39 child tax credit worksheet 2016

Printable Maine Income Tax Forms for Tax Year 2021 - Tax … Adjustments to Tax/Child Care Credit Worksheet. Tax Credit: Get Form 1040 Schedule A: Form 1040-ME Tax Tables. 2021 Income Tax Table & Tax Rate Schedule. Get Form 1040-ME Tax Tables: Schedule B. 2018 Minimum Tax Worksheet for Schedule B. Get Schedule B: Schedule NRH. 2021 Apportionment for Married Person Electing to File Single. Get Schedule ... PDF Credit Page 1 of 13 10:39 - 20-Dec-2016 Child Tax - IRS tax forms A qualifying child for purposes of the child tax credit is a child who: 1. Is your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or a descendant of any of them (for example, your grandchild, niece, or nephew), 2. Was under age 17 at the end of 2016, 3.

PDF SCHEDULE 8812 OMB No. 1545-0074 Child Tax Credit 2016 - 1040.com If you file Form 2555 or 2555-EZ stop here, you cannot claim the additional child tax credit. If you are required to use the worksheet in Pub. 972, enter the amount from line 8 of the Child Tax Credit Worksheet in the publication. Otherwise: Enter the amount from line 6 of your Child Tax Credit Worksheet (see the Instructions for Form 1040 ...

Child tax credit worksheet 2016

› revenue › tax-return-formsTax Return Forms | Maine Revenue Services Income/Estate Tax. Individual Income Tax (1040ME) Corporate Income Tax (1120ME) Estate Tax (706ME) Franchise Tax (1120B-ME) Fiduciary Income Tax (1041ME) Insurance Tax; Real Estate Withholding (REW) Worksheets for Tax Credits; Electronic Request Form to request individual income tax forms Forms and Instructions (PDF) - IRS tax forms Additional Child Tax Credit Worksheet (Spanish Version) 0122 06/02/2022 Form 13424-J: Detailed Budget Worksheet 0518 05/13/2020 Form 15111: Earned Income Credit Worksheet (CP 09) ... Penalty Computation Worksheet 1215 01/06/2016 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2021 ... › mainetaxformsPrintable Maine Income Tax Forms for Tax Year 2021 Adjustments to Tax/Child Care Credit Worksheet. Tax Credit: Get Form 1040 Schedule A: Form 1040-ME Tax Tables. 2021 Income Tax Table & Tax Rate Schedule. Get Form 1040-ME Tax Tables: Schedule B. 2018 Minimum Tax Worksheet for Schedule B. Get Schedule B: Schedule NRH. 2021 Apportionment for Married Person Electing to File Single. Get Schedule ...

Child tax credit worksheet 2016. Office of Child Support: Policy listed by Section FEN081: Notice of Intent to Report Child Support Debt to Credit Reporting Agencies; 6.21 Tax Refund Offset. Policy Manual: Section 6.21: Tax Refund Offset; IV-D Memorandums: 2021-011 Federal Child Support Portal Updates and Related Federal Tax Refund Offset (FTRO) Updates; 2015-020 Revisions to the Federal Tax Refund Offset (FTRO) Fraud Process ... › opportunity-maineOpportunity Maine – Tax Credit for Student Loans $2,500 refundable tax credit value per year, or $25,000 lifetime value. Simpler worksheet to fill out with your tax return each year. More details are being worked out by State Government - we'll post details as we get them to this webpage! › tax-center › irsTax Cuts & Jobs Act (TCJA) | H&R Block Oct 24, 2018 · Child Tax Credit Increased . Starting in 2018, the TCJA increases the maximum child tax credit from $1,000 to $2,000 per qualifying child. The refundable portion of the credit increases from $1,000 to $1,400 and the earned income threshold for claiming the refundable credit is lowered from $3,000 to $2,500. › publications › p503Publication 503 (2021), Child and Dependent Care Expenses Advance child tax credit payments. From July through December 2021, advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that taxpayers may properly claim on their 2021 returns.

