42 1023 ez eligibility worksheet

Get the free 1023 ez eligibility worksheet form - pdfFiller Instructions and Help about form 1023 ez eligibility worksheet pdf. Hey everyone welcome back since it's tax season I thought I would show you all how to prepare your own Texas today I want to go over how to file your taxes using form 1040ez this form is for single or married people with no children however if you made more than a hundred ... Leadership Guides - WSPTA 1023 EZ Eligibility Worksheet (1/2018) IRS Form 1023-EZ WSPTA Instructions (2/2021) PDF IRS Form 1023 Filing WSPTA Instructions (6/2020) PDF. Form 990 Information Reminder: IRS Form 990 is due November 15 990-N (ePostcard) User Guide (3/2018) Form 990EZ (2020) IRS Instructions for Form 990EZ (2020) IRS Form 990 EZ (WSPTA Instructions) (10/2021) PDF

Form 1023 Ez Eligibility Worksheet: Fill & Download for Free If you take an interest in Modify and create a Form 1023 Ez Eligibility Worksheet, heare are the steps you need to follow: Hit the "Get Form" Button on this page. Wait in a petient way for the upload of your Form 1023 Ez Eligibility Worksheet. You can erase, text, sign or highlight as what you want. Click "Download" to conserve the changes.

1023 ez eligibility worksheet

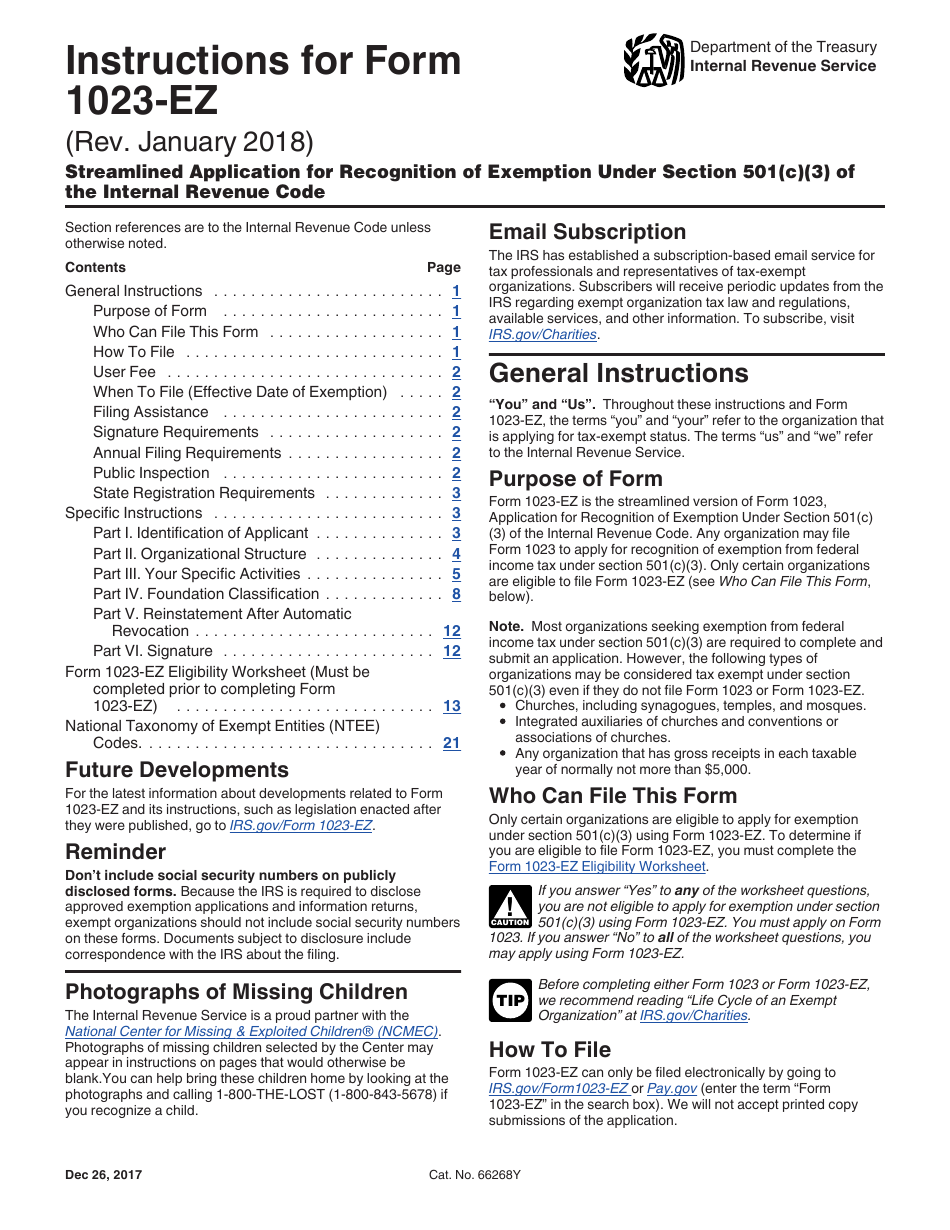

PDF Page 13 of 23 - WSPTA Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply Instructions for Form 1023-EZ (Rev. January 2018) Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. Filing the 1023 EZ Form for Your Nonprofit - Springly Eligibility Worksheet As previously mentioned, there are certain restrictions to qualifying for the 1023-EZ form. Prior to filling out the online form, you must first fill out the eligibility worksheet to verify that you fit all of the criteria for the streamlined service.

1023 ez eligibility worksheet. Pay.gov - Streamlined Application for Recognition of Exemption Under ... We apologize for this inconvenience. Note: You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file Form 1023-EZ. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501 (c) (3). 