40 sale of rental property worksheet

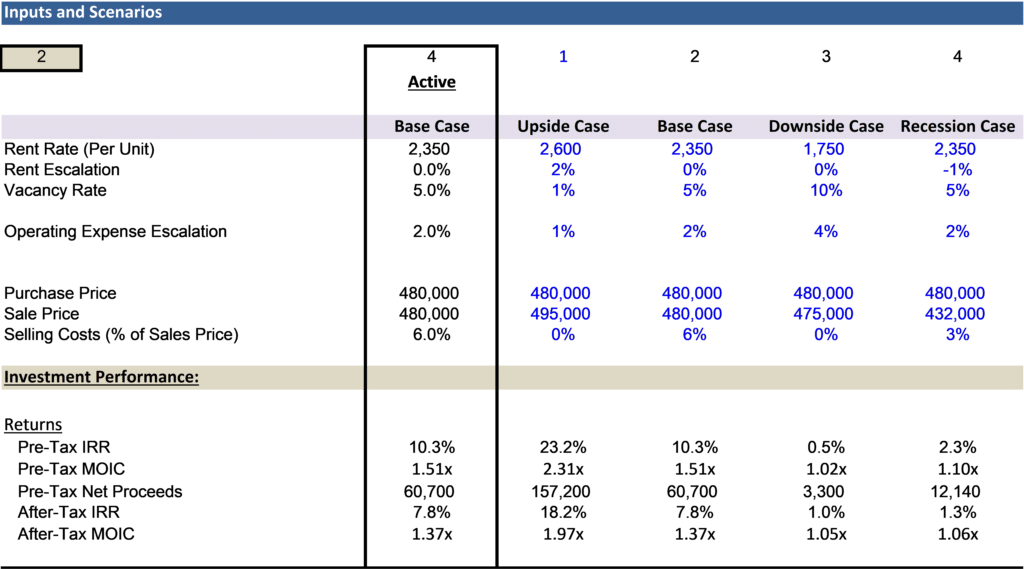

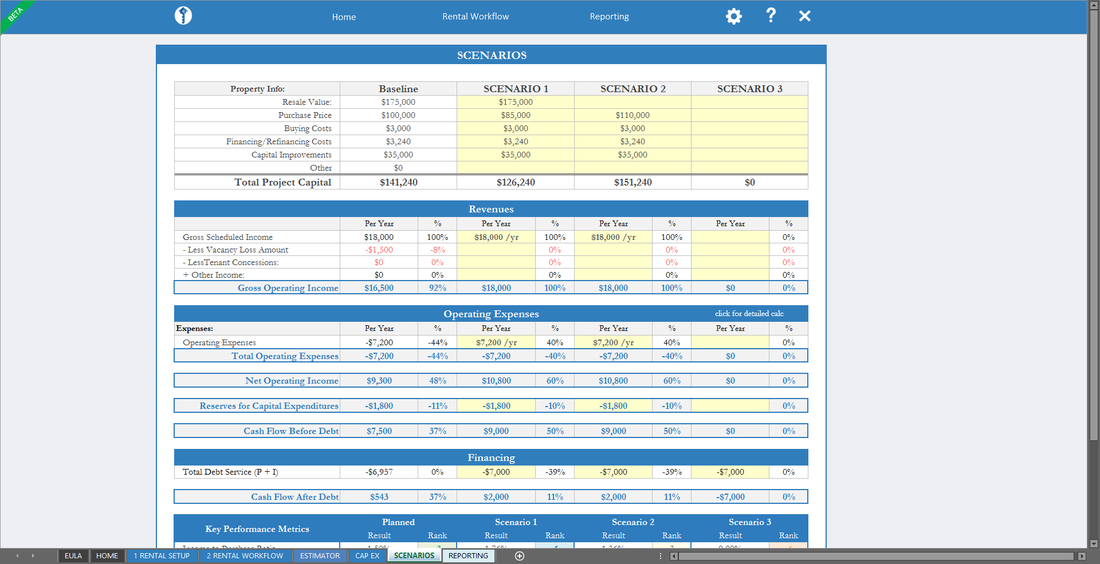

› sale-of-your-home-3193496Home Sale Exclusion From Capital Gains Tax - The Balance Mar 10, 2022 · How Does the Home Sale Exclusion Work? Your capital gain—or loss—is the difference between the sales price and your basis in the property, which is what you paid for it plus certain qualifying costs. You would have a gain of $200,000 if you purchased your home for $150,000 and you were to sell it for $350,000. › ExcelTemplates › rental-cash-flowCash Flow Analysis Worksheet for Rental Property - Vertex42.com Aug 18, 2021 · This spreadsheet is for people who are thinking about purchasing rental property for the purpose of cash flow and leverage. It is a fairly basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization rate, cash flow, and cash on cash return.