PDF 2016 Form 3514 California Earned Income Tax Credit 2016 California Earned Income Tax Credit FORM 3514 Attach to your California Form 540, Form 540 2EZ or Long or Short Form 540NR Name(s) as shown on tax return SSN Before you begin: If you claim the EITC even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. PDF Free Forms Courtesy of FreeTaxUSA 1 If you file Form 2555 or 2555-EZ stop here; you cannot claim the additional child tax credit. If you are required to use the worksheet in Pub. 972, enter the amount from line 8 of the Child Tax Credit Worksheet in the publication. Otherwise: 1040 filers: Enter the amount from line 6 of your Child Tax Credit Worksheet (see the › instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms Nonrefundable child tax credit and credit for other dependents (line 19) and refundable child tax credit or additional child tax credit (line 28). Head of household filing status. Credit for child and dependent care expenses (Schedule 3, line 2 or 13g). Exclusion for dependent care benefits (Form 2441, Part III). Earned income credit (line 27a). PDF Credit Page 1 of 12 14:42 - 6-Jan-2016 Child Tax - IRS tax forms A qualifying child for purposes of the child tax credit is a child who: 1. Is your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or a descendant of any of them (for example, your grandchild, niece, or nephew), 2. Was under age 17 at the end of 2015, 3.

2016 Child Tax Credit2016 Child Tax Credit - IRS Tax Break 2016 Child Tax Credit This credit is for people who have a qualifying child. It can be claimed in addition to the Credit for Child and Dependent Care expenses. Ten Facts about the 2016 Child Tax Credit The Child Tax Credit is an important tax credit that may be worth as much as $1,000 per qualifying child depending upon your income. PDF Form IT-216:2016:Claim for Child and Dependent Care Credit:IT216 00refundable portion of your New York State part-year resident child and dependent care credit. 22 . New York City child and dependent care credit If you were a resident of New York City at any time during the tax year and your federal adjusted gross income is $30,000 or less (see Note under New York City credit on page 1 of the instructions ... PDF Credit Page 1 of 13 13:22 - 23-Jan-2018 Child Tax - IRS tax forms However, most individuals can use a simpler worksheet in their tax form instructions. If you were sent here from your Form 1040, Form 1040A, or Form 1040NR instructions. Complete the Child Tax Credit Worksheet later in this publication. If you were sent here from your Schedule 8812 in- structions. PDF 2016 Instruction 1040 Schedule 8812 - IRS tax forms 2016 Instructions for Schedule 8812Child Tax Credit Use Part I of Schedule 8812 to document that any child for whom you entered an ITIN on Form 1040, line 6c; Form 1040A, line 6c; or Form 1040NR, line 7c; and for whom you also checked ... the end of the Child Tax Credit Worksheet, complete Parts II-IV of this schedule to fig-ure the amount of ...

What-if Worksheet" re: child tax credit & earned income credit ... This only works on the desktop version as far as I can tell. IF you are not claiming the earned income credit in any way, shape or form, to fix this and file you must: switch to forms view (up at the top, in the blue bar) Navigate to the "EIC Worksheet" form About a third of the way down, you should find a section titled "Election to Use 2016 Earned Income for Eligible Hurricane Victims Smart ...

Publication 503 (2021), Child and Dependent Care Expenses Advance child tax credit payments. From July through December 2021, advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that taxpayers may properly claim on their 2021 returns.

PDF 2016 Form 3596 Paid Preparer's California Earned Income Tax Credit ... 2016 Paid Preparer's California Earned Income Tax Credit Checklist CALIFORNIAFORM 3596 8471163 Attach to taxpayer's California Form 540, 540 2EZ, or Long or Short Form 540NR. Name(s) as shown on tax return. SSN or ITIN. For the definitions of Qualifying Child and Earned Income, see form FTB 3514, California Earned Income Tax Credit. Part I ...

Tax Credits - Department of Revenue An individual that is a partner, member or shareholder of a limited liability pass–through entity is allowed a limited liability entity tax (LLET) credit against the income tax imposed by KRS 141.020 equal to the individual’s proportionate share of LLET computed on the gross receipts or gross profits of the limited liability pass–through entity as provided by KRS 141.0401(2), after the ...

Tax Return Forms | Maine Revenue Services NOTE: Tax return forms and supporting documents must be filed electronically (see Electronic Services) or submitted on paper. Do NOT submit disks, USB flash drives, or any other form of electronic media.

