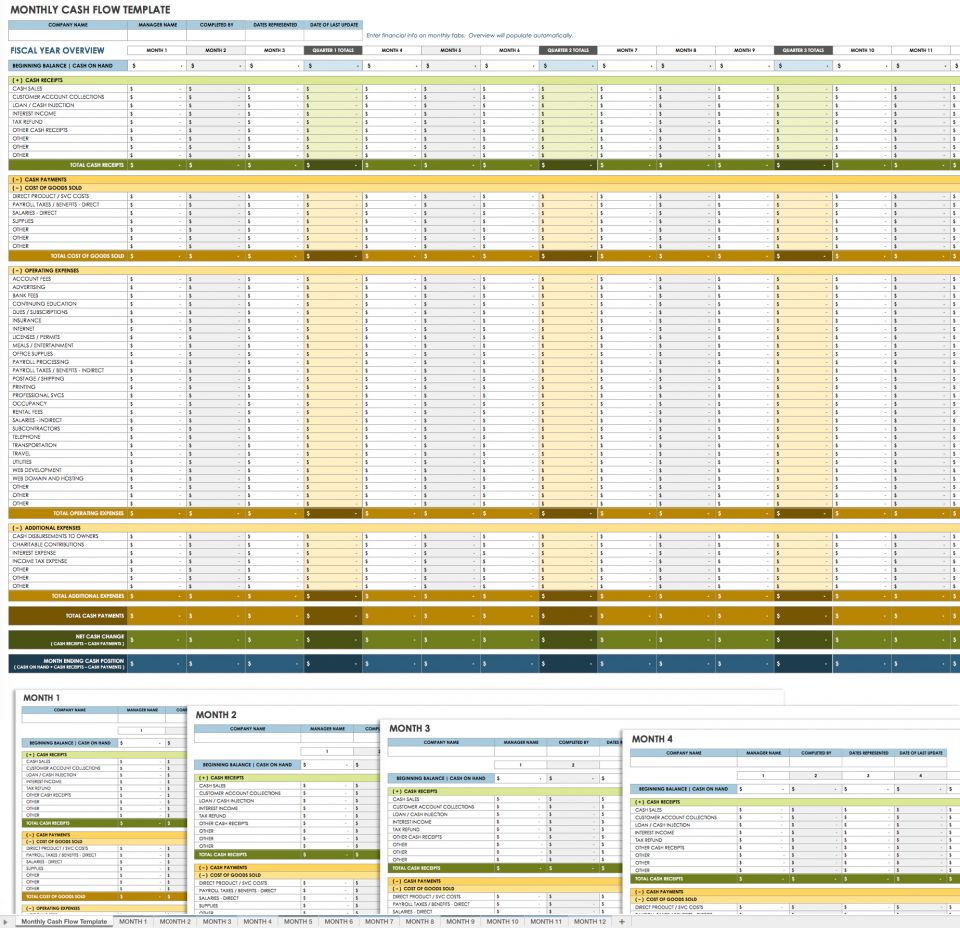

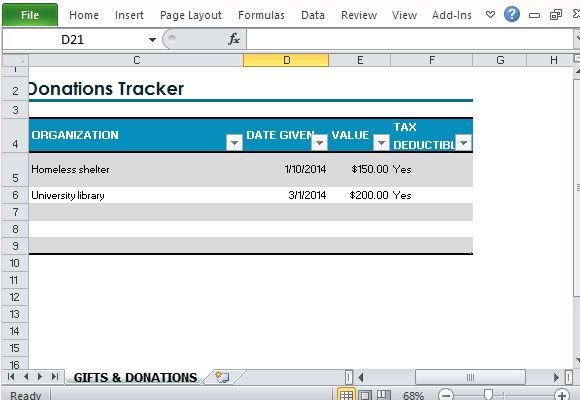

Charitable gifts and donations tracker - templates.office.com Charitable gifts and donations tracker. Keep track of your donations and charitable gifts throughout the year with this accessible donations tracker template. Use this Excel donation list template to mark whether each donation is tax-deductible for easy calculation of your deductions at the end of the year. Non cash charitable contributions / donations worksheet 2022 - Fill ... Non cash charitable contributions / donations worksheet 2022 Form: What You Should Know. Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Donation Value Guide Spreadsheet, steer clear of blunders along with furnish it in a timely manner:

Non Cash Charitable Contributions Worksheet 2021 - Fill Online ... Tax Return: Non-cash Charitable Contributions Worksheet. Prepared By : Generic & Associates PC. 02-14-2012. 2831 Brady St. Video instructions and help with filling out and completing non cash charitable contributions worksheet 2021 Instructions and Help about charitable donation worksheet form

