43 government spending worksheet answers

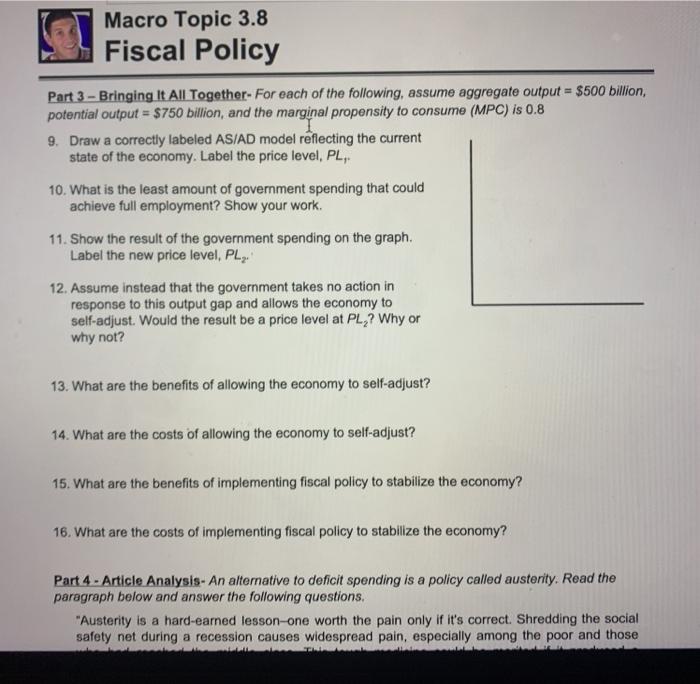

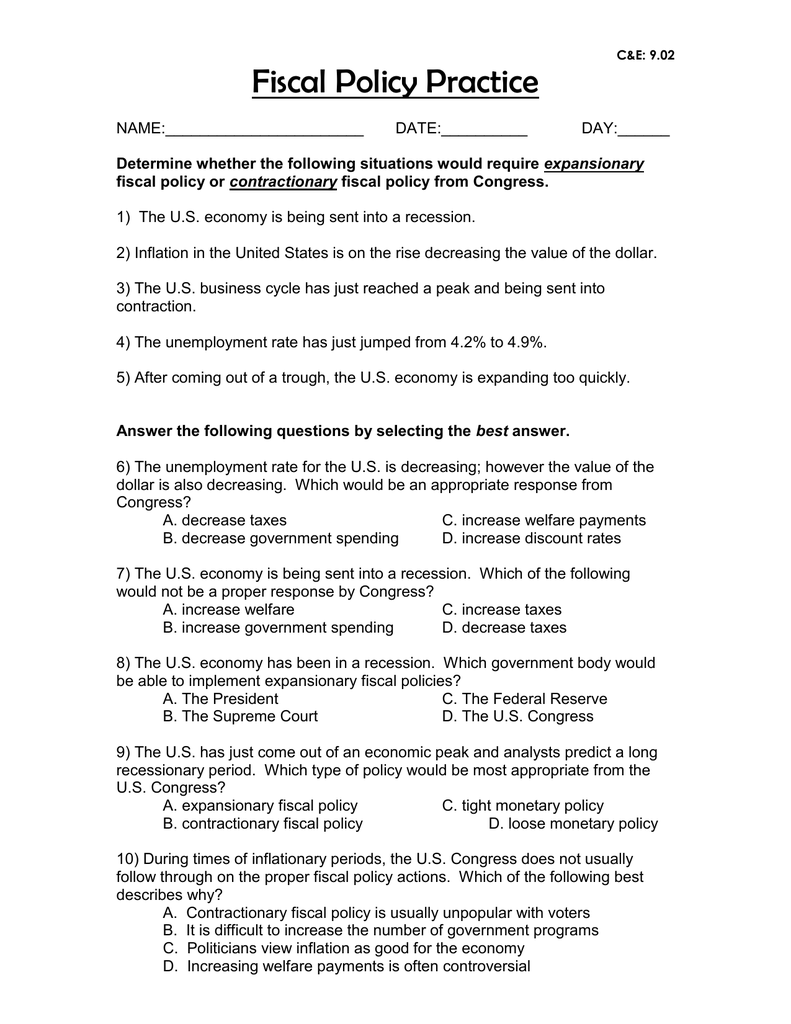

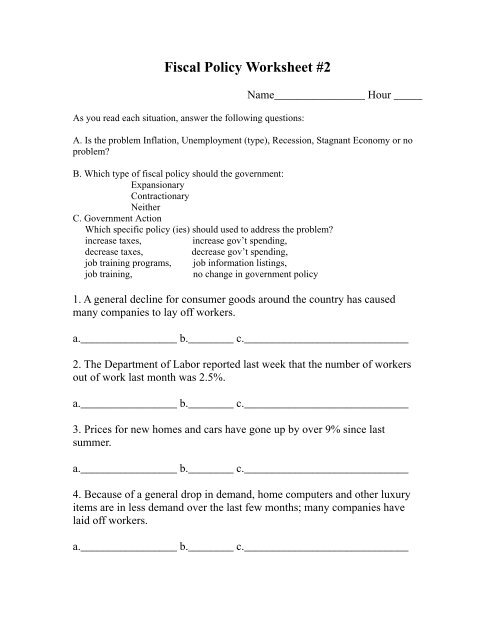

Question: Why Government Icivics Worksheet Answers ... Please follow these steps to create your assignment: Login. Click "My iCivics" Click on the "Classes" Select the class you want to create an assignment for. Click on the green "ADD" link on the right corner of the 'Assignments' section. Fill in the appropriate information in the "Add Assignment" pop-up and click "SAVE". PDF Fiscal Policy Worksheet 1 With Answers Fiscal Policy Worksheet #1 . name_____ hour _____ Follow these steps: 1. Identify if the problem is inflation or unemployment. ... - increase government spending - decrease government spending - decrease taxes - increase taxes . 1. MOST ALL PEOPLE ARE EMPLOYED. PEOPLE ARE SPENDING MORE MONEY THAN EVER BEFORE AND THEY ARE BUYING VERY HIGH DOLLAR ...

echte-freude-schenken.de › apex-governmentApex government unit 1 test answers Shopping Cart 0 items - £0 0 Edmentum mastery test answers algebra 2. com on January 17, 2022 by guest [MOBI] Apex Government Quiz Answers If you ally need such a referred apex government quiz answers books that will have the funds for you worth, acquire the agreed best seller from us currently from several preferred authors. SURVEY .

