40 gross pay vs net pay worksheet

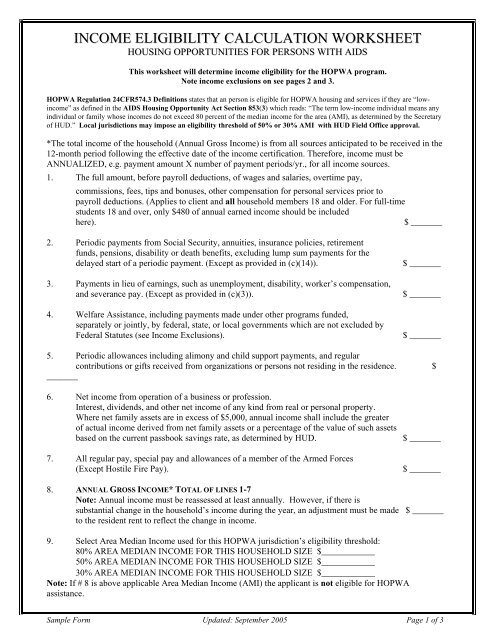

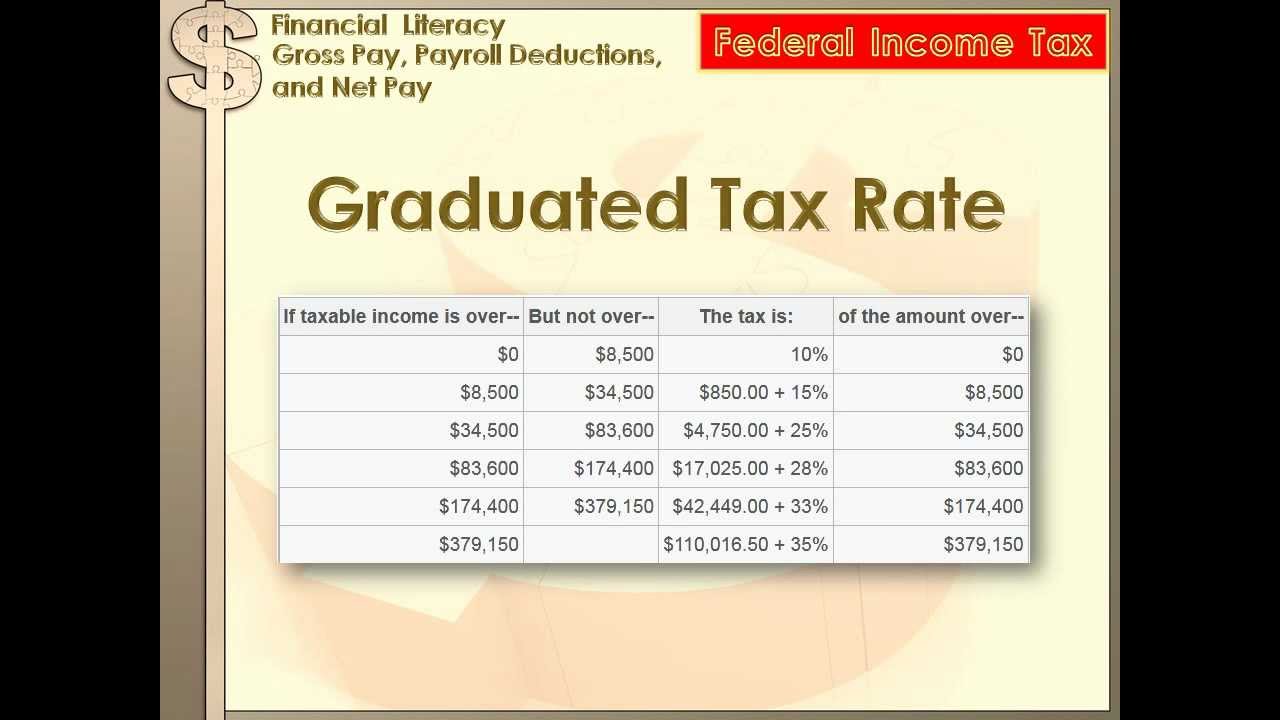

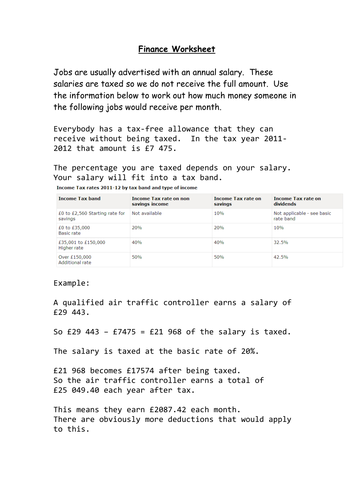

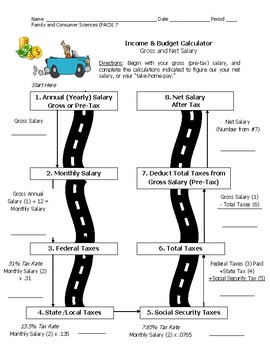

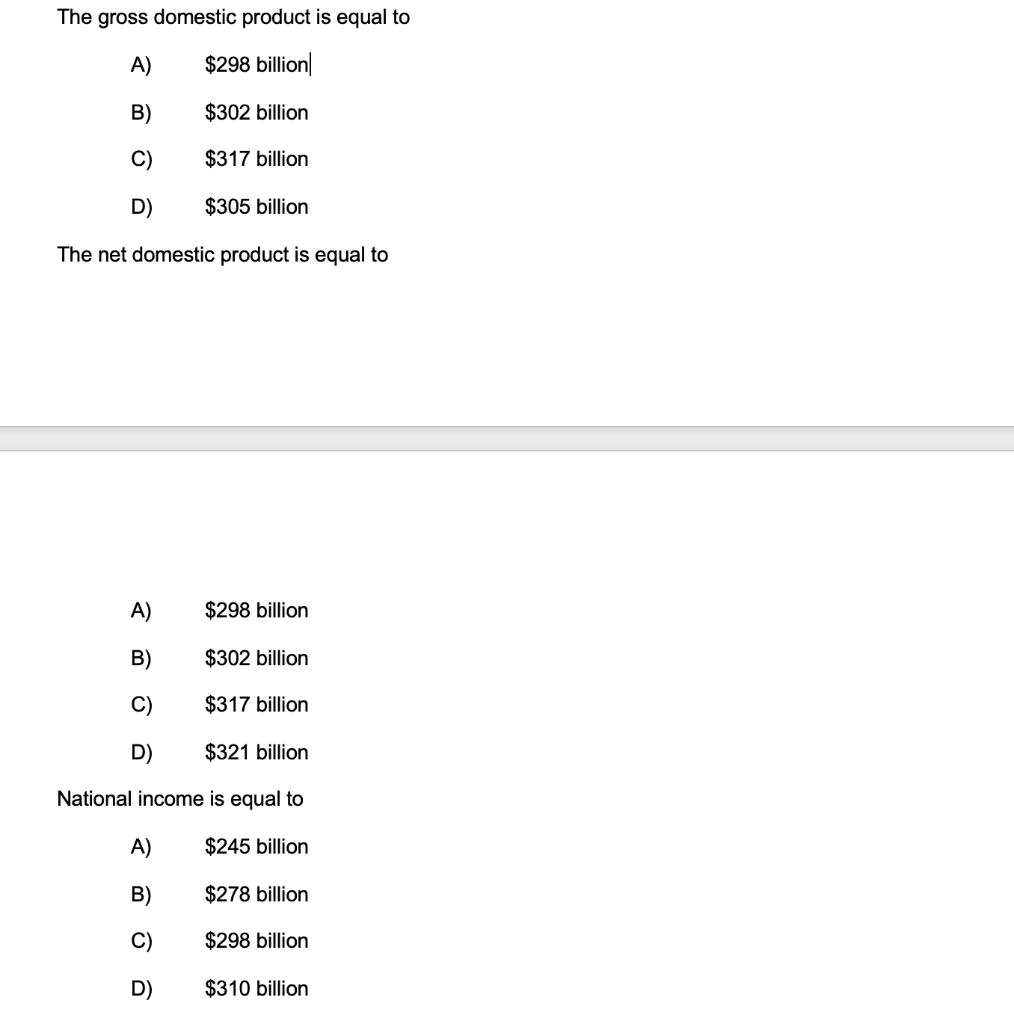

PDF It's Your Paycheck! Lesson 2: 'W' is for Wages, W-4, and W-2 Gross pay is the amount people earn per pay period before any deductions or taxes are paid. Net pay is the amount people receive after taxes and other deductions are taken out of gross pay. 6. Explain that one tax people pay is federal income tax. Income tax is a tax on the amount of income people earn. People pay a percentage of their income ... Gross Pay vs. Net Pay: Definitions and Examples | Indeed.com For example, if your employer agreed to pay you $15 per hour and you work for 30 hours during a pay period, your gross pay will be $450. Net pay is the final amount of money that you will receive after all taxes and deductions have been subtracted. Net pay is the amount that's actually deposited into your bank account or the value of your paycheck.

