38 1031 exchange worksheet excel

1031 Exchange - Overview and Analysis Tool (Updated Apr 2022) A 1031 Exchange, or Like-kind Exchange, is a strategy in which a real estate investor can defer both capital gains tax and depreciation recapture tax upon the sale of a property and use that money, which has not been taxed, to purchase a like-kind property. Important Note: This material has been prepared for informational purposes only, and is ... 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out We always effort to show a picture with high resolution or with perfect images. 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out can be valuable inspiration for those who seek an image according specific categories, you will find it in this website. Finally all pictures we have been displayed in this website will inspire you all.

Library of 1031 Exchange Forms Phone: 800-735-1031 Email: info@post1031.com "WASHINGTON STATE LAW, RCW 19.310.040, REQUIRES AN EXCHANGE FACILITATOR TO EITHER MAINTAIN A FIDELITY BOND IN AN AMOUNT OF NOT LESS THAN ONE MILLION DOLLARS THAT PROTECTS CLIENTS AGAINST LOSSES CAUSED BY CRIMINAL ACTS OF THE EXCHANGE FACILITATOR, OR HOLD ALL CLIENT FUNDS IN A QUALIFIED ESCROW ACCOUNT ...

1031 exchange worksheet excel

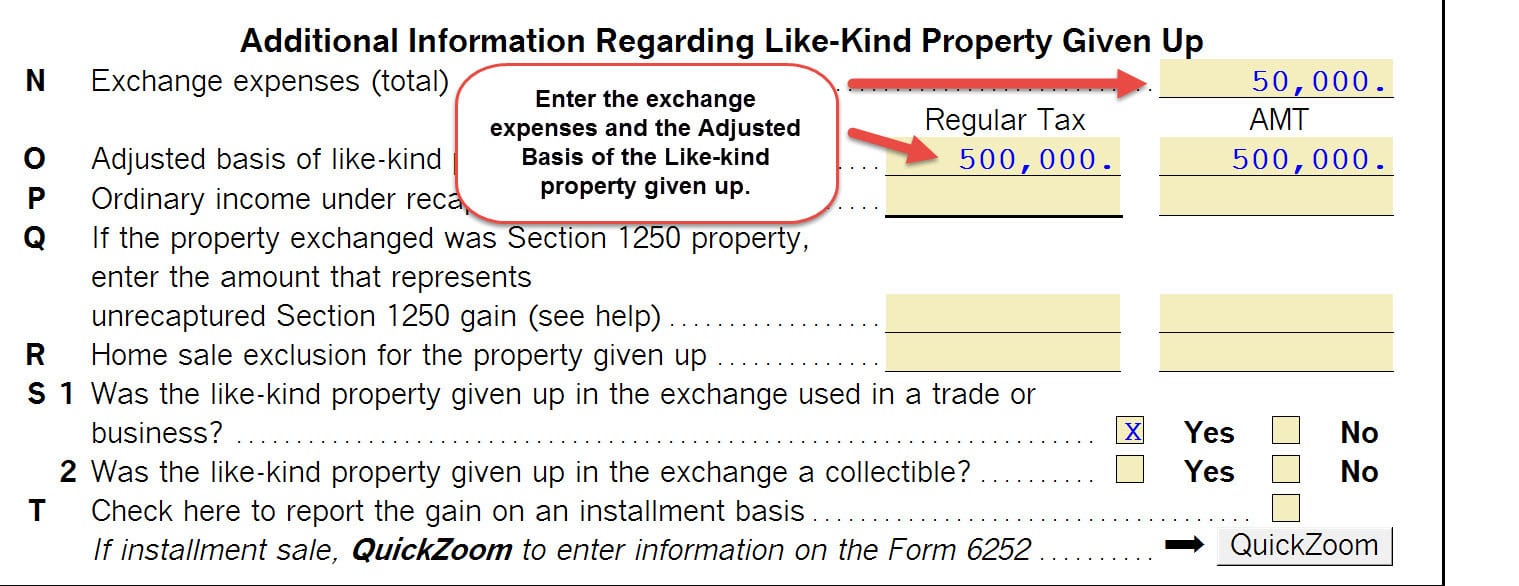

PDF §1031 Basis Allocation Worksheet - Irex received in exchange for the property sold.....$ _____ 4. Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost ... §1031 BASIS ALLOCATION WORKSHEET Replacement Property Depreciation Analysis (Supplement to §1031 Recapitulation Worksheet Form 354) Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824. IRS Form 8824, the 1031 Exchange form, is where you report your Section 1031 Exchange - Delayed, Reverse, or Construction. The Form 8824 is due at the end of the tax year in which you began the transaction, as per the Form 8824 Instructions. Even if you did not close on your Replacement Property until the following year, Form 8824 ... Excel 1031 Property Exchange - Business Spreadsheets Excel 1031 property exchange for real estate and loan Browse Main Excel Solution Categories Additional Excel business solutions are categorized as Free Excel solutions and the most popular. Further solutions proposed for specific user requirements can be either found in the Excel Help Forum .

1031 exchange worksheet excel. 1031 Exchange Calculator | Calculate Your Capital Gains (1) To estimate selling costs use 8 to 10% of selling price consider discounts or allowances given by seller. (2) To estimate residential depreciation taken multiply purchase price of property being sold by 3%, times the number of years the property has been rented. PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) 1031 Exchange Tax Worksheet And Free 1031 Exchange Worksheet Excel 1031 Exchange Tax Worksheet And Free 1031 Exchange