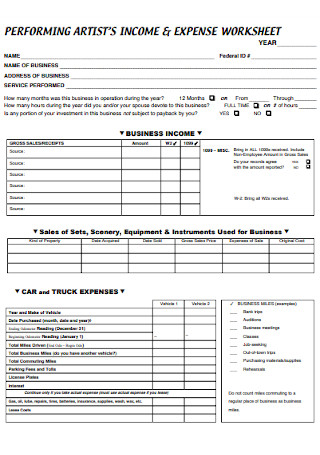

41 car and truck expenses worksheet

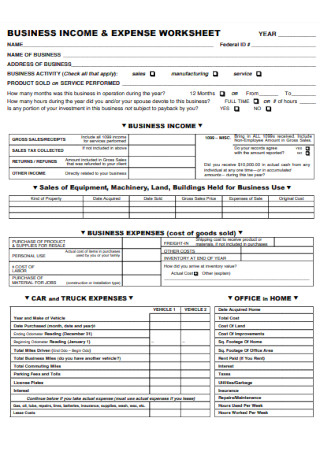

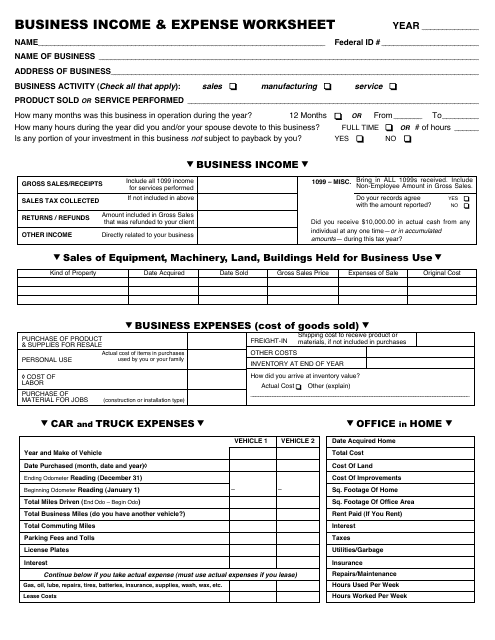

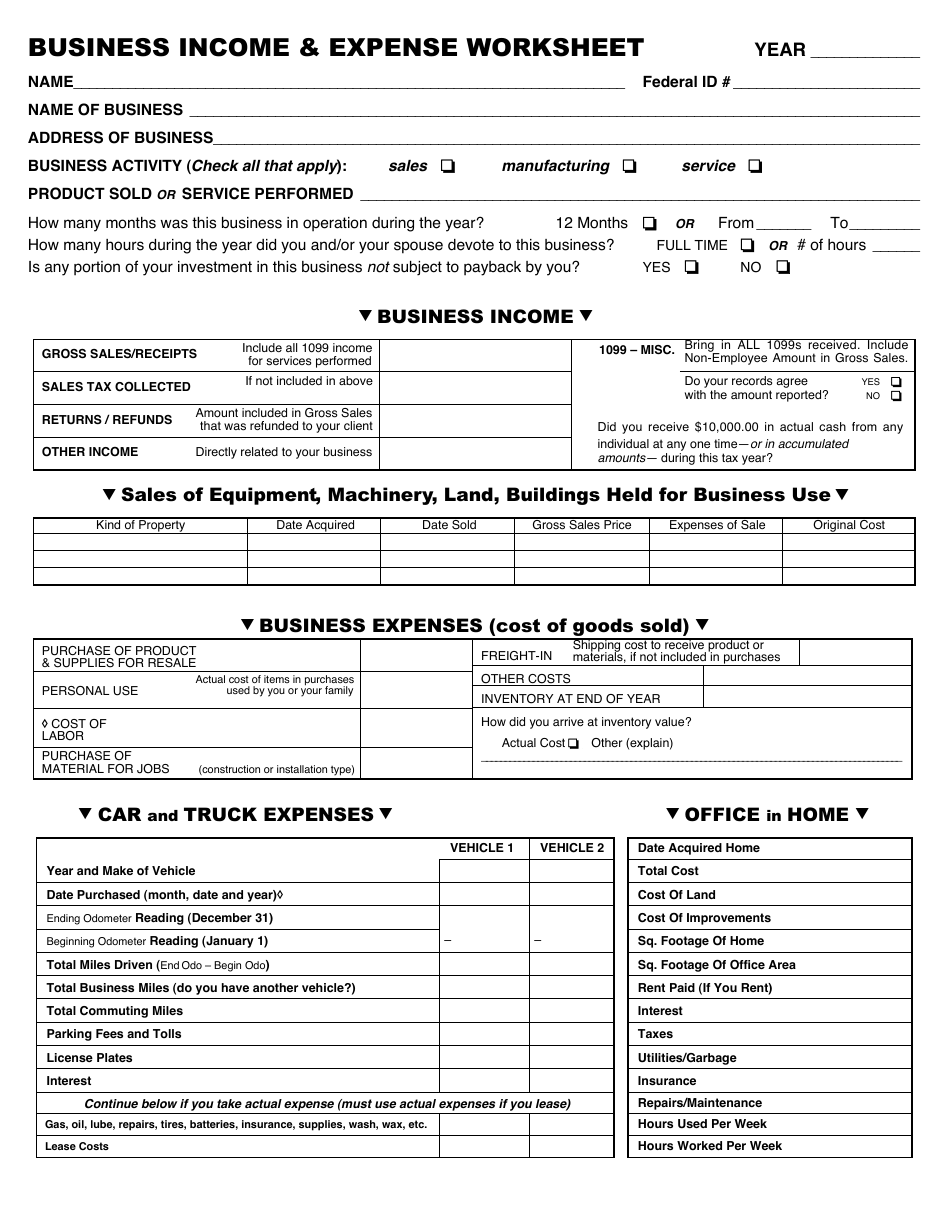

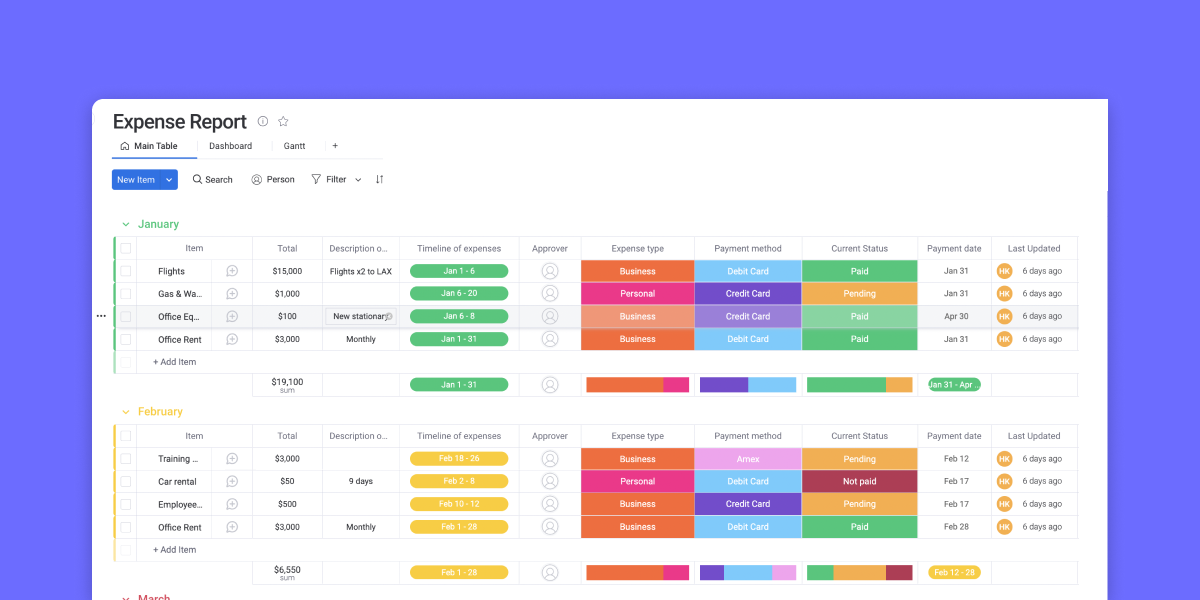

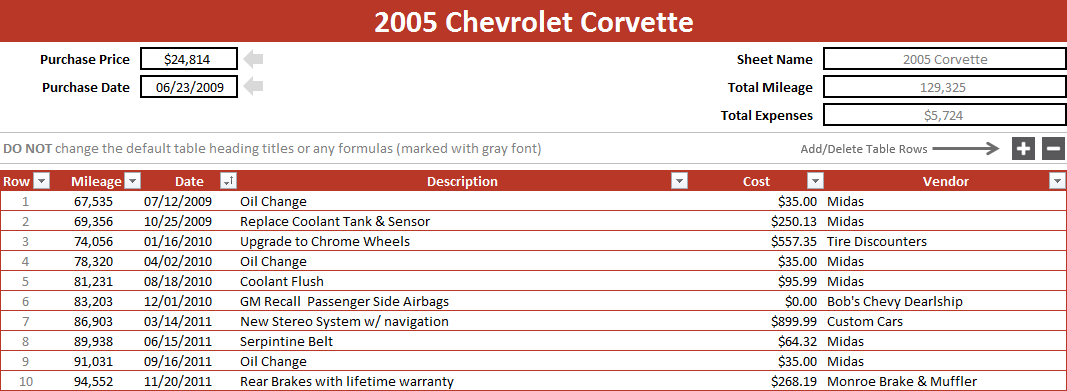

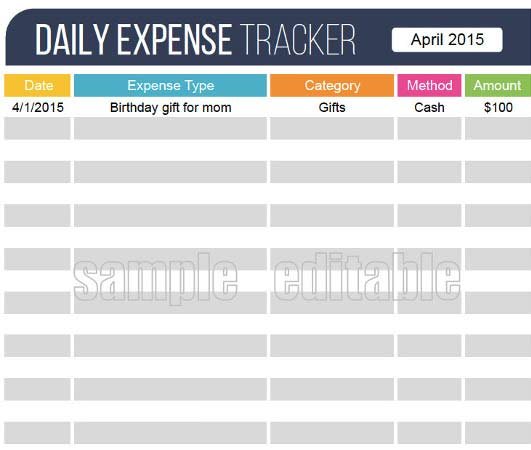

Vehicle Expense Spreadsheet Excel Template (Free) - Software for Enterprise This helps to minimize partial or complete failure, and thus minimize business interruption. It acts as a preemptive insurance policy against catastrophic failures. Excel Vehicle Expense Spreadsheet Template Download (Simply enter your name and email address) Video on how to create the Vehicle Expense Tracker (Part 1) Completing the Car and Truck Expenses Worksheet in ProSeries - Intuit Business entities don't have a separate worksheet and would use the asset entry worksheet to calculate depreciation on vehicles. Creating a car and truck worksheet: Completing the Vehicle Information section. Each vehicle must have the Vehicle Information filled out, regardless of the deduction method.

