39 1040 qualified dividends worksheet

Calculation of tax on Form 1040, line 16 - Thomson Reuters Tax Tables. You can find them in the Form 1040 Instructions. Qualified Dividend and Capital Gain Tax Worksheet. To see this select Forms View, then the DTaxWrk folder, then the Qualified Div & Cap Gain Wrk tab. Per the IRS Form 1040 Instructions, this worksheet must be used if: The taxpayer reported qualified dividends on Form 1040, Line 3a. 1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200.

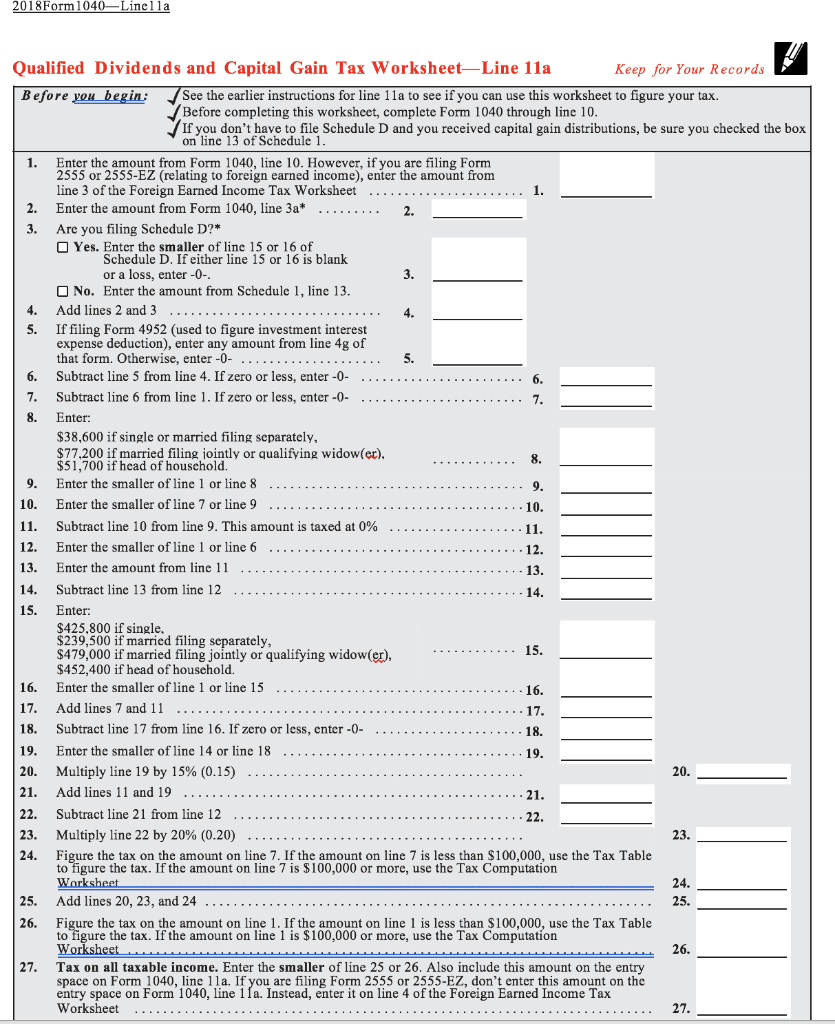

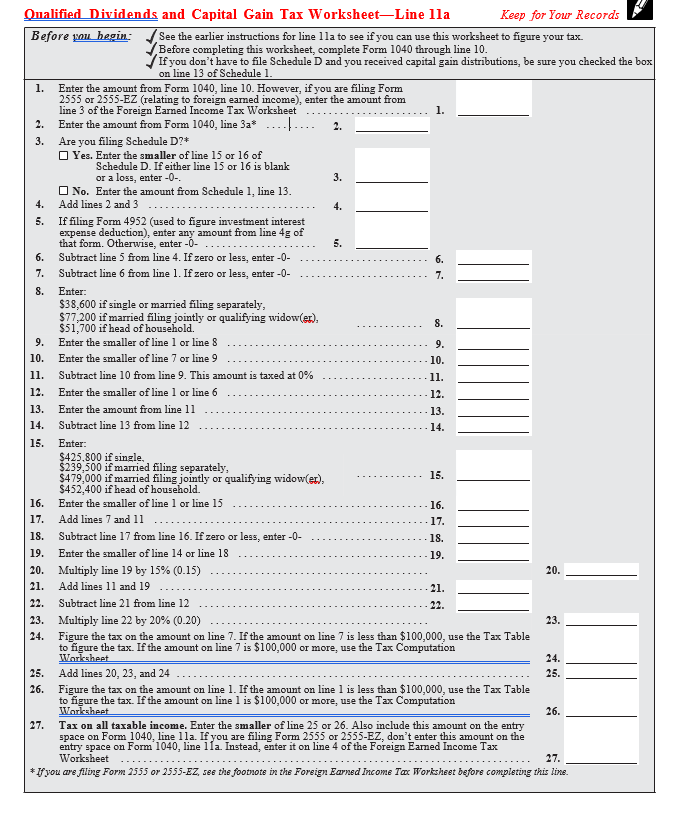

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

1040 qualified dividends worksheet

Qualified Dividends and Capital Gains Worksheet-Completed Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018. On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax ...

