41 2012 child tax credit worksheet

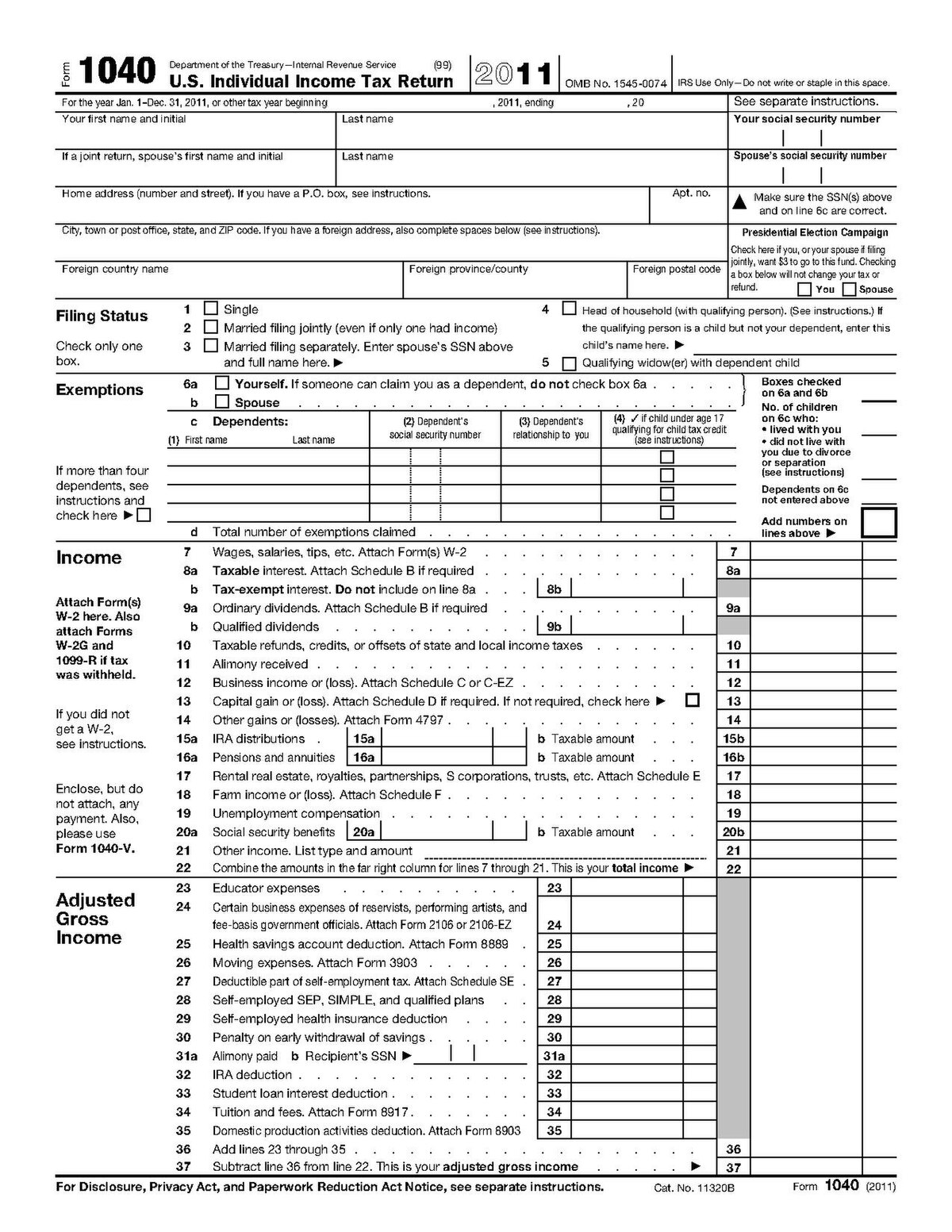

2012 Income Tax Forms | Nebraska Department of Revenue Form 4797N, 2012 Special Capital Gains Election and Computation. Form. Form CDN, 2012 Nebraska Community Development Assistance Act Credit Computation. Form. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms. Form 1040XN, 2012 Amended Nebraska Individual Income Tax Return. Prior Year Products - IRS tax forms Prior Year Products. Enter a term in the Find Box. Select a category (column heading) in the drop down. Click Find. Click on the product number in each row to view/download. Click on column heading to sort the list. You may be able to enter information on forms before saving or printing.

