38 ira deduction worksheet 2014

PDF TAXABLE YEAR California Adjustments — 2014 Nonresidents or Part-Year ... 2014 Important: Attach this schedule behind Long Form 540NR, Side 3 as a supporting California schedule. ... 32 IRA deduction ... Yes .Complete the Itemized Deductions Worksheet in the instructions for Schedule CA (540NR), line 43 ... PDF 2014 Instruction 1040 - TAX TABLE - IRS tax forms Cat. No. 24327A 1040 TAX TABLES 2014 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the Instructions for Form 1040 only.

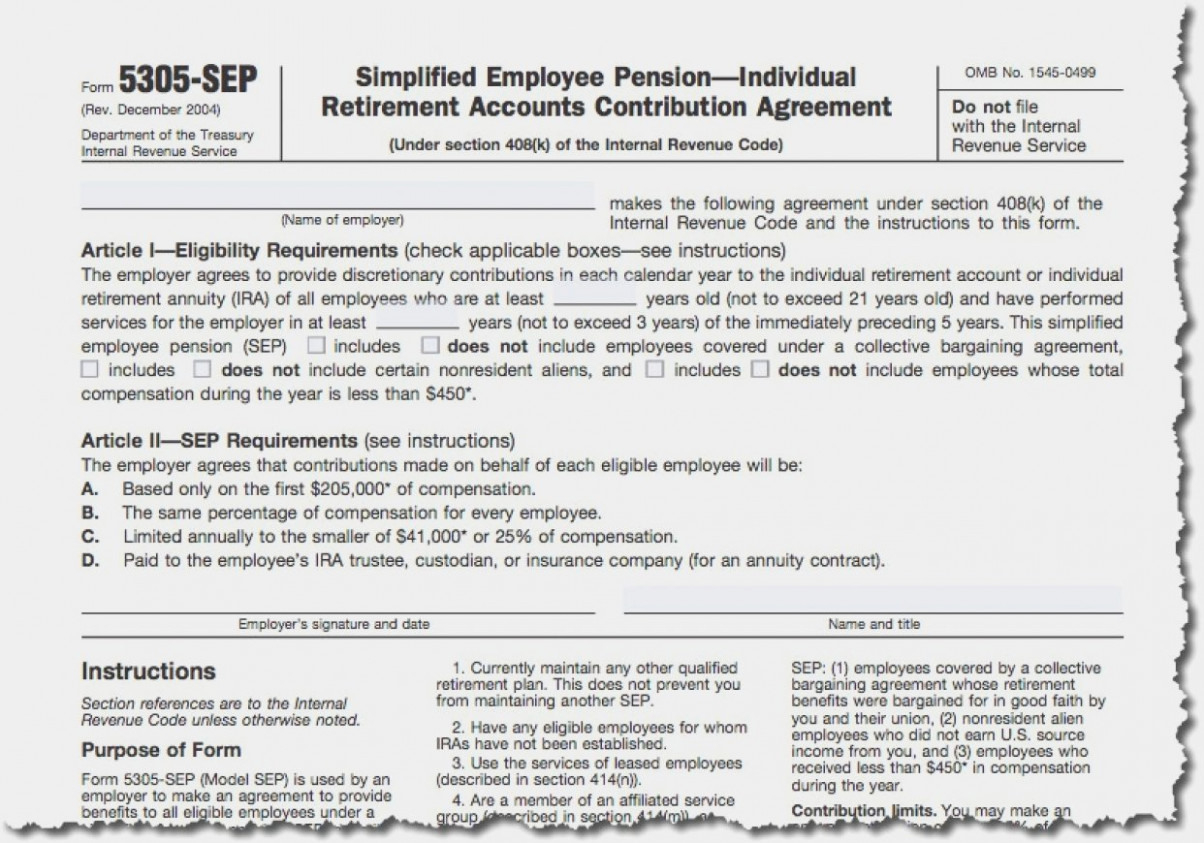

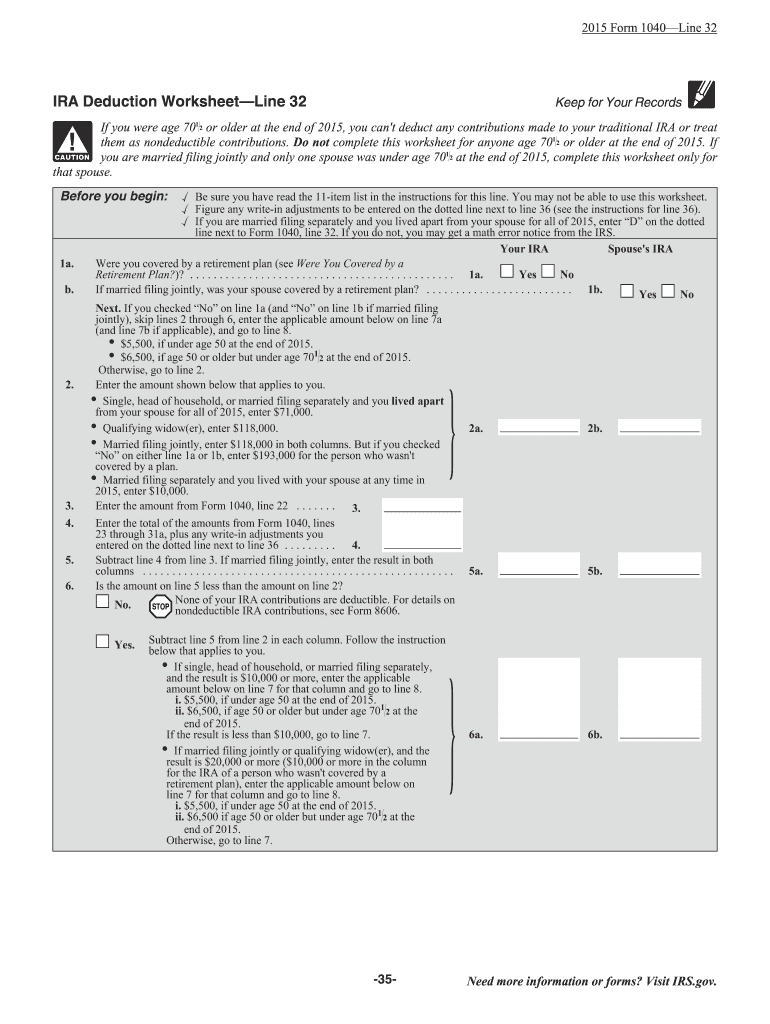

IRA Deduction Limits | Internal Revenue Service - IRS tax forms Traditional IRAs Retirement plan at work: Your deduction may be limited if you (or your spouse, if you are married) are covered by a retirement plan at work and your income exceeds certain levels. No retirement plan at work: Your deduction is allowed in full if you (and your spouse, if you are married) aren't covered by a retirement plan at work.