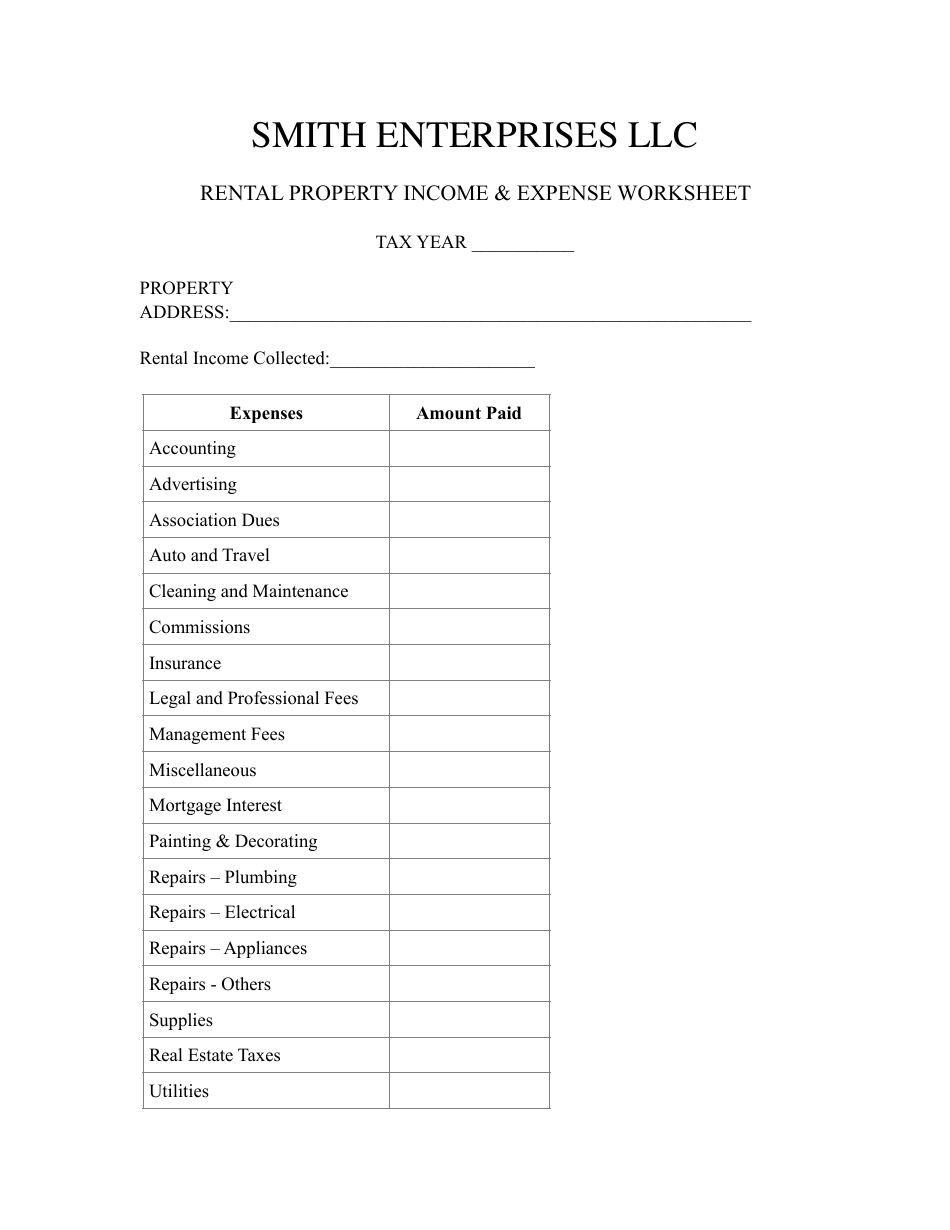

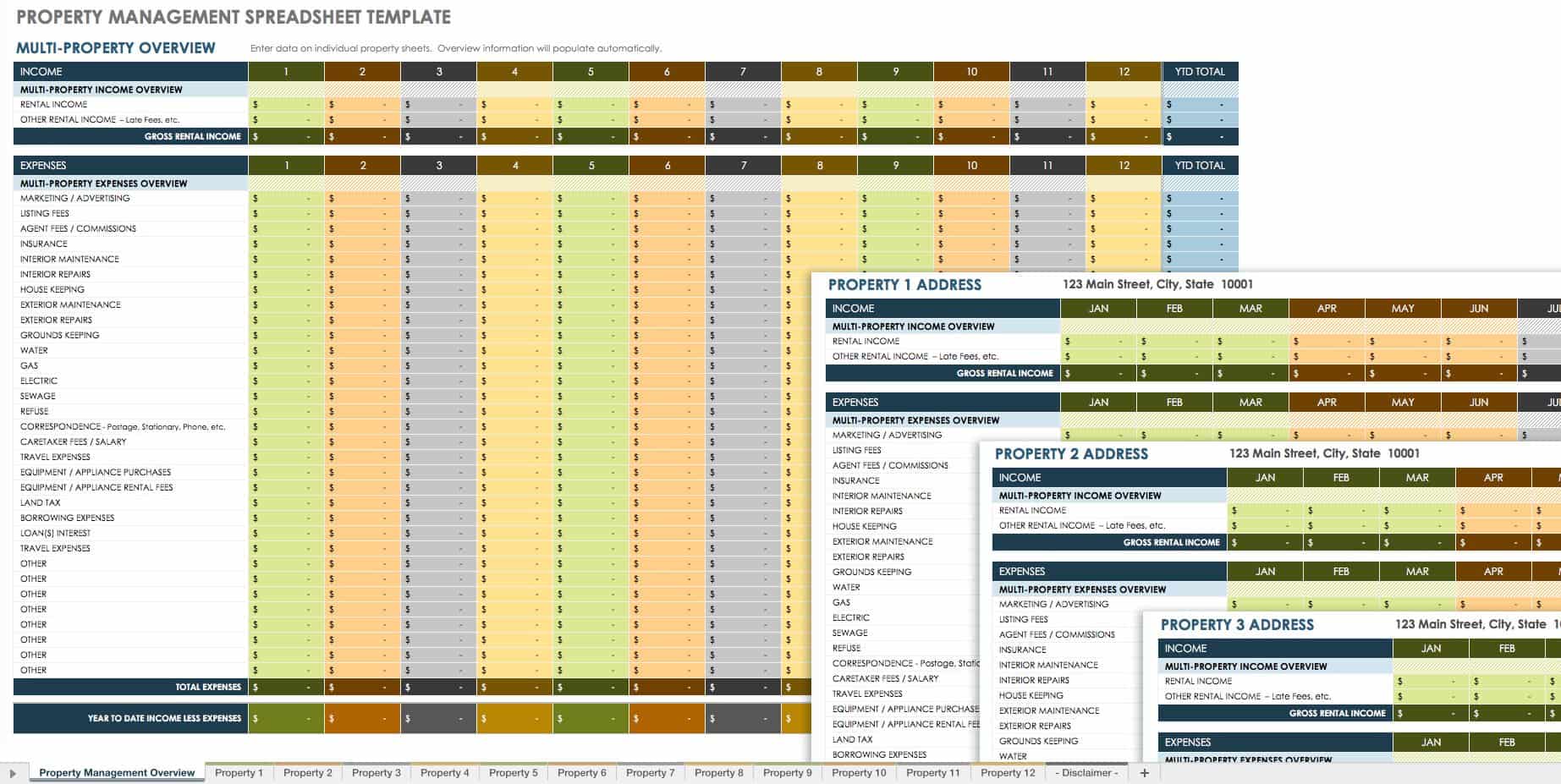

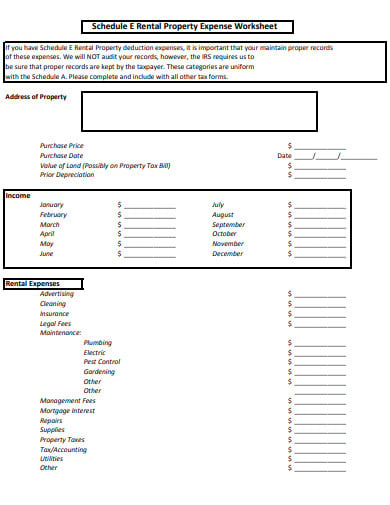

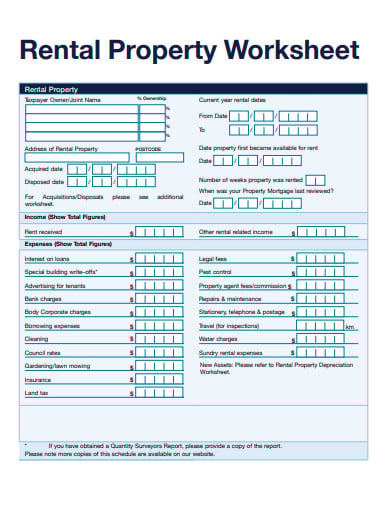

