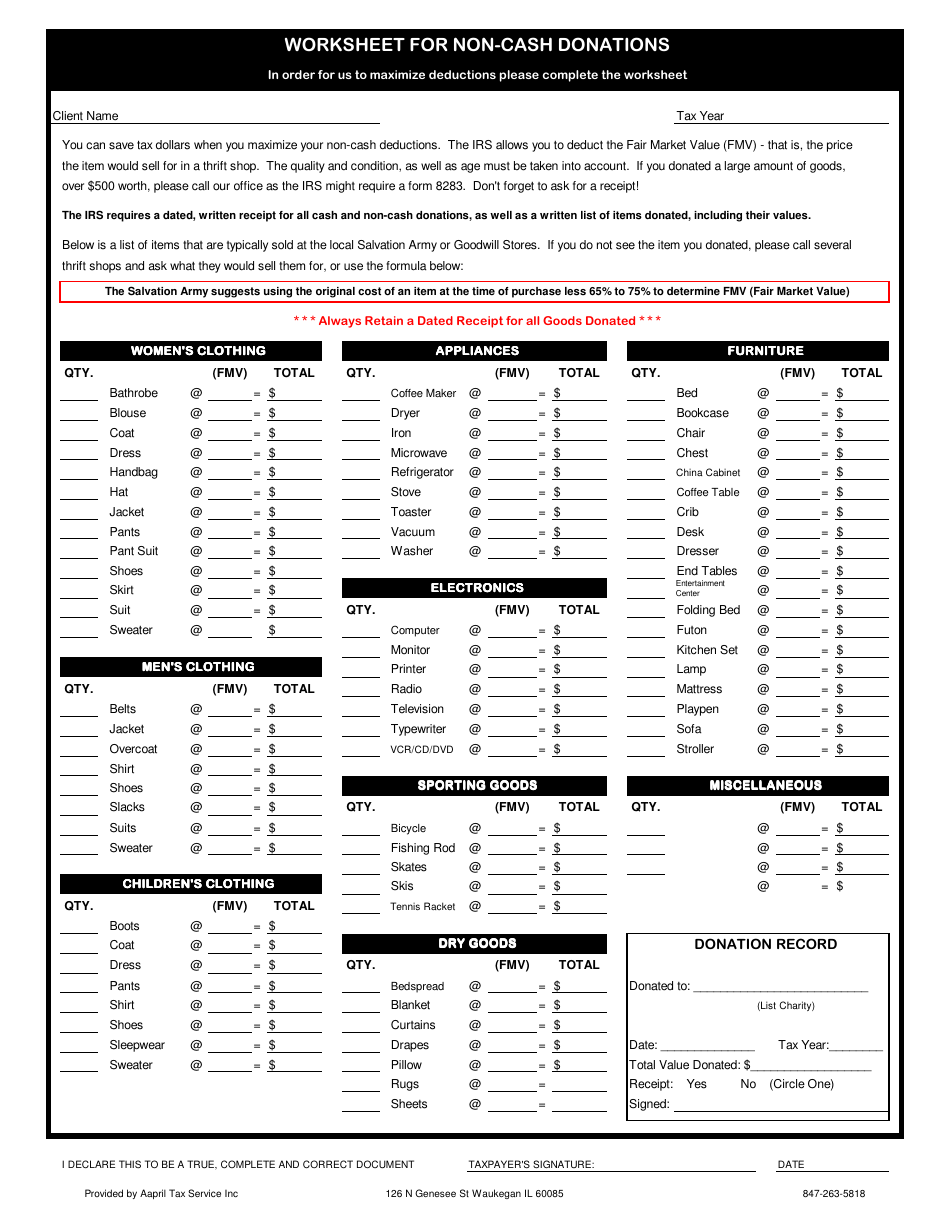

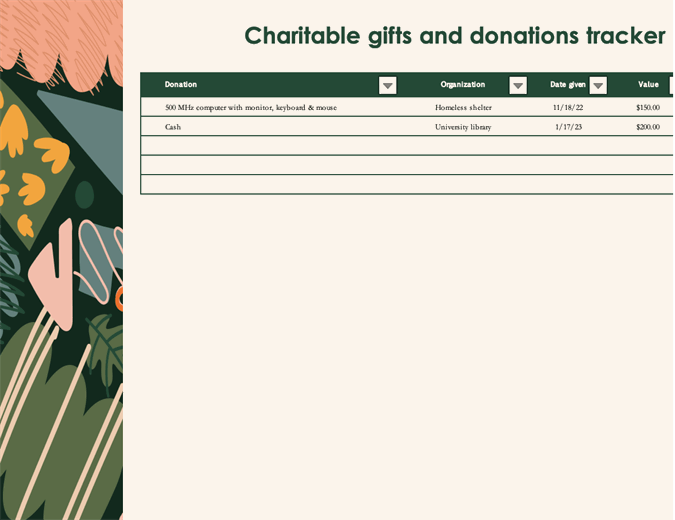

42 non cash charitable contributions donations worksheet

› publication › ppic-statewide-surveyPPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ... Donation Value Guide 2021 Spreadsheet - Fill Online, Printable ... A Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from ...

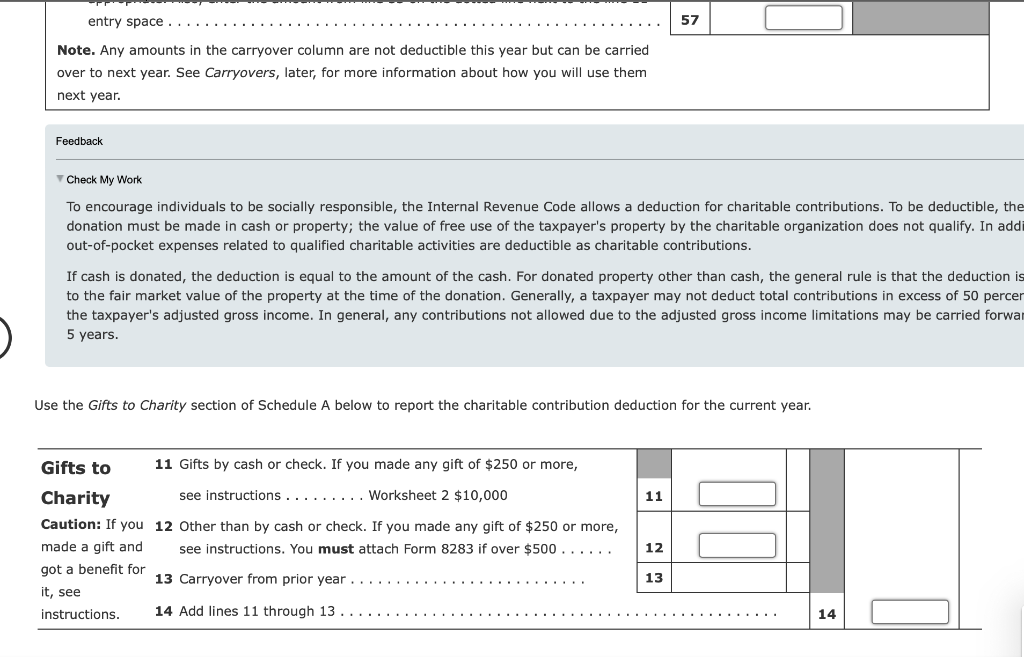

› tax-center › filingClaiming A Charitable Donation Without A Receipt | HR Block If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations

Non cash charitable contributions donations worksheet

eupolcopps.euThe EU Mission for the Support of Palestinian Police and Rule ... EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards. Ultimately the Mission’s ... › en › revenue-agencyTax-Free Savings Account (TFSA), Guide for Individuals For any year in which tax is payable by the holder of a TFSA on contributions made while a non-resident, it is necessary to fill out and send Form RC243, Tax-Free Savings Account (TFSA) Return, and Form RC243-SCH-B, Schedule B – Non-Resident Contributions to a Tax-Free Savings Account (TFSA). Non-cash Charitable Contributions / Donations One should prepare a list for EACH separate entity and date DONATIONS are made. For example: If one made a donation onJuly 1st to ARC, and another donation to ARC on Sept. Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations.