Ira deduction worksheet 2014

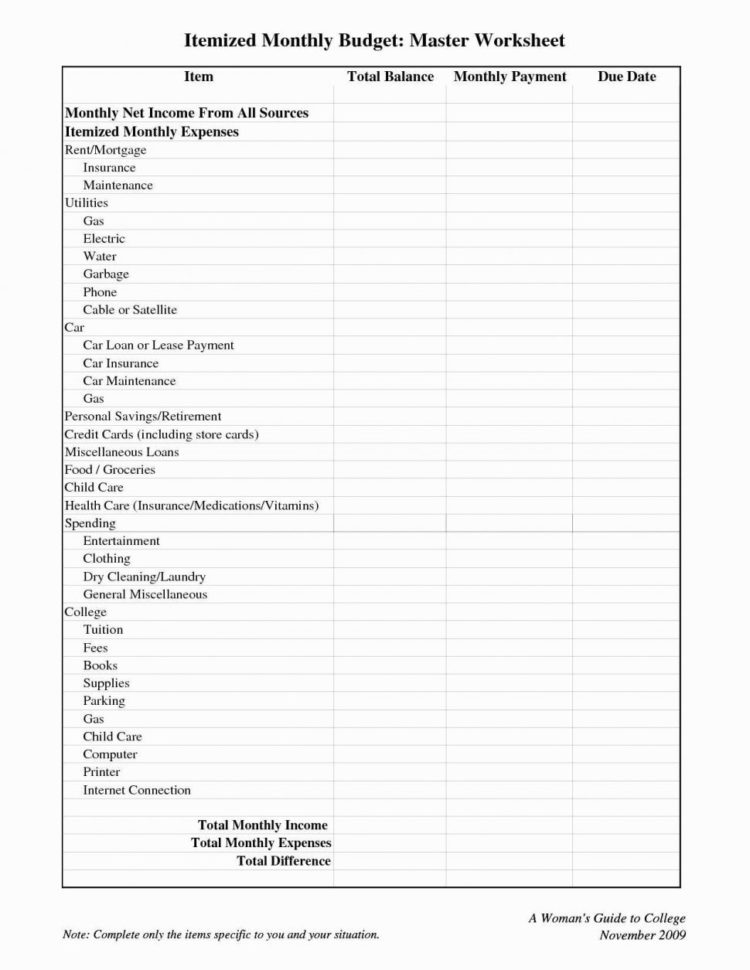

PDF 2014 Allocation of Income Worksheet (11-13) - ksrevenue.gov 1. Wages, salaries, tips, etc. 2. Taxable interest 3. Ordinary dividends 4. Taxable refunds, credits, or offsets of state and local income taxes 5. Alimony received . 6. Business income or loss 7. Capital gain or loss 8. Other gains or losses 9. IRA distributions KEEP FOR YOUR 10. Pensions and annuities . 11. PDF (IRAs) Page 1 of 61 15:36 - 18-Feb-2022 to Individual Contributions Contributions you make to an IRA may be fully or par- tially deductible, depending on which type of IRA you have and on your circumstances; and Generally, amounts in your IRA (including earnings and gains) aren't taxed until distributed. In some ca- ses, amounts aren't taxed at all if distributed accord- ing to the rules. Use Excel to File Your 2014 Form 1040 and Related Schedules Figure 1: Glenn Reeves has updated his Excel-based version of IRS Form 1040 for the 2014 tax year. The 2014 version of the spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A: Itemized Deductions Schedule B: Interest and Ordinary Dividends Schedule C: Profit or Loss from Business

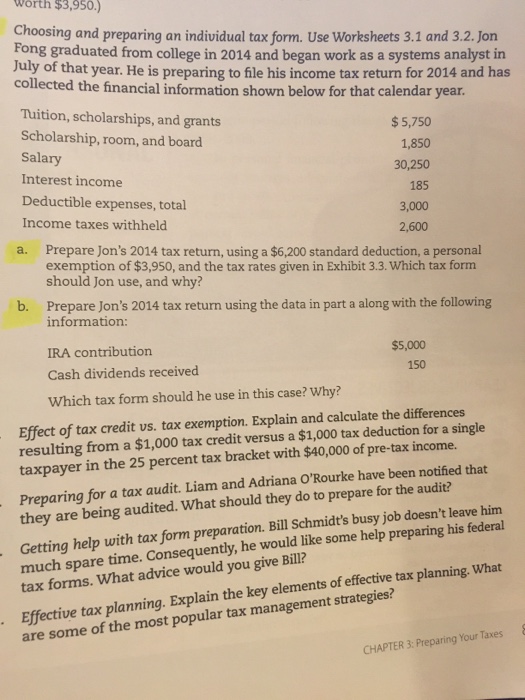

Ira deduction worksheet 2014. PDF 2014 Instructions for Form 8606 - IRS tax forms you can contribute to a roth ira for 2014 only if your 2014 modified agi for roth ira purposes is less than: $191,000 if married filing jointly or qualifying widow(er), $129,000 if single, head of household, or if married filing separately and you did not live with your spouse at any time in 2014, or $10,000 if married filing separately and you … PDF source 14:16 - 24-Jan-2019 - IRS tax forms IRA Deduction Worksheet—Continued Your IRA Spouse's IRA 7. Multiply lines 6a and 6b by the percentage below that applies to you. If the result isn't a multiple of $10, increase it to the next multiple of $10 (for example, increase $490.30 to $500). If the result is $200 or more, enter the result. But if it is less than $200, enter $200. Publication 590-A (2021), Contributions to Individual Retirement ... Sue figures her IRA deduction as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 2 Illustrated. ... IRA deduction. Compare lines 4, 5, and 6. Enter the smallest amount (or a smaller amount if you choose) here and on your Schedule 1 (Form 1040), line 20, whichever applies. ... SIMPLE IRA Plan - Sole Proprietor's Contribution - 2014 Worksheet SIMPLE IRA Plan - Sole Proprietor's Contribution - 2014 Worksheet This tax worksheet calculates a self-employed person's deductible contribution to a SIMPLE-IRA plan. Footnotes An eligible individual must make salary reduction contributions up to the regular limit for the year ($17,500 for 2014) before any are treated as catch-up contributions.

