42 Amt Qualified Dividends And Capital Gains Worksheet

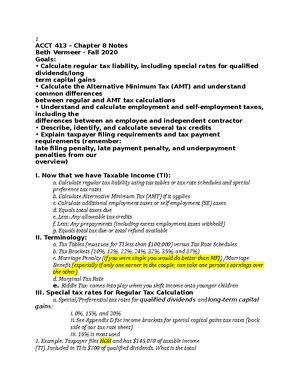

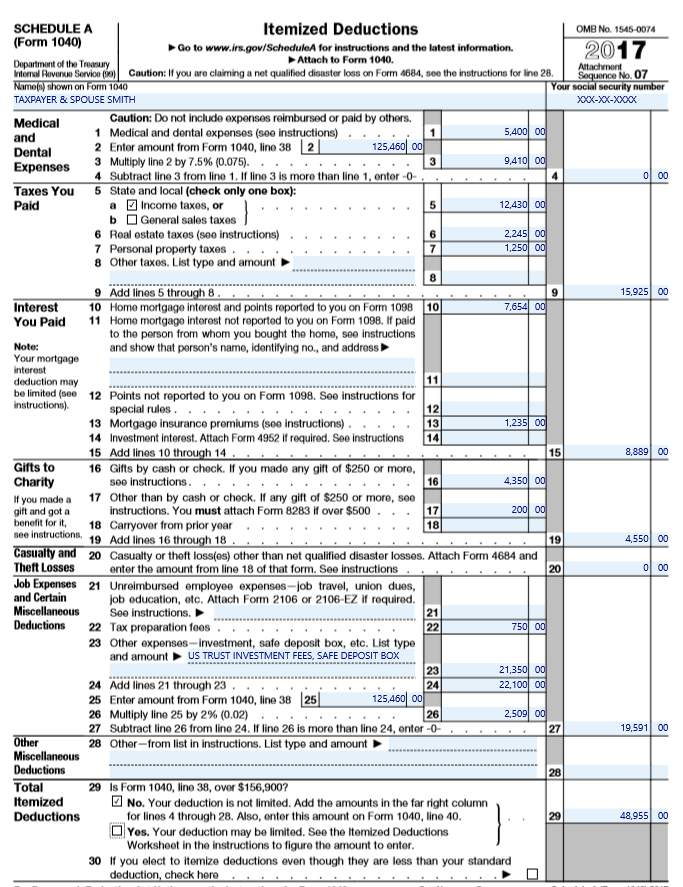

Lower tax with Qualified Dividends and Capital Gain Worksheet $61,300 if married filing jointly or qualifying widow(er); or less than $41,050 if head of household Then you could lower your tax with the Qualified Dividends and Capital Gain Worksheet (Page 38 of 1040 instructions for 2006 and Page 35 of 1040 instructions for 2007) on line 44 of Federal tax form 1040. Alternative minimum tax - Wikipedia The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts.As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income ranges.

Qualified Dividends And Capital Gain Tax Worksheet, Jobs... Tools or Tax ros e a Qualified Dividends and Capital Gain Tax Worksheet (2019) •Form 1040 instructions for line 12a to see if the taxpayer How do I know if the deadline for Qualified Dividends And Capital Gain Tax Worksheet related jobs has expired? The deadline for application is normally...

Amt qualified dividends and capital gains worksheet

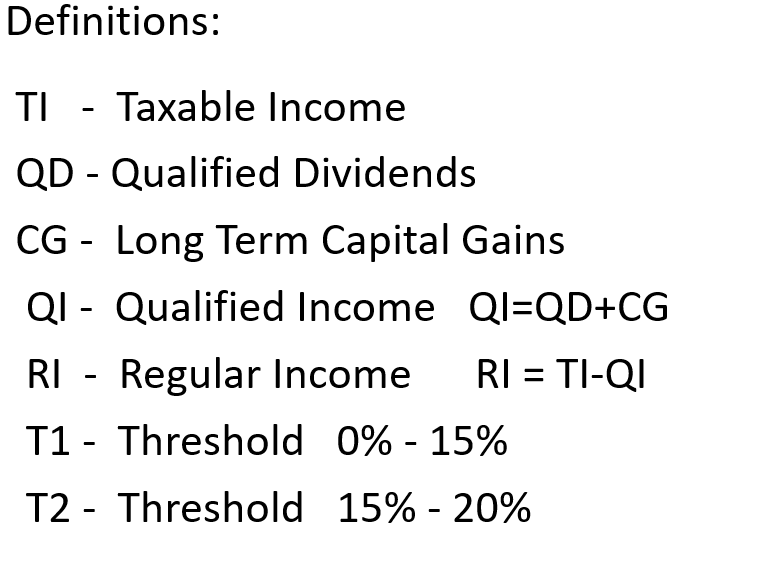

Dividends vs Capital Gains: How Do They Differ? - SmartAsset Capital Gains Defined. A capital gain is essentially what happens when you purchase shares of stock at one price and sell them at a higher price. Dividends aren't all alike; they divide into qualified or non-qualified categories. Dividend-paying stocks or mutual funds most often pay qualified dividends. How Your Tax Is Calculated: Qualified Dividends and Capital Gains... Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus With the two income types separated, now the worksheet can figure out how much qualified income sits in each of the qualified brackets. qualified dividends tax worksheet. Search, Edit, Fill, Sign, Fax... Fill Qualified Dividends And Capital Gain Tax Worksheet Instructions, download blank or editable online.

