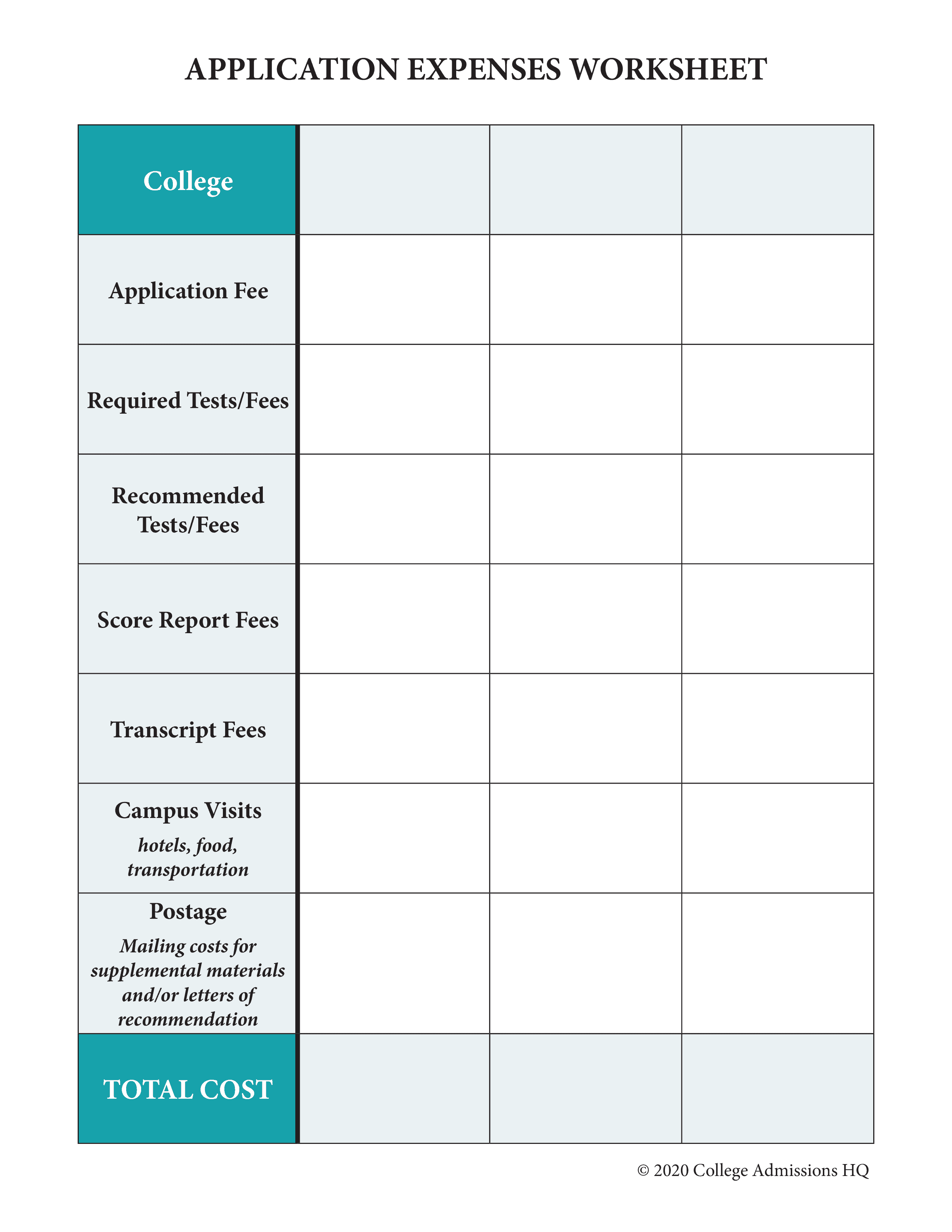

44 qualified education expenses worksheet

Qualified 529 expenses | Withdrawals from savings plan | Fidelity American Opportunity Tax Credit allows families of undergraduates to deduct the first $2,000 spent on qualified education expenses and 25% of the next $2,000. To qualify for the full credit in 2019, single parents must have a modified adjusted gross income of $80,000 or less, or $160,000 or less if married and filing jointly. Qualified Education Expenses Exception (Code 08) (for IRAs) - TaxAct Form 5329 - Qualified Education Expenses Exception (Code 08) (for IRAs) The qualified education expenses must not include amounts paid using grants, scholarships, or other tax-free benefits. Who Is Eligible. You can take a distribution from your IRA before you reach age 59 1/2 and not have to pay the 10% additional tax if, for the year of the ...

