41 life insurance needs analysis worksheet

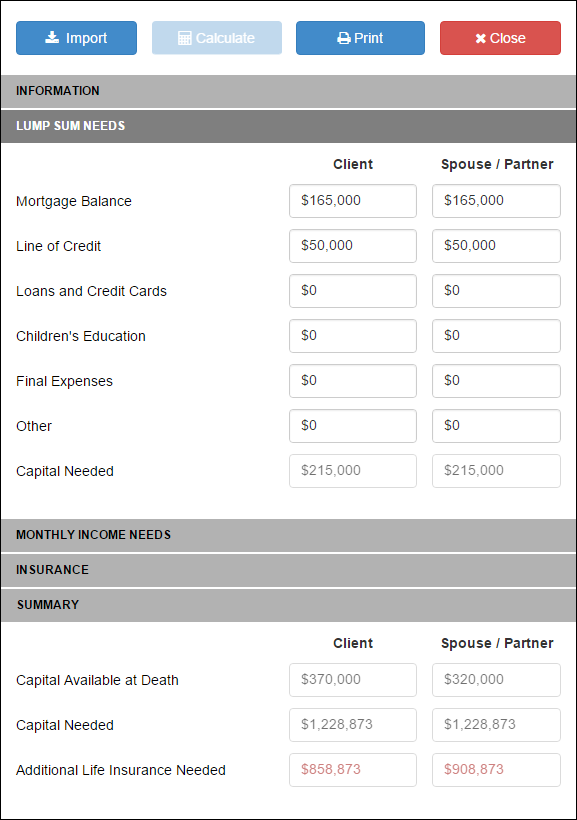

PDF Calculating your life insurance needs in 3 easy steps… - BMO Step A: Identify your current debts and financial needs Step B: Determine your future financial needs Step C: Deduct the portion to be recovered by your assets and financial resources A + B - C = Your Life Insurance Needs. A Identify your current debts and financial needs $ 1 Mortgages(s) 1 Third Party Insurance Ownership: Definition ... - Study.com Third-Party Ownership. New parents often worry about a baby's future and the unknown costs of raising a child. To help alleviate these concerns there is something called third party ownership of ...

Solved Jacques and Kyoko Smith have completed Step 1 of ... The life expectancy for a woman within Kyoko's demographic is 87. The couple has also saved $60,000 in a mutual fund, and Jacques's employer provides him a $100,000 life insurance policy. Using this information, complete Step 2 of the needs analysis worksheet to estimate their total financial resources available after death.

