42 chapter 7 federal income tax worksheet answers

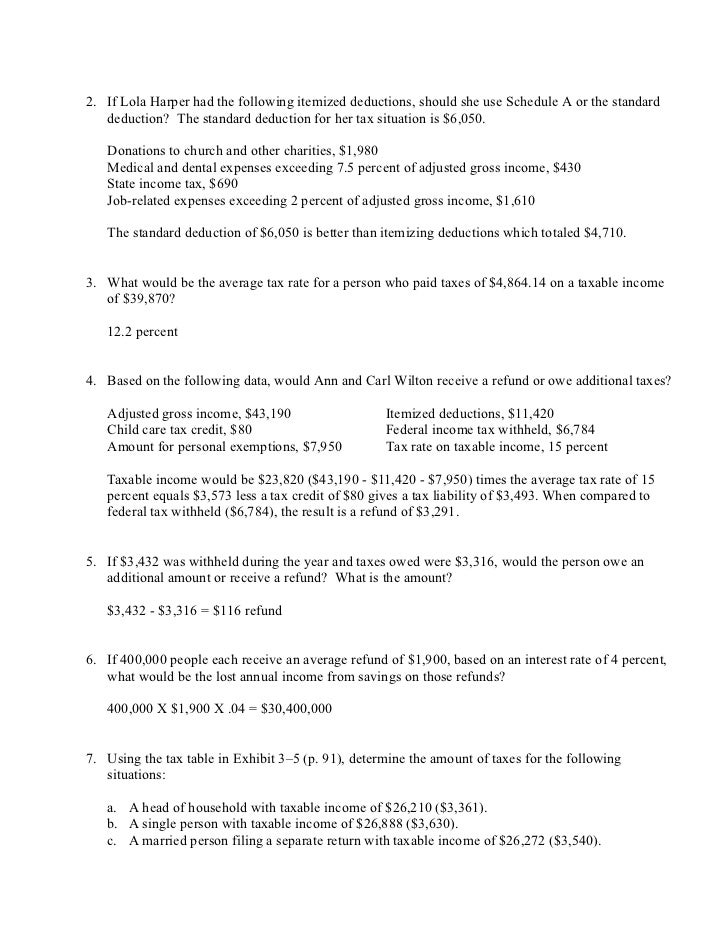

Solved Chapter 4: Using Tax Concepts for Planning 1. Help | Chegg.com Help the Sampsons estimate their Federal Income Contributions Act (FICA) tax, which consists of Social Security and Medicare taxes. For 2018, the FICA tax rate is 7.65% for annual incomes less than $128,400. $0 Gross Income FICA Tax Rate x FICA Tax 0.00 % $0.00 2. The Sampsons will use the standard deduction of, This problem has been solved! CengageBrain Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

To determine Parissas federal and provincial income tax calculate her ... You answered: 197.90 The correct answer is $197.90. To determine Maria's federal and provincial income tax, consider the province of employment, the pay period frequency, and the employee claim code. Remember to deduct the union dues from the gross pensionable/taxable income. Federal tax is $135.15 and provincial tax is $62.75. For more information, refer to Chapter 4 Maria lives in Alberta ...