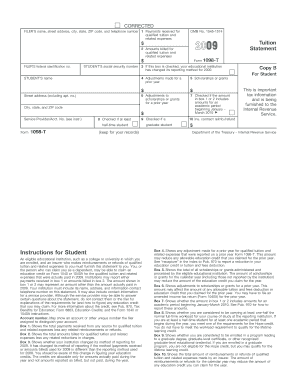

Non cash charitable contributions donations worksheet. goodwill donations worksheet Donation Values Guide and Printable - white house black shutters. 17 Pictures about Donation Values Guide and Printable - white house black shutters : Charitable Donation Spreadsheet Within Charitable Donation Worksheet Irs Donations Excel, Charity Donations worksheet - Free ESL printable worksheets made by teachers and also goodwill donation form in excel download - SampleBusinessResume.com ... About Form 8283, Noncash Charitable Contributions About Form 8283, Noncash Charitable Contributions Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Current Revision Form 8283 PDF Instructions for Form 8283 (Print Version) PDF Recent Developments Non Cash Charitable Contributions Worksheet 2021 - Fill Online ... Fill Non Cash Charitable Contributions Worksheet 2021, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. Try Now! ... NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year TAXPAYERS NAME S Insert Date Given ENTITY TO WHOM DONATED Note This worksheet non cash charitable contributions/donations worksheet 2007-2022 - Fill ... Stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: Get the document you require in the collection of legal forms. Open the template in the online editing tool. Read through the recommendations to discover which details you must give. Click the fillable fields and put the requested data.

goodwill donation value worksheet Donation Value Guide 2020 Excel Spreadsheet - Fill Online, Printable . donation spreadsheet form value guide donations printable charitable itemized list cash goodwill worksheet salvation template army clothing non contributions contribution. Goodwill Donation Excel Spreadsheet | Glendale Community Get NON-CASH DONATION WORKSHEET - US Legal Forms Ensure the details you fill in NON-CASH DONATION WORKSHEET is updated and accurate. Add the date to the record with the Date feature. Click on the Sign tool and create a digital signature. There are 3 available choices; typing, drawing, or uploading one. Be sure that every area has been filled in correctly. › publications › p526Publication 526 (2021), Charitable Contributions | Internal ... If you make cash contributions or noncash contributions (other than capital gain property) during the year (1) to an organization described earlier under Second category of qualified organizations, or (2) “for the use of” any qualified organization, your deduction for those contributions is limited to 30% of your AGI, or if less, 50% of ... itsdeductibleonline.intuit.comTax Deductions - ItsDeductible Existing Customers. Sign In. New Customers. Create New Account. Your account allows you to access your information year-round to add or edit your deductions.

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file. Non Cash Charitable Contributions Donations Worksheet .pdf - 50.iucnredlist books like this Non Cash Charitable Contributions Donations Worksheet, but end occurring in harmful downloads. Rather than enjoying a fine book behind a cup of coffee in the afternoon, on the other hand they juggled next some harmful virus inside their computer. Non Cash Charitable Contributions Donations Worksheet is genial in our digital ... 2022 Free Non Cash Charitable Contributions Worksheet Non Cash Charitable Contribution Worksheet PDF, Google Sheet, EXCEL from e-database.org. Worksheets are non cash charitable contributions donations work, non cash charitable contributions work, the. Most cell phones today can take pictures. This worksheet is provided as a convenience and aide in calculating. Source: XLS Noncash charitable deductions worksheet. - lstax.com Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the

