39 understanding your paycheck worksheet

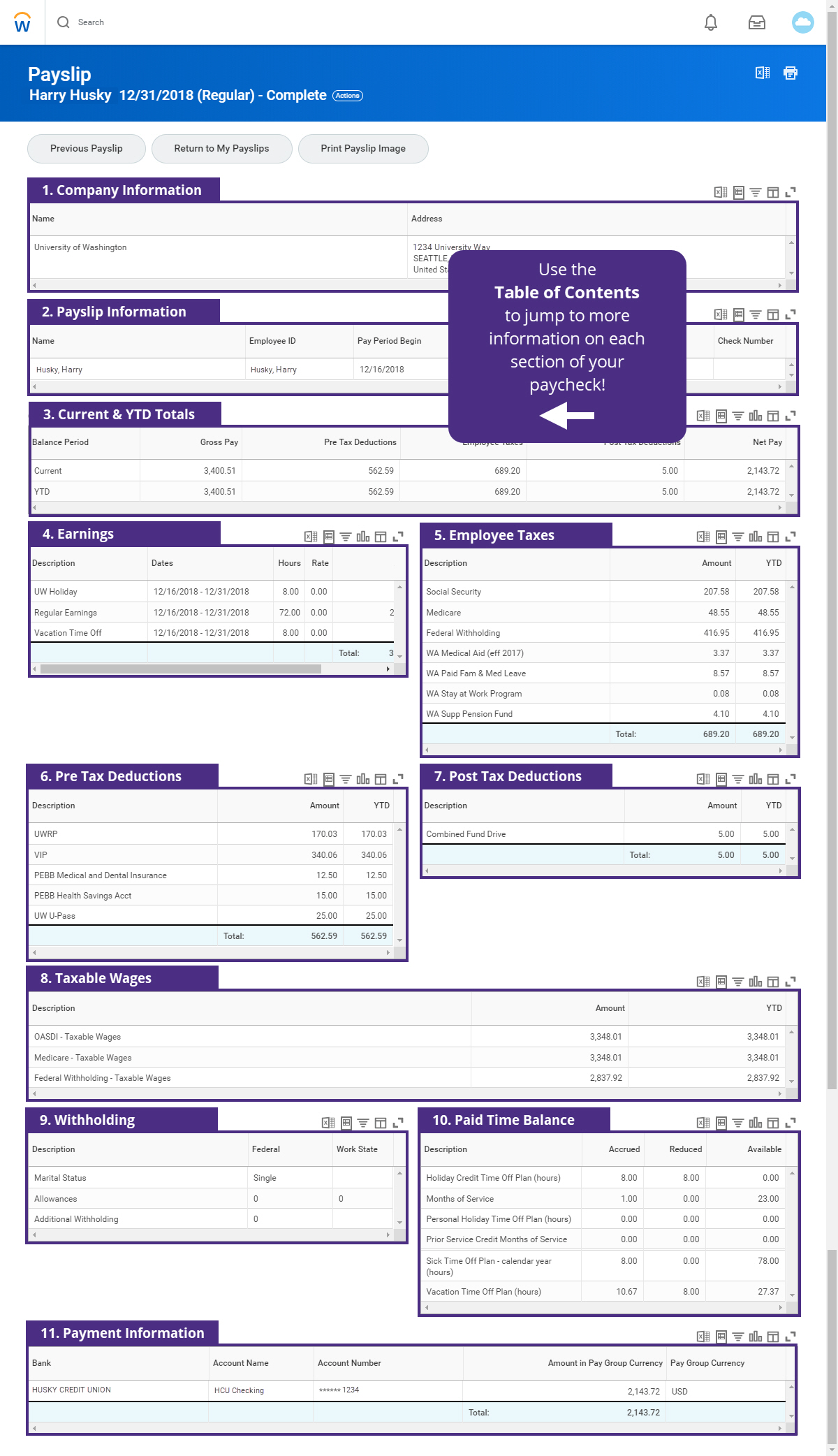

PDF UNDERSTANDING YOUR PAYCHECK - Litchfield Bancorp Gross pay is the larger of the two. Your gross pay is what you make before taxes and deductions. If you are an hourly employee, your gross pay is simply your hourly rate multiplied by the number of hours you worked. For a salaried employee, your gross pay is your annual salary divided by the number of paychecks you receive in a year (typically 26). Understanding Your Paycheck Worksheet Answers ... Understanding your paycheck can take some time. Use this free lesson to better understand your pay and work benefits. Identify paycheck learn the purpose of understand the difference . The skills you will learn in this chapter will be very valuable in your future. Use this free lesson to better understand your pay and work benefits.

