44 home daycare tax worksheet

Home-based childcare - ird.govt.nz Use our IR413 worksheet to see if you need to file a return. Actual costs Alternatively, you can claim actual expenses and costs in providing childcare against the income you receive. If you use this method, you need to: keep a record of all household and childcare service related expenses Daycare Tax Workbook - DaycareAnswers.com The Daycare Tax Workbook e-book helps you gather all the information you need to easily prepare your taxes. Whether you do it yourself or hire a professional tax preparer, this workbook makes it easy. $6.97 INCLUDES: End of Year Checklist Tax Worksheet End-of Year Receipts (W-10) Weekly Receipts Monthly Receipts Easy links to IRS forms

whereimaginationgrows.com › home-daycare-taxHome Daycare Tax Deductions for Child Care Providers Furniture and appliance purchases can be written off as home daycare tax deductions. Some items you can write off the whole cost while others will need to have your T/S% applied. Any furniture or appliance that you use in the daycare and for personal use needs to have the T/S% applied. Microwave Washer & dryer Refrigerator Stove Dishwasher Tables

Home daycare tax worksheet

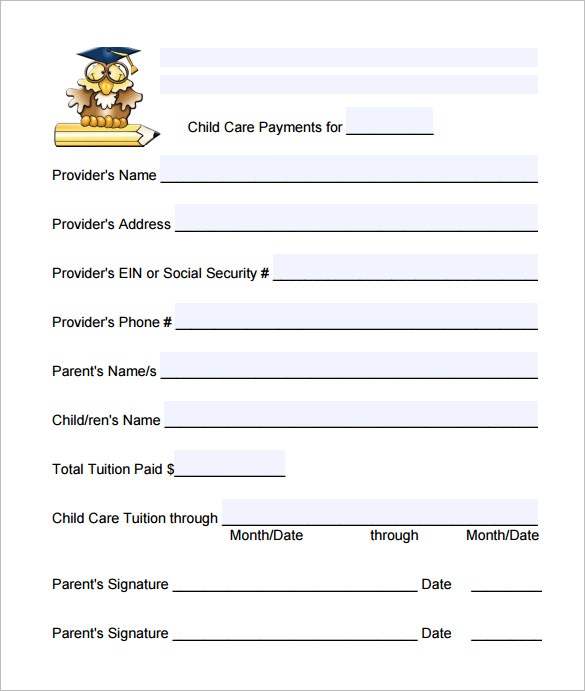

Daycare Worksheets - Free Preschool Worksheets to Print Free to Use Anywhere including Preschools, Daycare Centers, Summer Camps, and at Home One of the more common questions we get is "What are we allowed to do with the worksheets?". You can do everything you want with our free daycare worksheets except sell them. Print as many as you want and make as many copies as you would like. › graphics › budgetworksheetMONTHLY BUDGET WORKSHEET - Navy Federal Credit Union tax-advantaged 529 plan. • As a general rule of thumb, you’ll need 70% to 80% of your current annual income for each year of retirement. For tips on planning for retirement, visit makingcents.navyfederal.org. Regular Expenses Food • Plan ahead! Make a detailed food plan every week and buy only what you can store or use within that time ... Daycare Tax Statement - Simply Daycare A daycare tax statement must be given to parents at the end of the year. You will use it to claim all income received. The parents will use it to claim a deduction if they are eligible. The amount that you claim must match exactly with the amount parents are claiming. Keep track during the year of all payments made to you.

Home daycare tax worksheet. › calculators › childsupportMaryland Child Support Calculator | AllLaw Intercept state and federal tax refunds; Report the delinquent payer to the credit bureau; Report parent owing past due payments to the Motor Vehicle Administration for driver's license suspension; Intercept lottery winnings ; Bring Contempt of Court actions against delinquent parents Childcare Spreadsheets Use our FREE childcare spreadsheets below to aid in potty training, improve behavior, or log a child's daily activities. These templates are great for in-home daycare providers. All Practical Spreadsheets are easy to use and have pre-defined print areas. Most also include comments to aid in data entry. If these spreadsheets do not meet your needs, consider a Custom Spreadsheet solution. › publications › p587Publication 587 (2021), Business Use of Your Home Ordering tax forms, instructions, and publications. Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don't resubmit requests you've already sent us. Daycare in your home - Canada.ca Deduct, remit and report payroll deductions. Keeping daycare records. What you need to keep and for how long. Making payments for individuals. How to pay your income taxes owing, make payment arrangements, and send in instalment payments. Collecting goods and services tax/harmonized sales tax on your daycare services. Interest and penalties.