1023 Ez Eligibility Worksheet Form - signNow Follow the step-by-step instructions below to design your form 1023 EZ eligibility worksheet national pta: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. Form 1023-EZ (1023EZ) Application for 501c3 Pros & Cons When the IRS released its short and “easy or EZ” version of the Form 1023 (Form 1023 EZ the Application for Recognition of Tax Exemption under the 501c3 section of the Internal Revenue Code), it quickly became a bad joke and a failure on so many level that I don’t even know where to begin.In theory, most nonprofit organizations with gross receipts of $50,000 or less and assets … About Form 1023-EZ, Streamlined Application for Recognition of ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ...

IRS Form 1023-EZ Eligibility Worksheet - Nonprofit Corporations ... IRS Form 1023-EZ Eligibility Test Take the 30 question test below to see if your non-profit corporation is eligible to file IRS Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. IRS Form 1023-EZ Application for 501(c)(3) Nonprofits - Hurwit & Associates 2. Can I file the Form 1023-EZ? Perhaps. The IRS has created an eligibility worksheet (located on page 11 of the Form 1023-EZ instructions) to determine whether or not a particular organization may use the new form. As mentioned previously, one of the main qualifications is the anticipated level of gross receipts. All About IRS Form 1023-EZ - SmartAsset Wondering whether you're eligible to file Form 1023-EZ? You'll need to find the form's instructions and scroll down to the eligibility worksheet. If you respond "yes" to any of its questions, you can't submit Form 1023-EZ. That means you'll need to complete Form 1023. Generally, only small-scale organizations can file Form 1023-EZ. Instructions for Form 1023-EZ (01/2018) | Internal Revenue Service 20.12.2019 · You must also check the boxes regarding your gross receipts and total assets. If you check "Yes" to those questions, you do not meet the requirements to submit Form 1023-EZ; instead, file Form 1023. For additional information regarding the gross receipts and assets requirements, see questions 1 through 3 on the Form 1023-EZ Eligibility Worksheet.

