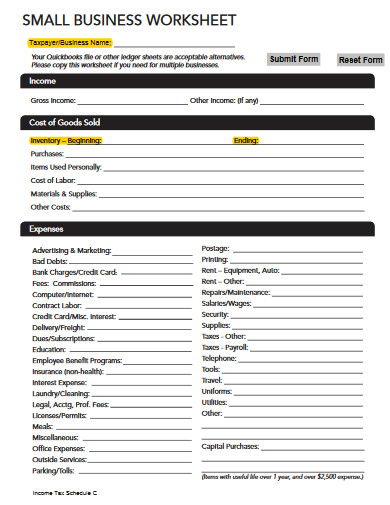

44 business income insurance worksheet

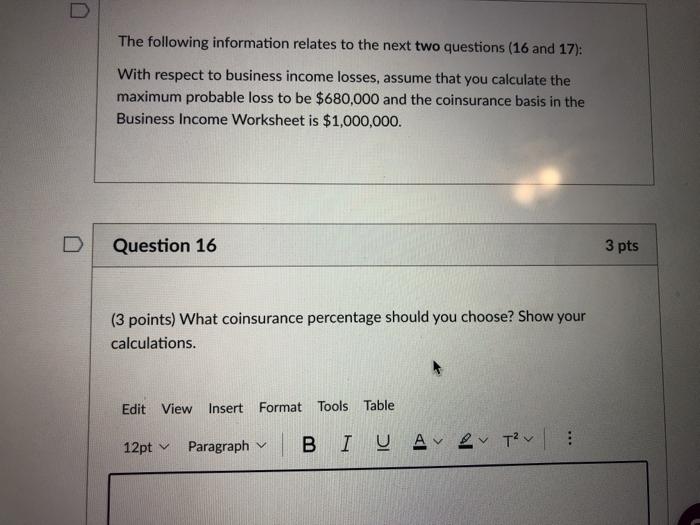

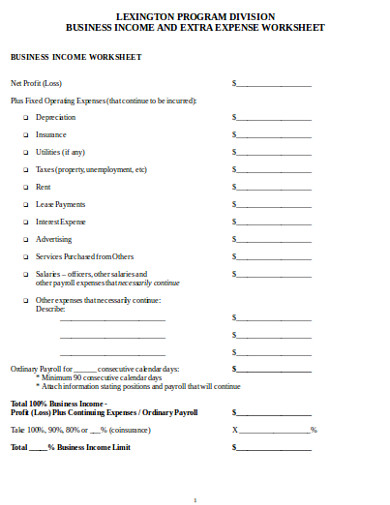

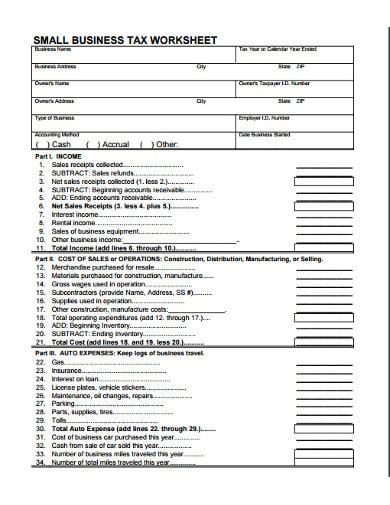

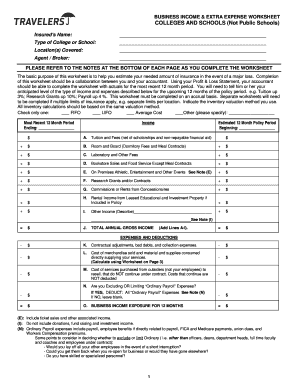

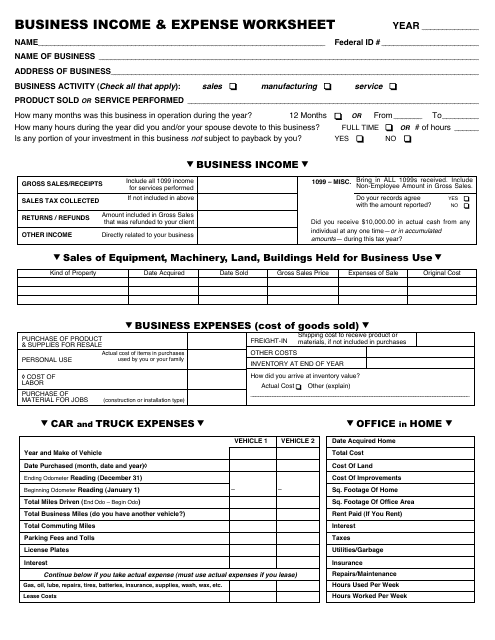

Calculating the Correct Business Income Coinsurance The business income section of the worksheet is completed in this post; and possibly more importantly, how the correct business income coinsurance percentage is developed is explained below. Not discussed in this commentary are the two remaining lines of the business income report/worksheet: the Extra Expense amount ("K.1.") ; and the Extended ... PDF Business Income Worksheet Non Manufacturing or Mercantile Operations and beyond your regular expenses. The purpose of this worksheet is to estimate the potential expsoure/expenses incurred as your business continues operations while trying to get back to normal after a loss. Business Income insurance covers what the business would have earned if no loss had occurred. Extra Expense covers the

