39 1120s other deductions worksheet

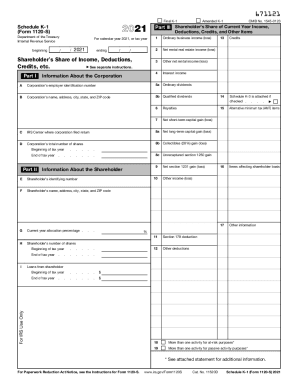

Forms and Instructions (PDF) - IRS tax forms Instructions for Schedule K-2 (Form 1120-S) and Schedule K-3 (Form 1120-S) 2021. 09/22/2021. Form 1120-S (Schedule B-1) Information on Certain Shareholders of an S Corporation. 1220. 12/16/2020. Form 1120-S (Schedule D) Capital Gains and Losses and Built-in Gains. Exporting Forms K1 from 1065, 1120S or 1041 (K1) Basis Worksheet Does Not Export. Basis information for individual partners or shareholders should be entered in the 1040 package in Drake, using the Basis Worksheet links on the K1P or K1S screen. This information cannot be exported from the 1065 or 1120S package to a 1040 return. Such an import would override limitations and carryovers ...

ttlc.intuit.com › community › business-taxeshow is non taxable EIDL advance grant report on 11... Jan 21, 2021 · Entering it on Schedule M1 worksheet under 'other permanent income items - per books' creates an auto fill to Form 1120S 16 'other tax exempt income smart worksheet' but no total in 16b. There is a caution note - 'if you are using schedule m1 items worksheet enter any other tax exempt income there not below' - this is what I am doing but its ...