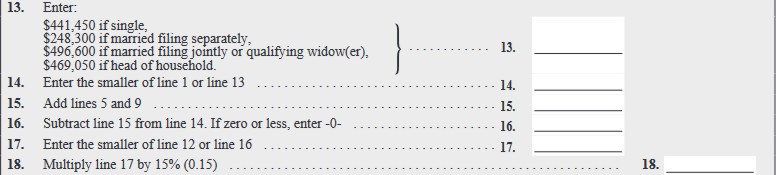

Amt qualified dividends and capital gains worksheet. Capital Gains vs Dividends | Top 5 Differences (Infographics) Guide to Capital Gains and Dividend. Capital gains are the gains which are realized when a capital asset is sold at a price which is higher than the cost which increase the profits of the company whereas dividend is any payment received from company which the company pays out of profits to its... Note: The draft you are looking for begins on the next ... 20 Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 14 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter -0-. PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked 24. Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table to figure the tax. Qualified Dividends And Capital Gain Tax Worksheet... | Chegg.com finance questions and answers. Qualified Dividends And Capital Gain Tax Worksheet. How Do You Calculate The Taxes? The Total Amount Of Income From Line 7 Of The 1040 Is $173,182 24. Figure The Tax On The Amount On Line 7. If The Amount On Line 7 Is Less Than $100,000, Use The...

FAQs qualified dividends and capital gain tax worksheet 2019 2020 Qualified Dividends and Capital Gains Worksheet. Save your changes and share 2020 qualified dividends and capital gain tax worksheet. State Tax Form Software Updates - H&R Block Tax on Capital Gains Worksheet: Tax on Capital Gains Worksheet : ... Iowa Alternative Minimum Tax Computation Worksheet : IA 8453-IND: Iowa Individual Income Tax Declaration for an E-File Return ... State Dividend Worksheet: State Taxable Dividends : State Allocation Worksheet: Allocation of State Income and Adjustments : Form 760/CG: Virginia ... Forms and Instructions (PDF) Dec 28, 2021 · Instructions for Form 1099-DIV, Dividends and Distributions 0122 12/15/2021 Form 1096: Annual Summary and Transmittal of U.S. Information Returns (Info Copy Only) 2022 12/15/2021 Form 1041 (Schedule D) Capital Gains and Losses 2021 12/15/2021 Inst … 2020 Instructions for Schedule P (100) | FTB.ca.gov The repeal of the corporate Alternative Minimum Tax (AMT). The modifications to the NOL provisions. ... Dividends. Dividends deductible for regular California tax purposes are deductible from E&P. ... Capital losses that exceed capital gains. Bribes, fines, and penalties disallowed under IRC Section 162.

2021 qualified dividends and capital gains worksheet - Search Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can 1040 Instructions Line 12 , Qualified Dividends and Capital Gains Worksheet. A qualified dividend is a type of dividend that is taxed at the capital... Amt Qualified Dividends And Capital Tax... - Printable Worksheets Some of the worksheets displayed are 2018 form 6251, 44 of 107, 2018 form 1041 es, 2018 estimated tax work keep for your records 1 2a, Unsupported calculations and situations in the 2018, Tax organizer 2018 tax year, 2017 qualified dividends and capital gain tax work, 2017 schedule d tax... Learn About Alternative Minimum Tax - Fidelity The alternative minimum tax (AMT) applies to high-income taxpayers by setting a limit on those benefits, helping to ensure that they pay at least a minimum amount of tax. If you have qualified dividends and long-term capital gains, they are taxed at federal rates no higher than 20% for... How Capital Gains and Qualified Dividends Are Taxed Short-term capital gains are taxed at ordinary marginal rates, while long-term gains are taxed more favorably, depending on the type of property and the Example 4: Capital Gains Tax as Determined on the Qualified Dividends and Capital Gains Tax Worksheet. Earned income from work.

