44 social security worksheet for 1040a

Forms and Publications (PDF) - IRS tax forms Social Security and Medicare Tax On Unreported Tip Income 2021 12/20/2021 Publ 4512-A (EN-SP) Getting Your Taxes Done--Obtaining Prior Year Returns, Transcripts and Social Security Numbers (English/Spanish) 1217 02/01/2018 Publ 5519: Economic Impact Payment: When Someone in Your Family Doesn't have a Social Security Number ... PDF 2017 Form 1040A - IRS tax forms 1040A U.S. Individual Income Tax Return (99) 2017 Department of the Treasury—Internal Revenue Service . OMB No. 1545-0074 IRS Use Only—Do not write or staple in this space. Your first name and initial . Last name Your social security number . If a joint return, spouse's first name and initial . Last name . Spouse's social security number

Tips for Seniors in Preparing their Taxes | Internal ... Use the Social Security benefits worksheet found in the instructions for IRS Form 1040 and Form 1040A, and then double-check it before you fill out your tax return. See Publication 915 PDF, Social Security and Equivalent Railroad Retirement Benefits.

Social security worksheet for 1040a

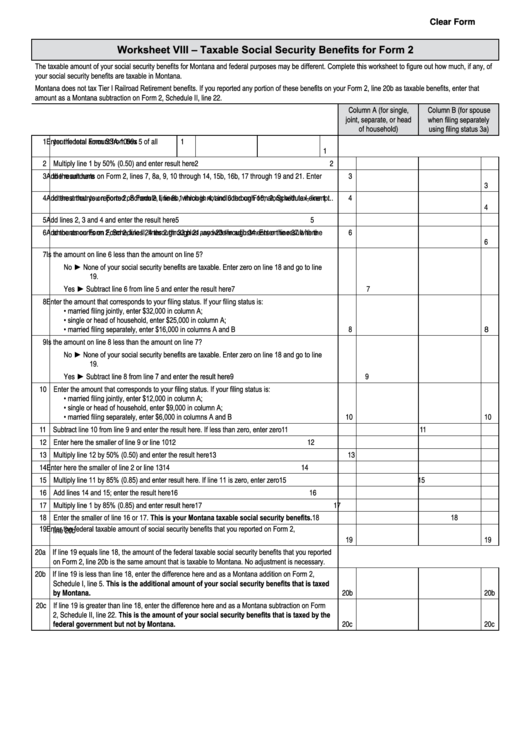

1040 - Literal D for SS Benefits Income You're referring to a statement at the top of the social security benefits worksheet in the 1040 and 1040A instructions. On a 1040 return, line 6a (line 5a in Drake19; line 5b in Drake18; line 20b, or 1040A return, line 14b in Drake17 and prior), the software inserts the literal "D" when these conditions are met: Will Your Social Security Benefits Be Taxed? - AARP sum of adjusted gross income plus nontaxable interest plus one-half of the Social Security benefit amount. (See lines 1-7 on the worksheet.) 4 Head of household ...2 pages Social Security Taxable Benefits Worksheets - K12 Workbook Worksheets are 30 of 107, Social security benefits work 2018, Social security benefits work forms 1040 1040a, Social security how much is taxable and 4 equivalent, 2013 social security benefits work lines 20a and 20b, Social security benefits work work 1 figuring, Social security and taxes, Benefits children selected by the center may appear in.

Social security worksheet for 1040a. Worksheet 1 Forms 1040, 1040A - Drake-produced PDF Form 1040A filers: Enter the amounts from Form 1040A, lines 16 and 17 Is the amount on line 7 less than the amount on line 6? None of your social security benefits are taxable. Enter -0- on Form 1040, line 20b, or Form 1040A, line 14b. Subtract line 7 from line 6 If you are: Married filing jointly, enter $32,000 Reportable Social Security Benefits - Iowa The reportable Social Security benefit is calculated using the worksheet below and entered on Step 4 of the IA 1040. Social Security Worksheet. 1. Enter the amount from Box 5 of form (s) SSA-1099. If you filed a joint federal return, enter the totals for both spouses. Do not include Railroad Retirement benefits from form RRB-1099 here. PDF Appendix B. Worksheets for Social Security Recipients Who ... Proceed to Worksheet 3. 3. Subtract line 2 from line 1 ............................................ 3. 4. Multiply line 3 by the percentage below that applies to you. If the result is not a multiple of $10, round it to the next highest multiple of $10. (For example, $611.40 is rounded to $620.) However, if the result is less than $200, enter $200. 36 Social Security Worksheet For 1040a - Worksheet Source ... 36 Social Security Worksheet For 1040a - Worksheet Source 2021 2019 Schedule 8812 Form and Instructions (Form 1040) 2020 Schedule E Form and Instructions (Form 1040) 36 Social Security Disability Worksheet - Worksheet Source 2021 2018 Schedule 1 Form and Instructions Fillable Form 1040 - Social Security Benefits Worksheet - Lines 20a And ...