Frequently Asked Questions on Gift Taxes | Internal Revenue ... The annual exclusion applies to gifts to each donee. In other words, if you give each of your children $11,000 in 2002-2005, $12,000 in 2006-2008, $13,000 in 2009-2012 and $14,000 on or after January 1, 2013, the annual exclusion applies to each gift.

2012 child tax credit worksheet

Publication 526 (2021), Charitable Contributions | Internal ... In return for your payment you receive or expect to receive a state tax credit of 70% of your $1,000 contribution. The amount of your charitable contribution to charity X is reduced by $700 (70% of $1,000). The result is your charitable contribution deduction to charity X can’t exceed $300 ($1,000 donation - $700 state tax credit). MoneyWatch: Financial news, world finance and market news ... Get the latest financial news, headlines and analysis from CBS MoneyWatch. Publication 972 (2020), Child Tax Credit and Credit for Other ... It is in addition to the credit for child and dependent care expenses (on Schedule 3 (Form 1040), line 2, and the earned income credit (on Form 1040 or 1040-SR, line 27)). The maximum amount you can claim for the credit is $2,000 for each child who qualifies you for the CTC. But, see Limits on the CTC and ODC , later.

2012 child tax credit worksheet. PDF Credit Page 1 of 11 8:27 - 14-Jan-2013 Child Tax - IRS tax forms household in 2012, that child meets condition (7) above to be a qualifying child for the child tax credit. Exceptions to time lived with you. A child is consid- ered to have lived with you for more than half of 2012 if the child was born or died in 2012 and your home was this child's home for more than half the time he or she was alive. Tax Year 2021/Filing Season 2022 Child Tax Credit Frequently Asked ... A2. For tax year 2021, the Child Tax Credit is increased from $2,000 per qualifying child to: $3,600 for each qualifying child who has not reached age 6 by the end of 2021, or The Child Tax Credit: What's Changing in 2022 - Northwestern Mutual For children under 6, the amount jumped to $3,600. For 2022, that amount reverted to $2,000 per child dependent 16 and younger. Last year the tax credit was also fully refundable, meaning that if the credit amount a taxpayer qualified for exceeded the amount of taxes they owed, they could get the difference back. 2021 Child Tax Credit Calculator | Kiplinger First, the credit amount was temporarily increased from $2,000 per child to $3,000 per child ($3,600 for children 5 years old and younger). Second, it authorized advance payments to eligible ...

