39 rental income calculation worksheet

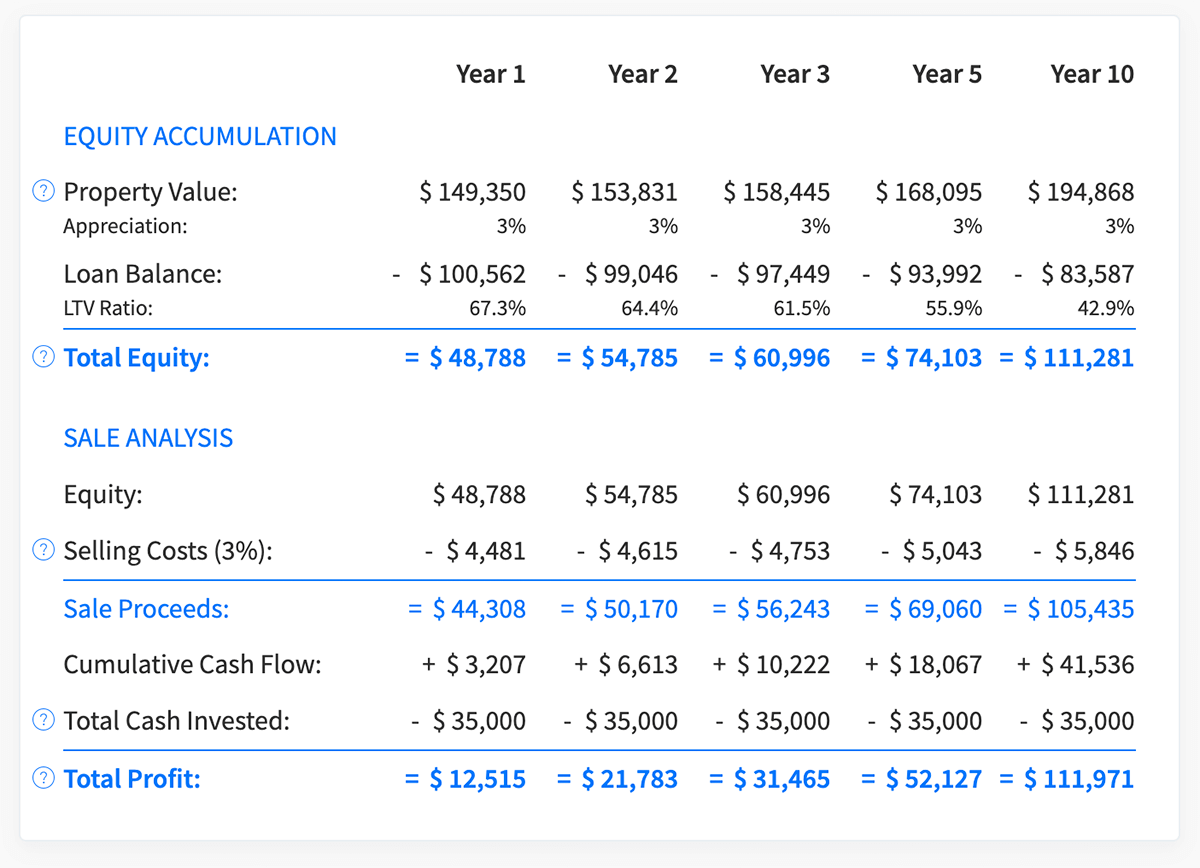

2022 Rental Property Analysis Spreadsheet [Free Template] - Stessa Next, set up your rental property analysis spreadsheet by following these four steps: 1. Estimate fair market value There are a number of methods for estimating the fair market value of a rental property. It's a good idea to use different techniques. That way you can compare the values and create a value range of low, middle, and maximum value. Publication 925 (2021), Passive Activity and At-Risk Rules The numerator of the fraction is the gross rental income from that class of property and the denominator is the activity's total gross rental income. The activity's average period of customer use will equal the sum of the amounts for each class. ... Include the income and losses in Worksheet 3 of Form 8582 (or Worksheet 2 in the Form 8810 ...