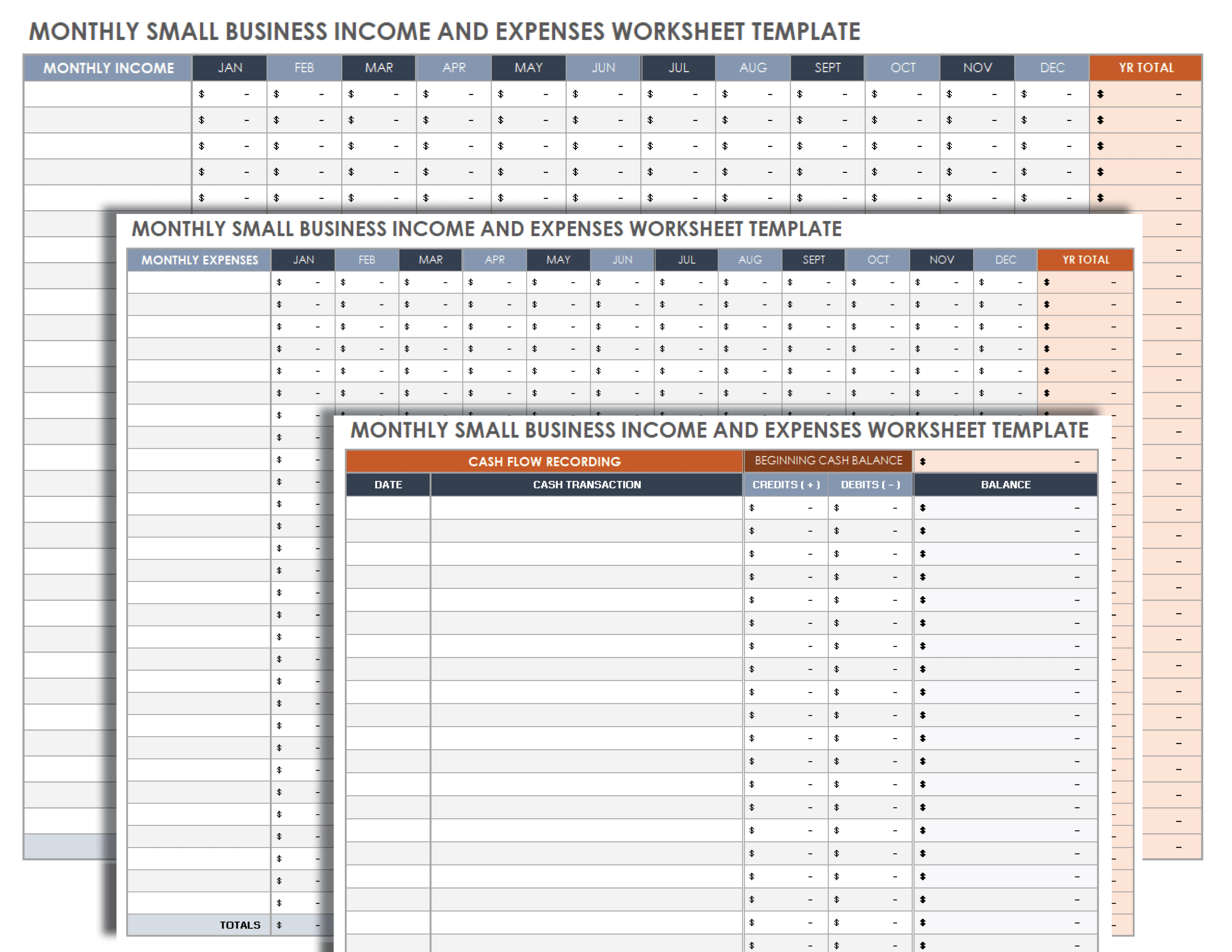

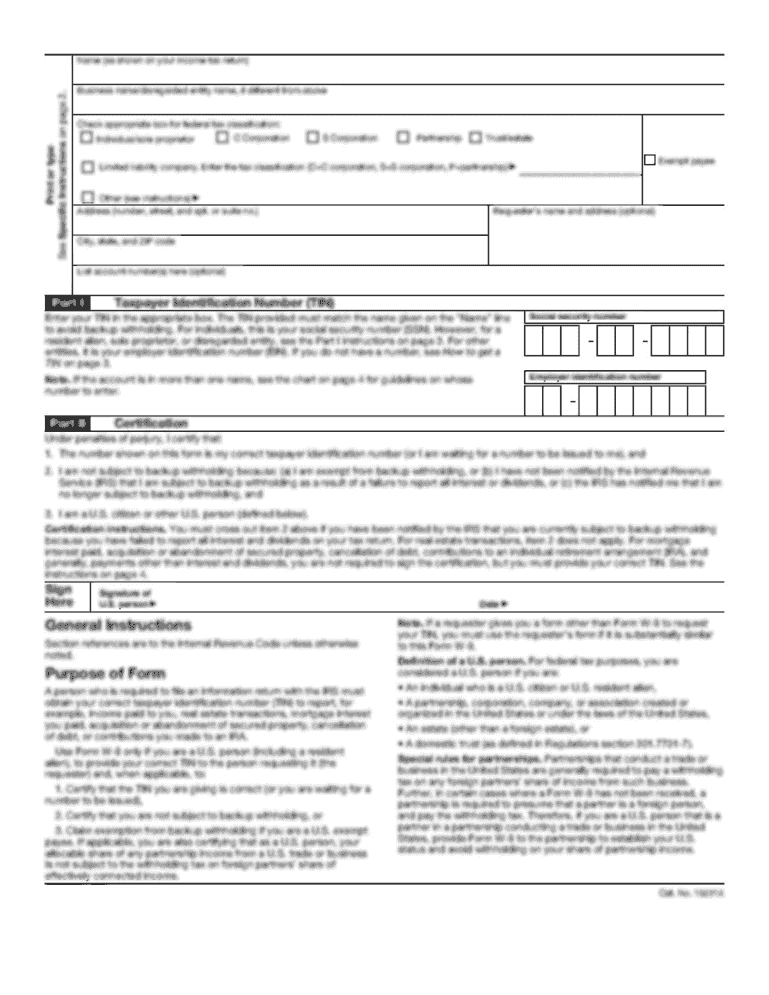

XLS Business Income Coverage Worksheet: PROFESSIONAL SERVICES The Business Income worksheet is constructed using two columns. The first column is the previous fiscal year actual values and the second column is where you enter the estimated values for the policy period beginning on the prospective effective date of the policy and estimating values out for 12 months from that date.

Business income insurance worksheet

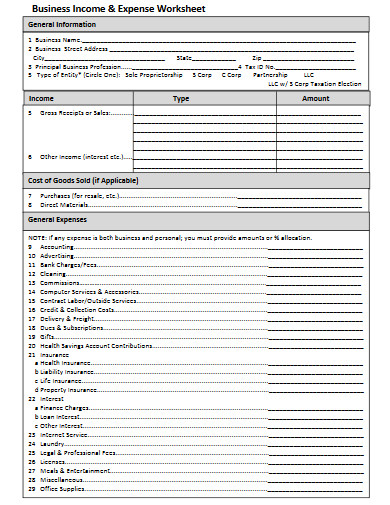

My Business Income Consultation from Chubb It is offered as a resource to help you establish adequate business income and extra expense values for insurance purposes. This guide is necessarily general in content and is intended as a tool that you can use together with others at your disposal to establish the values you wish to insure. A Guide to the Qualified Business Income Deduction (2022) - The Motley Fool May 18, 2022 · Here’s an example: Your taxable income is $150,000, of which $60,000 is QBI. You simply multiply QBI ($60,000) by 20% to figure your deduction ($12,000). Publication 334 (2021), Tax Guide for Small Business ... If you are a U.S. citizen who has business income from sources outside the United States (foreign income), you must report that income on your tax return unless it is exempt from tax under U.S. law. If you live outside the United States, you may be able to exclude part or all of your foreign-source business income.