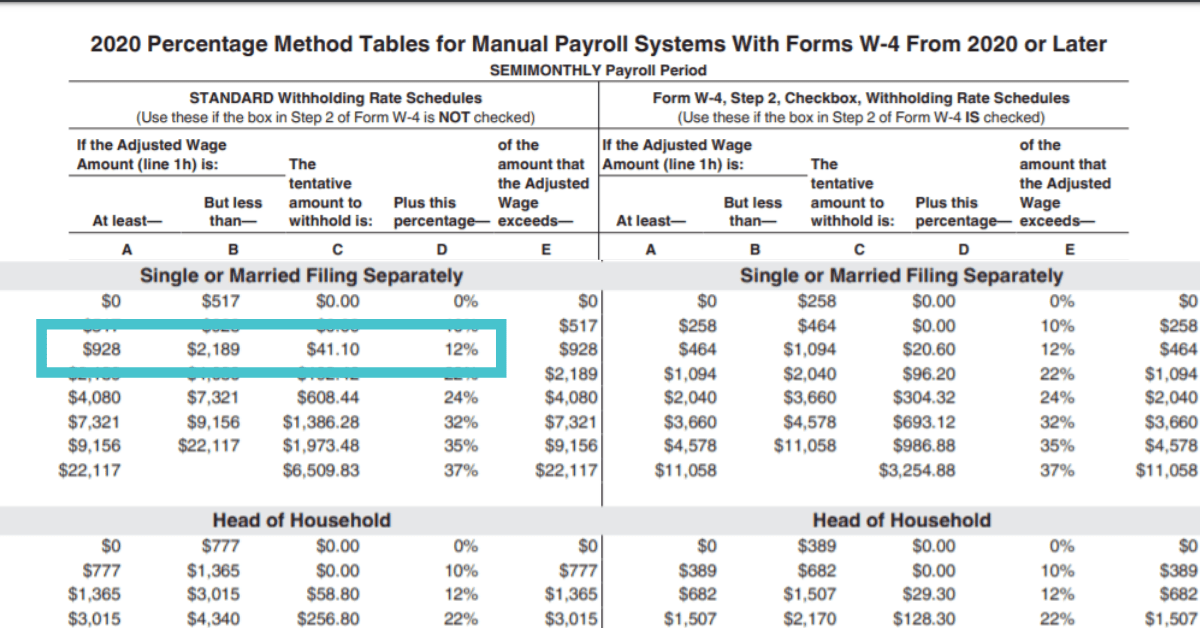

Lesson Plan: Calculating Gross and Net Pay - Scholastic So a person making $1,200 per week will have $50.40 (.042 x $1,200) deducted from his or her weekly gross pay. Step 4: Distribute the Plan, Save, Succeed! Worksheet: Where Did the Money Go? printable to students. Step 5: After students have completed the questions, use your copy of the Answer Key: Plan, Save, Succeed!

Gross pay vs net pay worksheet

Net And Gross Income Activities Worksheets - Learny Kids Displaying top 8 worksheets found for - Net And Gross Income Activities. Some of the worksheets for this concept are Worked, Gross receipts work, Sga work used when gross earned income is over the, Four cornerstones of financial literacy, Personal financial workbook, Net pay work calculate the net pay for each, Its your paycheck lesson 2 w is for wages w 4 and w 2, 2015 instructions for form 8582. Gross Pay And Net Pay Teaching Resources - Teachers Pay ... 8. $2.00. PDF. This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts. On the second worksheet, the students are given the wage and the deductions in percentages and asked to calculate the dollar amoun. Gross Pay vs Net Pay: How to Calculate the Difference - Article Gross pay, also called gross wages, is the amount an employee would receive before payroll taxes and other deductions. By contrast, net pay is the amount left over after deductions have been taken from an employee's gross pay. Net pay is sometimes called take-home pay.