Life insurance needs analysis worksheet

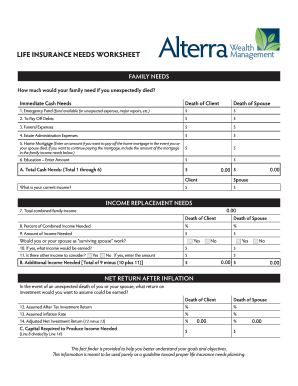

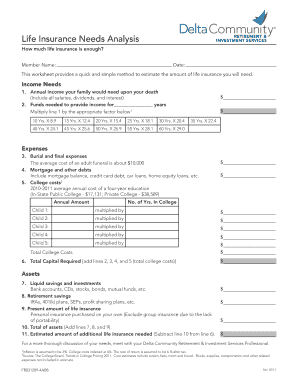

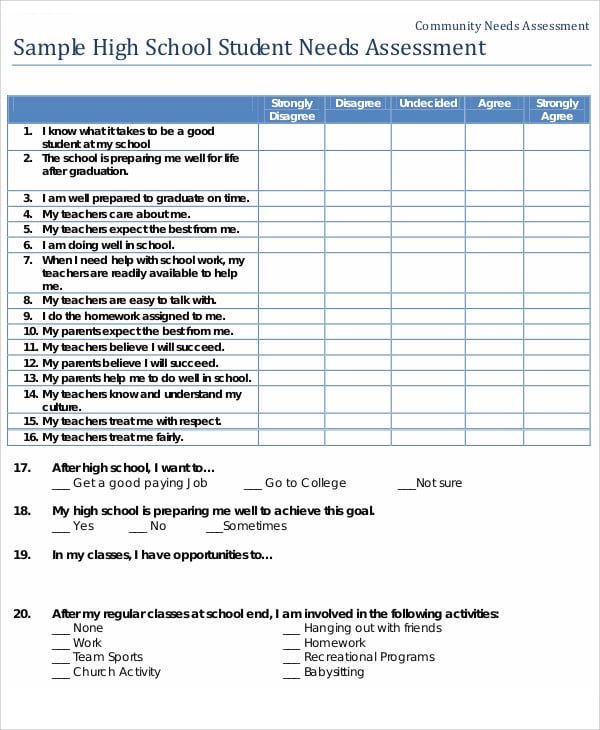

Chapter 8 Financial Planning Exercise 1 Estimating | Chegg.com Recommend the type of policy she should buy. In your analysis, assume an incidental special need amount of $5,000. LIFE INSURANCE NEEDS ANALYSIS METHOD Insured's Name Date Step 1: Financial resources needed after death 1. Annual living expenses and other needs: Period 1 Period 2 Period 3 a. Monthly living expenses b. PDF Life Insurance Needs Analysis - Harvard Financial Educators LIFE INSURANCE NEEDS ANALYSIS. Example YourSituation EXPENSES Immediate Funeral $6,000 Final Expenses $2,000. Subtotal $8,000 1-9 Months Probate Expenses $2,000 Estate Taxes Mortgage Pay-Off $50,000. Subtotal $52,000 Beyond 9 Months Emergency Fund $10,000 College Funding $100,000. Subtotal $110,000 Lifetime Living Expenses Annual Living Expenses $60,000 (from cash flow worksheet) Less Mortgage Payments -$12,000 (if you pay it off) Less Spouse's Take-Home Pay -$20,000 Less Social Security ... XLSX Wealth Link Financial Services This needs analysis demonstrates a life insurance need of (A+B+D-E) = Number of Family Members FAMILY INCOME NEED: PRIMARY FAMILY INCOME NEED: SPOUSE FINANCIAL ASSETS AVAILABLE: PRIMARY FINANCIAL ASSETS AVAILABLE: SPOUSE *Generally speaking, retirement assets should not be included in the calculation for life insurance because these assets are earmarked for the surviving spouse's retirement Primary Client Name Spouse Client Name

Life insurance needs analysis worksheet. How to determine eligibility | Washington State Health Care ... Mar 15, 2022 · You may continue any combination of medical, dental, life and AD&D insurance when you are between periods of eligibility and are not eligible for the employer contribution by self-paying for the benefits (for a maximum of 12 months). See WAC 182-12-142. The Right Way to Take IRA Withdrawals - Money Oct 14, 2015 · A collection of day-by-day rates and analysis. Mortgage Calculator. ... Our picks are based on common life insurance needs. ... The IRS has a worksheet that can guide ... Life Insurance Needs Analysis Worksheet - Calculators This calculator will help you determine what your life insurance needs are. First enter potential funeral costs and estate taxes. Then include amounts needed for non-mortgage debt, emergency expenses, and college funds. Then enter annual living expenses, your spouse's annual income after taxes, and annual Social Security benefits. Quiz & Worksheet - Life Insurance Needs Analysis | Study.com Personal Life Insurance Needs Analysis. Worksheet. 1. What are some things to keep in mind when deciding how much life insurance to have? Mortgage, Auto Loans, Funeral Expenses. Vacations, Build ...

Musashi and Rina Yamato have completed Step 1 of | Chegg.com The life expectancy for a woman within Rina's demographic is 87. The couple has also saved $60,000 in a mutual fund, and Musashi's employer provides him a $100,000 life Insurance policy. Using this information, complete Step 2 of the needs analysis worksheet to estimate their total financial resources available after death. worksheet 8.1 - LIFE INSURANCE NEEDS ANALYSIS METHOD ... LIFE INSURANCE NEEDS ANALYSIS METHOD Insured's Name Step 1: Financial resources needed after death 1. Annual living expenses and other nee Period 1 Period 2 a. Monthly living expenses $ $ b. $ - $ - c. Number of years in time pe d. Total living need per time p $ - $ - TOTAL LIVING EXPENSES (add line d for each period): 2. Special needs a. Spouse education fund b. DIME worksheet - North American Company DIME worksheet. Your financial security may affect your loved ones more than it affects you. A needs analysis can provide a snapshot of your current and future needs to help answer the question, "How much life insurance do I need in the event of . my spouse's death?" And the best part? Generic-Life-Insurance-Needs-Analysis-Worksheet.xlsx ... LIFE INSURANCE NEEDS ANALYSIS WORKSHEET 1 Client Data Client Name Age Annual Income Primary Spouse Number of Family Members HOUSEHOLD LIABILITIES: Mortgage Balance Car Loans Lines of Credit Credit Cards Final Expenses Emergency Fund SUB TOTAL $0 (A) LEGACY NEEDS AND WANTS: Education Fund Legacy Fund for Children Charitable Bequest Other SUB TOTAL $0 (B) Version 2014-10 What percentage of your income do you wish to replace? 0% What percentage of your income do you wish to replace? 0% Annual ...

