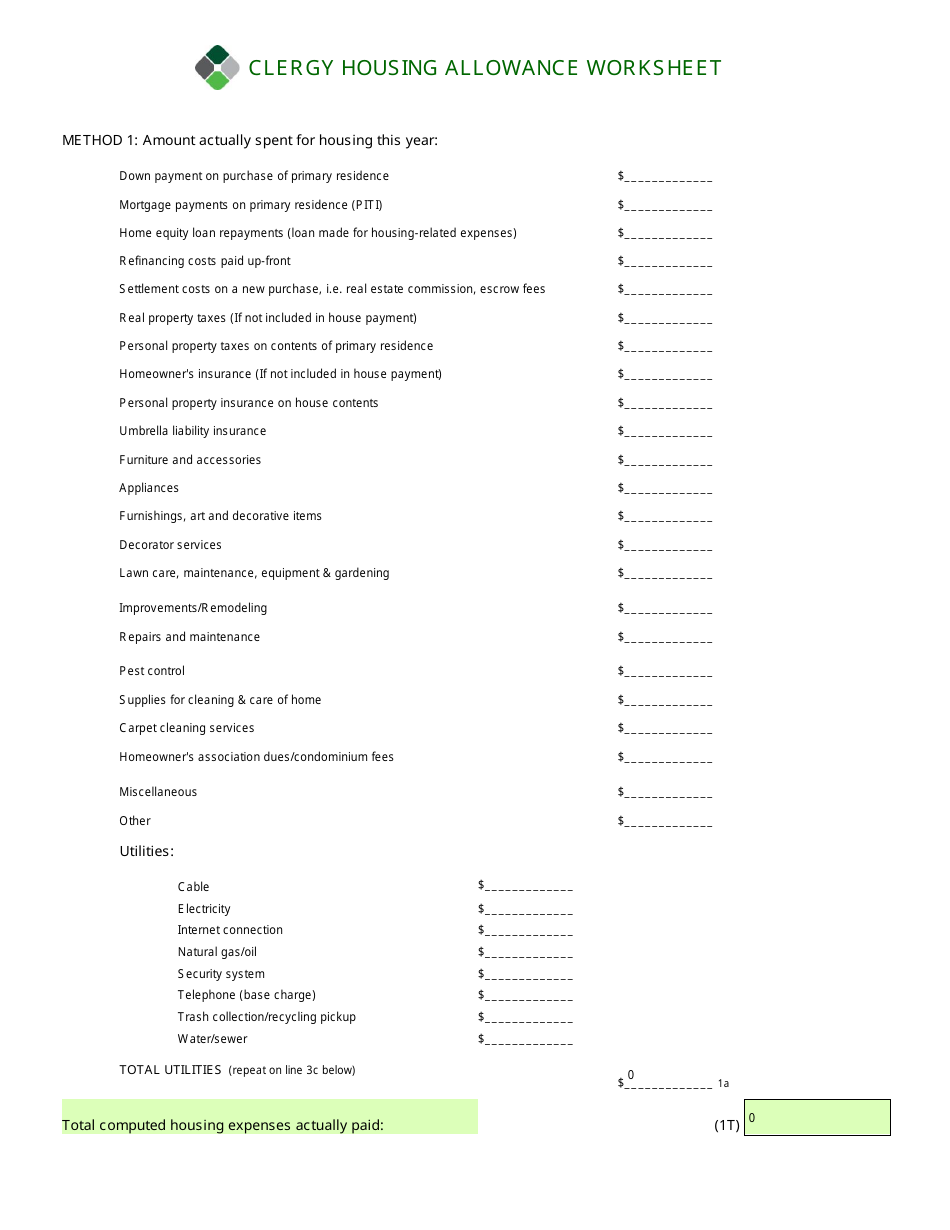

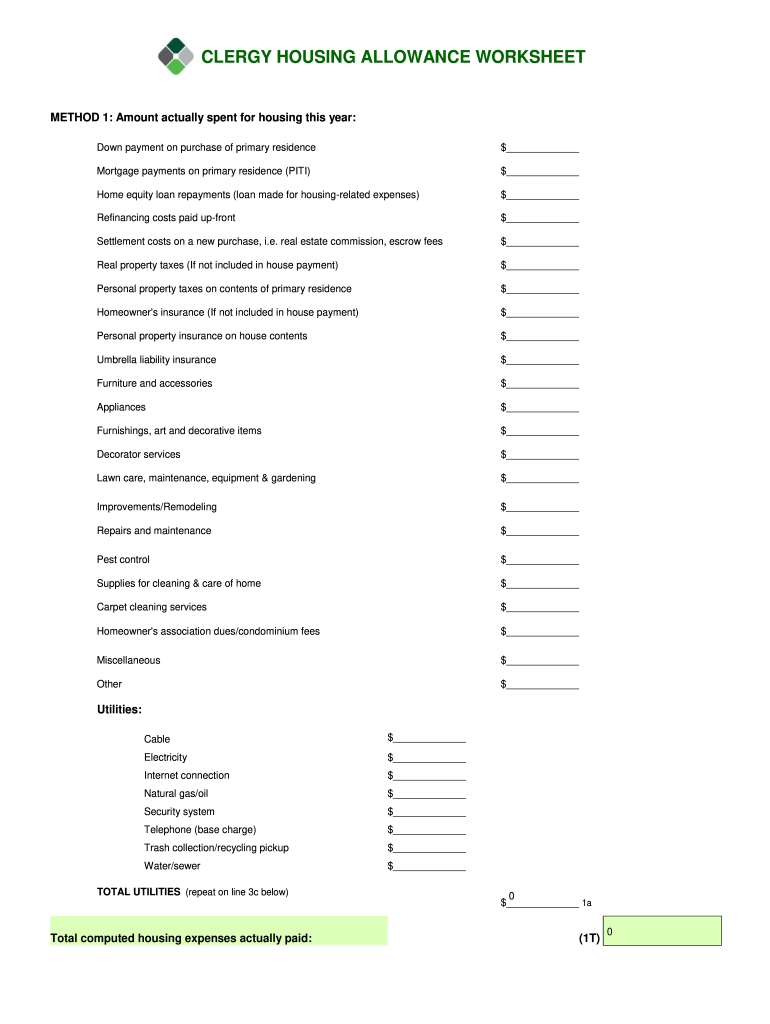

44 clergy housing allowance worksheet

pastorswallet.com › how-do-you-report-your-housingHow Do You Report Your Clergy Housing Allowance To The IRS ... Sep 13, 2021 · The housing allowance is exempt from income and should therefore not be reported here. If it is, the IRS will think you owe more in taxes and you will have a mess on your hands. If your church accidentally includes your housing allowance in Box 1, have them correct the mistake right away by filing an amended Form W-2. Boxes 3, 4, 5, and 6 2021 Minister's Housing Allowance Worksheet (Sources: IRS Publication 1828; Clergy Housing Allowance Clarification Act of 2002; IRS Regulation Section 1.107-1). MinistryCPA Corey A. Pfaffe, CPA, LLC 302 N. 3rd Street, Suite 107, Watertown, WI 53094

PDF Clergy Income & Expense Worksheet Year Housing Allowance Weddings & Funerals (see below) Speaking engagements Business Expense Reimbursement Liturgical work Direct reimbursement Auto Barter Set Amount Other Other Sales of Equipment and/or Machinery Held for Business Use Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost

Clergy housing allowance worksheet

CLERGY/PASTOR HOUSING ALLOWANCE FAQ’s - AccuPay A housing allowance is a portion of clergy income that may be excluded from income for federal ... ChurchPay Pros’ Housing Allowance Worksheet, is an excellent starting point for determining housing allowance amounts. The worksheet is available at . Clergy housing allowance - ttlc.intuit.com Clergy housing allowance. For me, while I normally do the step by step, it is easiest to do this part in the forms themselves. Look at the schedule SE adj sheet in section 2, line 5B. if you are seeing your housing allowance twice what you expect, you need to take additional action. Go to the W2 for that income. Ministerial Housing Allowance Worksheet - Miller … Mar 15, 2019 · vocational ministers can have a housing allowance as well, but only from their ministerial income. Secular employers cannot give an employee that also works as a minister a tax-free housing allowance generally. Retired ministers are also eligible to receive a housing allowance. Additionally, retired