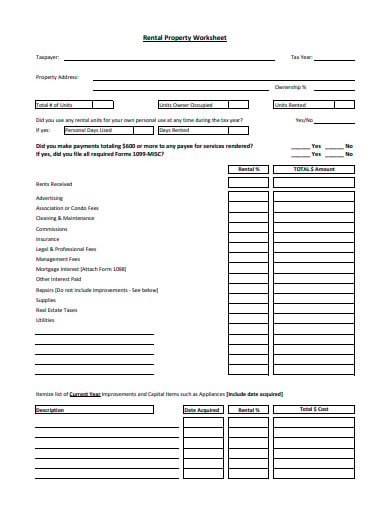

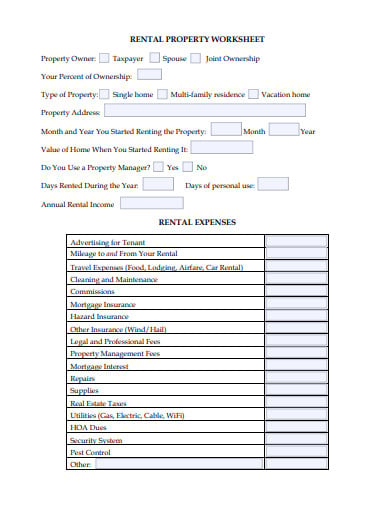

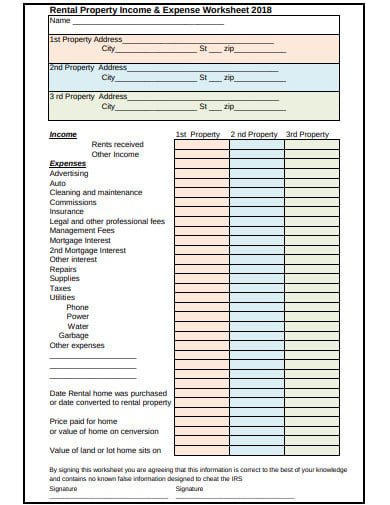

› rental-manager › resourcesRental Income and Expense Worksheet - Rentals Resource Center Jan 01, 2021 · To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or HOA dues, gardening service and utilities in the “monthly expense” category.

