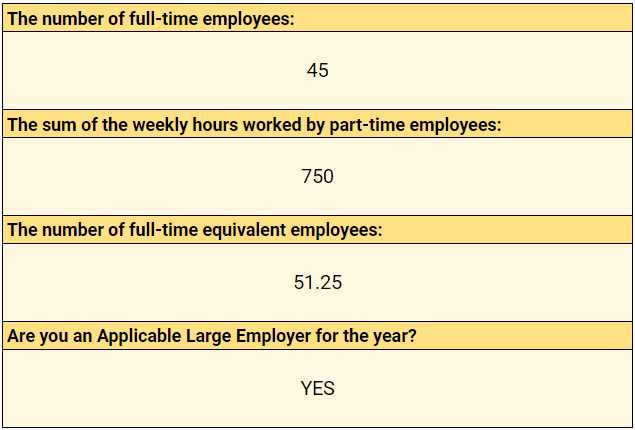

40 applicable large employer worksheet

Publication 590-A (2021), Contributions to Individual ... This is because she isn’t covered by her employer's retirement plan, and their combined modified AGI isn’t between $198,000 and $208,000. Therefore, she isn’t subject to the deduction phaseout discussed earlier under Limit if Covered by Employer Plan, and she doesn’t need to use Worksheet 1-2. Betty decides to treat her $6,000 IRA ... Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Applicable large employer worksheet

PAPPG Chapter II - NSF Jun 01, 2020 · NSF 20-1 June 1, 2020 Chapter II - Proposal Preparation Instructions. Each proposing organization that is new to NSF or has not had an active NSF assistance award within the previous five years should be prepared to submit basic organization and management information and certifications, when requested, to the applicable award-making division within the Office of Budget, Finance & Award ... Determining if an Employer is an Applicable Large Employer Sep 29, 2022 · This is solely for the purpose of determining whether an employer is an “applicable large employer” subject to the employer shared responsibility rules of § 4980H. For more information, see IRC § 4980H(c)(2) subparagraph (F) “Exemption for Health Coverage Under Tricare or the Veterans Administration.” Public Assistance Program's Simplified Procedures Large ... Aug 03, 2022 · FEMA requires that recipients of large projects fill out these supplemental forms to account for the actual costs for reconciliation purposes. These forms are not required for small projects. The decrease in the number of large projects as a result of the increase in the large project threshold means fewer applicants submitting these forms.

Applicable large employer worksheet. Publication 969 (2021), Health Savings Accounts and Other Tax ... Your employer’s contributions should be shown on Form W-2, box 12, code R. Follow the Instructions for Form 8853 and complete the Line 3 Limitation Chart and Worksheet in the instructions. Report your Archer MSA deduction on Form 1040, 1040-SR, or 1040-NR. Public Assistance Program's Simplified Procedures Large ... Aug 03, 2022 · FEMA requires that recipients of large projects fill out these supplemental forms to account for the actual costs for reconciliation purposes. These forms are not required for small projects. The decrease in the number of large projects as a result of the increase in the large project threshold means fewer applicants submitting these forms. Determining if an Employer is an Applicable Large Employer Sep 29, 2022 · This is solely for the purpose of determining whether an employer is an “applicable large employer” subject to the employer shared responsibility rules of § 4980H. For more information, see IRC § 4980H(c)(2) subparagraph (F) “Exemption for Health Coverage Under Tricare or the Veterans Administration.” PAPPG Chapter II - NSF Jun 01, 2020 · NSF 20-1 June 1, 2020 Chapter II - Proposal Preparation Instructions. Each proposing organization that is new to NSF or has not had an active NSF assistance award within the previous five years should be prepared to submit basic organization and management information and certifications, when requested, to the applicable award-making division within the Office of Budget, Finance & Award ...

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.11.56PM-f1acacbff47b48a183ac6e2538e1f774.png)

.jpg?width=850&height=567)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "40 applicable large employer worksheet"

Post a Comment