Instructions for Form 8606 (2021) | Internal Revenue Service Maximum Roth IRA Contribution Worksheet Overall Contribution Limit for Traditional and Roth IRAs If you aren't married filing jointly, your limit on contributions to traditional and Roth IRAs is generally the smaller of $6,000 ($7,000 if age 50 or older at the end of 2021) or your taxable compensation (defined below). 2014 Child Tax Credit Worksheet(1) - 2014 Form 1040Line 52... Income Limits for Roth Contributions in 2014 | Kiplinger The $181,000 represents the maximum modified adjusted gross income a married couple filing jointly in 2014 can have and still contribute the full $5,500 to a Roth IRA (or $6,500 if 50 or older... PDF 2014 Form Cf-1040 Individual Common Forms and Specifications Packet ... Page 11 IRA Deduction Worksheet Page 12 Self-employed SEP, SIMPLE, and Qualified Retirement Plan Deduction Worksheet ... 2014 CF-1040 INDIVIDUAL COMMON FORM (DRAFT VERSION 10/15/2014) Printed 10/15/14 Page 2 of 85. Page 14 Problems Noted on Past Common Forms Filed

PDF Deductions (Form 1040) Itemized - IRS tax forms The amount you can deduct for qualified long-term care in- surance contracts (as defined in Pub. 502) depends on the age, at the end of 2014, of the person for whom the premi- ums were paid. See the following chart for details. IF the person was, at the end of 2014, age . . . THEN the most you can deduct is . . . 40 or under $ 370. 2014 Traditional IRA Deductions | Ed Slott and Company, LLC 2014 Traditional IRA Deductions If you are covered by a retirement plan at work, use this IRS table to determine if you can deduct your 2014 Traditional IRA contribution: If you aren't covered by a retirement plan at work or one isn't offered, use this IRS table to determine if you can deduct your 2014 Traditional IRA contribution: Federal Form 8606 Instructions - eSmart Tax Use the Maximum Roth IRA Contribution Worksheet, later, to figure the maximum amount you can contribute to a Roth IRA for 2014. If you are married filing jointly, complete the worksheet separately for you and your spouse. ... If you used the worksheet Figuring Your Reduced IRA Deduction for 2014 in Pub. 590-A, enter on line 1 of Form 8606 any ... FREE 2014 Printable Tax Forms | Income Tax Pro Print 2014 federal income tax forms and instructions for 1040EZ, Form 1040A, and 2014 Form 1040 income tax returns. Printable 2014 federal tax forms 1040EZ, 1040A, and 1040 are grouped below along with their most commonly filed supporting IRS schedules, worksheets, 2014 tax tables, and instructions for easy one page access.

PDF 2014 z *149980110002 - Washington, D.C. 2014 SCHEDULE H WORKSHEET P3 Homeowner and Renter Property Tax Credit Revised 11/2014 *149980130002* z z z 2014 SCHEDULE H PAGE 3 Last name and SSN Federal Adjusted Gross Income of the tax fi ling unit (see instructions) - Report the AGI of every member of your tax fi ling unit, including income subject to federal but not DC income tax.

IRA - Allowable Contribution Options - 2014 Worksheet IRA - Allowable Contribution Options - 2014 Worksheet For further assistance on this topic, click the Tax Flowcharts item group button and view the IRA Contributions and Deductions tax flowchart. Footnotes Married individuals who file separately and did not live with their spouse at any time during the year are considered Single.

Use Excel to File Your 2014 Form 1040 and Related Schedules Figure 1: Glenn Reeves has updated his Excel-based version of IRS Form 1040 for the 2014 tax year. The 2014 version of the spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A: Itemized Deductions Schedule B: Interest and Ordinary Dividends Schedule C: Profit or Loss from Business

PDF (IRAs) Page 1 of 61 15:36 - 18-Feb-2022 to Individual Contributions Contributions you make to an IRA may be fully or par- tially deductible, depending on which type of IRA you have and on your circumstances; and Generally, amounts in your IRA (including earnings and gains) aren't taxed until distributed. In some ca- ses, amounts aren't taxed at all if distributed accord- ing to the rules.

PDF 2014 Allocation of Income Worksheet (11-13) - ksrevenue.gov 1. Wages, salaries, tips, etc. 2. Taxable interest 3. Ordinary dividends 4. Taxable refunds, credits, or offsets of state and local income taxes 5. Alimony received . 6. Business income or loss 7. Capital gain or loss 8. Other gains or losses 9. IRA distributions KEEP FOR YOUR 10. Pensions and annuities . 11.

0 Response to "38 ira deduction worksheet 2014"

Post a Comment