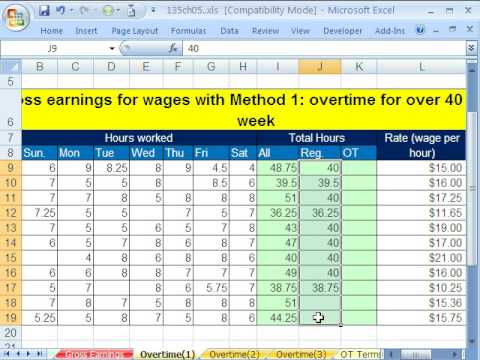

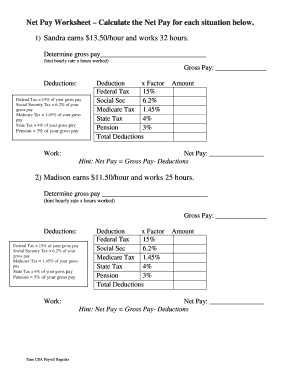

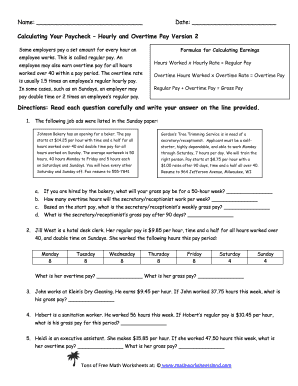

Gross pay vs net pay worksheet. PDF Name: Employee Pay & Benefits Review Worksheet Explain the difference ... Employee Pay & Benefits Review Worksheet Calculating Net Pay Directions: For each of the examples below calculate their net pay. 1. Sandra earns $13.50 per hour and works 32 hours a. What is her Gross Pay: 13.50 *32 = $432 b. Calculate her deductions Deduction % Of Gross Pay Amount Taken Out Federal Tax 15% 64.80 Social Security 6.2% 26.78 Gross Pay vs. Net Pay: Definitions and Examples | Indeed.com UK It's equivalent to gross pay minus all mandatory deductions. For instance, if you normally earn £1,200 while £350 is taken as deductions, then your gross pay will be £1,200, and the net pay will be £850. The gap between your gross pay and net pay is the deductions. In most cases, net pay will appear in a larger font or bolded to make it ... PDF Gross Pay and Net Pay Worksheet - Iwilliamsbusinesseducationclass GROSS/NET PAY PROBLEMS CONTINUED 7. Martha Green worked 40 regular-time hours at $10.00 per hour and 4 overtime hours at $15.00 per hour. Find Martha's gross pay for the week. 41 gross pay vs net pay worksheet - Worksheet Was Here Mar 21, 2022 · Gross And Net Pay Worksheets - Kiddy Math Gross And Net Pay - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Calculating the numbers in your paycheck, Teen years and adulthood whats on a pay stub, Its your paycheck lesson 2 w is for wages w 4 and w 2, My paycheck, Work 34 gross pay with overtime, Bring home the gold, Everyday math skills ...