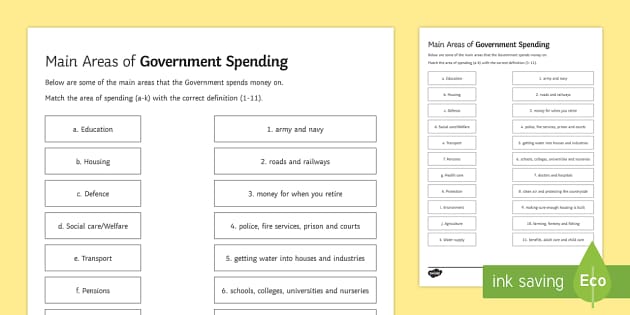

Government spending worksheet answers

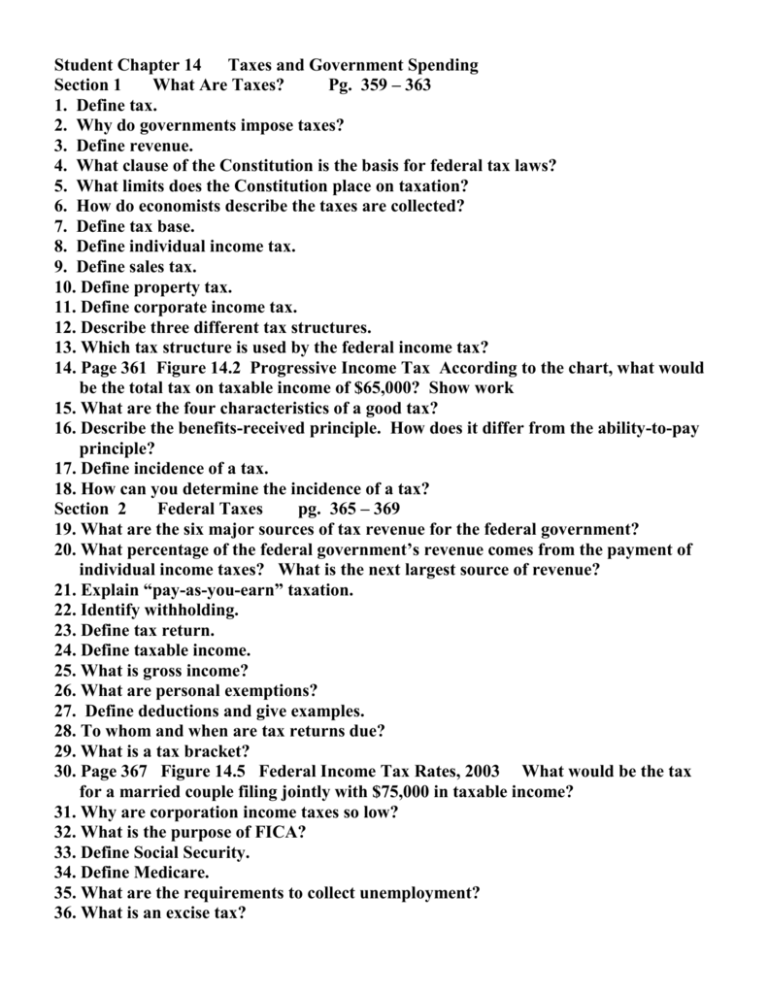

Economics Chapter 14 - Taxes and Government Spending ... Start studying Economics Chapter 14 - Taxes and Government Spending. Learn vocabulary, terms, and more with flashcards, games, and other study tools. PDF Government Spending and Economic Growth government spending. Simply put, government spending "crowds out" private investment. When government uses resources, there are fewer resources for private purposes. Temporarily, government spending and private investment can be complementary. Government's grab for resources can be met through reduction in savings or capital inflows from abroad. Study 15 Terms | ECON - Worksheet -... Flashcards | Quizlet ECON - Worksheet - Chapter 14.1 - Government Revenue & Spending - Section 1 - How Taxes Work Learn with flashcards, games, and more — for free.

