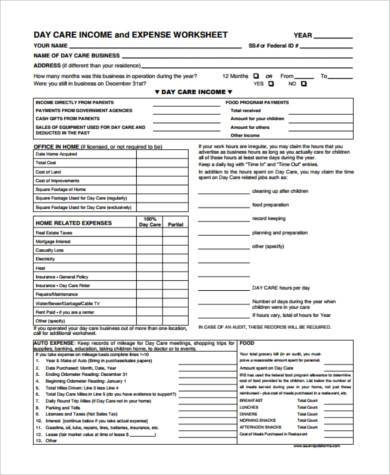

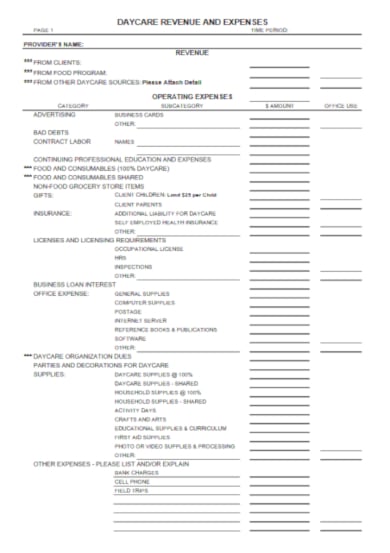

43 daycare income and expense worksheet

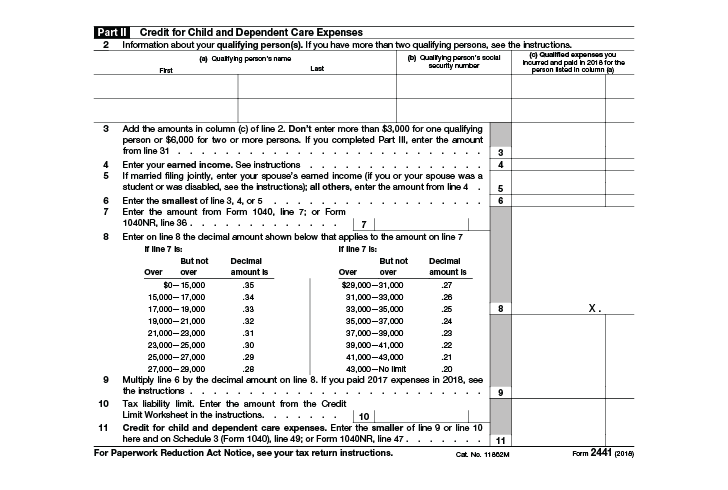

› instructions › i2441Instructions for Form 2441 (2021) | Internal Revenue Service Dec 20, 2021 · The credit for prior year’s expenses is now reported separately on line 9b. Previously, it was added to the current year credit and reported together on one line. We moved Worksheet A, Worksheet for 2020 Expenses Paid in 2021, from Pub. 503 to the end of these instructions. Get Daycare Income And Expense Worksheet - US Legal Forms Ensure the details you add to the Daycare Income And Expense Worksheet is updated and accurate. Include the date to the sample with the Date option. Select the Sign tool and make an electronic signature. You can find 3 available choices; typing, drawing, or capturing one. Make sure that each area has been filled in properly.

Daycare Expense Worksheet - atmTheBottomLine 1711 Woodlawn Ave., Wilmington, DE 19806 (302-322-0452) - - - - 118 Astro Shopping Center, Newark DE 19711 - - - -

Daycare income and expense worksheet

Daycare Income and Expense Worksheet Form - signNow Follow the step-by-step instructions below to design your printable daycare income and expense worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. › publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. › publications › p503Publication 503 (2021), Child and Dependent Care Expenses Changes to the credit for child and dependent care expenses for 2021. For 2021, the American Rescue Plan Act of 2021 (the ARP) increases the amount of the credit for child and dependent care expenses. It also makes the credit refundable for taxpayers that meet certain residency requirements, increases the percentage of employment-related expenses for qualifying care considered in calculating ...

