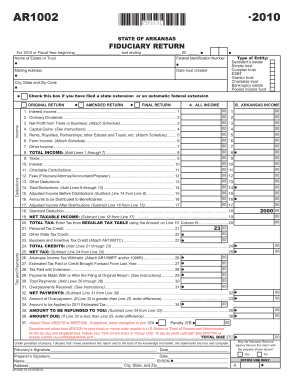

39 capital gain worksheet 2015

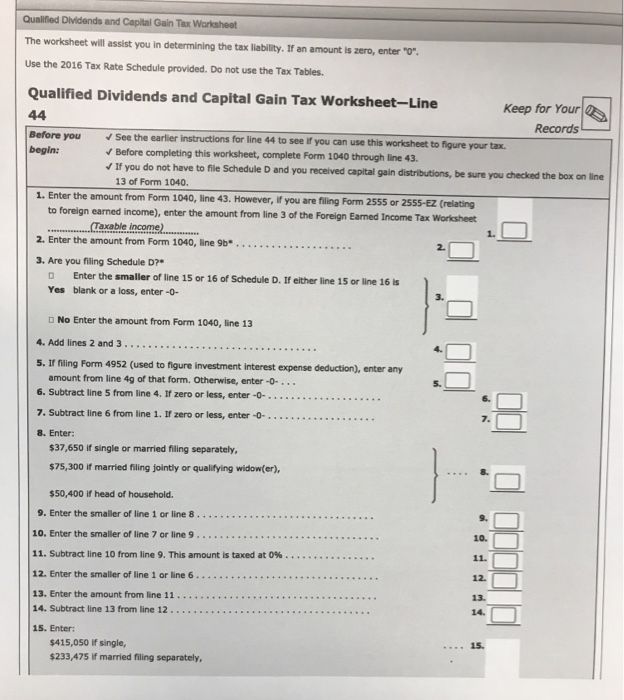

capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 Qualified ... View Homework Help - capital_gain_tax_worksheet_1040i from ACCT 4400 at University of North Texas. 2015 Form 1040Line 44 Qualified Dividends and Capital Gain Tax WorksheetLine 44 Keep for Your › Capital-Gain-Tax-WorksheetCapital Gain Tax Worksheet - 2015 Form 1040Line 44... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.Before completing this worksheet, complete Form 1040 through line 43.If you do not have to file Schedule D and you received capital gain distributions, be sure you checkedthe box on line 13 of Form 1040.Before you begin: 1.

Qualified Dividends and Capital Gain Tax Worksheet Form 2015-2022 ... Get and Sign Qualified Dividends and Capital Gain Tax Worksheet 2015-2022 Form Use the qualified dividends and capital gain tax worksheet 2021 2015 template to simplify high-volume document management. Show details How it works Upload the capital gains tax worksheet 2021

Capital gain worksheet 2015

Worksheet: Calculate Capital Gains | Realtor Magazine A Special Real Estate Exemption for Capital Gains Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale. PDF CAPITAL GAIN OR CAPITAL LOSS WORKSHEET - Australian Taxation Office This worksheet helps you calculate a capital gain for each CGT asset or any other CGT event1 using the indexation method2, ... to capital gains tax 2015. 2 Indexation method* For CGT assets acquired before 11.45am (by legal time in the ACT) on 21 September 1999, Qualified Dividends and Capital Gain Tax Worksheet Form … How to make an eSignature for the Qualified Dividends Tax Worksheetpdffillercom 2015 2019 Form on iOS capital gains worksheet 2021reate electronic signatures for signing a qualified dividends and capital gain tax worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them.