Non cash charitable contributions worksheet

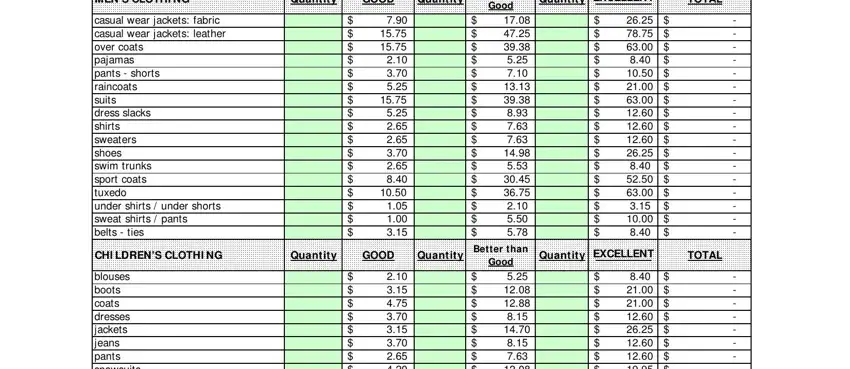

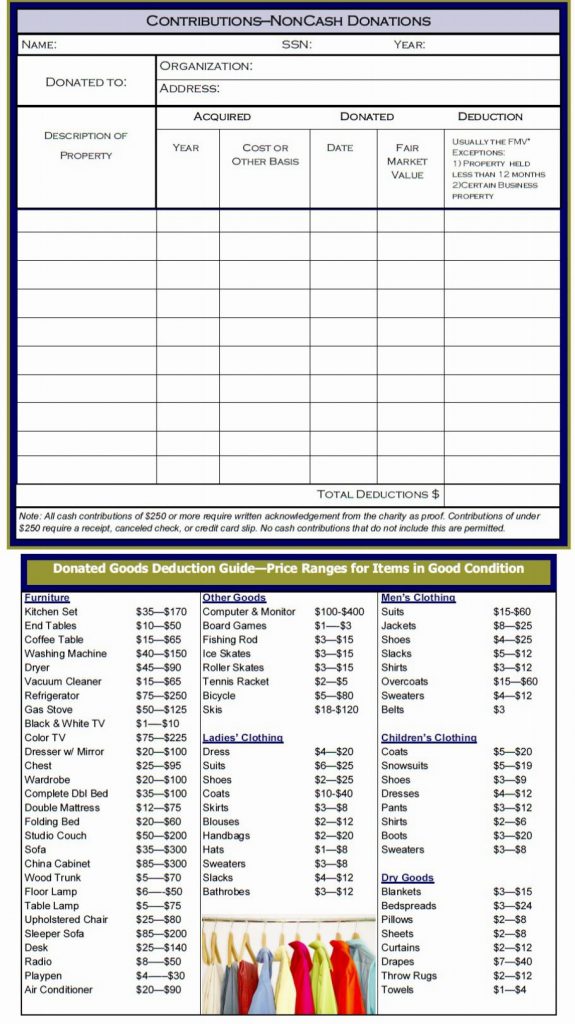

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file. Non Cash Charitable Contributions Donations Worksheet: Fillable ... Read the following instructions to use CocoDoc to start editing and completing your Non Cash Charitable Contributions Donations Worksheet: In the beginning, look for the "Get Form" button and click on it. Wait until Non Cash Charitable Contributions Donations Worksheet is ready. Customize your document by using the toolbar on the top. Online Donation Value Guide Spreadsheet - Printable and Editable PDF Form How to prepare Donation Value Guide Spreadsheet 1 Open the template You do not have to search for a sample of Donation Value Guide Spreadsheet online and download the document. Open up the sample immediately inside the editor with one click. 2 Fill the form Fill every single field in the template supplying legitimate details.

