39 1040 qualified dividends and capital gains worksheet

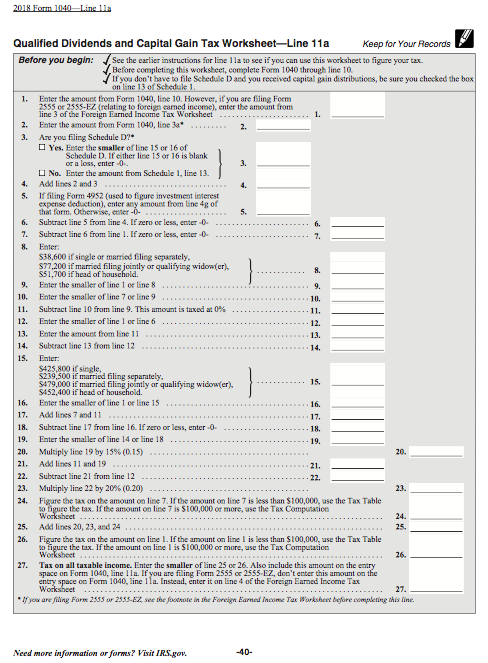

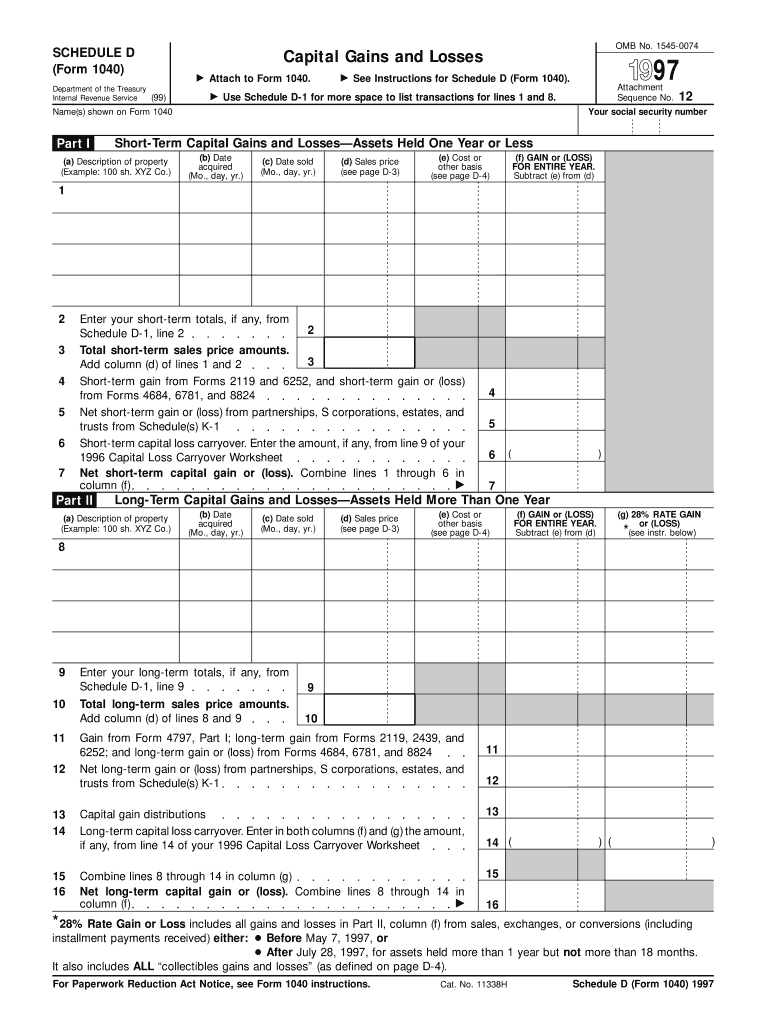

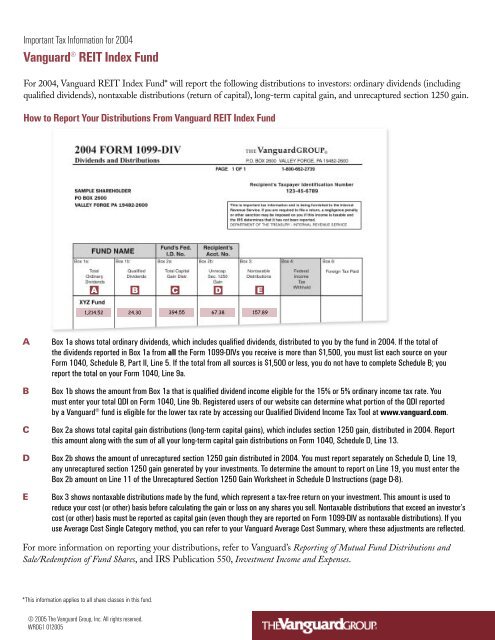

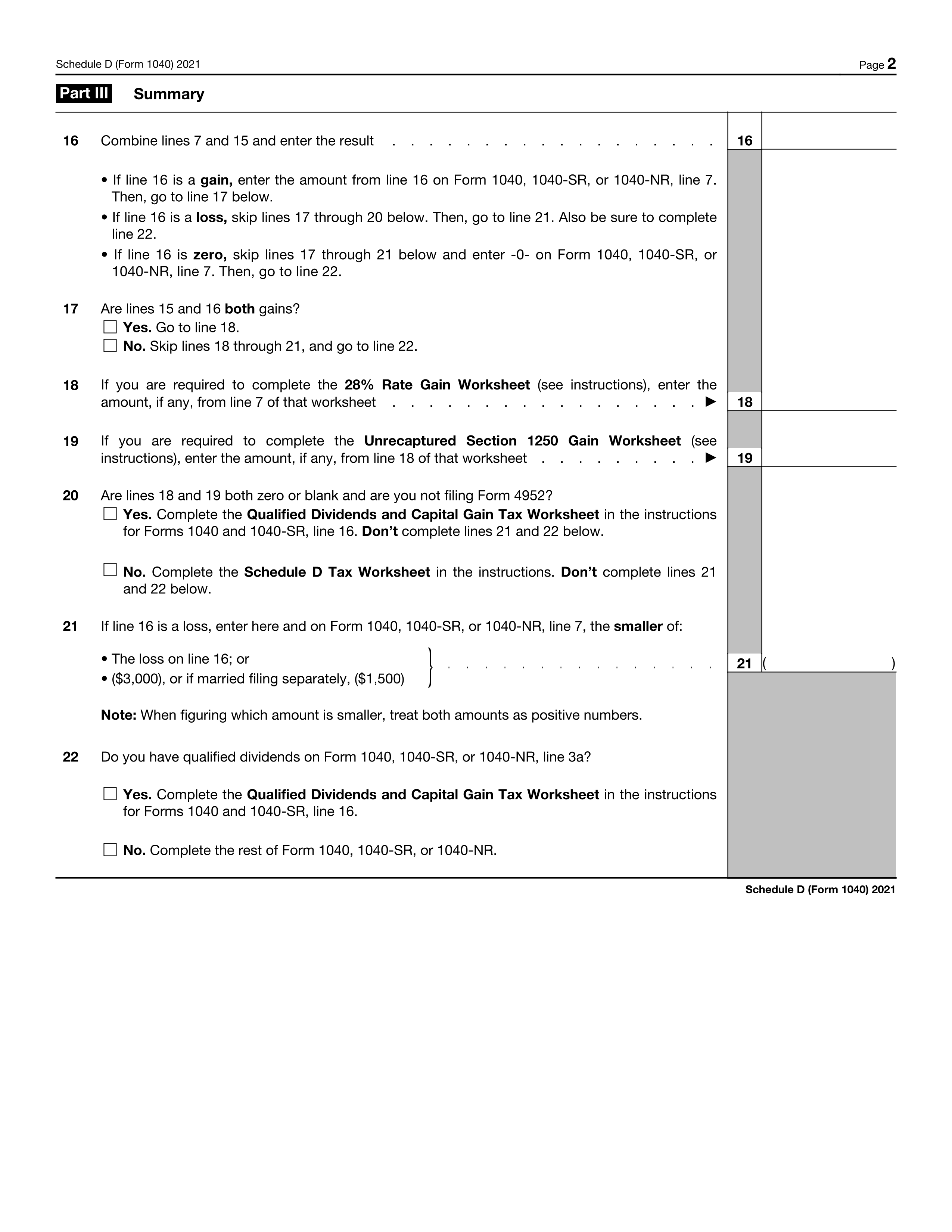

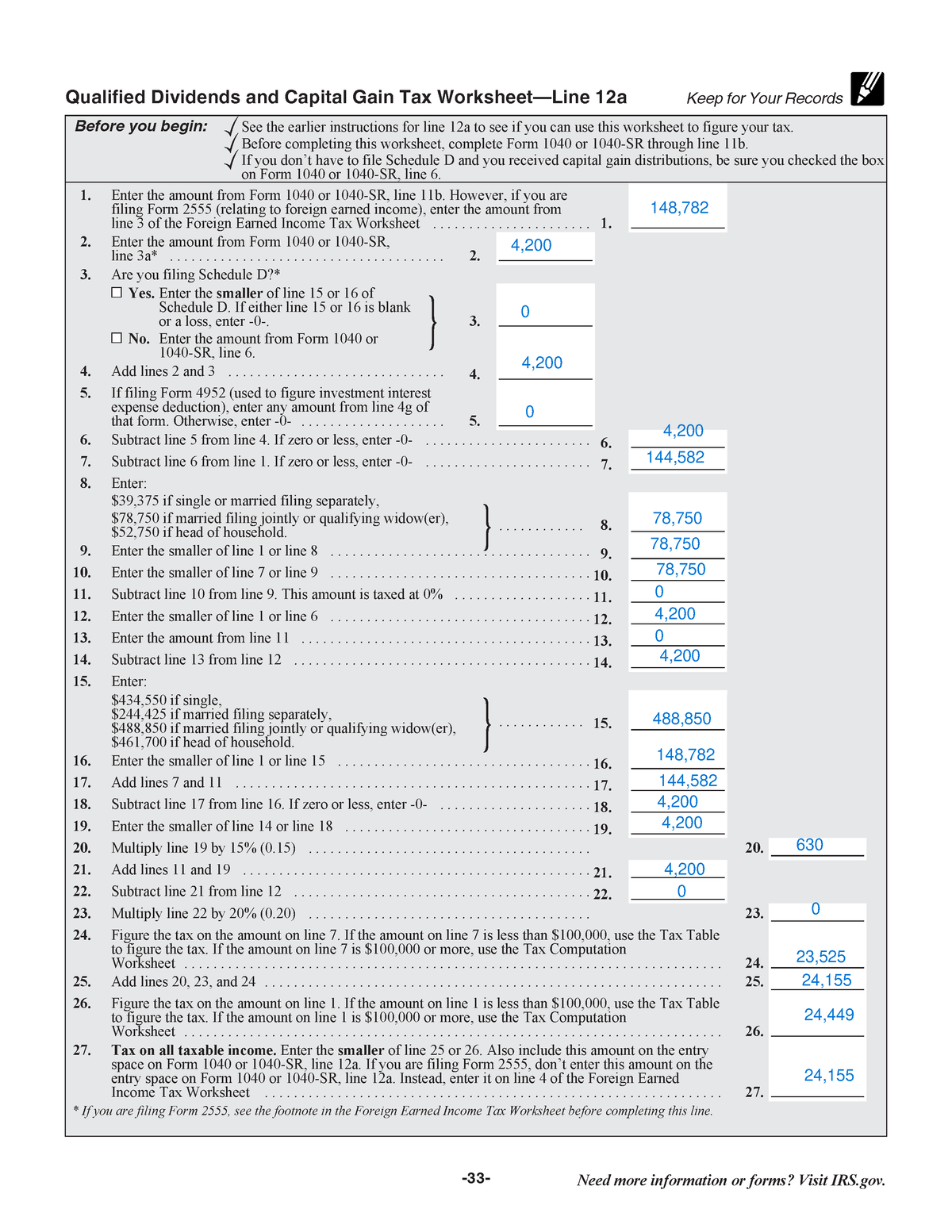

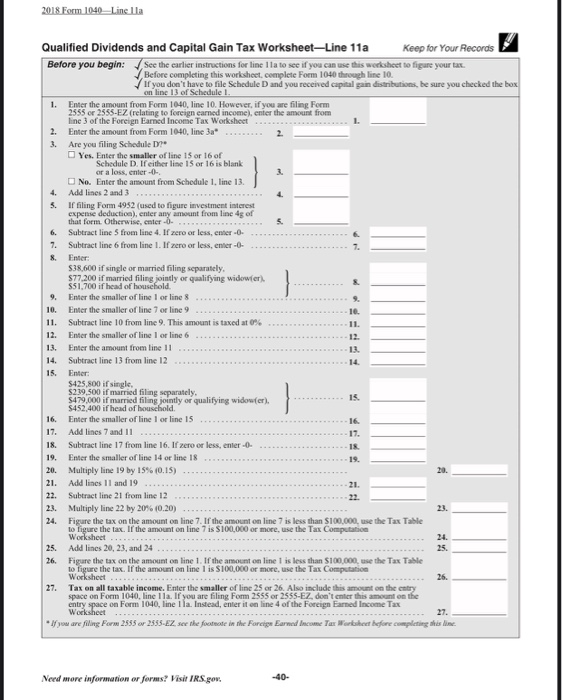

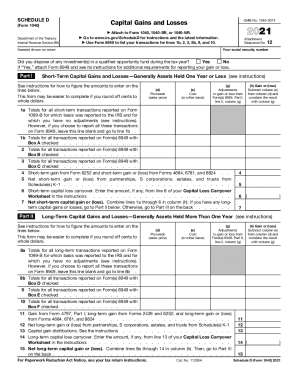

Capital gains tax in the United States - Wikipedia The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains and qualified dividends as though they were the last income received, then applies the preferential tax rate as shown in the above table. Qualified Dividends and Capital Gain Tax Worksheet: An ... rates to qualified dividends received after 2002 and before 2009. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the different rates that apply during 2003 and to include the dividend tax break. Schedule D will be much shorter for 2004, when one set of rates will apply for the whole year. Worksheet Alternative

