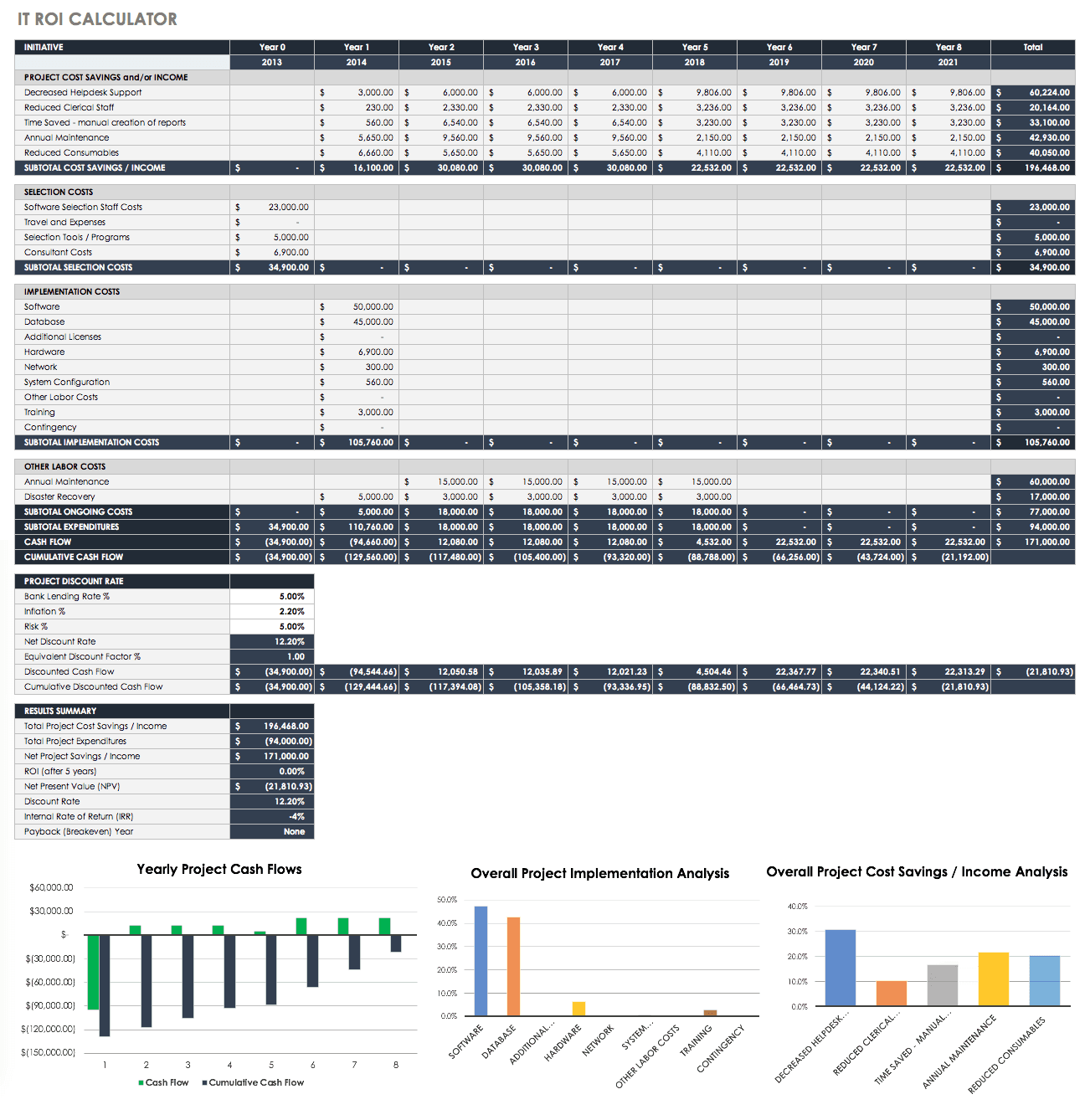

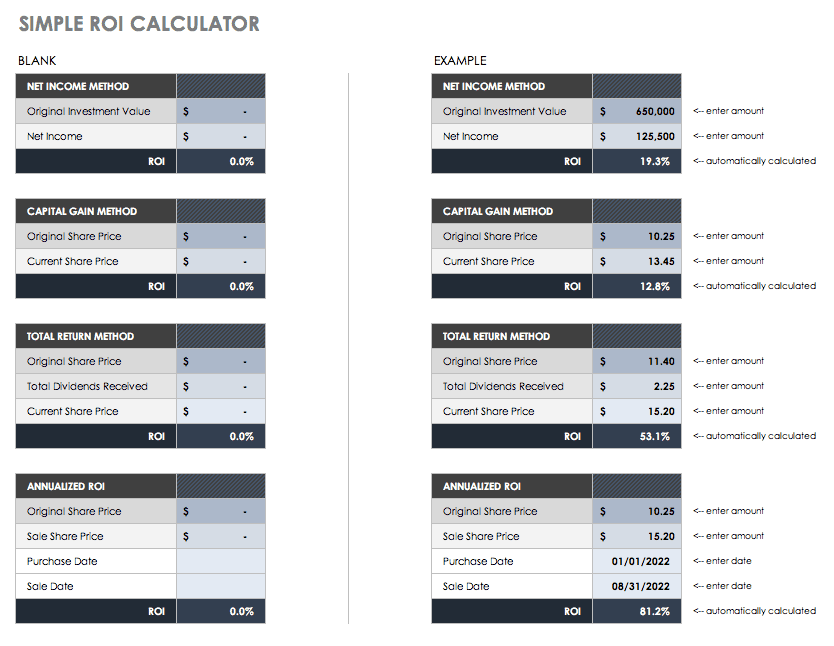

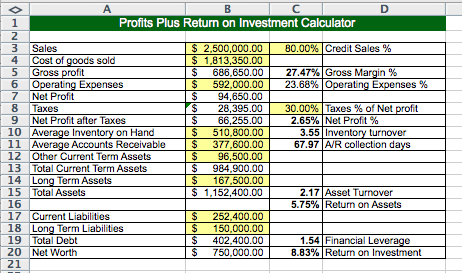

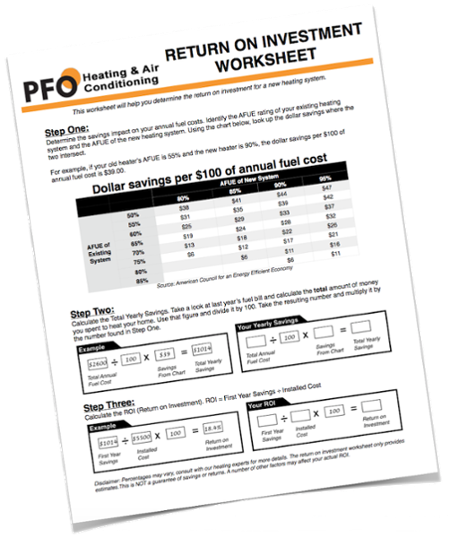

