41 cancellation of debt worksheet

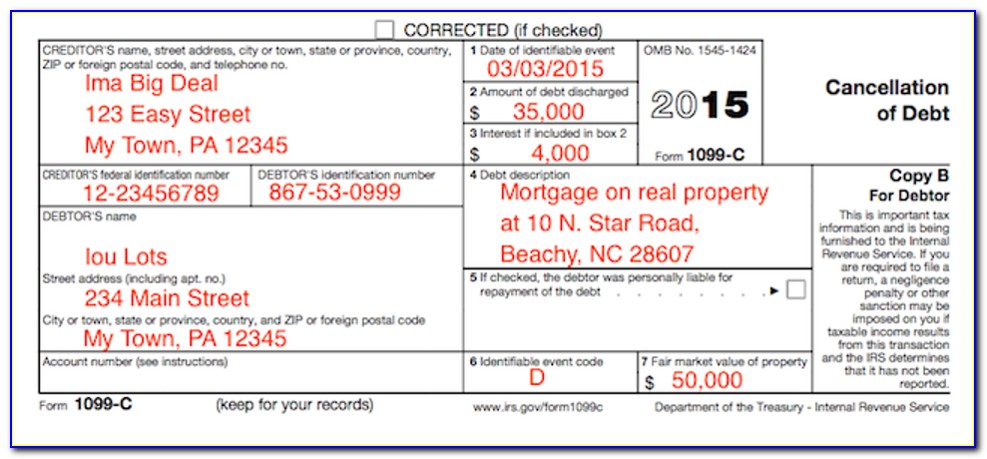

What You Need To Know About Debt Cancellation | National ... The Internal Revenue Service considers forgiven debt of $600 or more to be income for income tax purposes. If your canceled debt falls under this definition, you'll receive a Form 1099-C, Cancellation of Debt, from the lender that forgave the debt. You must report any canceled debt — including debts of less than $600 — on your income tax return. The Best Free Debt-Reduction Spreadsheets Download the Credit Repair Edition of the debt-reduction spreadsheet to first pay down each credit card to specific levels determined by your FICO score. Once you reach that that goal, the spreadsheet shows you how to start paying off all credit card balances. Squawkfox Debt-Reduction Spreadsheet

How to Deal With Debt Collectors: 3-Step Guide - NerdWallet 3 steps for dealing with a debt collector. 1. Don't give in to pressure to pay on first contact. Just as you wouldn't jump into a contract without understanding its terms, don't rush to make a ...