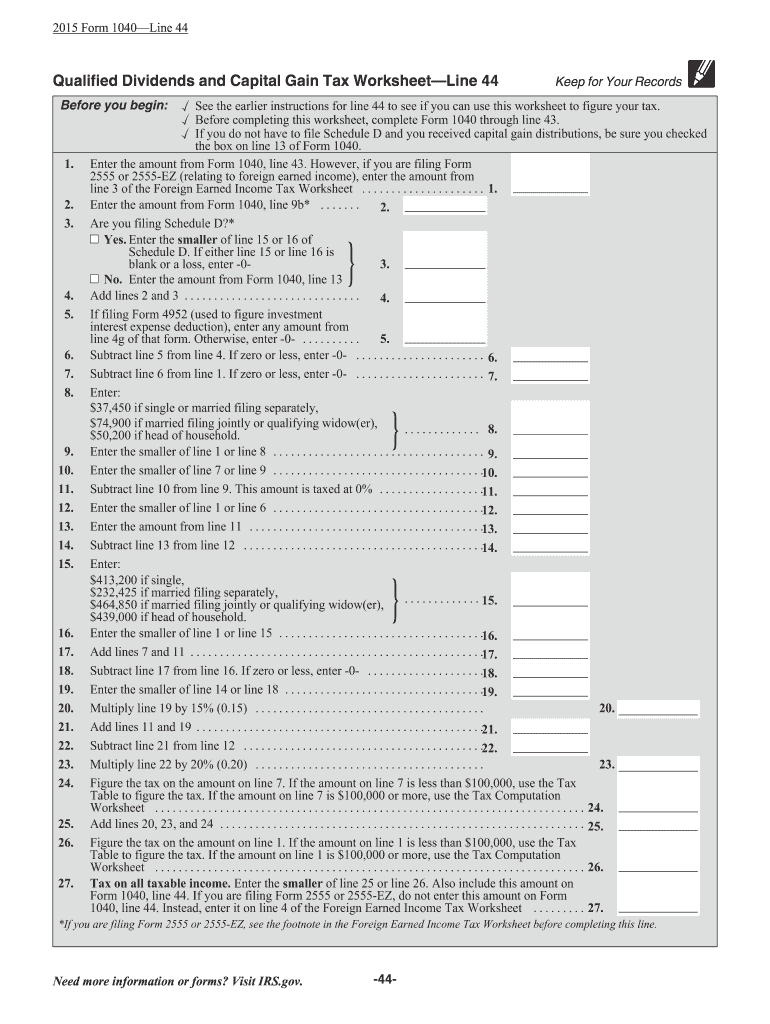

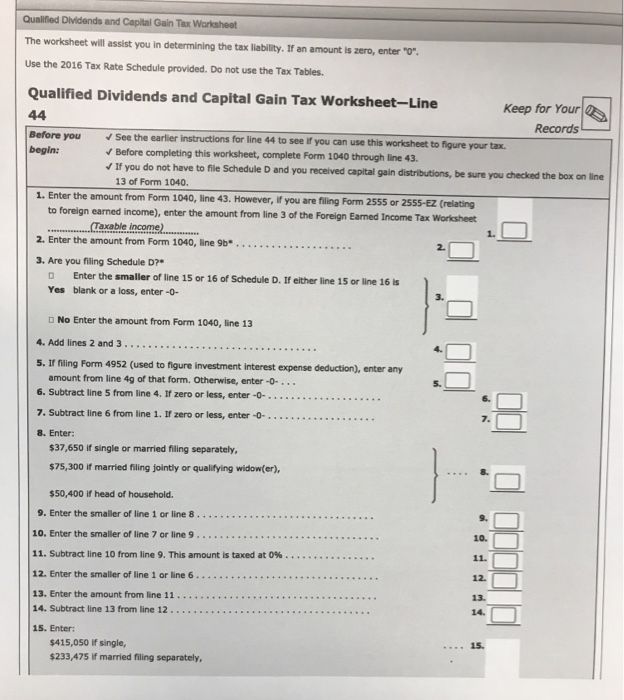

1040 qualified dividends worksheet. 2018 Qualified Dividends Worksheets - K12 Workbook Worksheets are 2018 form 1041 es, 2018 form 1040 es, 2018 estimated tax work keep for your records 1 2a, 44 of 107, Pacific grace tax accounting, Qualified dividends and capital gain tax work an, 2017 qualified dividends and capital gain tax work, Qualified dividends and capital gain tax work line. What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D. Qualified Dividends & Capital Gain_ ax Worksheet.pdf Tools for Tax Pros TheTaxBook™ Qualified Dividends and Capital Gain Tax Worksheet (2019) • See Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 11b. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions ... Free Microsoft Excel-based 1040 form available - Accounting Advisors, Inc. Line 42 - Deductions for Exemptions Worksheet; Line 44 - Qualified Dividends and Capital Gain Tax Worksheet; Line 52 - Child Tax Credit Worksheet; Lines 64a and 64b - Earned Income Credit (EIC) ... Excel-based versions of Form 1040 are available for all years from 1996 through 2008. In addition, the 2008 format is also available in Open ...

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. 'Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple ... by Anura Gurugeon February 24, 2022 This is NOT sophisticated or fancy. It is very SIMPLE & BASIC. I do my taxes by hand. SMILE. Have done so for years. I was well trained by an AMAZING tax accountant over a decade. He did all of his returns, & he had HUNDREDS of clients, by […] Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet one of the forms due with the final project University Southern New Hampshire University Course Federal Taxation I (ACC330) How to Figure the Qualified Dividends on a Tax Return Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. ... Qualified Dividends and Capital Gain Tax Worksheet Line 44 (Form 1040) Line 28 (Form 1040A) (Keep for Your Records) NAMEBefore you begin:SSN See the instructions for line 44 to see if you can use. PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... 1040, line 44 (Form 1040A, line 28). If you are filing Form 2555 or 2555-EZ, do not enter this amount on Form 1040, line 44 (or Form 1040A, line 28). Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet * If you are filing Form 2555 or 2555-EZ, see the footnote in the Foreign Earned Income Tax Worksheet before completing this ...

Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form. Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H ...

Qualified dividends, on 1040 Schedule D, worksheet, does not… This worksheet directly compute Qualified Dividends, into lower Tax rate. In 2018, they eliminated the Worksheet below. 2018 Schedule D Tax Worksheet, asks for data, but eliminated link to lower Tax rate for Qualified Divdidends.I have suspicion, how they are handling this issue of Qualified Dividends built into 2018 Schedule D worksheet.