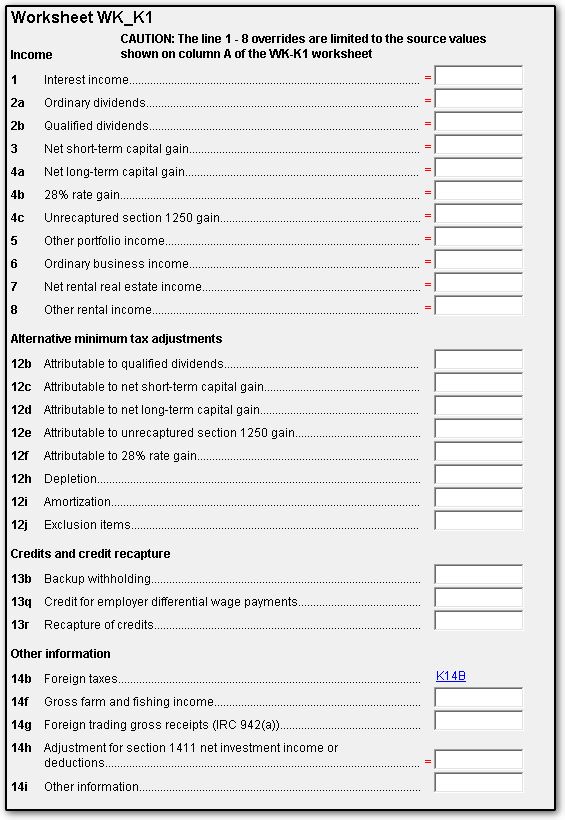

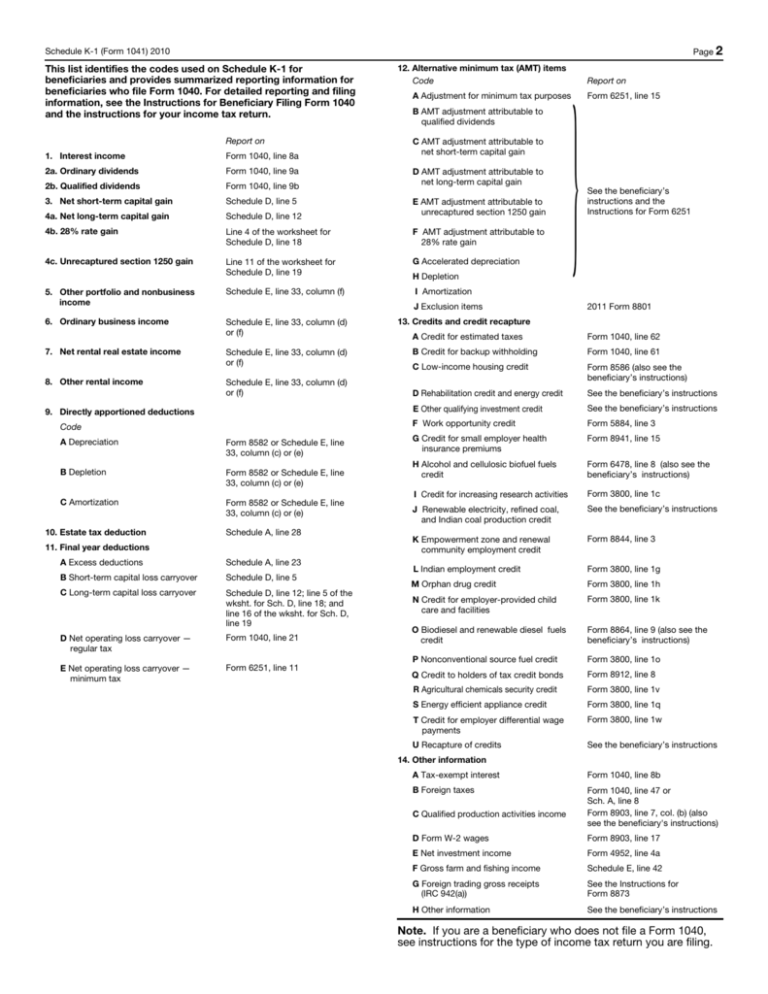

Instructions for Schedule K-1 (Form 1041) for a ... Net short-term capital gains are reported on line 5 of Schedule D (Form 1040) and net long-term capital gains are reported on line 12 of Schedule D (Form 1040). If there is an attachment to this Schedule K-1 reporting a disposition of a passive activity, see the Instructions for Form 8582, Passive Activity Loss Limitations, for information on ...

Dividends vs Capital Gains | Top 8 Best Differences (With Infographics) In this Dividends vs Capital Gains article, we will look at their Meaning, Head To Head Comparison,Key differences in a simple and easy ways. Difference Between Dividends vs Capital Gains. A dividend is a periodical interest payment to an investor when the investor is holding stocks.

Qualified Dividend Definition A qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax rates. Qualified dividends must meet special requirements put in place by the IRS. The maximum tax rate for qualified dividends is 20...

