42 Qualified Dividends And Capital Gain Tax Worksheet Line 44

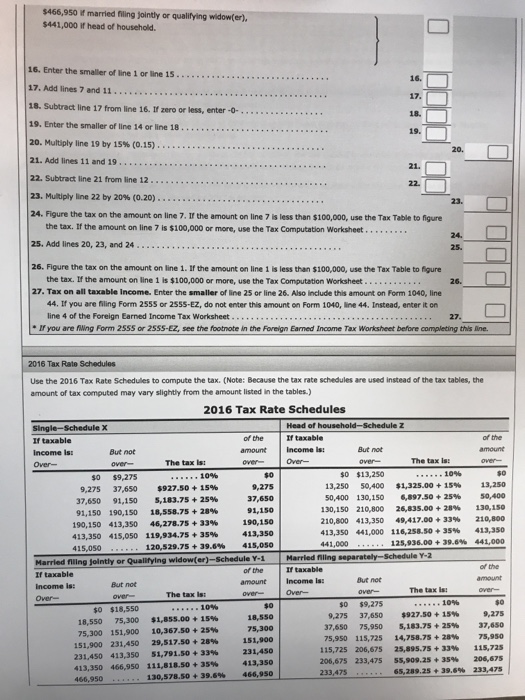

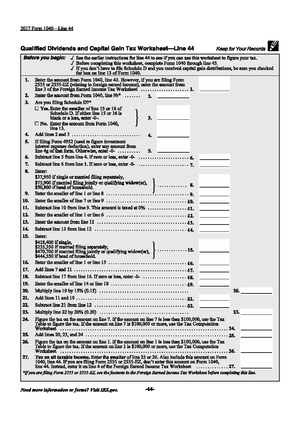

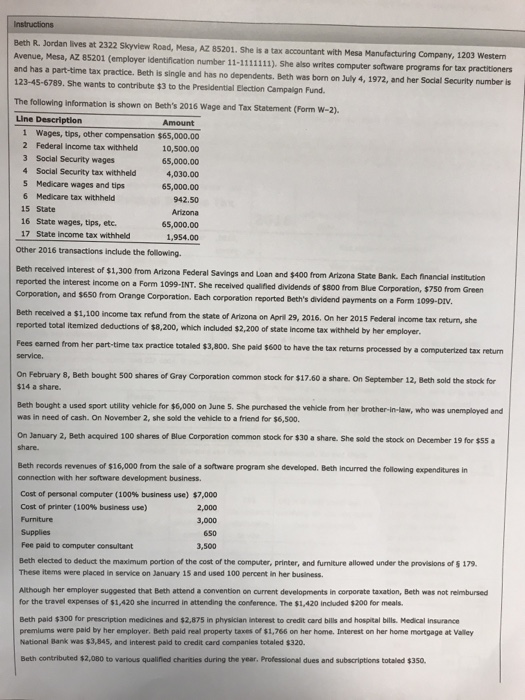

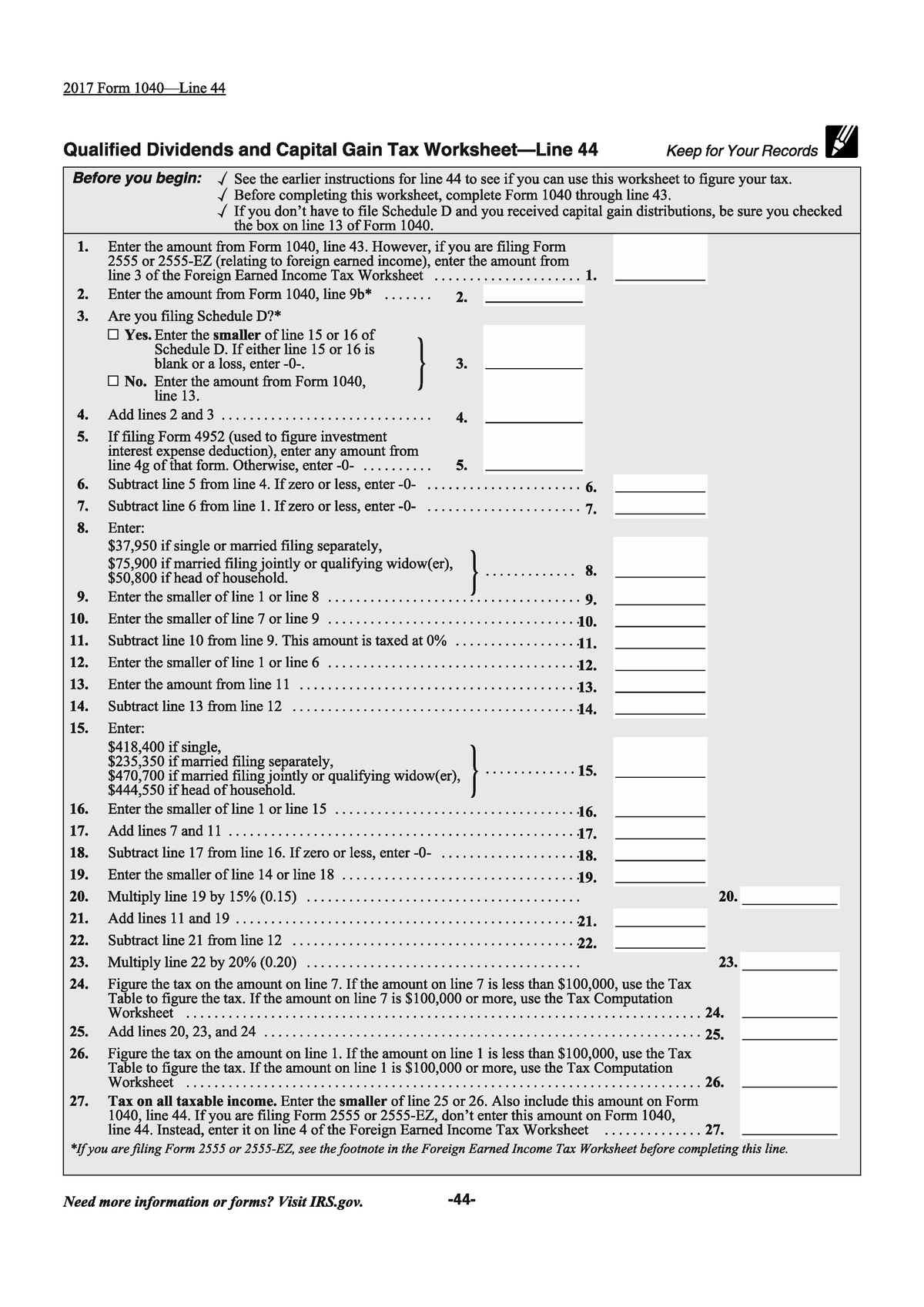

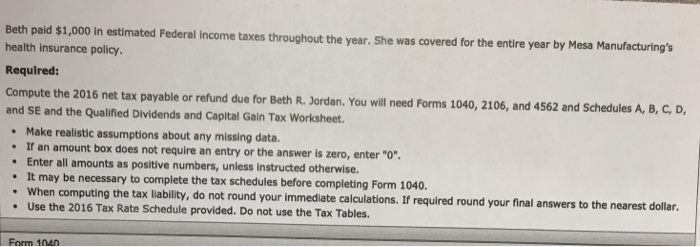

PDF 2009 Tax Computation Worksheet—Line 44 - Uncle Fed See the instructions for line 44 that begin on page 37 to see if you must use the worksheet below to figure your tax. CAUTION! Note. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the Qualified Dividends and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J ... ACC 330 6-2 Final Project Two Submission Tax Return ... 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line ...

Line 44 the Tax Computation Worksheet on if you are filing ... Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records 2010 Form 1040—Line 44 Before you begin: See the instructions for line 44 on page 35 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure

