39 mortgage insurance premiums deduction worksheet

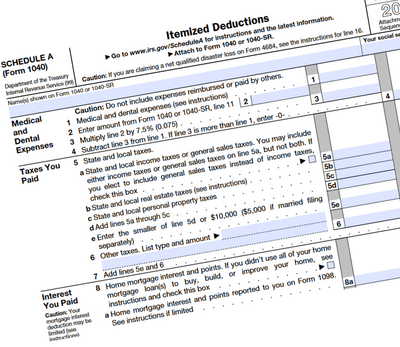

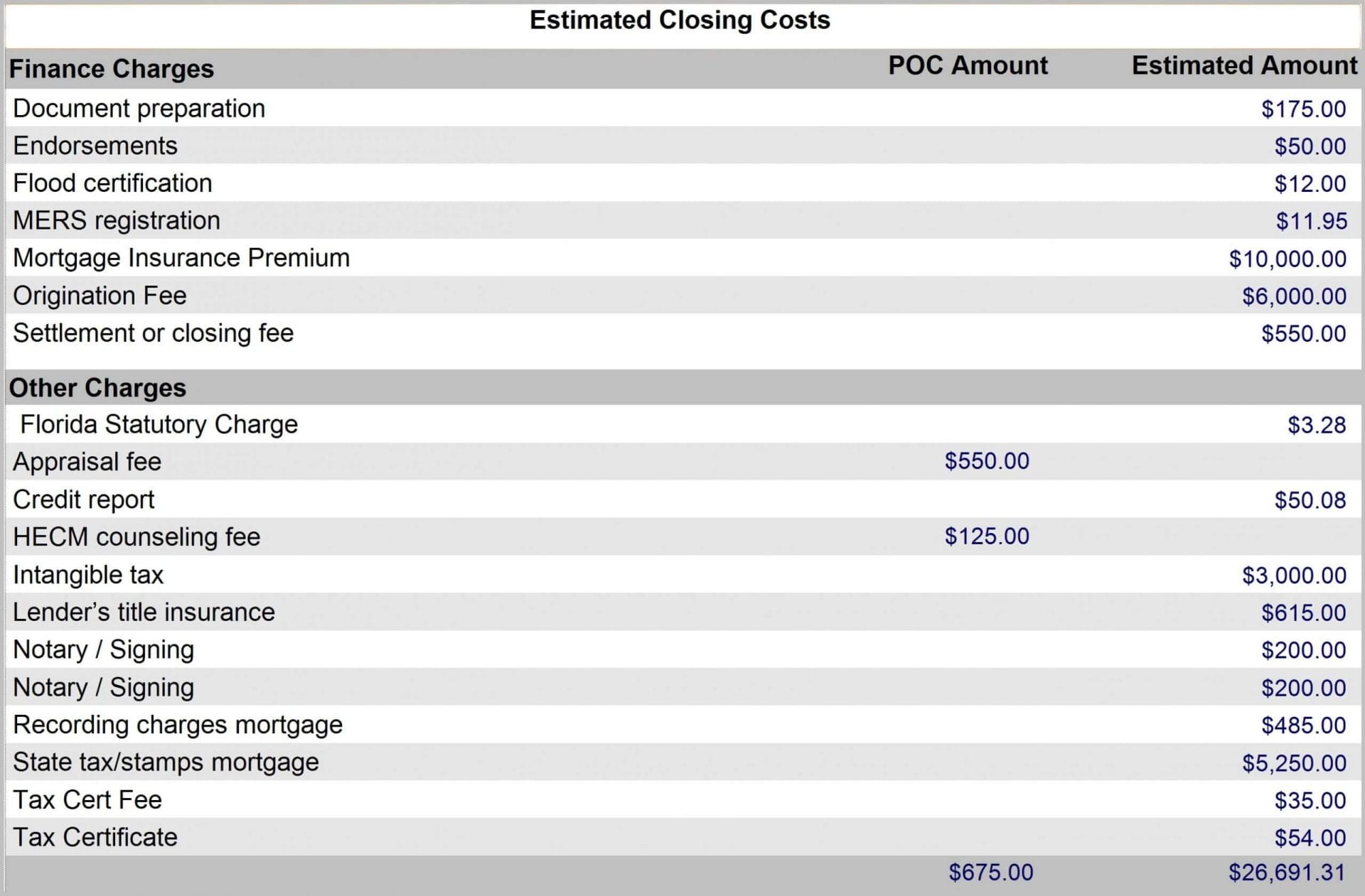

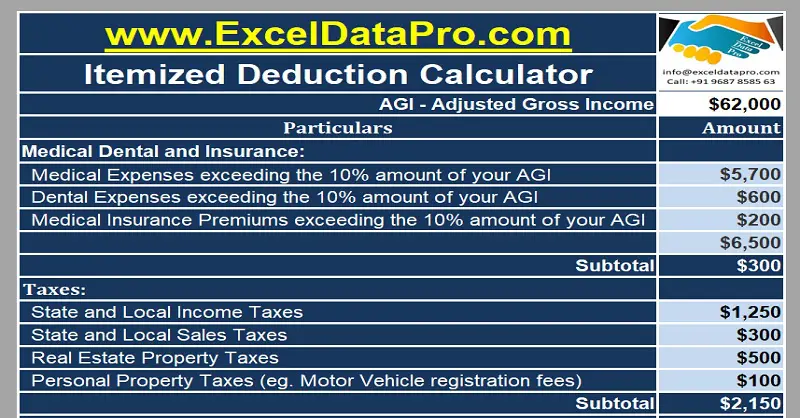

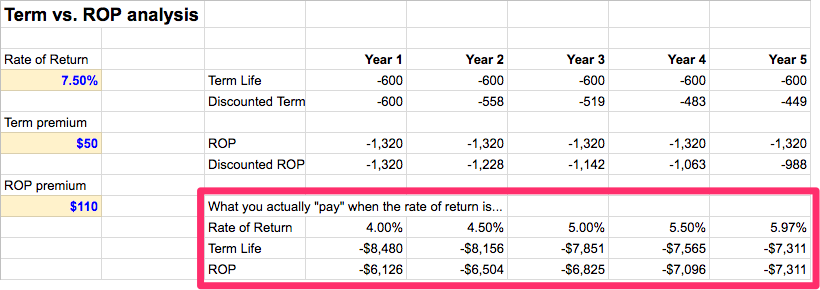

Deductions (Form 1040) Itemized can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Form 1040, line 29. You can't deduct in-surance premiums paid with pretax dol-lars because the premiums aren't inclu-ded in box 1 of your Form(s) W-2. If you are a retired public safety officer, you can't deduct any premiums you paid Publication 936 (2021), Home Mortgage Interest Deduction See line 8d in the Instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your AGI is more than $109,000 ($54,500 if married filing separately), you cannot deduct your …