Life Insurance Needs Calculator Life Insurance Needs Calculator. Answer a few simple questions to estimate the amount of life insurance coverage you need to take care of your family. This is an estimate only. For a complete assessment, contact a qualified insurance professional. Question 1 of 7. PDF Life Insurance Needs Worksheet - Independent Benefit Solutions buying life insurance, it makes sense to consult with an insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Income 1. Total annual income your family would need if you died today What your family needs, before taxes, to maintain its current standard of living PDF Life Insurance Needs Worksheet Life Insurance Needs Worksheet This worksheet can help you get a general sense of how much life insurance you need to protect your family. Before buying any insurance products, you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Created Date Life Insurance Needs Analysis - Right Ways and Wrong Ways There is a right way and a wrong way to calculate how much life insurance you need. First, let's look at the wrong way. The typical life insurance agent will steer you toward cash value life insurance of some sort.

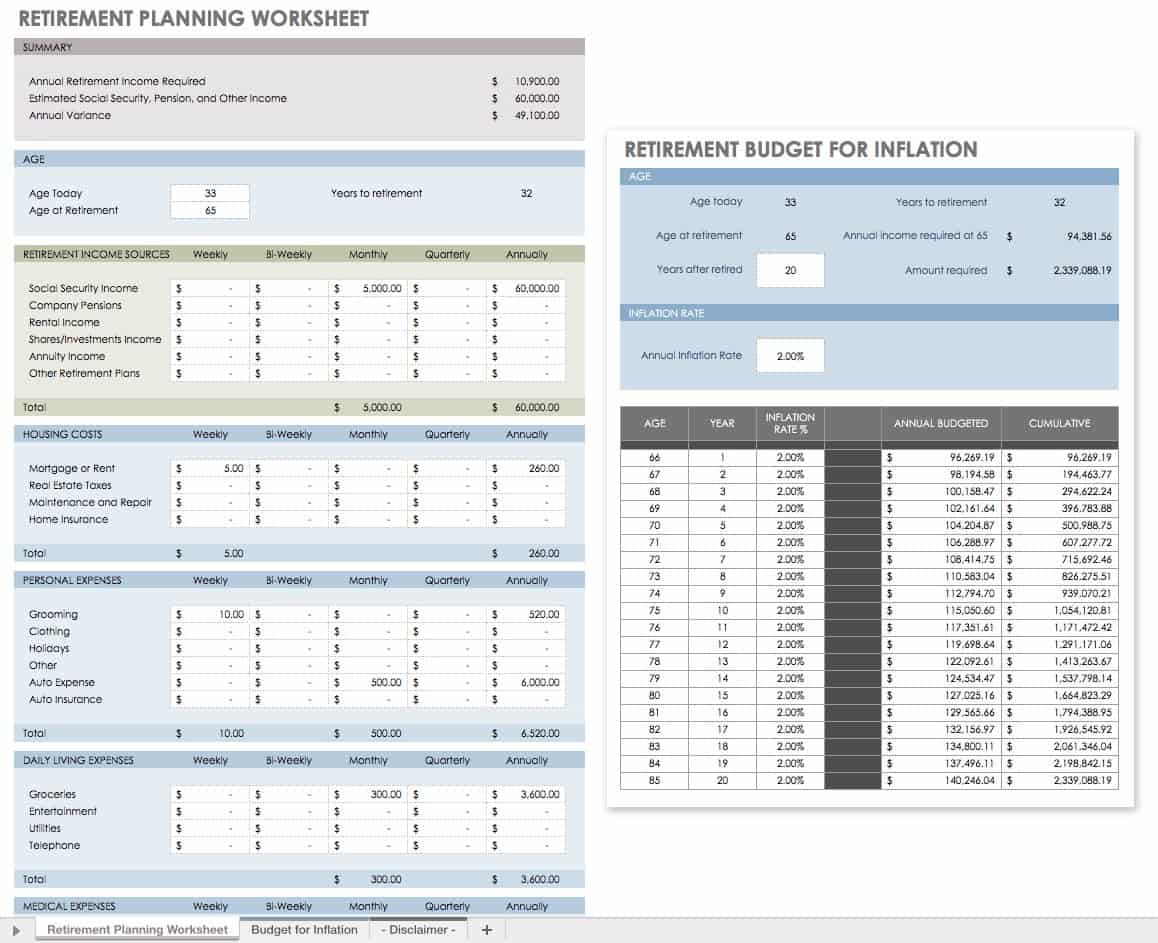

Use a retirement planning worksheet | Vanguard Potential new costs to consider Health care expenses. Once you reach age 65, you qualify for Medicare, the federal health insurance program. But you'll still have deductibles, copays, and coinsurance based on your income and the plan you choose—along with expenses not covered by Medicare, like dental and vision costs.

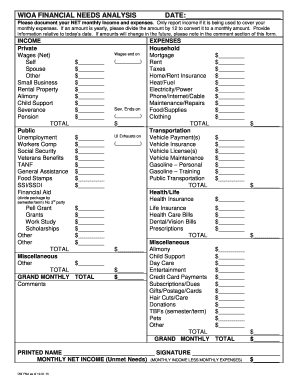

PDF Easy Disability Insurance Needs Analysis - My Family Life Easy Disability Insurance Needs Analysis Determine Total Disability Insurance Needs Enter Numbers Below Monthly Expenses Monthly Amounts (1) Rent or Mortgage (2) Children's Daycare (3) Food (4) Debt Repayment/Student Loans (5) Utilities (6) Medical / Dental Insurance (7) Homeowners/Auto Insurance (8) Other Insurance Premiums (Life, etc) (9) Gas ...

Life Insurance Needs Analysis Worksheet Excel And Life ... Life Insurance Needs Analysis Worksheet Excel And Life Insurance Needs Analysis can be valuable inspiration for those who seek a picture according specific categories, you can find it in this site. Finally all pictures we have been displayed in this site will inspire you all. Thank you for visiting.