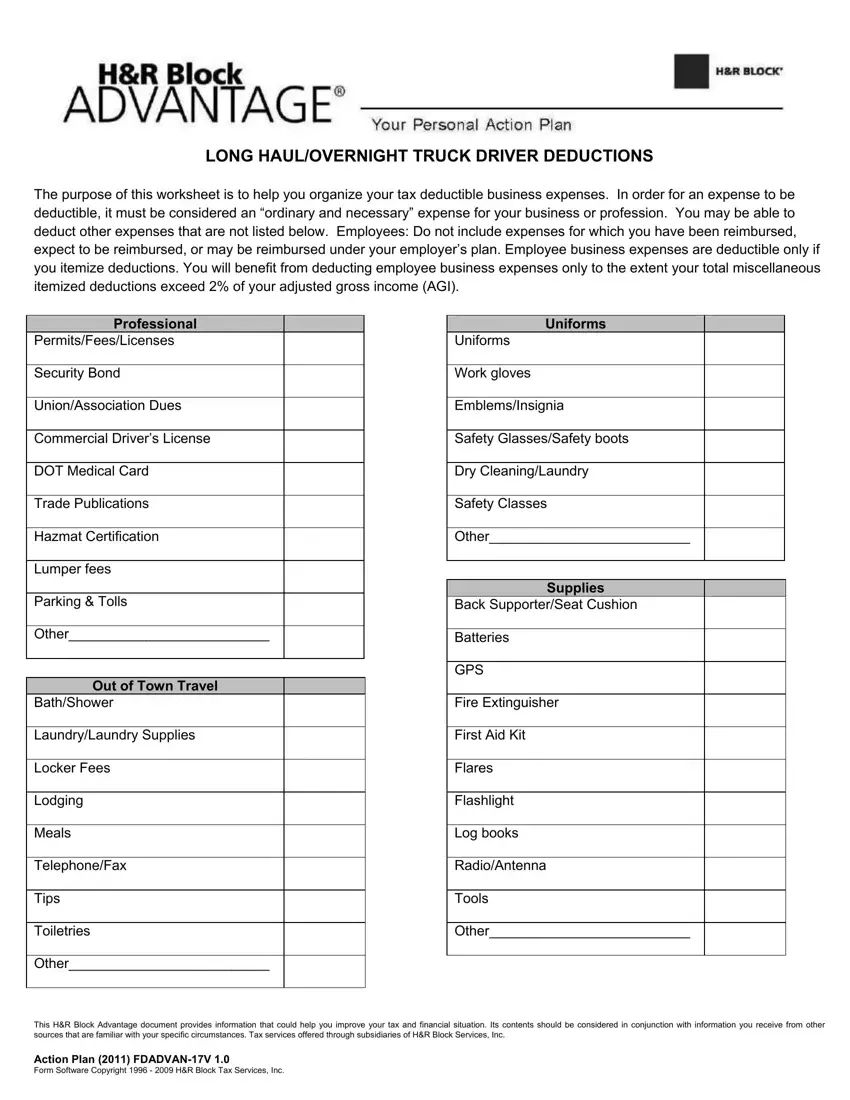

Tax-Deductible Car and Truck Expenses - The Balance Small Business You have two options for deducting car and truck expenses. The first is using your actual expenses, which include parking fees and tolls, vehicle registration fees, personal property tax on the vehicle, lease and rental expenses, insurance, fuel and gasoline, repairs including oil changes, tires, and other routine maintenance, and depreciation. 6