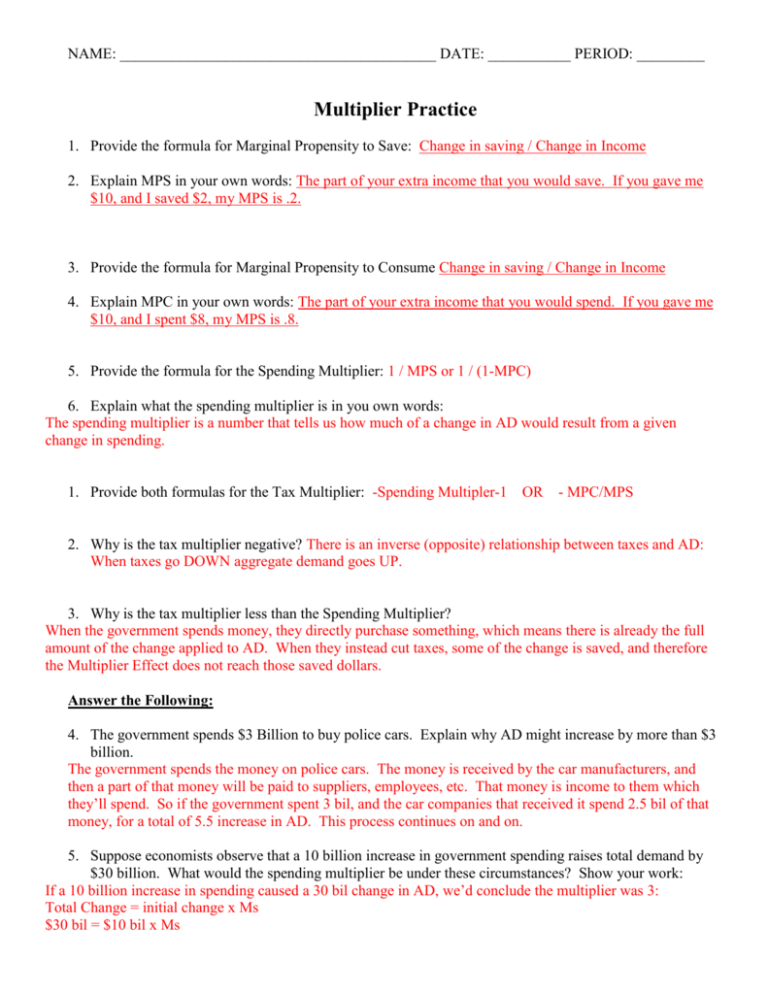

Government spending worksheet answers. PDF UNIT 3 Macroeconomics LESSON 8 - Denton ISD 3. Government spending goes up while taxes remain the same. Expansionary. Higher government spending without a corresponding rise in tax receipts increases aggregate demand in the economy. 4. The government reduces the wages of its employees while raising taxes on consumers and businesses. Other government spending remains the same. Contractionary. PDF Government Spending and Taxes - stlouisfed.org Government Spending and Taxes Lesson Author Barbara Flowers, Federal Reserve Bank of St. Louis Standards and Benchmarks (see page 11) Lesson Description In this lesson, students engage in an activity that matches programs for low-income Chapter+13+Practice+Worksheet+Answer+Key.pdf - Econ 201 ... View Chapter+13+Practice+Worksheet+Answer+Key.pdf from ECON 201 at Eastern Washington University. Econ 201 Chapter 13 Practice Worksheet - Answer Key MULTIPLE CHOICE: the correct answer is ... Government spending must be cut to balance the budget because the federal government is required by law to run a balanced budget. d. PDF Is Government Spending Too Easy an Answer? Is Government Spending Too Easy an Answer? By N. GREGORY MANKIW WHEN the Obama administration finally unveils its proposal to get the economy on the road to recovery, the centerpiece is likely to be a huge increase in government spending. But there are ample reasons to doubt whether this is what the economy needs.

