41 income tax worksheet excel

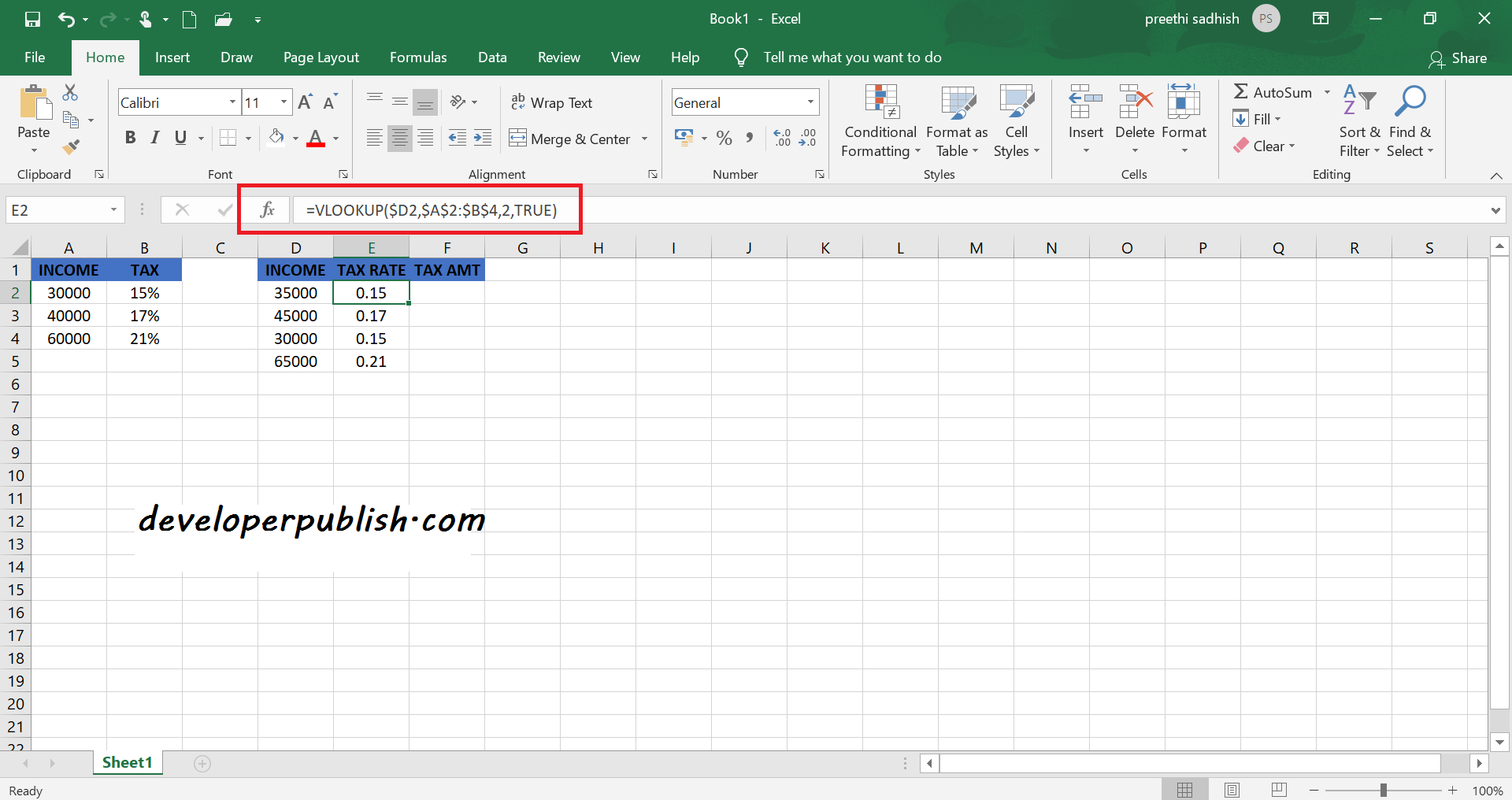

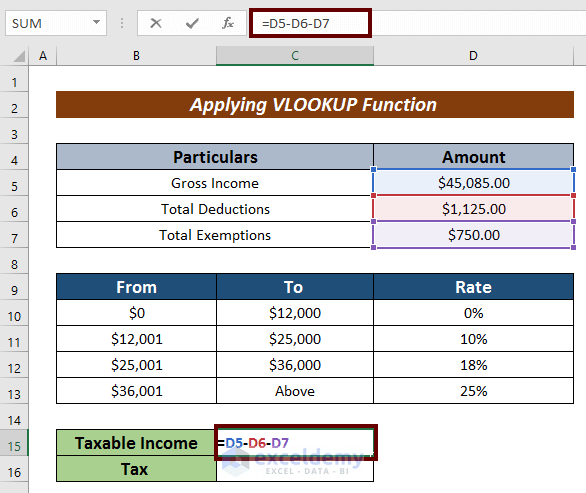

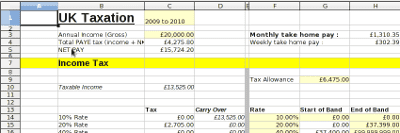

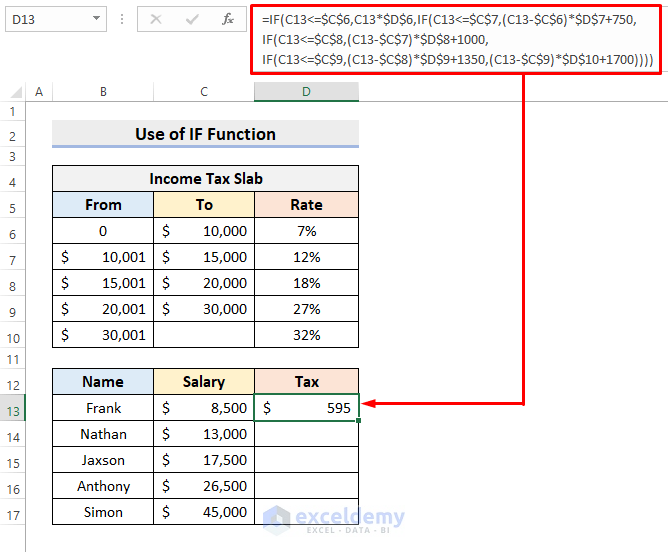

Tax Rates in Excel (Easy Formulas) This example teaches you how to calculate the tax on an income using the VLOOKUP function in Excel. The following tax rates apply to individuals who are residents of Australia. Example: if income is 39000, tax equals 3572 + 0.325 * (39000 - 37000) = 3572 + 650 = $4222. To automatically calculate the tax on an income, execute the following steps. Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The procedure for downloading and filling out forms is as follows: 1. To download this form to your computer click on the thumbnail above. The form will automatically be downloaded to your computer. Customarily what you download will be stored in your "download" folder. So once it is downloaded, look in your download folder to find the PDF for ...

Estimated Tax Worksheet Use 100% of the 2022 estimated total tax. 0. Refund from 2021 designated as an estimated payment. Income tax withheld and estimated to be withheld. Balance (override if a different amount is desired: ) (Payment not required if less than $1000) 0. Quarterly amount.