Sale of rental property worksheet

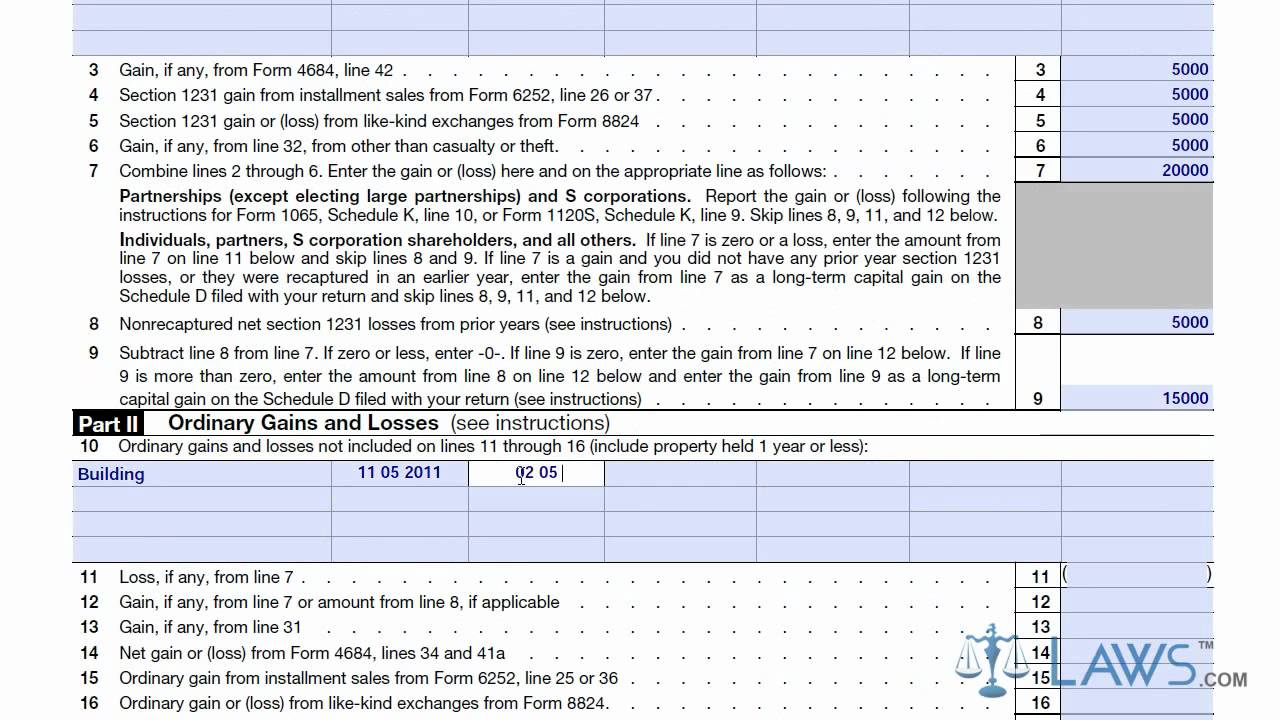

› publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... For more information about using any part of your home for business or as a rental property, see Pub. 587, Business Use of Your Home, and Pub. 527, Residential Rental Property. Gain from the sale or exchange of your main home isn’t excludable from income if it is allocable to periods of non-qualified use. › publications › p946Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,700,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022 is $27,000. › publications › p525Publication 525 (2021), Taxable and Nontaxable Income Sale of the stock. There are no special income rules for the sale of stock acquired through the exercise of a nonstatutory stock option. Report the sale as explained in the Instructions for Schedule D (Form 1040) for the year of the sale. You may receive a Form 1099-B reporting the sales proceeds.