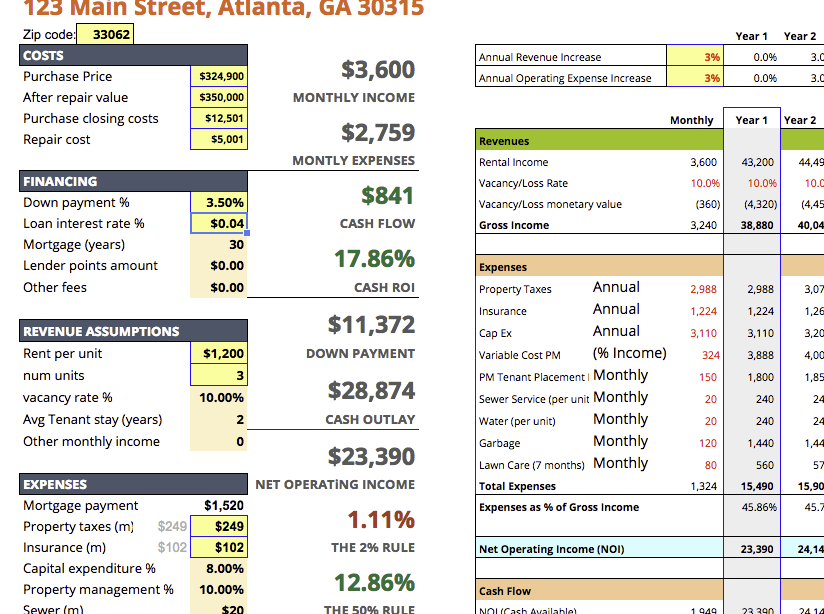

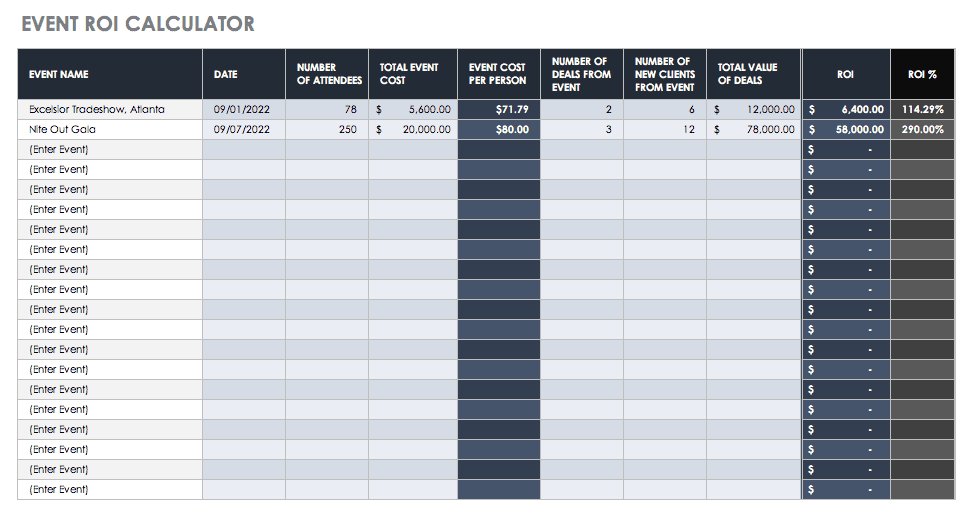

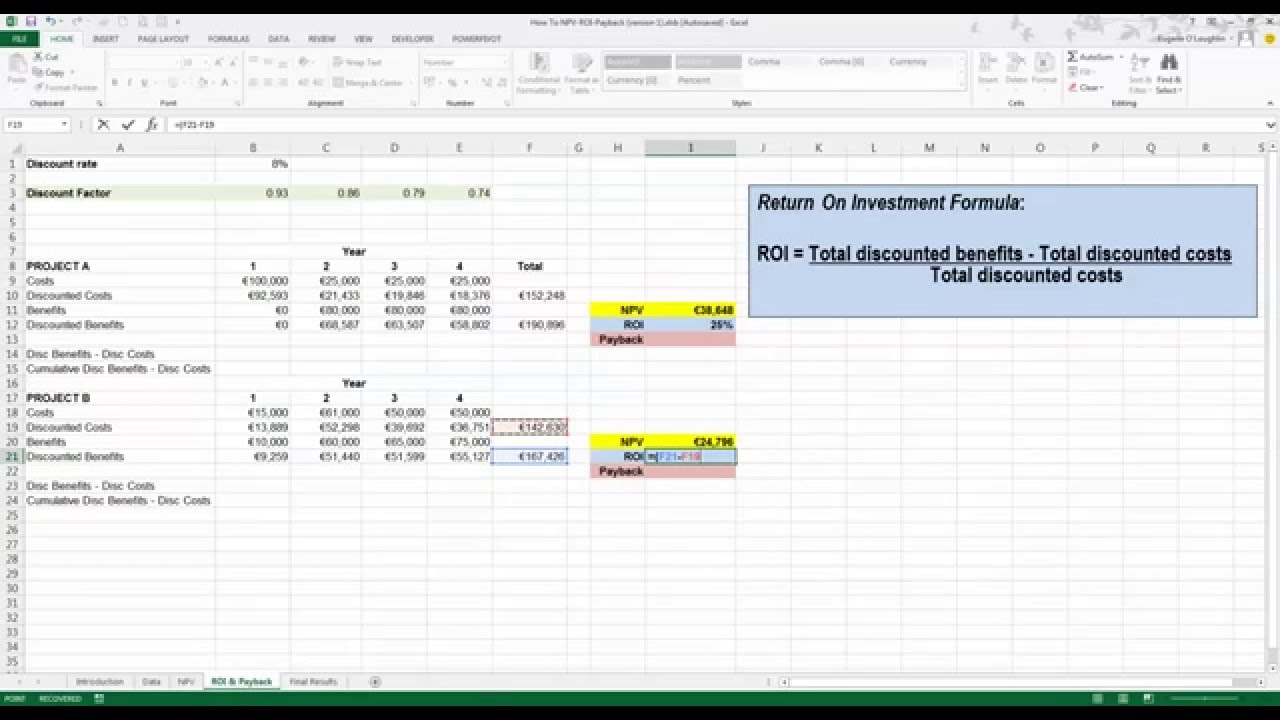

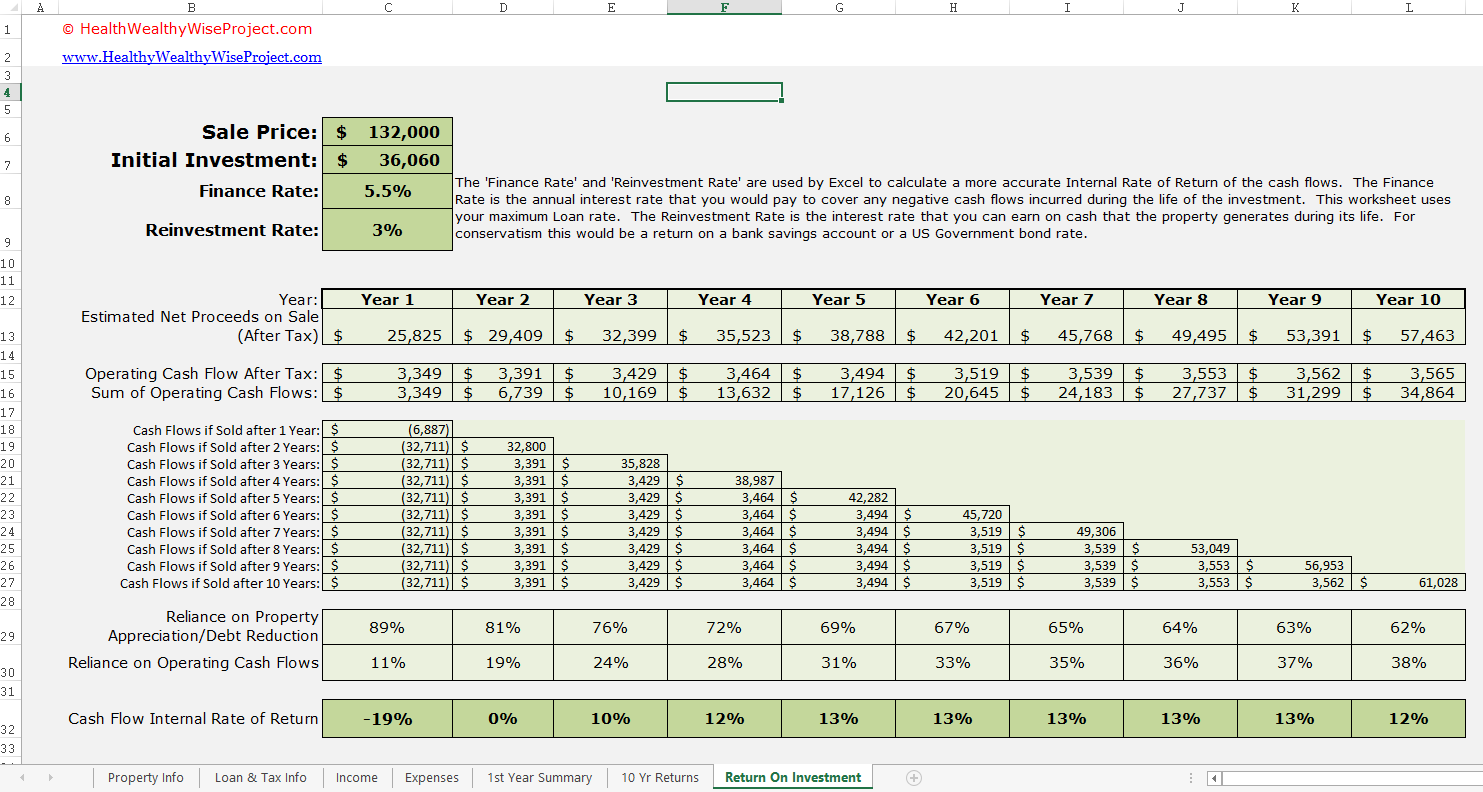

