40 credit card comparison worksheet answers

PDF Math 101 Chapter 4/Section 4: Topic: Credit Cards: Paying ... Answer the following questions: 1.Suppose we have a card with an APR of 33%. The minimum payment is 9% of the balance. Suppose we have a balance of $322 on the credit card. We decide to stop charging and to pay it o by making the minimum payment each month. Calculate the new balance after the rst minimum payment is made and then calculate the ... PDF Financial Literacy: Credit Card Lesson Plan - OTF/FEO Big Idea - Designing a credit card and sample credit card statement . Description: Review of a credit card and credit card statement . Action: Students will work in groups to produce a credit card and credit card statement. Students need to show a purchase of a $1000 television. Students will then show how long and much it

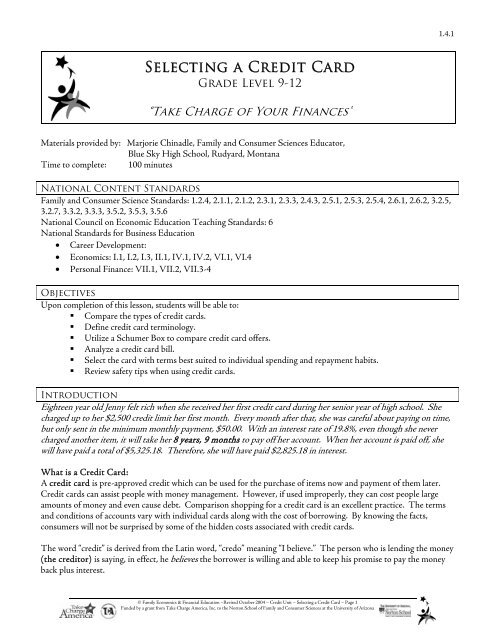

PDF Credit Card Hunt - Weebly Credit Card Hunt Project ! Objective: Students must research, compare and choose 3 credit cards from the sites listed below or other search engines. !! Rationale: Students will soon need to choose their first credit card and this assignment is designed to teach students to look into the positives and negatives of potential credit cards. Students should have prior knowledge of Credit (Credit

Credit card comparison worksheet answers

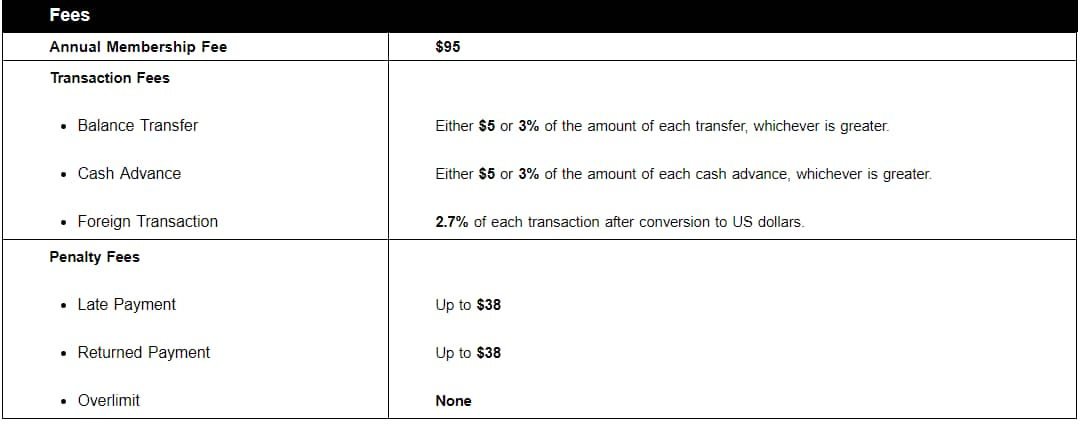

PDF Full Year Course: Answer Key Document 3.2 Intro to Credit Cards - Sample Completed Student Activity Packet 9 CALCULATE: Shopping with Interest 13 RESEARCH: Credit Card Laws WebQuest Do More PROJECT: Budgeting for Your Credit Card Payments CQs Intro to Credit Cards Comprehension Questions *No Answer Key available - assignment is open-ended. B ack to Top Last updated: 4 ... 4 Credit Card Comparison Charts (Rewards, Fees, Rates ... There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5). The standard variable APR for Citi Flex Plan is 13.99% - 23.99% based on your creditworthiness. What's Up In Finance? . For Educators . Lesson 3 ... Finally, students will compare different credit card offers for young people, and determine which card offers the best deal. Students will use a chart to make a comparison of the different ...