1120s other deductions worksheet

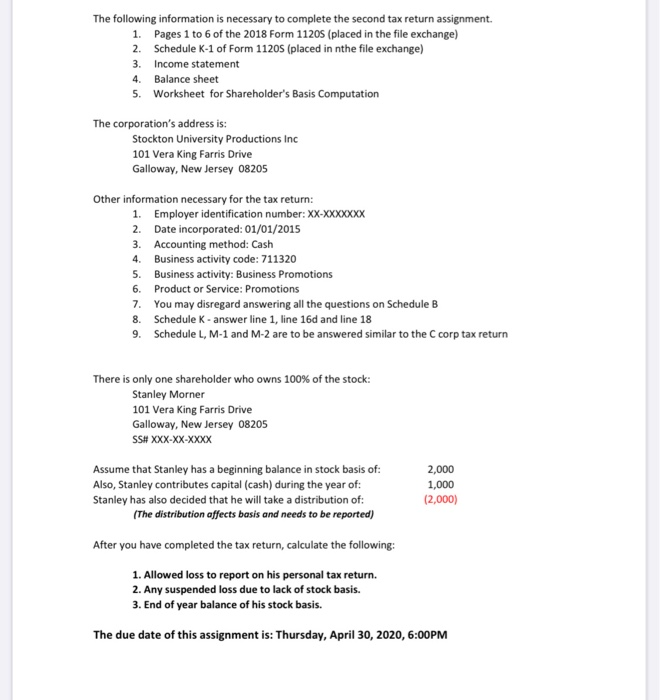

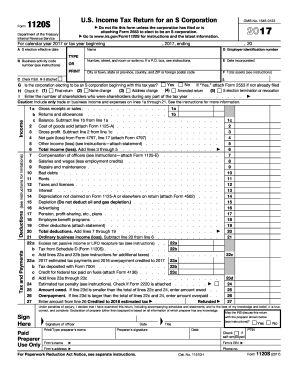

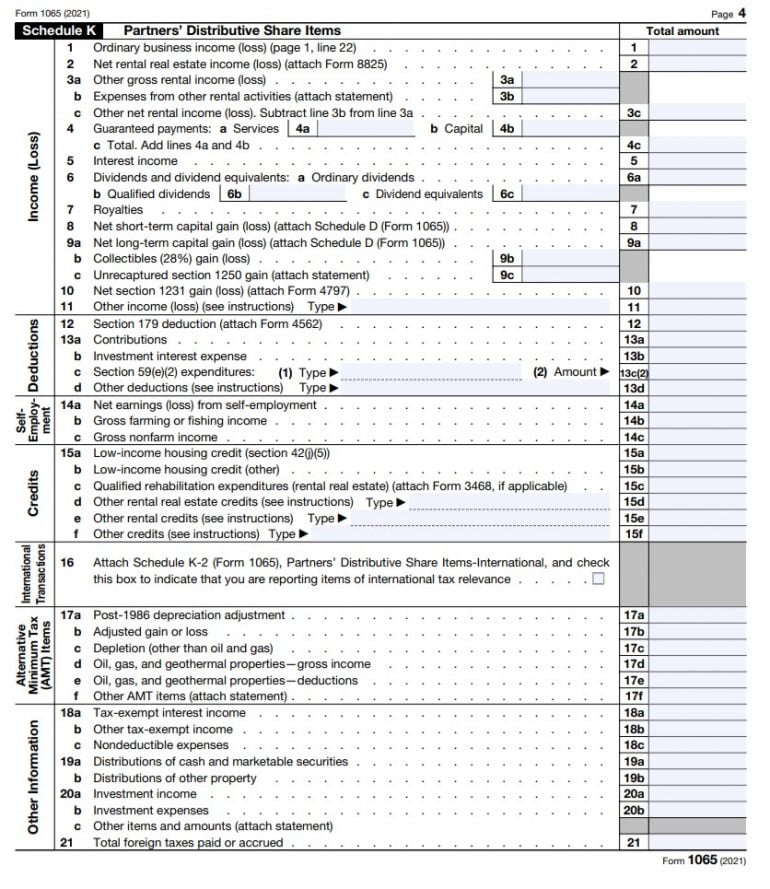

How do I enter Shareholder Distributions in an 1120S ... - CCH Go to the Income/Deductions > Schedule K Other Income / Deductions Worksheet. Select Section 9 - Summary of Sch K Income & Deduction Items with Book/Tax Adj. Click Detail. In Line 1 - Class code, use the lookup value (double-click or press F4) to select DIS - Property distributions. In Lines 2-19 - Other Income Detail Items, enter applicable ... 1120s Other Deductions Worksheets - Kiddy Math Some of the worksheets for this concept are 2020 instructions for form 1120 s, Forms required attachments, Us 1120s line 19, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Corporation tax organizer form 1120, Self employment income work s corporation schedule, Instructions and work to schedule k 1, 2018 net profit booklet 11 18. 1120S - Shareholders Adjusted Basis Worksheet (Basis Wks) (K1) This article refers to screen Shareholder's Adjusted Basis Worksheet, in the 1120-S (S corporation) package. The worksheet is available from screen K1 by using the Basis Wks tab at the top of the screen.. Basis is tracked at both the 1120-S level and the 1040 level, however, the worksheets are not always the same between the 1120-S and 1040 returns.