Non cash charitable contributions worksheet. Non Cash Charitable Contribution Worksheet - PDFSimpli Ensure the non cash charitable contribution worksheet is 100% complete, reflects your goals and accurately reflects the work you have put into drafting the document. Download, Save & Print: Whew! Now you are done. Just click any of the easy buttons at the top of editor to download, save or print non cash charitable contribution worksheet. Goodwill Donation Worksheets - K12 Workbook Worksheets are Non cash charitable contributions donations work, Non cash donation work based on salvation army, Valuation guide for goodwill donors, 2020 charitable contributions noncash fmv guide, Charitable contributions or donations, Non cash contribution work, Itemized deductions work, The salvation army valuation guide for donated items. XLSX This worksheet has been provided to help you determine the value of your noncash contributions. The values on this worksheet are based on valuation ranges provided by the Salvation Army 1 and are intended to be used as general guidelines. Amounts should be adjusted upward or downward based on your actual assessment of condition of each item. Goodwill Donation Sheet Worksheets - Learny Kids Displaying top 8 worksheets found for - Goodwill Donation Sheet. Some of the worksheets for this concept are Valuation guide for goodwill donors, Goodwill donated goods value guide, Non cash donation work based on salvation army, Non cash charitable contributions donations work, The salvation army valuation guide for donated items, Anderson financial services, Itemized deductions work, Thrift ...

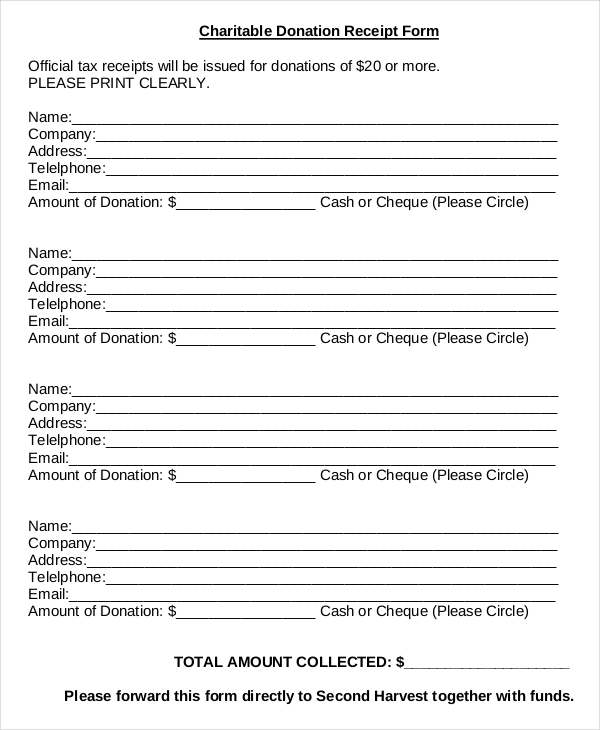

Charitable Worksheet ≡ Fill Out Printable PDF Forms Online NOTE: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the values are believed to be reasonable, there are no guarantees or warranties as to their accuracy. Donation Calculator Use this donation calculator to find, calculate, as well as document the value of non-cash donations. DONATION CALCULATOR. Purpose of this Site ... household goods furniture and appliances. Using The Spreadsheet. If you are using a tablet or mobile device, you cannot ... We got the data from lists at websites of charities. Then we placed a ... XLS Noncash charitable deductions worksheet. NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year ===> Insert Date Given ===> ENTER ITEMS NOT PROVIDED FOR IN THE ABOVE CATEGORIES. SET YOUR OWN VALUE. WHAT IS YOUR ORIGINAL COST BASED ON RECIEPTS, OR YOUR BEST ESTIMATE, OF THE ITEMS DONATED? Charity's Address Blouse Coats Dresses Evening dresses Handbags WOMEN's CLOTHING Donation Value Guide 2021 Spreadsheet - Fill Online, Printable ... A Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from the tax return.

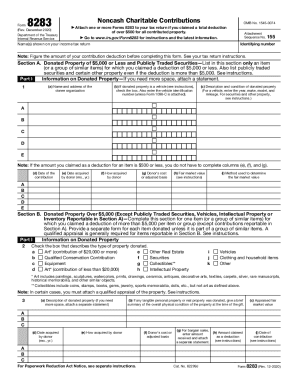

non cash charitable contributions/donations worksheet 2007-2022 - Fill ... Stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: Get the document you require in the collection of legal forms. Open the template in the online editing tool. Read through the recommendations to discover which details you must give. Click ... Download Non Cash Charitable Contribution Worksheet for Free Non Cash Charitable Contribution Worksheet; Download Non Cash Charitable Contribution Worksheet for Free . Page 1; Page 2; ... This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source. information used is from a Salvation Army "V aluation Guide" published several yea rs ago and ... About Form 8283, Noncash Charitable Contributions Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500. Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Tax Tip: Deducting Non-Cash Charitable Donations for 2021 Make Sure You Select a Qualified Charity. It's important to be sure any charity you are giving to is a qualified organization as only donations to eligible organizations are tax-deductible. Select Check, a searchable online tool available on IRS.gov, lists most organizations that are eligible to receive deductible contributions. Churches, synagogues, temples, mosques and government agencies are eligible to receive deductible donations, even if they are not listed in this database.