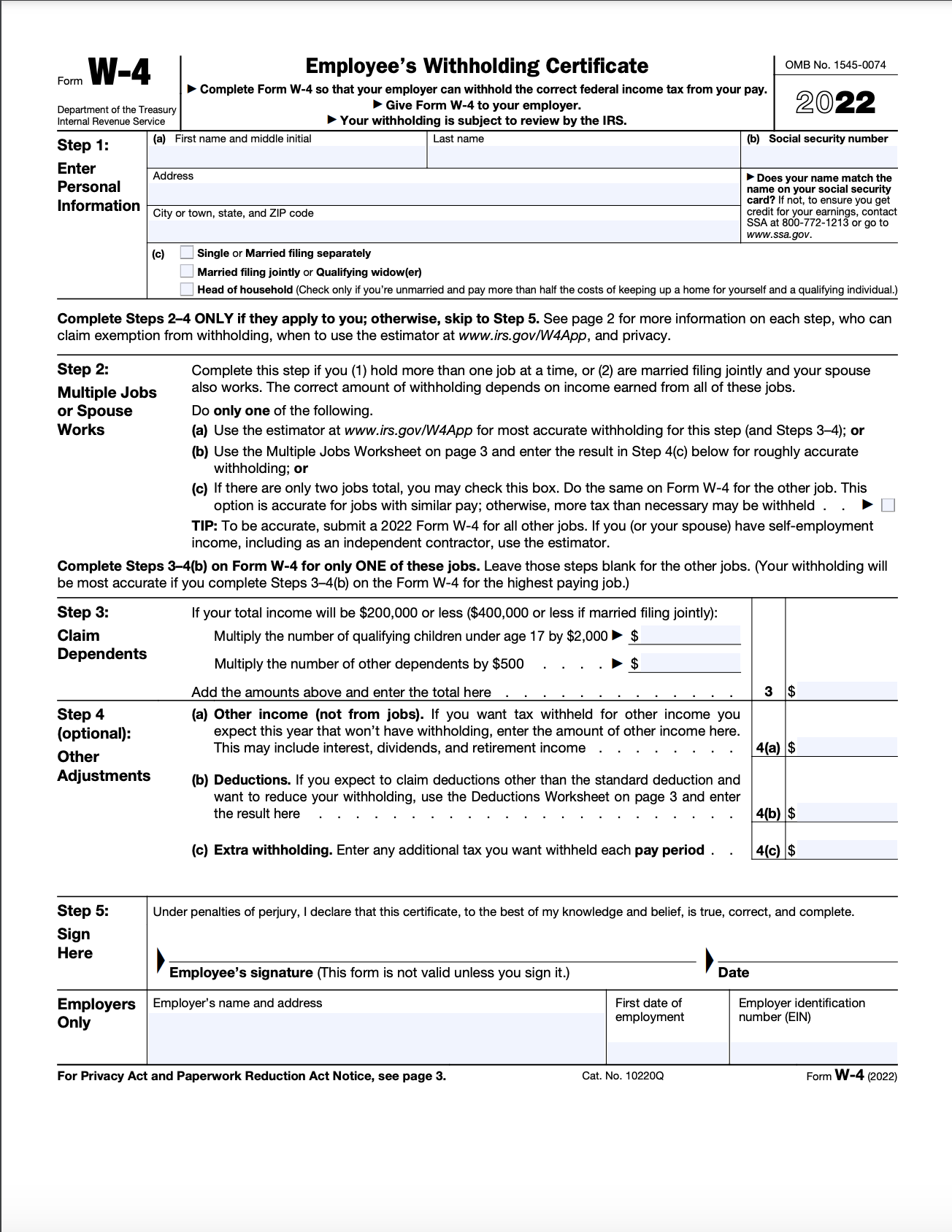

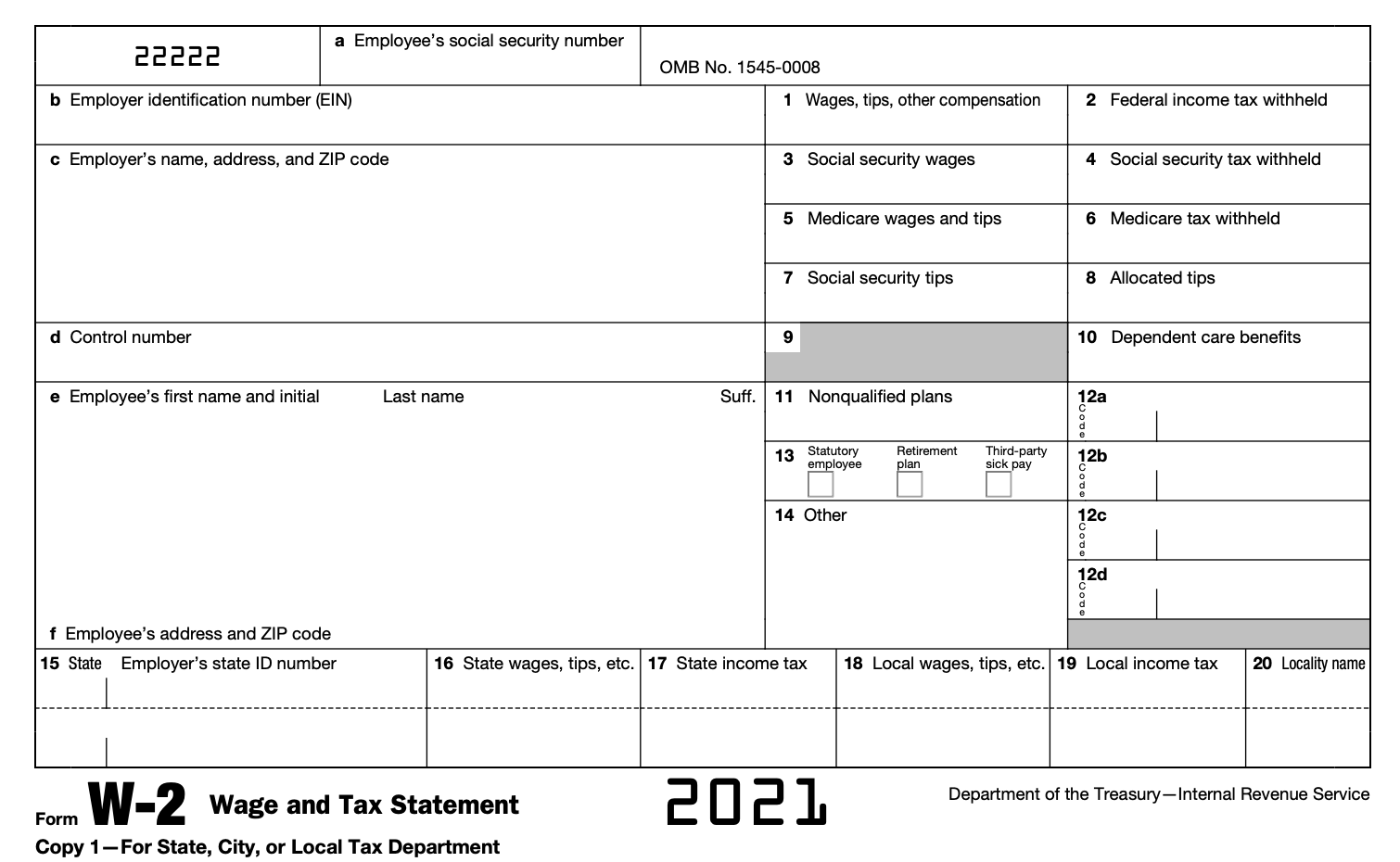

PDF It's Your Paycheck! Lesson 2: 'W' is for Wages, W-4, and W-2 It's Your Paycheck! | Lesson 2: "W" is for Wages W-4 and W-2 3. Display Slide 2 and distribute a copy of Handout 2.1: John A. Dough's Pay Stub to each student. Ask a student to read the information about John A. Dough in the paragraph by the pay stub.