PDF IL-1040-RCPT, Receipt for Qualified K-12 Education Expenses Add the amounts in the "Total Amount of Qualified Expenses Paid by Parent or Guardian" column for each student. Use this total to complete the K-12 Education Expense Credit Worksheet on Schedule ICR. Total $ (This required information may be (K-12 only) provided by the recipient)

Qualified education expenses worksheet

PDF A OPPORTUNITY TAX CREDIT WORKSHEET - Tyler Hosting qualified education expenses and $4,400 for his room and board for the fall 2013 semester. He and the college meet all the requirements for the American opportunity credit. He figures his American opportunity credit based on qualified education expenses of $4,000, which results in a credit of $2,500. Can I Deduct My Computer for School on Taxes? - TurboTax 16.10.2021 · Education tax credits. The government uses tax policy to encourage activities such as paying for education and saving for retirement. While the names and amounts vary, the IRS generally provides for some type of educational tax credit to help offset the costs of qualifying tuition and related expenses.. A computer for school purposes may or may not qualify for … How do I report Qualified Education Expenses involving a 1099-Q? Throughout the year, he paid qualifying expenses totaling $8000. Option 1: To exclude his earnings ($1500) from being included in his income, Dave chooses to report his information as follows: What he enters: When entering his 1099-Q, he enters his distribution and earnings in the appropriate fields. For qualified expenses paid with his 1099-Q ...

Qualified education expenses worksheet. Reporting 529 Plan Withdrawals on Your Federal Tax Return When 529 plan funds are used to pay for qualified education expenses there is usually nothing to report on your federal income tax return. Form 1099-Q and Form 1098-T will list the amount of the 529 plan distribution and how much was used to pay for college tuition and fees, but it is up to the 529 plan account owner to calculate the taxable portion. 8863/8917 - Education Credits and Deductions - Drake Software In Drake 15 and prior, Details for two schools can be entered on the first 8863 screen for each student Press Page Down to enter additional information for 3 or more schools on subsequent screens.; Complete the Adjusted Qualified Education Expenses Worksheet in the Instructions for Form 8863 to determine what amount to enter on line 27 for the American Opportunity Credit or line 31 for the ... Education Expenses Worksheet for 2018 Tax Year Remaining expenses that qualify for scholarships/grants but not LLC/AOC Line 9 $0. Line 3 - Line 4. Put 0 if negative. Amount of scholarships/grants to transfer to student as income Line 10 $0. See "Your 2018 tax return included education expenses" for amount to put on return. Line 7 - Line 8 - Line 9. Put 0 if negative. Publication 502 (2021), Medical and Dental Expenses If you can't use the worksheet in the Instructions for Forms 1040 and 1040-SR, use the worksheet in Pub. 535, Business Expenses, to figure your deduction. If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet.

Qualified Education Expense Tax Credit - Georgia Department of Revenue 2020 Qualified Education Expense Tax Credit - cap status 7-1-20.pdf (221.7 KB) 2020 Qualified Education Expense Tax Credit - cap status 6-5-20.pdf (220.81 KB) 2020 Qualified Education Expense Tax Credit - cap status 4-30-20.pdf (221.75 KB) 2020 Qualified Education Expense Tax Credit - cap status 4-6-20.pdf (221.58 KB) Guide to IRS Form 1099-Q: Payments from Qualified Education Programs For example, suppose your qualified education expenses are $10,000, you receive a $2,000 Pell grant and boxes 1 and 2 of your 1099-Q report a gross distribution of $8,000 and earnings of $1,000. Your adjusted expenses are $8,000—which means you don't have to report any education program distributions on your tax return. Monthly Budget Spreadsheet for Excel - Vertex42.com 08.09.2021 · The purpose of this type of budget worksheet is to compare your monthly budget with your actual income and expenses. You record your desired budget for each category in the "Budget" column. This represents your goal - you're trying to keep from spending more than this amount. At the end of the month, you record in the "Actual" column how much you really spent … PDF Educational Expenses Worksheet - University of Michigan The Educational Expenses Worksheet is a form you can complete if you wish to request an adjustment to your financial aid budget ... regulations are subject to change through legislation or policy changes by the U.S. Department of Education. REV: 01/28/2022 O:/InDesign/Tracking Forms/Archive tracking forms/Forms2122.