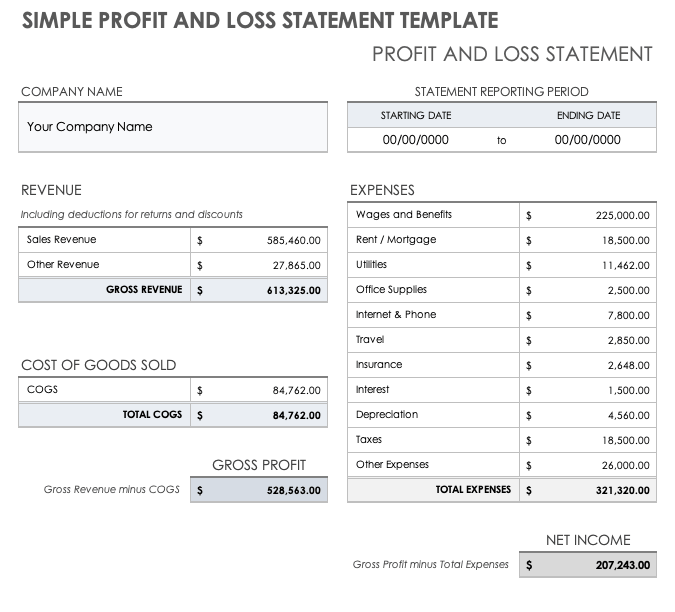

Daycare income and expense worksheet. Income Deduction Order - dekalbsuperiorcourt.com Before income can be deducted for child support, a separate Income Deduction Order (IDO) must be signed by a judge and filed with the clerk of court. (See Uniform Superior Court Rule 24.11.) The Georgia Commission on Child Support has made available a fillable PDF template of the IDO form (Step 1) for your use. (See Uniform Superior Court Rule ... DAYCARE INCOME and EXPENSE Worksheet/daycare Tax Time/perfect - Etsy DAYCARE INCOME and EXPENSE Worksheet/Daycare Tax Time/Perfect for In home,preschool,daycare centers/Editable Form $10.00 In stock Add to cart 39 shop reviews Sort by: Recommended I was very pleased with my order. I was able to add my daycare logo and name to the editable forms. The forms had more information than what was required by my state. Daycare Expenses List (Sample Budget Template Included) One infant attending your daycare will net you $11,640 per year. Let's do the math! 16 infants x $11,640 annual income per infant= $186,240 per year for the infant classes 20 toddlers x $10,220 annual income per toddler= $204,000 per year for the toddler classes $186,240 + $204,000 Total annual tuition income= $390,240 10+ Day Care Budget Templates - PDF | Free & Premium Templates This template gives you a simple but effective day care budget which covers all details regarding the revenue, operating expenses and expenditure for the complete year. The sample daycare budget template can be used as a perfect reference document. Make use of the framework while making your own day care budget. 5.

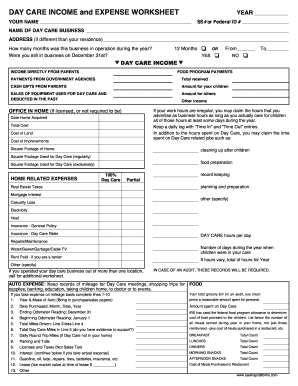

2021 IL-1040 Schedule ICR Instructions - Illinois If you will not claim a K-12 Education Expense Credit in Section B, enter “0” on Line 8 and continue to Section C, Line 9. Section B: K-12 Education Expense Credit You must complete the K-12 Education Expense Credit Worksheet on the back of Schedule ICR before completing this section. Line 7a — the total amount of K-12 education expenses from Home | TexFlex IRS Resources. Medical and Dental Expenses - IRS Publication 502; Dependent Care Expenses - IRS Form 2441; Dependent Care Expenses - Instructions for IRS Form 2441 DAY CARE INCOME and EXPENSE WORKSHEET - MER Tax - YUMPU Other 100% Day Care Partial If you operated your day care business out of more than one location, call for additional worksheet. If your work hours are irregular, you may claim the hours that you advertise as business hours as long as you actually care for children all of those hours at least some days during the year. Virginia Child Support Calculator | AllLaw How to Get a Child Support Order in Virginia . If a child support order was not part of your divorce or separation agreement or you need help locating your child's father or mother to start receiving child support payments, the Virginia Department of Social Services Division of Child Support Enforcement (DCSE) may be able to assist you in establishing a child support order.