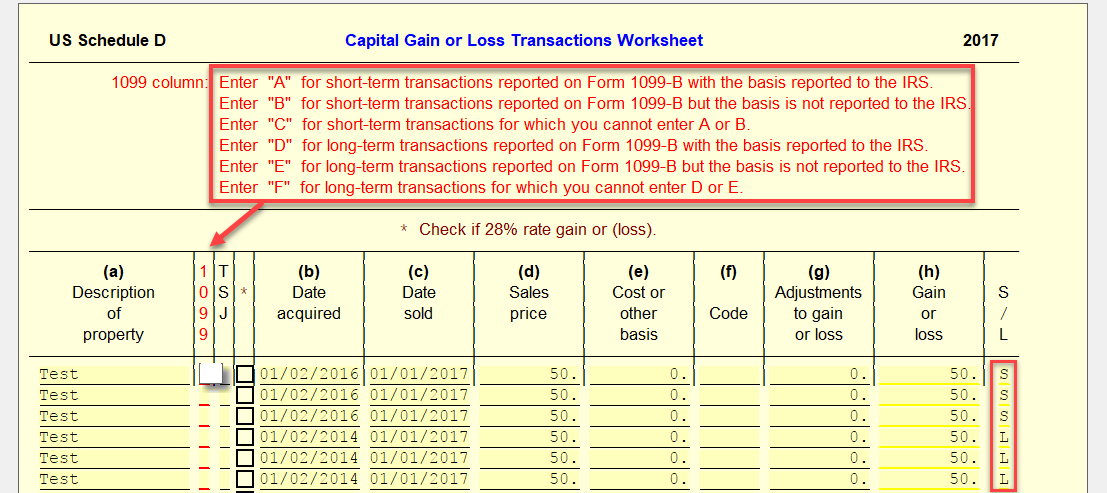

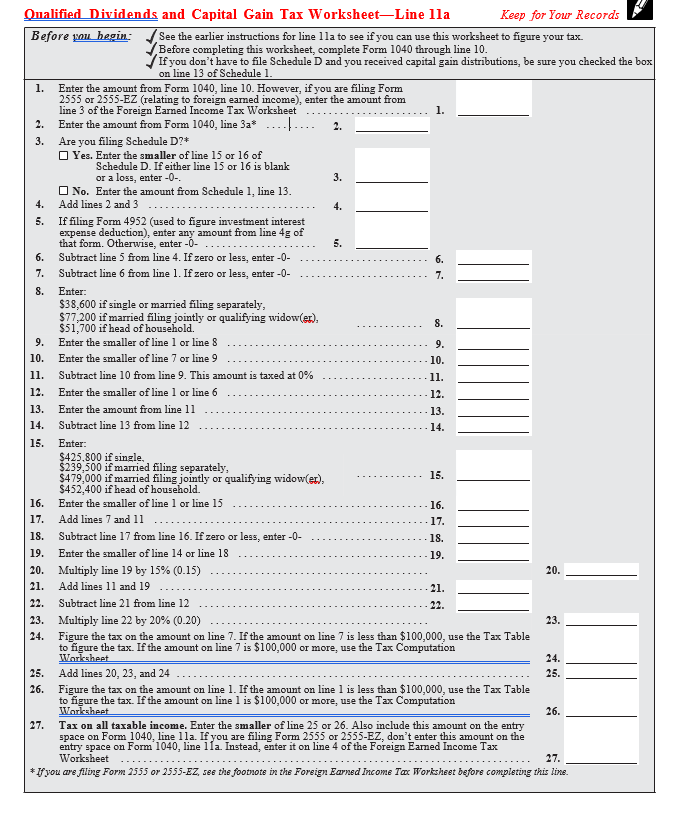

Capital gain worksheet 2015. Capital Gains and Losses - IRS tax forms 2015. Attachment Sequence No. 12. Name(s) shown on return . Your social security number. Part I Short-Term Capital Gains and Losses—Assets Held One Year or Less . See instructions for how to figure the amounts to enter on the lines below. This form may be easier to complete if you round off cents to whole dollars. (d) Proceeds (sales price ... PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. 2015 Capital Gains Carryover Worksheet - Templates : Resume Sample #27161 2015 Capital Gains Carryover Worksheet. irs qualified dividends and capital gains worksheet form california instructions federal tax simpletax 4684 2014 tax covers 3 21 3 individual in e tax returns 2014 federal tax forms bloethe tax school december 3 3 21 3 individual in e tax returns irs qualified dividends and capital gains worksheet 2010 ... PDF Capital Gains and Losses - IRS tax forms 2015 Attachment Sequence No. 12 Name(s) shown on return Your social security number Part I Short-Term Capital Gains and Losses—Assets Held One Year or Less See instructions for how to figure the amounts to enter on the lines below. This form may be easier to complete if you round off cents to whole dollars. (d) Proceeds (sales price) (e)

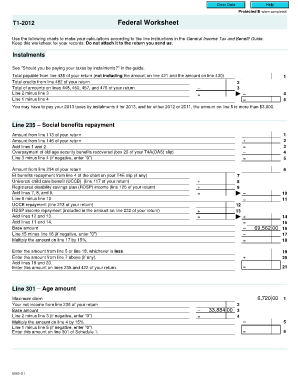

2015 Tax Return - Elizabeth Warren Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42).39 pages 2015 Capital Gains Rates - Bradford Tax Institute The table below indicates capital gains rates for 2015. Short-term capital gains. One year or less. Ordinary income tax rates, up to 39.6%. Long-term capital gains. More than one year. 0% for taxpayers in the 10% and 15% tax brackets. 15% for taxpayers in … Capital Gains Tax Calculation Worksheet - The Balance Feb 23, 2022 · Capital gains are short-term or long-term, depending on how long you owned the assets before selling them. Long-term tax rates are lower in most cases, set at 0%, 15%, or 20% as of 2022. Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another ... 2015 California Capital Gain or Loss Adjustment - CA.gov 2015 California Capital Gain or Loss Adjustment. SCHEDULE. D (540NR) ... Gain or Loss Adjustment, and the Schedule D (540NR) Worksheet for.4 pages

