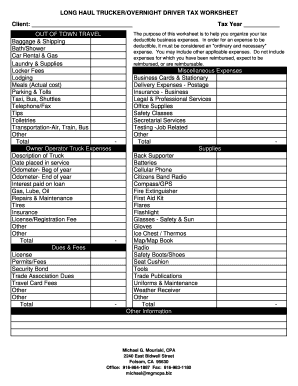

41 trucker tax deduction worksheet

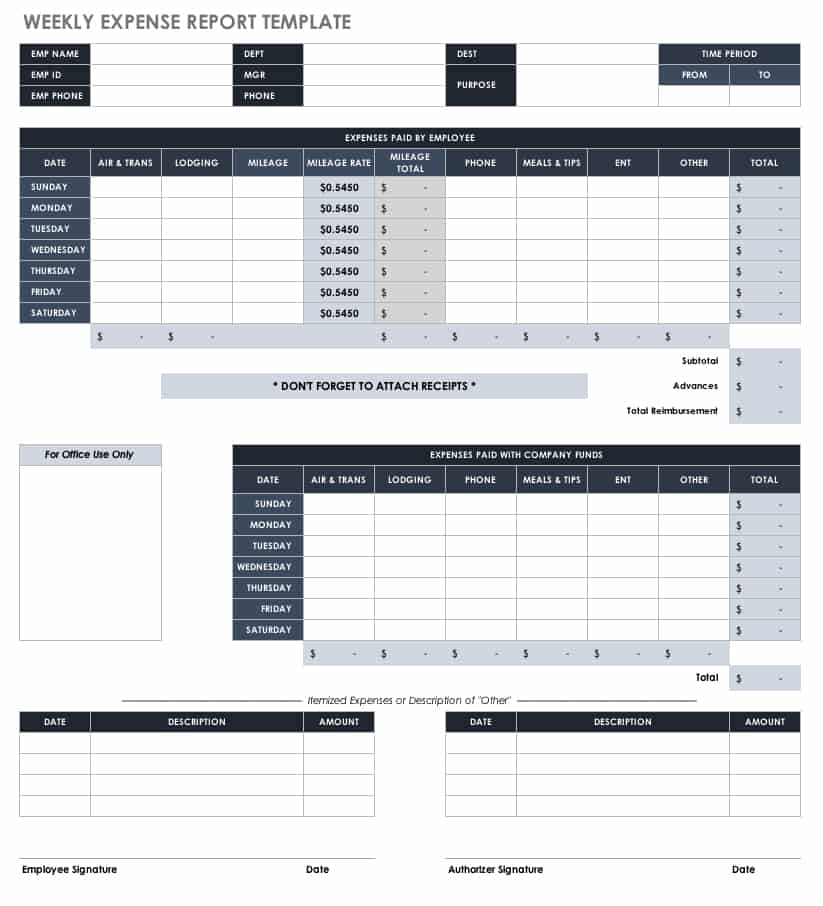

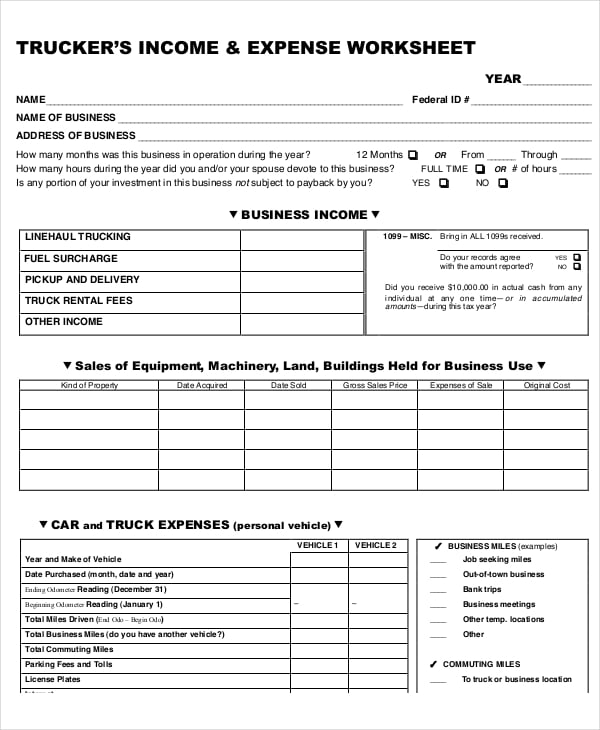

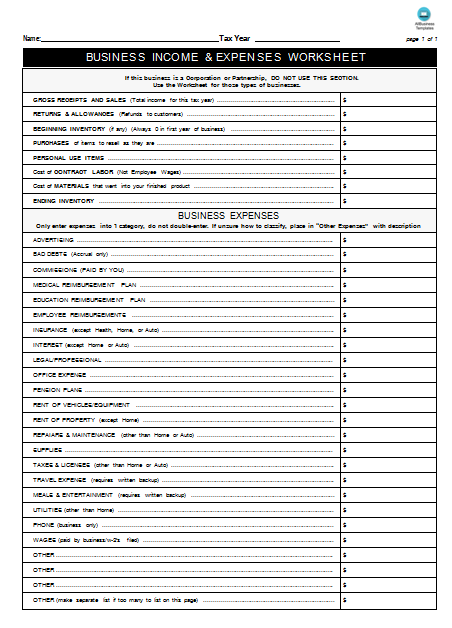

Are Independent Contractor Truck Driver Taxes Different? Without a tax home, some trucker tax deductions may not be allowed. Typically, the tax home is the regular place of business. It does not matter where the Independent contractor driver tax deductions are nearly aligned with all truck driver standard tax deductions. However, there are some caveats... Small Business Tax Deductions Worksheet (Part 1) Download our free 2020 Small Business Tax Deductions Worksheet, and we'll walk through how to use it right now in this very blog post. When we're done you'll know exactly how to reduce your income tax bill by making sure you're claiming all the tax deductions available to your small business.

How A Trucking Company Saved Over $100k With These... - YouTube #Taxes #Trucking #TruckersHow A Trucking Company Saved Over $100k With These 3 Deductions!!!In this video, we'll recount a story of a time a trucking...

Trucker tax deduction worksheet

Trucker Tax Deductions You Won't Want to Miss Out On Tax season is here again. Take a look at these tips for trucker tax deductions that are sure to save you time and money! But, first, you need to make sure you deduct business expenses that are appropriate for your work situation. 19 Truck Driver Tax Deductions That Will Save You... - Truckstop.com But exactly what tax deductions can a truck driver claim, and which drivers are eligible? Let's take a deep dive into truck driver tax deductions and truck driver tax credits. Other education may be tax deductible too, as long as it's directly related to your trucking career. As a self-employed trucker... Sales Tax Deduction Worksheet Sales Tax Deduction Worksheet (for use with IRS Sales Tax Calculator). Clear and reset calculator. Print a taxpayer copy. + Income for IRS Sales Tax Calculator. The entry above shown as may be an error. 1 Include any 1099-R with a distribution code 6 (Tax-free Section 1035 exchange) as a rollover.

