43 sec 1031 exchange worksheet

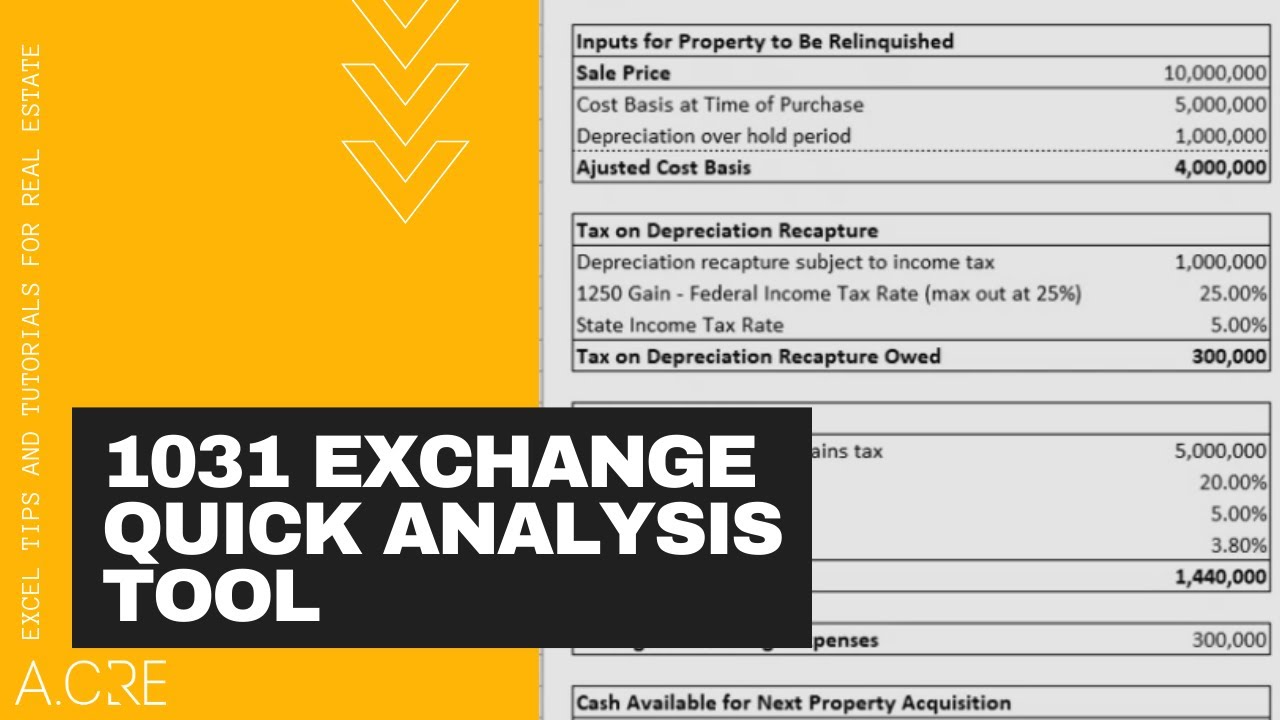

1031 Exchange Calculator | Calculate Your Capital Gains Restart & Clear Fields (1) To estimate selling costs use 8 to 10% of selling price consider discounts or allowances given by seller. (2) To estimate residential depreciation taken multiply purchase price of property being sold by 3%, times the number of years the property has been rented. XLS 1031 Corporation Exchange Professionals - Qualified Intermediary for ... 1031 Corporation Exchange Professionals - Qualified Intermediary for ...

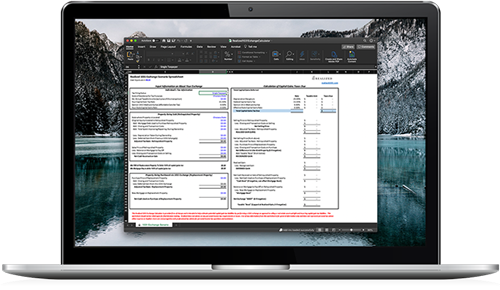

1031 Exchange Worksheet - Pruneyardinn Worksheet April 19, 2018 18:23 The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet.

Sec 1031 exchange worksheet

Real Estate Investment Software Product Comparison ... - RealData Software Real Estate Calculator. A potent collection of 16 modules, each with lots of valuable features and options that you would only hope to find in programs costing a great deal more. This is a must-have tool for anyone in real estate or finance. Learn More →. PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 1031 Exchange Examples: Like-Kind Examples to Study & Learn From You would like to do a 1031 exchange into a $3,975,000 Walgreens in McDonough, Georgia. You exchange your $4,000,000 property for the $3,975,000 7-Eleven and an adjoining lot worth $275,000 for a total value of $4,250,000. This means that there is no boot in the exchange. You qualify for a full tax deferral for the $500,000 capital gain.