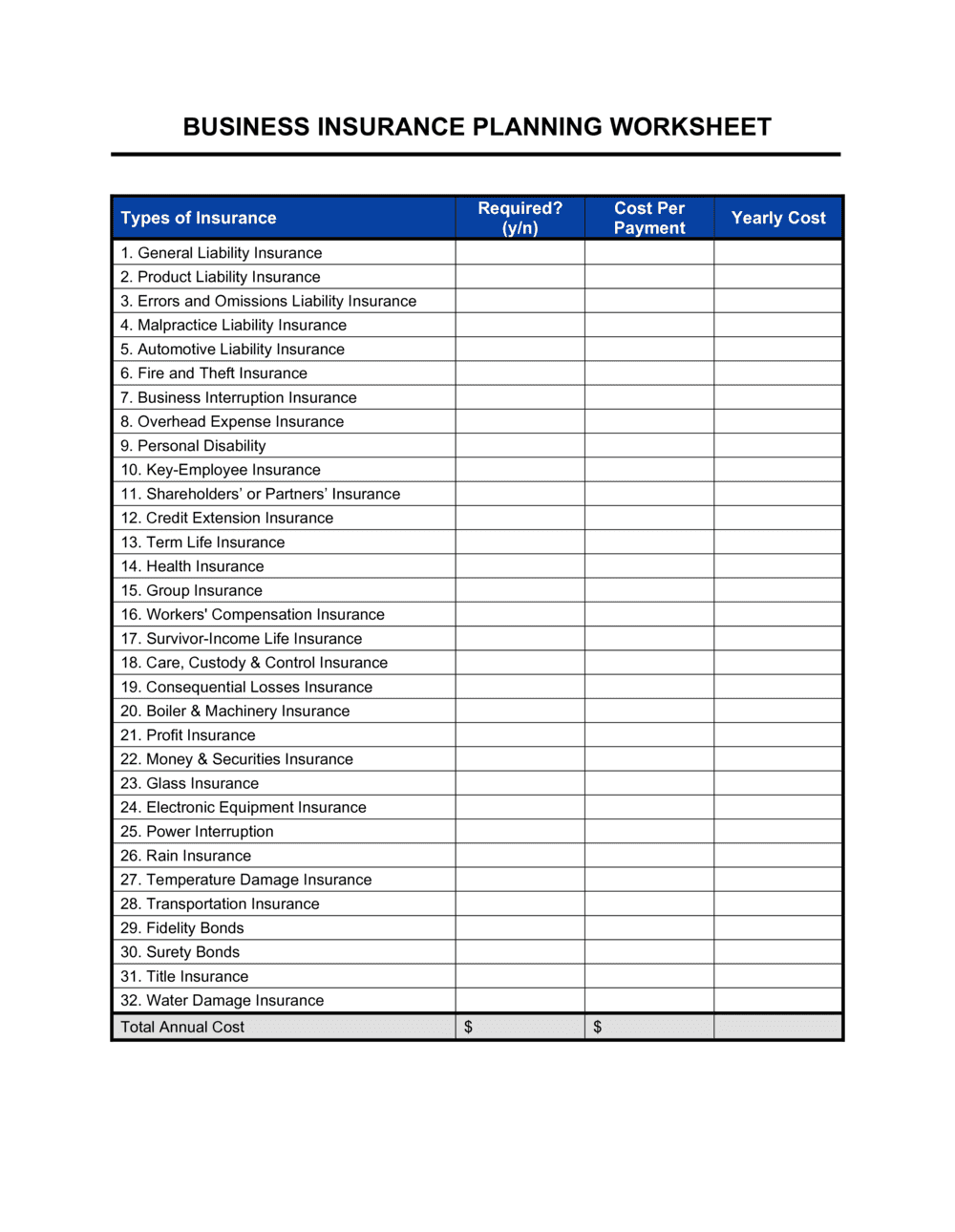

Business income insurance worksheet. Business Income Worksheets For Insurance - getallworks.com Business Income Insurance Coverage: Calculating How … 6 hours ago Completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Together with a sound business continuity plan, it serves as a critical planning tool to help your business recover from unplanned business interruptions. To get started, choose from the industry selections ... Publication 541 (03/2022), Partnerships | Internal Revenue Service Introduction. This publication provides supplemental federal income tax information for partnerships and partners. It supplements the information provided in the Instructions for Form 1065, U. S. Return of Partnership Income; the Partner's Instructions for Schedule K-1 (Form 1065); and Instructions for Schedule K-2 and Schedule K-3 (Form 1065). Wynward Insurance Group - Business Income Worksheet Business Income Worksheet Wynward is pleased to provide our customers with a tool to assist in establishing the correct limit of insurance for the resultant loss of business income after a loss occurs. Please be sure to consult with one of our professional broker partners for advice in this area and in completing the form. Qualified Business Income Deduction | Internal Revenue Service The qualified business income (QBI) deduction allows you to deduct up to 20 percent of your QBI. Learn more. ... Generally this includes, but is not limited to, the deductible part of self-employment tax, self-employed health insurance, and deductions for contributions to qualified retirement plans (e.g. SEP, SIMPLE and qualified plan deductions).

Business Income Worksheet | Insurance Glossary Definition - IRMI Definition Business Income Worksheet — a form used to estimate an organization's annual business income for the upcoming 12-month period, for purposes of selecting a business income limit of insurance. Business Income and Extra Expense Insurance - Travelers Even though your business is closed, you may still have financial responsibilities, like payroll, rent, taxes and other bills. Business income and extra expense coverage helps replace your income and expenses while your business is recovering from a covered loss. Some business policies provide additional protection, like extended business ... Business Income Insurance Coverage: Calculating How Much ... - Travelers Business Income