Clergy housing allowance worksheet. iksynod.org › 01 › housingallowanceworksheetCLERGY HOUSING ALLOWANCE WORKSHEET - Indiana-Kentucky Synod CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year: PDF Ministers' Housing Allowance Resource Kit MINISTERS' HOUSING ALLOWANCE RESOURCE KIT The following ministers' housing allowance information is for the benefit of CBF Church Benefits (CBB) participants and employers. CBB is proud to partner with the Evangelical Council for Financial Accountability (ECFA) to offer an in-depth ... • Housing Allowance Worksheet - Minister Living in ... PDF Housing Allowance Information for Retired Ministers Information for Retired Ministers Regarding Housing Allowance 08-19 Page . 2. of . 4. I\9814896.5. The minister's housing allowance designation is only an . estimate. of his or her expected housing expenses for the year. Housing allowance exclusion — This is the amount a retired minister legally canexclude from income taxes and is limited to ... Housing Allowance Worksheet 2021 - Fill Out and Sign ... housing allowance worksheet and laptop computers. You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. Therefore, the signNow web application is a must-have for completing and signing housing allowance worksheet 2021 on the go.

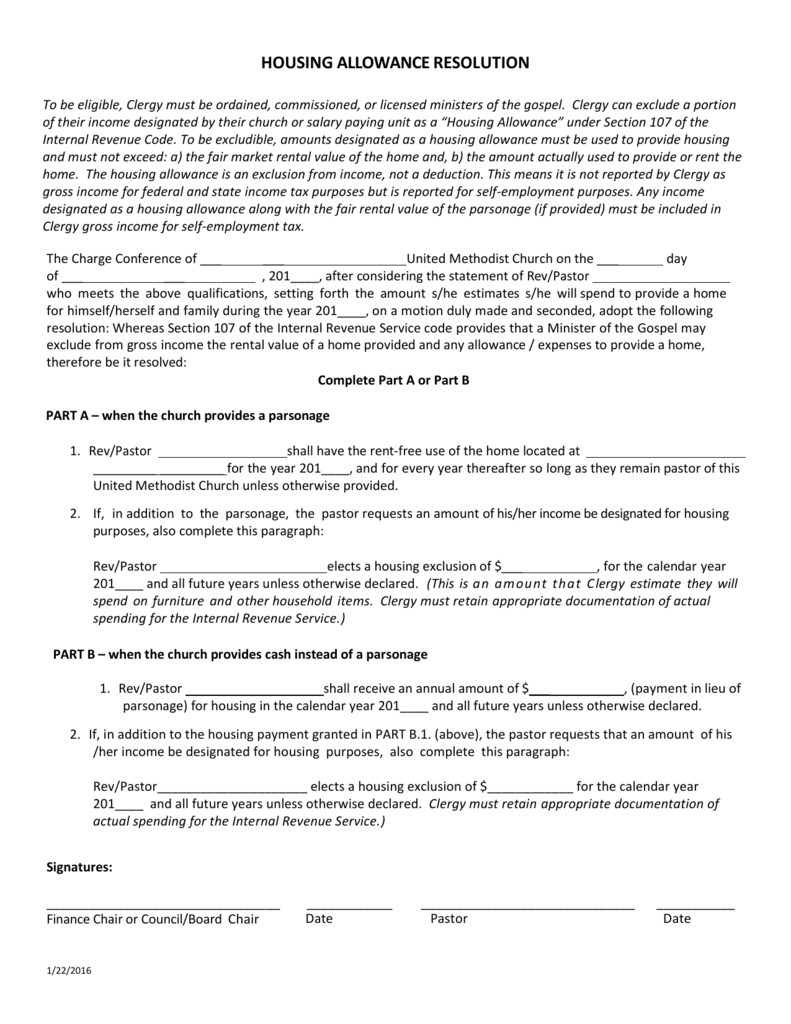

Ministers' Compensation & Housing Allowance | Internal ... For more information on a minister's housing allowance, refer to Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers. For information on earnings for clergy and reporting of self-employment tax, refer to Tax Topic 417, Earnings for Clergy. Chapter 2: Housing Allowance and Parsonage For this publication, references to “housing allowance” will include all allowances paid to a worker for providing a home. This includes housing allowance, utilities allowance and furnishings allowance. The two terms, “housing allowance” and “parsonage,” are different and distinctive. They may be provided separately or in combination. › fill-and-sign-pdf-form › 32612Housing Allowance Worksheet 2021 - Fill Out and Sign ... Use a check mark to indicate the answer where needed. Double check all the fillable fields to ensure full accuracy. Utilize the Sign Tool to add and create your electronic signature to signNow the Housing Allowance Worksheet - PCA Retirement Benefits Inc - pcarbi form. Press Done after you finish the form. Now you'll be able to print, save, or ... › 05 › Housing-Allowance-KitCLERGY/PASTOR HOUSING ALLOWANCE FAQ’s - AccuPay ChurchPay Pros' Housing Allowance Worksheet, is an excellent starting point for determining housing allowance amounts. The worksheet is available at ... A. Ideally, clergy should keep careful housing expense records to determine whether expenses are greater or less than the annual designation. Records are also important for estimating a

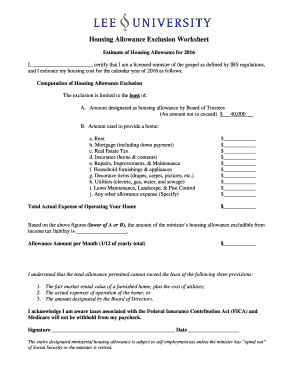