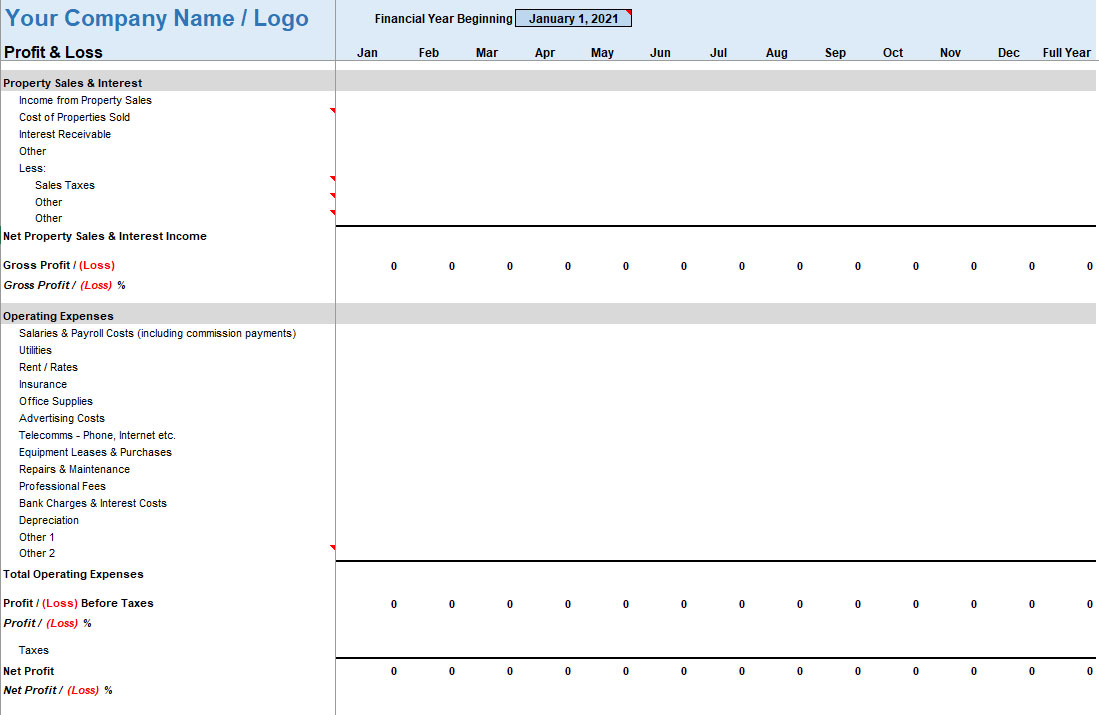

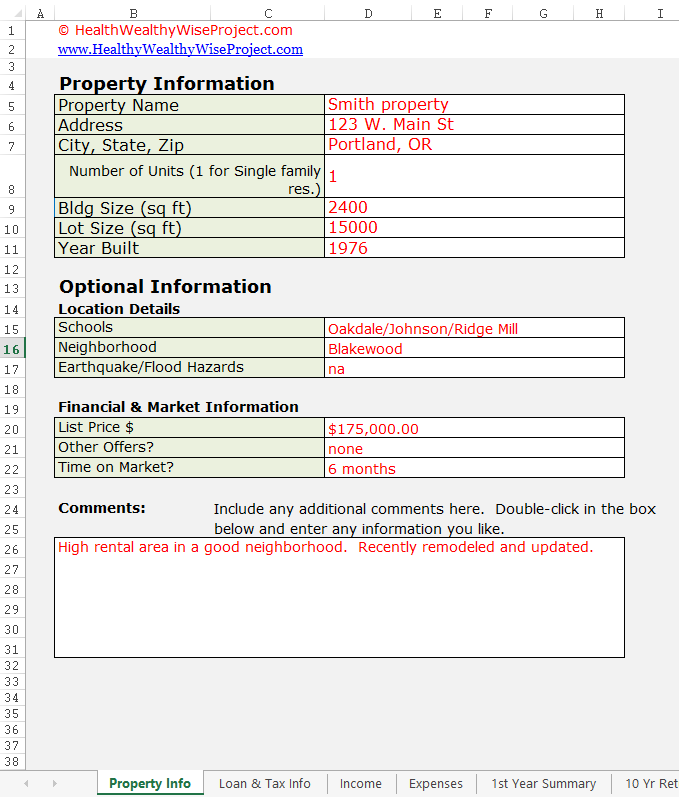

Sale of rental property worksheet. › blog › operating-expenses-rentalWhich expenses are operating expenses for rental property? Where to find a free template for rental property operating expenses. Downloading a rental property expense worksheet template from Zillow is one option for keeping track of operating expenses. The Microsoft Excel worksheet is easy to use, and may be a good match for owners with 1-5 properties. Publication 527 (2020), Residential Rental Property Sale or exchange of rental property. For information on how to figure and report any gain or loss from the sale, exchange, or other disposition of your rental property, ... in column (b) of Form 8582, Worksheet 1 or 3, as required. Exception for Personal Use of Dwelling Unit. › publications › p525Publication 525 (2021), Taxable and Nontaxable Income Sale of the stock. There are no special income rules for the sale of stock acquired through the exercise of a nonstatutory stock option. Report the sale as explained in the Instructions for Schedule D (Form 1040) for the year of the sale. You may receive a Form 1099-B reporting the sales proceeds. › publications › p946Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,700,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022 is $27,000.

› publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... For more information about using any part of your home for business or as a rental property, see Pub. 587, Business Use of Your Home, and Pub. 527, Residential Rental Property. Gain from the sale or exchange of your main home isn’t excludable from income if it is allocable to periods of non-qualified use.

![2022 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

0 Response to "40 sale of rental property worksheet"

Post a Comment