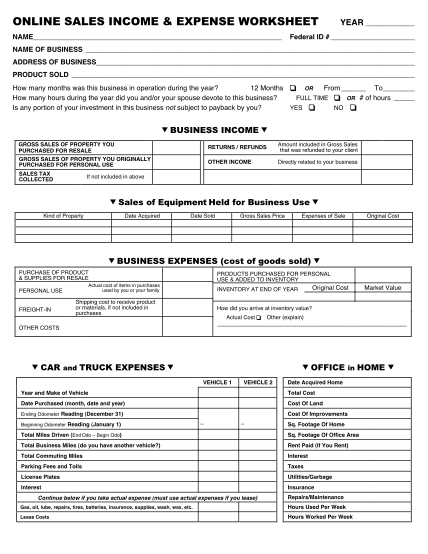

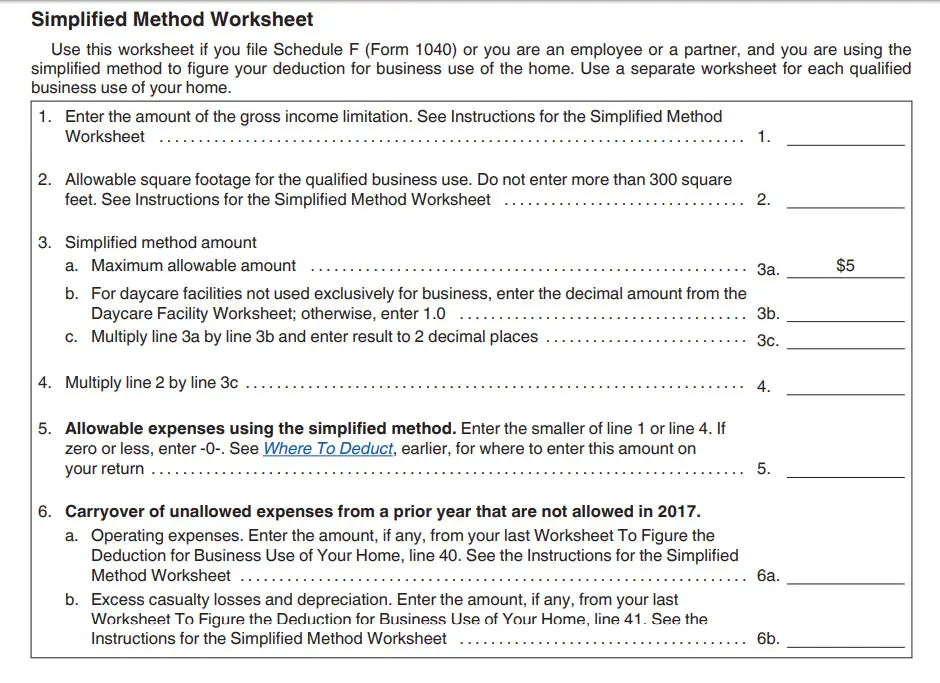

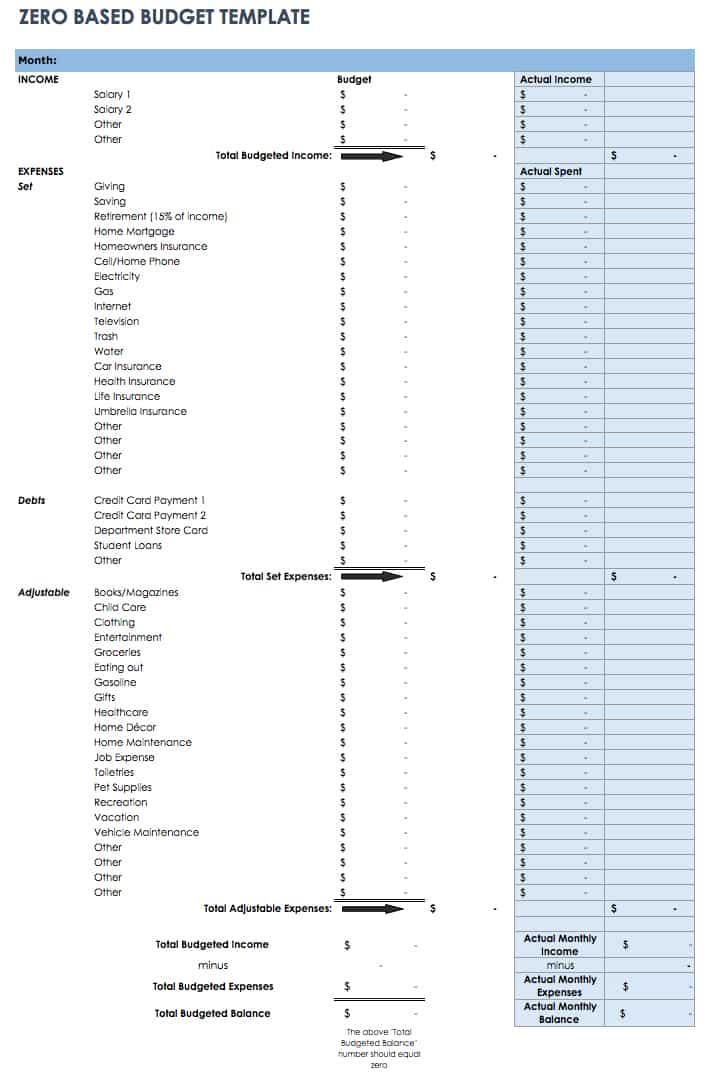

Fillable DAY CARE INCOME AND EXPENSE WORKSHEET DAY CARE Use Fill to complete blank online OTHERS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. The DAY CARE INCOME AND EXPENSE WORKSHEET DAY CARE form is 2 pages long and contains: Fill has a huge library of thousands of forms all set up to be filled in easily and signed. › publications › p587Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the partnership ... › faqs › small-business-self-employedSmall Business, Self-Employed, Other Business | Internal ... Sep 07, 2022 · When you file your income tax return each year: Include the income from the business on your Form 1040, U.S. Individual Income Tax Return, Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), Schedule E (Form 1040), Supplemental Income and Loss, and/or Schedule SE (Form 1040), Self-Employment Tax. Easy Budgeting Tool - The Savings Spot - RBC Royal Bank Child Care (daycare, nanny, child support, etc) $ Loans, Lines of Credit and Credit Cards (monthly payments on existing credit) $ Long Term Savings (Pension, RSP, TFSA, RESP, etc) $ Other Fixed Expenses (Payroll deductions -if not already included elsewhere - insurance, pension, RSP, charitable donations. Alimony, etc) $

How are Work-related Daycare Expenses Factored in Child Support ... Duluth Divorce Attorney - Visit us today at or call (770) 383-1973.In this video, Duluth Divorce Attorney David Ward answers, W...

PDF Day Care Income and Expense Worksheet - nelsontaxmn.com 2 Page of 2 Day Care Income and Expense Worksheet (Continued) Food - A standard food allowance may be claimed in lieu of actual food costs. List below the number of meals served in each category not including meals for you or members of your household.

