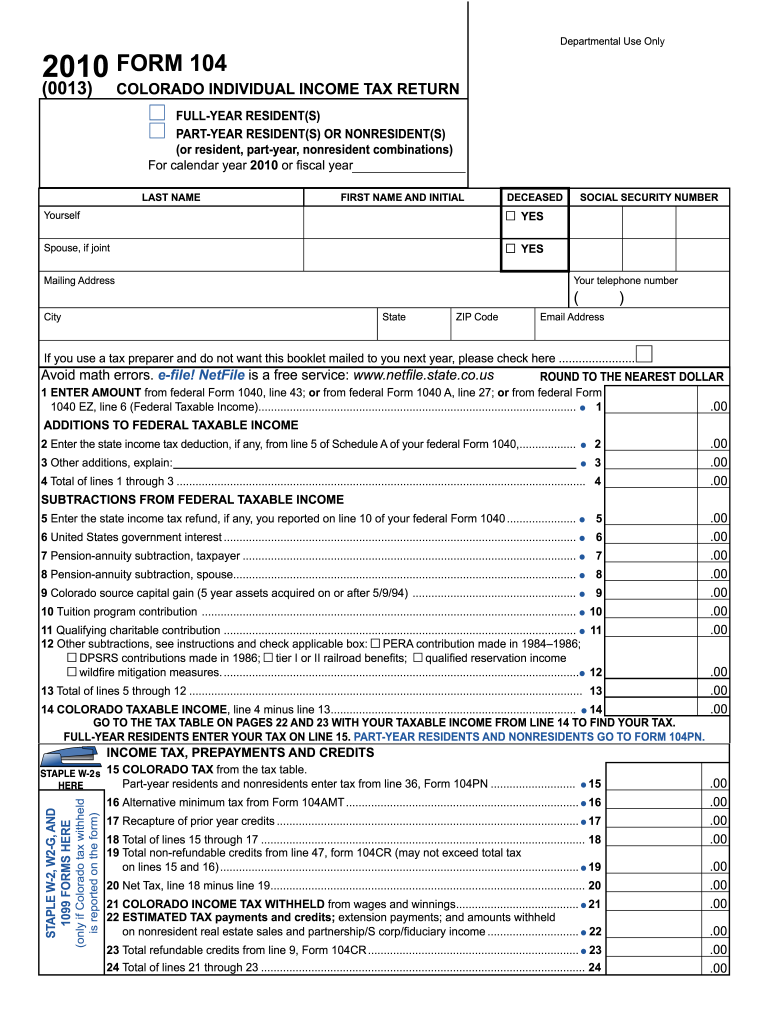

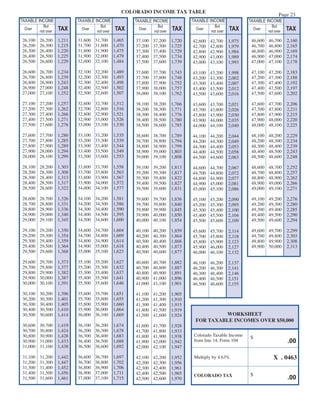

39 colorado pension and annuity exclusion worksheet

› 35224186 › Dictionary_ofDictionary of Accounting Terms.pdf - Academia.edu Enter the email address you signed up with and we'll email you a reset link. cotaxaide.org › toolsAARP Tax-Aide Tool List This worksheet determines the amounts that should be removed from the pension exclusion and calculates the amount that should be added as the RRB benefits line on the State Return section of TaxSlayer. Although designed specifically for Colorado it may work for other states if the problem is the same.

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Colorado pension and annuity exclusion worksheet