Qualified dividends and capital gain tax worksheet line 44

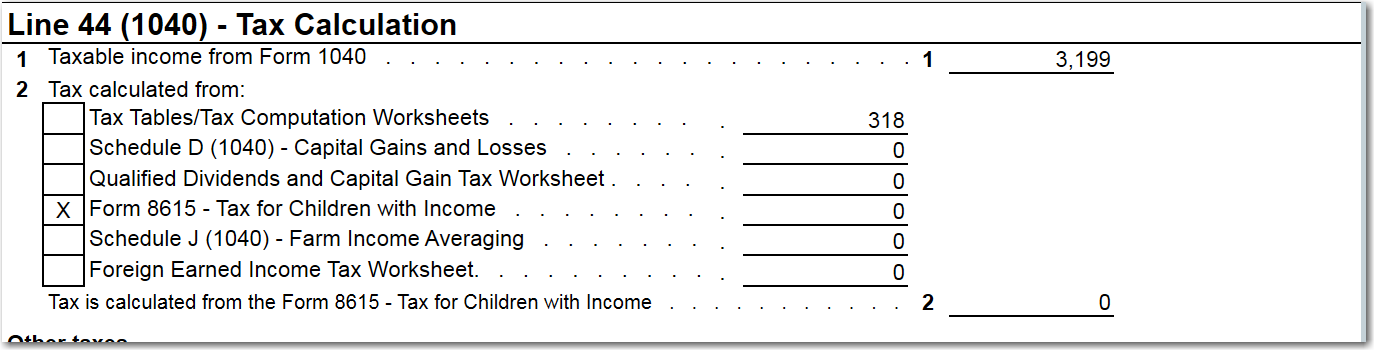

Qualified And Dividends Form Gain Worksheet Capital Tax ... 2017 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 • See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax. companies For individuals whose income tax bracket is 10% or 25%, then the capital gains tax rate is zero. Instructions for Line 44 on Tax Form 1040 | Sapling Line 44 Inclusions. The figure entered on line 44 is a total of taxes related to various applicable items. It can cover taxable income, unearned income of a dependent child (e.g., interest and dividends), lump sum distributions and capital gains, and foreign earned income. Line 44 also includes taxes on educational assistance or refunds. Qualified Dividends and Capital Gain Tax Worksheet -Line 44 ... to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet Tax on all taxable income. Enter the smaller of line 25 or line 26. Also include this amount on Form 1040, line 44 (Form 1040A, line 28). If you are filing Form 2555 or 2555-EZ, do not enter this amount on Form 1040, line 44 (or Form 1040A, line 28).

Qualified dividends and capital gain tax worksheet line 44. capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. Diy Qualified Dividends And Capital Gain Worksheet - The ... Instead 1040 Line 44 Tax asks you to see instructions In those instructions there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet which is how you actually calculate your Line 44 tax. I have in fact even checked the programming of this worksheet for the Taxes and Growth model. Line 44 No Tax or Tax Different than Tax Table in ... The Tax Tables (located in the back of the 1040 instructions) would indicate a tax for the amount shown on line 43, however, the tax on line 44 is 0 (zero). The return qualifies for the capital gains tax versus regular tax in the tax tables, and worksheet Wks CG is produced. The lesser of lines 25 or 26 flows to line 27. How can I find the " Qualified Dividends and Capital Gain ... For the Desktop version you can switch to Forms Mode and open the worksheet to see it. Click Forms in the upper right (upper left for Mac) and look through the "Forms In My Return" list and open the Qualified Dividends and Capital Gain Tax Worksheet. The "Line 44 worksheet" is also called the Qualified Dividends and Capital Gain Tax Worksheet.

Qualified dividends and capital gain tax worksheet | Chegg.com Question: Qualified dividends and capital gain tax worksheet line 44 This question hasn't been solved yet Ask an expert Ask an expert Ask an expert done loading PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. Free Microsoft Excel-based 1040 form available ... Line 42 - Deductions for Exemptions Worksheet; Line 44 - Qualified Dividends and Capital Gain Tax Worksheet; Line 52 - Child Tax Credit Worksheet; Lines 64a and 64b - Earned Income Credit (EIC) Six additional worksheets round out the tool: W-2 input forms that support up to 4 employers for each spouse; 1099-R Retirement input forms for ... QUAL DIV - 2013 Form 1040—Line 44 Qualified Dividends and ... 2013 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

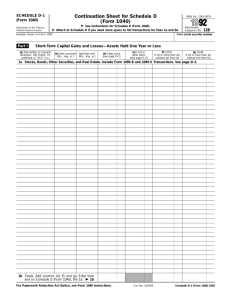

Qualified Dividends and Capital Gain Tax Worksheet. - CCH According to the IRS Form 1040 instructions for line 44: Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet. How Your Tax Is Calculated: Understanding the Qualified ... May 16, 2017 · Instead, 1040 Line 44 “Tax” asks you to “see instructions.” In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. Qualified Dividends And Capital Gain Tax Worksheet ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow). 2021 Instructions for Schedule D (2021) - IRS tax forms Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don't need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