Worksheets | Pride Tax Preparation Worksheets These are NOT all-inclusive worksheets, but only a guide for the information that your tax preparer will need. Your tax preparer will only need the annual amounts, but most clients find it easier to fill out monthly. If you did not have Excel, you can download OpenOffice for free. Daycare Budget Template: Tips for Budgeting Child Care 2. Take Advantage of Tax Credits. There are plenty of expenses that are tax-deductible, including daycare costs. The tax credit for dependents can allow you to claim up to 35% of your daycare costs up to a maximum of $3,000 (for one qualifying person) or at $6,000 (for two or more qualifying persons). home daycare income and expense worksheet - another-place-another-story Download our editable Word fill-in daycare income and expense worksheet for your home daycare. The number one question I hear about taxes is how much will I pay. If you do not separate items like. Gross income from day care. If you take expense on mileage basis complete lines 1-10Your total grocery bill in an audit you must- 1. Essential Deductions for Day Care Providers - QuickBooks To calculate your deduction, divide the space you use for day care by the home's total space. Say you use a 20 square metre basement for day care and your home is 140 square metres. You may write off 14% (20 divided by 140) of your eligible bills as business expenses. But you do have to separate business and personal use: if you relax on the ...

List of Tax Deductions for an In-Home Daycare Provider Use the Daycare Facility Worksheet provided by the IRS to determine what percentage of shared expenses, like heating, can be deducted. ... carpeting or child-proof safety measures. Utilities and home-related expenses such as property taxes, insurance and mortgage interest are also deductible based on the time and space formula. Internet, phone ... › pub › irs-pdfPage 1 of 35 18:11 - 10-Feb-2022 of Your Home Business Use to the IRS Interactive Tax Assistant page at IRS.gov/ Help/ITA where you can find topics by using the search feature or viewing the categories listed. Getting tax forms, instructions, and publications. Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications. Ordering tax forms, instructions, and publications. Daycare Record Keeping | Pride Tax Preparation Square feet of your house separated into three categories: Space used ONLY for daycare, Space used PARTLY for daycare, and Space NOT used for daycare. Include your garage space. Amount spent for daycare licenses and training. Keep receipts! Amount spent for items that are used 100% for daycare. Keep items over $200 separately. Keep all receipts! Filing a Tax Return for Your In-Home Daycare - 2022 TurboTax® Canada Tips For example, if your daycare area measures 20 square metres and your entire home is 200 square metres, use 10 percent. Multiply that same figure by expenses including mortgage or rent, utilities, and repairs related to your entire home. If you use your space for both your daycare and for personal use, you must do an additional calculation.

rental property tax deductions worksheet 31 Home Daycare Tax Worksheet - Worksheet Project List isme-special.blogspot.com. mcalarney. Deductions And Adjustments Worksheet briefencounters.ca. donation spreadsheet template worksheet value goodwill deductions guide salvation army truck driver excel tax adjustments inspirational donations regarding values luxury.

PDF DAY CARE INCOME and EXPENSE WORKSHEET YEAR - Karla Havemeier, Ltd. If you take expense on mileage basis complete lines 1-10Your total grocery bill (in an audit, you must- 1. Year & Make of Auto (Bring in purchase/sales papers)prove a reasonable amount spent for personal. 2. Date Purchased: Month, Date, Year Amount spent on Day Care 3.

income tax worksheet Expense daycare. Tax form self income return deduction employment worksheet 1040 rico exclusion claim earned puerto federal certain adjustments income tax worksheet Home Daycare Income And Expense Worksheet — db-excel.com. 11 Pics about Home Daycare Income And Expense Worksheet — db-excel.com : Income Vs.

Child Care Provider Taxes | H&R Block Answer. The IRS usually considers childcare providers as independent contractors. Since independent contractors are self-employed, you should report your income on Schedule C. Also, if your income minus expenses from self-employment is more than $400, you must file Schedule SE. This will determine your taxes for childcare. However, if a state ...

PDF DAY CARE INCOME AND EXPENSE WORKSHEET - Haukeness Tax & Accounting Inc DAY CARE INCOME AND EXPENSE WORKSHEET . NAME _____ YEAR _____ DAY CARE INCOME . Gross income from day care $ ... _____ Federal food reimbursement $ _____ OFFICE IN HOME - IF LICENSED. Date home acquired Real estate taxes Total cost Interest Cost of land Casualty loss Cost of improvements Electricity Square footage of home Heat ...

Daycare Recordkeeping - Simply Daycare You'll need to get a large file box (or two) and folders to keep all the information in one place. Keep the receipt for the file box and folders. These are items that are tax deductible. Daycare recordkeeping is easy when you give each child their own folder. The entire file should be easily accessible.

texflex.payflex.comHome | TexFlex IRS Resources. Medical and Dental Expenses - IRS Publication 502; Dependent Care Expenses - IRS Form 2441; Dependent Care Expenses - Instructions for IRS Form 2441

0 Response to "44 home daycare tax worksheet"

Post a Comment