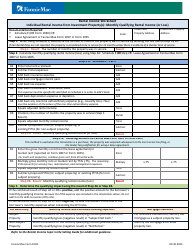

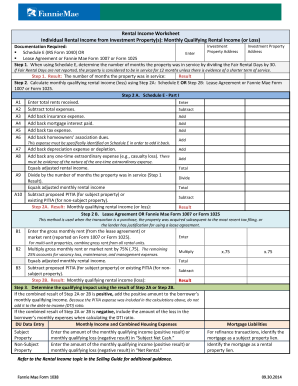

Form 1038: Rental Income Worksheet - Genworth Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form. 1007 or Form 1025.

Rental income calculation worksheet

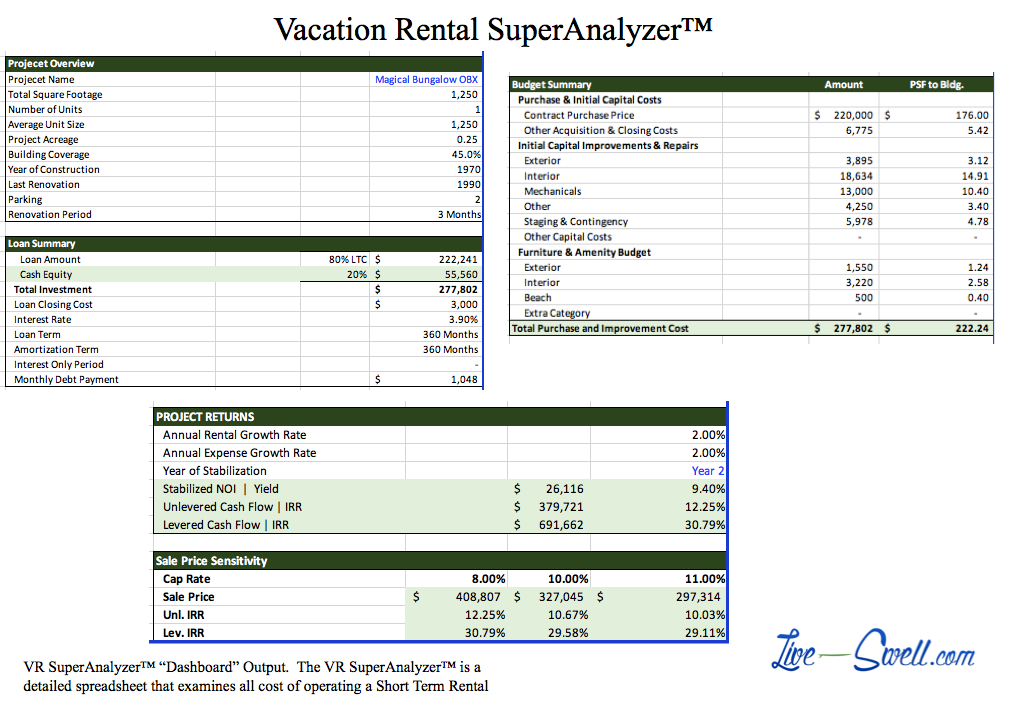

Rental Property Calculator 2022 - WOWA.ca Jul 4, 2022 — Calculate the returns of your rental property. Learn about factors like Cap Rate, ROI formula and other important information that are ... GTranslate - HUD.gov / U.S. Department of Housing and Urban … Maximum Insurable Loan Calculation (MILC) (.xlsx) HUD-92264-HCF: Health Care Facility Summary Appraisal Report: HUD-92264-T: Rent Estimates For Low/Moderate Income Units Non-Section 8 Projects Involving Tax-Exempt Financing Or Low Income Housing Tax Credits (CS) HUD-92265-W: Multifamily Housing Search Data Entry Worksheet: HUD-92266 Publication 936 (2021), Home Mortgage Interest Deduction Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