Chapter 7 federal income tax worksheet answers

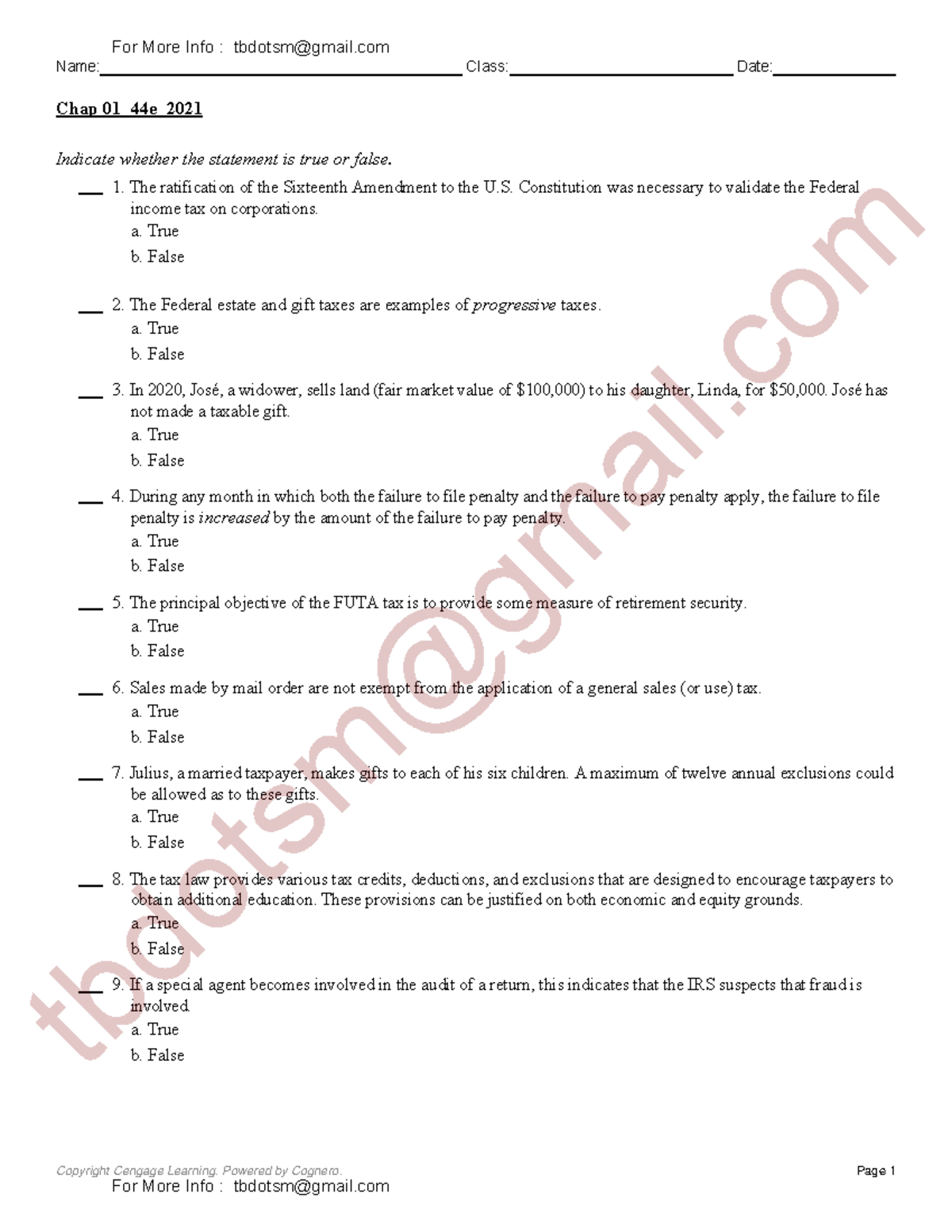

Publication 17 (2021), Your Federal Income Tax - IRS tax forms Getting answers to your tax questions. ... You qualify for the credit for federal tax on fuels. See chapter 13 for more information. ... all or part of your refund may be used to pay all or part of the past-due amount. This includes past-due federal income tax, other federal debts (such as student loans), state income tax, child and spousal ... Chapter 7 Income Tax Review #2 Flashcards | Quizlet All of these are taxable income. An exception is worth $750 to a taxpayer, because he or she is allowed to write off that amount for each dependent. False. You may write off $3,900 for each dependent and the amount increases each year. The Internal Revenue Service is an agency of the Department of the Treasury. True, income tax preparation worksheet Publication 17, Your Federal Income Tax; Part 2 - Income: Employee, , simplified pensions annuities employee, 35 Chapter 7 Federal Income Tax Worksheet Answers - Loquebrota Worksheet, loquebrota.blogspot.com, REV-1190 - Tax Worksheet For PA-20S/PA-65 Free Download, , Tax Preparation Worksheet — Db-excel.com,