PDF DAY CARE INCOME AND EXPENSE WORKSHEET - Haukeness Tax & Accounting Inc Because of day care If hours vary, total of hours for year Rent paid - if you are a renter Other . Be sure to include storage areas, basement, garage or storage sheds when figuring are used. Keep a daily log with "TIME IN" and "TIME OUT". In addition to the hours spent on Day Care you . may claim the time spent on Day Care related ...

› instructions › i1040sc2021 Instructions for Schedule C (2021) | Internal Revenue ... For amounts includible in income and deductible as expense under an accrual method, see Pub. 538. To change your accounting method, you must generally file Form 3115. You may also have to make an adjustment to prevent amounts of income or expense from being duplicated or omitted. This is called a section 481(a) adjustment.

Customer Support | American Fidelity To be used after you become disabled to claim benefits under the spousal accident only disability income rider. Paper. Annuity Account. Death Benefit Form ... File for a dependent care expense reimbursement. This form is also known as a Provider Acknowledgement Form. AFmobile. Online. ... 25% Key Employee Non-Discrimination Worksheet 2021

Travel and expense Jobs in Lithonia, GA | Glassdoor Search Travel and expense jobs in Lithonia, GA with company ratings & salaries. 769 open jobs for Travel and expense in Lithonia.

Four Types of Expenses: How to Plan for an Cut Some From Your … Weekly expenses like a daycare payment, dog walking services, or house cleaners, while not a monthly bill, are fixed expenses too. ... Having a savings account for each type of non-recurring expense means when that expense hits, your pulling from a savings account, not your monthly income. Let’s say your water bill hits twice a year and is ...