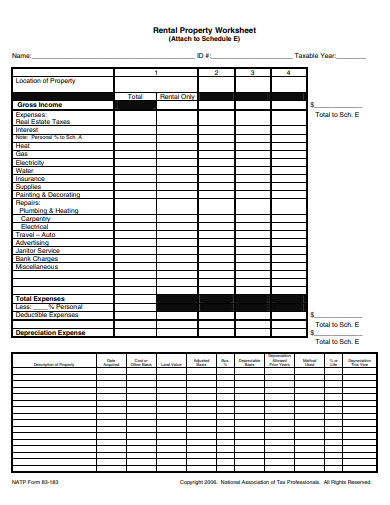

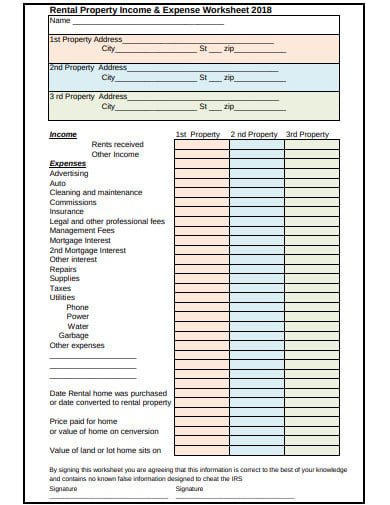

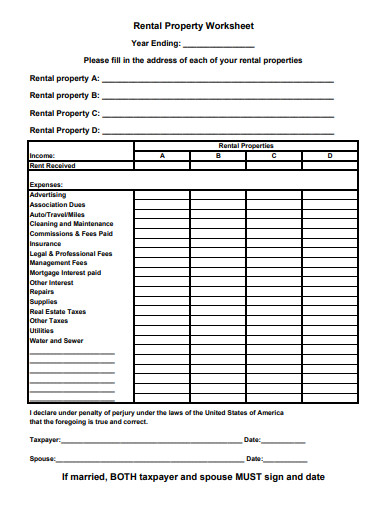

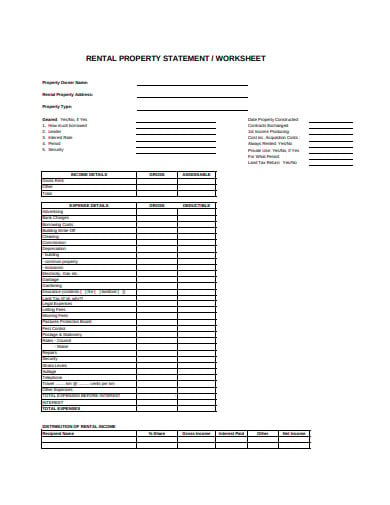

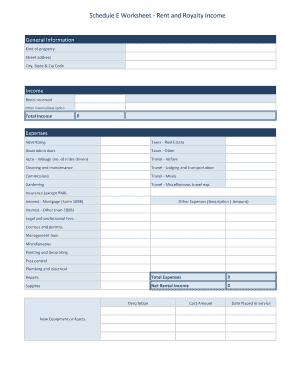

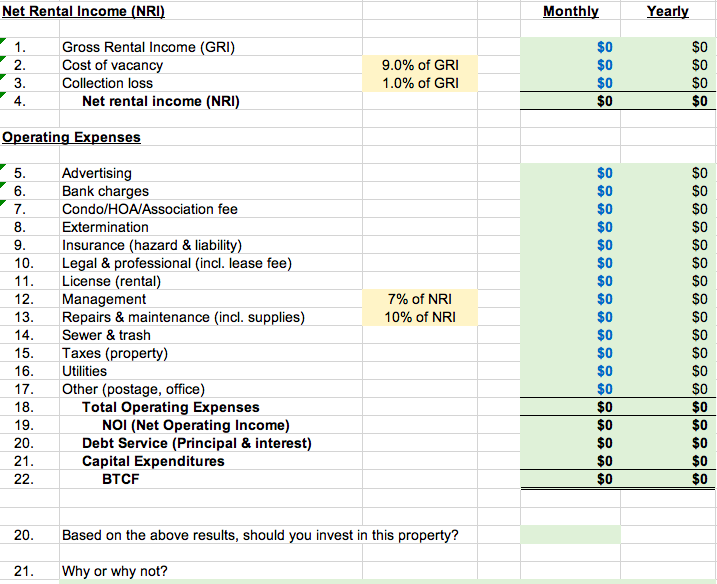

Rental income calculation worksheet. Rental Income and Expense Worksheet Once entered, the worksheet will calculate the totals for you, so you can see your gross income, net income, and total yearly expenses refresh every time ... PDF Enact MI Enact MI Where can I find rental income calculation worksheets? - Fannie Mae Rental Income Calculation Worksheets Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*, rental income calculation worksheet Rental Income and Expense Worksheet - PropertyManagement.com. 18 Pics about Rental Income and Expense Worksheet - PropertyManagement.com : Rental Income Calculation Worksheet Along with Investment Property Calculator Excel Spreadsheet, Rental Income Calculation Worksheet Along with Investment Property Calculator Excel Spreadsheet and also Rental Property Mao Worksheet - Real Estate Worksheets.

Income Analysis Worksheet | Essent Guaranty Download Worksheet (PDF) Download Calculator (Excel) Income Analysis Job Aids. ... Guideline Comparison - Rental Income Generated From an ADU. Use this job aid to easily compare agency guidelines for determining when you can and cannot use rental income from an accessory dwelling unit on a 1-unit primary residence. SEB cash flow worksheets - MGIC Updated for the 2021 tax year, our editable and auto-calculating cash flow analysis worksheets are fitted specifically for loan officers and mortgage pros. MGIC's self-employed borrower worksheets are uniquely suited for analyzing: Cash flow and YTD profit and loss (P&L) Comparative income Liquidity ratios Rental income Get the worksheets PDF Income & Resident Rent Calculation Worksheet - HUD Exchange 6) Net income from operation of a business or profession. $0 . 7) Interest, dividends, and other net income of any kind from real or personal property. Where net family assets are in excess of $5,000, annual income shall include the . greater of actual income derived from net family assets or a percentage of the value B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Oct 05, 2022 · Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet – Principal Residence, 2– to 4–unit Property ,

