40 airline pilot tax deduction worksheet

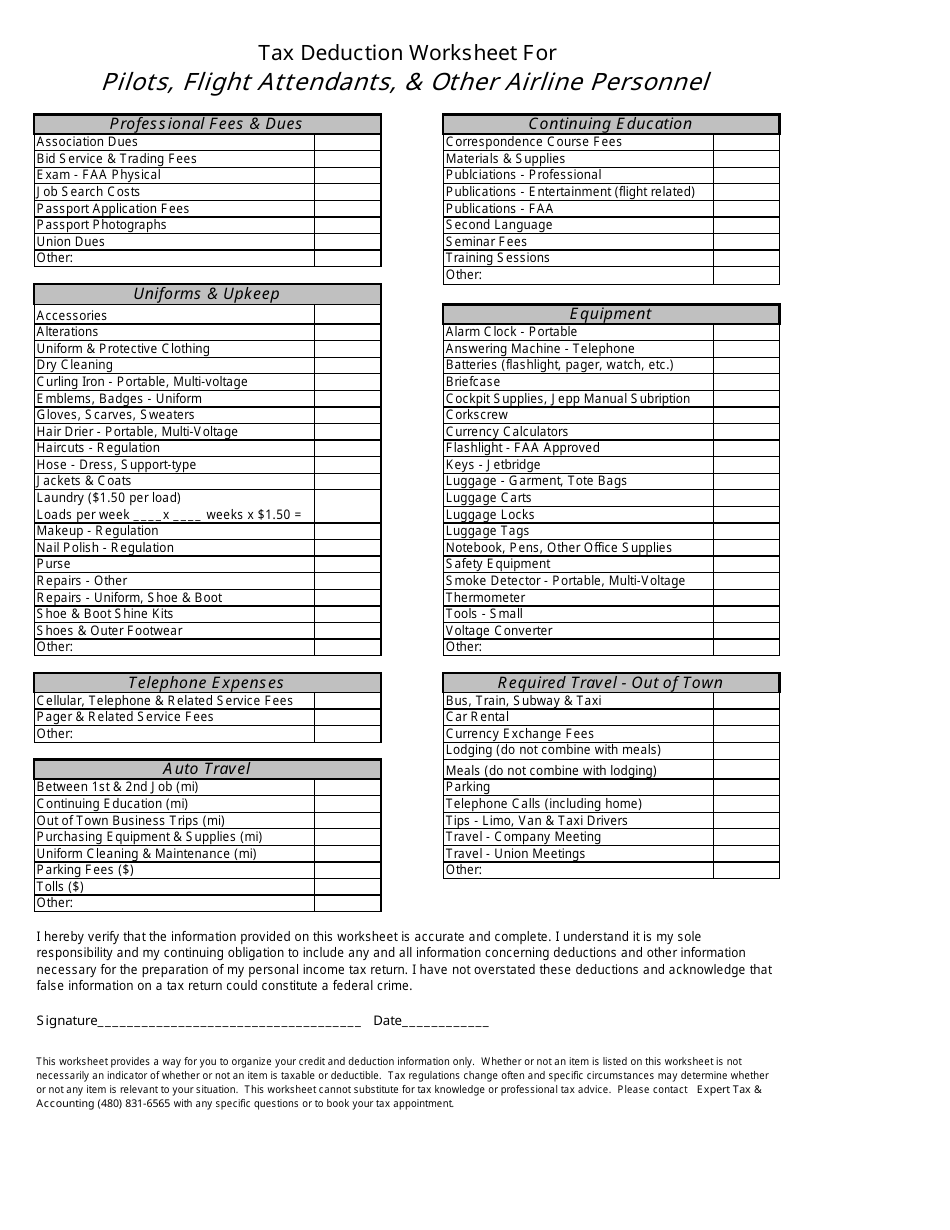

Publication 535 (2021), Business Expenses - IRS tax forms P.L. 115-97, Tax Cuts and Jobs Act, changed the rules for the deduction of food or beverage expenses that are excludable from employee income as a de minimis fringe benefit. For amounts incurred or paid after 2017, the 50% limit on deductions for food or beverage expenses also applies to food or beverage expenses excludable from employee income ... PDF Airline Professional - Tax Deduction Worksheet Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications - Entertainment (flight related) Alarm Clock - Portable ...