Car and truck expenses worksheet

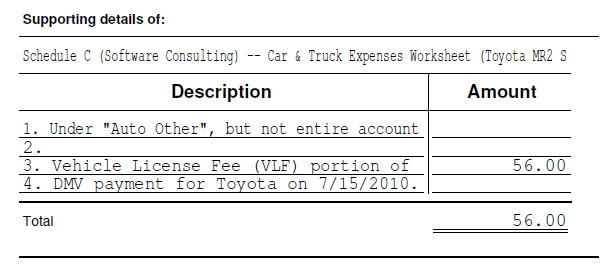

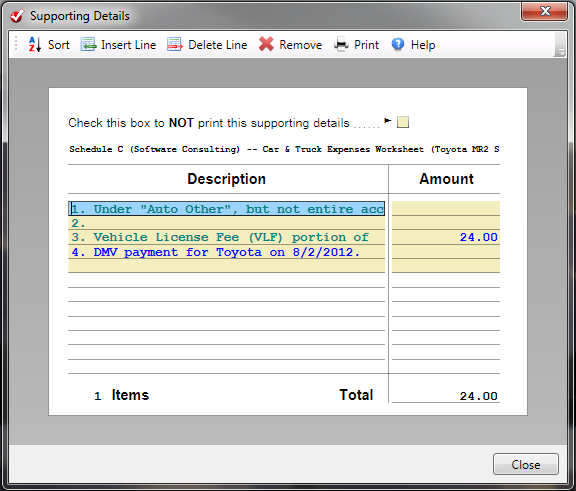

PDF 2020 Tax Year Car and Truck Expense Worksheet - pdvcpa.com Title: 2020 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET.xlsx Author: jodi Created Date: 1/29/2021 8:33:36 AM What is Xbas under car and truck expense worksheet? - Intuit You may want to delete the Vehicle entry completely and start over on reporting the Vehicle Expense. Actual expenses include depreciation, gas and maintenance. Alternatively, standard mileage includes depreciation in the rate per mile that is deductible. It must be used the first year if you want to be able to choose between Actual or Standard. Car & Truck Expenses Worksheet: Cost must be entered "schedule C -- Car & Truck Expenses Worksheet: Cost must be entered." Hi everyone, I almost complete my tax return but at the end the program asked me to entered my vehicle cost. There are an empty box next to the question and I need to enter a number before I can file my tax return electronically.

Car and truck expenses worksheet. PDF Car and Truck Expenses Worksheet (Complete for all vehicles) - ARAI, CPA Car and Truck Expenses Worksheet (Complete for all vehicles) 1 Make and model of vehicle 2 Date placed in service 3 Type of vehicle 4a Ending mileage reading b Beginning mileage reading cTotal miles for the year The Corner Forum - New York Giants Fans Discussion Board ... Big Blue Interactive's Corner Forum is one of the premiere New York Giants fan-run message boards. Join the discussion about your favorite team! What expenses can I list on my Schedule C? - Support Enter your mileage and your actual expenses here. Actual Car Expenses include: Depreciation, License and Registration, Gas and Oil, Tolls and Parking fees, Lease Payments, Insurance, Garage Rent and Repairs and Tires. For more information regarding your Car and Truck Expenses, see section 4 of Publication 463. Business Use of Home Car Sales Worksheet Template | Excel Templates The Car Sales Worksheet Template excel will be applicable to far more than just the car industry. Due to the inherently customizable nature of the Car Sales Worksheet Template almost any organization that is engaged in sales will be able to find some kind of benefit from using the template software that we have made available.

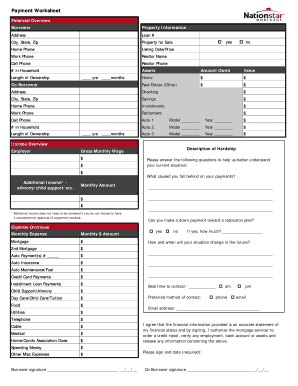

PDF Vehicle Expense Worksheet - ACT CPA Accounting, Coaching, Taxes Car and Truck Expense Worksheet GENERAL INFO Vehicle 1 Vehicle 2 * Must have to claim standard mileage rate Dates used if not for the time period Description of Vehicle * Date placed in service* Total Business miles* Total Commuting Miles* Other Miles* Total Miles for the period* car and truck expenses worksheet 27 Car And Truck Expenses Worksheet - Worksheet Resource Plans starless-suite.blogspot.com. schedule template excel spreadsheet expenses worksheet costing project truck cost within luxury construction monthly budget templates student spreadshee expense google. Car And Truck Expenses Worksheet Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. TaxWise Online Community - Car and Truck Expenses Car and Truck Expenses. Last post 02-12-2011, 10:26 AM by LRS416. 3 replies. Sort Posts: Previous Next: 02-07-2011, 3:45 PM: 66905: LRS416; Posts 19; Car and Truck Expenses Reply Quote. I am preparing a Sch. F and have filled out the car and truck worksheet. The truck is a grain truck and not listed property. The diagnostics indicate that I ...