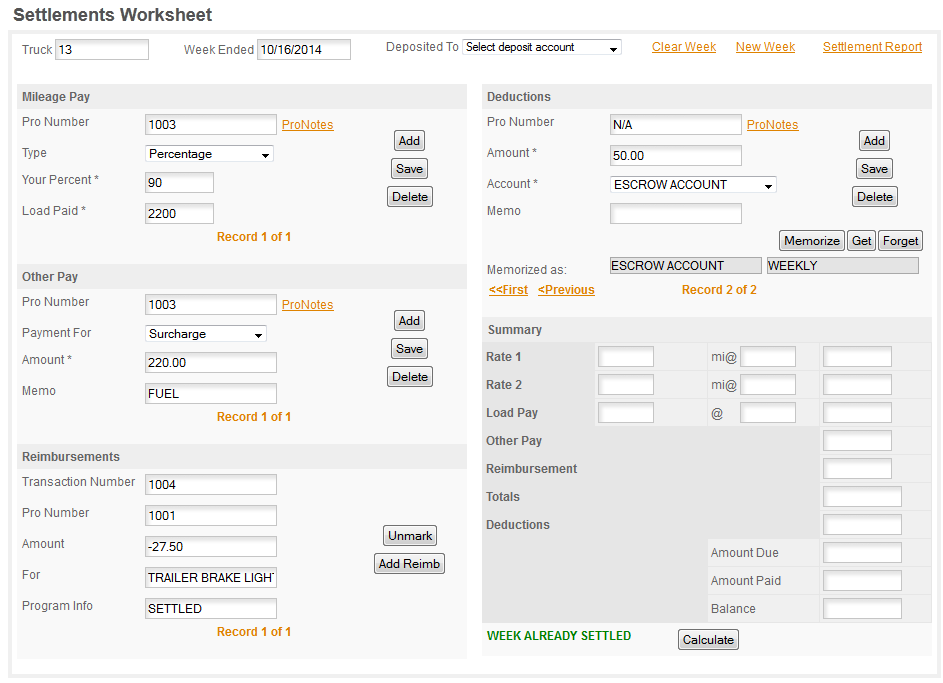

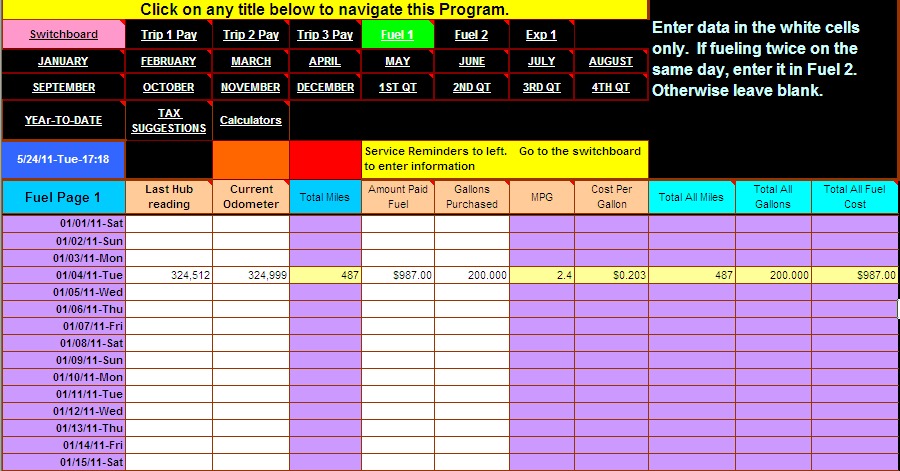

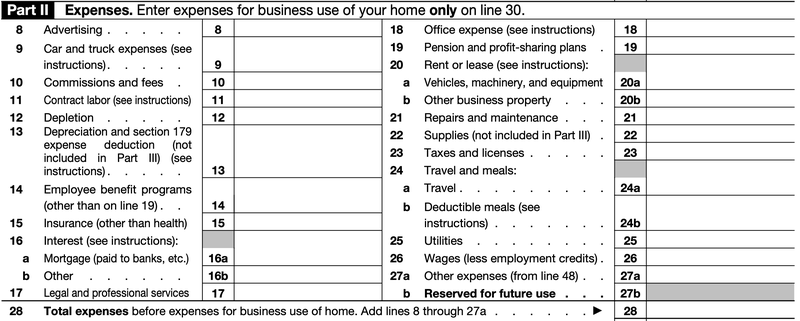

Trucker tax deduction worksheet. Truck Driver Tax Deductions | H&R Block Truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. You need to sleep or rest to meet the demands of your work while away from home. As a trucker, you're not considered to be traveling away from home if both of these... Vehicle Tax Deduction: Car Expenses You Can Deduct for Tax Year... Vehicle tax deductions you can and can't write off How can I calculate my vehicle tax deduction? What's the vehicle purchase tax deduction? Truck Expenses Worksheet | Spreadsheet template, Tax deductions... The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Owner Operator Expense Spreadsheet PDF Download, federal taxes and truckers deductions list. consultant's income amp expense worksheet mer tax. ATBS | Trucker Tax Deduction Worksheet Trucker Tax Deduction Worksheet. Our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Keep track of what deductions you are taking advantage of.

Truckers' Tax Tips and Tax Deductions for Truck Drivers Truckers' Tax Tips & Truck Driver Tax Deduction Help. There are are number of fees and expenses related to trucking that are tax deductible, and a well-organized trucker takes all tax deductions available. Trucker Tax Deductions Worksheets Pdf , Jobs EcityWorks Download - Trucker Tax Deduction Worksheet. Our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Keep track of what deductions you are taking advantage of. Typical tax deductions for truck drivers Trucker Tax service. nationwide tax consultant to the otr driver. 888-799-1099. Whatever claims of deductible items you see here or in other publications, remember, they are never promises or guarantees that the items listed are all deductible. 2020 tax deductions worksheet - Search Small Business Tax Deductions Worksheet 2020 Neat Education Advertising and marketing Computers and tech supplies Cleaning and janitorial expenses Moving expenses Intangibles like licenses, trademarks, and other intellectual property Business meals Legal and professional fees.