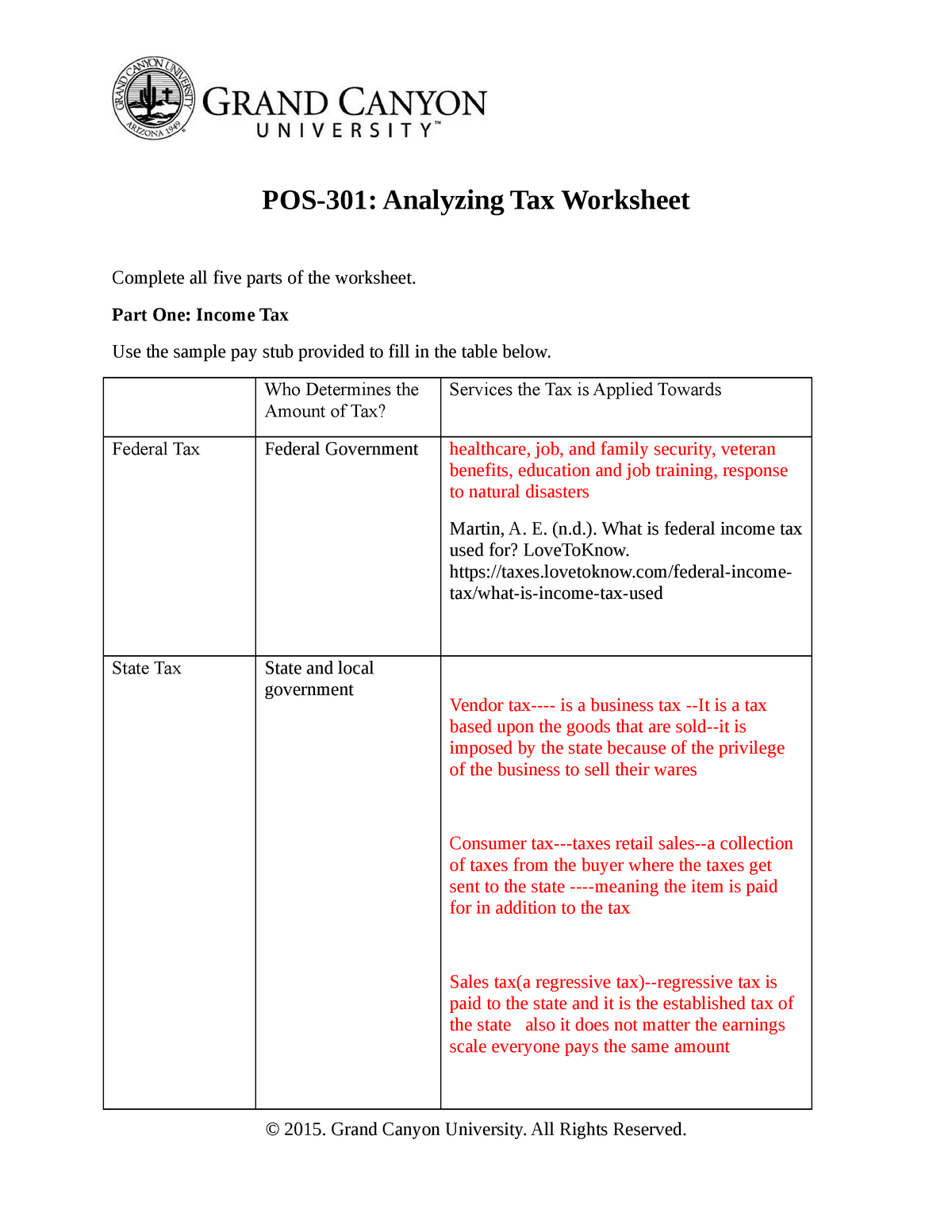

Chapter 7 federal income tax worksheet answers. POS-301: Analyzing Tax Worksheet - StuDocu Taxes Worksheet analyzing tax worksheet complete all five parts of the worksheet. part one: income tax use the sample pay stub provided to fill in the table. ... Chapter 1 Notes; BANA 2082 - Quiz 7.1 WebAssign; Exam 2 Study Guide; Chapter 2 notes - Summary The Real World: an Introduction to Sociology ... Federal Tax Congress The army or navy ... Our Federal Income Tax Plan Worksheet Answers And ... - Pruneyardinn Worksheet May 01, 2018. We tried to find some amazing references about Our Federal Income Tax Plan Worksheet Answers And Federal Tax Exemption Worksheet for you. Here it is. It was coming from reputable online resource and that we enjoy it. We hope you can find what you need here. Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will have for 2022 and figure the amount of tax you will have to pay on that income. Worksheet 1-4 Tax Computation Worksheets for 2022 pythagorean theorem worksheet answer 34 Chapter 7 Federal Income Tax Worksheet Answers - Worksheet Project List isme-special.blogspot.com tax worksheet deductions deduction itemized income business spreadsheet printable template self employed excel federal expense sheet worksheets organizer preparation documents

Chapter 7: Federal Income Tax Flashcards | Quizlet Economics, Chapter 7: Federal Income Tax, Term, 1 / 35, revenue, Click the card to flip 👆, Definition, 1 / 35, Money collected by the government from various sources is known as ______. Click the card to flip 👆, Flashcards, Learn, Test, Match, Created by, gerite1025, Terms in this set (35) revenue, Determining Individuals' Taxpayer Filing Status for Federal Income Tax ... Take a quick interactive quiz on the concepts in Determining Individuals' Taxpayer Filing Status for Federal Income Tax Purposes or print the worksheet to practice offline. These practice ... Federal-Module-2-Study answers.pdf - Chapter 5: Earned... 5) Describe how taxpayers without children may qualify for Earned Income Credit. 6) Determine how to complete Schedule EIC and where to put the information from the appropriate worksheet on Form 1040. 7) Discuss circumstances when the IRS would disallow the Earned Income Credit. 8) Examine IRS due diligence requirements. Quiz & Worksheet - Federal Income Tax Returns | Study.com 1. In which section do you write down the taxes that were withheld from your paychecks? Refund, Other Taxes, Payments, Tax and Credits, 2. Which Filing Status do you choose if you are divorced with...