Tax Cuts and Jobs Act, Provision 11011 Section 199A ... A3. S corporations and partnerships are generally not taxable and cannot take the deduction themselves. However, all S corporations and partnerships report each shareholder's or partner's share of QBI items, W-2 wages, UBIA of qualified property, qualified REIT dividends and qualified PTP income, and whether or not a trade or business is a specified service trade or business (SSTB) on a ...

1040 qualified dividends and capital gains worksheet

How Capital Gains and Dividends Are Taxed Differently Dec 25, 2021 · In the case of qualified dividends, these are taxed the same as long-term capital gains. For 2021 and 2022, individuals in the 10% to 12% tax bracket are still exempt from any tax. Publication 544 (2021), Sales and Other Dispositions of Assets Schedule D (Form 1040) Capital Gains and Losses. 1040 U.S. Individual Income Tax Return. 1040-X Amended U.S. Individual Income Tax Return. 1099-A Acquisition or Abandonment of Secured Property. 1099-C Cancellation of Debt. 4797 Sales of Business Property. 8824 Like-Kind Exchanges. 8949 Sales and Other Dispositions of Capital Assets 1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

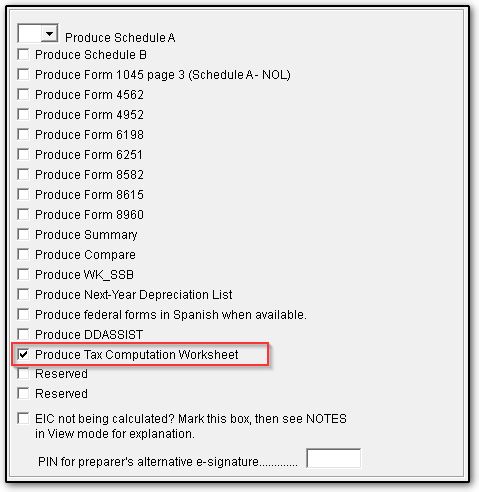

1040 qualified dividends and capital gains worksheet. Instructions for Form 2210 (2021) | Internal Revenue Service To compute the tax, see the instructions for your tax return for the applicable Tax Table or worksheet to use. For example, Form 1040 or 1040-SR filers can use the Tax Table; Tax Computation Worksheet; Qualified Dividends and Capital Gain Tax Worksheet; Schedule D Tax Worksheet; Foreign Earned Income Tax Worksheet; Schedule J; or Form 8615, Tax ... 1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments Publication 544 (2021), Sales and Other Dispositions of Assets Schedule D (Form 1040) Capital Gains and Losses. 1040 U.S. Individual Income Tax Return. 1040-X Amended U.S. Individual Income Tax Return. 1099-A Acquisition or Abandonment of Secured Property. 1099-C Cancellation of Debt. 4797 Sales of Business Property. 8824 Like-Kind Exchanges. 8949 Sales and Other Dispositions of Capital Assets How Capital Gains and Dividends Are Taxed Differently Dec 25, 2021 · In the case of qualified dividends, these are taxed the same as long-term capital gains. For 2021 and 2022, individuals in the 10% to 12% tax bracket are still exempt from any tax.

0 Response to "39 1040 qualified dividends and capital gains worksheet"

Post a Comment