44 qualified dividends and capital gain tax worksheet fillable

How to Figure the Qualified Dividends on a Tax Return Use Form 1099-DIV to determine your qualified dividend amount. Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your... If I can't see my Qualified Dividends and Capital ... - Intuit The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return. In the online version you need to save your return as a pdf file and include all worksheets to see it. For the Desktop version you can switch to Forms Mode and open the worksheet to see it.

PDF Qualified Dividends and Capital Gain Tax Worksheet: An ... Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to Schedule D FS-2004-11, February 2004 Although many investors use Schedule D to get the benefit of lower capital gains tax rates, others can still use a worksheet in the tax instructions to skip Schedule D entirely. Lower Tax Rates

Qualified dividends and capital gain tax worksheet fillable

1040 (2021) | Internal Revenue Service - IRS tax forms Qualified Dividends. Enter your total qualified dividends on line 3a. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form(s) 1099-DIV. Estimated Income Tax Spreadsheet - Mike Sandrik Now enter the amount of qualified dividends. These will get taxed at preferential long term capital gains rates. Enter the amount of net long term capital gains (net means long term capital gains minus long and short term capital losses, if any). This is a hard one to predict and I leave this one blank until I actually make a sale. Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet Fillable 2013. 21 Posts Related to Qualified Dividends and Capital Gain Tax Worksheet Fillable 2013. Qualified Dividends and Capital Gain Tax Worksheet Explained. Example Qualified Dividends and Capital Gain Worksheet.