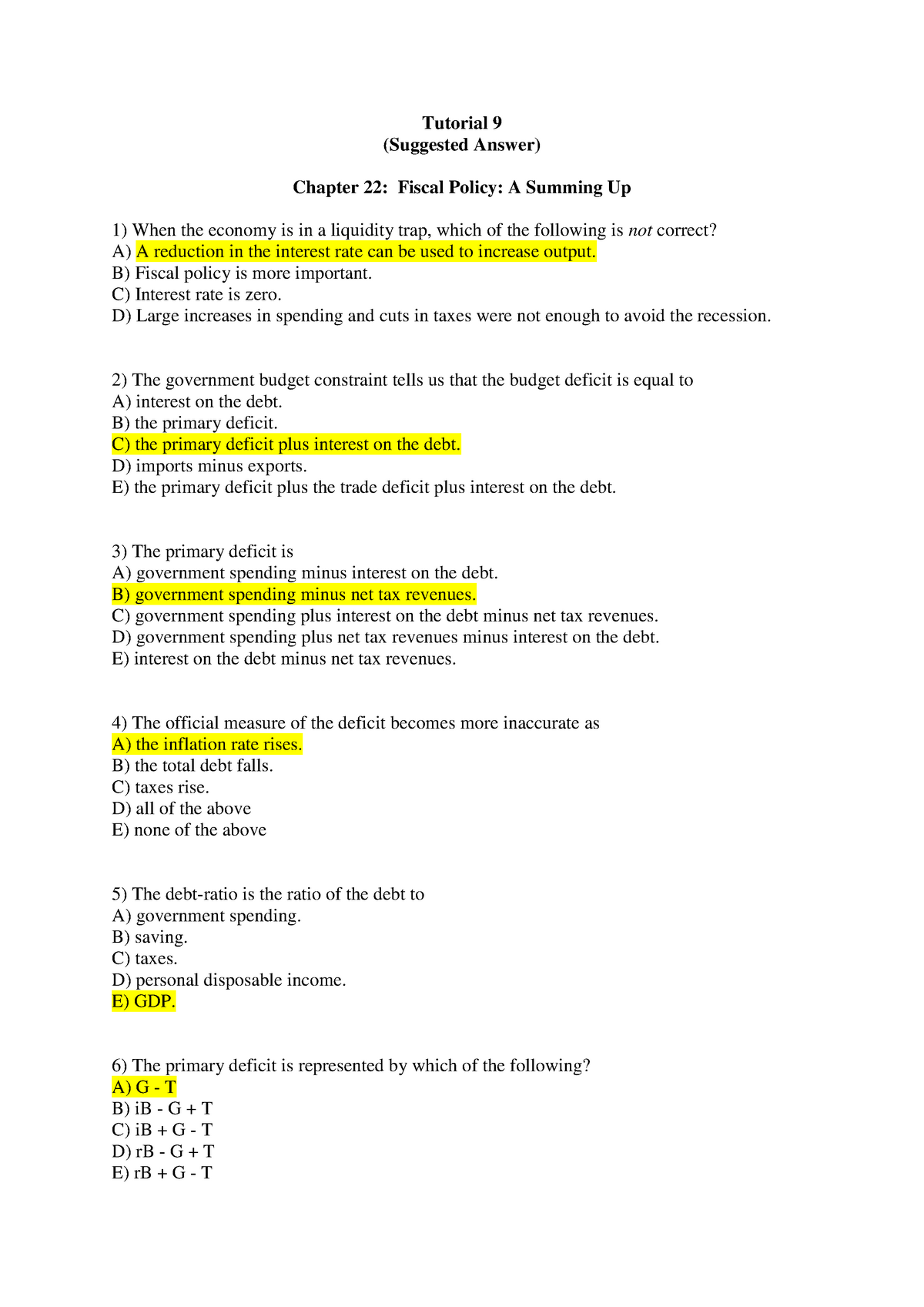

PDF Monetary and Fiscal Policy Worksheet 1 With Answers Monetary and Fiscal Policy Worksheet #1 Name _____ Hour _____ 1. The rate of inflation has increased by 6.8% over the last year. ... Decrease Government Spending . Increase taxes . 2. The Consumer Price Index has gone up by 6.8% over the last year. The Federal Reserve wonders what it can do to help improve this situation. a. Quiz & Worksheet - Government Spending & Crowding Out ... This worksheet and quiz will let you practice the following skills: Knowledge application - use your knowledge to answer questions about the federal budget. Defining key concepts - ensure that you ... Quiz & Worksheet - Government Spending and Taxes as Fiscal ... The government has many fiscal policy tools at their disposal, and this quiz/worksheet combo will help test your understanding of the vocabulary surrounding this topic. Quiz & Worksheet Goals PDF Worksheet - IRS tax forms Name _____ Date _____ Worksheet Government Spending Theme 1: Your Role as a Taxpayer Lesson 1: Why Pay Taxes? Key Terms public goods and services—Benefits that cannot be withheld from those who don't pay for them, and benefits that may be "consumed" by one person without reducing the amount of the product