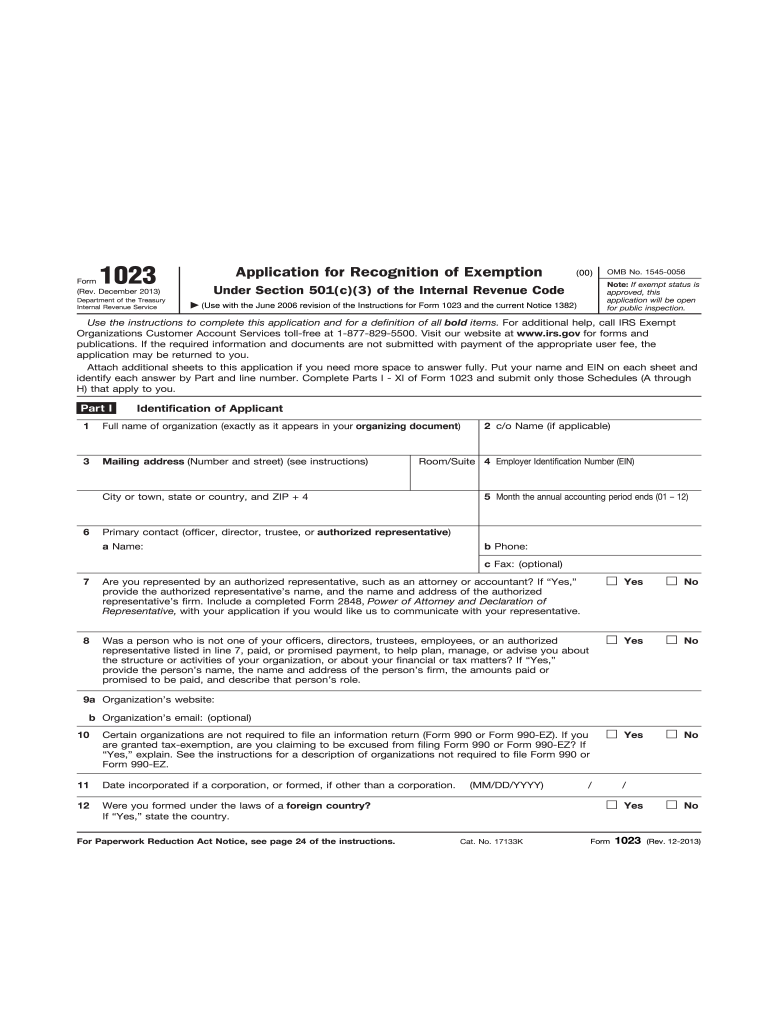

irs form 1023 ez eligibility worksheet 1023 ez eligibility worksheet. 19 printable form 1023-ez templates. Form 1023 ez eligibility worksheet. Random Posts. iso line lab answer key; lesson 13 homework 5.2 answer key; math answers with work; mathworksheetsgo answer key; independent living worksheets; keystone algebra 1 practice worksheets; About Form 1023, Application for Recognition of Exemption Under Section ... You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ PDF to determine if you are eligible to file this form. If you are not eligible to file Form 1023-EZ, you can still file Form 1023. Current Revision To submit Form 1023, you must: Register for an account on Pay.gov. Application for Recognition of Exemption Under Section 501(c)(3) You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file that form. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501 (c) (3). Filing Your Nonprofits Tax Exempt Forms: 1023 vs. 1023 EZ Form 1023-EZ: Eligibility Criteria For determination of whether your nonprofit meets eligibility criteria for completing the EZ version of Form 1023, fill out this Eligibility Worksheet . If even a single time you must answer "yes" to one of the 30 questions, your organization is not eligible for the shortcut and must fill out the standard Form 1023.

PDF ----------------------------------------------------------------------- Form 1023-EZ must be filled and submitted online on , this PDF copy is for reference only! ... Please go to and read the Pros & Cons and eligibility requirements before using the Form 1023-EZ.----- ¾ È» ÏÅË ÅȽ·Ä¿Ð»º ·É ·Ä »ÄÊ¿ÊÏ Åʾ»È ʾ·Ä · ¹ÅÈÆÅÈ·Ê¿ÅÄ ËÄ ...