PDF Non-cash Charitable Contributions / Donations Worksheet NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET TAXPAYERS NAME(S): Insert Tax Year ===> ENTITY TO WHOM DONATED: Insert Date Given ===> Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source

2022 Free Non Cash Charitable Contributions Worksheet Non Cash Charitable Contribution Worksheet PDF, Google Sheet, EXCEL from e-database.org. Worksheets are non cash charitable contributions donations work, non cash charitable contributions work, the. Most cell phones today can take pictures. This worksheet is provided as a convenience and aide in calculating. Source:

Non-Cash Contribution Definition | Law Insider Define Non-Cash Contribution. means non-monetary payment to a non-assignable child support obligation owed to a payee. Non-cash contributions may include goods or services provided by the payor. Non-cash contributions shall be assigned a whole dollar amount, be based on the current market value of the goods or services, be agreed upon by both the custodial and non-custodial parties and must be ...

PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: MISCELLANEOUS LOW HIGH AVG QTY AMOUNT VALUE Adding Machines 24.00 90.00 57.00 Christmas Trees 18.00 60.00 39.00 Broiler Ovens 18.00 30.00 24.00 Copier 120.00 240.00 180.00 Home Computer 180.00 600.00 390.00

Publication 526 (2021), Charitable Contributions - IRS tax forms If you make cash contributions or noncash contributions (other than capital gain property) during the year (1) to an organization described earlier under Second category of qualified organizations, or (2) "for the use of" any qualified organization, your deduction for those contributions is limited to 30% of your AGI, or if less, 50% of your AGI minus all your contributions to 50% limit organizations (other than contributions subject to a 100% limit or qualified conservation ...

Non Cash Charitable Donations Worksheets - Lesson Worksheets Displaying all worksheets related to - Non Cash Charitable Donations. Worksheets are Non cash charitable contributions donations work, The salvation army valuation guide for donated items, Thrift store valuation guide, Non cash donation work based on salvation army, Anderson financial services, Fair market value guide for used items, 2019 publication 526, Valuation guide for goodwill donors.

Goodwill Donations Worksheets - Printable Worksheets Showing top 8 worksheets in the category - Goodwill Donations. Some of the worksheets displayed are Valuation guide for goodwill donors, Valuation guide for goodwill donors, Goodwill donated goods value guide, Fair market value, Occupational health and safety workplace safety training, Howmuchismystuffworth, The salvation army valuation guide for donated items, Non cash charitable ...

Non Cash Worksheets - Lesson Worksheets Worksheets are Non cash charitable contributions donations work, Non cash contribution work, Cash flow analysis work, Sale of home work, Cash flow analysis form 1084, Dcnr bureau of recreation and conservation community, Match documenting cash and in kind, The salvation army valuation guide for donated items.

Non Cash Charitable Donations Worksheets - K12 Workbook Worksheets are Non cash charitable contributions donations work, The salvation army valuation guide for donated items, Thrift store valuation guide, Non cash donation work based on salvation army, Anderson financial services, Fair market value guide for used items, 2019 publication 526, Valuation guide for goodwill donors.

The Salvation Army Thrift Stores | Donation Valuation Guide - SA-TRUCK 1-800-SA-TRUCK (1-800-728-7825) The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items. It includes low and high estimates. Please choose a value within this range that reflects your item's relative age and quality. The Salvation Army does not set a valuation on your ...

Online Donation Value Guide Spreadsheet - Printable and Editable PDF Form How to prepare Donation Value Guide Spreadsheet 1 Open the template You do not have to search for a sample of Donation Value Guide Spreadsheet online and download the document. Open up the sample immediately inside the editor with one click. 2 Fill the form Fill every single field in the template supplying legitimate details.

Non Cash Charitable Contributions Donations Worksheet: Fillable ... Read the following instructions to use CocoDoc to start editing and completing your Non Cash Charitable Contributions Donations Worksheet: In the beginning, look for the "Get Form" button and click on it. Wait until Non Cash Charitable Contributions Donations Worksheet is ready. Customize your document by using the toolbar on the top.

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file.

:max_bytes(150000):strip_icc()/assetandcashdonationsforbusinesses-ee0eb9be3ea145b8bd327ece7729f86e.jpg)

0 Response to "42 non cash charitable contributions worksheet"

Post a Comment