PDF 2020 Education Expense Worksheet - H&R Block Education Expenses 1. Payments received for qualified tuition and related expenses (total from column B above)1. 2. Amounts actually paid during 2020 for qualified tuition and related expenses (total from column D above) . . . . . . . 2. 3. › pit › creditsCollege tuition credit or itemized deduction Nov 22, 2021 · Qualified tuition expenses include only tuition paid for the undergraduate enrollment or attendance of the student at an institution of higher education. This includes expenses paid from a qualified state tuition program (like New York's 529 College Savings Program). Qualified tuition expenses do not include: tuition paid through scholarships ... College tuition credit or itemized deduction 22.11.2021 · Qualified tuition expenses include only tuition paid for the undergraduate enrollment or attendance of the student at an institution of higher education. This includes expenses paid from a qualified state tuition program (like New York's 529 College Savings Program). Qualified tuition expenses do not include: tuition paid through scholarships or other financial aid that …

PDF Education Expenses - IRS tax forms scholarship. (But for exceptions, see Payment for services in Publication 970, Tax Benefits for Education.) Use Worksheet 1-1 below to figure the amount of a scholarship or fellowship you can exclude from gross income. Education Expenses The following are qualified education expenses for the purposes of tax-free scholarships and fellowships:

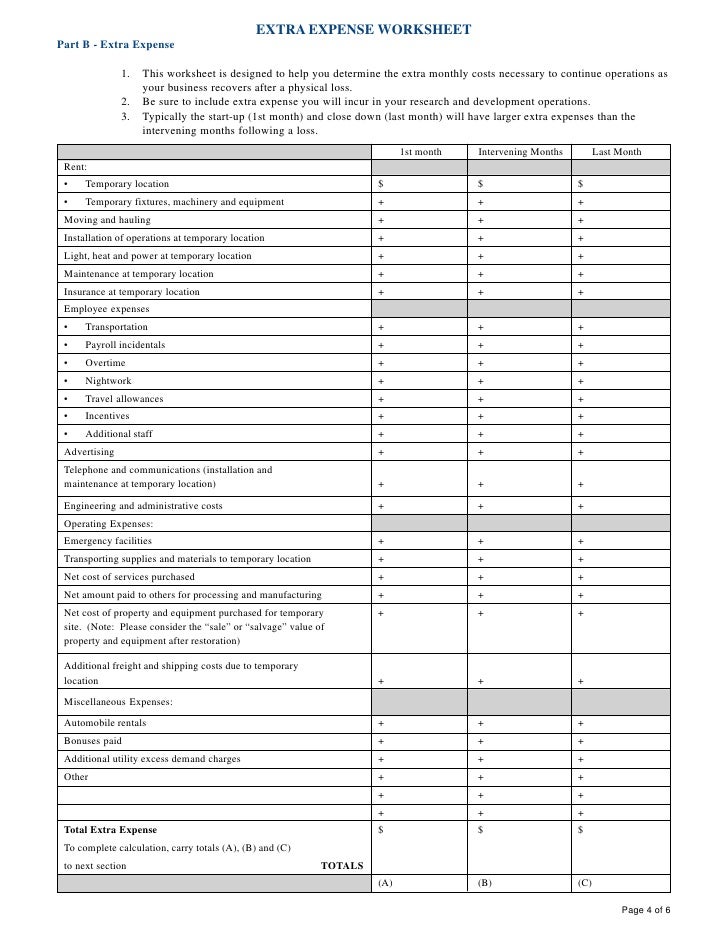

Intelligent, Free Excel Budget Calculator Spreadsheet | Download ... Expenses that you don’t expect, or which don’t occur on a monthly basis, can cause you to reach for a credit card. Then it can feel like your spending plan is off track as you try to get out of debt. Using the budget calculator spreadsheet will help you identify the different types of expenses that you need to plan for and what to save for ...

turbotax.intuit.com › tax-tips › college-andCan I Deduct My Computer for School on Taxes? - TurboTax Oct 16, 2021 · Education tax credits. The government uses tax policy to encourage activities such as paying for education and saving for retirement. While the names and amounts vary, the IRS generally provides for some type of educational tax credit to help offset the costs of qualifying tuition and related expenses.

Qualified Ed Expenses | Internal Revenue Service 03.11.2021 · Qualified education expenses are amounts paid for tuition, fees and other related expenses for an eligible student. Who Must Pay Qualified education expenses must be paid by: You or your spouse if you file a joint return, A student you claim as a dependent on your return, or; A third party including relatives or friends. Funds Used. You can claim an education credit for …

Qualified Education Expenses: What Can You Deduct in 2022? Qualified education expenses primarily include tuition, but also costs that are required for you to enroll in a course or program. You will probably receive a copy of Form 1098-T from each school where you have eligible expenses. The tuition and fees deduction, available to all taxpayers, allows you to deduct up to $4,000.