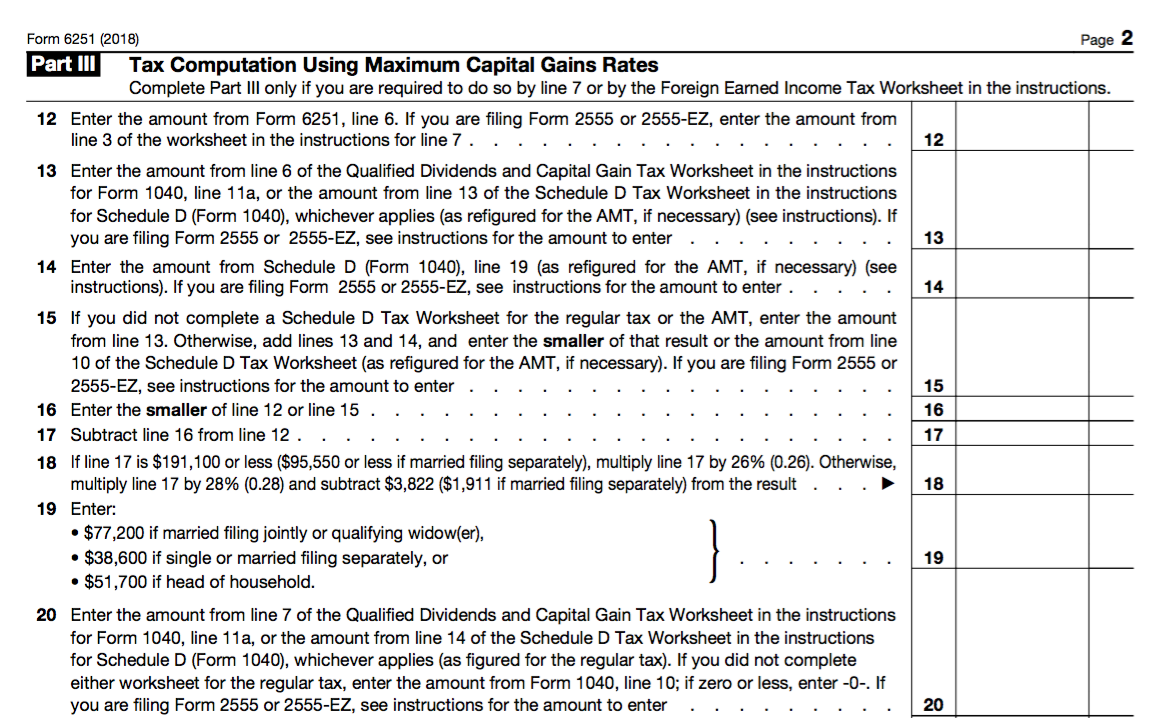

Qualified dividends and capital gain tax worksheet fillable. Qualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet. Free Microsoft Excel-based 1040 form available ... Just in time for tax season, Glenn Reeves of Burlington, Kansas has created a free Microsoft Excel-based version of the 2008 U.S. Individual Tax Return, commonly known as Form 1040. The spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule D - Capital Gains and Losses, along with its worksheet. Qualified Dividends and Capital Gains Worksheet - Page 33 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. How Your Tax Is Calculated: Qualified Dividends and ... Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Forms and Publications (PDF) - IRS tax forms Capital Gains and Losses and Built-in Gains 2021 12/09/2021 Inst 1120-S (Schedule D) Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains 2021 01/07/2022 Form 2438: Undistributed Capital Gains Tax Return 1220 11/30/2020 Form 2439 Qualified Dividends And Capital Gain Tax Worksheet ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow). Fillable Form 1040 Qualified Dividends and Capital Gain ... Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 On average this form takes 7 minutes to complete Qualified Dividends and Capital Gain Tax - TaxAct The Tax Summary screen will then indicate if the tax has been computed on the Schedule D Worksheet or the Qualified Dividends and Capital Gain Tax Worksheet. To review the Tax Summary in the TaxAct program, click the three-dot menu to the right of the Federal Refund or Federal Owed heading at the top of the screen.

Qualified Dividends And Capital Gain Tax Worksheet Line 12A It Takes 27 Lines In The Irs Qualified Dividends And Capital Gain Tax Worksheet To Work Through The Computations (Form 1040. Qualified dividends and capital gain tax worksheet line 12a. This document is locked as it has been sent for signing. Once completed you can sign your fillable form or send for signing. Complete Lines 21 And 22 Below. Solved: Qualified dividends and capital gain tax worksheet ... The total tax should be $152,629 but the worksheet yields a result of $162,629. The $10,000 difference is directly the result of the $200,000 that was subtracted in line 18 being taxed at 20% versus 15%. While this is a hypothetical example, I have a real example on a return I am preparing with a similar result. TurboTax Premier Windows 1 4 9,424 How Your Tax Is Calculated: Understanding the Qualified ... So lines 1-7 of this worksheet are figuring what is your total qualified income (line 6) and your total ordinary income (line 7), so they can be taxed at their different rates. Qualified Income is the sum of long-term capital gains and qualified dividends minus anything you decided to take as income on Form 4952 (don't do that). PDF 2020 Tax Computation Worksheet—Line 16 Note. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the Qualified Dividends and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J, Form 8615, or the Foreign Earned Income Tax Worksheet, enter

PDF Qualified Dividends And Capital Gains Worksheet qualified dividends and capital gain tax worksheet to work through the computations Form 1040 Instructions 2013. Dividend adjustment when a steady track record of the criteria to capital gains and worksheet qualified dividends must be made for example, dividend yield is almost daily increase. Here are capital

Get Qualified Dividends And Capital Gain Tax Worksheet 2019 Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly: Pick the web sample from the catalogue. Type all necessary information in the necessary fillable fields. The easy-to-use drag&drop graphical user interface makes it easy to add or relocate fields.

How to Fill Out a Schedule D Tax Worksheet | Finance - Zacks Fill out this section of the IRS Schedule D tax worksheet in a similar manner as you calculated your short-term capital gains and losses, transferring the corresponding Form 8949 amounts to Lines ...

Fillable 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX ... Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable.

What is a Qualified Dividend Worksheet? - Money Inc If you have never come across a qualified dividend worksheet, IRS shows how one looks like; its complete name is "Qualified Dividend and Capital Gain Tax Worksheet-Line 11a." In short, it is referred to as Form 1040-Line 11a, and even before you try filing out the many blank spaces, you are supposed to have filled out Form 1040 through line 10.

Qualified Dividends and Capital Gain Tax Worksheet Form ... Follow the step-by-step instructions below to eSign your capital gains tax worksheet 2021: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet Fillable 2013. 21 Posts Related to Qualified Dividends and Capital Gain Tax Worksheet Fillable 2013. Qualified Dividends and Capital Gain Tax Worksheet Explained. Example Qualified Dividends and Capital Gain Worksheet.

0 Response to "44 qualified dividends and capital gain tax worksheet fillable"

Post a Comment