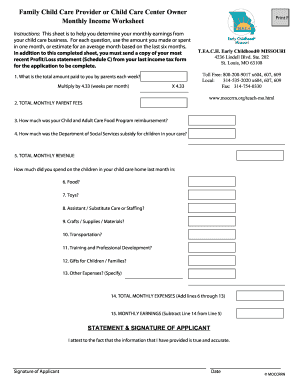

Monthly Daycare Expense Spreadsheet - Fill Online, Printable, Fillable ... 2014 DAYCARE INCOME & EXPENSE WORKSHEET Business Name Total Income $ Income from parents Government payments Food program payments Other income (cash child care receipt template Receipt for Child Care Services Date Received from /100 Dollars Child Care payment for the weeks of Payment method Cash Money Order Quality Child Care

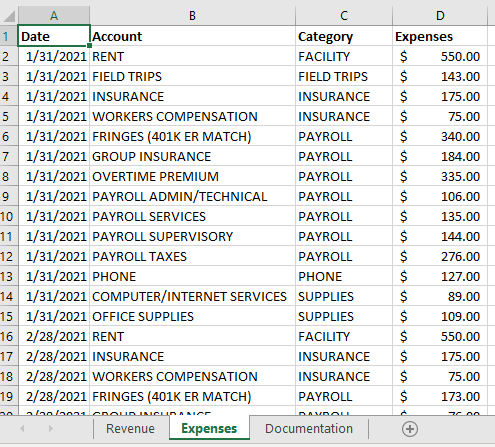

Peachtree Learning: Chart of accounts - Perdisco In the Company Navigation Center, click the Chart of Accounts icon and select New Account from the drop down list provided. This displays the Maintain Chart of Accounts window where you can enter the Account ID of the account you wish to modify or delete. Alternatively you can click the Chart of Accounts icon and select View and Edit Accounts ...