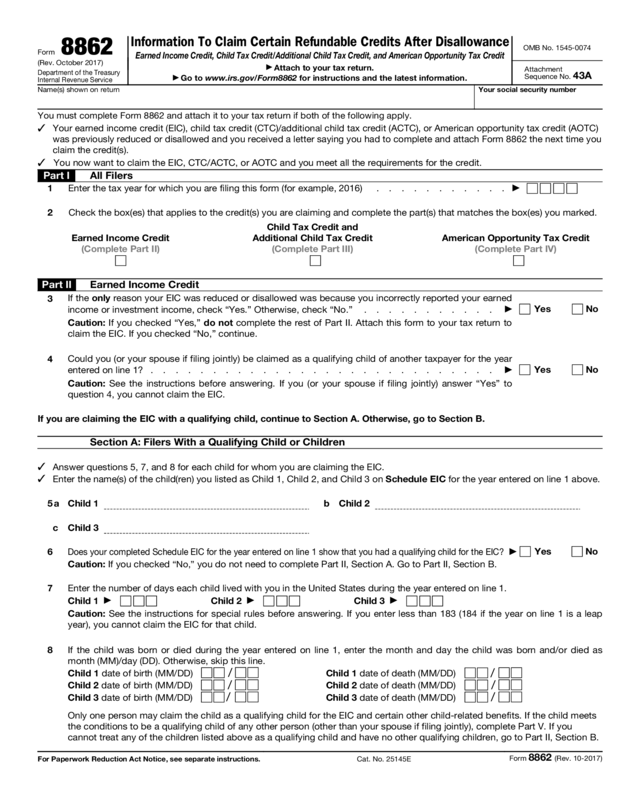

PDF Introduction Objectives Topics - IRS tax forms Form 1040 Instructions, Child Tax Credit Worksheet Schedule 8812, Credits for Qualifying Children and Other Dependents Pub 17, Chapter 14, Child Tax Credit . TaxSlayer Demo: Entering Basic Credits, Verify the amount of the credit in TaxSlayer by viewing the return summary Determining Eligibility and PDF Quality Child-care Investment Tax Credit Worksheet for Tax Year 2012 36 ... 2012 QUALITY CHILD-CARE INVESTMENT TAX CREDIT WORKSHEET INSTRUCTIONS Rev. 11/12 A taxpayer that has made an investment during the tax year toward the goal of providing quality child-care services is allowed a credit in an amount equal to the qualifying portion of expenditures paid or expenses incurred by the taxpayer for PDF Worksheet—Line 12a Keep for Your Records Draft as of - IRS tax forms This is your child tax credit and credit for other dependents. Enter this amount on Form 1040, line 12a. You may be able to take the additional child tax credit on Form 1040, line 17b, if you answered Yes on line 11 or line 12 above. First, complete your Form 1040 through line 17a (also complete Schedule 5, line 72). Then, use Schedule 8812 to gure any additional child tax credit. 11 12 Publication 721 (2021), Tax Guide to U.S. Civil Service ... The child must complete line 3 of Worksheet A using a number in Table 1 at the bottom of the worksheet corresponding to the child's age at the annuity starting date. If more than one child is entitled to a temporary annuity, an allocation like the one shown under Surviving spouse with child , earlier, must be made to determine each child's ...

Child Tax Credit Amount 2012: Child Tax Credit Worksheet - Blogger Child Tax Credit Amount 2012: Child Tax Credit Worksheet Child Tax Credit Amount 2012 If you have children who are under 17 as of the end of the tax year, you can get $1,000 from the child tax credit on your tax return. Your child must be 17 before December 31 of the year in which you claim them. Child Tax Credit Worksheet Additional Child Tax Credit Amount for 2012, 2013 - YouTube Additional Child Tax Credit Amount for 2012, 2013http:// Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Home - Montana Department of Revenue The Free File Alliance allows commercial income tax software providers to offer free tax filing services to qualified taxpayers. Approved Software Providers Commercial software available from software providers. TransAction Portal (TAP) Businesses, Alcoholic Beverage Licensees, and Livestock Owners can file and renew most account types through TAP.

Child Tax Credit Deduction Calculator 2012, 2013 - YouTube 2012, 2013 Child Tax Credit Deductionhttp://

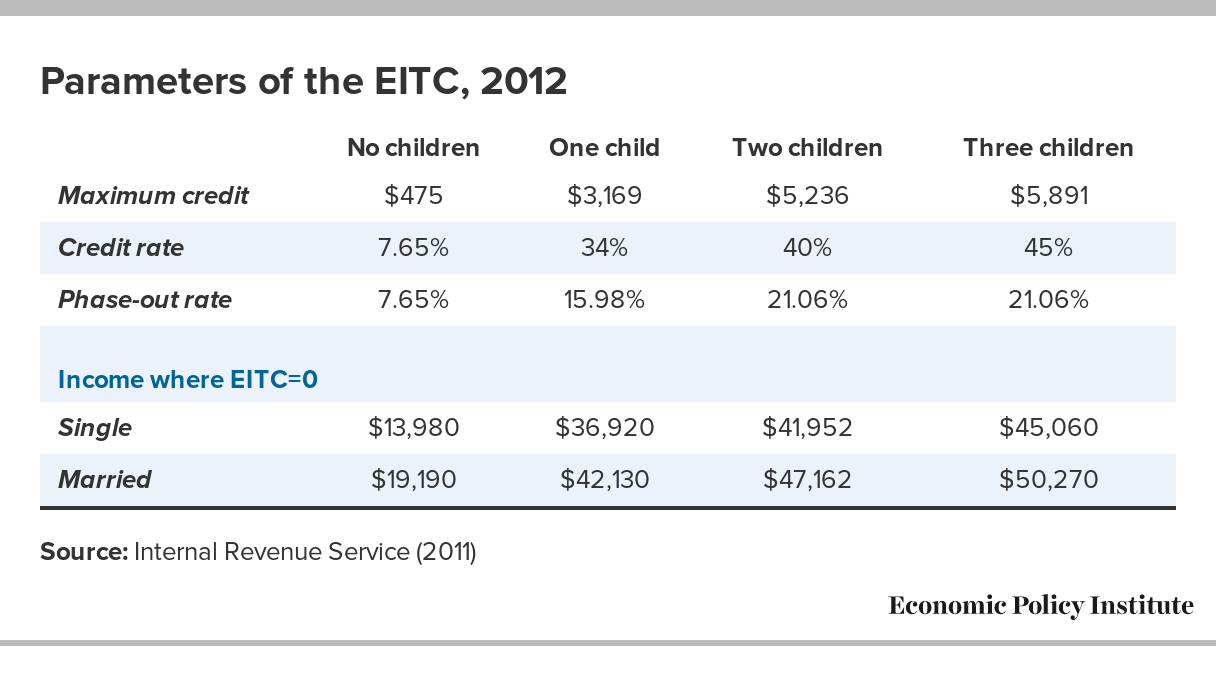

2022 to 2023 Child Tax Credit (CTC) Qualification and Income Thresholds For 2012 the child tax credit started phasing out (reducing) for those above a specified modified adjusted gross income ( MAGI ). For married taxpayers filing a joint return, the phase-out begins at $110,000. For married taxpayers filing a separate return, it begins at $55,000. For all other taxpayers, the phase-out begins at $75,000 .

Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

The 2021 Child Tax Credit | Information About Payments & Eligibility Thanks to the American Rescue Plan, the vast majority of families will receive $3,000 per child ages 6-17 years old and $3,600 per child under 6 as a result of the increased 2021 Child Tax Credit. The Child Tax Credit helps all families succeed. The Child Tax Credit provides money to support American families — helping them make ends meet ...

2021 Schedule 8812 Form and Instructions (Form 1040) - Income Tax Pro Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents, asks that you first complete the Child Tax Credit and Credit for Other Dependents Worksheet. See the instructions for Form 1040, line 19, or Form 1040NR, line 19. The 2021 Schedule 8812 Instructions are published as a separate booklet which you can find below.

What Is The 2013 Child Tax Credit & Additonal Child Tax Credit? The child tax credit is a federal tax credit up to $1000 per child, for individuals with a qualifying child (or children), under age 17. To receive the child tax credit, you must meet six requirements, provided by the IRS. The requirements to claim the 2013 child tax credit are as follows; The credit may only be for a qualifying child.

Child Tax Credit Amount 2012 In 2012, the Child Tax Credit can be worth a maximum of $1,000 for each qualifying child below 17 years old. Depending on your income level, the Child Tax Credit may be used to lower your federal income tax by a specific amount. To qualify for Child Tax Credit, the child must meet the qualifying requirements as outlined by six tests: Age Test

PDF 2012 Instructions for Form 8863 - IRS tax forms credit equals 100% of the first $2,000 and 25% of the next $2,000 of adjusted qualified expenses paid for each eligible student. The amount of your credit for 2012 is gradually reduced (phased out) if your MAGI is between $80,000 and $90,000 ($160,000 and $180,000 if you file a joint return). You cannot

Form 1040 Child Tax Credit for 2012, 2013 - YouTube Form 1040 Child Tax Credit for 2012, 2013http://

PDF Instructions for Preparing your 2012 Nonresident and Part ... - Louisiana 13 Enter the amount of your 2012 Child Care Credit (Line 2 or Line 2A, above). 13.00 14 Subtract Line 13 from Line 12. 14.00 15 If Line 14 is greater than or equal to zero, your entire Child Care Credit for 2012 (Line 2 or 2A, above) has been utilized. Enter the amount from Line 13 above on Form IT-540B, Line 13B. Stop here; you are finished with the

2016 Child Tax Credit2016 Child Tax Credit - IRS Tax Break The Child Tax Credit is an important tax credit that may be worth as much as $1,000 per qualifying child depending upon your income. Here are 10 important facts from the IRS about this credit and how it may benefit your family. Amount - With the Child Tax Credit, you may be able to reduce your federal income tax by up to $1,000 for each ...

2012 Federal 1040 Tax Forms to download, print, and mail - e-File Filing a 2012 Return Now. In order to file a 2012 IRS Tax Return, download, complete, print, and sign the 2012 IRS Tax Forms below and mail them to the address listed on the IRS and State Forms. Select your state (s) and download, complete, print, and sign your 2012 State Tax Return income forms. You can no longer claim a Tax Refund for Tax ...