Tax Deduction Worksheets - Kiddy Math Tax Deduction - Displaying top 8 worksheets found for this concept. Some of the worksheets for this concept are Tax deduction work, Realtor, Truckers work on what you can deduct, Small business tax work, Itemized deduction work tax year, Small business work, Work to estimate... Tax Deductions for Truck Drivers - Support Due to the Tax Cuts and Jobs Act, truck drivers that receive wages reported on a W-2 can no longer deduct items such as mileage and travel on their tax However, local truck drivers typically cannot deduct travel expenses. For more information regarding the standard meal allowance, please refer to... How to choose a tax preparer for truckers | TruckingOffice What Makes a Good Trucker Tax Preparer? Trucking taxes are complex and it's easy to miss deductions if you're trying to do them yourself. However, when you hire a professional, you can verify their credentials and history by checking with the IRS Office of Enrollment for Enrolled Agents (EA's)... Tax Deduction Worksheet For Truck Drivers | Qualads Small Business Tax Deductions Worksheet And Small Business Tax | 800 X 1035. Thanks for visiting my blog, article above(Tax Deduction Worksheet For Truck Drivers) published by lucy at November, 15 2016.

Trucker Tax Deduction Worksheet | Free Printables Worksheet We found some Images about Trucker Tax Deduction Worksheet

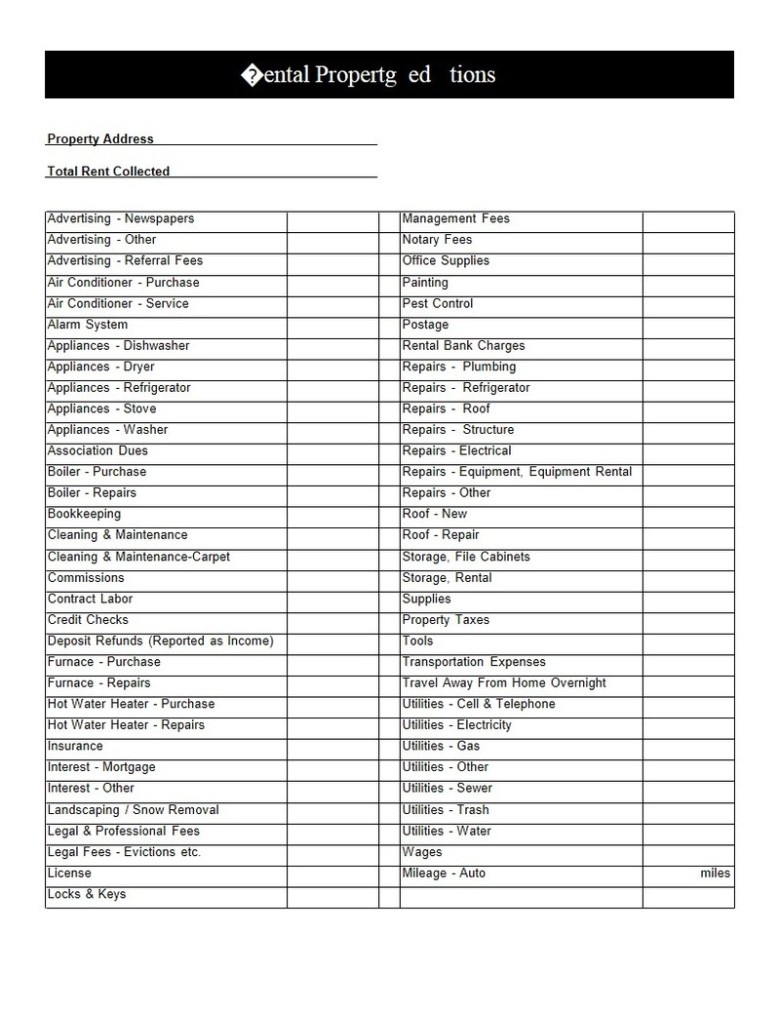

Tax Deductions Worksheets - Teacher Worksheets Some of the worksheets displayed are Tax deduction work, Truckers work on what you can deduct, Realtors tax deductions work, Realtor, Schedule a tax deduction work, Rental property tax deduction work, Day care income and expense work year...

Home Office Deduction Worksheet (Excel) | Free Tax Tools The home office deduction gives you a tax write-off for such items as mortgage interest, rent, utilities, real estate taxes, maintenance, repairs, and Our worksheet assumes that you will be filing using the actual expense method because the simplified method bases the size of the home office deduction...