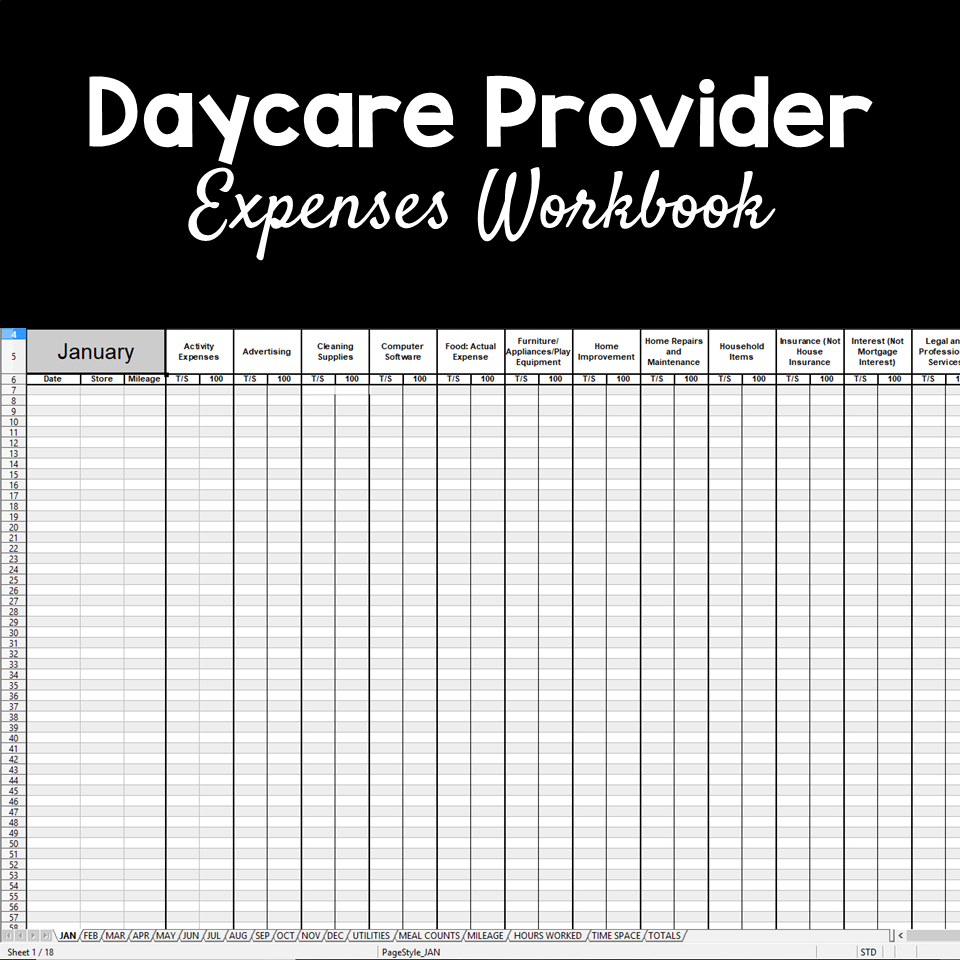

PDF DAY CARE PROVIDERS WORKSHEET - Lake Stevens Tax Service 100% Day Care Use-Notice the left side of Page 2 of the daycare sheet is for items that are used exclusively for daycare. 6. Shared Expenses-Notice the right side of Page 2 lists those items you share with daycare. If you do not separate items like household supplies, cleaning supplies, kitchen supplies, bottle water,

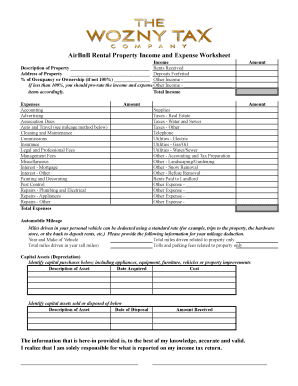

PDF Daycare Income and Expense Worksheet - SUN CREST TAX SERVICE DESCRIPTION DATE PURCHASED COST + SALES TAX DAYCARE USE % Date Amount % VEHICLE EXPENSES NOTES: 1. Make, Model and Year of Auto 2. Purchase Date (mm/dd/yy) 3. Beginning Odometer Reading - Jan 1 4. Ending Odometer Reading - Dec 31 5. Total Miles Driven(Personal & Business) 6. Total Business Miles 7.

PDF DAY CARE INCOME and EXPENSE WORKSHEET YEAR - Karla Havemeier, Ltd. If you take expense on mileage basis complete lines 1-10Your total grocery bill (in an audit, you must- 1. Year & Make of Auto (Bring in purchase/sales papers)prove a reasonable amount spent for personal. 2. Date Purchased: Month, Date, Year Amount spent on Day Care 3.

whereimaginationgrows.com › home-daycare-taxHome Daycare Tax Deductions for Child Care Providers Feb 09, 2017 · T/S% refers to your Time/Space Percentage. It’s a very important number at tax time to home daycare providers. It’s essentially the % of the total cost that you can claim of shared expenses. Every expense shared by your household and the daycare, from electric to toilet paper, uses this percentage to determine the amount a provider can ...