PDF HOUSING ALLOWANCE GUIDE - churchbenefits.org In this illustration there is a $3,360 tax savings with the Housing Allowance. Q: What is the advantage of declaring a minister's housing allowance? A. No. Section 107 of the Internal Revenue Code allows only a "minister of the gospel" to. have a housing allowance. Thus, only taxpayers who are serving as clergy under IRS rules PDF Housing Allowance Exclusion Worksheet This worksheet is designed to help a clergyperson determine the amount that he or she may exclude from gross income . pursuant to the provisions of Section 107 of the Internal Revenue Code (Code). Those provisions provide that "a minister of . the gospel" may exclude a "housing allowance" from his or her gross income. Housing Allowance Worksheet - Fill Out and Sign Printable ... clergy housing allowance worksheet 2021 iOS device like an iPhone or iPad, easily create electronic signatures for signing a housing allowance worksheet in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field. Clergy - Exempt Wages and Housing Allowance Clergy housing allowance. Generally, the housing allowance is reported in Box 14 of the W-2 and is not included in Boxes 1, 3, or 5. ... the TaxAct program requires that the housing allowance be entered on the Self-Employment Tax Adjustment Worksheet for calculation of the SE tax. The allowance is then transferred to Schedule SE Self-Employment ...

2022 Housing Allowance Form - Clergy Financial Resources Want create site? Find Free WordPress Themes and plugins.Housing / Manse / Parsonage Designation The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. Treas. Reg. § 1.107-1(b). While this Regulation does not require the designation to be...

› taxtopics › tc417Topic No. 417 Earnings for Clergy | Internal Revenue Service Mar 14, 2022 · Housing Allowance. A licensed, commissioned, or ordained minister who performs ministerial services as an employee may be able to exclude from gross income the fair rental value of a home provided as part of compensation (a parsonage) or a housing allowance provided as compensation if it is used to rent or otherwise provide a home.

How Do You Report Your Clergy Housing Allowance To The IRS ... Sep 13, 2021 · This is an excerpt from my book, The Pastor’s Wallet Complete Guide to the Clergy Housing Allowance: The church is not required to report the housing allowance to the IRS. Unless a church includes it in an informational section on Form W-2, the IRS and the Social Security Administration (SSA) are only made aware of the housing allowance when a minister …

PDF Housing Exclusion Worksheet Housing Exclusion Worksheet. Minister Living in Housing. Owned by or Rented by the Church. Minister's name: _____ For the period _____, 20___ to _____, 20____ ... Properly designated housing allowance $ _____(B) The amount excludable from income for federal income tax purposes is the lower of A or B (or reasonable compensation). Title:

CLERGY HOUSING ALLOWANCE WORKSHEET - Indiana … CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of …

PDF MMBB's Housing Allowance Worksheet Example Remember the tax code limits the nontaxable portion of housing compensation designated as. housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Ministers who own their homes should take the following expenses into account in. computing their housing allowance exclusion.