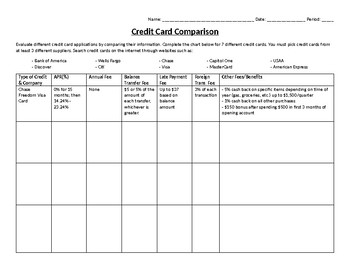

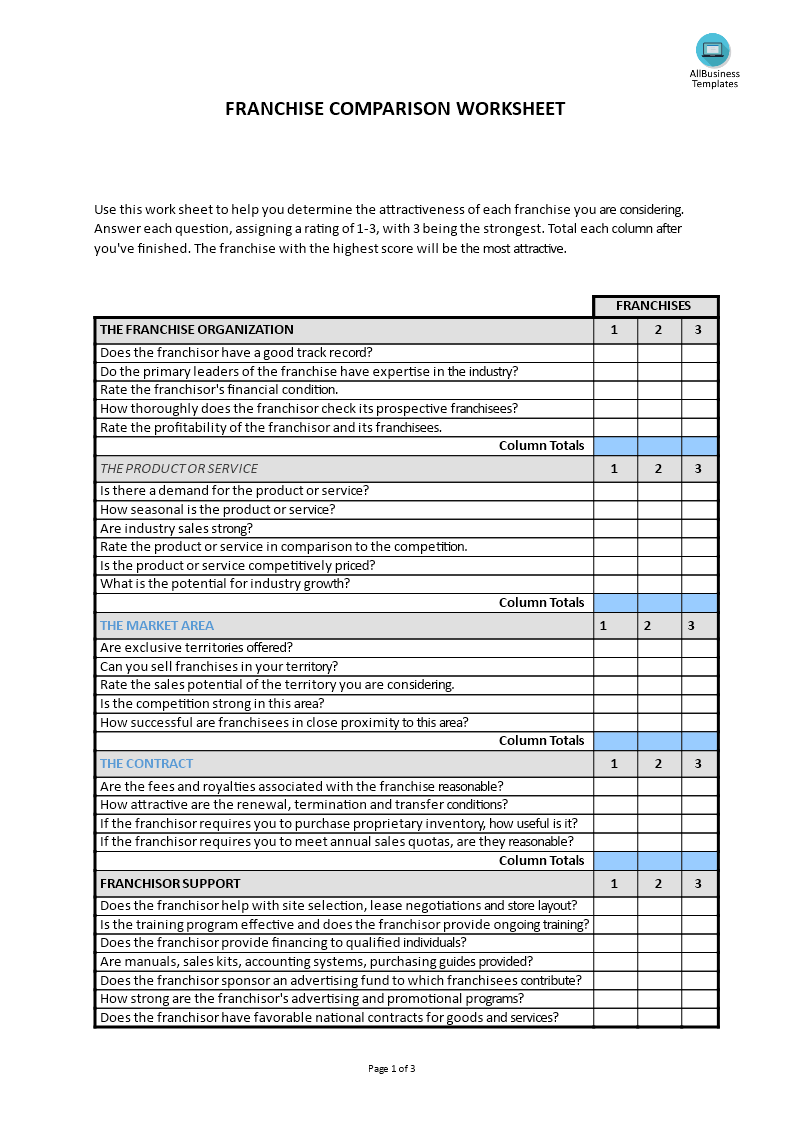

Credit card comparison worksheet answers. Credit card answers - Consumer Financial Protection Bureau Whether you're shopping for a new card or managing an existing card, it helps to have the facts. From late fees to lost cards, get answers to your credit card questions. Narrow your results. Clear search. Showing 109 results within credit cards. My credit card statement now has a credit score. PDF Choosing a Credit Card - Save and Invest Worksheet: Choosing a Credit Card Select the primary reason(s) for obtaining a credit card. 1. ewar R/ edsbates r Yes No 2. Cre dt Bil ui d Yes No 3. Emergenseahccysr up Yes No 4. You got an offer in the mail Yes No 5. herOt Describe: _____ Select the following places you looked to obtain a credit card: Bank Credit Union Mail Offers Other ... PDF Take Charge of Credit Cards Answer Key 1.6.1 b. When using a credit card, sign the back with a signature and "Please See I.D." c. Do not leave cards lying around. d. Never give out a credit card number unless making purchases. e. If you close a credit card account, notify the credit card company in writing and by phone, then cut up the card. f. CREDIT CARD COMPARISON - Finance in the Classroom CREDIT CARD COMPARISON Evaluate different credit card applications comparing finance charges, interest, late fees, closing costs, annual fees, etc. Credit Card information: . Store Cards and Pay Day Lenders search individually on internet. Type of Credit & Company APR (%) Annual Fee Other Fees Balance Transfer Finance