Understanding your paycheck worksheet

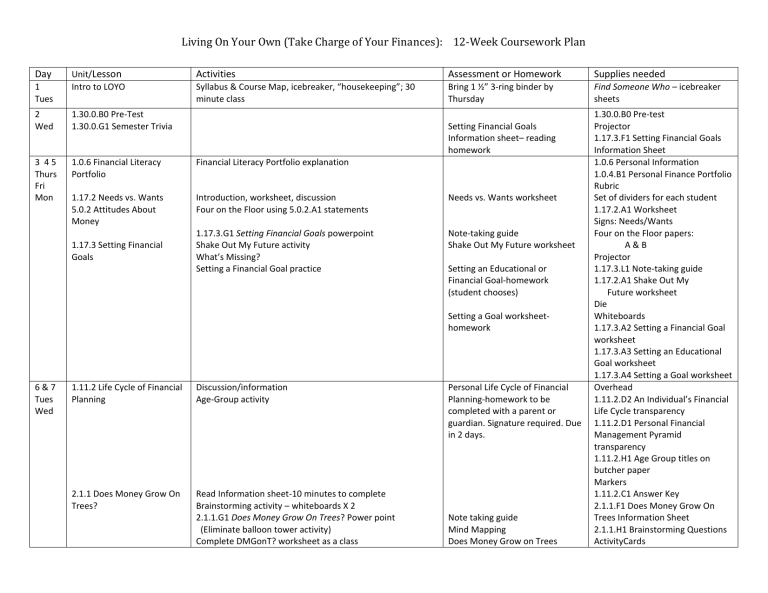

Understanding Your Paycheck | Biz Kids Lesson Plan ... Understanding Your Paycheck. Students receive a sample earnings statement and break down the different categories of information. Students then break into groups of four and play the 'Paycheck Mystery Word Game'. What Students Learn. Why there are deductions on your paycheck; PDF Understanding Your Paycheck Lesson Plan 1.13 Susan worked 85 hours in the last pay period and she earns $18 per hour. Susan's gross pay= 85 hours x $18.00 23. $_____ Calculate Susan's Social Security deduction, which is 6.2% of her gross pay. Gross pay 24. $_____ (answer to #23) x .062= 25. $_____ Social Security deduction PDF Pay Stub Explanation Worksheet Pay Stub Explanation Worksheet Attached to your paycheck is a pay stub that details what exactly happened to your salary. Items on the stub below have numbers that correspond to the explanations that follow. Strategy #7 • orking It Out: Take-Home Pay, Benefits, and TaxesW ORKSHEET 85 2 1. No.of regular hrs.worked: 40 Rate of pay:$8/hr. 2.

Understanding your paycheck worksheet. Understanding Your Paycheck Teacher Information 5. Pass out Understanding Your Paycheck Worksheet information sheet 1.13.1.F1. 6. Have student's correct their note taking guides using the Understanding Your Paycheck information sheet 1.13.1.F1. 7. Use a transparency of Paycheck Stub 1 1.13.1.A2 and fill out the parts as a class. For additional practice pass out Paycheck Stub 2 1.13.1.A3. 8. PDF Understanding taxes and your paycheck § Understanding taxes and your paycheck (worksheet) cfpb_building_block_activities_understanding-taxes-paycheck_worksheet.pdf. Exploring key financial concepts. When you get your first paycheck, the terms and amounts on the pay stub may not always be easy to understand. You may wonder why your take-home pay is different from what you expected, Publication 505 (2022), Tax Withholding and Estimated Tax | Internal ... - IRS tax forms If self-employed, first complete Worksheet 2-3 to figure your expected deduction for self-employment tax. Subtract the amount from Worksheet 2-3, line 11, to figure the line 1 entry: 1. 2. If you: • Don’t plan to itemize deductions on Schedule A (Form 1040), use Worksheet 2-4 to figure your expected standard deduction. • Understanding and calculating year to date in payroll 2022-02-15 · Understanding Year to Date (YTD) in Payroll - Updated on Feb 15, 2022 - 11:00 AM by 123PayStubs Team An employer and employees need to pay attention to the year to date (YTD). Payroll YTDs are required for record-keeping, calculations of tax obligations, and providing accurate tax documents at the year-end to employees. The reconciliations between the YTD …