Income tax worksheet excel

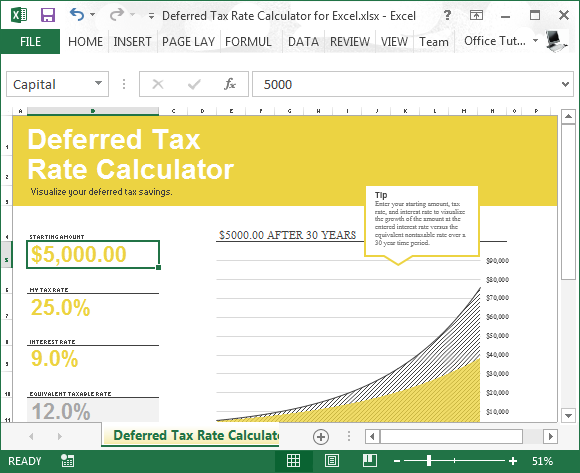

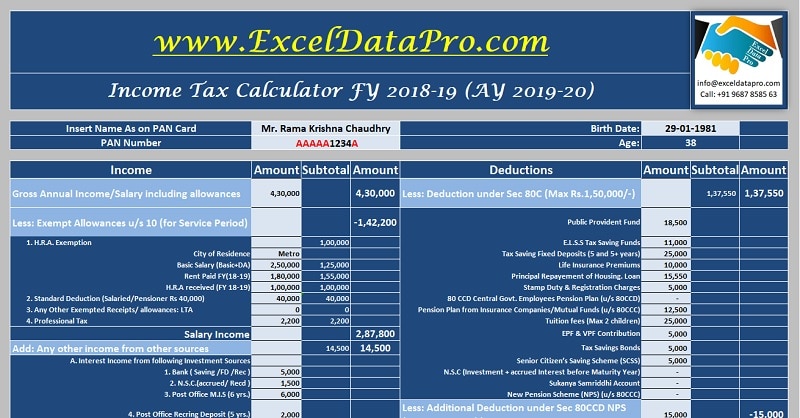

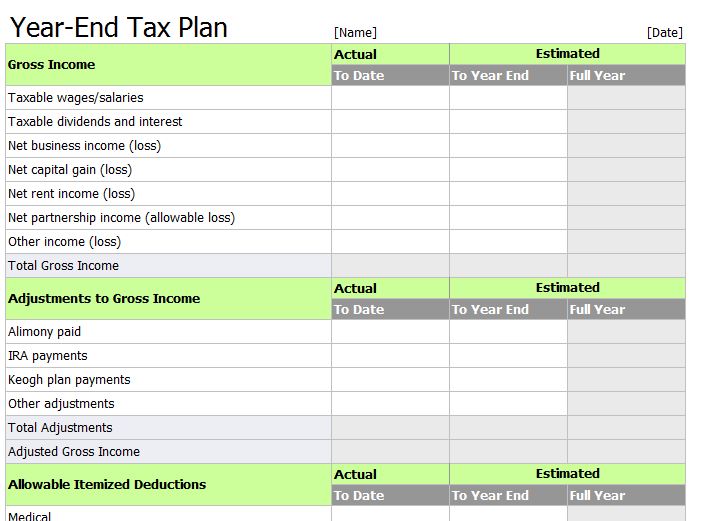

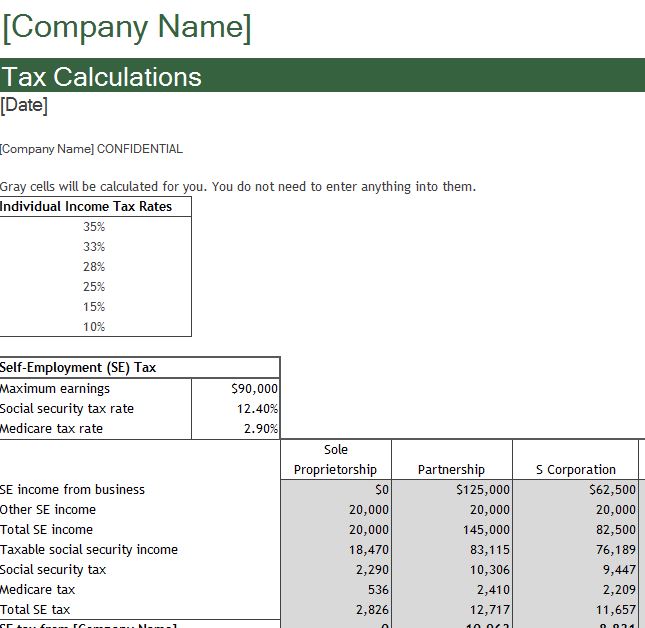

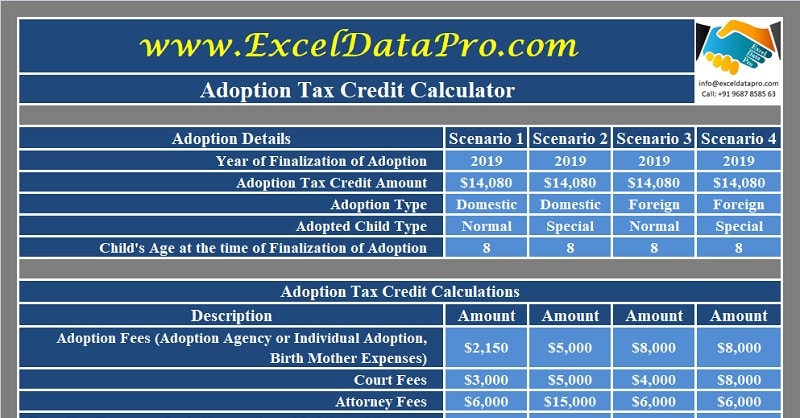

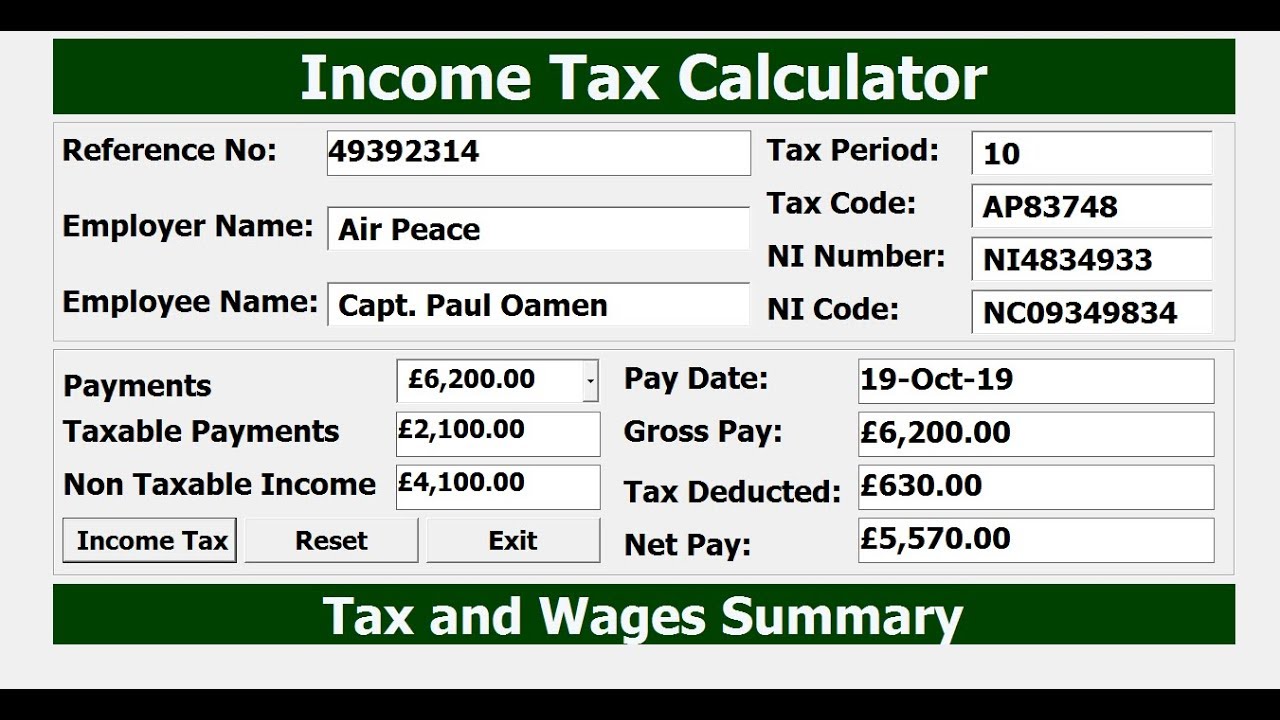

Tax Planner Spreadsheets - Taxvisor.com The tax planner spreadsheets allow you to perform on-the-fly tax planning with minimal effort. Most people will be able to model their federal and state taxes in a matter of minutes. This is no hoax and no joke: you will be able to plan for your taxes in less time and at significantly less cost than you have ever been able to in the past. Tax Deduction | Excel Templates The Tax Deduction Template is specially designed to provide you with an easier solution to your yearly deduction's calculator. It can be extremely difficult to keep track of all the standard yearly deductions you have, and the itemized deductions throughout the year. Keep track of your itemized deductions using our calculator will help you ... Income Tax Calculator FY 2020-21 (AY 2021-22) - Excel Download Last Update February 2, 2021. Download Income Tax Calculator FY 2020-21 (AY 2021-22) in Excel Format. This calculator is designed to work with both old and new tax slab rates released in the budget 2020. You can calculate your tax liabilities as per old and new tax slab. It will help you to make an informed decision to opt for a suitable tax ...

Income tax worksheet excel. Income tax bracket calculation - Excel formula | Exceljet The second VLOOKUP calculates the remaining income to be taxed: ( inc - VLOOKUP ( inc, rates,1,1)) // returns 10,525 calculated like this: (50,000-39,475) = 10,525 Finally, the third VLOOKUP gets the (top) marginal tax rate: VLOOKUP ( inc, rates,2,1) // returns 22% This is multiplied by the income calculated in the previous step. Independent Contractor Expenses Spreadsheet [Free Template] - Keeper Tax It calculates how much you can deduct from your taxable income, and It takes everything you buy for work and translates into IRS-speak It does this using three different tabs, which are color-coded green, blue, and purple. Let's go through them one by one. What tax write-offs can I claim? I am a (n): Freelance designer See write-offs 1. Downloadable tax organizer worksheets Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The source information that is required for each tax return is unique. Therefore we also have specialized worksheets to meet your specific needs. All the documents on this page are in PDF format. Rental Income and Expense Worksheet - Rentals Resource Center Jan 01, 2021 · To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or HOA dues, gardening service and utilities in the “monthly expense” category.