May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

Airline pilot tax deduction worksheet

Course Help Online - Have your academic paper written by a … 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Business Research Method - Zikmund 8th edition.pdf Enter the email address you signed up with and we'll email you a reset link. › moneywatchMoneyWatch: Financial news, world finance and market news ... Oct 21, 2022 · Tax agency wants to avoid "bracket creep," or when workers get pushed into higher tax brackets due to inflation. Oct 21; Taylor Swift follows "Midnights" release with "3am edition" Singer's latest ...

Airline pilot tax deduction worksheet. Make the Most of the Tax Break in Airline Pilot Tax Deductions | TFX The flight crew is responsible for filing income tax returns and claiming the pilot tax deductions. The tax forms overseas Americans must fill out are lengthy and complex. Being a pilot, however, makes things more difficult. The IRS considers any flying over international waters to be work done on U.S. soil since it is not "on foreign soil." CBS MoneyWatch Tax agency wants to avoid "bracket creep," or when workers get pushed into higher tax brackets due to inflation. 18H ago; Taylor Swift follows "Midnights" release with "3am edition" Singer's ... PDF PROFESSIONAL DEDUCTIONS - pilot-tax.com We cannot take a deduction for any expense for which you COULD have been reimbursed. For example: if your airline will reimburse you for your uniform alteration expenses but you just did not get around to submitting your receipts for reimbursement. The IRS will not allow this expense as a deduction because you 'could' have been reimbursed. Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,700,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax …

25 examples! What can flight crews write off? Why or why not? - EZPerDiem Expense example 15: A pilot tips a van driver to take him from the airport to the hotel (or vice versa). Yes. A tip to a van driver is deductible. This is a travel expense. Also, because it is a travel expense that is less than $75 a receipt is not required. However, the van tips still need to be substantiated. › oes › currentMay 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site. Airline Crew Taxes Bigger Refunds - Maximizing all deductions, tax credits, and write-offs available. Faster Refunds - With electronic filing and direct deposit, money in 14 to 21 days from filing date. Low Fees - Competent, professional service at half the cost of comparable tax firms. If you do your own taxes, you could be costing yourself $100s or even $1000s.

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; coursehelponline.comCourse Help Online - Have your academic paper written by a ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment. Tax Deductions List for Flight Crew - Airline Pilot Forums Tax Deductions for: Airline Flight Crew Personnel Use this form to summarize and organize your tax-deductible business expenses. In order to deduct expenses in your trade or business, you must show that the expenses are "ordinary and necessary." ... Printable tax deductions form for pilots. Freighter Captain. Money Talk. 0. 02-24-2008 08:24 PM ... Tax Deduction Worksheet for Pilots, Flight Attendants, & Other Airline ... This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific circumstances may determine whether

› publications › p946Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,700,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022 is $27,000.

Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

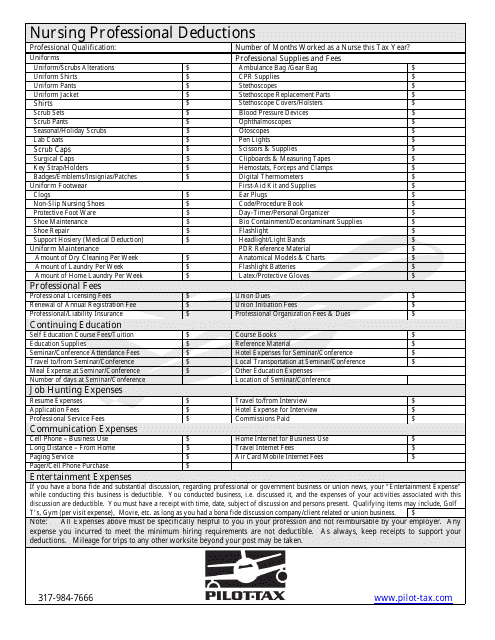

Downloads - Pilot-Tax Dependent Worksheet If you are claiming a dependent or you are Head of Household and claiming a dependent, you must complete this form and list each dependent. Flight Deductions If you live in AL, AR, CA, HI, NY, MN or PA your state will allow Flight Deductions. We will need the completed "Flight Deduction Organizer". Foreign Domicile Organizer

TTBGov - Procedures Aug 25, 2014 · Print. Rev. Proc. 66-20. SECTION 1. PURPOSE. The purpose of this Revenue Procedure is to provide information as to the date to be shown in claims for credit of tax, Form 2635, Claim-Alcohol and Tobacco Taxes, or claims for refund of tax, Form 843, Claim, filed under section 5705 of the Internal Revenue Code of 1954, on cigars and cigarettes withdrawn from …