Understanding Your Paycheck Worksheets - Learny Kids Displaying top 8 worksheets found for - Understanding Your Paycheck. Some of the worksheets for this concept are Understanding taxes and your paycheck, Understanding taxes and your paycheck, Its your paycheck lesson 2 w is for wages w 4 and w 2, Understanding your paycheck, Nothing but net understanding your take home pay, Understanding it managing it making it work for you, My paycheck, Teen ... Understanding Paychecks Worksheets & Teaching Resources | TpT 12. $1.00. PDF. Paychecks- Understanding Pay and Paycheck Stub/Earnings Statement Exploration WorksheetThis activity involves students analyzing a paycheck stub/earnings statement in order to get a better understanding of it. Students will be given information about the pay period and tax amounts and asked to fill. PDF Understanding Your Paycheck - so044.k12.sd.us understand paycheck deductions taken out of a paycheck and what they are used for. The first step to understanding a paycheck is to understand the vocabulary associated with paychecks and the paycheck process. Employers pay their employees on a regular schedule known as a pay period. Most businesses pay How to Read a Pay Stub | Understanding Your Pay Stub - OppU 2021-12-06 · A salaried worker can expect the exact same amount of money for each paycheck, whereas an hourly employee’s wages will vary based on the number of hours the person works each pay period. 5. Pay date. The date that an employee receives a check is their pay date. Companies often pay their employees according to a regular schedule, such as every other …

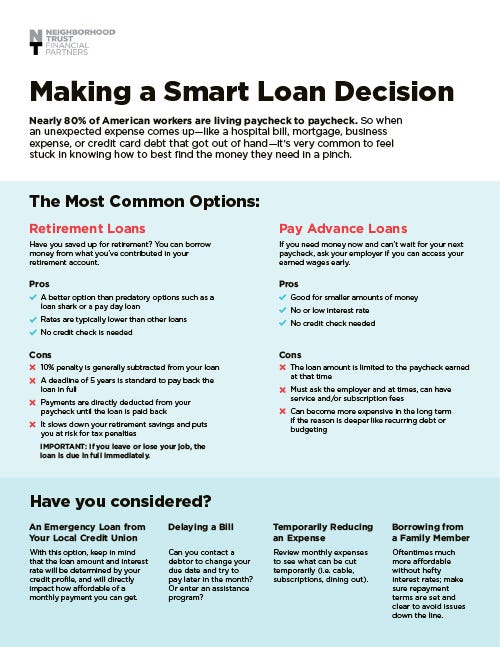

Financial planning worksheets - Nationwide Whether you're sitting pretty or living paycheck to paycheck, completing the following financial planning worksheets may help give your investment professional a better understanding of your financial situation: Net Worth This worksheet will help you figure it out. Just print it out, fill in a total for each category and do some simple math. If your net worth is a negative number, … PPT Understanding Your Paycheck Family Economics & Financial Education Paychecks and Tax Forms Take Charge of your Finances Where Does My Money Go? Almost 31% of an individual's paycheck is deducted Taxes are the largest expense most individuals will have Therefore, it is important to understand the systematic deductions U.S. tax system operates on an ongoing payment system Taxes are immediately paid on income earned ... About How Frequently Does Hope Receive A Paycheck - Fill ... Related searches to understanding your paycheck worksheet answer key. paycheck stub 1 worksheet answers. paychecks worksheet 1.13 1 a1 answer key. paycheck stub worksheet answers. understanding your paychecks worksheet 1.13 1 a1 answer key. navigating paycheck stubs answer key. Understanding Your Paycheck | Money Mentor | Bangor ... Give Understanding Your Paycheck 4/5. Give Understanding Your Paycheck 5/5. Ready to test your knowledge? You'll have ten multiple choice questions to answer. Click on each question to reveal the question and multiple choice answers. After you've completed answering all ten questions, click "Grade Me!" at the end of the quiz to see how you did.

Schwab MoneyWise - Net Worth Worksheet Understanding Your Credit Score ... Making the Most of Your Paycheck Saving for an Emergency Eight Savings Fundamentals ... Schwab Moneywise ® can help you budget, save, and invest your money, manage debt, and achieve your life goals. Best of all, it's free and available to everyone from Charles Schwab Foundation. We're glad you're here. Master the …

Understanding Your Paycheck Worksheet - Sixteenth Streets Understanding Your Paycheck Worksheet. §the consumer.gov webpage on taxes: Study the types of deductions. 31 Understanding Your Paycheck Worksheet Worksheet from starless-suite.blogspot.com A way to double check your work is to add your deductions and your net income. Payroll taxes and income tax. Some of the worksheets for this concept are understanding taxes and your

PDF Understanding Your Paycheck - ctaeir.org Understanding Your Paycheck 1. Examine your gross pay. Most paychecks come with a "stub" (an attachment) that shows the total earned and the deductions. Begin by examining your gross pay.This is what you earned before any amounts were deducted. Here's a basic fact to remember: Employees are classified as either "exempt" from federal ...