Sec 1031 exchange worksheet. Instructions for Form 8824 (2022) | Internal Revenue Service Exchanges limited to real property. Beginning after December 31, 2017, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. See Definition of real property, later, for more details. 1031 Exchange Examples | 2022 Like Kind Exchange Example Step 1 Determine Adjusted Basis After several years, Ron and Maggie's adjusted basis in the property may look like this: Step 2 Calculate Realized Gain Ron and Maggie are contemplating selling their property. They believe the property could be sold for $2,850,000. Assuming $50,000 in closing costs, their "realized gain" may look like this: IRS 1031 Exchange Worksheet And Section 1031 Exchange ... - Pruneyardinn IRS 1031 Exchange Worksheet And Section 1031 Exchange Calculation Worksheet can be valuable inspiration for people who seek an image according specific topic, you can find it in this website. Finally all pictures we've been displayed in this website will inspire you all. Thank you. Download by size: Handphone Tablet Desktop (Original Size) PlayStation userbase "significantly larger" than Xbox even if … 12.10.2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

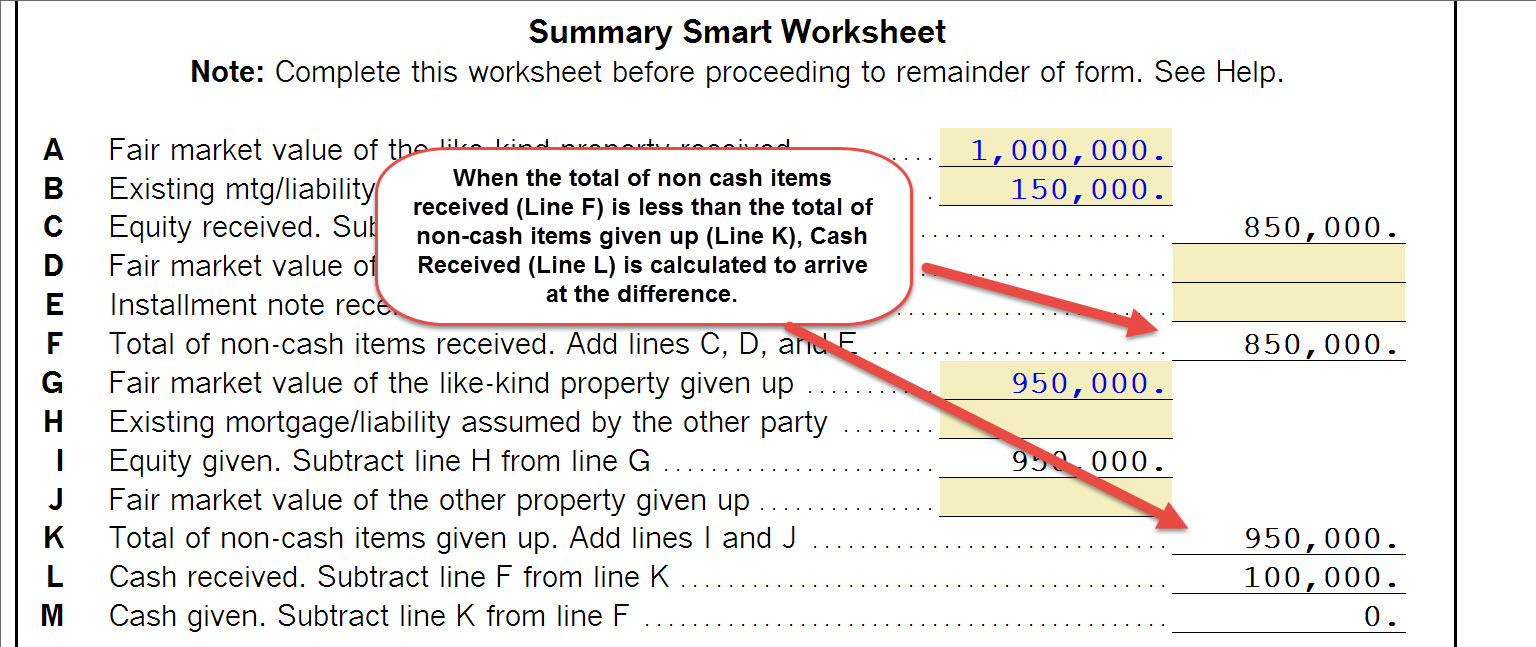

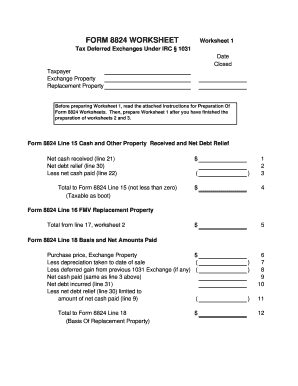

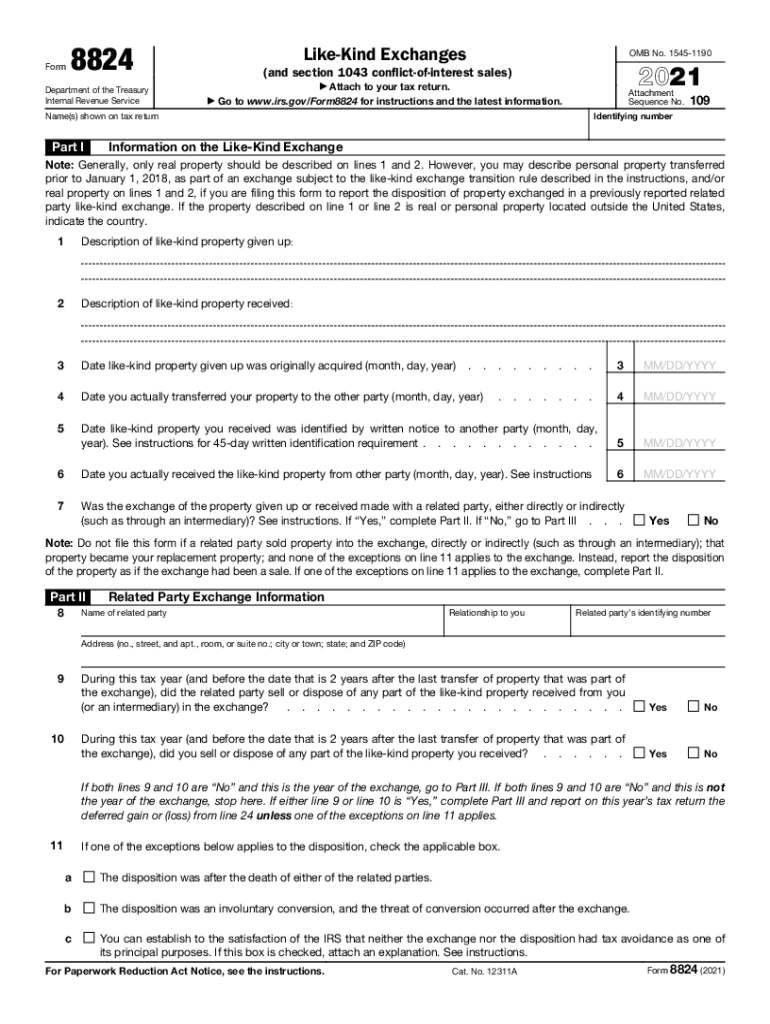

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms type of Section 1031 exchange is a simultaneous swap of one property for another. Deferred exchanges are more complex but allow flexibility. They allow you to dispose of property and subsequently acquire one or more other like-kind replacement properties. To qualify as a Section 1031 exchange, a deferred exchange must be distinguished from the case Exchanges Under Code Section 1031 - American Bar Association What is a 1031 Exchange? An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to acquire replacement property. A 1031 exchange is governed by Code Section 1031 as well as various IRS Regulations and Rulings. PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) PDF §1031 BASIS ALLOCATION WORKSHEET - firsttuesday Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost basis of all §1031 Replacement Property received.....