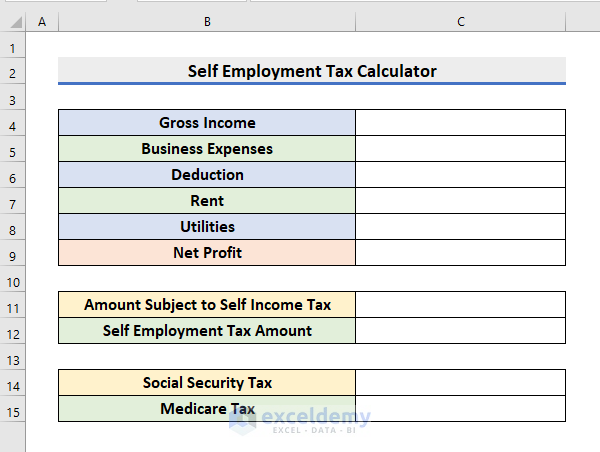

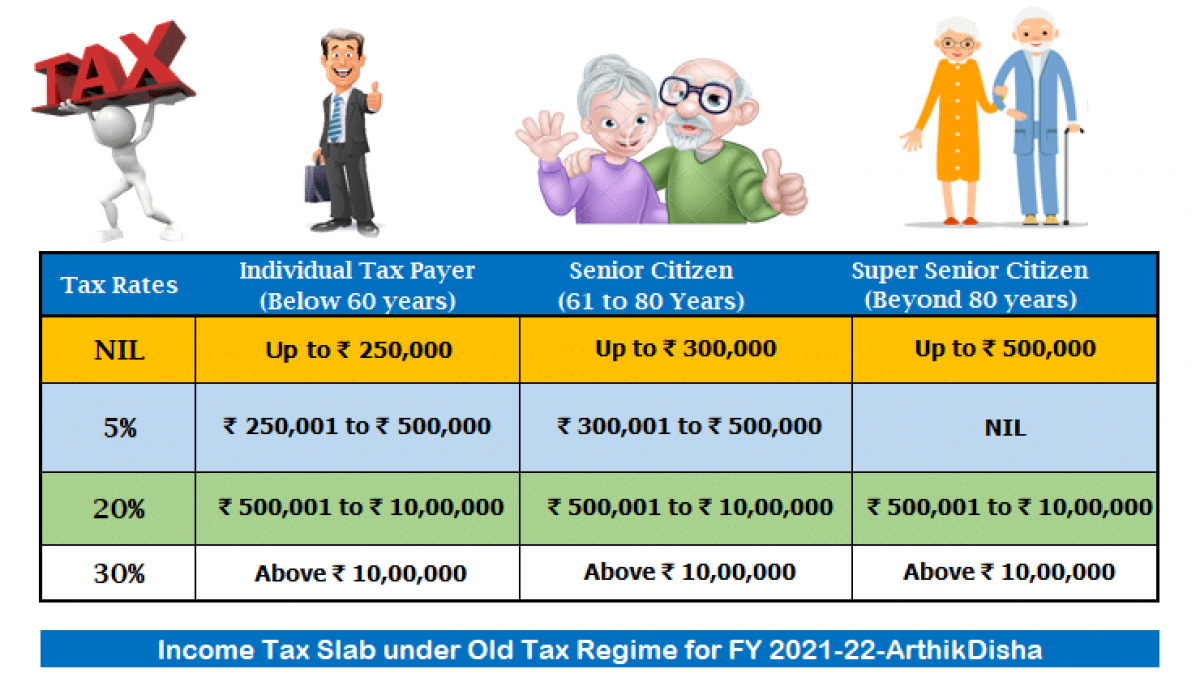

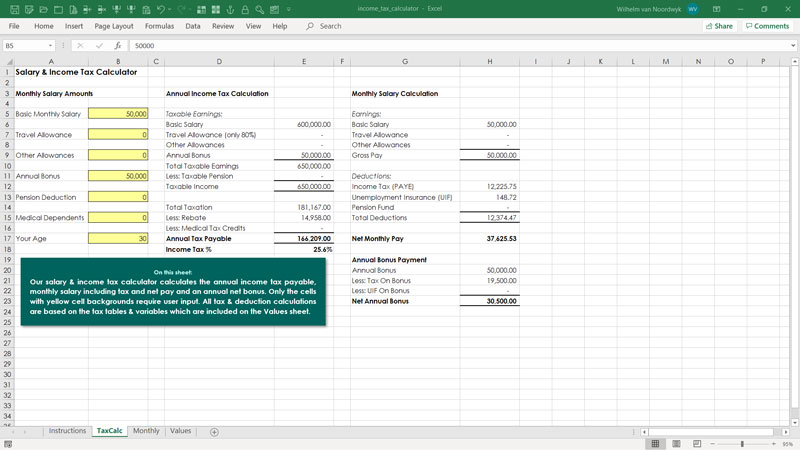

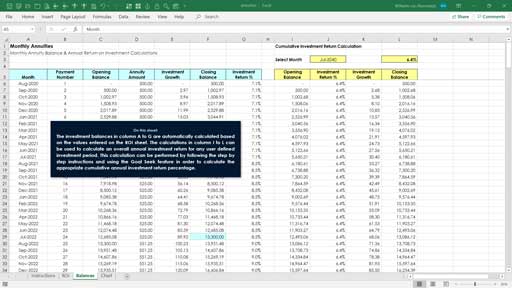

Download Income Tax Calculator FY 2021-22 (AY 2022-23) - Moneyexcel This calculator will work for both old and new tax slab rate which were released in 2020. You can calculate your tax liability and decide tax efficient investment options and suitable tax structure for FY 2021-22. The calculator is created using Microsoft excel. Simple excel based formulas and functions are used in creating this calculator. Personal monthly budget spreadsheet - templates.office.com Excel does the math so you can concentrate on your finances. This budget Excel template compares project and actual income and projected and actual expenses. It includes an array of categories and subcategories, so you can set it up exactly how you'd like. Utilize this monthly budget worksheet to organize and plan your personal finances. Estimated Income Tax Spreadsheet - Mike Sandrik Now the spreadsheet can calculate your effective tax rate based on the estimated amount of income you expect to make. The tax rates calculated depend on the tax tables on the right side of the sheet, which define the income tax brackets. You'll need to update the data in yellow each year for the new brackets and for your filing status. Rental Income and Expense Worksheet - PropertyManagement.com Rental Income and Expense Worksheet Between maintaining your properties, communicating with tenants, and bookkeeping, there's no question that being a landlord keeps you busy. With so many competing priorities, it's always a relief to find tools that can save you time, effort, and money.