PDF Housing Allowance Worksheet Clergy-Owned Housing Tax Year ... Housing Allowance Worksheet Clergy-Owned Housing Tax Year 2021 Name Date designation approved Allowable Housing Expenses (expenses from current income) Estimated Amounts Actual Amounts Housing loan principal and interest payments Homeowner's association dues/condominium fees Real property taxes Local telephone expense (base charge) Homeowner ...

PDF 2020 Minister Housing Allowance Worksheet - The Pastor's ... 2020 Minister Housing Allowance Worksheet Mortgage Payment *Real Estate Taxes *Homeowners Insurance Mortgage Down Payment & Closing Costs Rent Renter's Insurance HOA Dues/Condo Fees Home Maintenance & Repairs Utilities Furniture & Appliances Household Items Home Supplies Yard Service Yard Care Tools & Supplies Miscellaneous

PDF Clergy Tax Worksheet Clergy Tax Worksheet PARSONAGE ALLOWANCE: Many members of the clergy are paid a cash "housing allowance," which they use to pay the expenses related to their homes (e.g. interest, real property taxes, utilities etc.). Alternatively, some may live in a parsonage owned by the church. Neither a cash allowance (to the extent it is used to pay for home

PDF Housing Expenses Worksheet - Reform Pension Board Retired clergy can have eligible distributions from their 403(b) and Rabbi Trust accounts designated as a . housing allowance and potentially excluded from gross income for federal income tax purposes. RPB will designate 100 percent of your distribution income as your potential housing allowance, but this does

Housing Allowance: What Every Retired Minister Should ... To figure out your specific housing expenses when filing your annual tax return, download the free Ministers Housing Expenses Worksheet. It’s a great way to make sure you get the most out of your housing allowance each year. It’s important to know the IRS does place some limits on how much can be designated as clergy housing allowance.

› sites › default2021 Minister's Housing Allowance Worksheet by the church. The IRS lists only food and servants as prohibitions to allowance housing expenses. If a minister owns a home, the amount excluded from the minister's gross income as a housing allowance is limited to the least of the following: (a) the amount actually used to provide a home, (b) the amount officially

Get Your Free Downloadable 2019 Minister Housing Allowance ... Downloadable .PDF Document. 2019 Minister Housing Allowance Worksheet Download. If you just want a real piece of paper to write on, click the download button above and print out the document. It includes spaces for the most common housing expenses and several open spaces for your own unique expenses.

goodfaithaccounting.com › wp-content › uploadsMinisterial Housing Allowance Worksheet - Miller Management What is a housing allowance? A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers. The amount spent on housing reduces a qualifying minister's federal and state income tax burden. Section 107 of the Internal Revenue Code (IRC) states that:

Get Clergy Housing Allowance Worksheet 2010-2022 - US ... The tips below will allow you to fill out Clergy Housing Allowance Worksheet quickly and easily: Open the form in our feature-rich online editing tool by clicking on Get form. Complete the required fields that are marked in yellow. Hit the arrow with the inscription Next to jump from one field to another. Go to the e-autograph tool to e-sign ...

Housing Allowance Worksheet - Clergy Financial Resources Download Fillable PDF | Templateroller

PDF Minister'S Housing Expenses Worksheet PO Box 2515 • Springfield, MO 65801-2513 • Phone: 800.622.7526 • Fax: 417.831.7429 • agfinancial.org AGFinancial is a DBA of Assemblies of God Ministers Benefit Association

PDF Housing Allowance for Retired Ministers Worksheet Worksheet for Calculating . Housing Allowance Exclusion for Retired Ministers => Retain this sheet for your tax records. Under current law, retired ministers may exclude all or a portion of their church retirement pension from gross income as housing a llowance if the pension represents contributions made while performing services in the exercise

0 Response to "44 clergy housing allowance worksheet"

Post a Comment