PDF Understanding Your Paycheck page 4 Revised 8/26/2013 Understanding Your Paycheck Eisd # Activity #1: BIZ TERM$ WORKSHEET FOR STUDENTS Biz Term$ With students, read aloud the Biz ...

Understanding Your Paycheck Worksheets & Teaching ... #TEACHERGRAM Understanding Your Paycheck Worksheet. by . Math and Glitter. 12. $1.00. PDF; Paychecks- Understanding Pay and Paycheck Stub/Earnings Statement Exploration WorksheetThis activity involves students analyzing a paycheck stub/earnings statement in order to get a better understanding of it. Students will be given information about the ...

PDF Paycheck Stub 2 Paycheck Stub 2 Name _____ Date _____ Class _____ Directions: Read the following scenario. Complete the blanks on the paycheck stub by entering the personal information and paycheck deductions in the appropriate places. Calculate the gross pay, total deductions, and net pay. Hank's Culinary Center Employee

Understanding Your Paycheck Worksheets - Kiddy Math Understanding Your Paycheck - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Understanding taxes and your paycheck, Understanding taxes and your paycheck, Its your paycheck lesson 2 w is for wages w 4 and w 2, Understanding your paycheck, Nothing but net understanding your take home pay, Understanding it managing it making it work for you, My ...

Workplace Basics: Understanding Your Pay, Benefits, and ... Earnings vs. net pay. When you view your pay stub, you'll find two notable figures: your earnings (or gross pay) and your net pay.Your earnings is the amount of money you make based on your pay rate.After a number of taxes and deductions are applied, you're left with your net pay, or the money that's available to you on your paycheck.. Upon your initial payment, you might be surprised at the ...