Worksheets Business Income Insurance Coverage: Calculating How Much Your Company Needs Commercial property coverage can help protect your company property from physical damage caused by a fire, windstorm, vandalism or other covered cause of loss. Sometimes, the covered property damage causes your business to shut down temporarily. Business Interruption (Income) Insurance and Coverage Basics | Chubb Business insurance policies vary from insurance company to insurance company, but business interruption coverage typically includes compensation for: Lost revenue - based on prior financial records Mortgage, rent and lease payments Employee payroll Taxes and loan payments - due during the covered period

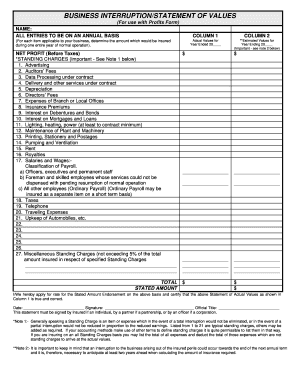

Business interruption coverage calculator | Services | Zurich Insurance Completing a BI Worksheet is oftentimes perceived as a complicated event, the BICC tool simplifies this process. The result is a mutual benefit of the insurance buying customer, the producer and the insurance provider. A successfully completed BI Worksheet is the foundation for proper Business Interruption valuation and coverage needs. Publication 523 (2021), Selling Your Home | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. PDF Business Income Report/Worksheet - Iiat Business Income following resumption of operations for up to 60 days or the number of days selected under Extended Period Of Indemnity option) + + 3. Combined (all amounts in K.1. and K.2.) $ "Estimated" Column L. Total Of J. And K. $ The figure in L. represents 100% of your estimated Business Income exposure for 12 months, and additional expenses. Form 4506-T (Rev. 11-2021) - IRS tax forms (shows basic data such as return type, marital status, AGI, taxable income and all payment types), Record of Account Transcript (combines the tax return and tax account transcripts into one complete transcript), Wage and Income Transcript (shows data from information returns we receive such as Forms W-2, 1099, 1098 and Form 5498), and

How a Business Income Worksheet Helps You Rebuild after Disaster Completing a worksheet may seem like a hassle, but it will help you estimate recovery costs and give you a blueprint to follow during the restoration period. It also documents your organization's pre-loss income and expenses when you submit a worksheet as part of your application for coverage. This is important if you want "agreed value ...