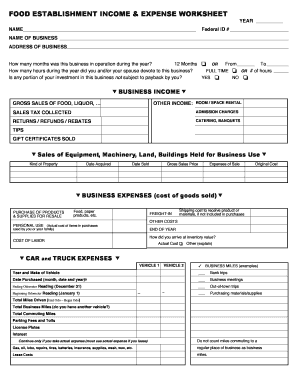

PDF VEHICLE EXPENSE WORKSHEET - Pace and Hawley VEHICLE EXPENSE WORKSHEET Pace & Hawley, LLC COMPLETE A SEPARATE WORKSHEET FOR EACH VEHICLE WITH BUSINESS USE ... Taxpayer name: Tax year: Vehicle make: Vehicle model: Vehicle year: Type of vehicle? Auto Truck/Van/SUV Heavy vehicle Other (describe) Date in service: From / / To / / Date of disposition (if applicable) / / YES NO 1. ... PDF TRUCKER'S INCOME & EXPENSE WORKSHEET!!!!!!!!!!!!!! - Webflow TRUCKER'S INCOME & EXPENSE WORKSHEET!!!!! YEAR_____ NAME ... TRUCK RENTAL FEES individual at any one time—or in ... Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost and ! CAR TRUCK EXPENSES (personal vehicle) ! VEHICLE 1 VEHICLE 2 " BUSINESS MILES (examples) Year and Make of Vehicle ____ Job seeking ... PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287,48( Year T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle Date Purchased (month, date and year) Ending Odometer Reading (December 31) Beginning Odometer Reading (January 1) - Total Miles Driven (End Odo -Begin Odo) Total Business Miles (do you have another vehicle?) PDF Over-the-road Trucker Expenses List - Pstap When determining passenger vehicle expenses, you cannot use, under current IRS rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and 50.5 cents per mile for 2008) for vehicles used for hire such as taxicab, bus or tractor (over-the-road trucks). Only actual passenger vehicle operating expenses are permitted

self employed expense worksheet column printable spreadsheet template sheets excel accounting employed self business templates expenses income taxes excelxo. Car And Truck Expenses Worksheet briefencounters.ca. worksheet expenses truck spreadsheet template business self employed expense bud personal source sheet. Simplified Home Office Deduction: When Does It Benefit Taxpayers?

PDF VEHICLE EXPENSE WORKSHEET - Beacon Tax Services VEHICLE EXPENSE WORKSHEET (If claiming multiple vehicles, use a separate sheet for each) Required for all claims: • Do you have any other vehicle available for personal use? Yes No • Do you have written mileage records to support your deduction? Yes No

Deducting Auto Expenses - Tax Guide - 1040.com For 2020, the rate is 57.5 cents per mile. With the mileage rate, you won't be able to claim any actual car expenses for the year. You cannot also claim lease payments, fuel, insurance and vehicle registration fees. Also, if you use your vehicle for both business and personal use, you can deduct only the business miles.

PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services TRUCKER'S INCOME & EXPENSE WORKSHEET ... Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost CAR and TRUCK EXPENSES ... truck Insurance, etc. INTEREST: Mortgage (business bldg.): Paid to financial institution Paid to individual OTHER INTEREST:

1040 - Auto Expenses (K1, ScheduleC, ScheduleE, ScheduleF) - Drake Software The choices are: Schedule C*, Schedule E, Schedule F, Form 4835, or K-1 from a Partnership. Enter the same description and date placed in service as appeared on the 4562 screen. Answer the four required questions about business/personal use of the vehicle. Enter the Current Year Mileage. The current year business mileage is used to calculate ...

