45 tax write off worksheet

PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... make sure I have your last year's tax return so I can follow it. Otherwise, answer the following: Date you purchased the property ... ***Please email or fax worksheet De'More Tax Service Office: 817-726-2181 Mobile: 972-885-9709 Fax: 206-736-0982 Email: taxes@demoretaxservice.com Email: demoretaxservice@gmail.com . Tax Deductions for Photographers - FreshBooks - FreshBooks While you should always make responsible purchases based on your business plan and level of revenue, you should also know that many of these investments are tax deductible. The limit on equipment write-offs is typically around 50% for the first year. The remainder can be written off over the next five years. 2.

FREE Home Office Deduction Worksheet (Excel) For Taxes - Bonsai The Simplest Do It Yourself Option - A Home Office Deduction Worksheet If you are already keeping track of your expenses on your own then using a spreadsheet with all of the calculations built-in should be a straightforward process. If the spreadsheet has the necessary calculations built-in then are a few tax definitions worth remembering.

Tax write off worksheet

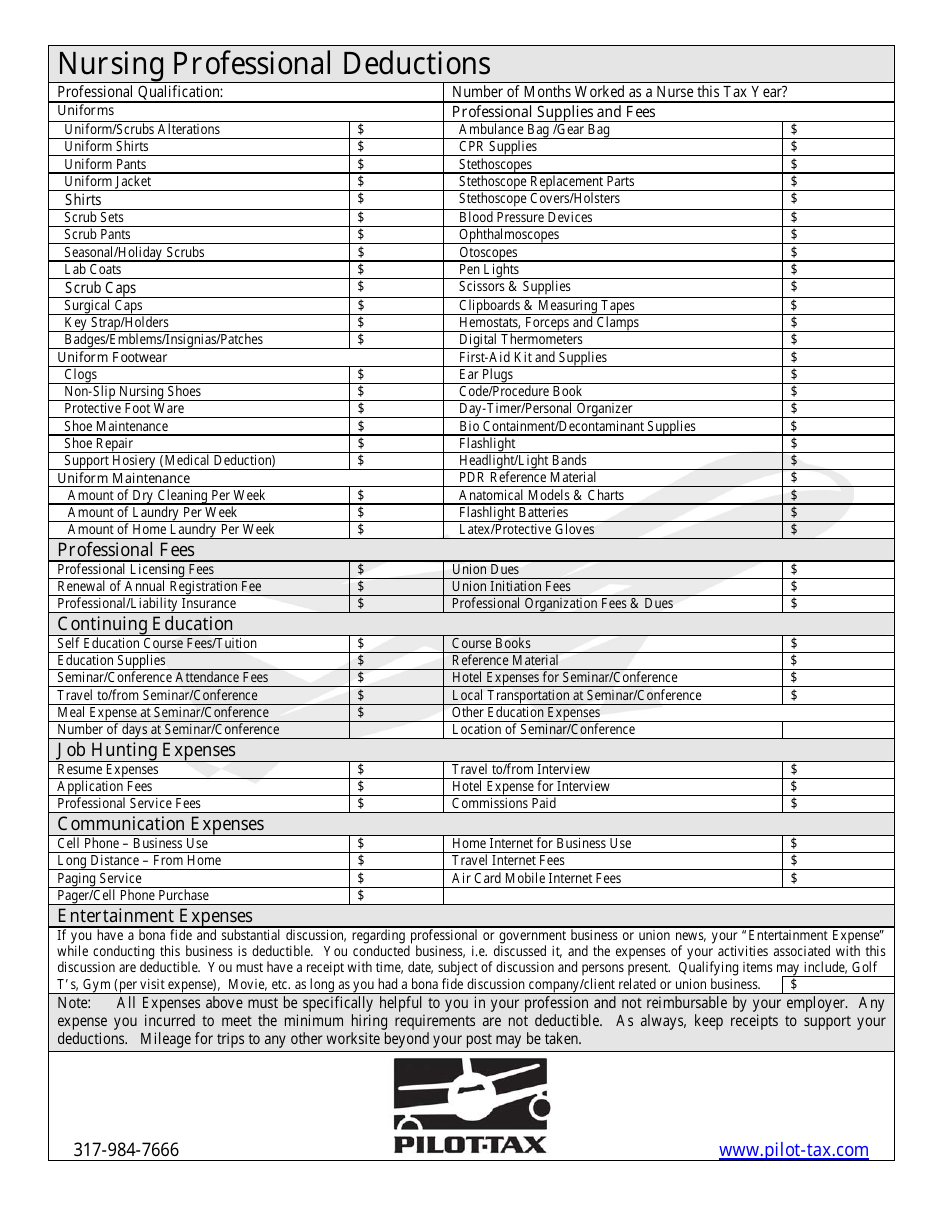

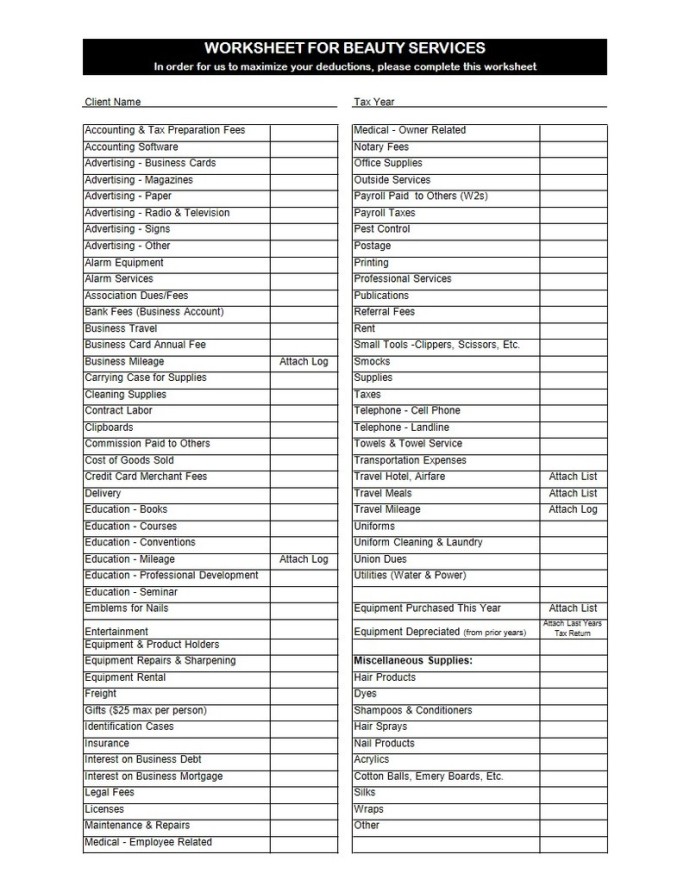

21 Tax Write-Offs for Real Estate Agents - Keeper Tax A portion of your gas station fill ups are tax-deductible. Car maintenance Oil changes, repairs, and regular checkups are all tax-deductible if you drive for work. Insurance & registration Car insurance, roadside assistance, registration costs, etc. are all tax-deductible. Parking Parking for a meeting downtown or other work trip is tax-deductible! TAX ORGANIZERS - Riley & Associates: Certified Public Accountants Excel Tax Organizer 2021 Year-End Tax Letter Universal Tax Deduction Finder 2021 (pdf) Tax Apps (pdf) Tax Organizer for Estates & Trusts (pdf) Tax Organizer for Small Corporations (pdf) Engagement Letter Downloadable Riley & Associates Engagement Letter (.PDF Adobe Acrobat Format) Profession Specific Deduction Checklist Hairstylist Tax Write Offs Checklist for 2022 | zolmi.com Here are the most common tax write offs for self employed hairstylist deductions: Professional Expenses: These common hairstylist tax write-offs include things that you deduct because they're necessary for running your business, like legal fees or salon accounting services.