Get Form 1023 Ez Eligibility Worksheet 2020-2022 - US Legal Forms Keep to these simple instructions to get Form 1023 Ez Eligibility Worksheet completely ready for submitting: Get the sample you will need in the collection of legal forms. Open the template in our online editing tool. Go through the guidelines to discover which information you need to give. Click the fillable fields and put the required data.

What is IRS Form 1023-EZ? Filing Fees & Eligibility - Hurwit & Associates What is the Form 1023-EZ? Form 1023-EZ is a new, streamlined, online form created by the IRS for smaller organizations that wish to apply for federal tax-exempt status under Internal Revenue Code Section 501(c)(3), and anticipate receiving $50,000 or less in annual gross receipts.; Can I file the Form 1023-EZ? Perhaps. The IRS has created an eligibility worksheet (located on page 11 of the ...

Form 1023-EZ Eligibility Worksheet - Cognito Forms Form 1023-EZ Eligibility Worksheet - Cognito Forms

PDF …ˇ¯¸•˜É˝»¨ ˝»É ˚¯•˜ˇ¯…˚¾»˝¯¨`ɾ»»˚˙¸»É˚¿¯˜É ˇ¯¸•¨»˜¯˚»´¿‰¿‚´»˚¯•˘˘´ˇ ... ‚„fl ¨»ˇ¯¸•„¾¸¨„¾¯¨•„¯˜Ì»˜˚¿¯˜¯¨•Éɯ„¿•˚¿¯˜¯…„¾¸¨„¾»É"»É„¨¿‚»"¿˜É»„˚¿¯˜ ‚¾ ...

form 1023-ez eligibility worksheet. 36 1023 Ez Eligibility Worksheet - Support Worksheet martindxmguide.blogspot.com. form formtemplate. Form 1023 Ez Eligibility Worksheet briefencounters.ca. 1023 eligibility ez worksheet form irs faq unique source. 19 Printable Form 1023-ez Templates - Fillable Samples In PDF, Word To