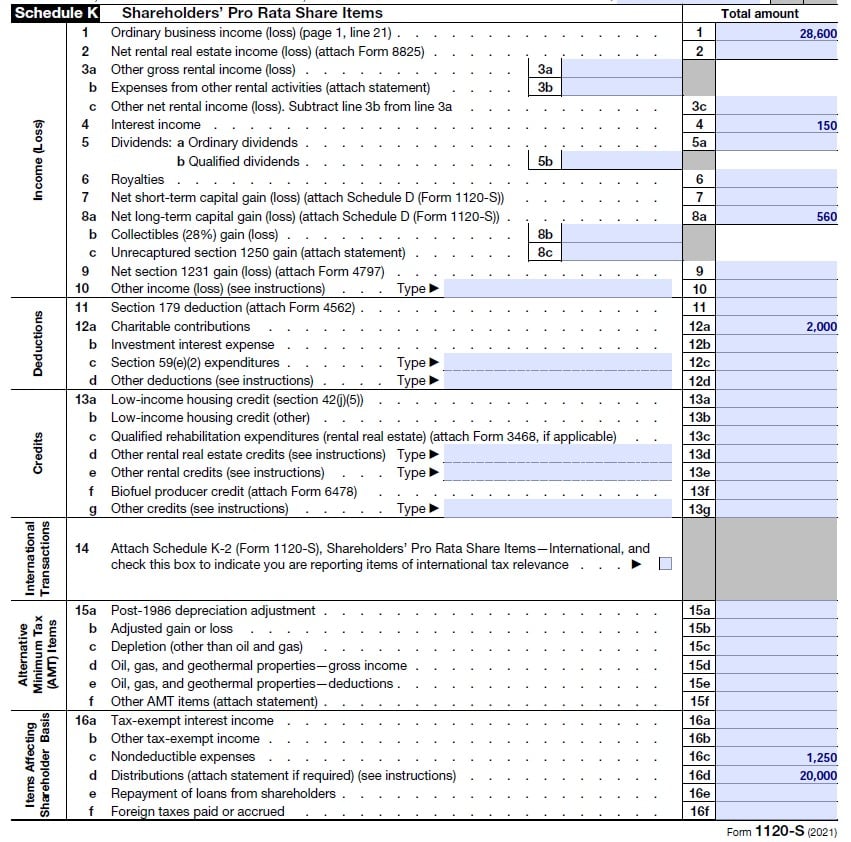

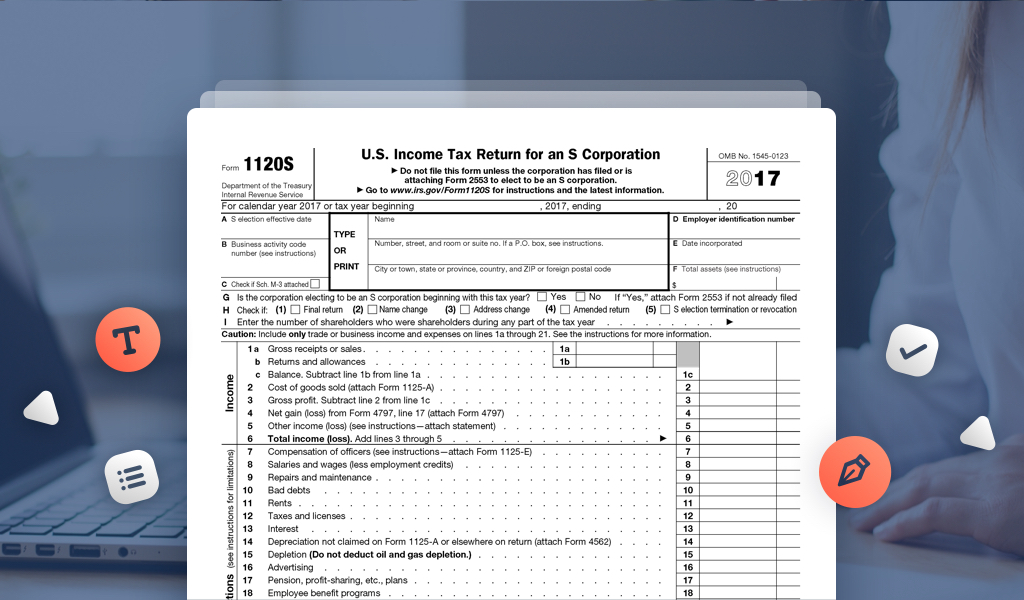

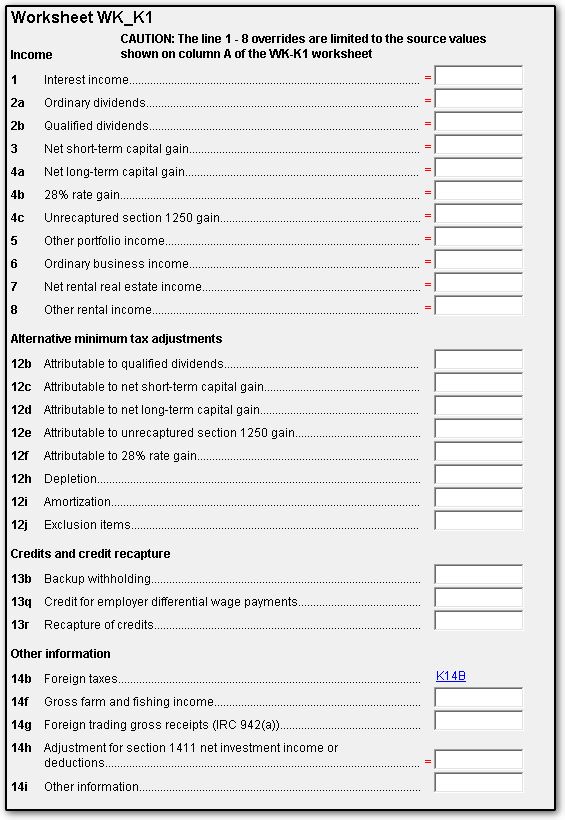

1120s other deductions worksheet. Shareholder's Instructions for Schedule K-1 (Form 1120-S ... The corporation should have attached a statement that shows any income from, or deductions allocable to, such properties that are included in boxes 2 through 12, 16, and 17 of Schedule K-1. Use the amounts reported here and any other reported amounts to help you figure the net amount to enter on Form 6251, line 2t. 1120s Other Deductions Worksheets - Printable Worksheets Some of the worksheets displayed are 2020 instructions for form 1120 s, Forms required attachments, Us 1120s line 19, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Corporation tax organizer form 1120, Self employment income work s corporation schedule, Instructions and work to schedule k 1, 2018 net profit booklet 11 18. › instructions › i1120ssdInstructions for Schedule D (Form 1120-S) (2021) | Internal ... Dec 31, 2020 · Enter the amount from line 28 of Form 1120 on line 17 of Schedule D. Attach to Schedule D the Form 1120 computation or other worksheet used to figure taxable income. For corporations figuring the built-in gains tax for separate groups of assets, taxable income must be apportioned to each group of assets in proportion to the net recognized built ... Future Developments 21 - IRS tax forms Use Form 1120-S to report the income, gains, losses, deductions, credits, and other information of a domestic corporation or other entity for any tax year covered by an election to be an S corporation. How To Make the Election. For details about the election, see Form 2553, Election by a Small Business Corporation, and the Instructions for Form ...