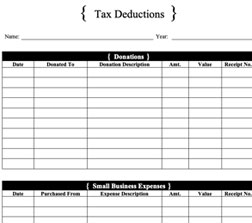

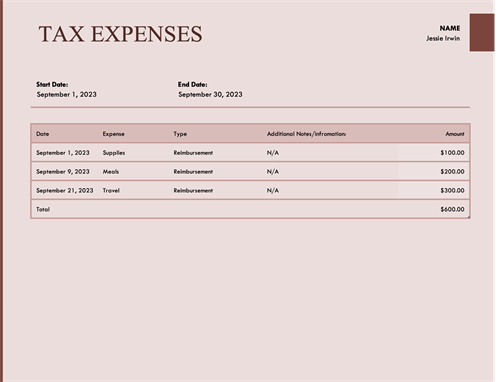

Tax write off worksheet. Tax expense journal - templates.office.com Tax expense journal Track your tax expenses with this accessible tax organizer template. Utilize this tax expense spreadsheet to keep a running total as you go. Take the stress out of filing taxes with this easy-to-use tax deduction spreadsheet. Excel Download Open in browser Share More templates like this Loan amortization schedule Money in Excel Real Estate Agent Tax Deduction Wordsheet - Google Sheets Real Estate Agent Tax Deduction Wordsheet - Google Sheets Some fonts could not be loaded. Try reloading when you're online. Dismiss Something went wrong. Reload. Real Estate Agent Tax Deduction... tax write off worksheet Debt Write Off Worksheet Printable - Fill Online, Printable, Fillable debt write bad pdffiller forms Anchor Tax Service - Self Employed (general) tax self worksheet employed expenses deductions service anchor deduction general firefighters medical touch schedule employees PBS Tax And Accounting PDF Tax Deduction Worksheet - Oxford University Press Tax Deduction Worksheet . This worksheet allows you to itemize your tax deductions for a given year. Tax deductions for calendar year 2 0 ___ ___ HIRED HELP SPACE $_____ Accountant