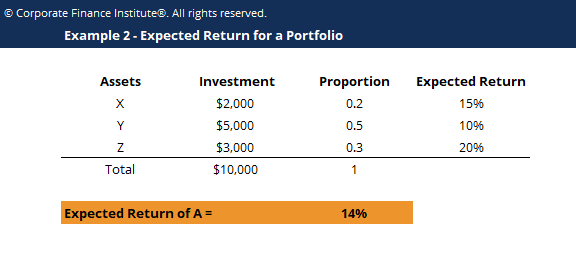

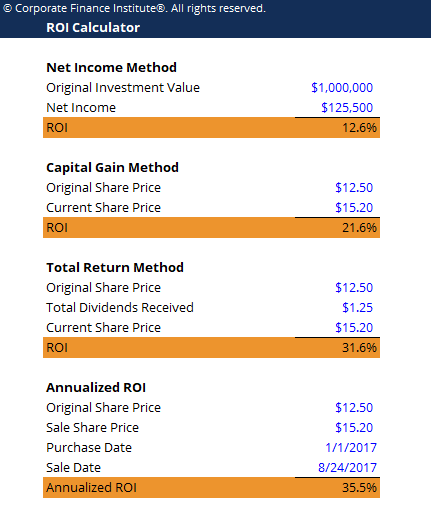

43 return on investment worksheet

Required Minimum Distribution Worksheets | Internal Revenue ... Apr 27, 2022 · Required Minimum Distribution Worksheet - use this only if your spouse is the sole beneficiary of your IRA and is more than 10 years younger than you Required Minimum Distribution Worksheet - for everyone else (use if the worksheet above does not apply) News and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ...