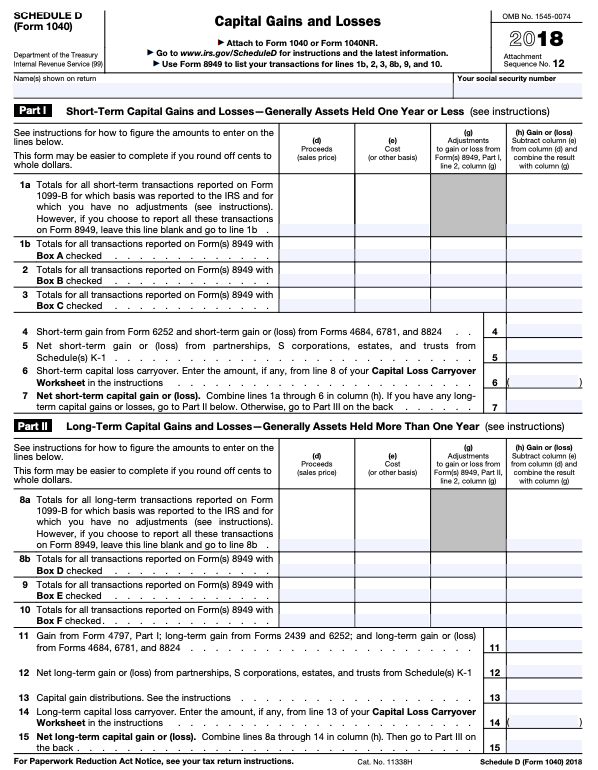

Publication 501 (2021), Dependents, Standard Deduction, and … If (a) or (b) applies, see the Form 1040 and 1040-SR instructions to figure the taxable part of social security benefits you must include in gross income. Gross income includes gains, but not losses, reported on Form 8949 or Schedule D. Gross income from a business means, for example, the amount on Schedule C, line 7; or Schedule F, line 9. PDF Form 1038: Rental Income Worksheet - Enact MI Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: ... Click the gray button to calculate the adjusted monthly rental income. If Line A9 is zero, "error" will show. Schedule E, Line 3 Schedule E, Line 20 Schedule E, Line 9 Schedule E, Line 12 Mortgage industry tools and resources from MGIC Rethink MI: Fresh solutions for lenders and loan officers. If you think mortgage insurance is just for first-time homebuyers, it's time to rethink your MI strategy. MI Solutions can broaden your borrowers' financial options so they find the loan - and home - that's best for them. Single-Family Homepage | Fannie Mae Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) ... Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. A1 Enter total rents received. A2 Subtract A3 Add A4 A5 A6

rental property income and expense worksheet Rental Income Calculation Worksheet And Rental Expense Spreadsheet . calculation spreadsheet expense. Rental Income And Expense Worksheet - Ideal REI idealrei.com. income rental worksheet expense expenses property track easy spreadsheet super tracker. New Free Rental Income And Expense Worksheet Stock - Worksheet For Kids rugby ...

PDF Net Rental Income Calculations - Schedule E - Arch Mortgage Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2 . Refer to Chapter 5304 and Form 91 for the treatment of all rental real estate income or loss reported on IRS Form 8825, regardless of Borrower's percentage of ownership interest in the buisiness or whether the Borrower is personally obligated on

PDF Net Rental Income Calculations - Schedule E - Freddie Mac Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2 . Refer to Chapter 5304 and Form 91 for the treatment of all rental real estate income or loss reported on IRS Form 8825, regardless of Borrower's percentage of ownership interest in the buisiness or whether the Borrower is personally obligated on

How to create an accurate rental income worksheet Rental income is cash or the fair market value of property or services received for the use of real estate, according to IRS Topic No. 414. Examples of rental income include: Rent received from a tenant, including additional rental income such as pet rent or late fees. Advance rent received, such as the first and last month of rent.

PDF VA REO NET RENTAL INCOME CALCULATION WORKSHEET JOB AID - Franklin American Notes for VA REO Net Rental Income Calculation Worksheet usage: • Enable Macros before using the worksheet (if required). • Do not include one-unit Primary Residence on this worksheet. • Always refer to FAMC/Agency guidelines for correct Net Rental calculation. • Use additional worksheet for more properties than this worksheet allows.

Rental Income - Canada.ca If you are claiming interest as a rental expense on Form T776, do not include it as a carrying charge on Form 5000-D1, Worksheet for the return ... If you are a partner, include the net rental income or loss from your T5013 slip in the calculation. Combine the rental income and loss from all your properties, even if they belong to different ...