PDF Life Insurance Needs Assessment Worksheet - MCC Brokerage Life Insurance Needs Assessment Worksheet Purchasing life insurance is an important step toward protecting your family. Determining the amount life insurance that you need is something that should be taken seriously and considered carefully. The first step is to estimate how much you family will need when you are gone.

FEGLI Calculator - U.S. Office of Personnel Management Calculate the premiums for the various combinations of coverage, and see how choosing different Options can change the amount of life insurance and the premiums. See how the life insurance carried into retirement will change over time. Instructions. Enter the information below and click on the Calculate button to get a report on those choices.

Schwab MoneyWise - Net Worth Worksheet Schwab Moneywise ® can help you budget, save, and invest your money, manage debt, and achieve your life goals. Best of all, it's free and available to everyone from Charles Schwab Foundation . We're glad you're here.

PDF Life Insurance Needs Analysis - scic.com Life Insurance Needs Analysis A Tool to Estimate the Right Amount of Life Insurance Coverage Immediate Cash Needs 1. Final Expenses: The amount needed to cover all final expenses upon your death. This includes funeral costs, medical expenses, probate fees, etc. Current average funeral expenses are about $10,000. ...

Federal Employees’ Group Life Insurance • The amount of life insurance one needs varies by individual. Some general guidelines to help you calculate your needs are on page 5. OFEGLI Service Standards • The Office of Federal Employees’ Group Life Insurance (OFEGLI) is an administrative unit of Metropolitan Life Insurance Company (MetLife) that pays claims for the FEGLI Program.

PDF FINANCIAL NEEDS ANALYSIS WORKSHEET - Producers XL This worksheet is a tool to assist you in estimating your basic life insurance needs. It is not intended to provide a thorough and comprehensive analysis of your life insurance needs or to recommend a specific amount of type of coverage. The actual amount of life insurance you need will depend on several factors that you need to consider carefully.