Worksheet Excel Worksheet April 17, 2018 We tried to get some amazing references about 1031 Exchange Tax Worksheet And Free 1031 Exchange Worksheet Excel for you. Here it is. It was coming from reputable online resource which we enjoy it. We hope you can find what you need here. 1031 Tax Deferred Exchange Worksheet And 1031 Exchange Excel Spreadsheet We always attempt to show a picture with high resolution or with perfect images. 1031 Tax Deferred Exchange Worksheet And 1031 Exchange Excel Spreadsheet can be beneficial inspiration for those who seek an image according specific topic, you can find it in this website. Finally all pictures we've been displayed in this website will inspire you all.

Instructions for Form 8824 (2021) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1. IRC 1031 Like-Kind Exchange Calculator Everything You Need to Know About 1031 Exchanges. 1031 tax-deferred swaps allow real estate investors to defer paying capital gains taxes when they sell a property that is used "for productive use in a trade or business," or for investment.This is due to IRC Section 1031, and when structured correctly, it lets you sell a property and reinvest the proceeds in a new property - while deferring ... 1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property Includes state taxes and depreciation recapture Immediately download the 1031 exchange calculator PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ ____________________________ B. Taxable gain from WorkSheet #7 (Line J) $____________________________

The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) In a partial 1031 exchange, "boot" refers to any leftover sale proceeds subject to tax. Boot results from a difference in value between the original property, known as the relinquished property, and the replacement property. When the replacement property has a lower value than the sale price of the relinquished property, that difference is ... Real Estate Investment Software Product Comparison ... - RealData Software View all Excel-based real estate investment and development software products for commercial and residential income property analysis. We've been hiding our bundles under a bushel! Find out more >> 800-899-6060 Sign in Email us Software customers - Download your software, get updates and serial numbers. Sign In ... PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 1031 Exchange Calculator - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

1031 Exchange Calculator - Dinkytown.net Colorful, interactive, simply The Best Financial Calculators! This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received). If you take cash ...

1031 Exchange Calculator - Penn's Grant Realty Corporation 1031 Exchange Calculator We'll be happy to help you with calculating your 1031 Exchange, please give us a call 215-489-3800.