PDF 2015 Instructions for Schedule 8812 Child Tax Credit - IRS tax forms the end of the Child Tax Credit Worksheet, complete Parts II-IV of this schedule to fig-ure the amount of any additional child tax credit you can claim. k!-1-Oct 07, 2015 Cat. No. 59790P. ... stantial presence test for 2016, your child may be considered a resident of the United

Dependent Care Tax Credit Worksheet - FSAFEDS The IRS allows a maximum of $3,000 for one child or $6,000 for two or more children when determining your tax credit. For more information, see IRS Publication 503, ... Dependent Care Tax Credit Worksheet Author: WageWorks Inc. Created Date: 10/28/2016 8:43:34 AM ...

Child and Dependent Care Credit or Early Childhood Development ... - Iowa Only one of the following two credits may be taken: Child and Dependent Care Credit OR Early Childhood Development Tax Credit Only taxpayers with a net income of less than $45,000 are eligible to take one of these credits. If you are married, your net income and the net income of your spouse must be combined to determine if you qualify, even if your spouse does not file an Iowa return.

1040 (2021) | Internal Revenue Service - IRS tax forms Nonrefundable child tax credit and credit for other dependents (line 19) and refundable child tax credit or additional child tax credit (line 28). Head of household filing status. Credit for child and dependent care expenses (Schedule 3, line 2 or 13g). Exclusion for dependent care benefits (Form 2441, Part III). Earned income credit (line 27a).

› revenue › tax-return-formsIndividual Income Tax Forms - 2019 | Maine Revenue Services Property Tax Fairness Credit and Sales Tax Fairness Credit: Included: Schedule A (PDF) Adjustments to Tax / Child Care Credit Worksheet: See 1040ME General Instructions: Worksheet for "Other" Tax Credits (PDF) Other Tax Credits Worksheet Worksheet for Form 1040ME, Schedule A, Line 20: Included: Tax Credit Worksheets

Individual Income Tax Forms - 2019 | Maine Revenue Services Adjustments to Tax / Child Care Credit Worksheet: See 1040ME General Instructions: Worksheet for "Other" Tax Credits (PDF) Other Tax Credits Worksheet Worksheet for Form 1040ME, Schedule A, Line 20: Included: Tax Credit Worksheets: Worksheets for Tax Credits Claimed on Form 1040ME, Schedule A: Included: Minimum Tax Credit Worksheet (PDF)

Opportunity Maine – Tax Credit for Student Loans For Bachelors degrees NOT considered to be in STEM (science, technology, engineering or math) fields by Maine Revenue Services, tax credits may offset any individual income taxes you owe the State of Maine (non-refundable). If the tax credit is worth more than what you owe the State of Maine in individual income taxes, you may use the balance over the following 10 tax …

PDF Credit (EIC) Page 1 of 38 16:23 - 21-Dec-2016 Earned Income - IRS tax forms • $39,296 ($44,846 for married filing jointly) if you have one qualifying child, or • $14,880 ($20,430 for married filing jointly) if you do not have a qualifying child. 2. You must have a valid social security number by the due date of your 2016 return (including extensions). 3.Your filing status cannot be Married filing separately. 4.

Prior Year Products - IRS tax forms Prior Year Products. Enter a term in the Find Box. Select a category (column heading) in the drop down. Click Find. Click on the product number in each row to view/download. Click on column heading to sort the list. You may be able to enter information on forms before saving or printing.

PDF Forms 1040, 1040A, Child Tax Credit Worksheet 1040NR 2016 To be a qualifying child for the child tax credit, the child must be under age 17 at the end of 2016 and meet the other requirements listed earlier under Qualifying Child.Also see Taxpayer identification number needed by due date of return, earlier. If you do not have a qualifying child, you cannot claim the child tax credit.

Credit For Children | NCDOR An individual may claim a child tax credit for each dependent child for whom a federal child tax credit was allowed under section 24 of the Code. The amount of credit allowed for the taxable year is equal to the amount listed in the table below based on the individual's adjusted gross income, as calculated under the Code, Form D-400, Line 6.