(=)$ _____ 4.2 Allocation of basis between two or more §1031 Replacement Properties: a.Identification: _____

How To Record A 1031 Exchange - realized1031.com Your replacement property is recorded as a credit to the account, which decreases that balance. Using the same piece of land valued at $200,000, you do a 1031 like-kind exchange for another piece of land valued at $175,000. Your loss or credit on the exchange is $25,000. If it was the other way around, your relinquished property was valued at ... 1031worksheet - Learn more about 1031 Worksheet In a 1031 Exchange, Section 1031 of the Internal Revenue Code (IRC) allows taxpayers to defer capital gain taxes by exchanging qualified, real or personal property (known as the "relinquished property") for qualified "like-kind exchange" property (replacement property). The net result is that the exchanger can use 100% of the proceeds (equity) from their sale to buy another property ... PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 ️1031 Exchange Worksheet Excel Free Download| Qstion.co 1031 Exchange Worksheet Excel Master Of This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost basis of all §1031 replacement property received. (=)$ _____ 4.2 allocation of basis between two or more §1031 replacement properties:

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

PDF Home - Realty Exchange Corporation | 1031 Qualified Intermediary Home - Realty Exchange Corporation | 1031 Qualified Intermediary

Completing a like-kind exchange in the 1040 return 19.7.2022 · A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset. Open the Asset Entry Worksheet for the asset being traded.