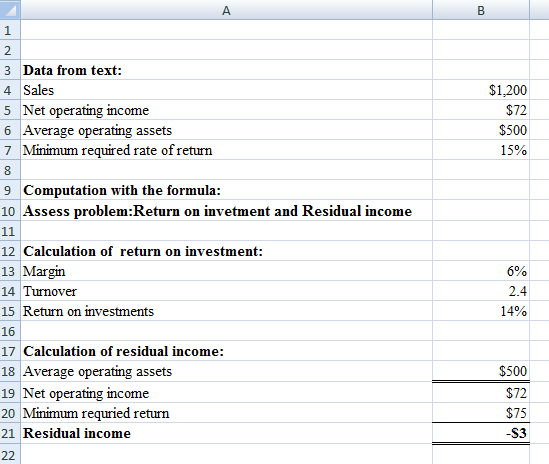

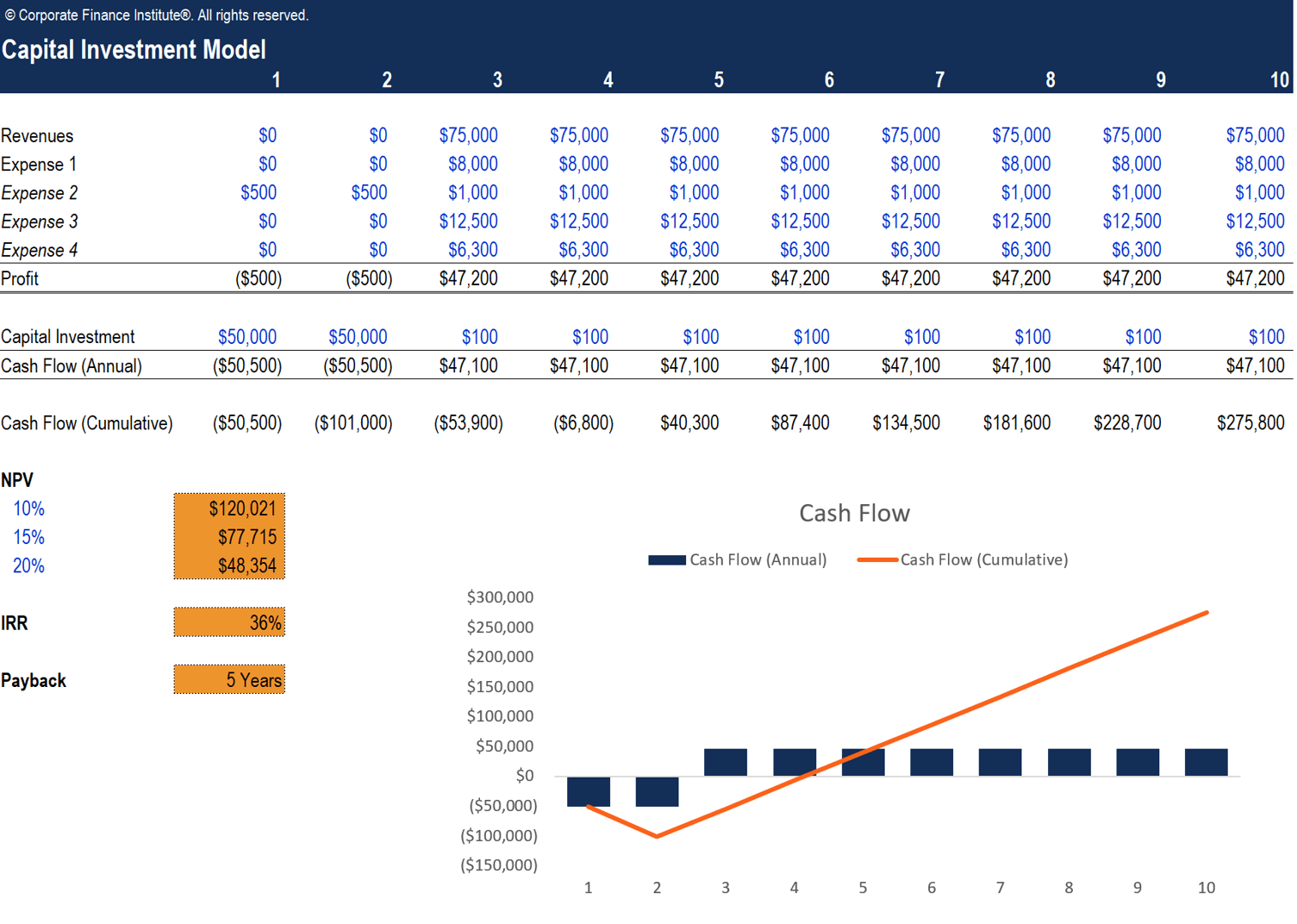

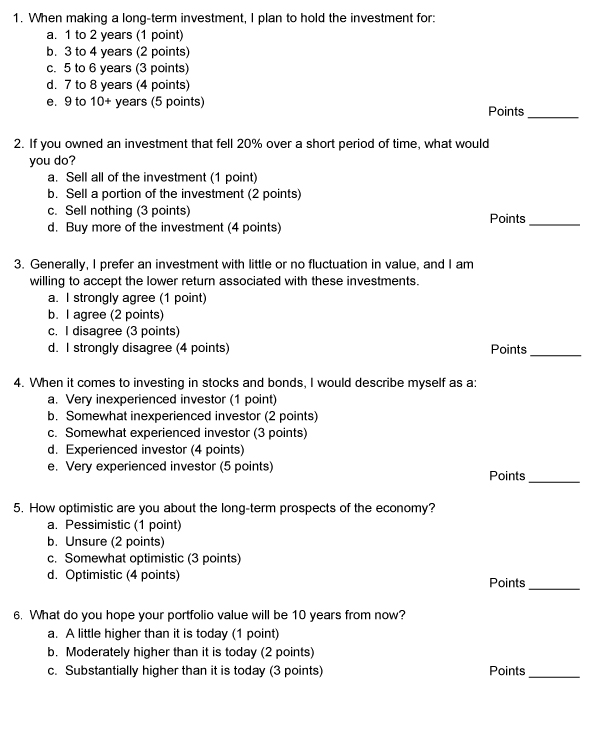

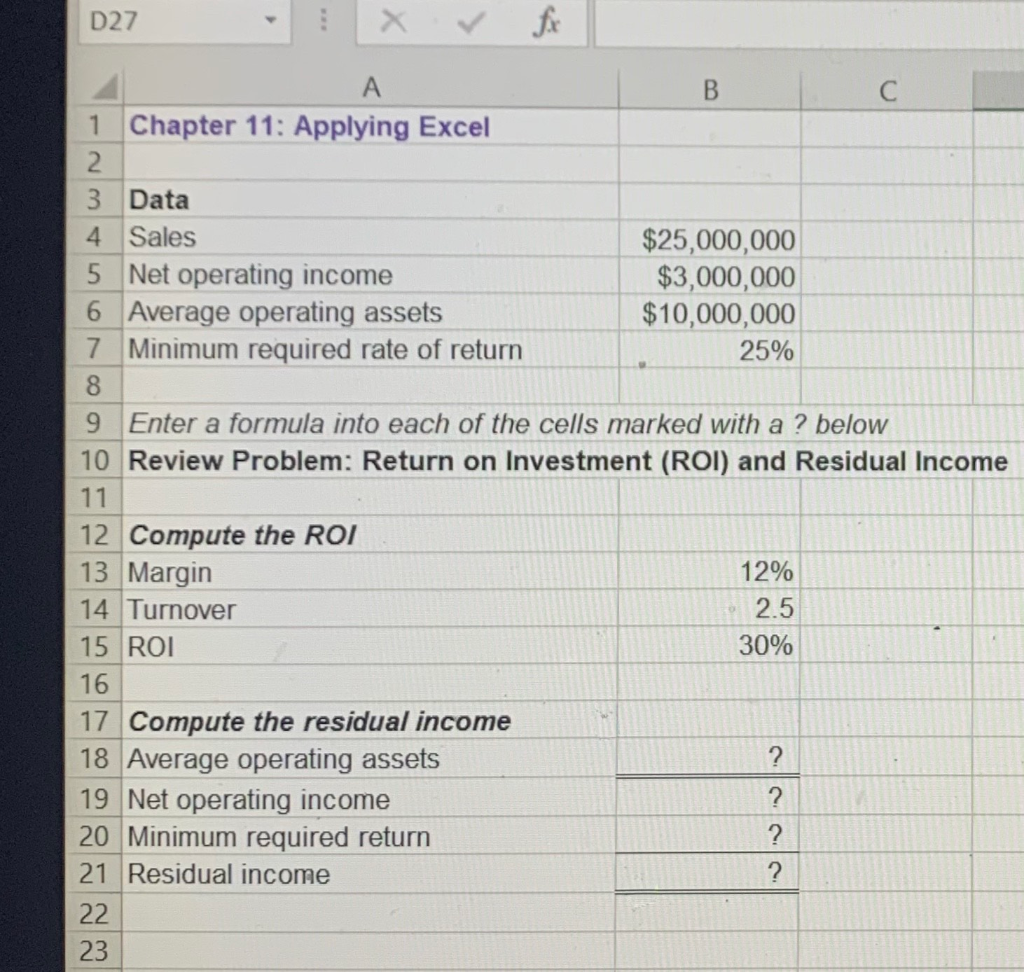

Return on investment worksheet

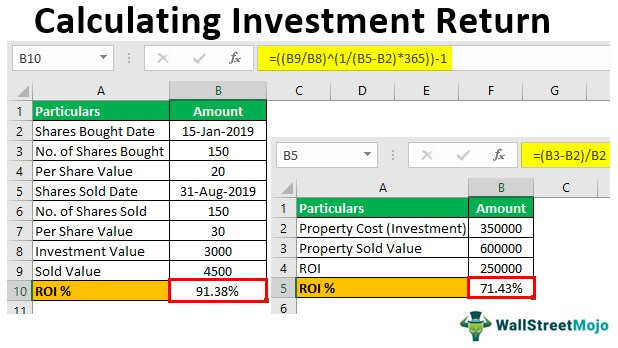

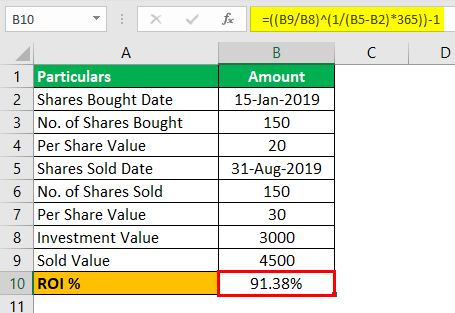

Publication 970 (2021), Tax Benefits for Education | Internal ... You paid $7,000 tuition and fees in August 2021, and your child began college in September 2021. You filed your 2021 tax return on February 17, 2022, and claimed an American opportunity credit of $2,500. After you filed your return, you received a refund of $4,000. Tax Cuts and Jobs Act, Provision 11011 Section 199A ... A3. S corporations and partnerships are generally not taxable and cannot take the deduction themselves. However, all S corporations and partnerships report each shareholder's or partner's share of QBI items, W-2 wages, UBIA of qualified property, qualified REIT dividends and qualified PTP income, and whether or not a trade or business is a specified service trade or business (SSTB) on a ... Calculating Investment Return in Excel - WallStreetMojo Then, after two months, you sold it for ₹2 million. In this case, ROI is 0.5 million for the investment of ₹1.5 million, and the return on investment percentage is 33.33%. Like this, we can calculate the investment return (ROI) in excel based on the numbers given. To calculate the ROI, below is the formula. ROI = Total Return – Initial ...

Return on investment worksheet. Publication 527 (2020), Residential Rental Property ... Otherwise, figure your depreciation on your own worksheet. You don’t have to attach these computations to your return, but you should keep them in your records for future reference. You may also need to attach Form 4562 if you are claiming a section 179 deduction, amortizing costs that began during 2020, or claim any other deduction for a ... Calculating Investment Return in Excel - WallStreetMojo Then, after two months, you sold it for ₹2 million. In this case, ROI is 0.5 million for the investment of ₹1.5 million, and the return on investment percentage is 33.33%. Like this, we can calculate the investment return (ROI) in excel based on the numbers given. To calculate the ROI, below is the formula. ROI = Total Return – Initial ... Tax Cuts and Jobs Act, Provision 11011 Section 199A ... A3. S corporations and partnerships are generally not taxable and cannot take the deduction themselves. However, all S corporations and partnerships report each shareholder's or partner's share of QBI items, W-2 wages, UBIA of qualified property, qualified REIT dividends and qualified PTP income, and whether or not a trade or business is a specified service trade or business (SSTB) on a ... Publication 970 (2021), Tax Benefits for Education | Internal ... You paid $7,000 tuition and fees in August 2021, and your child began college in September 2021. You filed your 2021 tax return on February 17, 2022, and claimed an American opportunity credit of $2,500. After you filed your return, you received a refund of $4,000.

0 Response to "43 return on investment worksheet"

Post a Comment