Cancellation of debt worksheet

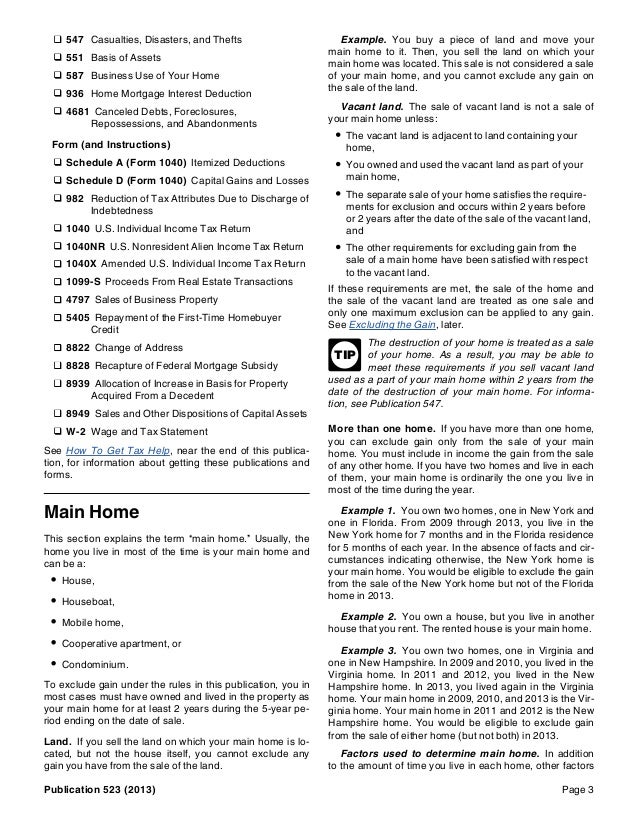

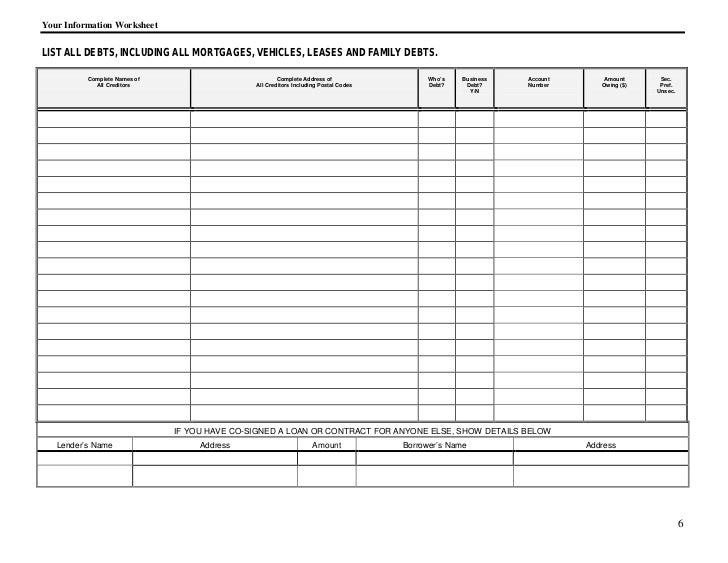

› publications › p4681Publication 4681 (2021), Canceled Debts, Foreclosures ... Dec 31, 2020 · By completing the Insolvency Worksheet, James determines that, immediately before the cancellation of the debt, he was insolvent to the extent of $5,000 ($15,000 total liabilities minus $10,000 FMV of his total assets). He can exclude $5,000 of his $7,500 canceled debt. What if I am insolvent? | Internal Revenue Service The forgiven debt may be excluded as income under the "insolvency" exclusion. Normally, a taxpayer is not required to include forgiven debts in income to the extent that the taxpayer is insolvent. The forgiven debt may also qualify for exclusion if the debt was discharged in a Title 11 bankruptcy proceeding or if the debt is qualified farm ... How do I report excludable (non-taxable) canceled debt? Debt canceled due to insolvency . To qualify, you must demonstrate that your total debt exceeded the fair market value of all of your assets immediately before the cancelation occurred. Use the Insolvency Worksheet in IRS Publication 4681 to figure out if you were insolvent at the time of the debt cancelation.

Cancellation of debt worksheet. What Is Cancellation of Debt? | SOLVABLE Cancellation of debt form refers to IRS Form 1099-C, which will be filed by a creditor that agrees to forgive all or a portion of your debt. Under most circumstances, the amount forgiven must be reported as income for the year in question. What Is Cancellation of Debt? Is canceled, forgiven, or discharged debt taxable? Most likely. Canceled, forgiven, or discharged debt is considered taxable income unless it qualifies for either an exclusion or an exception. Debt that qualifies for an exclusion. Cancelation of qualified principal residence indebtedness (aka mortgage debt relief). In this scenario, TurboTax will complete Form 982 and include it with your return. 1099-C Cancellation of Debt Form: What Is It? | Credit.com Not every debt cancellation involves a 1099-C form. But if you received this form in the mail, it's because of a debt cancellation that occurred at some point during the previous tax year. Box 6 on the 1099-C form should have a code to help you determine why you received the form. How To Report Ppp Loan Forgiveness On Tax Return ... The process of filing Form 1099-C for cancellation of debt is so standard that many lenders have automated the filing as part of their typical tax information reporting obligations. ... On the Shareholders Basis Worksheet, Page 1, Line 7.

How to write off a bad debt — AccountingTools There are two ways to account for a bad debt, which are noted below. Direct Write Off Method The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be paid. The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. Insolvency Worksheet - 16 images - irs insolvency ... [Insolvency Worksheet] - 16 images - insolvency worksheet, qualified dividends and capital gain tax worksheet, worksheet for form 982 printable worksheets and, form 10 example insolvency worksheet printables ez db, Entering Form 1099-C with insolvency (Form 982) in Lacerte Scroll down to the Alimony and Other Income section. Enter the Cancelation of debt (1099-C) as a positive amount. Enter the same amount as a negative amount in Other income (Ctrl+E). For example, if the amount you entered for step 3 was 5,000, you should enter -5,000 for step 4. This will generate a statement on Form 1040, line 8. Forms - Defense Finance and Accounting Service Debt Repayment Forms (Voluntary Repayment / Financial Hardship Application (VRA/FHA)): Used by debtors/claimants that are unable to pay their debt in a lump sump payment to apply for a debt repayment plan based on financial circumstances. Debtors have the right to apply for a monthly repayment plan within 30 days of receipt of their debt letter.

Is Student Loan Forgiveness Tax-Free? Receiving $50,000 of student loan cancellation might sound wonderful on the surface. But if those forgiven dollars are considered taxable income by the federal government, you could find that you... Free Debt Forgiveness Letter Template | Sample - PDF ... Record the Debt Amount being forgiven on the blank line after the dollar sign. Next, state why this money was owed on the second blank line (i.e. loan, accident, etc.) 4 - This Letter Will Need A Closing Signature. In order to successfully close this letter, the Sender must sign his or her Name on the blank line under the word "Sincerely.". What if my debt is forgiven? | Internal Revenue Service Generally, if you borrow money from a commercial lender and the lender later cancels or forgives the debt, you may have to include the cancelled amount in income for tax purposes. The lender is usually required to report the amount of the canceled debt to you and the IRS on a Form 1099-C, Cancellation of Debt. How To Report Relief Of Indebtedness On A Partnership ... If a lender or creditor cancels a $600-800 debt owed to them on Form 1099-C, Cancellation of Debt, then they must issue that form on their behalf. For taxpayers filing Form 1040, all amounts canceled on or before August 31, 2017, will need to be included on the line "Other Income".