Taxable Social Security Benefits If filing federal 1040A, use lines 7, 8a, 9a, 10, 11b, 12b, and 13, plus one-half of any Railroad Retirement Social Security benefits from RRB-1099. Include any bonus depreciation / section 179 adjustment from line 14 of the Iowa 1040 to compute correct amount. PDF Social Security Benefits Worksheet (PDF) - IRS tax forms Social Security Benefits Worksheet—Lines 5a and 5b. Keep for Your Records. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). If you are married filing separately and you lived apart from your spouse for all of 2018, enter "D" to STATE OF CONNECTICUT AN 2017(10) Taxability of Social ... Taxability of Social Security Benefits for ... taxable, you must use federal Form 1040A or. Form 1040. ... Social Security Benefit Adjustment Worksheet in.2 pages Social Security Benefits Worksheet—Lines 14a and 14b Social Security Benefits Worksheet—Lines 20a and 20bKeep for Your Records 1. Enter the total amount from box 5 of allyour Forms SSA-1099 and RRB-1099 Add the amounts on Form 1040, lines 7, 8a, 9 through 14, 15b, 16b, 17 through 19, and 21. Do not include amounts from box 5 of Forms SSA-1099 or RRB-1099 3. Add lines 2, 3, and 4 4. 5.

Worksheet to Figure Taxable Social Security Benefits The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount. Social Security worksheet for Form 1040 Social Security worksheet for Form 1040A The file is in Adobe portable document format (PDF), which requires the use of Adobe Acrobat Reader. 1040a Worksheet - Fill and Sign Printable Template Online ... Ines 14a and 14b Social Security Benefits Worksheet Lines 14a and 14b Before you begin: Keep for Your Records Complete Form 1040A, lines 16 and 17, if they apply to you. If you are married filing separately and you lived apart from your spouse for all of 2005, enter D to the right of the word benefits on line 14a. PDF Social Security Benefits Worksheet (2019) - Thomson Reuters Social Security Benefits Worksheet (2019) Caution: Do not use this worksheet if any of the following apply. 1) If the taxpayer made a 2019 traditional IRA contribution and was covered (or spouse was covered) by a qualified retirement plan, see IRA Deduction and Taxable Social Security on Page 14-6. Social Security Worksheet For 1040a Some of the worksheets displayed are 30 of 107 social security benefits work work 1 social security benefits work 2018 social security benefits work forms 1040 1040a 2013 social security benefits work lines 20a and 20b introduction objectives topics 450 columbus blvd ste 1 hartford ct 06103 1837 2018.

Social Security Benefits Worksheet Pdf - Isacork Social security benefits worksheet figuring your taxable benefits 2016 tip worksheet 1 forms 1040, 1040a before you begin: Social security benefits worksheet 2019 caution. Then after completing the social security worksheet you can come back and fill out the unemployment compensation worksheet and you should get the to the $4,976 taxable amount.

2021 Publication 915 - Internal Revenue Service Jan 6, 2022 — They complete Worksheet 1, shown below, entering $29,750 ($15,500 + $14,000 +. $250) on line 3. They find none of Ray's social security benefits ...

PDF Social Security Benefits Worksheet—Lines 14a and Social Security Benefits Worksheet—Lines 14a and 14bKeep for Your Records Complete Form 1040A, lines 16 and 17, if they apply to you. If you are married filing separately and you lived apart from your spouse for all of 2013, enter "D" to the right of the word "benefits" on line 14a. If you do not, you may get a math error notice from the IRS.

0 Response to "44 social security worksheet for 1040a"

Post a Comment