1031 Exchange Worksheet - Pruneyardinn The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet.

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 The following example is used throughout this workbook, and a completed Worksheet using this example is included. EXAMPLE: To show the use of the Worksheet, we will use the following example of an exchange transaction. In this example, the exchanger will buy down in value and receive excess exchange escrow funds. 1. Basis.

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template We always effort to reveal a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be valuable inspiration for people who seek an image according specific topic, you will find it in this website. Finally all pictures we have been displayed in this website will inspire you all.

Form 8824 - 1031 Corporation Exchange Professionals We hope that this worksheet will help with these reporting issues that present difficulties in reporting 1031 Exchanges. However, we recognize that almost all Exchanges are different and that this worksheet might or might not work for any given Exchange. It is offered as a possible tool for the use of our clients and their tax professionals.

1031 Tool Kit - TM 1031 Exchange Analyze Reinvestment - Exchange: The power of a 1031 Exchange is the ability to use dollars otherwise spent in paying taxes. Over the course of a lifetime the benefits of greater cash flow, appreciation and equity buildup can equal many times the actual taxes paid. The above calculations are meant as an estimate and are not guaranteed for accuracy.

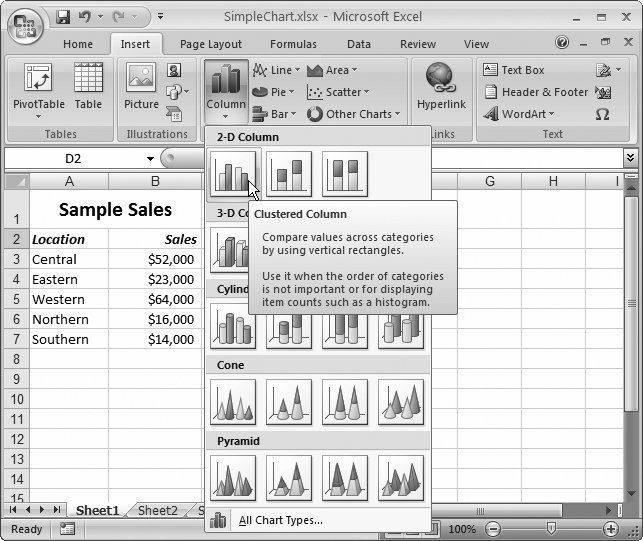

PDF 2019 Exchange Reporting Guide - 1031 Corp We realize the form used to report your 1031 exchange is not the easiest form to complete so we have included line by line instructions to assist you. Additionally, we have developed a Microsoft Excel spreadsheet to help you with the preparation of IRS Form 8824 "LikeKind Exchanges."

1031 Exchange Analysis Calculator - Inland Investments CLEAR SESSION. Step 2: Enter Exchange Options. Enter the information on the replacement property or properties that have been identified for the exchange. ADD EXCHANGE OPTIONS NEXT: SUMMARY. Step 3: 1031 Exchange Analysis Summary. This step summarizes the percent ownership in a real estate exchange transaction.

Excel 1031 Property Exchange - Business Spreadsheets Excel 1031 property exchange for real estate and loan Browse Main Excel Solution Categories Additional Excel business solutions are categorized as Free Excel solutions and the most popular. Further solutions proposed for specific user requirements can be either found in the Excel Help Forum .

Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824. IRS Form 8824, the 1031 Exchange form, is where you report your Section 1031 Exchange - Delayed, Reverse, or Construction. The Form 8824 is due at the end of the tax year in which you began the transaction, as per the Form 8824 Instructions. Even if you did not close on your Replacement Property until the following year, Form 8824 ...

PDF §1031 Basis Allocation Worksheet - Irex received in exchange for the property sold.....$ _____ 4. Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost ... §1031 BASIS ALLOCATION WORKSHEET Replacement Property Depreciation Analysis (Supplement to §1031 Recapitulation Worksheet Form 354)

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

0 Response to "38 1031 exchange worksheet excel"

Post a Comment