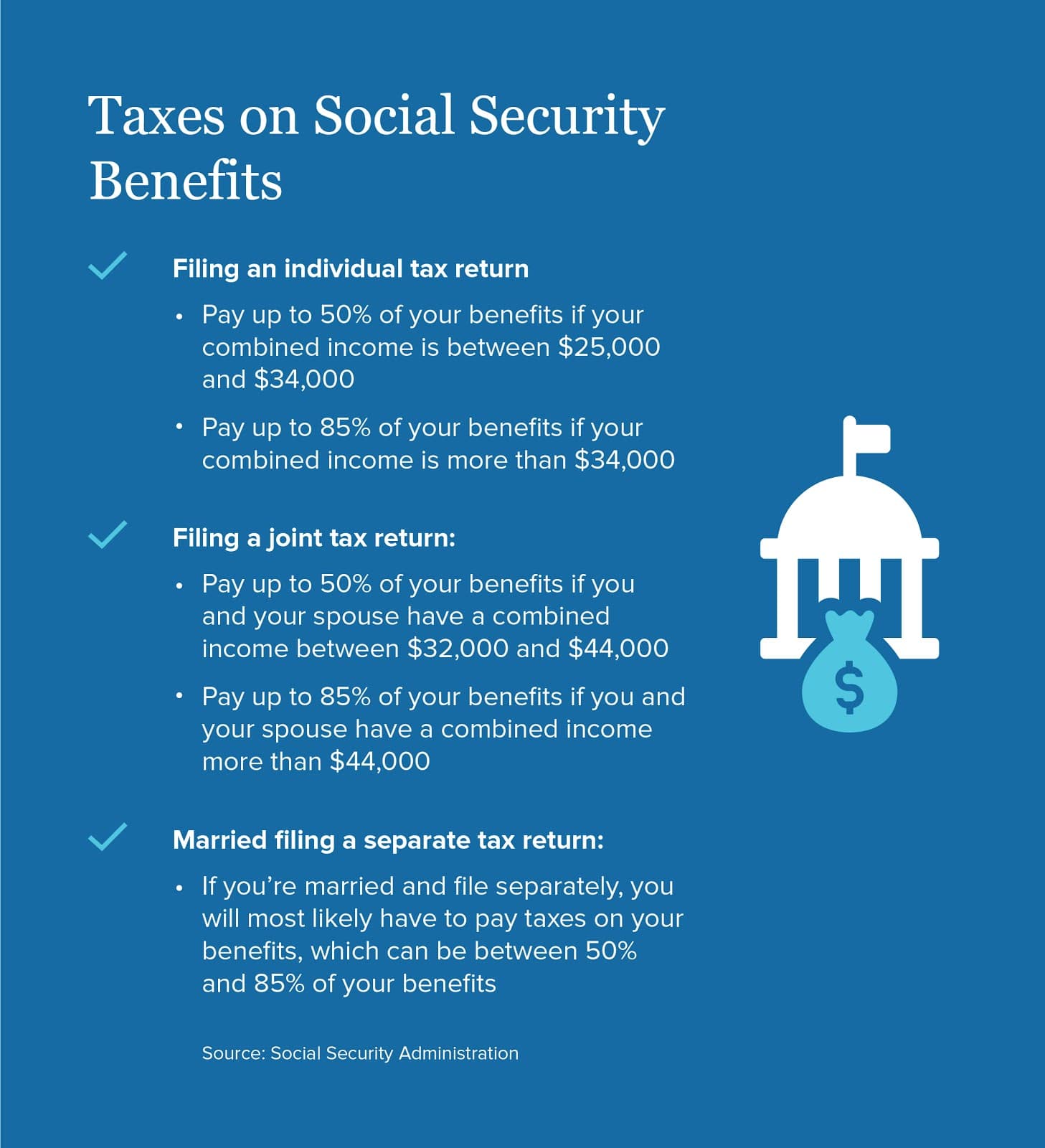

› service-details › view-other-statesView other states' tax treatment of out-of-state government ... May 18, 2020 · Complete the Pension Exclusion Computation Worksheet shown in Instruction 13 in the Maryland resident tax booklet. Be sure to report all benefits received under the Social Security Act and/or Railroad Retirement Act on line 3 of the pension exclusion worksheet - not just those benefits you included in your federal adjusted gross income. › publications › p525Publication 525 (2021), Taxable and Nontaxable Income 575 Pension and Annuity Income. 907 Tax Highlights for Persons With Disabilities. 915 Social Security and Equivalent Railroad Retirement Benefits. 970 Tax Benefits for Education. 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments cotaxaide.org › tools › indexAARP Tax-Aide Tool List - Colorado Tax-Aide Resources This worksheet determines the amounts that should be removed from the pension exclusion and calculates the amount that should be added as the RRB benefits line on the State Return section of TaxSlayer. Although designed specifically for Colorado it may work for other states if the problem is the same.

Colorado pension and annuity exclusion worksheet. achieverpapers.comAchiever Papers - We help students improve their academic ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment. cotaxaide.org › tools › indexAARP Tax-Aide Tool List - Colorado Tax-Aide Resources This worksheet determines the amounts that should be removed from the pension exclusion and calculates the amount that should be added as the RRB benefits line on the State Return section of TaxSlayer. Although designed specifically for Colorado it may work for other states if the problem is the same. › publications › p525Publication 525 (2021), Taxable and Nontaxable Income 575 Pension and Annuity Income. 907 Tax Highlights for Persons With Disabilities. 915 Social Security and Equivalent Railroad Retirement Benefits. 970 Tax Benefits for Education. 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments › service-details › view-other-statesView other states' tax treatment of out-of-state government ... May 18, 2020 · Complete the Pension Exclusion Computation Worksheet shown in Instruction 13 in the Maryland resident tax booklet. Be sure to report all benefits received under the Social Security Act and/or Railroad Retirement Act on line 3 of the pension exclusion worksheet - not just those benefits you included in your federal adjusted gross income.

0 Response to "39 colorado pension and annuity exclusion worksheet"

Post a Comment