Irs Assets And Liabilities Worksheet? - ictsd.org Cancellations of debt are exempt from cancellation fees if certain amounts are transferred as gifts, bequests, devises, or inheritances. Student loans are subject to Cancellation in certain circumstances when working as a member of a broad group of employers in certain professions for a period of time. What Does Insolvency Mean Irs?

› how-to-use-irs-form-982-andHow to Use IRS Form 982 and 1099-C: Cancellation of Debt Feb 15, 2021 · The Internal Revenue Service (IRS) considers debt cancellation to be a form of income and so if you have had cancelled debt, you can probably expect to see a 1099-C. If you are not certain why you received a 1099 C form, look at Box 6 to identify cancellation code.

1099-C Cancellation of Debt | H&R Block The 1099-C form reports a cancellation of debt; creditors are required to issue Form 1099-C if they cancel a debt of $600 or more. Form 1099-C must be issued when an identifiable event in connection with a cancellation of debt occurs. Who files a 1099-C? A lender files a 1099-C with the IRS - and they'll send you a copy of the form.

I Have a Cancellation of Debt or Form 1099-C - Taxpayer ... In general, if you're liable for tax because a debt was canceled, forgiven, or discharged, you'll receive an Form 1099-C, Cancellation of Debt, from the lender or the person who forgave the debt. You may receive an IRS Form 1099-C while the creditor is still trying to collect the debt. If so, the creditor may not have canceled it.

Free Debt Payoff Log Worksheet Printable |Finances ... Option One: Look for the bill that has the highest interest and work at paying that one off first. This means that you work at paying more than the minimum due each month to knock it out the fastest. The idea here is that you should eliminate the highest interest charges first. After you paid off the highest rate debt, move on to the next one.

Form 1099-C: Cancellation of Debt Definition How to File Form 1099-C: Cancellation of Debt. Form 1099-C is used to declare amounts of $600 or more that is forgiven or canceled by a lender or creditor, including the abandonment of secured ...

1099-C frequently asked questions - CreditCards.com At its most basic level, a 1099-C reports a debt that was canceled, forgiven, never paid back or wiped out in bankruptcy. Here are some reasons you may have gotten a Form 1099-C: You cut a deal with your credit card issuer, and it agreed to accept less than you owed. You had a student loan, or part of a student loan, forgiven.

I Received a 1099-C, Cancellation of Debt. Is this taxable ... The other common way to exclude cancelled debt from taxation is through insolvency. You are insolvent if your total debts exceed your total assets. If you are insolvent at the time of bankruptcy, the cancelled debt can be excluded from taxation up to the amount you are insolvent. The IRS provides an insolvency worksheet in Publication 4681.

Entering canceled debt in ProSeries - Intuit Type in CAN to highlight the line labeled Canceled Debt. Click OK to open the Canceled Debt Worksheet. Scroll down to the Business, Farm, and Rental Debt Smart Worksheet below line 30. Double-click one of the following options to link the 1099-C to that activity: Schedule C, Business Schedule E, Rental Schedule F, Farm Form 4835, Farm Rental

Insolvency Worksheet - SOLVABLE You can determine the degree of your individual or business insolvency by filling out the insolvency worksheet. In the worksheet, you will list all your assets and liabilities. Be careful to only list assets you acquired before the day of debt cancellation.

What Is IRS Form 1099-C? - The Balance Box 1 tells you the date when the debt was canceled. Box 2 cites the amount of debt that was forgiven. Box 3 reports any interest that might have been included in the figure in Box 2. Box 4 describes the debt in question. Box 5 states whether you were personally liable for repaying the debt.

When to Use Tax Form 1099-C for Cancellation of Debt ... Since you essentially received money for free, the cancellation of your obligation to pay it back makes it taxable income. Form 1099-C According to the IRS, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you. You'll receive a Form 1099-C, "Cancellation of Debt," from the lender that forgave the debt.

How do I report excludable (non-taxable) canceled debt? Debt canceled due to insolvency . To qualify, you must demonstrate that your total debt exceeded the fair market value of all of your assets immediately before the cancelation occurred. Use the Insolvency Worksheet in IRS Publication 4681 to figure out if you were insolvent at the time of the debt cancelation.

What if I am insolvent? | Internal Revenue Service The forgiven debt may be excluded as income under the "insolvency" exclusion. Normally, a taxpayer is not required to include forgiven debts in income to the extent that the taxpayer is insolvent. The forgiven debt may also qualify for exclusion if the debt was discharged in a Title 11 bankruptcy proceeding or if the debt is qualified farm ...

› publications › p4681Publication 4681 (2021), Canceled Debts, Foreclosures ... Dec 31, 2020 · By completing the Insolvency Worksheet, James determines that, immediately before the cancellation of the debt, he was insolvent to the extent of $5,000 ($15,000 total liabilities minus $10,000 FMV of his total assets). He can exclude $5,000 of his $7,500 canceled debt.

0 Response to "41 cancellation of debt worksheet"

Post a Comment