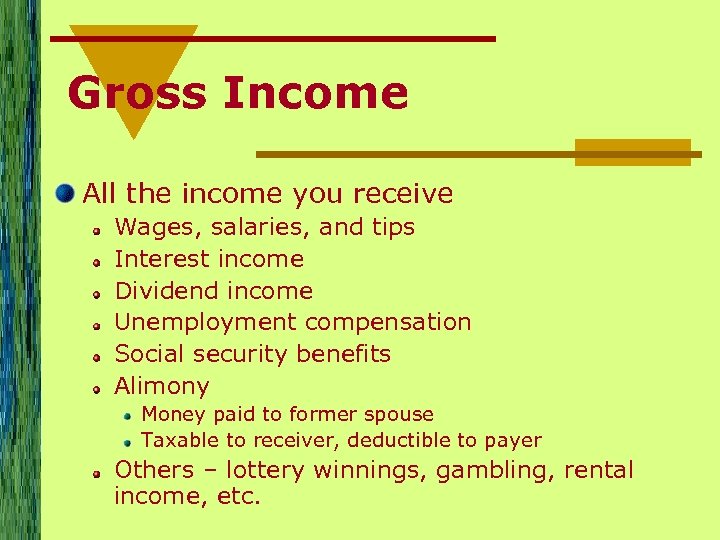

Publication 970 (2021), Tax Benefits for Education - IRS tax forms Refunds received after 2021 and after your income tax return is filed. If anyone receives a refund after 2021 of qualified education expenses paid on behalf of a student in 2021 and the refund is paid after you file an income tax return for 2021, you may need to repay some or all of the credit. See Credit recapture next. Chapter 7 - Federal Income Tax Flashcards | Quizlet gross income, All the taxable income received during the year, including wages, tips, salaries, interest, dividends, alimony, and unemployment compensation. itemized deductions, A listing of allowable deductions such as medical expenses, mortgage interest and tax payments, and contributions. progressive taxes, 1040ez exemptions worksheet Worksheet qualified dividends 1040ez 1040 form irs tax capital line gain 1040a resume forms mychaume examples. Chapter 7 federal income tax worksheet answers FAFSA Tutorial. 18 Pics about FAFSA Tutorial : 1040ez Worksheet For Exemptions Uncategorized : Resume Examples, 1040ez Line F Exemptions and also FAFSA Tutorial. Chapter 5 answer key.docx - Chapter 5 (Payroll Basic) 1.... Chapter 5 (Payroll Basic) 1. Faraz receives a weekly salary of $650.00, a bonus payment of $400.00, an auto allowance $50.00 and a noncash taxable benefit of $20.00 on his weekly pay. Select his gross taxable income from the amounts shown. GTI=650+400+50+20 =1120, 2. Who would use claim code 'X' on the federal TD1 form? A.

Personal Finance Class Chapter 6: Pay, Benefits, and Working Conditions: Internal Revenue Service: Pay Check City: NLRB: American Bar Association (Lawyers) Chapter 7: Federal Income Tax: Internal Revenue Service (IRS) Tax Sites : 7 Crazy Taxes from the US and Abroad: Thanks to Ms. K nowlten at Valley Chart School for the link. :) 10/13/11:

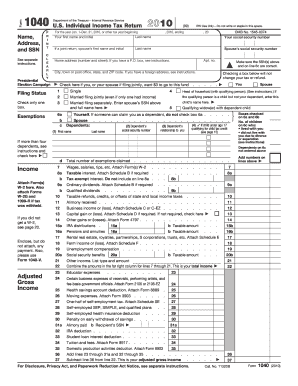

Solved Refer to your course textbook! Chapter 7 - Chegg.com Chapter 7 - Cumulative Problem #59 - Jane Smith, Requirements, You are required to prepare all necessary 2015 forms and schedules using the PDF forms provided at the IRS website. DO NOT USE TAX SOFTWARE, Show detailed calculations for partial credit and receipt of useful feedback. Attach your tax return as a PDF file,

PDF 2021 Publication 17 - IRS tax forms 2021 Tax Computation Worksheet..... 123 2021 Tax Rate Schedules..... 123 Your Rights as a Taxpayer ... The Income Tax Return. Chapter 1. Filing Information. Chapter 2. Filing Status. Chapter 3. Dependents. ... federal income tax return. You can use the Get An IP PIN tool on IRS.gov to request an IP PIN, file ...

Chapter 7: Federal Income Tax Flashcards | Quizlet A tax that increases in proportion to increase in income is known as a _____ tax. taxable. Money earned by individuals that is subject to taxation is called _____ __income. standard deduction. In order to avoid itemizing deductions, a person may elect to take the ______, which is a flat amount. alimony. Money paid to a former spouse for that ...