File S Corp Business Taxes | Download TaxAct 1120S Edition TaxAct Business 1120S. 2021 Download Edition. Easy Guidance, Tools & Support to Maximize Deductions. Maximize your deductions and save time with various imports & reports. $ 109 95 State Additional Bundle with 1040 Software Benefits Forms Requirements 100% Accuracy Guarantee Rest assured, TaxAct guarantees the calculations on your return are 100% correct. ... SCHEDULE K-1 OWNER’S SHARE OF INCOME, CREDITS, DEDUCTIONS … any (loss) reported in Section A, Lines 1, 2, or 3 and any other related items of income, (loss), and deductions reported on Kentucky Schedule K-1. Refer to the federal Instructions for federal Schedule K-1 (Form 1120S or Form 1065) to determine … Form 1120 Other Deductions Worksheet - Fill Out and Sign ... Use this step-by-step guide to fill out the Form 1120 other deductions worksheet swiftly and with ideal precision. How to complete the 1120 fillable form online: To start the form, utilize the Fill & Sign Online button or tick the preview image of the blank. The advanced tools of the editor will lead you through the editable PDF template. PDF US 1120S Line 19 - Other Deductions 2008 Copyright form software only, 2008 Universal Tax Systems, Inc. All rights reserved. USWSA$$1 Accounting Uniforms Tools Temporary help Telephone Supplies