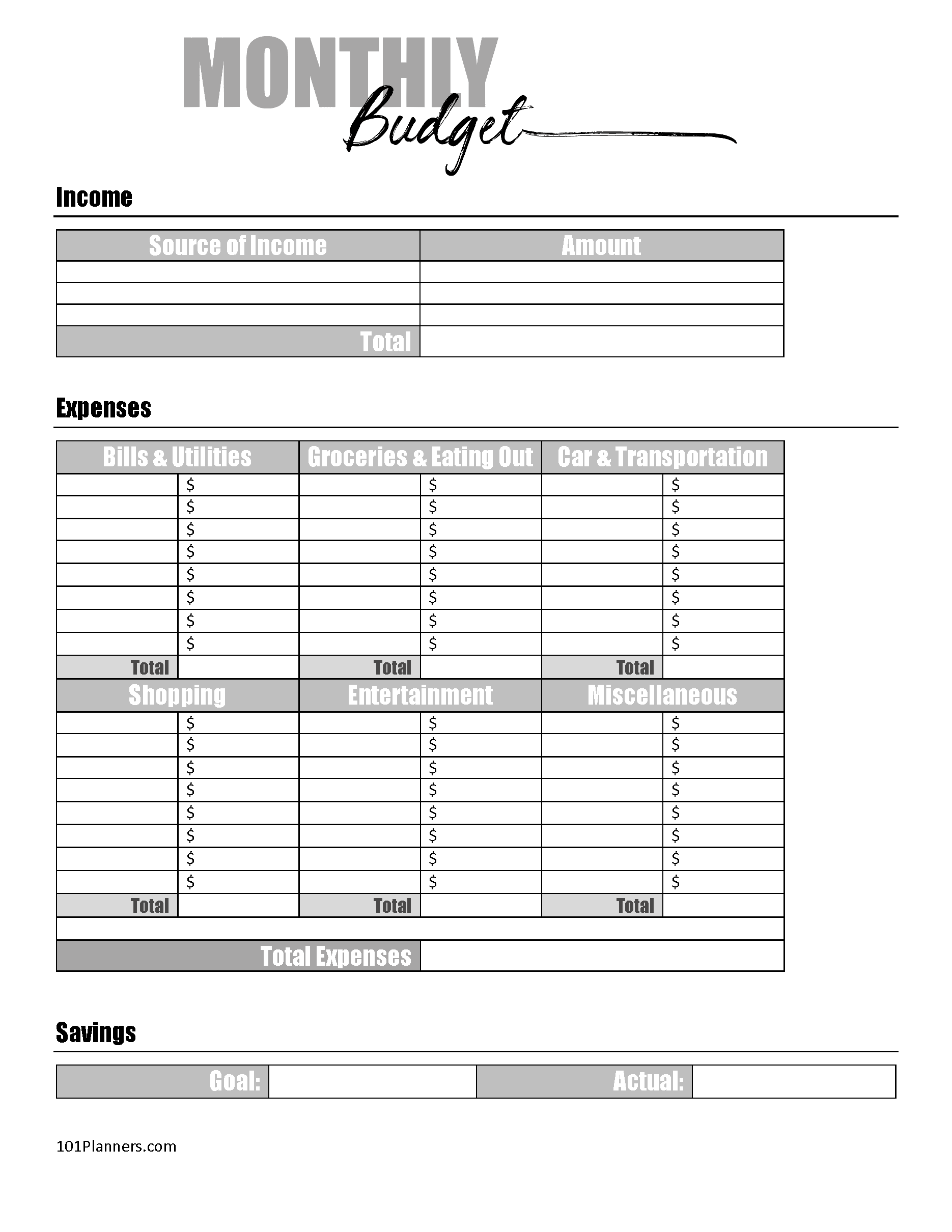

Your 6-Step Guide To Making a Personal Budget - The Balance 2022-01-24 · Financial goals fit into the savings section of your budget. You'll need to crunch some numbers to figure out how exactly to work each goal into your budget. For instance, if you want to save $5,000 to remodel your kitchen in the next year, divide $5,000 by 12. To reach your goal, you'll need to budget to save about $417 per month. Comparing ...

High School Functions Worksheets - Math Worksheets Land What is the Importance of Understanding Functions? In real life we often talk or define relationships between people. For example, there may be a boy in the street that you waive to and a friend may ask you how you know him. That boy could be a friend, a cousin, a brother, a teammate, and maybe you were just being courteous to a stranger. When you define that …

PDF Understanding Your Paycheck Essentials Lesson Plan 7.13 Susan worked 85 hours in the last pay period and she earns $18 per hour. Susan's gross pay= 85 hours x $18.00 23. $_____ Calculate Susan's Social Security deduction, which is 6.2% of her gross pay. Gross pay 24. $_____ (answer to #23) x .062= 25. $_____ Social Security deduction

Building Your Financial House - Understanding Your Pay ... Understanding Your Pay Statement. Did you know that there is no standard form that employers must use to report pay information to their employees? Although there is a minimum amount of information that must be included, each company chooses its own format, abbreviations, and level of detail in reporting employee pay information.

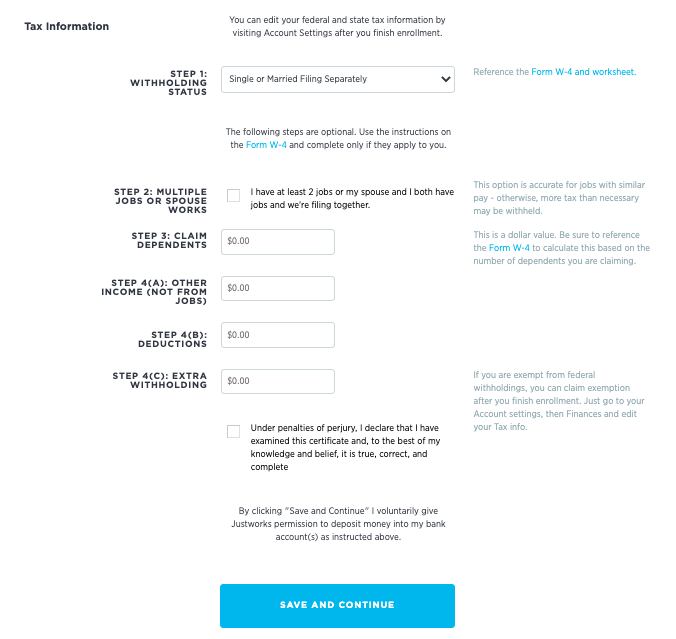

PDF Understanding Your Paycheck - Grant Community High School income withheld from your pay. •The lower the number of allowances the more money that is withheld from your check. -Adjusting your allowance if you are withholding too much or too little. -Overwithholding as a way to save. 1.3.4.G1 ... Understanding Your Paycheck ...