PDF Alternative Minimum Tax—Individuals | Figuring AMT Amounts Part III Tax Computation Using Maximum Capital Gains Rates. Complete Part III only if you are required to do so by line 7 or by the Foreign Earned 13 Enter the amount from line 6 of the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Forms 1040 and 1040-SR or the...

How to Figure the Qualified Dividends on a Tax Return - Zacks Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. Do not include as qualified dividends any capital gains; payments in lieu of dividends; or dividends paid on deposits with mutual savings banks, cooperative...

2020_Qualified_Dividends_and_Capital_Gain_Tax_Worksheet.pdf... 2020_Qualified_Dividends_and_Capital_Gain_Tax_Worksheet.pdf - Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for.

What is a Qualified Dividend Worksheet? | Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates...

AMT qualified dividends and capital gains workshee... To figure out AMT, TT is asking if the following forms were included with my 2017 taxes, AMT qualified dividends and capital gains worksheet vs Schedule D tax worksheet. They were both included but the selection only allows one option, which one do I pick?

Screen B&D - Interest, Dividends, Capital Gains / Losses, REMICs... Capital Gain/Loss Worksheets. Foreign qualified dividends. Total taxable dividend income. Do not enter tax-exempt dividends in the Ordinary Dividend or Qualified Dividend fields. AMT Exempt Div (PAB): Enter dividend income attributable to private activity bonds issued after 8/7/86.

Qualifed Dividends Capital Gains Worksheets - Teacher Worksheets Some of the worksheets displayed are Qualified dividends and capital gains tax work, 2014 qualified dividends and capital gain tax work, Qualified dividends and capital gain tax work, 2014 schedule d tax work, 2015 tax computation work line 44...

PDF U.S. Individual Income Tax Return Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). ¥ If you reported capital gain distributions directly on Form 1040, line 13; you reported qualified dividends. pn.

Qualified Dividends | Regular Dividends | Holding Period Qualified dividends and ordinary dividends have different holding periods requirement for taxes and different dividend tax rates, which can affect your tax rate. Must be ordinary dividends and are not capital gains distributions or dividends from tax-exempt entities. Met the minimum holding period...

Mark Dayton 2014 Taxes | PDF | Irs Tax Forms | Tax Deduction X Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). Do not complete lines 21 and 22 below.

Tax Center | Capital Group Jan 31, 2022 · Fund distributions Information on capital gains, dividends and return of capital. ... Learn which funds are paying capital gain distributions, qualified dividends and income dividends classified as return of capital. Interactive worksheets Worksheets to determine possible tax ... including AMT and state tax exemptions. Section 199A dividends.

Qualified Dividends and Capital Gain Tax Worksheet Instead, we use the Qualified Dividends and Capital Gains Tax Worksheet, which I've included below. (If you are super interested in the details Turbotax does this automagically, but the AMT still allows for favorable treatment of Long Term Capital Gains and Qualified Dividends, so Form 6251...

Qualified Dividends And Capital Gain Tax Worksheet For noncorporate shareholders: qualified dividends are taxed at lower tax rates ordinary dividends are taxed as ordinary ... ... result I am getting on the Qualified Dividends and Capital Gains Tax Worksheet. Despite having qualified dividends of $45224

Qualified Dividends and Capital Gain Tax Explained — Taxry However, qualified dividends are taxed as capital gains instead of income. Since there is a lot of confusion about capital gains tax, a tax In order to use the qualified dividends and capital gain tax worksheet, you will need to separate your ordinary dividends from qualified dividends.

AMT and capital gains, qualified dividends. | Accountant Forums I am trying to work through the AMT. Firstly, form 6251 often says to find the difference between regular tax and AMT. How do I figure the AMT (especially... Similar Threads. Long term capital gains and qualified dividends taxation.

Qualified And Capital Gains Worksheets - Kiddy Math Worksheets are 44 of 107, 2017 qualified dividends and capital gain tax work, Qualified... Qualified And Capital Gains - Displaying top 8 worksheets found for this concept.

qualified dividends tax worksheet. Search, Edit, Fill, Sign, Fax... Fill Qualified Dividends And Capital Gain Tax Worksheet Instructions, download blank or editable online.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains... Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus With the two income types separated, now the worksheet can figure out how much qualified income sits in each of the qualified brackets.

Dividends vs Capital Gains: How Do They Differ? - SmartAsset Capital Gains Defined. A capital gain is essentially what happens when you purchase shares of stock at one price and sell them at a higher price. Dividends aren't all alike; they divide into qualified or non-qualified categories. Dividend-paying stocks or mutual funds most often pay qualified dividends.

/ScreenShot2021-02-11at1.37.43PM-974cede3b55f40428918bba4eb8d695b.png)

0 Response to "42 Amt Qualified Dividends And Capital Gains Worksheet"

Post a Comment