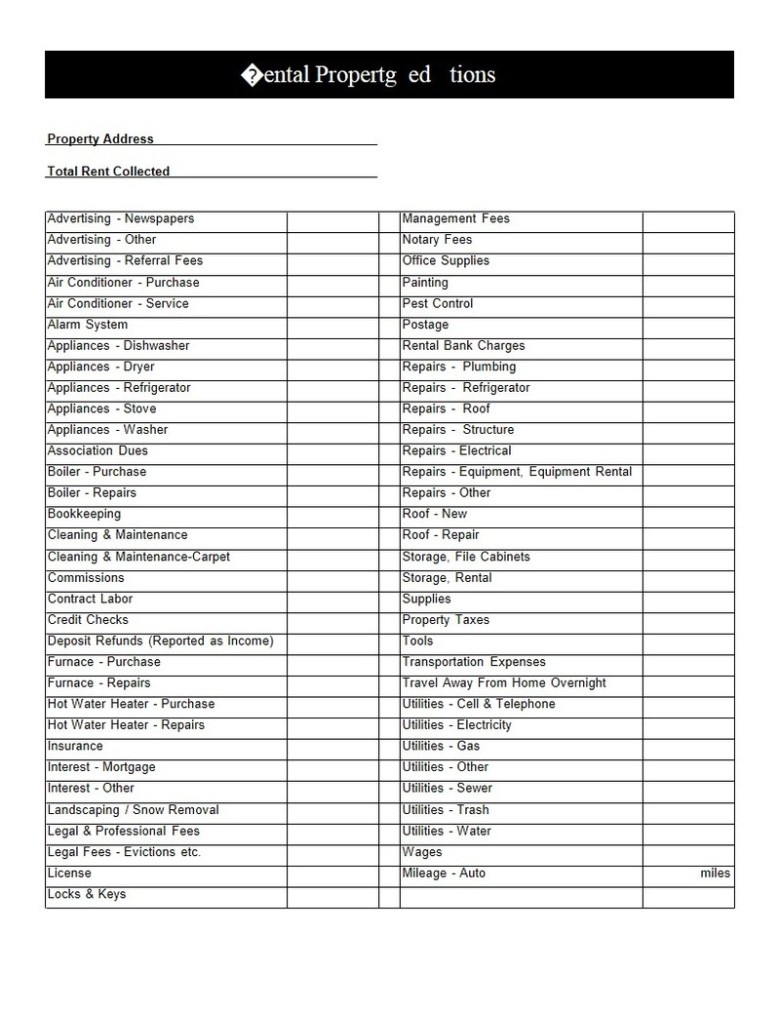

Rental Income and Expense Worksheet - Rentals Resource Center To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category. Realtor Tax Deduction Worksheet Form - signNow Follow the step-by-step instructions below to design your rEvaltor tax deduction worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. An Updated Tax Write-Off Worksheet, by the Nosiest Employee at the IRS Did you receive a stimulus payment (Notice 1444-C or Letter 6475)?; Did you receive wages (Form W-2)?; Did you receive state and city refunds (Form 1099-G)?; Did you receive Venmo payments from your ex (Handle @MattDereklol46) AFTER you broke up on July 23, 2021?. If "Yes," were the Venmo payments for previously shared household items, or was it just Matt Johnston trying to get your ... 15 Tax Deductions and Benefits for the Self-Employed - Investopedia IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