PDF Life Insurance Needs Analysis Worksheet - Mike Russ Life Insurance Needs Analysis Worksheet # of Years 10 Life Insurance Needs Worksheet This worksheet can help you determine how much life insurance you need. The letters in the left column correspond with the explanations below. Just complete the boxes to the left and it will automatically figure how much life insurance you should purchase. D H I J CURRENT CASH NEEDS Factor 0.008744 0.005964 Key to H

How Much Life Insurance Do I Need? - State Farm A simple way to determine the amount of life insurance needed is to multiply your current income by 10 to 15. Get a term life insurance quote Want term life insurance? State Is my current life insurance coverage enough?

XLSX Life Insurance Needs Analysis Worksheet Insured's Name: Stephanie Ehrlich Age 40 1. Annual living Expenses and other Needs: Period 1 Period 2 Period 3 a. Monthly Living Expenses b. Net Yearly Income Needed (a x 12) c. Number of Years in Time Period d. Total Living Need Per Time Period (b x c) TOTAL LIVING EXPSENSES (add line d for each period): a.

PDF Easy Life Insurance Needs Analysis Easy Life Insurance Needs Analysis Determine Total Life Insurance Needs Enter Numbers Below (1) Enter Your Gross Annual Income (2) Cost Of Living Factor (recommend 5 - 10 X or more depending on your situation) (3) Remaining Mortgage / Rent (4) College Funding (5) Your Funeral (6) Debt You Own / Cosigned (7) Anything Else? (charity, other funds, etc.) Total Life Insurance Needs $0

PDF Insurance Needs Analyzer - BMO Insurance Needs Analyzer - BMO

Life Insurance Needs Calculator for Excel | Excel Templates Number of years you need to pay from your income; Annual income that the survivor will need; Number of survivors; The amount you have in savings; The amount you have invested; Details about the expenses you want to be refunded; Many people find it very hard to use the life insurance needs calculator in an attempt to determine their needs.

INSURERIGHT Life insurance worksheet - CIBC Manulife's life insurance worksheet provides an estimate of the amount of life insurance you may need, based on the information you provide. Your insurance needs will change over time, so you should periodically review these needs with your advisor. 1 Canadian Funerals Online. "Differences in costs between burials and cremation in Canada." .

PDF Life Insurance Needs Analysis Worksheet LIFE INSURANCE NEEDS ANALYSIS WORKSHEET Aatif Akhtar Broker-Agent CA DOI Lic. #0K77816 Cell: 818-448-0246 (Direct) Office: 818-217-4816 Fax: 818-670-7887 Email: info@coverlineinsurance.com I believe Life insurance is the greatest preventer of poverty... I would strongly suggest getting your life insured before you become

PDF Life Insurance Needs Analysis This worksheet from Ash Brokerage provides a quick and simple method to estimate the amount of life insurance you will need. Income Needs 1. Annual income your family would need if you die today Enter a number that's typically 10%-80% of total income. Include all salaries, dividends, interest and any other sources of income. $ 2.

XLSX Wealth Link Financial Services This needs analysis demonstrates a life insurance need of (A+B+D-E) = Number of Family Members FAMILY INCOME NEED: PRIMARY FAMILY INCOME NEED: SPOUSE FINANCIAL ASSETS AVAILABLE: PRIMARY FINANCIAL ASSETS AVAILABLE: SPOUSE *Generally speaking, retirement assets should not be included in the calculation for life insurance because these assets are earmarked for the surviving spouse's retirement Primary Client Name Spouse Client Name

PDF Life Insurance Needs Analysis - Harvard Financial Educators LIFE INSURANCE NEEDS ANALYSIS. Example YourSituation EXPENSES Immediate Funeral $6,000 Final Expenses $2,000. Subtotal $8,000 1-9 Months Probate Expenses $2,000 Estate Taxes Mortgage Pay-Off $50,000. Subtotal $52,000 Beyond 9 Months Emergency Fund $10,000 College Funding $100,000. Subtotal $110,000 Lifetime Living Expenses Annual Living Expenses $60,000 (from cash flow worksheet) Less Mortgage Payments -$12,000 (if you pay it off) Less Spouse's Take-Home Pay -$20,000 Less Social Security ...

Chapter 8 Financial Planning Exercise 1 Estimating | Chegg.com Recommend the type of policy she should buy. In your analysis, assume an incidental special need amount of $5,000. LIFE INSURANCE NEEDS ANALYSIS METHOD Insured's Name Date Step 1: Financial resources needed after death 1. Annual living expenses and other needs: Period 1 Period 2 Period 3 a. Monthly living expenses b.

0 Response to "41 life insurance needs analysis worksheet"

Post a Comment