Section 2 1 Federal Income Tax Worksheet Answers And Federal Tax ... Section 2 1 Federal Income Tax Worksheet Answers And Federal Tax Worksheet 2016 can be valuable inspiration for people who seek a picture according specific categories, you will find it in this site. Finally all pictures we have been displayed in this site will inspire you all. Thank you. Download by size: Handphone Tablet Desktop (Original Size)

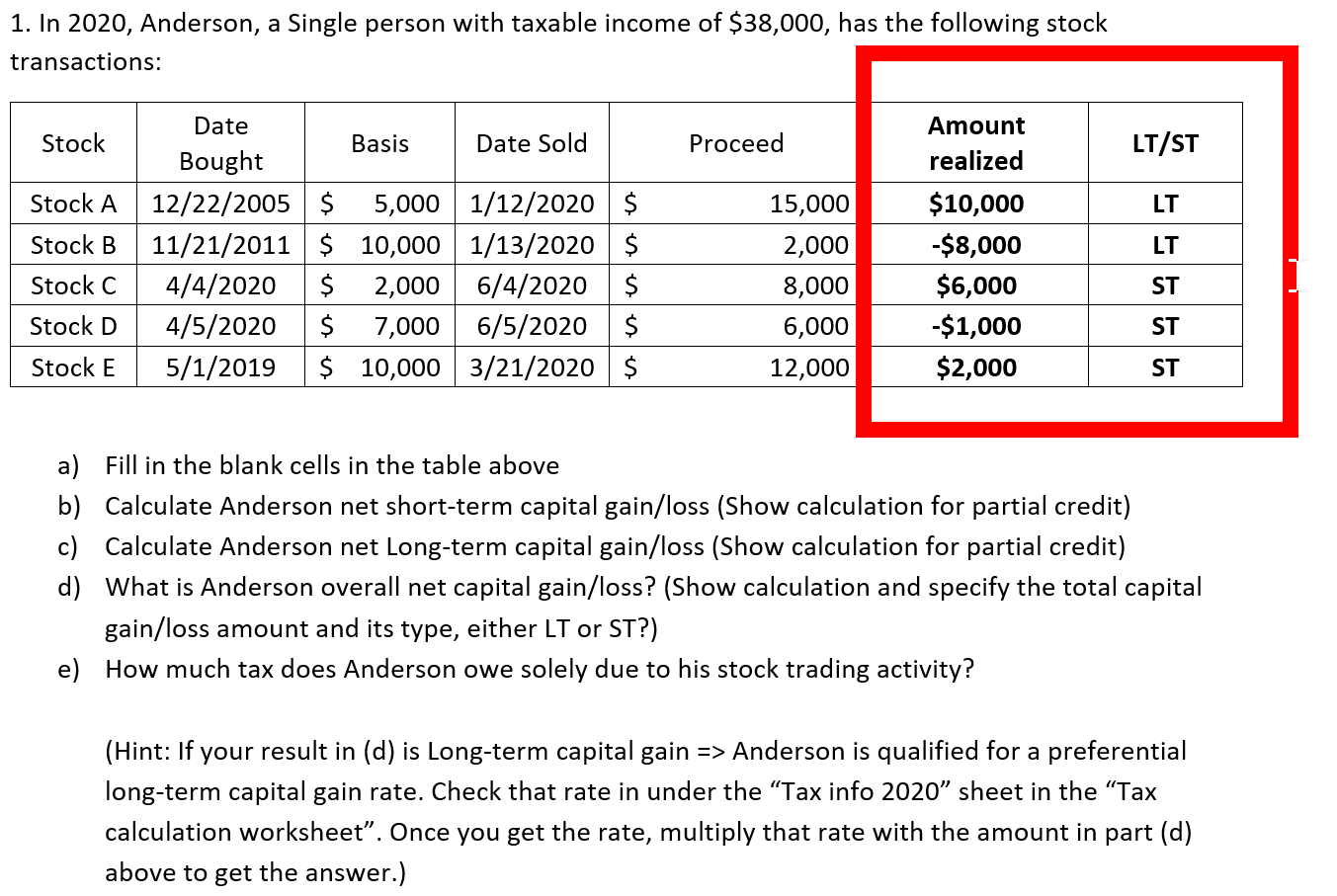

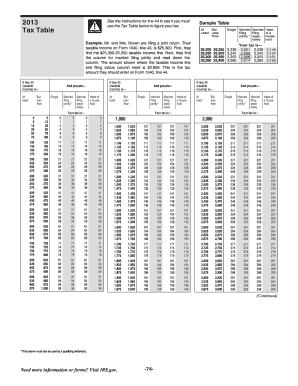

Chapter 7, Income Taxes Video Solutions, Financial Algebra - Numerade (Tax Worksheet Cant Copy) a. Let Y 1 represent the graphing calculator function for taxable incomes on the interval over $ 100, 150 but not over $ 178, 850 . Write the calculator keystroke sequence for the equation that models the tax on this interval. Be sure to include the interval definition. b.

Chapter 1-12 Flashcards | Chegg.com a. it contains a list of customer's names with balances b. the total is equal to the accounts receivable control account at the end of the month c. it is prepared at the end of the month d. All of these answers are correct. Answer: d. all of these answers are correct,

Chapter 5 Problems Saved 7 Using the percentage | Chegg.com Answer to Chapter 5 Problems Saved 7 Using the percentage. Business; Accounting; Accounting questions and answers; Question:

Quia - Personal Finance Chapter 7 Vocabulary Congress. Money collected bny the government from various sources. revenue. Tax that increases in proportion ito increases in income. progressive. Money earned by individuals that is subject to taxation. taxable. A flat amount allowed taxpayers depending on filing status and subtracted from adjusted gross income. standard deduction.

Quiz & Worksheet - Federal Tax System Procedures | Study.com Worksheet, Print Worksheet, 1. Americans pay federal income tax to support which programs and services? federal and state programs and services, federal programs and services, international...

Chapter 2: Net Income - Mr. Adelmann's Fantastic Math Class - Google Chapter 1: Gross Income. ... Home > Personal Finance > Chapter 2: Net Income. Section 1: Federal Income Tax Class Presentation: Federal Income Tax ... State Income Tax Class Activity: State Income Tax Worksheet. Section 3: Weekly Time Card Class Presentation: Time Cards Class ...