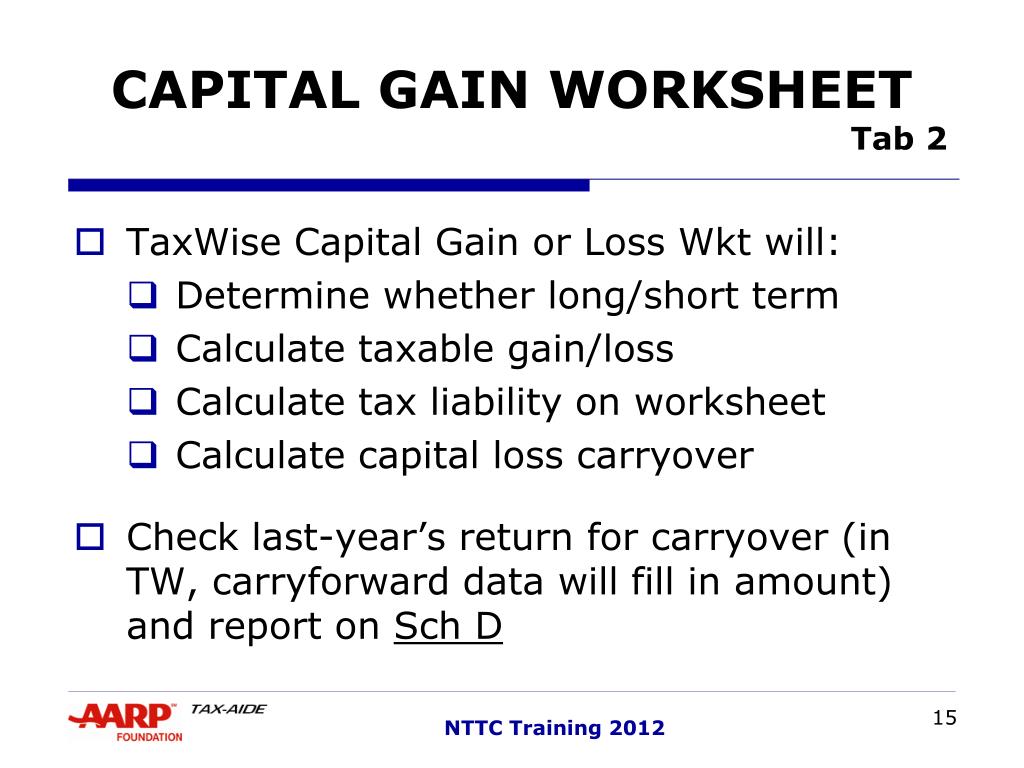

Capital Gains And Losses Worksheet 2015 - Worksheet : Template Sample # ... > Capital Gains And Losses Worksheet 2015. Capital Gains And Losses Worksheet 2015. Posts Related to Capital Gains And Losses Worksheet 2015. Capital Gains And Losses Worksheet. Capital Gains And Losses Worksheet 2010. Capital Gains Tax Worksheet Ato. Capital Gains Tax Worksheet Irs. PDF 2015 Schedule D (540) -- California Capital Gain or Loss Adjustment 2015 C alifornia Capital Gain or Loss Adjustment SCHEDULE Do not complete this schedule if all of your California gains (losses) are the same as your federal gains (losses). ... Use the worksheet on this page to figure your capital loss carryover to 2016. Line 9 - If line 8 is a net capital loss, enter the smaller of the loss on . blueterminal.co › capital-gains-worksheet-2015Capital Gains Worksheet 2015 - Blueterminal Worksheet. add lines, and. . figure the tax on the amount on line. if the amount on line is less than, use the tax table to figure the tax. if the amount on line is, or more, use the tax computation worksheet. tax on all taxable income. enter the. smaller of line or. also include this amount on the capital gain and capital loss to part of the summary worksheet if required. capital gain or capital loss worksheet this worksheet helps you calculate a capital gain for each asset or any other ... 2015_TaxReturn_GregAbbott.pdf 2015 estimated tax payments and amount applied from 2014 return ... Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions.14 pages

Capital Gain Tax Worksheet - 2015 Form 1040Line 44... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked …

Capital Gains Tax Calculation Worksheet - The Balance Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage. Worksheet 1: Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. A second transaction then sold 100 shares of XYZ stock.