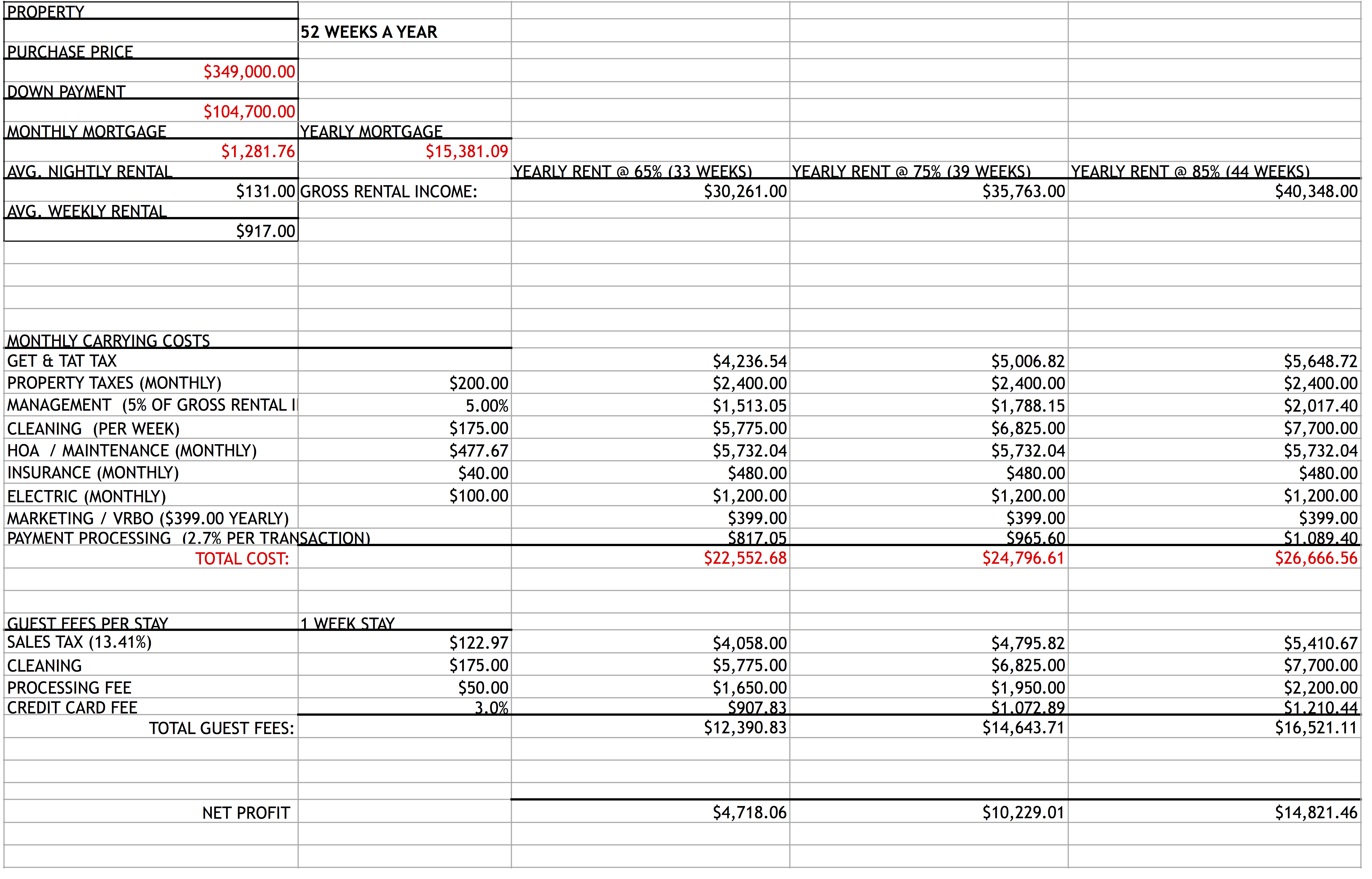

Rental Property Cash Flow Analysis - Vertex42 Aug 18, 2021 — It is a fairly basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization rate, ...

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ),

Income Analysis Tools - Essent Guaranty Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Rental Property - Investment (Schedule E) Determine the average monthly income/loss for a non-owner occupied investment property. Download Worksheet (PDF)

Publication 970 (2021), Tax Benefits for Education | Internal … Example 3—Scholarship partially included in income. The facts are the same as in Example 2—Scholarship excluded from income. If, unlike Example 2, Bill includes $4,000 of the scholarship in income, he will be deemed to have applied that amount to pay for room and board. The remaining $1,600 of the $5,600 scholarship would reduce his ...

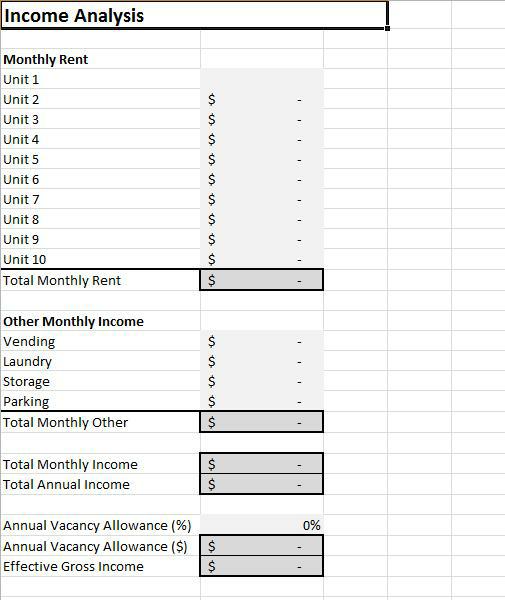

Free Rental Income and Expense Worksheet - Zillow To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

rental assistance calculation worksheet - CMHC Calculation Worksheet 1 ... 37, (B) CALCULATION OF RENT GEARED-TO-INCOME (RGI) ... 84, Total Rent-geared-to income, $ 456.00, ( C4 ) + ( B3 ).