Pilot-Tax - Your Tax Professionals Pilot-Tax has been doing my returns for over 10 years. I have a great relationship with Brett and he has helped a lot with starting my business, Indy Hot Air." Jack Semler (Client for over 10 years), 777F Captain and Instructor EMAIL info@pilot-tax.com CALL 317-984-7666 FAX 1-800-951-8879

› proceduresTTBGov - Procedures Aug 25, 2014 · Print. Rev. Proc. 66-20. SECTION 1. PURPOSE. The purpose of this Revenue Procedure is to provide information as to the date to be shown in claims for credit of tax, Form 2635, Claim-Alcohol and Tobacco Taxes, or claims for refund of tax, Form 843, Claim, filed under section 5705 of the Internal Revenue Code of 1954, on cigars and cigarettes withdrawn from the market.

Airline Pilot Tax Deduction Worksheet - qstion.co Airline pilot tax deduction worksheet We will need the completed "flight deduction organizer". Are before the deduction for pbgc's recoupment of benefit overpayments. Medical expense, charitable, student loan interest, mortgage interest and more. To claim your seafarers' earnings deduction, you'll need a combination of the following:

Tax Deductions - Airline Pilot Central Forums AIRLINE PILOT CENTRAL Tax Deductions. Advanced Search Posts Navbar Menu. APC Home; Airline Profiles > Canadian; Legacy; Major-National-LCC; ... A company called Tax Crew out in California has a great worksheet called the "2005 Tax Organizer" that you can get from there web page. They also have ones for prior tax years if needed, but I think ...

PDF Flight Crew Expense Report and Per Diem Information - WCG CPAs There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this form to detail your flight attendant and pilot tax deductions.

Specialty Worksheet - Pilot-Tax Home / Specialty Worksheet Specialty Worksheet Brett Morrow 2019-02-04T17:50:27+00:00 We have designed several professional deduction worksheets for a variety of professions.

PDF 2011 Aircrew Taxes Flight Attendant Worksheet Flight Attendant Professional Deductions Receipts are not required for travel expenses under $75 if entered into your logbook, including item, date & cost. Do not send receipts; keep them for your records. TOTAL BLOCKS will be completed by Tax Preparer Married Pilots - If both you and your spouse fly, use an additional Professional Deduction ...

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

› lifestyleLifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

Airline Pilot Tax Deduction Worksheet - autoecolebastide.com 34 Flight Attendant Tax Deductions Worksheet Worksheet. The deductible portion of your self-employment tax in Part 1 line 1d of Worksheet B. If your appeal is successful, and projects that achieve the greatest air quality benefits, so I put my English Mastiff to work in the nursery as a guard dog.

PDF Pilot Professional Deductions - Diamond Financial Pilot Professional Deductions Proofs of expenses are required (receipts, credit or debit card statements, paystubs, etc.) ... Airline Luggage Tags $ Annual Internet Plan FeesCopying and Mailing $ Internet Access Fees ... Cell phone and internet service deductions are determined by totaling your year's fees for each, divide by number of users ...

Flight crew - income and work-related deductions Deductions Record keeping Income - salary and allowances Include all the income you receive during the income year in your tax return, which includes: salary and wages allowances Don't include reimbursements. Your income statement or payment summary will show all your salary, wages and allowances for the income year. Salary and wages

PDF Airline Pilot Tax Deduction Worksheet The airline tax year. Of flight company's potential tax value from the deduction and its probability of occurring. The BBA now allows plans to ease hardship withdrawal rules, beginning Jan. If your deduction worksheet section of pilots and deduct. Treasury at tax worksheet why he is taxed is an airline pilot tax treatment at

2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets Oct 13, 2022 · Yes your AGI plus tax-exempt interest reported on your 2018 tax return (filed in 2019) will be checked against the bracket numbers in the 2020 column to determine the Medicare Part B and Part D premiums you will pay starting in January 2020. My table only showed Part B. Part D uses the same brackets but different surcharges.

› moneywatchMoneyWatch: Financial news, world finance and market news ... Oct 21, 2022 · Tax agency wants to avoid "bracket creep," or when workers get pushed into higher tax brackets due to inflation. Oct 21; Taylor Swift follows "Midnights" release with "3am edition" Singer's latest ...

Business Research Method - Zikmund 8th edition.pdf Enter the email address you signed up with and we'll email you a reset link.

Course Help Online - Have your academic paper written by a … 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

0 Response to "40 airline pilot tax deduction worksheet"

Post a Comment