Car & Truck Expenses - Drake Software Input car and truck expenses in the Schedule C or the Drake-recommended Auto Screen. Skip to main content Site Map. Menu. Sales: (800) 890-9500 Sign In. Home; Products. Drake Tax ... Learn how to enter expenses for automobiles used in trade or business. Other videos from the same category. Drake Software. 235 East Palmer Street Franklin, NC 28734.

PDF Car and truck expenses worksheet 2019 - nslogisticservice.com Car and truck expenses worksheet 2019 Below is a list of scarce program C and a brief description of each: car and truck expenses: ã, there are two methods that you can use to deduce vehicle expenses, the standard mileage rate or current expenses . You can only use a vehicle method. To use the standard mileage speed, go to the car and truck ...

Car and Truck Expense Deduction Reminders - IRS tax forms Expenses related to travel away from home overnight are travel expenses. These expenses are discussed in Chapter One of Publication 463, “Travel, Entertainment, Gift, and Car Expenses.” However, if a taxpayer uses a car while traveling away from home overnight on business, the rules for claiming car or truck expenses are the same as stated ...

2021 Instructions for Schedule C (2021) | Internal Revenue Service Also, use Schedule C to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint ventures, and (c) certain amounts shown on a Form 1099, such as Form 1099-MISC, Form 1099-NEC, and Form 1099-K. See the instructions on your Form 1099 for more information about what to report on Schedule C.

2021 Publication 535 - IRS tax forms your car, van, pickup, or panel truck for each mile of business use is 56 cents per mile. For more information, see chapter 11. What's New for 2022. The following item highlights a change in the tax law for 2022. Standard mileage rate. For tax year 2022, the standard mileage rate for the cost of operating your car, van, pickup, or panel truck ...

Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Publication 463 (2021), Travel, Gift, and Car Expenses ... You figure the deductible part of your air travel expenses by subtracting 7 / 18 of the round-trip airfare and other expenses you would have had in traveling directly between New York and Dublin ($1,250 × 7 / 18 = $486) from your total expenses in traveling from New York to Paris to Dublin and back to New York ($750 + $400 + $700 = $1,850).