T2 Corporation – Income Tax Guide – Chapter 8: Page 9 of the … General rate income pool (GRIP) A CCPC or a deposit insurance corporation may pay eligible dividends to the extent of its GRIP – a balance generally reflecting taxable income that has not benefited from the small business deduction or any other special tax rate – without incurring Part III.1 tax. The GRIP is calculated at the end of the tax year. . However, a corporation can pay …

fha rental income calculation worksheet 28 Rental Income Calculation Worksheet - Worksheet Information nuviab6ae4.blogspot.com. expense spreadsheet investing esprit. Debt-to-Income Ratio For Kentucky Mortgage Loans: - Louisville Kentucky . 31 Fannie Mae Rental Income Worksheet Excel - Free Worksheet Spreadsheet

Arch Mortgage | USMI - Calculators Qualifying Income Calculator (AMIQuiC) A Set of Arch MI Qualifying Income Calculator Tools. Download XLSX. ... Individual Rental Income from Investment Property(s) (up to 10 properties) Download XLXS. Freddie Mac Form 92 Schedule E - Net Rental Income Calculations.

HOPWA Income Eligibility Worksheet & Tenant Income and Rent Calculation ... This Excel workbook was created to assist HOPWA grantees and project sponsors determine household income eligibility for all HOPWA program activities, except Housing Information Services, which does not require an income eligibility assessment. Resource Links. HOPWA Income Eligibility Worksheet & Tenant Income and Rent Calculation Worksheet (XLSX)

Rental Income Calculator - Enact Mortgage Insurance Please use the following calculator and quick reference guide to assist in calculating rental income from IRS Form 1040 Schedule E.

Fuel tax credits calculation worksheet - Australian Taxation Office There are three steps to calculate your fuel tax credits using our Worksheet. Download a printable version of Fuel tax credits calculation worksheet (NAT 15634, 372KB) in PDF This link will download a file. Step 1: Work out your eligible quantities. Work out how much fuel (liquid or gaseous) you acquired for each business activity.

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ),

Monthly Qualifying Rental Income (or Loss) - Fannie Mae 1, Rental Income Worksheet ... Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form ...

PDF FHA REO NET RENTAL INCOME CALCULATION WORKSHEET JOB AID - Franklin American Notes for FHA REO Net Rental Income Calculation Worksheet usage: • Enable Macros before using the worksheet (if required). • Do not include one-unit Primary Residence on this worksheet. • Always refer to FAMC/Agency guidelines for correct Net Rental calculation. • Use additional worksheet for more properties than this worksheet allows.

Income Calculation Worksheet - NRPS Income Calculation Worksheet is required to be utilized on all wage earner, fixed income, rental income, residual income types. This Worksheet can also be used to calculate Schedule C income. Click on the hyperlink above to download the Worksheet.

Publication 936 (2021), Home Mortgage Interest Deduction Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

GTranslate - HUD.gov / U.S. Department of Housing and Urban … Maximum Insurable Loan Calculation (MILC) (.xlsx) HUD-92264-HCF: Health Care Facility Summary Appraisal Report: HUD-92264-T: Rent Estimates For Low/Moderate Income Units Non-Section 8 Projects Involving Tax-Exempt Financing Or Low Income Housing Tax Credits (CS) HUD-92265-W: Multifamily Housing Search Data Entry Worksheet: HUD-92266

Rental Property Calculator 2022 - WOWA.ca Jul 4, 2022 — Calculate the returns of your rental property. Learn about factors like Cap Rate, ROI formula and other important information that are ...

0 Response to "39 rental income calculation worksheet"

Post a Comment