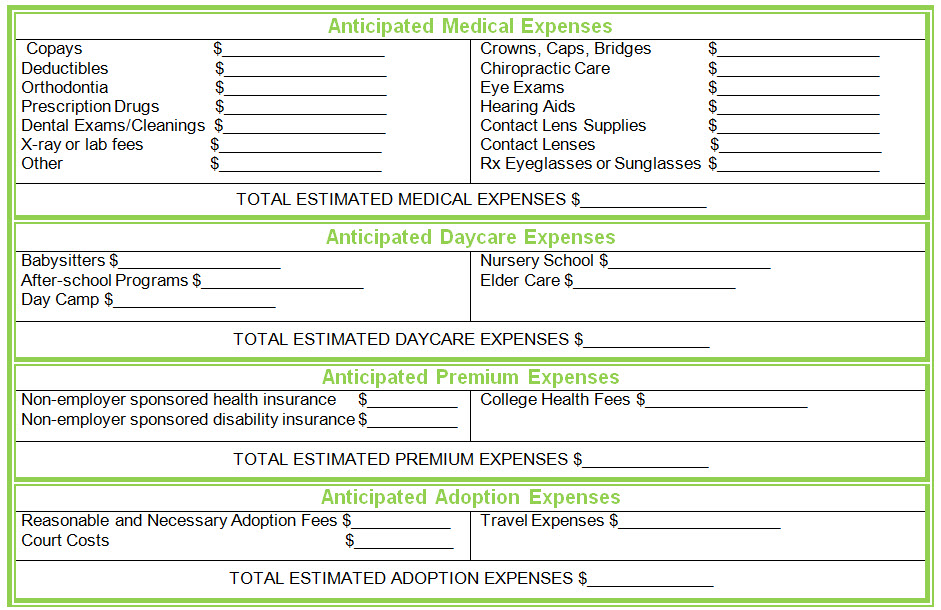

Flexible Spending Account (FSA) | Chard Snyder Employees give information about their daycare provider (name, address and tax ID number, or social security number if an individual) on Form 2441 or Schedule 2 of their income tax return. Employees cannot take both the Dependent Care FSA deduction and an income tax return deduction for the same expense.

Home Daycare Monthly Budget Worksheet | Tax Preparation Records | Expense Reporting | Childcare | Income | Profit | PDF Printable | Editable

About Publication 587, Business Use of Your Home (Including … Aug 26, 2022 · Publication 587 explains how to figure and claim the deduction for business use of your home. It includes special rules for daycare providers. This publication explains how to figure and claim the deduction for business use of your home. It includes special rules for daycare providers.

Instructions for Form 8829 (2021) | Internal Revenue Service Treat all the mortgage insurance premiums you paid under a mortgage insurance contract issued after December 31, 2006, in connection with home acquisition debt that was secured by your first or second home as a personal expense and complete a separate Mortgage Insurance Premiums Deduction Worksheet in the Instructions for Schedule A for Form 8829.