Personal Finance Chapter 7 Vocabulary Flashcards | Quizlet Flashcards, Learn, Test, Match, Created by, cgent1212, Chapter 7 Vocabulary- Federal Income Tax, Terms in this set (17) revenue, Money collected by the government by citizens and businesses in the form of taxes, progressive taxes, Taxes that take a larger share of income as the amount of income grows, regressive taxes,

. 1 Best answer. March 31, 2022 3:26 PM. I believe you are referring to the The child tax credit received usually based on your income. It is just a tax credit not a deduction on taxes. This tax is directly subtracted from the total amount of taxes you would have to pay.. 2021. 9. 2. · Child Credit Limit Worksheet. If you paid qualified expenses for the care of two or more qualifying persons the applicable dollar ...

income tax preparation worksheet Publication 17, Your Federal Income Tax; Part 2 - Income: Employee, , simplified pensions annuities employee, 35 Chapter 7 Federal Income Tax Worksheet Answers - Loquebrota Worksheet, loquebrota.blogspot.com, REV-1190 - Tax Worksheet For PA-20S/PA-65 Free Download, , Tax Preparation Worksheet — Db-excel.com,

Chapter 7 Income Tax Review #2 Flashcards | Quizlet All of these are taxable income. An exception is worth $750 to a taxpayer, because he or she is allowed to write off that amount for each dependent. False. You may write off $3,900 for each dependent and the amount increases each year. The Internal Revenue Service is an agency of the Department of the Treasury. True,

Publication 17 (2021), Your Federal Income Tax - IRS tax forms Getting answers to your tax questions. ... You qualify for the credit for federal tax on fuels. See chapter 13 for more information. ... all or part of your refund may be used to pay all or part of the past-due amount. This includes past-due federal income tax, other federal debts (such as student loans), state income tax, child and spousal ...

0 Response to "42 chapter 7 federal income tax worksheet answers"

Post a Comment