Schedule K-1 (Form 1120S) - Deductions – Support The amount entered will flow to Form 8582, Worksheet 3 where, based on other passive items affecting the taxpayer, it will determine if any amount will be allowed on Schedule E (Form 1040), line 28, column (f). Any remaining deductions above the $10,000 ($5,000 if married filing separately) for each qualified timber property can be amortized. See: 41 1120s other deductions worksheet - Worksheet Works Form 1120 Line 26 Other Deductions Worksheet To stay clear of terrifying the youngster away, these questions aren't indicated to be specifically challenging. Nevertheless, if a principle is used over and over again, the infant may end up being bored as well as try to distance themselves. BOARD OF EDUCATION OF FAYETTE COUNTY Net Profits ... BOARD OF EDUCATION OF FAYETTE COUNTY Net Profits Occupational License Tax Return This form must be filed and PAID IN FULL on or before April 15, 2021, or by the 15th day of the 4th month after close of fiscal year. Form 1120 Line 26 Other Deductions Worksheet - Studying ... Displaying top 8 worksheets found for - 1120s Other Deductions. Reap the benefits of a electronic solution to generate edit and sign documents in PDF or Word format on the web. Enter total returns and allowances on Line 1b. Enter deduction type and amounts in the Other CtrlE field in Screen 201 Deductions.

2020 Us 1120s Line 19 Other Deductions - Kiddy Math some of the worksheets for this concept are 2020 instructions for form 1120 s, forms required attachments, fannie mae cash flow analysis calculator, partners adjusted basis work outside basis tax, fnma self employed income, calculating income from 1040 k1 1120s s corporation, tax work for self employed independent contractors, chapter 4 borrower …

› iowaPrintable Iowa Income Tax Forms for Tax Year 2021 Form IA 1120S Instructions. 2021 Form IA 1120S/K-1 Instructions: Download / Print e-File with TurboTax: Form IA 1120S Shhedule K-1. 2021 Schedule K-1 - Shareholder’s Share of Iowa Income, Deductions, Modifications: Download / Print e-File with TurboTax: Form IA 130. 2021 † Tax Credit: Out-of-State Tax Credit 41-130: Download / Print e-File ...

1120s Other Deductions 2020 Worksheets - Kiddy Math some of the worksheets for this concept are 2020 instructions for form 1120 s, corporation tax organizer form 1120, 2020 ia 1120s income tax return for s corporations, 20 purpose of schedule k 1 general instructions, engagement letter for 2020 s, schedule a itemized deductions, fannie mae cash flow analysis calculator, tax work for self employed …

Schedule K-1 (Form 1120-S) - Health Deduction Worksheet If you need the amount reported in Box 14 of your W-2 to transfer to Line 16 of Schedule 1 (Form 1040) Additional Income and Adjustments to Income, and you received a Schedule K-1 (Form 1120-S) Shareholder's Share of Income, Deductions, Credits, etc., you need to complete the Self-Employed Health Insurance Deduction Worksheet.

Instructions for Form 1120-S (2021) | Internal Revenue Service If the income, deductions, credits, or other information provided to any shareholder on Schedule K-1 or K-3 is incorrect, file an amended Schedule K-1 or K-3 (Form 1120-S) for that shareholder with the amended Form 1120-S. Also give a copy of the amended Schedule K-1 or K-3 to that shareholder.

Forms and Instructions (PDF) - IRS tax forms Instructions for Schedule H (Form 1120-F), Deductions Allocated To Effectively Connected Income Under Regulations Section 1.861-8 2021 12/20/2021 Form 1120-F (Schedule I) Interest Expense Allocation Under Regulations Section 1.882-5 2021 12/16/2021 Inst 1120-F (Schedule I) ...

33 1120s Other Deductions Worksheet - Worksheet Database ... 33 1120s Other Deductions Worksheet - Worksheet Database Source 2020. dd form 1966 usmc - Edit, Fill, Print & Download Online ... 31 Printable Example Of Organizational Chart Forms and ... Form VS-142.3 Download Fillable PDF or Fill Online Mail ... Unique Employee Application form #xlstemplate #xlssample # ...