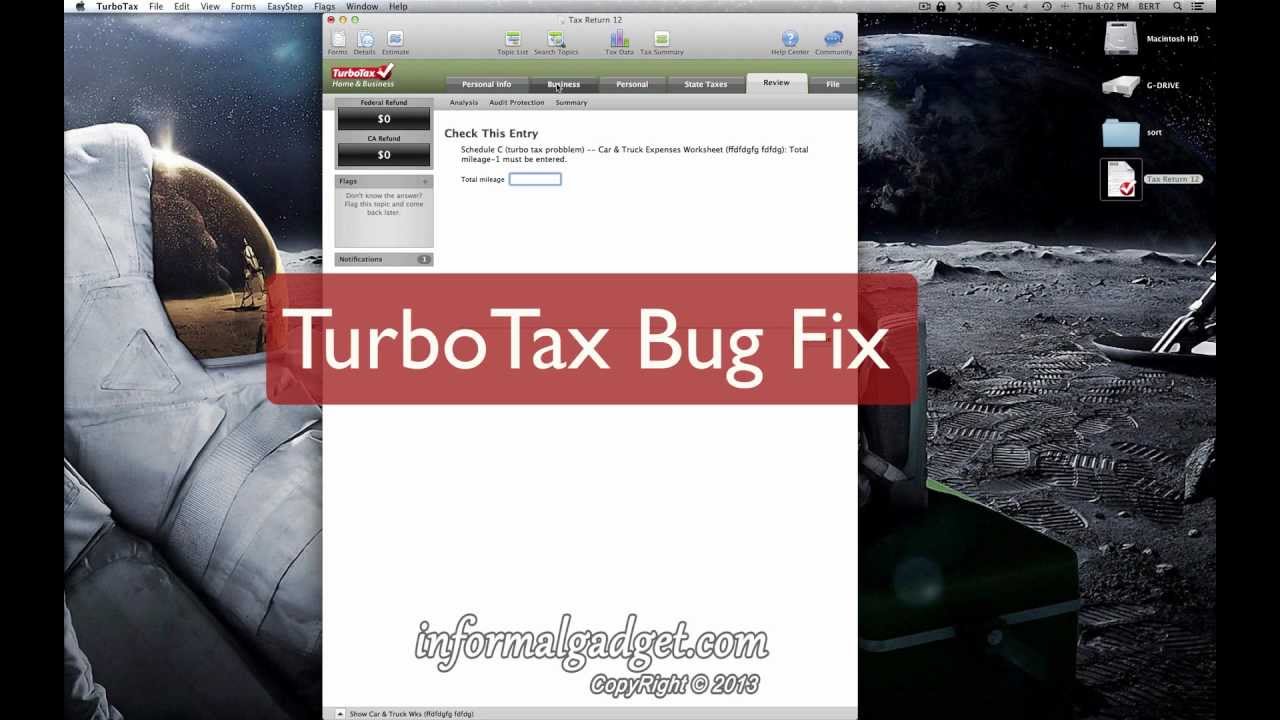

Car and Truck Expense Worksheet - Intuit Car and Truck Expense Worksheet cginetto Level 2 03-07-2021 09:38 AM Jump to solution The worksheet will not permit an entry for personal miles. Instead, it adds up business and commuting and then come up with a negative figure where other personal miles is supposed to be. What's wrong with the software now? Solved! Go to Solution. Labels

PDF NEW CLIENT Car And Truck Expenses ORG18 (Employees use ORG17 ORG19 ACTUAL EXPENSES Vehicle 1 Vehicle 2 Vehicle 3 8Gasoline, oil, repairs, insurance, etc ........................................ 9Vehicle registration fee (excluding property tax) .......................... 10Vehicle lease or rental fee.....................................................

PDF Car and Truck Expenses Worksheet 201 G - Centro Latino de Capacitacion Car and Truck Expenses Worksheet 201__ G Keep for your records Activity: Part I ' Vehicle Information 1 Make and model of vehicle Example: Ford Taurus 2 Date placed in service Example: 06/15/2016 3 Type of vehicle 4aEnding mileage reading Enter mileage readings, or b Beginning mileage reading enter total miles on line 4c c Total miles vehicle was driven during the year Line 4a less line 4b

PDF (Schedule C) Self-Employed Business Expenses Worksheet for Single Expenses: (NOTE: Expenses must be ordinary and necessary for your business to be deductible.) Advertising $_____ Car and Truck expenses: From worksheet on next page $_____ Commissions & fees paid to others $_____ Contract labor $_____ Did you pay $600 or more in total during the year to any individual? ...

PDF 2021 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET - pdvcpa.com Title: 2021 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET.xlsx Author: mvoytovich Created Date: 2/8/2022 2:19:28 PM

Car & Truck Expenses Worksheet: Cost must be entered "schedule C -- Car & Truck Expenses Worksheet: Cost must be entered." Hi everyone, I almost complete my tax return but at the end the program asked me to entered my vehicle cost. There are an empty box next to the question and I need to enter a number before I can file my tax return electronically.

What is Xbas under car and truck expense worksheet? - Intuit You may want to delete the Vehicle entry completely and start over on reporting the Vehicle Expense. Actual expenses include depreciation, gas and maintenance. Alternatively, standard mileage includes depreciation in the rate per mile that is deductible. It must be used the first year if you want to be able to choose between Actual or Standard.

PDF 2020 Tax Year Car and Truck Expense Worksheet - pdvcpa.com Title: 2020 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET.xlsx Author: jodi Created Date: 1/29/2021 8:33:36 AM

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fc922f6c345b025c4868_1099-excel-template.png)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/623904ff7e759b4bc31836a2_all-business-expenses-tab.png)

0 Response to "41 car and truck expenses worksheet"

Post a Comment