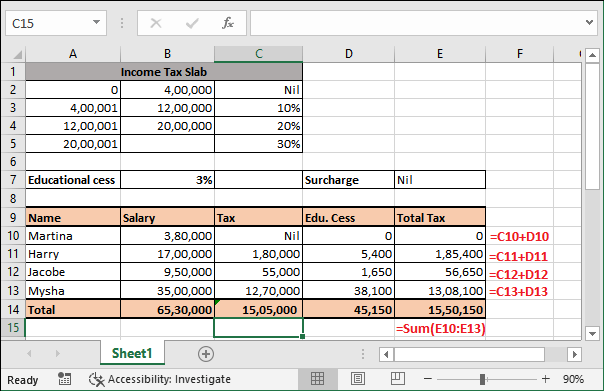

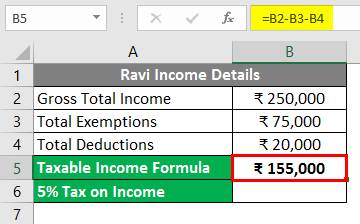

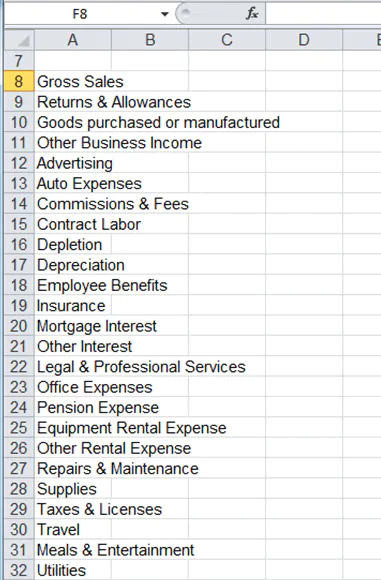

Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax ... - Google This site makes available, for free, a spreadsheet that may be used to complete your U.S. Federal Income Tax Return. Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator Search this site Tax expense journal - templates.office.com Utilize this tax expense spreadsheet to keep a running total as you go. Take the stress out of filing taxes with this easy-to-use tax deduction spreadsheet. Excel Download Open in browser Share More templates like this Loan amortization schedule Excel Retirement readiness checklist Word Mortgage loan calculator Excel Budget Wheel Excel Download Free Federal Income Tax Templates In Excel Download Free Federal Income Tax Templates In Excel Prepare your Federal Income Tax Return with the help of these free to download and ready to use ready to use Federal Income Tax Excel Templates. These templates include Simple Tax Estimator, Itemized Deduction Calculator, Schedule B Calculator, Section 179 Deduction Calculator and much more. Income tax calculating formula in Excel It is a simple way to calculate income tax and easy to understand. Step 1: Open the Excel worksheet that contains the income details of someone. We have this income dataset: Step 2: As we want to calculate the taxable income and tax. So, create two rows: one for the taxable value and another for the tax.