Each kind of investment income can ... - enukabu.fabbro.fvg.it taxpayers who receive form 1099-div showing they received qualified dividends must use the qualified dividends and capital gains tax worksheet - line 44 this amount is normally reported to you on form 1099-div qualified dividend and long-term capital gains tax rate: • dividends from equities, traditional preferred stocks, and foreign stocks that …

Qualified Dividends And Capital Gain Tax Worksheet ... Tools or Tax ros ea 2017 Qualified Dividends and Capital Gain Tax WorksheetLine 44 See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax. However if the child has to file Schedule D and line 18 or line 19 of the childs Schedule D is more than zero use the Schedule D Tax Worksheet to figure this tax instead.

Creative Qualified Dividends And Capital Gains Tax Worksheet Qualified dividends and capital gain tax worksheet. The Line 44 worksheet is also called the Qualified Dividends and Capital Gain Tax Worksheet. Calculates a capital gain or capital loss for each separate capital gains tax cgt event. Before completing this worksheet complete Form 1040 through line 10.

Qualified Dividends and Capital Gain Tax Worksheet 2016 ... 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

How do I display the Tax Computation Worksheet? - Intuit I'm attempting to double check the 1040, line 44 entry. The Qualified Dividends and Capital Gain Tax Worksheet, line 24 just says to use "the Tax Computation Worksheet", but I cannot seem to find nor display it. Using TT Premier.

motosei.fabbro.fvg.it Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. 1041 and there are no amounts for Lines. 21 Posts Related to Qualified Dividends And Capital Gain Tax Worksheet 2017.

9+ Best Irs Capital Gains Worksheet - Countevery vote Template Qualified Dividends And Cap Gains Tax Worksheet. Qualified Dividends Capital Gains Worksheet Line 44. Capital Asset Most property you own and use for per-sonal purposes or. 1 You owned and lived in the home as your principal residence for two out of the last five years.

PDF Capital Gains and Losses - IRS tax forms Unrecaptured Section 1250 Gain Worksheet: in the ... Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). Do not : complete lines 21 and 22 below. No.

Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records Form 1040—Line 44 Before you begin: See the instructions for line 44 that begin on page 36 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure

Qualified Dividends And Capital Gain Worksheet Qualified Dividends And Capital Gain Tax Worksheet. 2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller. 2011 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller. Review Alexander Smith S Information And The W2 Chegg Com.

Qualified Dividends And Capital Gain Tax Worksheet 2020 Qualified dividends and capital gain tax worksheet 2020. FDIA0612L 1223 Albert T. If there is an amount in box 2d in-clude that amount on line 4 of the 28 Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. You held the stock for 63 days from July 16 2020 through September 16 2020.

Qualified Dividends And Capital Gain Tax Worksheet 2021 ... qualified dividends and capital gains worksheet 2020 qualified dividends and capital gain tax worksheet 2021? signNow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. All you need is smooth internet connection and a device to work on.

Qualified Dividends and Capital Gain Tax Worksheet -Line 44 ... to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet Tax on all taxable income. Enter the smaller of line 25 or line 26. Also include this amount on Form 1040, line 44 (Form 1040A, line 28). If you are filing Form 2555 or 2555-EZ, do not enter this amount on Form 1040, line 44 (or Form 1040A, line 28).

Instructions for Line 44 on Tax Form 1040 | Sapling Line 44 Inclusions. The figure entered on line 44 is a total of taxes related to various applicable items. It can cover taxable income, unearned income of a dependent child (e.g., interest and dividends), lump sum distributions and capital gains, and foreign earned income. Line 44 also includes taxes on educational assistance or refunds.

Qualified And Dividends Form Gain Worksheet Capital Tax ... 2017 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 • See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax. companies For individuals whose income tax bracket is 10% or 25%, then the capital gains tax rate is zero.

0 Response to "42 Qualified Dividends And Capital Gain Tax Worksheet Line 44"

Post a Comment