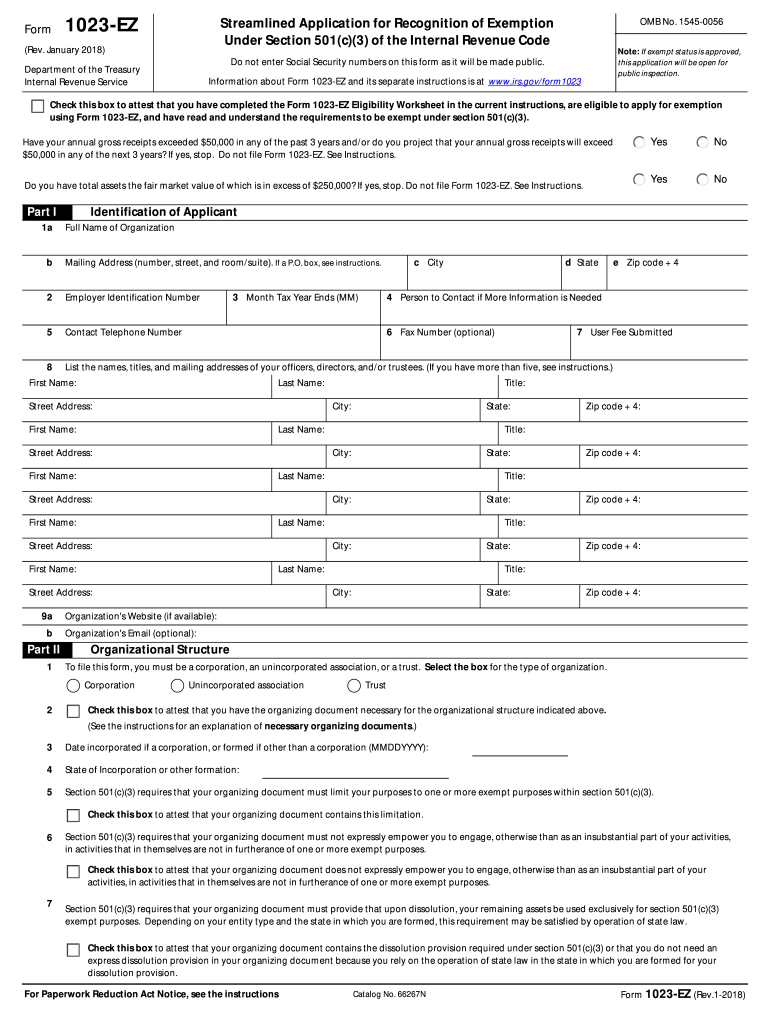

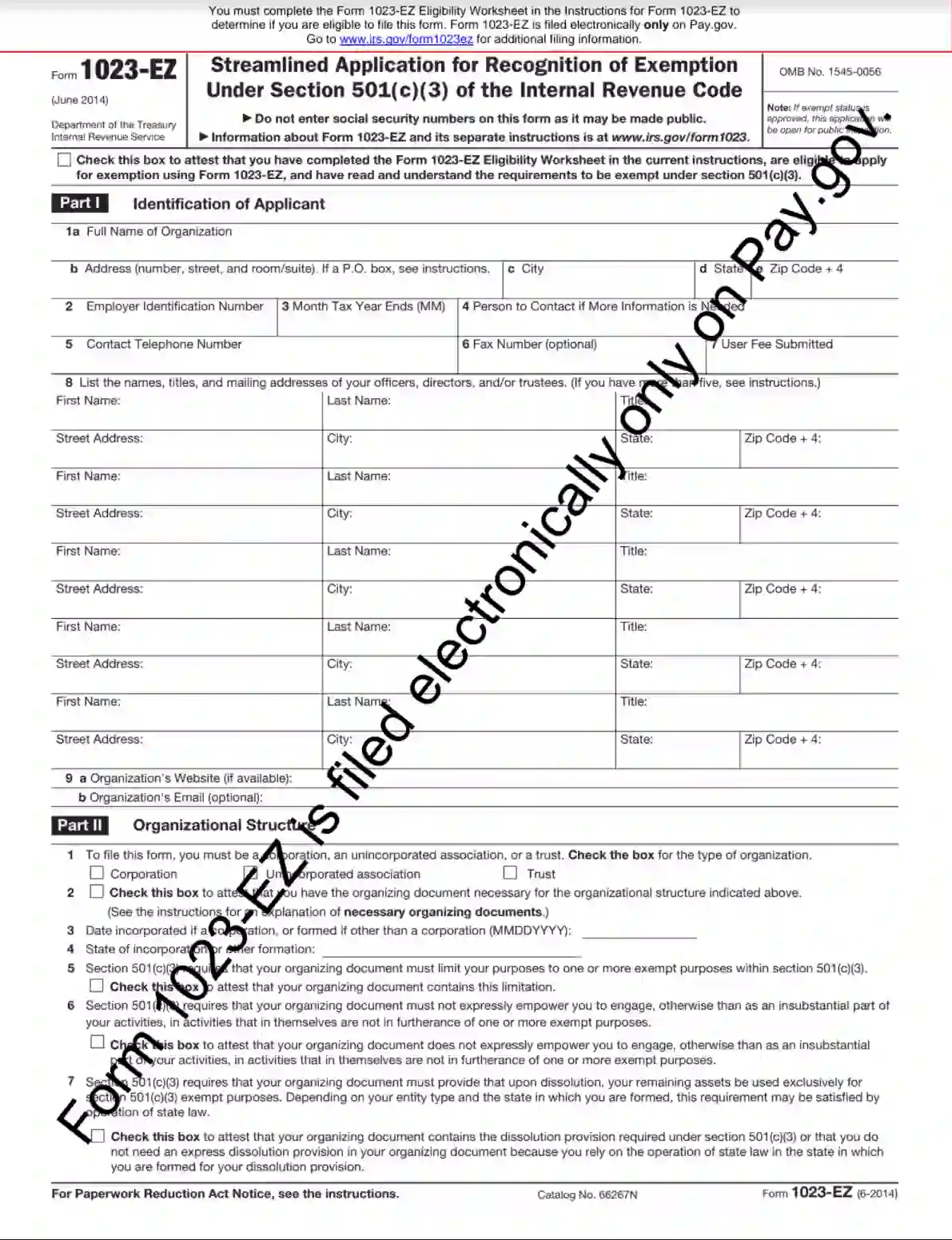

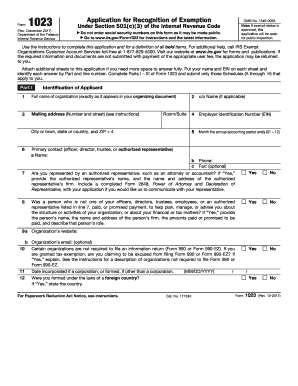

Form 1023 Ez - Fill Out and Sign Printable PDF Template | signNow Have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I 1a Identification of Applicant Full Name of Organization b Mailing Address (number, street, and room/suite).

Form 1023-EZ (June 2014) Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I Identification of Applicant . 1a . Full Name of Organization. b

Who Is Eligible to File Form 1023-EZ? - Foundation Group® Form 1023-EZ eligibility is dependent upon purpose. The organizational types below are usually required to supply the IRS with more information regarding their activity than is required by the streamlined process. These purpose exclusions include: Organizations investing more than 5% of assets in non-publicly traded securities.

Instructions for Form 1023 (01/2020) | Internal Revenue Service Complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you're eligible to file Form 1023-EZ. You can visit IRS.gov/Charities for more information on application requirements. Leaving a group exemption.

PDF Form 1023-EZ Streamlined Application for Recognition of Exemption Under ... Information about Form 1023-EZ and its separate instructions is at Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3).

Form 1023 Ez - Fill Out and Sign Printable PDF Template | signNow Sample Completed 1023 Ez Form. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Get everything done in minutes. ... Form Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using ...

Form OMB No. 1545-0056 Under Section 501(c)(3) of the Internal … Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I Identification of Applicant 1a Full Name of Organization