Download - Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax ... This site makes available, for free, a spreadsheet that may be used to complete your U.S. Federal Income Tax Return. Download - Federal Income Tax Form 1040 (Excel Spreadsheet) Income...

How to Do Taxes in Excel - Free Template Included - GoSkills.com Microsoft Excel Excel is a widely used spreadsheet program. While it's most popularly known for its ability to make use of heaps of data, Excel has an infinite number of capabilities, from making lists and charts to organizing and tracking information. Learn more Courses Microsoft Excel - Basic & Advanced Microsoft Excel - Basic

Income Tax Formula - Excel University The sample file below contains the formula for reference. If we assume a taxable income of $50,000, we need to write a formula that basically performs the following math: =5081.25+ ( (50000-36900)*.25) We can use VLOOKUP to obtain all of the related values from the tax table based on the taxable income. The basic syntax of the VLOOKUP function ...

Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download] Dec 11, 2014 · Over the years I have fine-tuned my Excel spreadsheet to require as little input as necessary, especially when it comes to correctly calculate my income tax withholding, based on the various brackets. I tried to find an example for Excel that would calculate federal and state taxes based on the 2017/2018/2019/2020 brackets. What I found was ...

Income Tax Calculator for FY 2022-23 (AY 2023-24) | Free Excel Download Free excel Income Tax Calculator for FY 2022-23 (AY 2023-24) is available for free to download. It calculates the Tax on income under below heads for individuals. Salary income Pension House Property Other Sources (Interest, Dividends etc.) Click on below link / button to download the free excel income tax calculator for FY 2022-23.

How to calculate income tax in Excel? - ExtendOffice Now you can calculate your income tax as follows: 1. Add a Differential column right to the tax table. In the Cell D6 type 10%, in the Cell D7 type the formula =C7-C6, and then drag the AutoFill Handle to the whole Differential column. See screenshot: 2. Add an Amount column right to the new tax table.

Required Minimum Distributions (RMDs) - IRS tax forms If John receives his initial required minimum distribution for 2022 by December 31, 2022, then his first RMD is included on his 2022 income tax return and the second on his 2023 return. However, if John waits to take his first RMD until April 1, 2023, then both his 2022 and 2023 distributions are included in income on his 2023 income tax return.

Income Analysis Worksheet | Essent Guaranty Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Rental Property - Investment Schedule E Determine the average monthly income/loss for a non-owner occupied investment property. Download Worksheet (PDF)

Income tax calculating formula in Excel - javatpoint It is a simple way to calculate income tax and easy to understand. Step 1: Open the Excel worksheet that contains the income details of someone. We have this income dataset: Step 2: As we want to calculate the taxable income and tax. So, create two rows: one for the taxable value and another for the tax.

Income Tax Calculator for FY 2020-21 [AY 2021-22] - Financial Control Excel based Income Tax Calculator for FY 2020-21-AY 2021-22. Budget 2020, bring two tax regimes, somehow benefit certain income taxpayers and drag additional tax from certain taxpayers. From the middle-class taxpayers, the choice is yours. This excel-based Income tax calculator can be used for computing income tax on income from salary ...