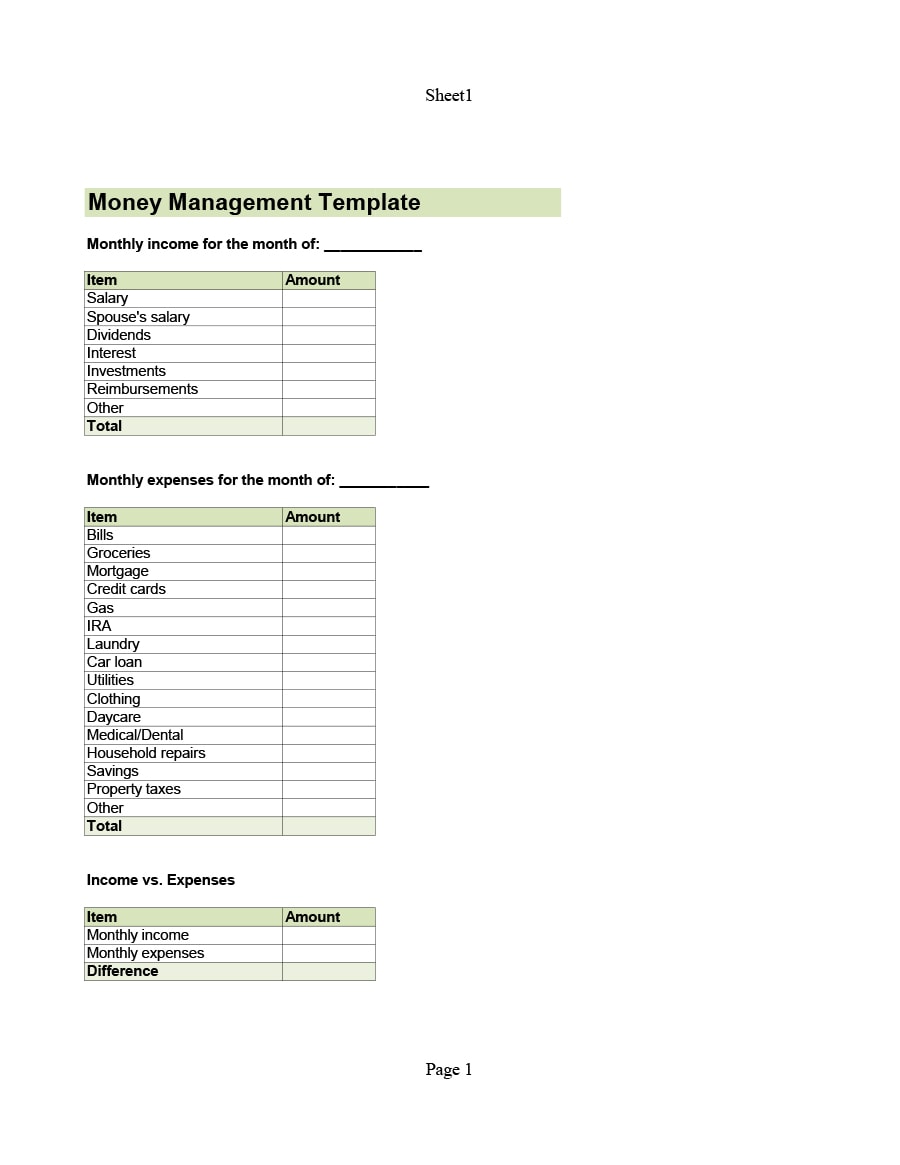

8+ Income & Expense Worksheet Templates - PDF, DOC | Free & Premium ... Open your spreadsheet or worksheet application. Let us Microsoft Excel for this example. Open the application, click on "File" and then select "New". Once you do that, click on the "Available Templates" option and choose "Blank Workbook". You can include both your income and expense spreadsheets in the same workbook.

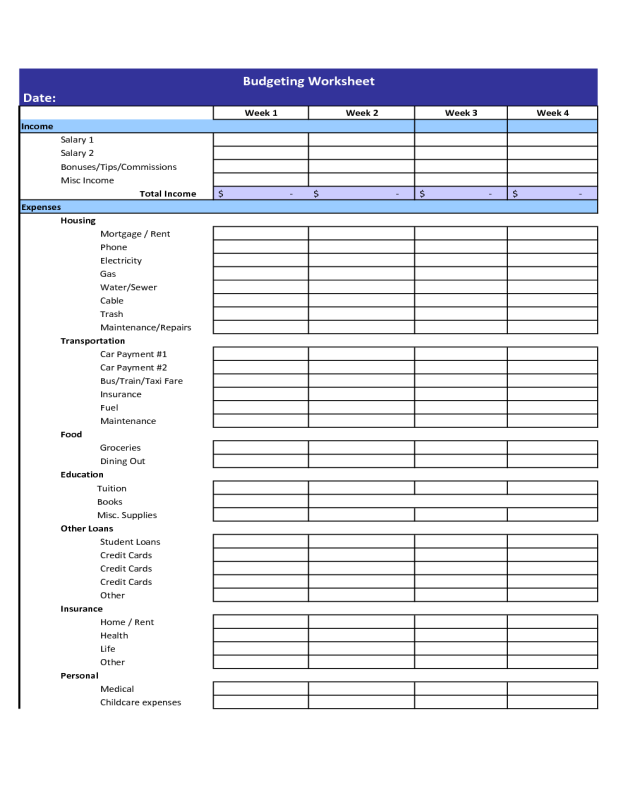

Monthly Expense Tracker, Calculator & Spending Planner Open a copy of our Monthly Expense Tracker. The expense categories listed further below and on page 1 of the Expense Tracker will help you decide which expenses to record where. For each week, record dates you are tracking. For example, a 7 day tracking period would be March 30th to April 5th. The next week would start on April 6th.

Daycare Income And Expense Worksheet: Fill & Download for Free - CocoDoc Follow these steps to get your Daycare Income And Expense Worksheet edited in no time: Click the Get Form button on this page. You will be forwarded to our PDF editor. Try to edit your document, like adding checkmark, erasing, and other tools in the top toolbar. Hit the Download button and download your all-set document for the signing purpose.

› publications › p503Publication 503 (2021), Child and Dependent Care Expenses Changes to the credit for child and dependent care expenses for 2021. For 2021, the American Rescue Plan Act of 2021 (the ARP) increases the amount of the credit for child and dependent care expenses. It also makes the credit refundable for taxpayers that meet certain residency requirements, increases the percentage of employment-related expenses for qualifying care considered in calculating ...

› publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Daycare Income and Expense Worksheet Form - signNow Follow the step-by-step instructions below to design your printable daycare income and expense worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

![Free Household Budget Worksheet [Excel, Word, PDF] - Best ...](https://www.bestcollections.org/wp-content/uploads/2021/04/free-printable-monthly-budget-worksheet.jpg)

0 Response to "43 daycare income and expense worksheet"

Post a Comment