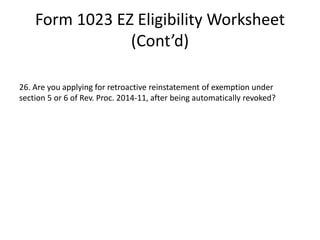

Form 1023-EZ Revisions | Internal Revenue Service 5.10.2022 · Question 29 on the Form 1023-EZ Eligibility Worksheet now requires that an automatically revoked organization applying for reinstatement must seek the same foundation classification they had at the time of automatic revocation to be eligible to use the Form 1023-EZ. Organizations that are not seeking that same foundation classification must ...

Who Is Eligible to Use IRS Form 1023-EZ? | Nolo To determine whether your organization is eligible to use the streamlined application, you can use the 1023-EZ eligibility worksheet. The basic requirements are as follows: gross income under $50,000 in the past 3 years estimated gross income less than $50,00 for the next 3 years fair market assets under $250,000 formed in the United States

1023-EZ Worksheet 2022 - 2023 - IRS Forms - Zrivo Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code is the easier version of Form 1023. ... The eligibility worksheet for Form 1023-EZ is eight pages long, and it should take you about ten minutes to complete from the start to finish. Before you start filling out Form 1023-EZ ...

Filing the 1023 EZ Form for Your Nonprofit - Springly Eligibility Worksheet As previously mentioned, there are certain restrictions to qualifying for the 1023-EZ form. Prior to filling out the online form, you must first fill out the eligibility worksheet to verify that you fit all of the criteria for the streamlined service.

Instructions for Form 1023-EZ (Rev. January 2018) Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ.

PDF Page 13 of 23 - WSPTA Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply

0 Response to "42 1023 ez eligibility worksheet"

Post a Comment