Capital Gains Worksheet 2015 - Cafedoing.com 1. 2015 Checklist Internal Audit Performance Evaluation. Qualified dividends and capital gain tax worksheet in the instructions for forms and, line. no. complete the rest of form,, or. schedule d form title schedule d form author subject capital gains and, below, find out what the capital gains tax rates were for and a couple ways you can cushion the blow of this tax Qualified dividends …

Unrecaptured Section 1250 Gain Worksheet 2020 - Fill Online, Printable, Fillable, Blank | pdfFiller

and Losses Capital Gains - IRS tax forms To report capital gain distributions not reported directly on Form 1040, line 13 ... 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information. See Pub. 544 and Pub. 550 for more details. Section references are to the Internal Revenue Code unless otherwise noted. ... Rate Gain Worksheet in these instruc ...

Self Assessment forms and helpsheets for Capital Gains Tax Find helpsheets, forms and notes to help you fill in the capital gains pages of your Self Assessment tax return. From: HM Revenue & Customs Published 4 July 2014 Log in and file your Self...

Qualified Dividends And Capital Gain Tax Worksheet 2015 Capital Gain Worksheet 2015 Worksheet List Roberta Santos 2015 Tax Return Assignment H R Block Studocu I Am Sorry I Don T Know What You Mean With Time Chegg Com Solved Complete For 1040 Schedule A Schedule B 2016 Qu Federal Tax Brackets In A Mobile Friendly Format Capital Gains ...

2015 Capital Gains Rates - Bradford Tax Institute The table below indicates capital gains rates for 2015. Effective for year 2013 and after, the Health Care Act of 2010 imposed an additional 3.8% net investment income tax (NIIT) on certain individual's investment income. Hence, it is possible that an individual's federal tax on capital gain could be as high as 23.8% (20% + 3.8% NIIT).

Capital Gains Worksheet 2015 - Blueterminal Worksheet. add lines, and. . figure the tax on the amount on line. if the amount on line is less than, use the tax table to figure the tax. if the amount on line is, or more, use the tax computation worksheet. tax on all taxable income. enter the. smaller of line or. also include this amount on the capital gain and capital loss to part of the summary worksheet if required. capital gain or …

Capital Gain Tax Worksheet (PDF) - IRS tax forms See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don’t have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1.

2015 Instructions for Schedule D - Capital Gains and Losses To report capital gain distributions not reported directly on Form 1040, line 13 ... 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information. See Pub. 544 and Pub. 550 for more details. Section references are to the Internal Revenue Code unless otherwise noted. ... Rate Gain Worksheet in these instruc ...

PDF 2015- Capital Gains Calculations 2015- Capital Gains Calculations one page First Names Surname/s Tax file number (9 digits) Address of Property Sold Suburb State Postcode Establishing Cost Base ... Calculation for Total Capital Gain= Sales proceeds less Cost Base Street Name If you purchased land & built on the site we will need both contract prices. If you

Capital gains - Google Sheets Total amount of Capital Gains repayment due to IPSA: Amount paid to IPSA: Amount owed to IPSA: End date of repayment plan: Start date of claims: End date of claims: 2. David Anderson: Blaydon BC: ... 4/1/2015: 5/10/2013: 5/12/2013: 20. Frank Doran: Aberdeen North BC: AB21: Stuart Dunne BSc (Hons) MRICS: J & E Shepherd: Property sold :

Using the capital gain or capital loss worksheet for shares | Capital gain, Capital gains tax, Gain

How to Use The Capital Gains Worksheet | Passiv How To Use The Worksheet. You can record five different types of actions in the Capital Gains Worksheet - buy, sell, split, name change, and return of capital. Let me go through each one. Buy and sell actions should be self-explanatory for the most part. Security refers to the stock/ETF/bond that you bought or sold.

Capital Gains Worksheet 2015 Upd. - Depar Mekanik A.Ş. Capital Gains Worksheet 2015 Upd. Homepage. blog. Capital Gains Worksheet 2015 Upd. Posted by admin. 26 Kasım 2021 blog 0. The slogans "traveling is meals for the soul" and "no travels - no lifetime" are very persuasive, appropriate? But really don't you imagine that they search a tiny identical to any other tagline from the entire ...

2019 Qualified Dividends And Capital Gains Worksheet The tax will be calculated on the qualified dividends and capital gain tax worksheet. The qualified dividends and capital gains worksheet uses taxable income as the starting point for calculating taxes. If you do not have to file schedule d and you received capital gain distributions, be sure you checked the box on line 13 of form 1040. Capital ...

Capital Gains Worksheet 2015 - Cafedoing.com 1. 2015 Checklist Internal Audit Performance Evaluation. Qualified dividends and capital gain tax worksheet in the instructions for forms and, line. no. complete the rest of form,, or. schedule d form title schedule d form author subject capital gains and, below, find out what the capital gains tax rates were for and a couple ways you can cushion the blow of this tax Qualified dividends and ...

0 Response to "39 capital gain worksheet 2015"

Post a Comment