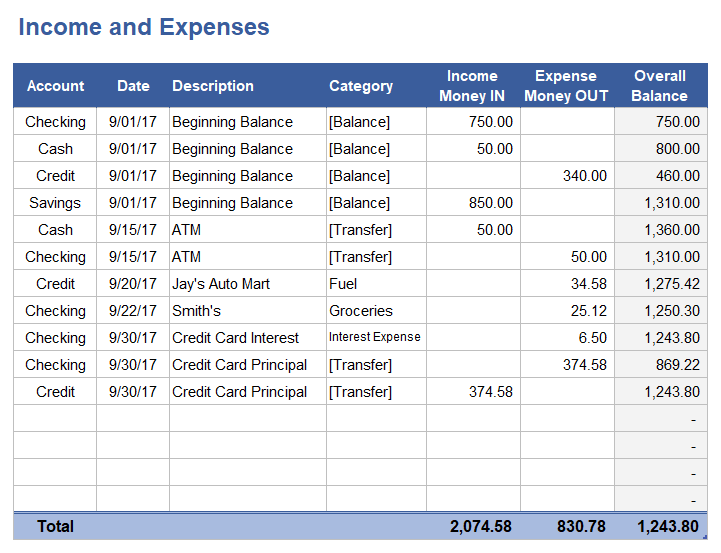

How to Create Expense and Income Spreadsheets in Microsoft Excel Add Totals for the Income and Expenses Having your data formatted as a table makes it simple to add total rows for your income and expenses. Click in the table, select "Table Design", and then check the "Total Row" box. A total row is added to the bottom of the table. By default, it will perform a calculation on the last column.

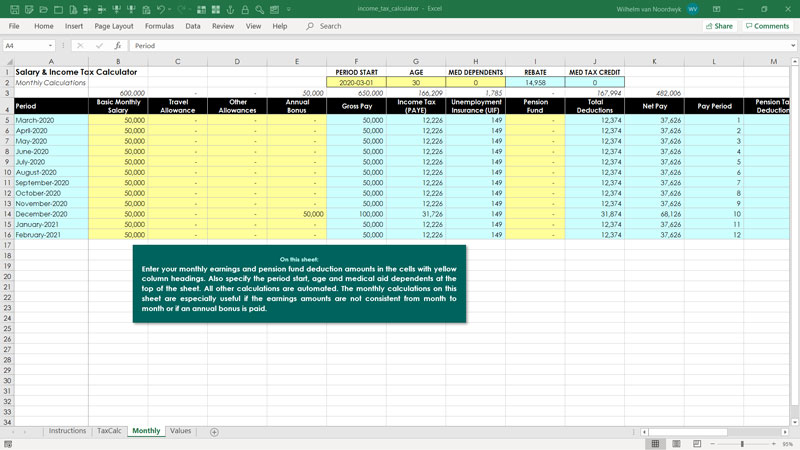

Income Tax Withholding Assistant for Employers Save a copy of the spreadsheet with the employee's name in the file name. Each pay period, open each employee's Tax Withholding Assistant spreadsheet and enter the wage or salary amount for that period. The spreadsheet will then display the correct amount of federal income tax to withhold. Page Last Reviewed or Updated: 03-Dec-2021

Monthly Income Statement Template | Excel Templates A monthly income statement can also be useful when filing taxes, as it tracks taxes paid as well as the amount of income that will be claimed and does so all in one place. Features of a monthly income statement spreadsheet. Revenues/income: This is a record of the amount of money received through sales or providing services.

Income Tax Calculator India in Excel★ (FY 2021-22) (AY 2022-23) 4 How to Calculate Income Tax in India? 4.1 Step 1: Calculate Gross total income from salary: 4.2 Step 2: Tax Deductions 4.3 Step 3: Other Income 4.4 Step 4: Net Taxable Income 4.5 Step 5: Calculating using Income Tax Formula 5 Income Tax Calculator FY 2020-21 Excel 6 Income Tax Calculator FY 2019-20 Excel 7 Income Tax Calculator FY 2018-19 Excel

Income Tax Calculator FY 2020-21 (AY 2021-22) - Excel Download Last Update February 2, 2021. Download Income Tax Calculator FY 2020-21 (AY 2021-22) in Excel Format. This calculator is designed to work with both old and new tax slab rates released in the budget 2020. You can calculate your tax liabilities as per old and new tax slab. It will help you to make an informed decision to opt for a suitable tax ...

Tax Deduction | Excel Templates The Tax Deduction Template is specially designed to provide you with an easier solution to your yearly deduction's calculator. It can be extremely difficult to keep track of all the standard yearly deductions you have, and the itemized deductions throughout the year. Keep track of your itemized deductions using our calculator will help you ...

Tax Planner Spreadsheets - Taxvisor.com The tax planner spreadsheets allow you to perform on-the-fly tax planning with minimal effort. Most people will be able to model their federal and state taxes in a matter of minutes. This is no hoax and no joke: you will be able to plan for your taxes in less time and at significantly less cost than you have ever been able to in the past.

![Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel ...](https://www.apnaplan.com/wp-content/uploads/2020/02/New-Regime-Income-Tax-Slabs-for-FY-2020-21-AY-2021-22-1024x547.png)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-facebook.jpg?strip=all&lossy=1&ssl=1)

0 Response to "41 income tax worksheet excel"

Post a Comment