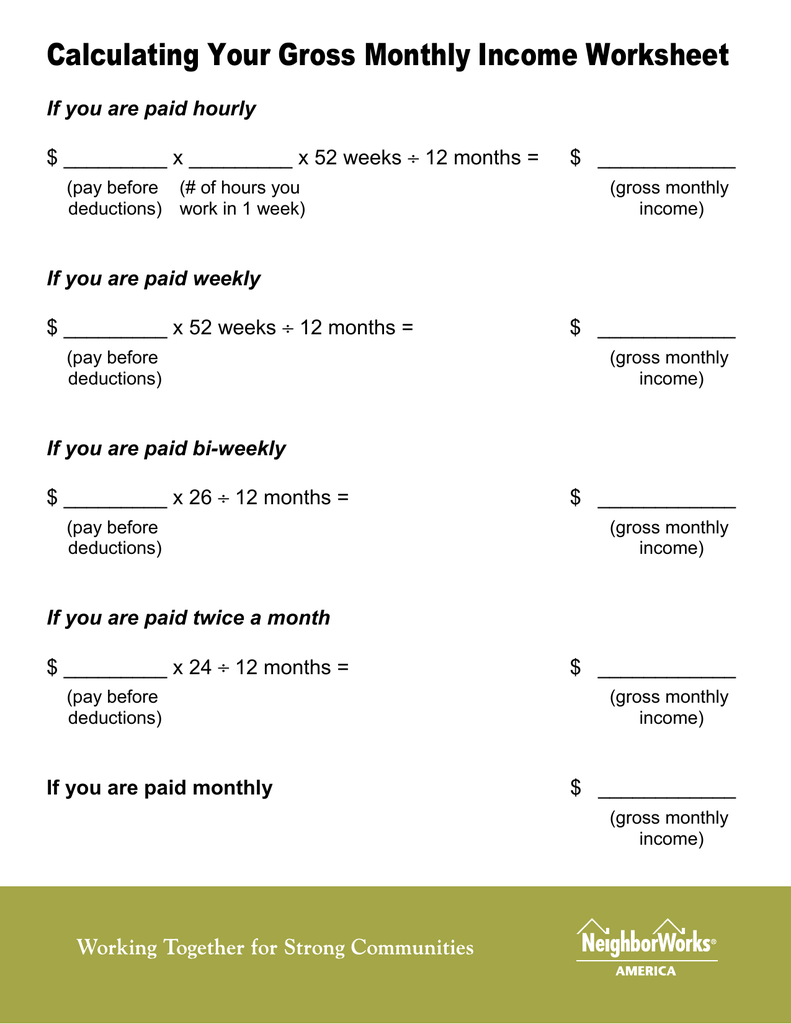

Calculating the numbers in your paycheck | Consumer Financial ... Understand what types of taxes are deducted from a paycheck; Calculate the difference between gross income and net income; What students will do. Review information on how to read a pay stub and answer questions about earnings and deductions. Calculate tax withholdings, deductions, and the difference between gross income and net income. Gross Net Deductions Teaching Resources Results 1 - 24 of 92 — This spreadsheet is a great way to get students calculating Gross pay, Net pay and payroll deductions with or without a calculator. Subjects ... Gross Pay Worksheet Teaching Resources Results 1 - 24 of 744 — This resource is meant to come after you have discussed net vs. growth pay, and social security and medicare (FICA). The first slide/ ... Gross Pay vs. Net Pay: What's the Difference? | ADP The method for calculating gross wages largely depends on how the employee is paid. For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year (see chart below). So, if someone makes $48,000 per year and is paid monthly, the gross pay will be $4,000. Pay Schedule. Pay Periods.

Paydays Lesson Plan, Payroll, Gross, Net Pay, Classroom Teaching Worksheet The class treasurer and payroll clerks will learn to fill out payroll paperwork and pay students for both part-time and full-time jobs. Students will differentiate between gross pay and net pay . Students will use purchase orders to buy items from the class store. Gross Pay vs. Net Pay: What's the Difference? Running payroll can be confusing. Although it's natural to have payroll questions when starting out, you can't afford to get tripped up when it comes to gross vs. net pay. Knowing the difference between gross and net pay impacts employee wages, payroll withholdings, recordkeeping, and even employer laws. Learn gross pay vs. net pay, how to find both types of wages, and where to record ... Gross And Net Pay Worksheets - Kiddy Math Gross And Net Pay - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Calculating the numbers in your paycheck, Teen years and adulthood whats on a pay stub, Its your paycheck lesson 2 w is for wages w 4 and w 2, My paycheck, Work 34 gross pay with overtime, Bring home the gold, Everyday math skills workbooks series, Reading a pay stub extension ... Net And Gross Income Worksheets & Teaching Resources | TpT Word Document File. This worksheet asks students to- -Find net income given an hourly wage and hours worked -Figure out how long a person needs to save to afford an item given a weekly income -Determine gross income given net income and amount paid in taxes -Fill out a simple budget form to determine the amount of mone.

Gross vs. Net - Softschools.com Gross estate is the total value of a person's estate before deductions of any costs like for example taxes, living and funeral expenses or any other administration costs. Net is the term opposite to the gross and refers to the amount after we have done any deductions. So, net income is the income we receive after paying taxes.

Gross And Net Pay Teaching Resources Net and Gross Pay (Workbook- 4 Worksheets) by. Sophie's Stuff. 9. $2.00. PDF. This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts. On the second worksheet, the students are given the wage and the deductions in percentages and ...

Net and Gross Pay (Workbook- 4 Worksheets) | Financial literacy ... Oct 5, 2021 - This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts. On the second worksheet, the students are given the wage and the deductions in percentages and asked to calculate the dollar amoun...

Net Pay Teaching Resources Results 1 - 24 of 3399 — Life Skills Reading and Writing: Gross Pay Versus Net Pay ... On the second worksheet, the students are given the wage and the ...

Gross Pay vs Net Pay: How to Calculate the Difference - Article Gross pay, also called gross wages, is the amount an employee would receive before payroll taxes and other deductions. By contrast, net pay is the amount left over after deductions have been taken from an employee's gross pay. Net pay is sometimes called take-home pay.

Gross Pay And Net Pay Teaching Resources - Teachers Pay ... 8. $2.00. PDF. This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts. On the second worksheet, the students are given the wage and the deductions in percentages and asked to calculate the dollar amoun.

Net And Gross Income Activities Worksheets - Learny Kids Displaying top 8 worksheets found for - Net And Gross Income Activities. Some of the worksheets for this concept are Worked, Gross receipts work, Sga work used when gross earned income is over the, Four cornerstones of financial literacy, Personal financial workbook, Net pay work calculate the net pay for each, Its your paycheck lesson 2 w is for wages w 4 and w 2, 2015 instructions for form 8582.

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

0 Response to "40 gross pay vs net pay worksheet"

Post a Comment