5.04 Government Spending Worksheet.docx - Government ... View Homework Help - 5.04 Government Spending Worksheet.docx from ENGLISH Honor at Cuthbertson High. Government Spending A. Nam e: True or False? Mark each statement as True (T) or False (F). If the PDF Worksheet Solutions Government Spending Worksheet Solutions Government Spending Theme 1: Your Role as a Taxpayer Lesson 1: Why Pay Taxes? Key Terms public goods and services—Benefits that cannot be withheld from those who don't pay for them, and benefits that may be "consumed" by one person without reducing the amount of the product 5.04 Government Spending Worksheet.docx - Name Government ... View 5.04 Government Spending Worksheet.docx from AA 1Name Government : A. True or False? Mark each statement as True (T) or False (F). If the statement is false, Spending cross out the wrong part PDF Icivics Government Spending Answers Icivics Government Spending Answers This lesson tackles a variety of topics related to government spending, including the federal budget, mandatory versus discretionary spending, and government debt. Students learn the difference between a surplus and deficit, the basics of federal budgeting, and the

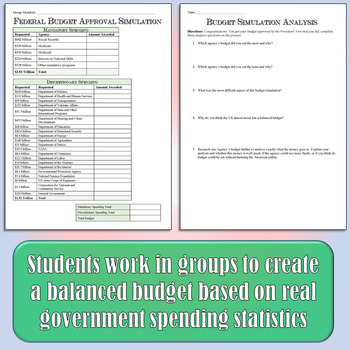

PDF Federal Budget Simulation Lesson Plan - John F. Kennedy ... The president and Congress decide how much spending they will finance through taxes, and debate how to use the budget to help the economy grow or to redistribute income. More recently, they have been debating how long we can sustain large budget deficits that many government leaders feel have been necessary to stimulate our economy.

PDF FRED Activity Worksheet Answer Key - EconEdLink also increase so the government can increase their revenue, by doing this incomes of households will fall, which may in turn decrease consumption) 6. Identify and explain some of the benefits a balanced budget would have on taxes, and spending in other categories (healthcare, defense, education, etc.…). (Student answers may vary.

PDF Teacher's Guide - ISTE County Government: High School Learning Objectives. Students will be able to: Identify the organizational structures and duties of county government Define Dillon's Rule and home rule Describe the types of services counties provide Compare counties' revenue sources Simulate balancing a county budget Analyze the benefits and challenges of unfunded

icivics government and the economy answers key Icivics Government Spending Answers Government Spending Icivics Answer Key 2 Government spending Government is said to be spending close to 30 billion rand in public money to fund just over 27-thousand managers in the Government Spending, Taxes and the Economy Government … Instead the government makes those decisions.

PDF The Fiscal Ship Worksheet - EconEdLink Federal Budget: Fiscal Ship Game 1 The Fiscal Ship Handout Packet Budget Background Guiding Notes and Questions Directions: Answer the questions in a complete sentence and fill-in the blanks. Make sure to follow along with the PowerPoint presentation.

PDF Answer Key - Federal Reserve Bank of Atlanta Government spending A local library purchases new audio books . 4. Net exports or imports A retailer purchases tennis shoes from a manufacturer in China and sells them . 5. Consumption Mother purchases those tennis shoes from the retailer . Write one more example of each of the four components. 6. Answers will vary Consumption . 7. Answers will ...

PDF Teacher's Guide - Theodore Roosevelt High School Government Spending Learning Objectives. Students will be able to: Describe what a budget is. Compare the national budgeting process to the personal budgeting process. Explain the difference between a surplus and a deficit. Explain why and how the government borrows money. Analyze federal spending data. Make cuts to a fictional personal budget.

PDF Types of Government Reading and Worksheets forms of government that exist (or have existed) in the world. King Hara/d V of Norway with his wife, Queen Sonja. Norway is a constitutiona/ monarchy. The king is the head of state and has a mainly ceremonia/ role. The actual government is a democracy. Power to the People! Me, Myself, and I An autocracy is a government in which one person has ...