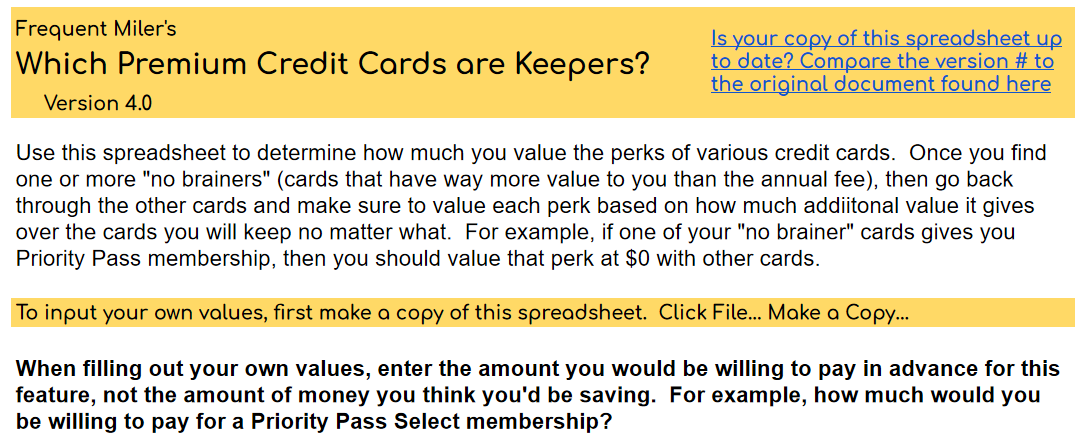

16 Free Banking Worksheets PDF (Teach Kids how to Use Banks) This lesson plan includes worksheets and guidance on how to teach students all about interest at banks. Including: Compounding daily vs. monthly vs. quarterly vs. annually (makes a big difference!) Calculating APR. Calculating APY. Interest rate vocabulary. Etc. 4. Beware Banking Fees. credit card comparison shopping worksheet publisher.pub Also, credit card issuers can change your rate if they make proper notifica-tion to you. • A variable rate card can fluctuate at the card issuer's discretion. MCU Visa® Platinum Smart Rate Card MCU Visa® Platinum Smart Reward Card Card #4 Card #5 Annual Percentage Rate [APR] 7.99%APR to 15.99%APR Based on Credit Score 9.99%APR to 16.99%APR PDF Semester Course: Answer Key Document - NGPF Key SC-5.3 Young People & Credit Cards - Sample Completed Student Activity Packet 5 THE FINE PRINT: Credit Card Statement Resource # SC-5.4 Select a Credit Card - Sample Completed Student Activity Packet 4 COMPARE: Select a Credit Card* *No Answer Key available - assignment is open-ended. B ack to Top Last updated: 3/27/20 9 premier-eye.com › why-a-credit-card-comparisonWhy A Credit Card Comparison Worksheet Is So Important ... A credit card comparison worksheet is a very useful tool for ranking credit cards in the order of their value to you. A credit card is only useful if it can meet your needs. So using this worksheet will eventually save you loads of time as well as money in the long-run. Many credit cards come with great rewards but may attract huge fees.

Teacher Printables - FITC - Finance in the Classroom Coin Recognition Worksheets Set up an FREE account with Education.com and access hundreds of amazing printables. ... Watching for Credit Card Tricks (pdf) A spin-free guide to reading the fine print on credit car offers and agreements. 10-12 Grades. Credit Card Comparison (pdf) Practice choosing the right credit card for you! Credit Masquerade ... PDF Understanding a Credit Card Statement 5. What will happen if the credit card bill is not paid on time this month? How will this affect future purchases? (2 points) 6. The cardholder pays the minimum payment of $53.00 this month and makes no new purchases during the next billing cycle. What will be the new credit card balance during the next billing cycle if the cardholder has a $10.27 Introducing the Credit Card: Answer Guides - CompareCards ... Explanation: Credit card numbers must be 16 to 19 digits long. A is 15, B is 16, and C is 20. 3. How many digits are in a standard credit card number? A: 16 B: 17 C: 18 D: 19 E: A credit card number can be 16 to 19 digits long. 4. What happens after the expiration date on a credit card? A: The card no longer works B: The cardholder has to get a new card Types of Credit Activities - NGPF Determine what features they value in a credit card and then conduct online research to determine which credit cards best meet their needs; Compare and then select which card would be best for them; View Google Doc ... Since the NGPF Teacher Account will grant access to answer keys to our lessons and activities, we need proof of your educator ...

PDF Personal Financial Workbook - Consumer Credit Bank Account Comparison Worksheet 14. Investment Options Worksheet 15. Creditworthiness Worksheet 16. Debt-to-Income Ratio Worksheet 17. Credit Card Options Worksheet 18. Annual Credit Report Request Form 19. Resources American Consumer Credit Counseling (ACCC) is a nonprofit 501(c)(3) organization. Founded in 1991, ACCC

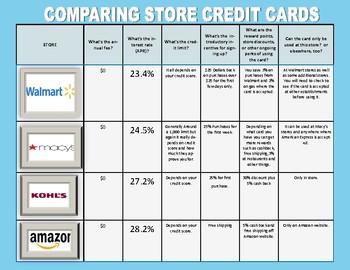

W05 Application Credit Card Comparison.docx - Comparing ... Comparing Credit Card Offers Instructions Compare credit card offers from 2 banks, 2 retail stores, and a travel/entertainment card. Look for the features each card offers. Compare these offers with other cards that you already hold (if applicable). Complete the table below to summarize your findings. For the category "Customer Service," call each credit card company's customer service ...