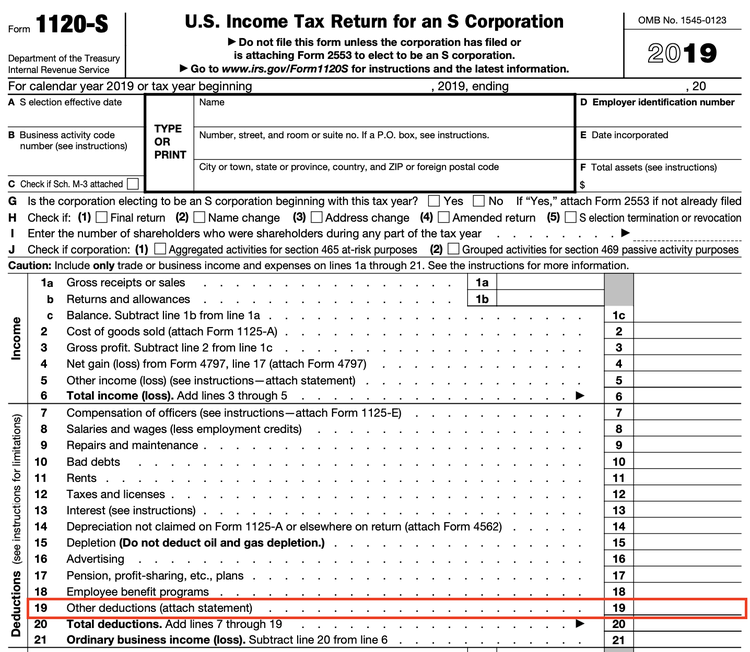

Publication 535 (2021), Business Expenses | Internal Revenue … Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received ... This applies to prepaid interest, prepaid insurance premiums, and any other prepaid expense that creates an ... P.L. 115-97, section 11043, limited the deduction for mortgage interest paid on home equity loans and line ...

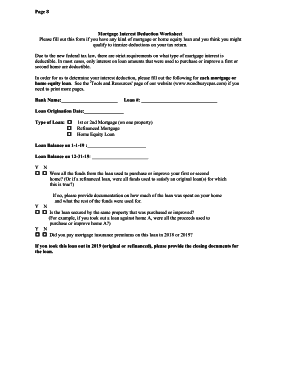

Mortgage insurance premiums deduction worksheet

Publication 587 (2021), Business Use of Your Home If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can include in … Are health insurance premiums tax deductible? 19.8.2022 · Health insurance premiums are tax deductible, but only if your total health care expenses, including premiums, exceed 7.5% of your adjusted gross income, and only the amount above that threshold. Few taxpayers qualify for the deduction. Is PMI Mortgage Insurance Tax Deductible in 2022? - RefiGuide 2.1.2018 · According to Turbo Tax, the mortgage insurance deduction began in 2006 and was extended by the Protecting American from Tax Hikes Act of 2015. For most Americans today, PMI is tax deductible. It is required that the loan was made in 2007 or later, and it has to be either for a primary residence or a second home that you are not renting out.

Mortgage insurance premiums deduction worksheet. 2021 Instructions for Schedule A (2021) | Internal Revenue Service Mortgage Insurance Premiums Deduction Worksheet—Line 8d. Tax Tables . See the instructions for line 8d to see if you must use this worksheet to figure your deduction. ... Mortgage insurance premiums deduction. Subtract line 6 from line 1. Enter the result here and on Schedule A, line 8d: 2021 Instructions for Schedule A - IRS tax forms •Insurance premiums for medical and dental care, including premiums for qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 (Form 1040), line 17. You Publication 530 (2021), Tax Information for Homeowners See Line 8d in the Instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you can't deduct your mortgage insurance premiums. Publication 554 (2021), Tax Guide for Seniors You had paid no tax on the payments that your employer made to the plan, and the payments weren't used to pay for accident, health, or long-term care insurance premiums (as discussed later under Insurance Premiums for Retired Public Safety Officers). The entire $1,200 is taxable. You include $1,200 only on Form 1040 or 1040-SR, line 5b.

Is PMI Mortgage Insurance Tax Deductible in 2022? - RefiGuide 2.1.2018 · According to Turbo Tax, the mortgage insurance deduction began in 2006 and was extended by the Protecting American from Tax Hikes Act of 2015. For most Americans today, PMI is tax deductible. It is required that the loan was made in 2007 or later, and it has to be either for a primary residence or a second home that you are not renting out. Are health insurance premiums tax deductible? 19.8.2022 · Health insurance premiums are tax deductible, but only if your total health care expenses, including premiums, exceed 7.5% of your adjusted gross income, and only the amount above that threshold. Few taxpayers qualify for the deduction. Publication 587 (2021), Business Use of Your Home If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can include in …

.png)

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

0 Response to "39 mortgage insurance premiums deduction worksheet"

Post a Comment