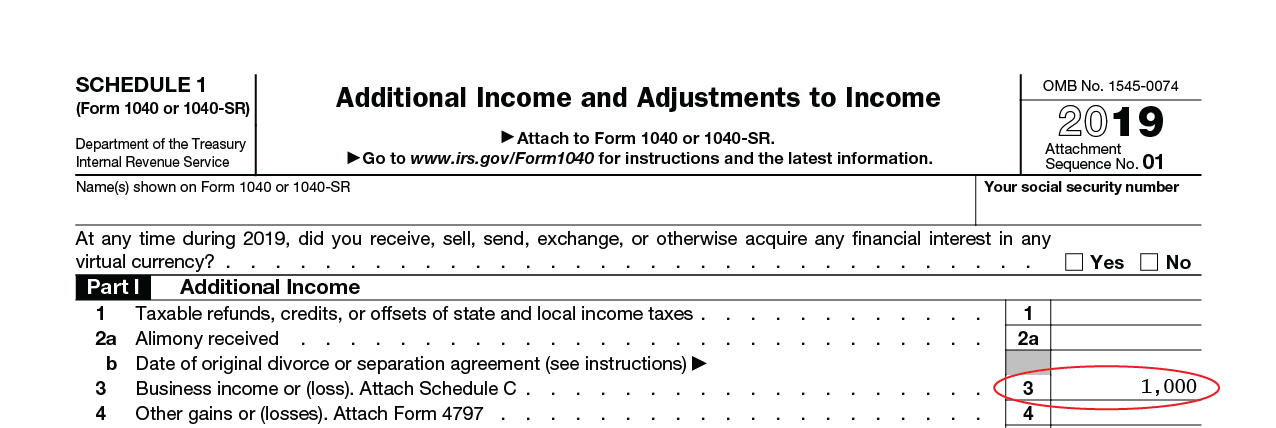

PDF Child Tax Credit 2012 or 1040) Attach to Form 1040, Form 1040A, or Form ... 2012. 47. Name(s) shown on return . Your social security number . ... If you used Pub. 972, enter the amount from line 8 of the Child Tax Credit Worksheet in the publication.} 1. 2 . Enter the amount from Form 1040, line 51; Form 1040A, line 33; or Form 1040NR, line 48 . . . . . 2 3 .

credit limit worksheet 2021 - kkaa.pifotografie.shop Child tax credit worksheet is a document used to provide a helpful lift to the income of parents or guardians who have dependents or children. ... also prepare the following documents for a smoother transaction in case you are eligible for immunity to the Two Child Limit; Your Child's Adoption Certificate ... 2021. 20+ Free Process Map.

PDF Credit Page 1 of 12 8:57 - 17-Dec-2013 Child Tax 1. To figure the child tax credit you claim on Form 1040, line 51; Form 1040A, line 33; or Form 1040NR, line 48; and 2. To figure the amount of earned income you enter on line 4a of Schedule 8812 (Form 1040A or 1040), Child Tax Credit. This publication is intended primarily for individuals sent here by the instructions to Forms 1040, 1040A, or

Adoption Tax Credit 2022 - The North American Council on Adoptable Children The amount is now $2,000 per child, but only $1,400 of it can become the refundable additional child tax credit (dependent on the family's earned income), with the remaining $600 a non-refundable Child Tax Credit. This credit will supersede the adoption tax credit when reducing the tax liability.

PDF 2012 Instruction 1040 Schedule - IRS tax forms 2012 Instructions for Schedule 8812Child Tax Credit Use Part I of Schedule 8812 to document that any child for whom you entered an ITIN on Form 1040, line 6c; Form 1040A, line 6c; or Form 1040NR, line 7c; and for whom you also checked the box in column 4 of that line, is a resident of the United States because the child meets the

PDF 2012 Louisiana Nonrefundable Child Care Credit Worksheet (For use with ... 2012 Louisiana Refundable Child Care Credit Worksheet (For use with Form IT-540) 3 Add the amounts in column G, Line 2. Do not enter more than $3,000 for one qualifying person or $6,000 for two or more persons. Enter this amount here and on Form IT-540, Line 19A. 3 .00 4Enter your earned income. See the definitions on page 31.4.00 5

Publication 972 (2020), Child Tax Credit and Credit for Other ... It is in addition to the credit for child and dependent care expenses (on Schedule 3 (Form 1040), line 2, and the earned income credit (on Form 1040 or 1040-SR, line 27)). The maximum amount you can claim for the credit is $2,000 for each child who qualifies you for the CTC. But, see Limits on the CTC and ODC , later.

MoneyWatch: Financial news, world finance and market news ... Get the latest financial news, headlines and analysis from CBS MoneyWatch.

Publication 526 (2021), Charitable Contributions | Internal ... In return for your payment you receive or expect to receive a state tax credit of 70% of your $1,000 contribution. The amount of your charitable contribution to charity X is reduced by $700 (70% of $1,000). The result is your charitable contribution deduction to charity X can’t exceed $300 ($1,000 donation - $700 state tax credit).

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at1.37.43PM-974cede3b55f40428918bba4eb8d695b.png)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-12.jpg)

0 Response to "41 2012 child tax credit worksheet"

Post a Comment