Tax Deductions For Truckers More tax deductions for truckers: Airfare, cab curtains, driver's license fees, bunjee cords, tarp straps, air freshener, calculator, electrical tape, laundry bag There are as many tax laws/rules/regulations as there are accountants. YOUR accountant will give you the best advice. Tax Deductions for Truckers.

How To Owner Operator Tax Deduction Worksheet › Get more: Trucker tax deductions worksheets pdfShow All. Worksheet for Long Haul and Overnight Truck Drivers. How. How. Details: Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed.

Trucker Tax Deductions Worksheets Pdf Convert Truckers Tax Deductions - Trucker to Trucker. Convert. Details: Long Haul Trucker/OTR Driver Worksheet for Tax Deductible Expenses Not filing your income tax return can get you into serious trouble with the IRS.

Trucker Tax Deduction Worksheet - Nidecmege Trucker tax deduction worksheet. Top FAQs From ▼. Truckers Tax Deductions - Trucker to Trucker. Search The Best FAQs at ▼.

Itemized Deduction Worksheet TAX YEAR - Learny Kids Some of the worksheets for this concept are Tax deduction work, Itemized deduction work tax year, Deductions form 1040 itemized, 2 deductions and adjustments work, Truckers work on what you can deduct, Supplemental work for tax year credit for taxes paid, Us 1120s line 19...

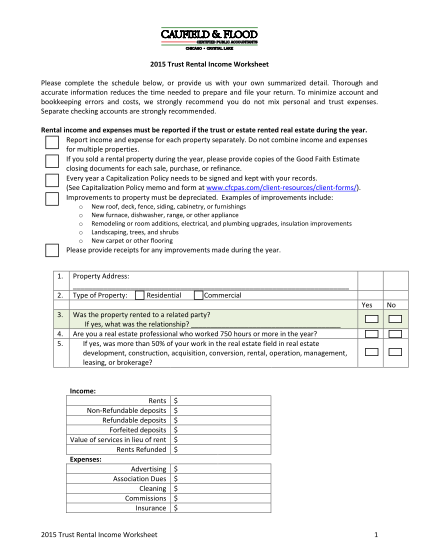

Top 12 Rental Property Tax Deductions & Benefits [+ Free Worksheet] Download Your Free Rental Property Tax Deduction Worksheet. In this article, we will discuss some of the tax benefits of rental property. "The depreciation deduction allows a taxpayer to deduct a portion of the cost of property purchased to produce income as part of a business.

Solved: What is the tax and interest deduction worksheet The state income tax paid will automatically import for any taxes withheld during the year. If you feel this is greater than the sales tax you paid during the year, which it often is, then you will not gain any additional deduction by filling out the sales tax section.

Truck Driver Tax Deductions: 9 Things to Claim - Drive My Way Truck driver tax deductions are the best way to save money at tax season. You can increase your refund just by claiming these common deductions. Tax season is right around the corner. It may not be your favorite time of the year, but we want to help make it as painless as possible.

Trucker Tax Deduction Worksheet - Nidecmege Trucker tax deduction worksheet. These include medical and dental expenses interest paid taxes paid charitable contributions. Truck driver tax deductions worksheet elegant tax deduction from truck driver tax deductions worksheet sourceplay texasholdemus in the event the car was merely a...

Sales Tax Deduction Worksheet Sales Tax Deduction Worksheet (for use with IRS Sales Tax Calculator). Clear and reset calculator. Print a taxpayer copy. + Income for IRS Sales Tax Calculator. The entry above shown as may be an error. 1 Include any 1099-R with a distribution code 6 (Tax-free Section 1035 exchange) as a rollover.

19 Truck Driver Tax Deductions That Will Save You... - Truckstop.com But exactly what tax deductions can a truck driver claim, and which drivers are eligible? Let's take a deep dive into truck driver tax deductions and truck driver tax credits. Other education may be tax deductible too, as long as it's directly related to your trucking career. As a self-employed trucker...

Trucker Tax Deductions You Won't Want to Miss Out On Tax season is here again. Take a look at these tips for trucker tax deductions that are sure to save you time and money! But, first, you need to make sure you deduct business expenses that are appropriate for your work situation.

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b6bbc9752d68cdd11bac_excel-template-1099.png)

0 Response to "41 trucker tax deduction worksheet"

Post a Comment