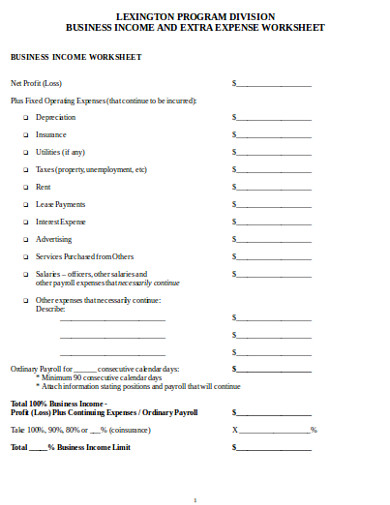

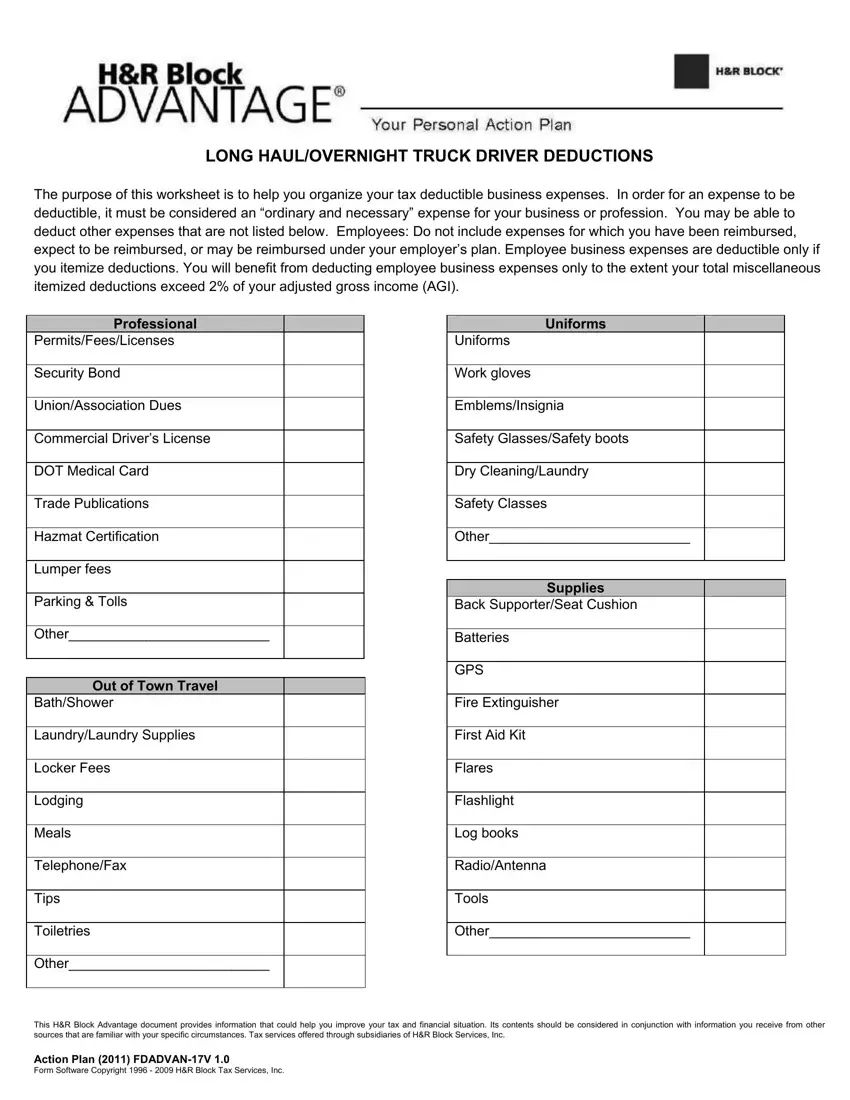

Publication 535 (2021), Business Expenses - IRS tax forms Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. PDF SMALL BUSINESS WORKSHEET - cpapros.com SMALL BUSINESS WORKSHEET Client: ID # TAX YEAR ORDINARY SUPPLIES The Purpose of this worksheet is to help you organize Advertising your tax deductible business expenses. In order for an Books & Magazines expense to be deductible, it must be considered an Business Cards "ordinary and necessary" expense. You may include tax write off worksheet Anchor Tax Service - Rental Deductions. 8 Pictures about Anchor Tax Service - Rental Deductions : Daily Life In Your Day Care | Business expense, Business tax deductions, Bookkeeping business, 7 Insanely Awesome Write-Offs that Solopreneurs Need to Know | Business tax, Tax write offs and also 7 Tax Deductions That You Need to Start Writing Off Immediately. Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai Note: If you want to skip out on manually recording/organizing your business expenses, try Bonsai Tax. Our tax deduction finder would scan your credit card/ bank statements to find all the tax write-offs you qualify for and help you save thousands of dollars. In fact, users typically save $5,600 from their tax bill. Claim your 14-day free trial ...

The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. Dragging down the deductible amount formula

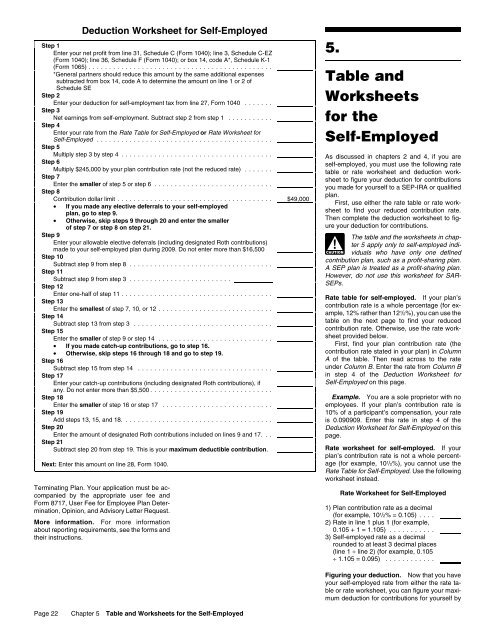

Deductions | FTB.ca.gov - California 1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction. 2. $1,100. 3. Enter the larger of line 1 or line 2 here. 3.

Hairstylist Tax Write Offs Checklist for 2022 | zolmi.com Here are the most common tax write offs for self employed hairstylist deductions: Professional Expenses: These common hairstylist tax write-offs include things that you deduct because they're necessary for running your business, like legal fees or salon accounting services.

TAX ORGANIZERS - Riley & Associates: Certified Public Accountants Excel Tax Organizer 2021 Year-End Tax Letter Universal Tax Deduction Finder 2021 (pdf) Tax Apps (pdf) Tax Organizer for Estates & Trusts (pdf) Tax Organizer for Small Corporations (pdf) Engagement Letter Downloadable Riley & Associates Engagement Letter (.PDF Adobe Acrobat Format) Profession Specific Deduction Checklist

21 Tax Write-Offs for Real Estate Agents - Keeper Tax A portion of your gas station fill ups are tax-deductible. Car maintenance Oil changes, repairs, and regular checkups are all tax-deductible if you drive for work. Insurance & registration Car insurance, roadside assistance, registration costs, etc. are all tax-deductible. Parking Parking for a meeting downtown or other work trip is tax-deductible!

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-01.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-03.jpg)

0 Response to "45 tax write off worksheet"

Post a Comment