How do I calculate the amount of qualified education expenses? This total would become the qualified expenses plus any eligible books and supplies. For example, Box 5 is $1000 and Box 1 is $3000, then the qualified expense amount would be $2000 plus any books or supplies. If the amount in Box 5 is greater than the amount in Box 1, then you are not eligible to take an education credit.

Education Expense Credit - Credits - Illinois Education Expense Credit You may figure a credit for qualified education expenses, in excess of $250, you paid during the tax year if you were the parent or legal guardian of a full-time student who was under the age of 21 at the close of the school year, you and your student were Illinois residents when you paid the expenses, and

Entering education expenses in ProSeries - Intuit Check the box for either Taxpayer or the spouse showing they have qualified education expenses. Click the QuickZoom to the Student Information Worksheet. You can have as many Student Information Worksheets as you need for the tax return. Just make sure every student has their own Student Information Worksheet, as their name will be at the top.

› publications › p970Publication 970 (2021), Tax Benefits for Education | Internal ... If you pay qualified education expenses in both 2021 and 2022 for an academic period that begins in the first 3 months of 2022 and you receive tax-free educational assistance, or a refund, as described above, you may choose to reduce your qualified education expenses for 2022 instead of reducing your expenses for 2021..

Knowledge Base Solution - How do I enter qualified education expenses ... How do I enter qualified education expenses for Form 8863 in a 1040 return using interview forms? Go to Interview Form IRS 1098-T - Tuition Statement. In Box 70 - Qualified expenses override, enter the applicable amount. In Box 71 - Education code, use the lookup value (double-click or press F4) to select the applicable codes. Calculate the return.

› forms › senior-citizensPENSION EXCLUSION COMPUTATION WORKSHEET (13A) Use the You Spouse were not used for qualified higher education expenses, and any refunds of contributions made under the Maryland College Investment Plan, to the extent the contributions were subtracted from federal adjusted gross income and were not used for qualified higher education expenses. See Administrative Release 32. l.

Why are the Adjusted Qualified Higher Education Expenses on my 1099-Q ... The qualified expenses for 1099-Q funds are tuition, books, lab fees, AND room & board. That's it. If there are any excess 1099-Q funds they are taxable. The amount is included in the total on line 7.. Finally, out of pocket money is applied to qualified education expenses

PDF Determining Qualified Education Expenses - IRS tax forms the worksheet above. The $3,000 Pell Grant will be entered on line 2a. The line 3 amount is $3,000. Subtracting line 3 from line 1, you get qualified education expenses of $4,500. If the resulting qualified expenses are less than $4,000, the student may choose to treat some of the grant as income to make more of the expenses eligible for the ...

340B Drug Pricing Program | Official web site of the U.S. Health ... Implementation of Section 121 of the Consolidated Appropriations Act of 2022 The Consolidated Appropriations Act of 2022 was signed into law on March 15, 2022. Section 121 of the law permits certain hospitals to be reinstated into the 340B Drug Pricing Program if …

Adjusted qualified education expenses worksheet form To calculate the eligible expenses for their credit, take the $7,000 ($3,000 grant + $4,000 loan) paid in 2019, plus the $500, for books and enter on line 1 of the worksheet above. The $3,000 will be entered on line 2a. The line 3 amount would be $3,000. Subtracting line 3 from line 1, you get qualified education expenses of $4,500.

PDF Education Expenses Worksheet for 2017 Tax Year Based on your education expenses, scholarships and grants reported on your Form 1098-T, and information found on your account activity statement from your school, we have filed your education credit in the following manner: $_____ in qualified education expenses were included in your tax return on Form 8863 to calculate your

› worksheet_formatsCost Report Data - Worksheet Formats Worksheet S-8 * Hospital-based Rural Health Clinic / Federally Qualified Health Center Statistical Data: form: instructions: S900: Worksheet S-9 Parts I-IV * Hospice Identification Data: form: instructions: S111: Worksheet S-11 Part I * Hospital-based FQHC Identification Data: form: instructions: S112: Worksheet S-11 Part II *

› ExcelTemplates › monthlyHousehold Budget Worksheet for Excel - Vertex42.com Jan 13, 2020 · If you are in need of a detailed budget worksheet with a large variety of budget categories, our Household Budget Worksheet for Excel, Google Sheets or OpenOffice will help you compare your actual spending to your intended budget on a monthly basis. If you prefer to create a budget for the entire year, use our family budget planner.

![HSA Qualified Medical Expenses List [HSA-QMELIST] - $49.00 : Banker ...](https://www.bankersonline.com/bankerstore/images/medium/QMELIST_MED.gif)

0 Response to "44 qualified education expenses worksheet"

Post a Comment