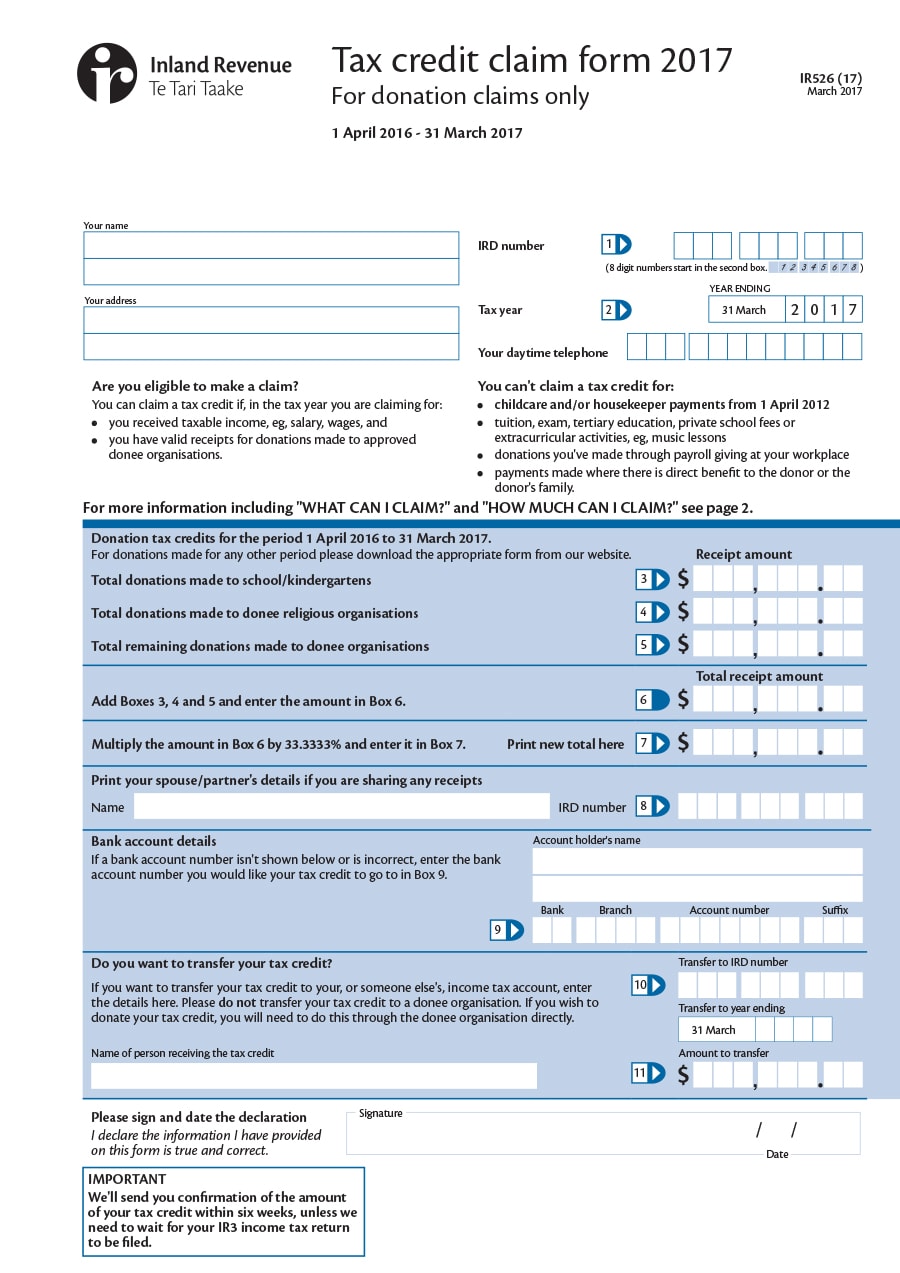

Calculators and tools - ird.govt.nz Business and organisations Ngā pakihi me ngā whakahaere. Income tax Tāke moni whiwhi mō ngā pakihi; Employing staff Te tuku mahi ki ngā kaimahi; KiwiSaver for employers Te KiwiSaver mō ngā kaituku mahi; Goods and services tax (GST) Tāke mō ngā rawa me ngā ratonga Non-profits and charities Ngā umanga kore-huamoni me ngā umanga aroha; IRD numbers Ngā tau …

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-10-350x350.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-07-350x350.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-13-212x300.jpg)

0 Response to "39 child tax credit worksheet 2016"

Post a Comment