SAM.gov The unique entity identifier used in SAM.gov has changed. On April 4, 2022, the unique entity identifier used across the federal government changed from the DUNS Number to the Unique Entity ID (generated by SAM.gov).. The Unique Entity ID is a 12-character alphanumeric ID assigned to an entity by SAM.gov.

PDF Specialty Human Services Division BUsiness income Worksheet Great american insurance Group | Specialty Human ServiceS DiviSion F.36220 (01/14) business income worksheet - pg 2 Business Income and Extra Expense Example $1,000,000 12-month expected BI exposure (item E, page 1) 8 month max expected period of recovery (item 2, page 1) 3 peak months generate an average of 33% greater business income ...

PDF Business Income & Extra Expense Worksheet Manufacturers Q. Minimum Amount of Business Income Insurance needed for your estimated Period of Restoration (Sum of Line N + P or Sum of Line O + P) =$ ... business income worksheet must be submitted to and accepted by us prior to a loss. A new worksheet must be submitted if you (1) change the limit of insurance mid-term, or (2) at the end of each 12 month ...

XLS Business Income Coverage Worksheet: HEALTHCARE The Business Income worksheet is constructed using two columns. The first column is the previous fiscal year actual values and the second column is where you enter the estimated values for the policy period beginning on the prospective effective date of the policy and estimating values out for 12 months from that date.

How to Calculate Business Income for Insurance | The Hartford Business income insurance can help cover these payroll costs. Utilities. For example, say you need to pay for utilities for the next two months while your business is being repaired. However, you can’t open your operation until after the repairs are finished. Your business income insurance can step in and help pay for your utility bills. Lost ...

Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

PDF Simplified Business Income and Extra Expense Worksheet - Vantreo Business Income Insurance is often extended to 18 or 24 months. ... License #0F69776 ___ SIMPLIFIED BUSINESS INCOME AND EXTRA EXPENSE WORKSHEET This worksheet is designed to help determine a 12-month business income and extra expense exposure. Business income, in general, pays for net income (or loss) the insured would have earned or incurred ...

PDF Business Income Worksheets: Simplified! Business Income Worksheets: Simplified! A Tutorial for the Confused By Robert M. Swift, CPCU, CIPA, CBCP Business Income (BI) worksheets are an integral part of the insurance selection process because they easily determine an organization's financial risk/exposure to loss. If "agreed amount" coverage is requested, insurance companies must ...

XLSM Business and Personal Insurance Solutions | Travelers Insurance This worksheet is a tool to help you estimate the amount of Business Income insurance you will need to cover your Business Income exposure in the event of a major covered loss. If the coverage you are purchasing includes Extra Expense, this worksheet also helps you estimate the additional amount of insurance needed to cover your Extra Expense ...

Publication 590-A (2021), Contributions to Individual Retirement ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

PDF Business Income & Extra Expense Worksheet Non-manufacturers M. Minimum Amount of Business Income Insurance needed for your estimated Period of Restoration (Sum Line J + L or Sum Line K + L.) =$ ... business income worksheet must be submitted to and accepted by us prior to a loss. A new worksheet must be submitted if you (1) change the limit of insurance mid-term, or (2) at the end of each 12 month ...

PDF BUSINESS INCOME REPORT/WORK SHEET - BSR Insurance The figure in L. represents 100% of your estimated Business Income exposure for 12 months, and additional expenses. Using this figure as information, determine the approximate amount of insurance needed based on your evaluation of the number of months needed (may exceed 12 months) to replace your property, resume

Publication 334 (2021), Tax Guide for Small Business ... If you are a U.S. citizen who has business income from sources outside the United States (foreign income), you must report that income on your tax return unless it is exempt from tax under U.S. law. If you live outside the United States, you may be able to exclude part or all of your foreign-source business income.

A Guide to the Qualified Business Income Deduction (2022) - The Motley Fool May 18, 2022 · Here’s an example: Your taxable income is $150,000, of which $60,000 is QBI. You simply multiply QBI ($60,000) by 20% to figure your deduction ($12,000).

My Business Income Consultation from Chubb It is offered as a resource to help you establish adequate business income and extra expense values for insurance purposes. This guide is necessarily general in content and is intended as a tool that you can use together with others at your disposal to establish the values you wish to insure.

0 Response to "44 business income insurance worksheet"

Post a Comment