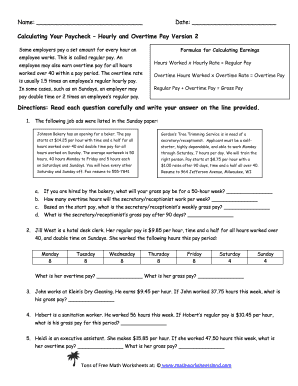

Calculating the numbers in your paycheck | Consumer ... Student materials. Calculating the numbers in your paycheck (worksheet) How to read a paystub (handout) Cómo calcular las cifras de su cheque de pago (hoja de ejercicios) Note: Please remember to consider your students' accommodations and special needs to ensure that all students are able to participate in a meaningful way.

PDF Directions: Using the pay check stub above, answer the ... 1. deductions (n): money that is subtracted or taken out from your pay 2. federal taxes (n): a percentage of an employee's wages that goes to the federal government 3. gross pay (n): the amount of money in an employee's paycheck before any deductions have been taken out 4. net pay (n): the amount of money left in an employee's paycheck ...

PDF Understanding taxes and your paycheck BUILDING BLOCKS STUDENT WORKSHEET. Understanding taxes and your paycheck Summer 2019 When you get your paycheck, you might ask, "Where did all my money go?" Understanding why and how taxes and other items are deducted from a worker's paycheck is an important step toward gaining financial knowledge.

Does Your Budget Have These Nine Features? - The Balance 2021-11-10 · Your budget isn't a set-it-and-forget-it exercise. You should be reviewing your budget and actual spending at least monthly so you can track your progress and make adjustments if necessary. Life changes can increase or reduce your spending and income, and regularly reviewing your budget ensures that your hard-earned dollars don't fall through ...

Understanding Your Paycheck - Printable Worksheets Showing top 8 worksheets in the category - Understanding Your Paycheck. Some of the worksheets displayed are Understanding taxes and your paycheck, Understanding taxes and your paycheck, Its your paycheck lesson 2 w is for wages w 4 and w 2, Understanding your paycheck, Nothing but net understanding your take home pay, Understanding it managing it making it work for you, My paycheck, Teen ...

PDF Understanding Your Paycheck - Ms. Christy Garrett Ann ... 1.13.1.A2 Worksheet © Family Economics & Financial Education - Revised May 2010 - Paychecks and Taxes Unit - Understanding Your Paycheck - Page 14

Quiz & Worksheet - Personal Finance Overview | Study.com 2. Jeff receives a paycheck of $2,100 twice per month. His monthly expenses include: $1,500 on rent, $400 on a car payment, $120 for his cellphone, $450 for utilities, $250 for groceries, and $200 ...

What Will Changing My Federal Withholding Do to My Paycheck… 2018-11-27 · Your calculation would go like this: $1,848.00 - $1,177.00 = $671.00 x 12 percent = $80.52 + $73.30 = $153.82 for your federal income tax each paycheck. If you had changed from one allowance to two, you would multiply the amount per biweekly allowance, $152.00 by two to get $304.00. Then you would subtract $304.00 from $2,000 to get $1,696.00, which means …

PDF Pay Stub Explanation Worksheet Pay Stub Explanation Worksheet Attached to your paycheck is a pay stub that details what exactly happened to your salary. Items on the stub below have numbers that correspond to the explanations that follow. Strategy #7 • orking It Out: Take-Home Pay, Benefits, and TaxesW ORKSHEET 85 2 1. No.of regular hrs.worked: 40 Rate of pay:$8/hr. 2.

PDF Understanding Your Paycheck Lesson Plan 1.13 Susan worked 85 hours in the last pay period and she earns $18 per hour. Susan's gross pay= 85 hours x $18.00 23. $_____ Calculate Susan's Social Security deduction, which is 6.2% of her gross pay. Gross pay 24. $_____ (answer to #23) x .062= 25. $_____ Social Security deduction

Understanding Your Paycheck | Biz Kids Lesson Plan ... Understanding Your Paycheck. Students receive a sample earnings statement and break down the different categories of information. Students then break into groups of four and play the 'Paycheck Mystery Word Game'. What Students Learn. Why there are deductions on your paycheck;

0 Response to "39 understanding your paycheck worksheet"

Post a Comment