Government Spending - Fiscal Policy Lesson Plan | iCivics This lesson tackles a variety of topics related to government spending, including the federal budget, mandatory versus discretionary spending, and government debt. Students learn the difference between a surplus and deficit, the basics of federal budgeting, and the method the government uses to borrow money. They consider the complexities of deciding where the government's money should go ...

Limiting Government Answer Key Pdf Icivics | GBGYABA ... Some limits on government the starting point was unlimited power. Icivics worksheet answers all limiting government homework icivics pdf one big party icivics worksheet answers pdf wiscbook may 9th 2018 icivics limiting government answer key the limits on government checks on goverment to secure balance in the. Limiting Government 3 Pdf Peru Separation Of Powers […]

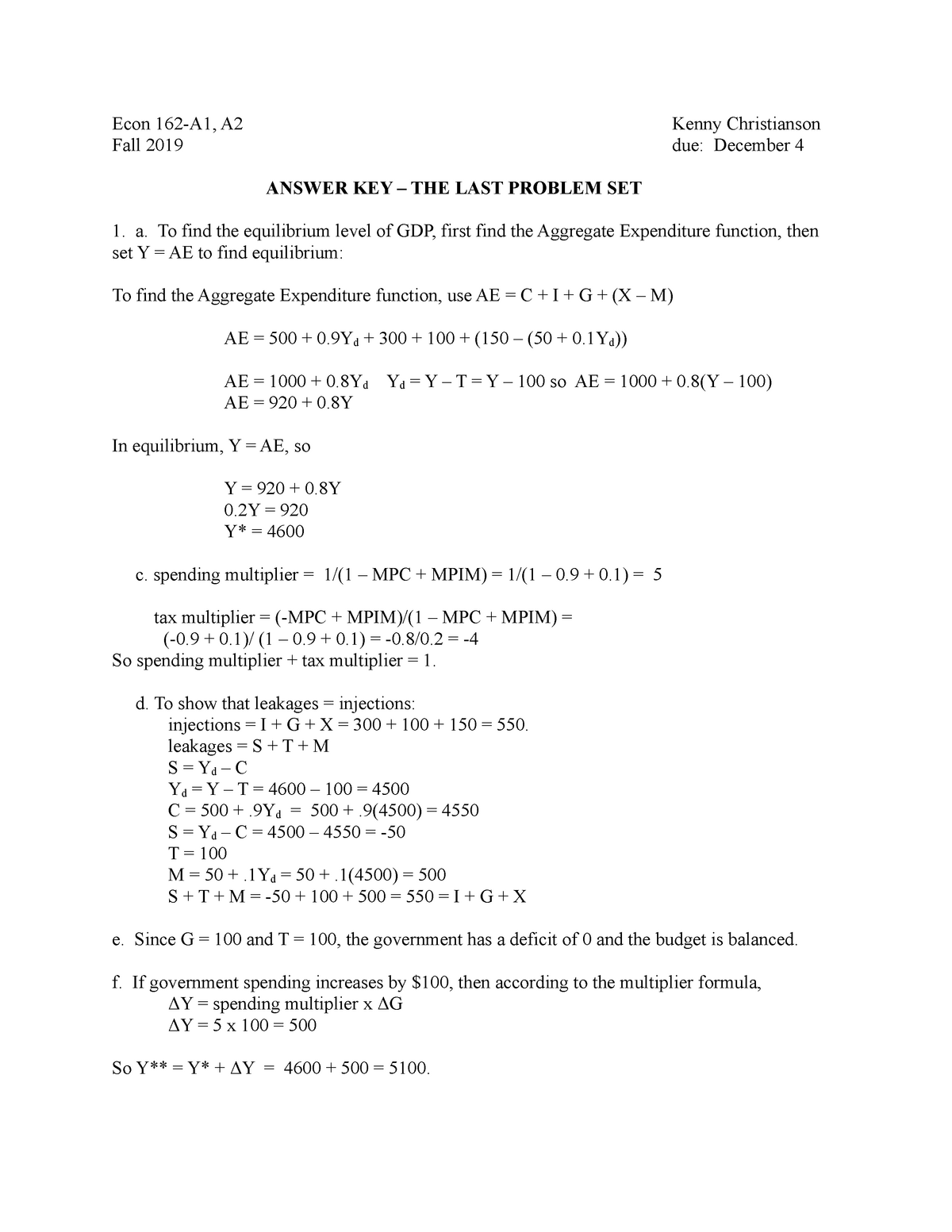

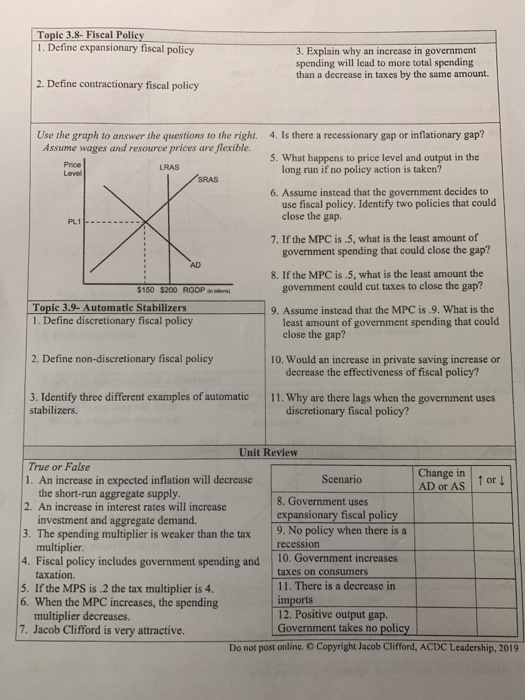

PDF UNIT 3 Macroeconomics Key - Denton ISD Econoland has the following values for income and consumption. Use this data to answer questions 7, 8 and 9. Income Consumption 100 150 200 225 300 300 400 375 500 450 600 525 7. The government spending multiplier in Econoland is (A) 3 (B) 4 (C) 5 (D) 10 (E) 30 8. If there is an increase in taxes of $200 in Econoland, the decrease in GDP will ...

study.com › academy › lessonEncumbrances in Government Budgeting: Definition ... - Study.com Aug 04, 2020 · Government budgeting is the process whereby a local, state, or federal government plans and spends money. It's similar to--but not exactly like--when people or private companies create budgets for ...

PDF Lesson 2 Taxing and Spending Bills - Weebly Lesson 2 Taxing and Spending Bills Guided Reading Activity Answer Key I. Making Decisions About Taxes A. The national government gets most of its revenue from taxes, the money that people and businesses pay to support the government. B. According to the Constitution, all revenue bills begin in the House of Representatives, but the

› business › economyOverview of Economics: Three Economists and Their Theories The three most important economists were Adam Smith, Karl Marx, and John Maynard Keynes (pronounced canes).Each was a highly original thinker who developed economic theories that were put into practice and affected the world's economies for generations.

Study 15 Terms | ECON - Worksheet -... Flashcards | Quizlet ECON - Worksheet - Chapter 14.1 - Government Revenue & Spending - Section 1 - How Taxes Work Learn with flashcards, games, and more — for free.

PDF Government Spending and Economic Growth government spending. Simply put, government spending "crowds out" private investment. When government uses resources, there are fewer resources for private purposes. Temporarily, government spending and private investment can be complementary. Government's grab for resources can be met through reduction in savings or capital inflows from abroad.

Economics Chapter 14 - Taxes and Government Spending ... Start studying Economics Chapter 14 - Taxes and Government Spending. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

0 Response to "43 government spending worksheet answers"

Post a Comment