PDF 2019 Exchange Reporting Guide - 1031 Corp A 1031 exchange must be reported for the tax year in which the exchange was initiated through ... 2018, repealed Section 1031 exchanges of tangible and intangible personal property assets. Reporting State Capital Gain/ Income Tax ; 1031 ; CORP. CORP.com ; 1031 ; CORP; CORP: 1031 ; CORP. CORP.com

Accounting for 1031 Like-Kind Exchange - BKPR Section 1031 exchanges are not new. But the rules have changed over time. A Section 1031 or like-kind exchange is an income tax concept. It applies when you swap two real estate properties with the same nature or character. Even if the quality or grade of these properties differs, they may still qualify for like-kind exchange treatment.

Unbanked American households hit record low numbers in 2021 Oct 25, 2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ...

1031 Exchange with Multiple Properties [Explained A-to-Z] Rules for ... Alternatives to 1031 Exchange with Multiple Relinquished Properties. Other approaches (with drawbacks specific to each, as well) are available. Completing a separate 1031 exchange for each property you sell may be viable. More 1031 exchanges will provide lower risk of missing identification and exchange deadlines.

1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

1031 Exchange Calculator - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

What Expenses Are Deductible in a 1031 Exchange? Total Allowable Exchange Expenses $137,915.00 REPLACEMENT PROPERTY $ AMOUNT IF TAXPAYER WANTS TO DEFER ALL TAXES IS: $2,162,085.00. How did we arrive at that figure? Sales Price of $2,300,000.00 less $137,915.00 in allowable exchange expenses = $2,162,085.00. Non-Allowed Exchange Expenses: Real Estate Taxes $ 26,500.00 Loan Payoff $ 455,000.00

Publication 550 (2021), Investment Income and Expenses Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Solved: 1031 exchange - Intuit Accountants Community A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset. Open the Asset Entry Worksheet for the asset being traded ...

What Is a 1031 Exchange? Know the Rules - Investopedia Broadly stated, a 1031 exchange (also called a like-kind exchange or a Starker exchange) is a swap of one investment property for another. Most swaps are taxable as sales, although if yours...

Publication 537 (2021), Installment Sales | Internal Revenue Service Under this type of exchange, the person receiving your property may be required to place funds in an escrow account or trust. If certain rules are met, these funds won’t be considered a payment until you have the right to receive the funds or, if earlier, the end of the exchange period. See Regulations section 1.1031(k)-1(j)(2) for these rules.

sec 1031 exchange worksheet 29 Sec 1031 Exchange Worksheet - Notutahituq Worksheet Information notutahituq.blogspot.com. 1031 tax. 1031 Like Kind Exchange Worksheet - Ivuyteq ivuyteq.blogspot.com. exchange 1031 kind worksheet entering wizard using. The Weaver CPA Firm, Folsom, CA| Real Estate Tax And Consulting Page | X

IRC 1031 Like-Kind Exchange Calculator This is known as the exchange period, and there is also an identification period, which is limited to 45 days after closing on the old property. These 45 days of identification are included in the 180-day exchange period. Calculate Your 1031 Deadline Use our 1031 deadline calculator to figure your deadlines. The Improvement Exchange

May 2021 National Occupational Employment and Wage Estimates 31.3.2022 · Occupation code Occupation title (click on the occupation title to view its profile) Level Employment Employment RSE Employment per 1,000 jobs Median hourly wage

2020 S Corporation Tax Booklet | FTB.ca.gov - California On a separate worksheet, using the Form 100S format, complete Form 100S, Side 1 and Side 2, line 1 through line 14, without regard to line 11. If any federal charitable contribution deduction was taken in arriving at the amount entered on Side 1, line 1, enter that amount as an addition on line 7 of the Form 100S formatted worksheet.

PPIC Statewide Survey: Californians and Their Government Oct 26, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ...

Microsoft takes the gloves off as it battles Sony for its Activision ... 12.10.2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition.

1031 Exchange Examples: Like-Kind Examples to Study & Learn From You would like to do a 1031 exchange into a $3,975,000 Walgreens in McDonough, Georgia. You exchange your $4,000,000 property for the $3,975,000 7-Eleven and an adjoining lot worth $275,000 for a total value of $4,250,000. This means that there is no boot in the exchange. You qualify for a full tax deferral for the $500,000 capital gain.

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

Real Estate Investment Software Product Comparison ... - RealData Software Real Estate Calculator. A potent collection of 16 modules, each with lots of valuable features and options that you would only hope to find in programs costing a great deal more. This is a must-have tool for anyone in real estate or finance. Learn More →.

0 Response to "43 sec 1031 exchange worksheet"

Post a Comment