Instructions for Form 1120 (2021) | Internal Revenue Service Other Deductions Travel, meals, and entertainment. Travel. Meals. Qualified transportation fringes (QTFs). Membership dues. Entertainment facilities. Amounts treated as compensation. Fines or similar penalties. Lobbying expenses. Line 28. Taxable Income Before NOL Deduction and Special Deductions At-risk rules. Line 29a.

How to File S Corp Taxes & Maximize Deductions | White ... Now repeat the process for any other shareholders (luckily since we're 50/50, this is very easy to do for us) and compile your return. It should look like this: Form 1120S pages 1-5; Form 1125-A; Form 1125-E; Statement of Explanation for 2019 Form 1120S Line 19 Other Deductions; Statement of Explanation for 2019 Form 1120S Schedule L Line 14 ...

2021 Shareholder's Instructions for Schedule K-1 (Form 1120-S) to replace the Worksheet for Figuring a Shareholder's Stock and Debt Basis. See the Instructions for Form 7203 for details. New item added to Part I. Item D is added for the corporation's total number of shares for the beginning and end of the tax year. General Instructions Purpose of Schedule K-1 The corporation uses Schedule K-1 to report your share …

kb.drakesoftware.com › Site › BrowseQBI Deduction - Frequently Asked Questions (K1, QBI ... In other words, the AGI minus the standard or itemized deduction amount: In Drake20, Form 1040, line 11 minus line 12. This is the amount shown on Form 8995, line 11 and the calculation is displayed at the bottom of the 8995 for your reference.

PDF US 1120S Line 19 - Other Deductions 2015 US 1120S Line 19 - Other Deductions 2015 Type: Created Date: 5/3/2016 10:10:40 AM ...

PDF FORMS REQUIRED: ATTACHMENTS - IRS tax forms Form 1120-S 2019 U.S. Income Tax Return for an S Corporation Department of the Treasury Internal Revenue Service aDo not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation. aGo to for instructions and the latest information. OMB No. 1545-0123

cs.thomsonreuters.com › ua › utQualified business income deduction (QBID) overview (1040) If the 1120S or 1065 return was prepared in UltraTax CS, the QBI is calculated in the business return and can be shared with the 1040 client via data sharing. See the following articles for information on the QBI calculation: Qualified business income for pass-through entities (1065) Qualified business income for pass-through entities (1120)

Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. IRS Form 1040 – Individual Income Tax Return Year_____ Year_____ 1. W-2 Income from Self …

1120S - Shareholders Adjusted Basis Worksheet (Basis Wks) (K1) This article refers to screen Shareholder's Adjusted Basis Worksheet, in the 1120-S (S corporation) package. The worksheet is available from screen K1 by using the Basis Wks tab at the top of the screen.. Basis is tracked at both the 1120-S level and the 1040 level, however, the worksheets are not always the same between the 1120-S and 1040 returns.

1120s Other Deductions Worksheets - Kiddy Math Some of the worksheets for this concept are 2020 instructions for form 1120 s, Forms required attachments, Us 1120s line 19, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Corporation tax organizer form 1120, Self employment income work s corporation schedule, Instructions and work to schedule k 1, 2018 net profit booklet 11 18.

How do I enter Shareholder Distributions in an 1120S ... - CCH Go to the Income/Deductions > Schedule K Other Income / Deductions Worksheet. Select Section 9 - Summary of Sch K Income & Deduction Items with Book/Tax Adj. Click Detail. In Line 1 - Class code, use the lookup value (double-click or press F4) to select DIS - Property distributions. In Lines 2-19 - Other Income Detail Items, enter applicable ...

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

/4592-f64c21a16a3847538c094ee48dee34fe.jpg)

0 Response to "39 1120s other deductions worksheet"

Post a Comment