Solved Instructions Form 1040 Schedule 1 Schedule 5 Schedule - Chegg.com instructions form 1040 schedule 1 schedule 5 schedule b qualified dividends and capital gain tax worksheet form 1040 x 7,000 6 173,182 4,453.50 + 22% 38,700 7 173,182 → 14,089.50 + 24% 2018 tax rate schedules 38,700 82,500 82,500 157,500 157,500 200,000 200,000 500,000 500,000 82,500 157,500 32,089.50 + 32% 9 8 24,000 45,689.50 + 35% 200,000 9 …

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

And Worksheet Capital Tax Form Qualified Dividends Gain Qualified Dividends and Capital Gain Tax Worksheet (2019) •Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer's tax 02)Source Code for Function that implements the "Qualified Dividends andCapital Gain Tax Worksheet" However it maintains the status quo for taxes on long-term capital ...

PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... for several years, the irs has provided a tax computation worksheet in the form 1040 and 1040a instructions for certain investors to get the benefit of the lower capital gains rates without the need to complete schedule d. taxpayers who had gains or losses from the sale, exchange, or conversion of investments or certain other items must use …

Qualified Dividends and Capital Gain Tax Worksheet Form 2015-2022 ... 2019 form 1040 qualified dividends and capital gain tax worksheet. qualified dividends and capital gain tax worksheet--line 12a. Create this form in 5 minutes! ... capital gains worksheet 2021 qualified dividends and capital gain tax worksheet 2021? signNow combines ease of use, affordability and security in one online tool, all without forcing ...

Qualified Dividends Tax Worksheet - Fill Out and Use The IRS has made available a new qualified dividends tax worksheet form (1096-DIV) for the 2019 tax year. The form is used to report distributions on Form 1040, Schedule B, and ensure that the correct amount of tax is withheld. This guide will provide an overview of the form and instructions on how to complete it. What are qualified dividends?

Solved: The Qualified Dividends and Capital Gains Tax worksheet ... The Qualified Dividends and Capital Gains Tax worksheet correctly calculates the 15% tax on these amounts but I cannot see how it is ever reflected on my 1040 return. The amount on line 27 of the Qualified Dividends and Capital Gains Tax worksheet is placed on line 11 of form 1040.

Qualified Dividends and Capital Gain Tax Worksheet. - CCH Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018. On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax ...

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15.

Qualified Dividends and Capital Gains Worksheet-Completed Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

0 Response to "39 1040 qualified dividends worksheet"

Post a Comment