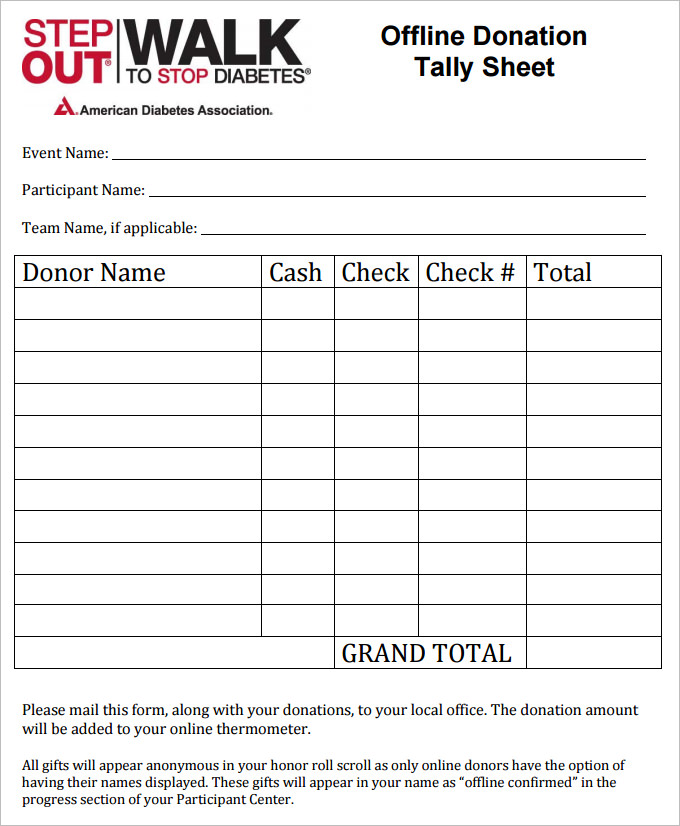

Non Charitable Donations Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET 2. NON-CASH DONATION WORKSHEET (Based on Salvation Army ... 3. Non Cash Charitable Contribution 4. Charitable Donations Worksheets (Non Cash Contributions) 5. Tax e-form Non-Cash Charitable Contribution Worksheet

PDF Non-cash Charitable Contributions / Donations Worksheet NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET TAXPAYERS NAME(S): Insert Tax Year ===> ... Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed ...

Salvation Army Non Cash Charitable Contributions Worksheet NON CASH CHARITABLE CONTRIBUTIONS DONATIONS WORKSHEET. Here are entitled to get your statement that there are right you contributed part of. Oct 22 2020 Free goodwill donation spreadsheet template donation spreadsheet. This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations.

PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: MISCELLANEOUS LOW HIGH AVG QTY AMOUNT VALUE Adding Machines 24.00 90.00 57.00 Christmas Trees 18.00 60.00 39.00 Broiler Ovens 18.00 30.00 24.00 Copier 120.00 240.00 180.00

Non cash charitable contributions / donations worksheet Form Submit non cash charitable contributions / donations worksheet 2022 in minutes, not hours. Save your time needed to printing, signing, and scanning a paper copy of non cash charitable contributions / donations worksheet 2022. Stay effective online!

XLS Noncash charitable deductions worksheet. NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year ===> Insert Date Given ===> ENTER ITEMS NOT PROVIDED FOR IN THE ABOVE CATEGORIES. SET YOUR OWN VALUE. WHAT IS YOUR ORIGINAL COST BASED ON RECIEPTS, OR YOUR BEST ESTIMATE, OF THE ITEMS DONATED? Charity's Address Blouse Coats Dresses Evening dresses Handbags WOMEN's CLOTHING

› articles › personal-financeCharitable Contributions: Tax Breaks and Limits - Investopedia Jul 30, 2022 · Corporations also have an increased ceiling for cash charitable contributions in 2021. For cash donations, the ceiling increases from 10% to 25% of taxable income (with some adjustments) for “C ...

Non-cash Charitable Contributions / Donations One should prepare a list for EACH separate entity and date DONATIONS are made. For example: If one made a donation onJuly 1st to ARC, and another donation to ARC on Sept. Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations.

› en › revenue-agencyTax-Free Savings Account (TFSA), Guide for Individuals For any year in which tax is payable by the holder of a TFSA on contributions made while a non-resident, it is necessary to fill out and send Form RC243, Tax-Free Savings Account (TFSA) Return, and Form RC243-SCH-B, Schedule B – Non-Resident Contributions to a Tax-Free Savings Account (TFSA).

eupolcopps.euThe EU Mission for the Support of Palestinian Police and Rule ... EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards. Ultimately the Mission’s ...

0 Response to "42 non cash charitable contributions donations worksheet"

Post a Comment