Compare Credit Cards: Compare & Apply Online Instantly Compare credit cards from all the major credit card companies and quickly find the best credit card for your needs. To use WalletHub's free credit card comparison tool, start by applying the filters on this page to narrow down your search based on card feature, required credit standing, issuer and more (some cards are from WalletHub partners).

ACTIVITY GOAL Comparing Two Credit Card Offers 3.99% APR ... Comparing Two Credit Card Offers 3.99% APR for the life of transferred balances; 13.25 % APR for all other purchases Minimum monthly payment of $ 15 or of balance Rewards program: $ I O shopping card with each $1 in spending 0.00% APR for 6 months; 19.8% APR for remaining lifetime of card Monthly balance must be paid in full each month

Types of Credit - NGPF Explain why a person may need or want credit. Identify the major types of credit and their characteristics. Understand and correctly use the three basic components of lines of credit: principal, interest rate, and term. Lesson.

Credit Card Calculators - Answer Financial Questions at ... Balance transfer calculator. Use this calculator to explore how much you could save on interest by transferring your debt to a card that charges zero interest for 12 months or more. Get started.

PDF Lesson Five Credit Cards - Practical Money Skills credit cardslesson outline credit cards teacher's guide 5-ii 5-G dealing with billing errors 5-H other credit card protections 5-I credit card dos and don'ts 5-J how much can you afford? (the 20-10 rule) student activities 5-1 Shopping for Credit Discuss how costs and features can vary between credit cards, and have students ...

quizlet.com › 17382241 › credit-card-comparisonCredit Card Comparison Flashcards | Quizlet The fee, expressed as a percentage, a borrower owes for the use of a creditor's money. At an interest rate of 10%, a borrower would pay $110 for $100 borrowed.

finance-portfolio-nagle.weebly.com › uploads › 4/8/7Comparison Shopping for a Credit Card - Weebly Comparison Shopping for a Credit Card Total Points Earned Name Kora Nagle 35 Total Points Date 5315 Directions : Compare at least three sample credit card offers. Identify which credit card you would choose and why. Card 1

Your Credit Card - EconEdLink Use an online credit card calculator to see how changes in the interest rate and monthly payment changes the length of time needed to pay off the credit card balance. Find three credit card offers and compare the offers. Prepare a chart showing how the finance charge is calculated, the interest rate, annual fee, and minimum payment.

PDF Before You Choose a Credit Card - Save and Invest 5. Evaluate students' comprehension (see assessment worksheet). Assessment Answer Key 1. A 2. C 3. D 4. B 5. B 6. A 7. C 8. D 9. D 10. D Before You Choose a Credit Card Introduction. 3 Offers for credit cards are everywhere. You receive them by mail, in your email ... credit cards, and like credit cards, they place a finance charge on month ...

PDF Lesson Five Credit Cards - Practical Money Skills credit cards student activity 5-3b Marie just used her new credit card to buy a bike for $400. Her budget allows her to pay no more than $25 each month on her credit card. Marie has decided not to use the credit card again until the bike is paid off. The credit card she used has an Annual Percentage Rate of 21%.

PDF Introducing the Credit Card - Credit Cards | Compare The ... Introducing the Credit Card Exercise 1 Choose the best answer. 1. What is a credit card? A: A plastic card with a magnetic strip on the back B: Something that represents a line of credit C: A source of free money. D: Both A and B 2. Which of these could be a credit card number? A: 1122 2542 2565 215 B: 4670 1016 4923 7710 C: 5581 5820 4387 0956 1370

What's Up In Finance? . For Educators . Lesson 3 ... Finally, students will compare different credit card offers for young people, and determine which card offers the best deal. Students will use a chart to make a comparison of the different ...

4 Credit Card Comparison Charts (Rewards, Fees, Rates ... There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5). The standard variable APR for Citi Flex Plan is 13.99% - 23.99% based on your creditworthiness.

PDF Full Year Course: Answer Key Document 3.2 Intro to Credit Cards - Sample Completed Student Activity Packet 9 CALCULATE: Shopping with Interest 13 RESEARCH: Credit Card Laws WebQuest Do More PROJECT: Budgeting for Your Credit Card Payments CQs Intro to Credit Cards Comprehension Questions *No Answer Key available - assignment is open-ended. B ack to Top Last updated: 4 ...

0 Response to "40 credit card comparison worksheet answers"

Post a Comment